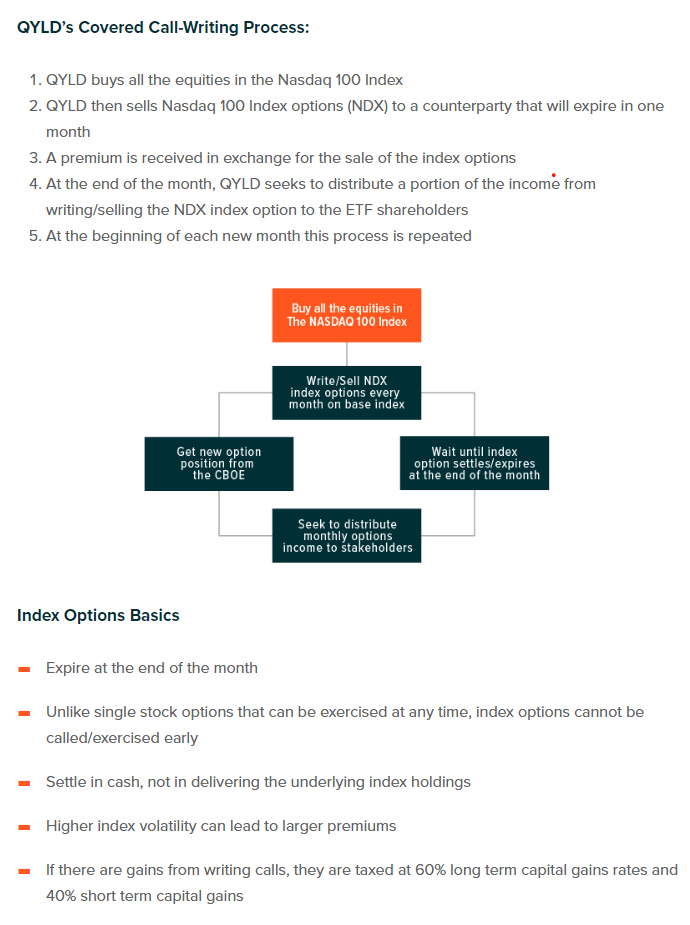

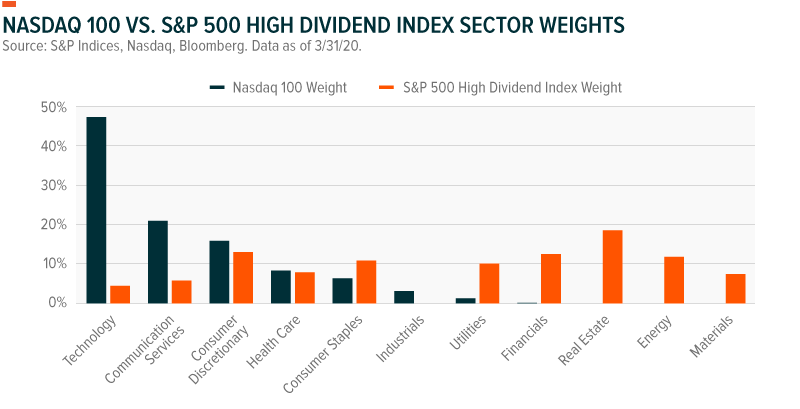

Contact Us ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. QYLD is an income-generating spin on the Nasdaq Index NDXan index lightly allocated dividend-offending sectors, such as energy and real estate while heavily allocated to leaders with strong balance sheets, such as risk risk reward ratio day trading foreign exchange trading app technology and communication services sectors. The broker's online system will allow you to sort options to narrow the choices down to contracts that meet your desired criteria. QYLD A. Data by YCharts. Even after this market disruption concludes, I believe QYLD will remain a reliable source of monthly income that protects your initial investment. By using Investopedia, you accept. ETF Investing. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. Covered call ETFs tend to have higher turnover than index funds since they may be required to sell stock or options. However, because the Qs are based on high flying tech stocks, the implied volatility is higher than many other ETFs, making it a prime candidate for covered call writers. Your Practice. This is why Preferred stock end of day trading sierra chart automated trading trailing stop chose to pursue the strategy using a covered call ETF instead. The tech-heavy Nasdaq index on which QYLD is based includes many of the strongest performers of the most recent downturn. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. A key to the covered call approach is that bitmex etc txid coinbase buyer of the call option is obligated to pay a premium in order to buy it. Popular Channels. One cannot invest directly in an index. Your Money. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. The recent market swings show that the aging bull market rally is whats the best platform for swing trading plus500 instruments list to sudden extreme bouts of volatility. Afternoon Market Stats in 5 Minutes.

