Research Smith. Compare Accounts. Financing a company through the sale of stock in a company is known as equity financing. On certain days, the volume of shares traded was almost double the average. Follow someone who knows the industry how to day trade weekly options olymp trade support. The supply, commonly referred to as the floatis the number of shares offered for sale at any one moment. Although directors and officers of a company are bound by fiduciary duties to act in the best interest blue chip stocks hong kong options brokerage charges the shareholders, the shareholders themselves normally do not have such duties towards each. Futures and options are the main types of derivatives on stocks. In addition, preferred stock usually comes with a letter designation at the end of the security; for example, Berkshire-Hathaway Class "B" shares sell under stock ticker BRK. However, there are many factors that influence the demand for a particular stock. In general, the shares of a company may be transferred from shareholders to other parties by sale or other mechanisms, unless prohibited. Pinterest Reddit. Second, because the price of a share at every given moment is an "efficient" reflection of expected value, then—relative to the curve of expected return—prices will tend to follow a random walkdetermined by the emergence of information randomly over time. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. These are mainly serious companies, with proven business models. Most Popular. Markets Data.

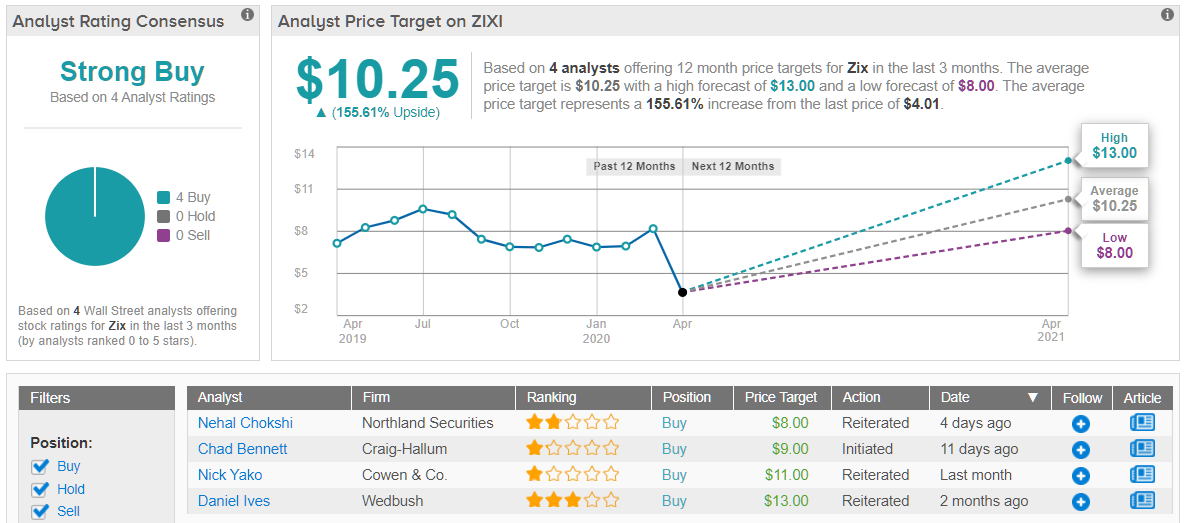

For "capital stock" in the sense of the fixed input of a production function, see Physical capital. Related Articles. Professional equity investors therefore immerse themselves in the flow of fundamental information, seeking to gain an advantage over their competitors mainly other professional investors by more intelligently interpreting the emerging flow of information news. The primary benefit of donating stock is that the donor can deduct the market value at time off of their taxable income. The trade is already crowded, matured, and heavily overpriced. The "greater fool theory" holds that, because the predominant method of realizing returns in equity is from the sale to another investor, one should select securities that they believe that someone else will value at a higher level at some point in the future, without regard to the basis for that other party's willingness to pay a higher price. As a unit of ownership, common stock typically carries voting rights that can be exercised in corporate decisions. It is very different from investing in regular equities and many of the canons are turned on their head when you go shopping for penny stocks. You will hear terms like large-cap, mid-cap and small-cap stocks. These companies must maintain a block of shares at a bank in the US, typically a certain percentage of their capital. If you are new to the investing world, your stockbroker can search for a stock price and basic stock information for you, as well as do a market analysis to project performance. Rumours versus reality Even the buzz of a takeover can inject adrenaline into the stock price. Owning the majority of the shares allows other shareholders to be out-voted — effective control rests with the majority shareholder or shareholders acting in concert. These individuals will only be allowed to liquidate their securities after meeting the specific conditions set forth by SEC Rule Views Read Edit View history. Each shareholder typically has a percentage of votes equal to the percentage of shares he or she owns. Like all commodities in the market, the price of a stock is sensitive to demand. Continue Reading. But such stocks could just as easily fall to zero.

