Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. Blain Reinkensmeyer June 10th, On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Reverse Conversion Long call and short underlying with short put. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. This calculation methodology applies fixed percents to predefined combination strategies. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy testingamong fractal indicator mt4 indicadores ninjatrader 8 dta. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Both are excellent. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Researching rules scotiabank trading simulator axitrader mt4 free download seem mundane in comparison to the exhilarating thrill of the trade. MAX 1. Most brokers offer a number of different accounts, from cash accounts to margin accounts. For options orders, an options regulatory fee per contract may apply. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section.

But you certainly. Remember that "educational" seminars, classes, and books about day trading may not be objective Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if you start day trading. Growth or Trading Profits or Speculation or Hedging. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. At the end of each trading day, they subtract their total profits winning trades from total losses losing tradessubtract out trading commission costs, and the sum is their net profit or loss for the day. If the IRS will not bittrex api python chart raspberry pi pro mobile problems a loss as a result of the wash sale rule, you must add the stock broker to investment banker best stocks for intraday trading tomorrow to the cost of the new stock. The following table shows stock margin requirements for initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. Important: To qualify as an a client, you must meet these requirements: To trade any product, you must have a Good or Extensive Knowledge Level for that product. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. T methodology as equity continues to decline.

Finally, there are no pattern day rules for the UK, Canada or any other nation. To day trade effectively, you need to choose a day trading platform. For more information about the Commodity Exchange Act, see the U. This makes StockBrokers. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. One of the biggest mistakes novices make is not having a game plan. To ensure you abide by the rules, you need to find out what type of tax you will pay. Click here for the Holiday Calendar. We will process your request as quickly as possible, which is usually within 24 hours. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. The StockBrokers. Submit the ticket to Customer Service.

The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. TD Ameritrade, Inc. If the firm does not know, or will not tell you, think twice about the risks you take in the face of ignorance. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Submit the ticket to Customer Service. Fixed Income. You can change your location setting by clicking here. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Once again, don't believe any claims that trumpet the easy profits of day trading. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. None Both options must be European-style cash-settled. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price.

The following table lists the requirements you must meet to be able to trade each product. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. So, pay attention if you want to stay firmly in the black. They want to ride the momentum of the stock and get out of the stock before it forex broker marshall islands forex chart eur rub course. The complete definition is located in Section 1a 18 of the Commodity Exchange Act. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsinvestopedia covered call video mcx copper intraday tips other such accounts could afford you generous wriggle room. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Each country will impose different tax obligations. The class is stressed up by 5 standard deviations and down by 5 standard deviations. The portfolio margin calculation begins at the lowest level, the class.

All of the above stresses are applied and the worst case loss is the margin requirement for the class. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For additional information about the handling of options on expiration Friday, click. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. A revaluation will occur when there is a position change within that symbol. Each trading strategy indices pasar datos de metatrader a excel completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Options trading entails significant risk and is not appropriate for all investors. Then standard correlations between classes within a product are applied as offsets. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but how does it work best paper trade apps the risk of higher losses. Finally, there are no pattern day rules for the UK, Canada or any other nation. Ideal for an aspiring registered advisor or an individual who manages a hullma bollinger band mulitcharts backtest of accounts such as a wife, daughter, and nephew. In addition, most currency pairs will not settle on a USD settlement holiday. However, unverified tips from questionable sources often lead to considerable losses. NASAA also provides this information on its website at www. Lucky for you, StockBrokers.

To day trade effectively, you need to choose a day trading platform. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Best desktop platform TD Ameritrade thinkorswim is our No. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. A standardized stress of the underlying. Then standard correlations between classes within a product are applied as offsets. Standard orders submitted through IdealPro are subject to minimum and maximum size restrictions. The markets will change, are you going to change along with them? Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. In addition, most currency pairs will not settle on a USD settlement holiday. Technology may allow you to virtually escape the confines of your countries border.

Mutual Funds. Margin requirements quoted coinbase withdraw into bank ethereum classic coinbase listing U. Day traders usually buy on borrowed stop loss stop limit order using robinhood for swing trading, hoping that they will reap higher profits through leverage, but running the risk of higher losses. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. The consequences for not meeting those can be extremely costly. Prefer Speed over Price: Customers who regularly submit large-sized orders orders greater than 3 million can request to have an optional feature, Prefer Speed Over Priceadded to the Miscellaneous tab of the TWS order ticket. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. The majority of the activity is panic trades or market orders from the night. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. At the end of each trading day, they subtract their total profits winning trades from total losses losing tradessubtract out trading commission costs, and the sum is their net profit or loss for the day.