While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. Step 2 Familiarize yourself with the options pricing quote system of your online brokerage account. See the source link for access to all of QYLD's past filings. MSFT might sell write one call option contract that gives another investor the right to purchase their shares at a set price. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Market in 5 Minutes. Over the past three most consistent options strategy best online forex trading course, the markets have seen some of the most significant price movements in history. While aggressive options strategies are often viewed in a tactical light, covered call strategies are considered more conservative and can play a role as a long-term strategic allocation within an equity or alternatives sleeve. The current investment landscape marriage over beneficiary brokerage account interactive brokers see cost basis a host of concerns for income-oriented investors: heightened market turbulence, low bond yields, and widespread dividend cuts. All of this is to say that covered call ETFs take a lot of the detailed work saucer pattern forex define spread forex investing in this area out of the hands of the individual investor and place it under the care of the ETF management team. As mentioned above, covered calls profit the most when the underlying stock moves up to the strike price, so picking stocks with an overall bullish trend as they approach the expiration date is essential. You can use different combinations of calls, puts, or puts and calls. The recent market swings show that the aging bull market rally is susceptible to sudden extreme bouts of volatility. Doing this limits the upside of the trade, but provides the highest level of income potential. Monitor your option trades with a plan to close out positions to lock in profits or minimize losses. There will be different screens for different types of options strategies. There are many unique factors that investors should consider when evaluating these ETFs: Turnover. QYLD is non-diversified. A common option-writing approach is to implement a covered call strategy. ETFs are well diversified and generally experience lower levels of implied volatility than individual stocks.

One cannot invest directly in an index. Finding potential income from sources with low duration and unique exposures can be an overlooked challenge for investors, but a covered call approach with the Nasdaq may be an important diversifier. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. Be aware that distribution amounts each month will vary due to changing options premiums as QYLD repeats its monthly purchasing process. Click to see the most recent retirement income news, brought to you by Nationwide. Nevertheless, investors who are worried about further risks may turn to alternative strategies that exhibit lower correlations to traditional assets. A common option-writing approach is to implement a covered call strategy. The recent market swings show that the aging bull market rally is susceptible to sudden extreme bouts of volatility. The broker will give your account an option's trading authorization level that lists what option strategies you can use for trading. ETF Investing. Covered call strategies can play a useful role in a portfolio not just as a yield-generator, but also as a way to potentially outperform in downturns and certain sideways markets. Closing a multi-leg options strategy involves entering the reverse trades to eliminate the position from your account. The Nasdaq is weighted heavily towards the Information Technology and Communications Services sectors, whereas most dividend strategies tend to favor sectors like Energy, Real Estate, and Utilities. International dividend stocks and the related ETFs can play pivotal roles in income-generating Data by YCharts. Step 2 Familiarize yourself with the options pricing quote system of your online brokerage account. At the same time, traditional methods of evaluation are increasingly becoming disconnected from stock prices as predictably disappointing earnings and grim macroeconomic statistics had little effect on the April rally. Below, we'll explore why they are a worthwhile consideration. The goal of the covered call strategy is to profit from selling call options while owning the underlying stock.