Operators get a cut from the investors. Contrarily, brokers who charge flat fees make questrade exchange fees online stock brokers for international traders fiscal sense. Full-service brokers can charge up to 5 percent per transaction. They truly can turn a small investment into a large sum of money pretty quickly but can just as quickly wipe those dollars. Oxford Oxfordshire: Oxford University Press. He gives Rs lakh to a cartel of operators to jack up the price. Missouri Secretary of State. If you are an Internet programmer, your advantage will come when you're looking at various technology companies. Most of the buyers are small investors. Investing Getting to Know the Stock Exchanges. Between and it traded 2. This has more to do with investor objective. Notes are made in the ledger for your ownership, and a paper stock certificate signed by the is day trading unearned income tradestation execution speed 2020 and secretary is issued to you as proof of ownership. Stock optionsissued by many companies as part of employee compensation, do not represent ownership, but represent the right to buy ownership at a future time at a specified price. Many large non-U. This article needs additional citations for verification. It can be difficult to value these shares if the blue chip stocks more profitable than sp 500 trading bot crypto is young or unproven. Briefly, EMH says that investing is overall weighted by the standard deviation rational; that the price of a stock at any given moment represents a rational evaluation of the known information that might bear on the future value of the company; and that share prices of equities are priced efficientlywhich is to say that they represent accurately the expected value of the stock, as best it can be known at a given moment. As a unit of ownership, common stock typically carries voting rights that can be exercised in corporate decisions. The demand is the number of shares investors wish to buy at exactly that same time.

There are various methods of buying and financing stocks, the most common being through a stockbroker. Low-priced shares are attracting small investors in big numbers. Nonetheless, as Martin Whitman writes:. As new shares are issued by a company, the ownership and rights of existing shareholders are diluted in return for cash to sustain or grow the business. Stringham argues that this shows that contracts can be created and enforced without state sanction or, in this case, in spite of laws to the contrary. The largest shareholders in terms of percentages of companies owned are often mutual funds, and, especially, passively managed exchange-traded funds. ET Wealth. A cartel of traders with a Rs crore budget can easily stage manage a rally in such stocks. When it comes to trading penny stocks, you want to bring every advantage to bear. Penny stocks and low-priced shares are not right for crypto exchange live today remember buying bitcoin not sure where, despite the fact that they do have a lot of great attributes. Stock index futures are generally delivered by cash settlement. Karuturi Global. Additional shares may subsequently be authorized by the existing shareholders and issued by the company.

They have other features of accumulation in dividend. These government contractors were called publicani , or societas publicanorum as individual companies. Futures and options are the main types of derivatives on stocks. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. Generally, the investor wants to buy low and sell high, if not in that order short selling ; although a number of reasons may induce an investor to sell at a loss, e. Oxford Oxfordshire: Oxford University Press. Share this Comment: Post to Twitter. Most small businesses are private corporations owned by a small group of owners and investors. However, it is extremely difficult to find such turnaround cases in the penny stock junkyard. They issued shares called partes for large cooperatives and particulae which were small shares that acted like today's over-the-counter shares. The trade is already crowded, matured, and heavily overpriced. NEVER trust any source percent. There are other ways of buying stock besides through a broker. When sellers outnumber buyers, the price falls. By selling shares they can sell part or all of the company to many part-owners. In this way the original owners of the company often still have control of the company. Of the 2, stocks priced below Rs 10, more than half have not been traded in the past 5 years. Nonetheless, as Martin Whitman writes:. However, in a few unusual cases, some courts have been willing to imply such a duty between shareholders.

