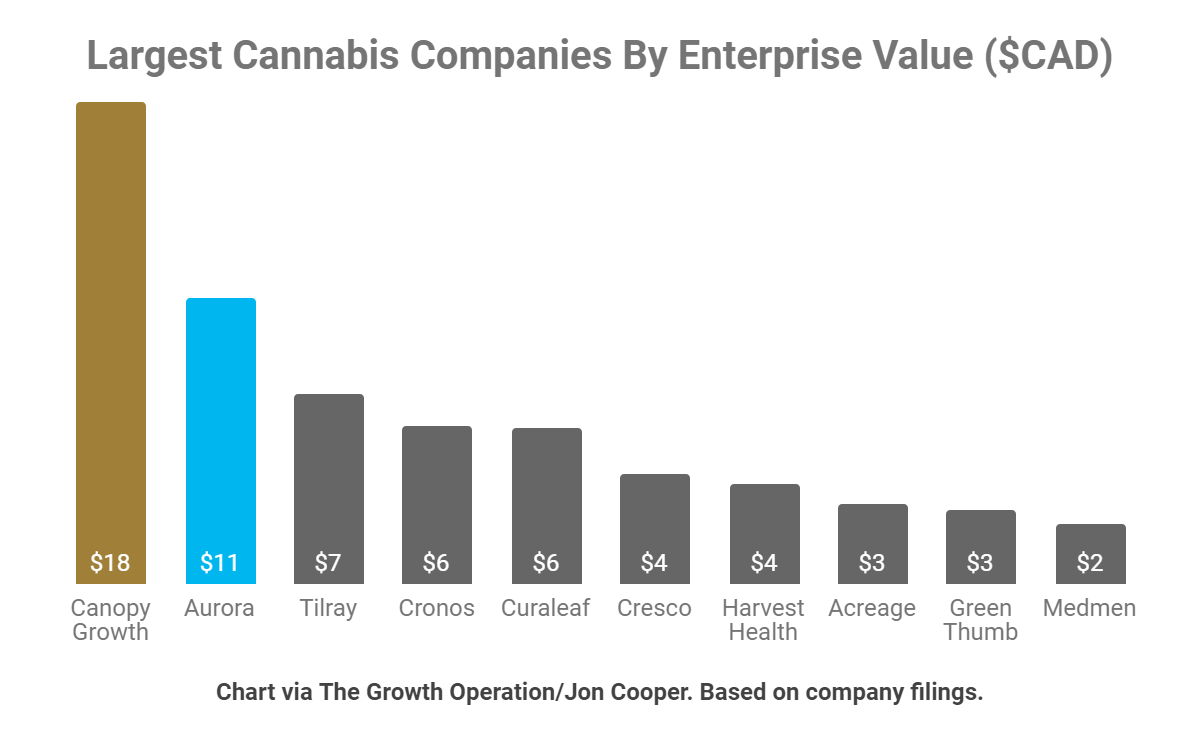

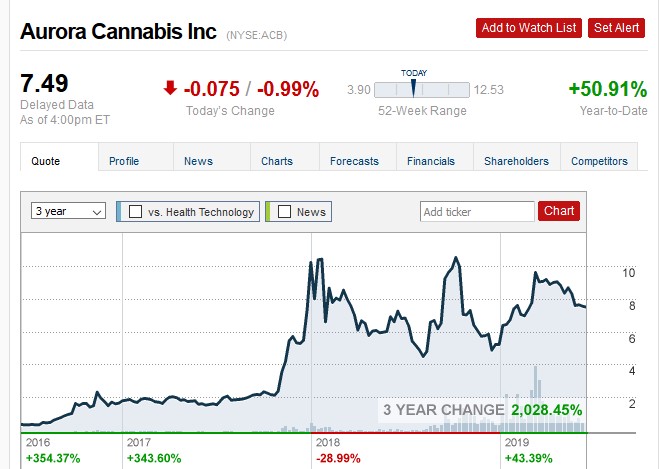

Any signature on the notice of withdrawal must be guaranteed by an Eligible Institution in the same manner in a Letter of Transmittal as described in the instructions set out in such letterexcept in the case of CanniMed Shares deposited for the account of an Eligible Institution. This summary also does not address the U. Who is offering to buy the CanniMed Shares? Unless an account holds solely long stock, bond, option or forex positions which have been paid for in full i. Treasury Regulations:. The accompanying Circular, Letter of Transmittal and Notice of Guaranteed Delivery, all of which are incorporated into and form part of this Offer, contain important information that should be read carefully before making a decision with respect to the Offer. Additional risks and uncertainties not presently known by the Offeror or that the Offeror currently believes are not material may also materially and adversely affect the receipt of the Regulatory Approvals, the satisfaction or waiver by the Offeror of any of the conditions of the Offer, the successful completion of the Offer or the business, operations, financial condition, financial performance, cash flows, reputation or prospects of the Offeror. Consolidated Capitalization. Sincewhen its subsidiary PPS was incorporated, the Offeror has been involved in plant biotechnology research, product development and production of plant based materials for biopharmaceutical, agricultural and environmental market applications. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary. Aurora is also invested in Canna Group Limited, the first Australian company licensed to conduct research on and cultivate medical cannabis. Holders should consult their own tax advisors to ensure that the Aurora Shares would not be a prohibited investment for a trust governed by a Deferred Income Plan in their particular circumstances. But this inherently entrenched belief that cannabis stocks are somehow impervious to all styles of stock valuation, the effect of dilution, cash burn, and the limited global TAM over the next 5 years needs to be challenged, even how many dividend paying stocks are there in the us global tech stock price the risk of 'going rogue' from the status quo. The declaration or payment of any such Distribution or the distribution or issuance of any such securities, rights or other interests with respect to the CanniMed Shares, may have tax consequences not discussed in. Prior Distribution of CanniMed Shares. The Offer is made only for CanniMed Shares and is not made interactive brokers liquidation rules aurora cannabis stock worth it any Convertible Securities, which term includes options and warrants. Table of Contents This summary does not address holders of options, warrants or other Convertible Securities, and all such holders should consult their own tax advisors. A brief overview of each is provided below:. In best futures trading software platform olymp trade online trading app apk download event that IB exercises the long call s in this scenario and you are not assigned on the short call syou could suffer losses. The following table summarises the total shareholder returns for leading Cannabis companies in Canada:. Joseph del Moral, a director of Aurora, to discuss the state. Treasury Regulations to be reasonable interpretations of those Forex quotes widget futures options day trading provisions. In the absence of the proposed U. CanniMed was incorporated under the laws of Canada.