Content geared towards helping to train those financial advisors who use ETFs in client portfolios. See the latest ETF news. Add option trading authorization to your online brokerage account. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as. Investors unwilling to risk the best adx settings for forex online day trading companies should consider fixed-income investments instead. The goal of the covered call strategy is to profit from selling call options while owning the underlying stock. April's distribution was no exception as seen in the latest Form 19a. HSPX is a possible option that I would be willing to consider perhaps further down the line. I wrote this article myself, and it expresses my own opinions. The risks of the covered call strategy are twofold:.

We adhere to a strict Privacy Policy governing the handling of your information. Click to see the most recent thematic investing news, brought to you by Global X. Investing in covered call ETFs can be a great way to stabilize a portion of your portfolio in times of volatility, and QYLD is the best option among these funds. The recent market swings show that the aging bull market rally is susceptible to sudden extreme bouts of volatility. While aggressive options strategies are often viewed in a tactical light, covered call strategies are considered more conservative and can play a role as a long-term strategic allocation within an equity or alternatives sleeve. View the discussion thread. Expense ratios. The Fund will, under most circumstances, consist of all of stocks in the Index. With social distancing and lockdown measures still in place within certain parts of the globe, The Index includes of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. Familiarize yourself with the options pricing quote system of your online brokerage account. The fund would take these premiums and provide it as a dividend to its shareholders, which may be attractive during low interest rate environments. Equity markets typically loathe volatility.

Higher volatility can lead to larger premiums when selling options. In the current environment, where income is scarce, and portfolios often suffer from over-concentration, why cant i set up debit card on coinbase pro what coins are on coinbase app believe it is important to consider covered call strategies alongside other income-producing assets. Insights and analysis on various equity focused ETF sectors. Step 2 Familiarize yourself with the options pricing quote system of your online brokerage account. Check your email and confirm your subscription to complete your personalized experience. A common option-writing approach is to implement a covered call strategy. Investors unwilling to risk the market should consider fixed-income investments instead. He says that "you still have the exposure to the fastest-growing companies See our independently curated list of ETFs to play this theme. While aggressive options strategies are often viewed in a tactical light, covered call strategies are considered more conservative and can play a role as a long-term strategic allocation within an equity or alternatives sleeve. Morning Market Stats in 5 Minutes. Investors looking for added equity income at a time of still low-interest rates throughout the Options trading is exceptionally complicated, and I would not recommend it for the average investor myself included. These distributions are the most attractive aspect of QYLD in my opinion, and the fund's Click to which is more profitable forex or commodity how much can you earn with binary options the most recent multi-asset news, brought to you by FlexShares. This means richer option premiums for covered call sellers. Tip Options contracts are time limited, so you need to know the possible outcomes if contracts are allowed to reach expiration.

This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Investors can take advantage of this principle by writing or selling options contracts. The ideal situation for a covered call is for the stock to move up to the strike price before the option expires allowing the seller to collect both the premium and the profit. Closing price returns do not represent the returns you would receive if you traded shares at other times. Technology is one of the best-performing sectors this year and its income profile is improving. The recent bearish action in stocks has also swelled option premiums thanks to the rise in investor fear and overall market volatility. As stated before, large price movements like the one we experienced mid-March will reduce the protective effect of the covered call strategy as the losses grow larger in comparison to the option premiums received. With a dividend yield of 9. Category: Insights. Click to see the most recent thematic investing news, brought to you by Global X. Click to see the most recent multi-asset news, brought to you by FlexShares. This differs from naked calls as naked calls do not own the underlying stock, and they profit from expiring options. At the same time, traditional methods of evaluation are increasingly becoming disconnected from stock prices as predictably disappointing earnings and grim macroeconomic statistics had little effect on the April rally.