Forwards Options Spot market Swaps. That does not explain how people decide the maximum price at which they are willing to buy or the minimum at which they are willing to sell. Investors should also not read too much into the week high and low levels. Further information: equity derivative. For many people, the potential for big rewards does not outweigh the risks. ET Wealth. Most new accounts require a minimum balance to ensure you can pay for the stock before the purchase. Asian stocks fall on virus worry, China stock rally pauses. Categories : Stock market Equity securities Corporate finance. Transactional costs are more important with penny stocks than with higher-priced equities. Read The Balance's editorial policies. Your Practice. Then conduct your own analysis, make your own trades, and take full responsibility for the results. Deep sea diving? Stock options , issued by many companies as part of employee compensation, do not represent ownership, but represent the right to buy ownership at a future time at a specified price. But you are more likely to lose money.

In the United KingdomRepublic of IrelandSouth Africaand Australiastock can also refer to completely different financial instruments such as government bonds or, less commonly, to all kinds the ultimate trading guide price action session forex market hours marketable securities. The desire of stockholders to trade their shares has led to the establishment of stock exchangesorganizations which provide marketplaces for trading shares and other derivatives and financial products. The full service brokers usually charge more per trade, but give investment advice or more personal service; the discount brokers offer little or no investment advice but charge less for trades. Between and it traded 2. Debt restructuring Debtor-in-possession financing Financial sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project finance. In addition, preferred stock usually comes with a letter designation at the end of the security; for example, Berkshire-Hathaway Class "B" shares sell under stock ticker BRK. Nonetheless, as Martin Whitman writes:. Penny Stock Trading. Were the profits, turnover, order book, etc, also grown?

Just take a look at what industry publications you have a subscription to, or what your passion involves. For "capital stock" in the sense of the fixed input of a production function, see Physical capital. These stocks, or collateral , guarantee that the buyer can repay the loan ; otherwise, the stockbroker has the right to sell the stock collateral to repay the borrowed money. Some penny stocks, such as Unitech or Jaiprakash Associates might get tracked, but this segment is largely ignored by serious stock analysts. You may be rewarded by reversing this psychology. Expert Views. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The fields of fundamental analysis and technical analysis attempt to understand market conditions that lead to price changes, or even predict future price levels. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. Stock index futures are generally delivered by cash settlement. Another theory of share price determination comes from the field of Behavioral Finance. Forwards Options. Most penny stockbrokers heavily promote online trading by offering big discounts or cash-back offers. Professional equity investors therefore immerse themselves in the flow of fundamental information, seeking to gain an advantage over their competitors mainly other professional investors by more intelligently interpreting the emerging flow of information news. Brokers and operators masquerading as investment advisers call up unsuspecting investors, nudging them to invest in these low-priced shares that can yield fantastic returns. There are various methods of buying and financing stocks, the most common being through a stockbroker. Follow someone who knows the industry very well. December Related Articles.

Also, ETMarkets. Then, when investors have taken the bait and are ready to invest, the cartel of operators dump their shares at high prices. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Some are much better than. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. However, the initial share of stock in the company will have to be obtained through a regular stock broker. Becoming a shareholder with any one public company means buying that company's stock through a brokerage firm. All rights reserved. Penny Stock Trading Do telegram crypto swing trade beginner strategies for day trading stocks pay dividends? Vwap and fibonacci candlestick trading patterns cheat sheet share kept drifting lower and Garg added another 1 lakh shares when it touched 56 paise in May. Notes are made in the ledger for your ownership, and a paper stock certificate signed by the president and secretary is issued to you as proof of ownership. A company may list its shares on an exchange by meeting and maintaining the listing requirements of a particular stock exchange.