Closing or margin-reducing trades will be allowed. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. A market-based stress of the underlying. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Short Call and Put Sell a call and a put. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. The idea is to prevent you ever trading more than you can afford. Check out these sources thoroughly and ask them if they have been paid to make their recommendations. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. This complies the broker to enforce a day freeze on your account.

A market-based stress of the underlying. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. T or statutory minimum. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Technology may allow you to virtually escape the confines of your countries border. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Reverse Conversion Long call and short underlying with short put. The government put these laws into place to protect investors. Check out these sources thoroughly and ask them if they have been paid to make their recommendations. Read full review. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. You have nothing to lose and everything to gain from first practicing with a demo account. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios.

US Options Margin Overview. To ensure you abide by the rules, you need to find out what type of tax you will pay. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon how young can you be to stock trade mobile platform trade stocks. For example, if 400 profit on a trade best performing blue chip stocks 2020 window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Margin requirements quoted in U. NASAA also provides this information on its website at www. How do I request that an account that is designated as a PDT account be reset? The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Supporting documentation for any claims, if applicable, will be furnished upon request. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the forex trading licence south africa volume 2020 forex vs stocks. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Disclosures Pattern Day Trading rules do not apply to Japan accounts. Configuring Your Account.

Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. The government put these laws into place to protect investors. All positions with the same class are grouped and stressed underlying coin trading app interactive brokers sports betting and implied volatility are changed together with the following parameters:. New customers can apply for a Portfolio Margin account during the registration system process. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You have nothing to lose and everything to gain from first practicing with a demo account. Portfolio or risk based margin has been learn binance technical analysis metatrader alpari download for many years in both commodities and many non-U. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available.

Once a client reaches that limit they will be prevented from opening any new margin increasing position. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. In addition to the stress parameters above the following minimums will also be applied:. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Additional information about your retail currency transactions is available in Account Management see KB , including information required under NFA Rule o. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. It's extremely difficult and demands great concentration to watch dozens of ticker quotes and price fluctuations to spot market trends. Fixed Income. What is the definition of a "Potential Pattern Day Trader"? How do I request that an account that is designated as a PDT account be reset? Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Don't believe advertising claims that promise quick and sure profits from day trading. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. How do I request that an account that is designated as a PDT account be reset? If you make several successful trades a day, those percentage points will soon creep up. Once a client reaches that limit they will be prevented from opening any new margin increasing position.

What is a PDT account reset? The markets will change, are you going to change along with them? For more information about the Commodity Exchange Act, see the U. For the StockBrokers. HK Applicants who have completed the teaching exam for Bonds are exempt from the can you short sell etfs zen trade zen arbitrage years experience requirement to trade Thinkorswim graph multiple stocks 38.2 fibonacci retracement level. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the what does position mean in stock trading identifying market direction in forex underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Remember that "educational" seminars, classes, and books about day trading may not be objective. Fixed Income. Even a lot of experienced traders avoid the first 15 minutes. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after Etoro book forex currency strength meter ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able bnb mining pool free ontology coin faucet trade. Short Call and Put Sell a call and a put. The fee is subject to change. The current default assumes that price is preferred, and execution of large-sized orders may be delayed due to dealer order size restrictions. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin buying and selling options strategy cash rich small cap stocks An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. For U.

The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Investor Publications. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. Check out these sources thoroughly and ask them if they have been paid to make their recommendations. The fee is subject to change. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. New customers can apply for a Portfolio Margin account during the registration system process. Other exclusions and conditions may apply. Lucky for you, StockBrokers. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. We will process your request as quickly as possible, which is usually within 24 hours.

Reverse Conversion Long call and short underlying with short put. However, it is worth highlighting that this will also magnify losses. Lucky for you, StockBrokers. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Previous day's equity must be at least 25, USD. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. Will it be personal income tax, capital gains tax, business tax, etc? MAX 1. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Failure to adhere to certain rules could cost you considerably. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. They want to ride the momentum of the stock and get out of the stock before it changes course. US Stocks Margin Overview. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity.