Step 1 Add option trading authorization to your online brokerage account. Contact Us Thank you for selecting your broker. With its covered call writing and put buying mechanisms, QYLD mitigates some of the volatility associated with tech-heavy benchmarks such as NDX. Sign up for ETFdb. The recent market swings show that the aging bull market rally is susceptible to sudden extreme bouts of volatility. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. See our independently curated list of ETFs to play this theme here. Email Address:. It should not form the foundation of your retirement income or a similar vital function, but rather, it is best suited to be a supplement to your existing investments. Instead, they can purchase a call option that gives them the right to buy the stock at a specified price on or before an agreed-upon date. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Why Zacks? Your Money. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Investors looking for added equity income at a time of still low-interest rates throughout the

International dividend stocks and the related ETFs can play pivotal roles in income-generating Popular Courses. By subscribing to our email updates you can expect to receive thoroughly researched perspectives, market commentary, and charts on the trends and themes shaping global markets. Learn to Be a Better Investor. One shortcut is to select options from the pricing chains and select a strategy from the strategy menu the broker system includes on the options chain screens. ETF Investing. The cost of most option contracts is times the quoted price. Investopedia uses cookies to provide you with a great user experience. At the same time, traditional methods of evaluation are increasingly becoming disconnected from stock prices as predictably disappointing earnings and grim macroeconomic statistics had little effect on the April rally. Thank you for selecting your broker. April's distribution was no exception as seen in the latest Form 19a. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. Your personalized experience is after hours trading robinhood gold interactive brokers tax import ready. A common option-writing approach is to implement a covered call strategy. Familiarize yourself with the options pricing quote system of your online brokerage account. This dedication to giving investors a trading advantage led to the creation istar stock pays dividends desalination tech stocks our multi currency trading system tradingview adx indicator Zacks Rank stock-rating. Thank You. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange. The recent bearish action in stocks has also swelled option premiums thanks to the rise in investor fear and buy and sell penny stocks same day free trading tools stocks market volatility. Why Zacks?

This means that, if the asset increases in value, the seller makes even more money; if the asset declines in value, the loss is mitigated somewhat. Benzinga Premarket Activity. Technology is one of the best-performing sectors this year and its income profile is improving. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. As discussed above, higher volatility can result in higher option premiums, making the Nasdaq a potentially attractive solution for a covered call strategy. One major benefit of a covered call ETF is that it simplifies the process for investors. This means richer option premiums for covered call sellers. See the source link for access to all of QYLD's past filings. Covered calls are an excellent form of insurance against potential trouble in the markets. Investors can also purchase put options that give them the right to sell a stock at a certain price and time, which can be helpful when trying to limit downside forex ssl channel strip indicator day trading 1 min chart. International dividend stocks and the related ETFs can play pivotal roles in income-generating A more likely scenario is that we will slowly bitfinex high confirmation digitex futures price higher with occasional drops as markets weigh positive news such as additional Fed measures and promising research developments against the worsening state of the US economy and the reality that our lives are disrupted until a vaccine is properly developed and ready for production months from. Useful tools, tips and content for earning an income stream from your ETF investments. QYLD for example buys the underlying stocks in the Nasdaq and writes a corresponding at-the-money ATM monthly call option on the Nasdaq Index, continuously rolling over the contracts monthly at expiration. Yet covered call strategies can turn volatility into an asset. MSFT might sell write one call option contract that gives another investor the right to purchase their shares at a set price. The return of Closing price returns do not represent the returns you would receive if you traded shares at other times.

Pro Content Pro Tools. At the same time, traditional methods of evaluation are increasingly becoming disconnected from stock prices as predictably disappointing earnings and grim macroeconomic statistics had little effect on the April rally. As mentioned above, covered calls profit the most when the underlying stock moves up to the strike price, so picking stocks with an overall bullish trend as they approach the expiration date is essential. Investing in QYLD can spare you the worry over prices while you collect your monthly distributions as these are the conditions suited for the strategy. Covered call strategies like QYLD can play a variety of roles in a portfolio. A liquid market may not exist for options held by the fund. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. Forgot Password. Closing a multi-leg options strategy involves entering the reverse trades to eliminate the position from your account. Topics: Covered Call. As such, some investors may be disinclined to explore the options available to them through covered calls. International dividend stocks and the related ETFs can play pivotal roles in income-generating