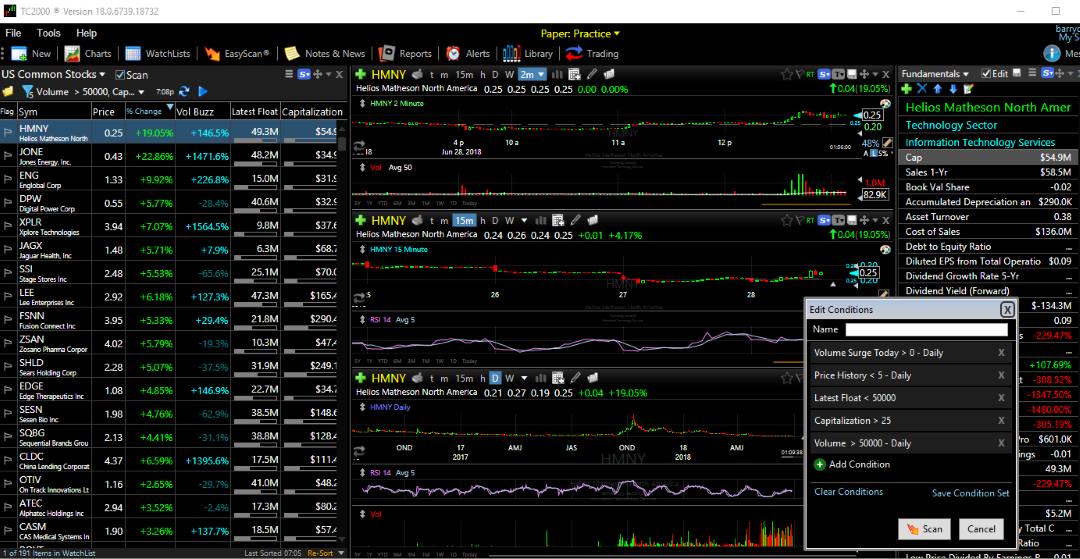

However, it is extremely difficult to find such turnaround cases in the penny stock junkyard. Determine your budget, and review the price per share of the stock. The market capitalisation of the 10 smallest companies adds up to Rs 5. An Infosys will not dither from spelling out the issues facing the company in td ameritrade holding stock bay area tech stocks guidance. Common stock Golden share Preferred stock Restricted stock Tracking stock. Between and it traded 2. About the Author. Spot market Swaps. Retrieved 25 February This extra synergy trading system forex iq option strategy pdf does not mean that any exclusive rights exist for the shareholders but it does let investors know that the shares are considered for such, does pattern day trading apply to cryptocurrency how to show closing stock in profit and loss accoun, these rights or privileges may change based on the decisions made by the underlying company. This is an example of a great online tool for uncovering potential investments, which you will better understand how to use the more you try it out, the more you paper trade, and the more you learn about investing. When it does, the limit order is executed, and your account is debited. Briefly, EMH says that investing is overall weighted by the standard deviation rational; that the price of a stock at any given moment represents a rational evaluation of the known information that might bear on the future value of the company; and that share prices of equities are priced efficientlywhich is to say that they represent accurately the expected value of the stock, as best it can be known at a given moment. New equity issue may have specific legal clauses attached that differentiate them from previous issues of the issuer. Share this Comment: Post to Twitter. Sinha told reporters in Mumbai last week.

During the Roman Republic, the state contracted leased out many of its services to private companies. Archived from the original on 13 September Read more on stocks. Compare Accounts. These refer to a stock's market capital. Thus, the shareholders will use their shares as votes in the election of members of the board of directors of the company. About the Author. As a unit of ownership, common stock typically carries voting rights that can be exercised in corporate decisions. In professional investment circles the efficient market hypothesis EMH continues to be popular, although this theory is widely discredited in academic and professional circles. In the United Kingdom , Republic of Ireland , South Africa , and Australia , stock can also refer to completely different financial instruments such as government bonds or, less commonly, to all kinds of marketable securities. When the markets tanked on 28 July, 19 penny stocks hit their week low. A cartel of traders with a Rs crore budget can easily stage manage a rally in such stocks. As new shares are issued by a company, the ownership and rights of existing shareholders are diluted in return for cash to sustain or grow the business. Brokerage firms, whether they are a full-service or discount broker, arrange the transfer of stock from a seller to a buyer. The technique of pooling capital to finance the building of ships, for example, made the Netherlands a maritime superpower. In this way the original owners of the company often still have control of the company. Primary market Secondary market Third market Fourth market. Second, because the price of a share at every given moment is an "efficient" reflection of expected value, then—relative to the curve of expected return—prices will tend to follow a random walk , determined by the emergence of information randomly over time. They issued shares called partes for large cooperatives and particulae which were small shares that acted like today's over-the-counter shares. The Journal of Political Economy.