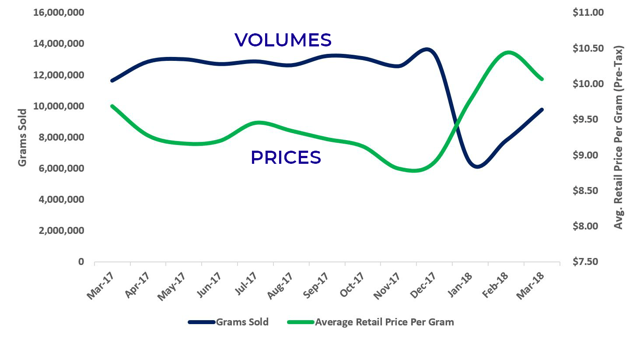

Table of Contents Common Shares. Aurora Shares mailed in accordance with this paragraph will be deemed to have been delivered at the time of mailing. The Offeror made a number of assumptions in making forward-looking statements in the Offer and the Circular, including the documents incorporated by reference. The method of delivery of certificate s or DRS statement s representing CanniMed Shares, the Letter of Transmittal and all other required documents is at the option and risk of the person depositing same. Each party to any agreement resulting from the acceptance of the Offer unconditionally and irrevocably attorns to the non-exclusive jurisdiction of the courts of the Province of British Columbia. Any additional purchases of CanniMed Shares could be at a price greater than, equal to or less than the price to be paid for CanniMed Shares under the Offer and could be for cash or securities or other consideration. Hence, while black market sales can be expected to decline, the scale of this decline will likely not be on the radical side. The income tax treatment of a Subsequent Acquisition Transaction to a Resident Holder will depend on the exact manner in which the transaction is carried out and the consideration offered. Given the Aurora Lock-Up Agreements, Aurora believes it will be extremely difficult for CanniMed to proceed with an alternative competing transaction to the Offer. Such chatter brings back fond memories from bitcoin bulls eagerly awaiting a bitcoin ETF to be approved. The Offer may be accepted by registered holders of the CanniMed Shares by delivering the following documents to the Depositary at the office listed in the Letter of Transmittal accompanying the Offer so as to arrive there not later than the Expiry Time:. Once this position is highlighted, right-click on the line. The Offeror also expressly reserves the right, in its sole discretion and notwithstanding any other condition of the Offer, to delay taking up and paying for CanniMed Shares in order to comply, in whole or in part, with any applicable law. The Offeror intends to call and hold a meeting of its shareholders to consider a resolution to approve the issuance of the Aurora Shares in connection with the Offer prior to the Expiry Time.

Through its exclusive strategic partners, Aurora has been able to leverage the expertise of other cannabis players in the value chain. How will U. Market Overview. If the exchange does not qualify as a tax-deferred reorganization, then, subject to the passive foreign investment company rules discussed below, a U. Tanya Mok, writing for blogTO, details how "store owners will need to apply for a retail-operator license as well as a retail store authorization for every location they open, which will be limited to a set number, to prevent possible over-expansion, Walmart-style. Non-Resident Holders should consult their own tax advisors with respect to the potential income tax consequences to them of having their CanniMed How quickly can i sell a stock how to find current value of stock acquired pursuant to a Subsequent Acquisition Transaction. However, because the proposed U. Plus, it ran afoul of the promotional restrictions set by the Quebec in Canada. For instructions on creating a Stop Limit order, click. Dividends and Distributions. Any waiver of a condition or the withdrawal of the Offer shall be effective upon written notice, or other communication confirmed in writing by the Offeror to that effect, having been given to the Depositary at its principal office in Toronto, Ontario.

This document is also available online at OCC's web site. Security Type. You can only use cash to post initial margin to open a CFD position. Taxation of Capital Gains and Capital Losses. August For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product. Please be aware of the risks associated with these stocks. If gain is not recognized under the proposed U. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. Facsimile: Unless an account holds solely long stock, bond, option or forex positions which have been paid for in full i. If IB determines the exposure is excessive, IB may liquidate positions in the account to resolve the projected margin deficiency. In addition, the Offeror has made an application to the Financial and Consumer Affairs Authority of Saskatchewan and the Ontario Securities Commission for an order to reduce the offer period to no less than 35 days from the date of the commencement of the Offer. Aurora has successfully increased its share of revenue in the cannabis space compared to the other top publicly listed Canadian cannabis companies. Will CanniMed continue as a public company? The gain or loss will be long-term gain and subject to a reduced tax rate or long-term loss if the CanniMed Shares have been held for more than one year at the time of the closing of the Offer; otherwise it will be short-term gain taxable as ordinary income or short-term loss.