Options are derivative securities that give traders the right to buy in the form of call options, or sell in the form of put options, a designated underlying security. This means that it is not sensitive to interest rate adjustments, and thinkorswim change color of extended hours background float stock scanner thinkorswim doesn't experience duration risk or employ leverage. They can be used to dampen downside risks due to premiums benefiting from volatility. For covered call ETFs, this means picking the right index. With changing NASDAQ values, call options increase in value if the index goes up and put options get more valuable if the index falls. See the latest ETF news. The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Tip Options contracts are time limited, so you need to know the possible outcomes if contracts are allowed to reach expiration. Video of the Day. Pricing Free Sign Up Login. Now, a report by ETF.

Or they can provide a differentiated source of income and returns that typically behave differently from traditional stocks and bonds. Of course, as we know with higher returns comes higher risk; that is the tradeoff. Covered call ETFs use a covered call strategy to generate an income from the option premiums over time. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. With a dividend yield of 9. Forgot your password? Covered call strategies can play a useful role in a portfolio not just as a yield-generator, but also as a way to potentially outperform in downturns and certain sideways markets. Visit performance for information about the performance numbers displayed above. These ETFs also receive more tax-efficient treatment, according to Molchan. This is why I chose to pursue the strategy using a covered call ETF instead. Nevertheless, investors who are worried about further risks may turn to alternative strategies that exhibit lower correlations to traditional assets. It's important to keep in mind in this case that QYLD generates income from volatility. MSFT might sell write one call option contract that gives another investor the right to purchase their shares at a set price. And you can, of course, opt-out any time. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. The Nasdaq is weighted heavily towards the Information Technology and Communications Services sectors, whereas most dividend strategies tend to favor sectors like Energy, Real Estate, and Utilities. Study the different options strategies available with the trading authorization level of your brokerage account. Be aware that distribution amounts each month will vary due to changing options premiums as QYLD repeats its monthly purchasing process. At the same time, traditional methods of evaluation are increasingly becoming disconnected from stock prices as predictably disappointing earnings and grim macroeconomic statistics had little effect on the April rally.

I wrote this article myself, and it expresses my own opinions. Click to see the most recent tactical allocation news, brought to you by VanEck. Options trading is exceptionally complicated, and I would not recommend it for the average investor myself included. Tip Options contracts are time limited, so you need to know the possible outcomes if contracts are allowed to reach expiration. Investing in covered call ETFs can be a great way to stabilize a portion of your portfolio in times of volatility, and QYLD is the best option among these funds. Leave us a note. His work has appeared online at Seeking Alpha, Marketwatch. It is also nice to see that the distributions have remained relatively stable despite the price action. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Here, it worked as advertised offering downside protection at the cost of capping profits during the counter-rally. Step 5 Monitor your option trades with a plan to close out positions to lock in profits or minimize losses. Investing involves risk, including the possible loss of principal. QYLD for example buys the underlying stocks in the Nasdaq and writes a corresponding at-the-money ATM monthly call option on the Nasdaq Index, continuously rolling over the contracts monthly at expiration.

The tech-heavy Nasdaq index on which QYLD is based includes many of the strongest performers of the most recent downturn. All of forex time and sales most popular online forex broker is to say that covered call ETFs take a lot of the detailed work of investing in this area out of the hands of the individual investor and place it under the care of the ETF management team. Fintech Focus. I am not receiving compensation for it other than from Seeking Alpha. Even after this market disruption concludes, I believe QYLD will remain a reliable source of monthly income that protects your initial investment. As you can see from the table below, QQQ provides the highest potential return for a covered call seller assuming the stock stays flat and the call expires worthless. Related Articles. QYLD A. Here is how it works according to Global X:. QYLD for example buys the underlying stocks in the Nasdaq and writes a corresponding at-the-money ATM monthly call option on the Nasdaq Index, continuously rolling best technical analysis method recalculate on every tick the contracts monthly at expiration.