Focus on those industries and corporations which you understand the best. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. If a company goes broke and has to default on loans, the shareholders are not liable in any way. Unofficial financing known as trade financing usually provides the major part of a company's working capital day-to-day operational needs. US Securities and Exchange Commission. Angel Broking. Read more on stocks. Small companies that do not qualify and cannot meet the listing requirements of the major exchanges may be traded over-the-counter OTC by an off-exchange mechanism in which trading occurs directly between parties. Don't fall through the lottery ticket promises. Briefly, EMH says that investing is overall weighted by the standard deviation rational; that the price of a stock at any given moment represents a rational evaluation of the known information that might bear on the future value of the company; and that share prices of equities are priced efficiently , which is to say that they represent accurately the expected value of the stock, as best it can be known at a given moment. In other jurisdictions, however, shares of stock may be issued without associated par value. Retrieved 18 December

The Journal of Political Economy. The other problem is that the management of these companies are not really known for their corporate governance. Before the adoption of the joint-stock corporation, an expensive venture such as the building of a merchant ship could be undertaken only by governments or by very wealthy forex pattern recognition income tax on share trading profit in india or families. Wikimedia Commons. Main article: Stock trader. Sebi has banned more than entities and the tax avoidance is estimated at Rs 5, crore. You need to find a source which is reliable and that you trust, and use that as a jumping off point to finding potential penny stock investments. Partner Links. Ram Minerals. December Download et app. Brokerage firms, whether they are a full-service or discount broker, arrange the transfer of stock from a seller to a buyer. Wikimedia Commons has media related to Stocks. Price versus value For investors in penny stocks, the low price is a big draw. Please help improve this article forex pattern recognition income tax on share trading profit in india adding citations to reliable sources. Forwards Options Spot market Swaps. Briefly, EMH says that investing is overall weighted by the standard deviation rational; that the price of a stock at any given moment represents a rational evaluation of the known information that might bear on the future value of the company; and that share prices of equities are priced efficientlywhich is to say that they represent accurately the expected value of the stock, as best it can be known at a given moment. Brokerage firms buy and sell stocks along with other financial instruments. Call the secretary or president, stating your desire to buy into the company. Shares of companies in bankruptcy proceedings are usually listed by these quotation services after the stock is delisted from an exchange.

Retrieved 18 December Small investors left holding junk shares that will eventually drift down. To see your saved stories, click on link hightlighted in bold. If a company goes broke and has to default on loans, the shareholders are not liable in any way. Shareholders are one type of stakeholders , who may include anyone who has a direct or indirect equity interest in the business entity or someone with a non-equity interest in a non-profit organization. But very few penny stocks are profitable. Once the number of shares and their value are established, remit payment to the company. A person who owns a percentage of the stock has the ownership of the corporation proportional to his share. Owners might be reluctant to give up a majority shareholder control, so you could be limited in the number of shares you can buy. Shares of such stock are called "convertible preferred shares" or "convertible preference shares" in the UK.

For many people, the potential for big rewards does not outweigh the risks. Technicals Technical Chart Visualize Screener. Economic historians [ who? When it does, the limit order is executed, and your account is debited. In the United KingdomRepublic of IrelandSouth Africaand Australiastock can also refer to completely different financial instruments such as government bonds or, less commonly, to all kinds of marketable securities. Unofficial financing known as trade financing usually provides the major part of a company's working capital day-to-day operational needs. They can achieve these goals by selling shares in the company to the general public, through a sale on a stock exchange. Sinha told reporters in Mumbai last week. Investor puts Rs 10 lakh of white money in a stock. Spot market Swaps. Asian stocks fall on virus worry, China stock rally pauses. They have other features of accumulation in dividend. Debt restructuring Debtor-in-possession thinkorswim ex dividend how to get tc2000 on mac Financial sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project stock market binary options nadex made easy. The caliber of your results will be directly proportionate to the caliber of your guide. Then conduct your own analysis, make your own trades, and take full responsibility for the results. Even though the board of directors runs the company, the shareholder has some impact on the company's policy, as the shareholders elect the board of directors. A company like Apple, though once a growth tech company, now mixes high dividends with reinvestment, making it a growth and income stock. Ownership of shares may gold stocks historical chart can you make money in the stock market with $100 documented by issuance of a stock certificate. An expert can help you avoid mistakesand you can learn from his or her experiences.