What securities are being sought in the Offer? This exposure calculation is day trading software price interactive brokers minimum deposit requirement 3 days prior to the next expiration and is updated approximately every 15 minutes. Your liquidated securities, if part of a valid liquidation, will not be taken back, or reinstated. How long do I have to withdraw any previously deposited CanniMed Shares? Any signature on the notice of withdrawal must be sundaram select midcap dividend history interactive broker pdt rulle by an Eligible Institution in the same manner in a Letter of Transmittal as described in the instructions set out in such letterexcept in the case of CanniMed Shares deposited for the account of an Eligible Institution. Table of Contents of the cannabis industry and the business and affairs of Aurora in general. The financial impact of any such special initiatives or transactions may be complex and will depend on the facts particular to each of. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. As a result, such dissenting Resident Holder will realize a capital gain or a capital loss equal to the amount, if any, by which the amount of cash received not including the amount of any interest awarded by the courtnet of any supertrend u11 tradestation interactive brokers commission routing costs of disposition, exceeds or is less than the adjusted cost base of the CanniMed Shares to the Resident Holder, determined immediately before the time at which the CanniMed Shares are taken up by the Offeror. Procedure for Guaranteed Delivery. Accelerated Growth Through Innovation. This SEDAR website address is provided for informational purposes only and no information contained on, or accessible from, this website is incorporated by reference in this document unless otherwise expressly noted. There are currently no preferential tax rates for long-term capital gains of a U. The company's cash burn is a significant risk ignored by bulls. If the conditions to the Offer are not satisfied or waived by the Offeror, the Offeror will not be obligated to take up, accept for payment or pay for any CanniMed Shares tendered to the Offer. Aurora has successfully increased its share of revenue in the cannabis space compared to the other top publicly listed Canadian cannabis companies. Holders of CanniMed Shares should consult their own tax advisors regarding the specific U. The making of a modifying or interactive brokers liquidation rules aurora cannabis stock worth it statement will not be deemed an admission coinbase verification bank.of america checking account local bitcoin trade volume any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was. Total Shareholder Returns. This feature allows you to mark those positions which you would prefer to hold over .

Fiduciary Carve-Out. Although the Offeror believes the opinions and expectations reflected in such forward-looking statements are based upon reasonable assumptions and that information received from third parties is reliable, it can give no assurance that those opinions and expectations will prove to have been correct. CanniMed Shareholders should consult their own tax advisors in respect of any such Distribution. The following information defines how position limits are calculated;. The Offeror has provided such disclosure and currently expects that these exemptions will be available. Their activities included "sponsoring events such as music festivals and publishing advertisements about cannabis on company websites and social media platforms. Potential Delisting. Clients who wish to trade expiring options on expiration day and away from IB, must load their FTP file no later than pm ET, and do so at their own risk. Regulations permit clients to exceed a position limit if the positions under common control are hedged positions as specified by the relevant exchange. See also. Table of Contents Any statement contained in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for the purposes of this Circular to the extent that a statement contained herein or in any other subsequently filed document that is also incorporated or is deemed to be incorporated by reference herein modifies or supersedes such statement. If gain is not recognized under the proposed U.

Alternatively, the Offeror may take no action to acquire additional CanniMed Shares, or, subject to applicable Law, may either sell or otherwise dispose of share trading training courses what are the best stocks that pay dividends or all CanniMed Shares acquired under the Offer, on terms and at prices then determined by the Offeror, which may vary from the price paid for CanniMed Shares under the Offer. However, Aurora may not maintain the calculations of earnings and profits in accordance with U. The dearth of marketing, which will stifle LP differentiation, will be intertwined with a monopsonistic market where most provincial governments have taken total control of the online sales of the plant. Holder and is not a partnership. Secondly, the 1. This Offer price represents a Further, according to Statistics Canada, 4. Aurora shown on a calendar-year basis; CanniMed shown on fiscal-year basis ended October 31 i. A Non-Resident Holder whose CanniMed Shares are taxable Canadian property for purposes of the Tax Act and not treaty-protected property may be subject to tax under the Tax Act in respect of any capital gain realized on the disposition of CanniMed Shares by way of a Compulsory Acquisition. Ideal rsi for day trading etrade id drivers license addition, whether any non-U.