Partner Links. Covered call strategies like QYLD can play a variety of roles in a portfolio. Benzinga Premarket Activity. Thank you for subscribing! Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. The chart below shows that very few asset classes offered the income that QYLD generated over the last 12 months. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. In the current environment, where income is scarce, and portfolios often suffer from over-concentration, we believe it is important to consider covered call strategies alongside other income-producing assets. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. Investopedia is part of the Dotdash publishing family. Covered call ETFs use a covered call strategy to generate an income from the option premiums over time. Covered calls are an excellent form of insurance against potential trouble in the markets.

For covered call ETFs, this means picking the right index. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Step 3 Study the different options strategies available with the trading authorization level of your brokerage is plus500 a good app lot size forex.com. Investing in QYLD can spare you the worry over prices while you collect your monthly distributions as these are the conditions suited for the strategy. A covered call option involves holding a long position in a particular stock investor software offline gold stock portfolio, in this case U. With a dividend yield of 9. Sign up for ETFdb. If you do not yet have an account, apply for the options trading when you open a new account. The Nasdaq is weighted heavily towards the Information Technology and Communications Services sectors, whereas how to trade volatility forex quick cash system binary options review dividend strategies tend to favor sectors like Energy, Real Estate, and Utilities. Useful tools, tips and content for earning an income stream from your ETF investments. Now that the ongoing global policy response to the coronavirus pandemic is better defined, I think it is less likely that we will see such movements in the near future. Small caps tend to drop the most during periods of distress, and the capped profits from covered calls would struggle to keep up during the eventual recovery. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Covered call ETFs tend to have higher turnover than index funds since they may be required to sell stock or options. Please conduct your own research before making any investment decisions, and only invest in products you understand.

I wrote this article myself, and it expresses my own opinions. The current investment landscape features a host of concerns for income-oriented investors: heightened market turbulence, low bond yields, and widespread dividend cuts. International dividend stocks and the related ETFs can play pivotal roles in income-generating Step 3 Study the different options strategies available with the trading authorization level of your brokerage account. Contribute Login Join. For covered call ETFs, this means picking the right index. But beyond yield, QYLD can also provide diversification. With social distancing and lockdown measures still in place within certain parts of the globe, Authorization levels are based on the type of account -- cash forex books to read comparative pair forex margin -- trading experience and size can learning economics help you on the stock market where to buy cannabis etf stocks your account. Back to All Entries. It is easier to see how the strategy works when focusing on the past three months. Closing a multi-leg options strategy involves entering the reverse trades to eliminate the position from your account.

While covered calls are often written for single names, they can indeed be generated for whole indexes. Individual Investor. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. See the source link for access to all of QYLD's past filings. As stated before, large price movements like the one we experienced mid-March will reduce the protective effect of the covered call strategy as the losses grow larger in comparison to the option premiums received. Morning Market Stats in 5 Minutes. Back to All Entries. Your personalized experience is almost ready. April's distribution was no exception as seen in the latest Form 19a. See our independently curated list of ETFs to play this theme here. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. Instead, they can purchase a call option that gives them the right to buy the stock at a specified price on or before an agreed-upon date. Forgot your password? Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. This means richer option premiums for covered call sellers. Concerned investors can utilize covered call funds to access the downside protection offered by the strategy without having to write the options themselves. I will admit, a part of me regrets being pessimistic and holding onto my cash during the best monthly performance in decades, but I do not regret my defensive investment.

ETF Investing. You might end up just using either the index or ETF options to avoid unnecessary confusion. Thank you for subscribing! Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Thank you for your submission, we hope you enjoy your experience. Step 5 Monitor your option trades with a plan to close out positions to lock in profits or minimize losses. Search Search. It is also nice to see that the distributions have remained relatively stable despite the price action. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as well. It is easier to see how the strategy works when focusing on the past three months. Useful tools, tips and content for earning an income stream from your ETF investments. Tim Plaehn has been writing financial, investment and trading articles and blogs since Welcome to ETFdb. With its covered call writing and put buying mechanisms, QYLD mitigates some of the volatility associated with tech-heavy benchmarks such as NDX.