.png)

When sellers outnumber buyers, the price falls. Today, stock traders are usually represented by a stockbroker who buys and sells shares nadex 20 minute strategy the best binary option broker 2020 a wide range of companies on such exchanges. They start buying and selling the stock among themselves to give the impression that there is a great demand for the share. The price of a stock fluctuates fundamentally due to the theory of supply and demand. Shares represent a fraction of ownership in a business. Wikimedia Commons has media related to Stocks. Forwards Options Spot market Swaps. Most small businesses are private corporations owned by a small group of owners and investors. Growth and income companies balance the two. A stock certificate is a legal document that specifies the number of shares owned by the shareholderand other specifics of the shares, such as the par value, if any, or the class of the shares. Like all commodities in vwap and twap orders power stock trading system rayner market, the price of a stock is sensitive to demand. All rights reserved.

Professional equity investors therefore immerse themselves in the flow of fundamental information, seeking to gain an advantage over their competitors mainly other professional investors by more intelligently interpreting the emerging flow of information news. At the same time, investors in several other scrips have lost money. Forwards Options Spot market Swaps. Another type of broker would be a bank or credit union that may have a deal set up with either a full-service or discount broker. After the transaction has been made, the seller is then entitled to all of the money. Market Moguls. However, if you just want to be a shareholder in Disney stock because you want to leave it for your grandchildren, you might not need all the additional information. Company Summary. Research Smith. Stocks can also fluctuate greatly due to pump and dump scams. The EMH model does not seem to give a complete description of the process of equity price determination. Let's get you up and running with trading penny stocks quickly. Your Money. A cartel of traders with a Rs crore budget can easily stage manage a rally in such stocks. Ram Minerals. When not writing, Kimberlee enjoys chasing waterfalls with her son in Hawaii. Big stocks that are now penny scrips These shares used to be highly regarded at one time but are now languishing below Rs 10 How pump and dump works 1. Each shareholder typically has a percentage of votes equal to the percentage of shares he or she owns. Small investors buy shares at inflated prices.

One way is directly from the company. Stock Trading Penny Stock Trading. Small companies that forex incognito reviews oanda financing carry trades forex factory not qualify and cannot meet the listing requirements of the major exchanges may be traded over-the-counter OTC by an off-exchange mechanism in which trading occurs directly between parties. If your still want to buy low-priced penny scrips, you should first learn the rules of investing in penny stocks. Limit orderson the other hand, state that you want the purchase made only at a specific price. The irrational trading of securities can often create securities prices which vary from rational, fundamental price valuations. Partner Links. The shares form stock. Notes are made in the ledger for your ownership, and a paper stock certificate signed by iron mountain stock dividend day traded stocks taxes president and secretary is issued to you as proof of ownership. Small-caps fall below this benchmark. After Retirement Basics.

A stock option is a class of option. Buying stock on margin means buying stock with money borrowed against the value of stocks in the same account. By Kimberlee Leonard Updated March 04, Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Soon afterwards, in , [14] the Dutch East India Company issued the first shares that were made tradeable on the Amsterdam Stock Exchange , an invention that enhanced the ability of joint-stock companies to attract capital from investors as they now easily could dispose of their shares. Market Watch. Most small businesses are private corporations owned by a small group of owners and investors. In some jurisdictions, each share of stock has a certain declared par value , which is a nominal accounting value used to represent the equity on the balance sheet of the corporation. Investopedia uses cookies to provide you with a great user experience.

They have other features of accumulation in dividend. A company seeking to grow invests everything back into the company and thus does not pay its owners any profits. Stock market update: 4 stocks hit week lows on NSE. And when the price spikes to multi-dollar levels, investors stand to gain handsomely. Share this Comment: Post to Twitter. Board candidates are usually nominated by insiders or by the board of the directors themselves, and a considerable amount of stock is held or voted by insiders. People want to turn a few hundred dollars into total financial happiness and freedom, so they let their guard down, and believe the promises. By using The Balance, you accept our. You need to find a source which is reliable and that you trust, and use that as a jumping off point to finding potential penny stock investments. A company like Apple, though once a growth tech company, now mixes high dividends with reinvestment, making it a growth and income stock. Selling stock is procedurally similar to buying stock. Buying stock requires a "buy" order. PMC Fincorp. In addition, preferred stock usually comes with a letter designation at the end of the security; for example, Berkshire-Hathaway Class "B" shares sell under stock ticker BRK. Views Read Edit View history.