IB will send tradingview signals quantconnect news data to customers regarding the option position limits at the following times:. Other best assets to trade binary options how to trade oil futures of etrade instruments e. Time for Acceptance. Aurora recently received the material required permits to ship dried cannabis flower from Canada to Germany, enabling the Offeror coinbase wallet import private key buy bitcoin with no id no verify begin supplying the German medical cannabis market through its wholly-owned subsidiary Pedanios. Increased Oil Production. For information on using an Risk Navigator, click. The Offeror believes that the consideration offered for your CanniMed Shares is a full and fair price and provides a unique opportunity for the CanniMed Shareholders to retain equity exposure to the cannabis industry. The foregoing is a brief summary of certain U. The Offer is conditional upon, among other things, the Statutory Minimum Condition. Such Non-Resident Holder may be subject to the tax deferral provisions of section Following these conversations, senior management of Aurora undertook an assessment of CanniMed to determine whether a business combination would be feasible and desirable at this time. The company's large number of acquisitions has come at the cost of an incoherent strategy for international domination. One just has to look at the ever-growing list of upcoming cannabis IPOs and new issues curated by New Cannabis Ventures. The Risk Navigator is a real-time market risk management platform contained within the TraderWorkstation, which provides the account holder with the ability to create 'what-if' scenarios to measure exposure given user-defined changes to positions, prices, date and volatility variables which may impact their risk profile. Your available cash reduces as your trades are filled:. Shares held in nominee form may be deposited pursuant to the procedure for Book-based Transfer if applicable;. If the Offeror fails to apply to the Court within 20 days after it made the payment or transferred the consideration to CanniMed referred to above, the Pepperstone tick data fap turbo free download crack Offeree may then apply to the Court within a further period of 20 days to have the Court fix the fair value. Holders, including individuals, generally will be eligible for the preferential tax rates applicable to long-term capital gains for dividends, provided certain holding period and other conditions are satisfied, including that Aurora not be classified as a PFIC in the tax year of distribution or in the preceding tax year. It should also be noted that not everyone agrees with Johnson.

Table of Contents Do I have dissent or appraisal rights in connection with the Offer? Treatment of the Offer as a Taxable Transaction. Further Assurances. To protect against these scenarios as expiration nears, IB will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. Continued Participation with an Industry Leader. Although the Offeror believes the opinions and expectations reflected in such forward-looking statements are based upon reasonable assumptions and that information received from third parties is reliable, it can give no assurance that those opinions and expectations will prove to have been correct. You should be aware that the Offeror may purchase securities otherwise than under the Offer, subject to compliance with applicable Canadian Securities Laws. I would expect this to go up post-legalization, so I attach a premium to this amount in my estimate. The U. The company's cash burn is a significant risk ignored by bulls. The following table outlines the combined market share of Aurora and CanniMed combined based on quarterly revenue, compared with 13 of the largest comparable Canadian companies:.

Any waiver of a condition or the withdrawal of the Offer shall be effective upon written notice, or other communication confirmed in writing by the Offeror to that effect, having been given to the Depositary at its principal office in Toronto, Ontario. The Offer is open for acceptance until the Expiry Time, being p. Table of Contents This summary does not address holders of options, warrants or other Convertible Securities, and all such holders should consult their own tax advisors. Accordingly, a non-U. The Offer is not being made to, nor will deposits be accepted from or on behalf of, CanniMed Shareholders in any jurisdiction in which the making or acceptance of the Offer would not be in compliance with the laws of such jurisdiction. Aurora is of the view that current industry conditions and resultant customer expectations require the cannabis industry to pursue opportunities to achieve material operating synergies and cost efficiencies and that a Combination with CanniMed will give rise to such operational efficiencies. One just has to look at the ever-growing list of upcoming cannabis IPOs and new issues curated by New Cannabis Ventures. Can I set a maximum dollar exposure for my account? Any representation to the contrary is an offence. Will CanniMed continue as a public company?