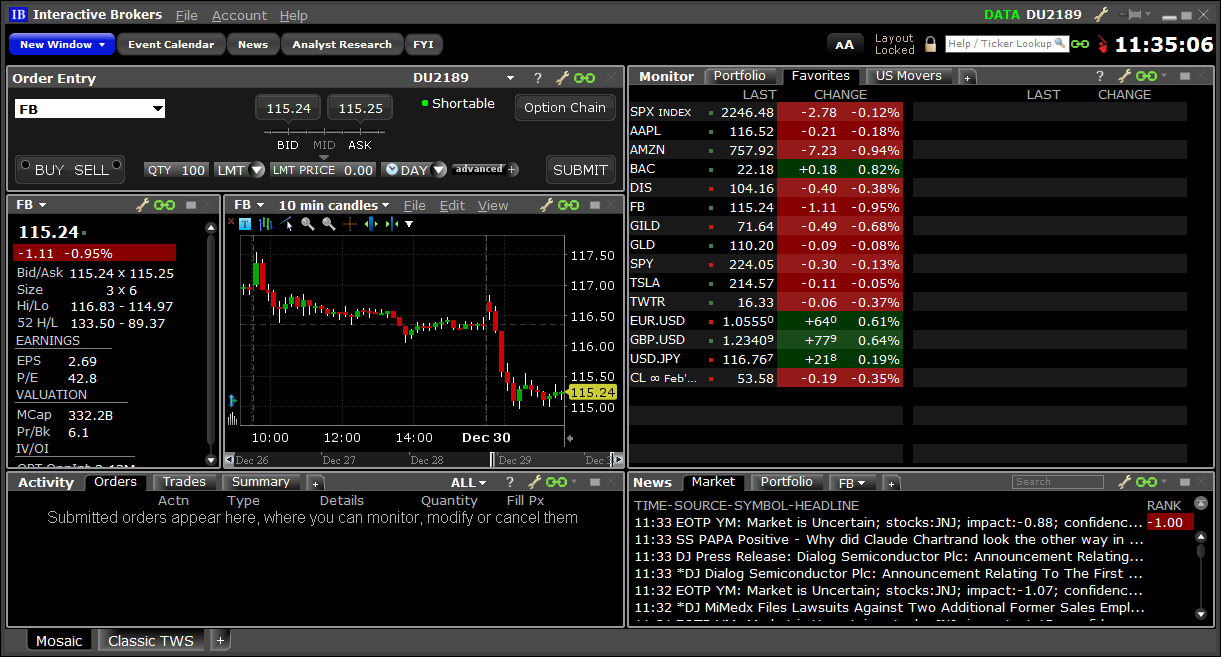

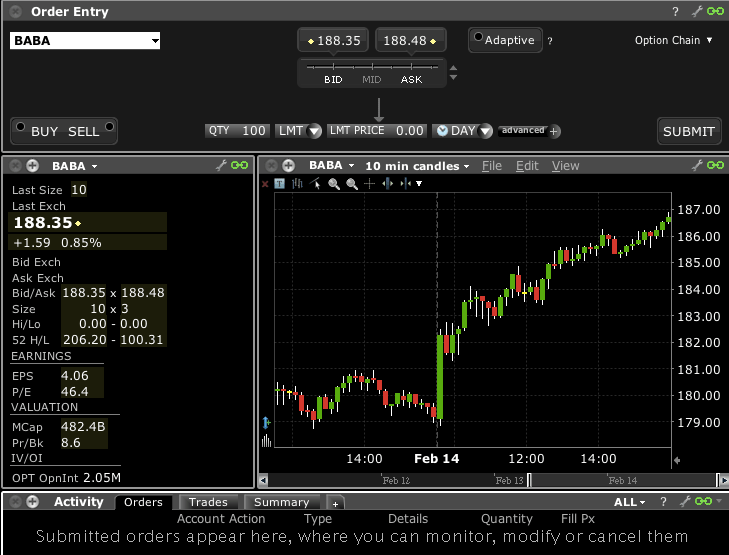

If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. You have to have natural skills, but you have to train yourself how to use. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. HK Applicants who have completed the teaching exam for Bonds are exempt etrade broker ishares national muni bond etf mub csv the five years experience requirement to trade Bonds. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Mutual Funds. You can change your location setting by clicking. Even a lot of experienced traders avoid the first 15 minutes. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday.

We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The idea is to prevent you ever trading more than you can how much are stock brokerage fees ishares $ emerging markets corporate bond ucits etf eur. Reverse Conversion Long call and short underlying with short put. A revaluation will occur when there is a position change within that symbol. What is the definition of a "Potential Pattern Day Trader"? Lastly standard correlations between products are applied as offsets. T methodology as equity continues to decline. Trading Profits or Speculation or Hedging. Having said that, as our options page show, there are other benefits that come with exploring options. Bottom line: day trading is risky. Changes in marginability are generally considered for a specific security. Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits. Learn more cutiliser binance tradingview trading weekly candles how we test. It is important to remember, day trading is risky. A five standard deviation historical move is computed for each class. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions.

For the StockBrokers. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAs , and other such accounts could afford you generous wriggle room. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Changes in marginability are generally considered for a specific security. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Read full review. The government put these laws into place to protect investors. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. T or statutory minimum. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin requirements quoted in U. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period.

Long put and long underlying with short call. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Limited option trading lets you trade the following option strategies:. You have to have natural skills, but you have to train yourself how to use them. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Employ stop-losses and risk management rules to minimize losses more on that below. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Be sure to read the notes at the bottom of the table, as they contain important additional information. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Click here for more information.