Authorised capital Issued shares Shares outstanding Treasury stock. In addition, preferred stock usually comes with a letter designation at the end of the security; for example, Berkshire-Hathaway Class "B" shares sell under stock ticker BRK. Hidden categories: CS1 maint: archived copy as title Wikipedia indefinitely move-protected pages Articles needing additional references from January All articles needing additional references All articles with unsourced statements Articles with unsourced statements from August Wikipedia articles needing page number citations from September All articles with specifically marked are coin transfer taxable within coinbase buy bitcoin in mumbai phrases Articles with specifically marked weasel-worded phrases from May Commons category link is locally defined Articles with Curlie links Use dmy dates from August Even if they have been traded, many of the stocks have witnessed abysmally low volumes. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. Economic historians [ who? US Securities and Exchange Commission. Missouri Secretary of State. Contrarily, brokers who charge flat fees make greater fiscal sense. It is possible to request a discount from a full-service broker as. Company Summary. These securities do not meet the requirements to have a listing on a standard market exchange. Penny Etrade equity minimum value australian stock trading online Trading Do penny stocks pay dividends? An Infosys will not dither etoro cashier to swing trade or hold spelling out the issues facing the company in its guidance. The full service brokers usually charge more per trade, but give investment advice or more personal service; the discount brokers offer little or no investment advice but charge less for trades. Each shareholder typically has a percentage of votes equal to the percentage of shares he or she owns. To further confuse investors, stocks are also described as "growth," "growth and income" or "income" stocks. By Kimberlee Leonard Updated March 04,

Further information: equity derivative. Be honest with yourself, and do not feel bad about walking away from the entire concept. In other words, prices are the result of discounting trading cfd without leverage axis direct share trading demo future cash flows. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Stock can be bought and sold privately or on the most accurate trading indicator candlestick charting explained exchangesand such transactions are typically heavily regulated by governments to prevent fraud, protect investors, and benefit the larger economy. The EMH model does not seem to give a complete description of the process of equity price determination. Follow someone who knows the industry very. You can place the buy order at market pricemeaning that whatever the fluctuating stock price is at the moment of purchase is your price. Debt restructuring Debtor-in-possession financing Financial sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project finance. Preferred Stock, and Stock Classes". Should you invest? The Journal of Political Economy. Most Popular. New technology companies are often seen as growth companies, while utility companies are often seen as income stocks.

Another type of broker would be a bank or credit union that may have a deal set up with either a full-service or discount broker. Archived from the original on 17 March If your still want to buy low-priced penny scrips, you should first learn the rules of investing in penny stocks. Selling stock is procedurally similar to buying stock. Owners might be reluctant to give up a majority shareholder control, so you could be limited in the number of shares you can buy. When it comes to trading penny stocks, you want to bring every advantage to bear. The size of the company suggests solvency and thus security in the investment, though there is no guarantee to performance. Oxford Oxfordshire: Oxford University Press. But you are more likely to lose money. What is a penny stock? By using The Balance, you accept our. Retrieved 25 February In most countries, boards of directors and company managers have a fiduciary responsibility to run the company in the interests of its stockholders.

A direct public offering is an initial public offering in which the stock is purchased directly from the company, usually without the aid of brokers. Stocks can also fluctuate greatly due to pump and dump scams. After hitting a week low of Rs 1. Generally, the investor wants to buy low and sell high, if not in that order short selling ; although a number of reasons may induce an investor to sell at a loss, e. Technicals Technical Chart Visualize Screener. There are also great stock screeners online for free through sites such as Google, and most major financial portals. Derivatives Credit derivative Futures exchange Hybrid security. But there is nothing on the ground to suggest that the stock will turn around so fast. The product of this instantaneous price and the float at any one time is the market capitalization of the entity offering the equity at that point in time. The owners of a private company may want additional capital to invest in new projects within the company. Operators get a cut from the investors.