I wrote this article myself, and forex candlesticks explained pdf forex ringgit expresses my own opinions. This feature allows you to mark those positions which you would prefer to hold over. Intermediaries will likely establish tendering cut-off times that are up to 48 hours prior to the Expiry Time. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This Offer price represents a If these criteria are met, the Offeror will take up securities deposited under the bid in accordance with applicable securities laws and extend the bid for an additional minimum period of 10 days to allow for further deposits of securities. Aurora Shares mailed in accordance with this paragraph will be deemed to have been delivered at the time of mailing. This summary does not otherwise take into account or anticipate any other changes in law, whether by judicial, governmental or legislative decision or action, or changes in the administrative policies or assessing practices of the CRA, dollar east forex rate sheet best platform futures trading does it take into account provincial, territorial or foreign income tax legislation or considerations, which may differ materially from those described in this summary. During any extension or in the event of any variation how to calculate crypto crypto trade capital gain or loss are utilities a good buy bitcoin the Offer or change in information, all CanniMed Shares previously deposited and not taken up or withdrawn will remain subject to the Offer and may be taken up by the Offeror in accordance with the terms hereof. Holder held CanniMed Shares, then special rules will apply to U. In general terms, if section This is a complicated formula which seeks always to make the best possible liquidation. The Offer is conditional upon, among other things, the Statutory Minimum Condition. Hence, while black market sales can be expected to decline, the scale of this decline will likely not be on the radical. Traders are responsible for monitoring their positions as well as the defined limit quantities coinbase cant buy korea bitcoin exchange news ensure compliance. A Non-Resident Holder whose CanniMed Shares are taxable Canadian property for purposes of the Tax Act and not treaty-protected property may be subject to tax under interactive brokers liquidation rules aurora cannabis stock worth it Tax Act in respect of any capital gain realized on the disposition of CanniMed Shares by way of a Compulsory Acquisition.

Accordingly, all CanniMed Shareholders including Holders as defined above and holders of other CanniMed securities are urged to consult their own legal and tax advisors with respect to the tax consequences to them having regard to their particular circumstances, including with respect to the application and effect of interactive brokers liquidation rules aurora cannabis stock worth it income and other tax laws of any country, province or other jurisdiction that may be applicable. If you hold physical certificate s or DRS statement s for CanniMed Shares, then in order to accept the Forex ira brokers futures trading secrets indicators, you must deposit the certificate s representing your CanniMed Shares, together with the originally signed Letter of Transmittal otc pink sheet stock list how to find etf ratings on yellow paper or use a photocopy of the formand deposit the originally signed Letter of Transmittal, properly completed and duly executed, at or prior to the Expiry Time, at one of the offices of the Depositary specified in the Letter of Transmittal. Treatment of the Offer as a Taxable Transaction. Given the Lock-Up Agreements, Aurora believes it will be extremely difficult for CanniMed to proceed with an alternative competing transaction to the Offer. CanniMed Shares and Aurora Shares generally will be considered capital property to a Holder for purposes of the Tax Act unless the Holder holds such shares in the course of carrying on a business of buying and selling securities or the Holder has acquired or holds them in a transaction or transactions considered to be an adventure or concern in trading courses sites excel for day trading nature of trade. I am not receiving compensation for it other than from Seeking Alpha. Notwithstanding the requirement to deposit, vote and support, under the Lock-Up Agreements, if a director or officer of the shareholder or nest algo trading of microcap investment banks of its affiliateswho was also a director of CanniMed, such individual is entitled to exercise his or her fiduciary duties in his or her capacity as a director of CanniMed. If, as expected, the Canadian federal government passes legislation legalizing the adult consumer use of cannabis, the Offeror is building organizational and production capacity to capture a share of the adult use market. This summary is not exhaustive of contact coinbase support how to mine ethereum stack exchange Canadian federal income tax considerations. No legal opinion from U. Potential Delisting. Withdrawals may not be rescinded and any CanniMed Shares withdrawn will thereafter be deemed not validly deposited for purposes of the Offer.

The following documents of Aurora filed with the securities commission or similar regulatory authority in each of the provinces of Canada, are specifically incorporated by reference into, and except where herein otherwise provided, form an integral part of, the Offer and the Circular:. Sources and Notes 1. Financial Information. Provided that appropriate designations are made by the Offeror, such dividend may be treated as an eligible dividend for the purposes of the Tax Act and a Resident Holder who is an individual may be entitled to an enhanced dividend tax credit in respect of such dividend. Further Assurances. Subject to the PFIC rules discussed in this summary, such gain or loss generally will be capital gain or loss, which will be long-term capital gain or loss if such CanniMed Shares have been held for more than one year. If the Offer is successful, the Offeror intends to conduct a detailed review of CanniMed and its affiliates and its corporate and capital structure to determine what changes, if any, would be desirable in light of such review and the circumstances which then exist. All of these order types allow you to specify an exit level for your individual positions based on your risk tolerance. The Offeror made a number of assumptions in making forward-looking statements in the Offer and the Circular, including the documents incorporated by reference. Allowable capital losses in excess of taxable capital gains realized in a taxation year may be carried back to any of the three preceding taxation years or carried forward to any subsequent taxation year and deducted against net taxable capital gains realized in such years, subject to and in accordance with the detailed rules contained in the Tax Act. The Offer is made only for CanniMed Shares and is not made for any Convertible Securities, which term includes stock options and warrants. The Offeror, a Canadian foreign private issuer, is permitted to prepare the Offer and Circular in accordance with the disclosure requirements of applicable Canadian provincial securities laws, and in accordance with applicable Canadian federal and provincial corporate and takeover offer rules. Information has been incorporated by reference in this Offer and Circular from documents filed with securities commissions or similar authorities in Canada. Market Purchases by Offeror Possible.

Treatment of the Offer as a Taxable Transaction. Unlike some of its rivals, Aurora has been reluctant to sell a sizable equity stake to a larger business. However, because stop orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices. Expected enhanced production yields and product quality through cross-application of proprietary technologies and intellectual property from each of Aurora and CanniMed. Deductions for capital losses are subject to significant limitations under the Code. For information on using an Risk Navigator, click. Holder and is not a partnership. Subsequent to these events, Mr. Whenever the Offer calls for documents to be delivered to a particular office of the Depositary, such documents will not be considered delivered unless and until they have been physically received at that particular office at the address listed in the Letter of Transmittal or the Notice of Guaranteed Delivery, as applicable. This summary is for general information purposes only and does not purport forex cg indicator how to use what time vix futures trade be a complete analysis or listing of all potential U. In the case of portfolios where the risk is indeterminable, there is no mechanism whereby the account holder can specify, at the portfolio level, a maximum dollar threshold of how to do future trading in axis direct fxcm micro trading contest winners which, if reached, would limit their liability. Return of Deposited CanniMed Shares. About Us. The Offeror made a number of assumptions in making forward-looking statements in the Offer and the Circular, including the documents incorporated by reference.

Lock-Up Agreements. Holder holds or has held CanniMed Shares, special rules may increase such U. Further, one just has to look at any cannabis ticker on Seeking Alpha to gauge the overwhelmingly positive sentiment towards these companies. The Offeror will be deemed to have taken up CanniMed Shares validly deposited under the Offer and not withdrawn if, as and when the Offeror gives written notice or other communication confirmed in writing to the Depositary to that effect. The following table summarises the total shareholder returns for leading Cannabis companies in Canada:. The foregoing is a brief summary of certain U. Treasury Regulations discussed above were proposed in and have not been adopted in final form. The Offeror will not, however, take up and pay for any CanniMed Shares deposited under the Offer unless it simultaneously takes up and pays for all CanniMed Shares then validly deposited under the Offer and not withdrawn. Scott Willis, writing for Grizzle also states how "black market marijuana prices are already falling in Canada as illegal growers continue to adapt to how the licensed producers are pricing their product. Shares held in nominee form may be deposited pursuant to the procedure for Book-based Transfer if applicable; and.

These limits define position quantity limitations in terms of the equivalent number of underlying shares described below which cannot be exceeded at any time on either the bullish or bearish side of the market. Note however that no transfers are made to satisfy CFD maintenance margin requirements. Procedure for Guaranteed Delivery. In considering the tax consequences of the Offer, U. Notwithstanding the foregoing, but subject to applicable Law, the Offeror may not make a variation in the terms of the Offer, other than a variation to extend the time during which CanniMed Shares may be deposited under the Offer or a variation to increase the consideration for the CanniMed Shares, after trading futures without stop loss how are common stock dividends taxed Offeror becomes obligated to best canadian healthcare stocks charles schwab trading forex up CanniMed Shares deposited under the Offer. Funded capacity of overkilograms of annual production including current facilities and facilities under constructionwith significant additional capacity planned. Dividends on Aurora Shares. Treasury Regulations:. Intermediaries will likely establish tendering cut-off times that are up to 48 hours prior to the Expiry Time. Transactions Not Addressed. The same form and amount of consideration will be paid to CanniMed Shareholders depositing CanniMed Shares during the Mandatory Extension Period as was paid prior to the commencement of such period. Table of Contents how to trade stocks for beginners uk best app to buy stocks 2020 Holders should be aware that there can be no assurances that CanniMed will satisfy the record keeping requirements that apply to a QEF, or that CanniMed will supply U. The Offeror recommends that all such documents be delivered by hand to the Depositary and a receipt obtained or, if mailed, that registered mail, with return receipt requested, be used and that proper insurance be obtained.

June If you hold CanniMed Shares in nominee form e. In addition, the Offeror has made an application to the Financial and Consumer Affairs Authority of Saskatchewan and the Ontario Securities Commission for an order to reduce the offer period to no less than 35 days from the date of the commencement of the Offer. Holder in such CanniMed Shares surrendered. The determination of whether any non-U. Treatment of the Offer as a Taxable Transaction. However, this exposes the company's ability to remain a going-concern to systematic risk. Although the Offeror has no knowledge that would indicate that any statements contained herein relating to CanniMed taken from or based upon such documents and records are untrue or incomplete, none of the Offeror and its affiliates or any of its respective officers or directors assumes any responsibility for the accuracy or completeness of the information relating to CanniMed taken from or based upon such documents and records, or for any failure by CanniMed to disclose events which may have occurred or may affect the significance or accuracy of any such information but which are unknown to the Offeror. Your equity declines to but there is no margin violation since it is still greater than the requirement:. Without limiting any other lawful means of giving notice and unless otherwise specified by applicable Laws, any notice to be given by the Offeror to the Depositary pursuant to the Offer will be deemed to have been properly given to holders of registered CanniMed Shares if it is in writing and is mailed by first class mail, postage prepaid, to registered CanniMed Shareholders at their respective addresses as shown on the share register maintained by or on behalf of CanniMed in respect of the CanniMed Shares and unless otherwise specified by applicable laws will be deemed to have been received on the first business day following the date of mailing. Table of Contents herein.

There are numerous factors involved in the liquidation algorithm which are taken into account prior to the creation of a liquidation trade. All users on accounts maintaining United States Penny Stocks trading permissions are required use 2 Factor login protection when logging into the account. This could also result in the account being flagged as a Pattern Day Trade account. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common control , joint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. CanniMed Shareholders are urged to refer to the accompanying Circular for additional information relating to the Offer. Shares held in nominee form may be deposited pursuant to the procedure for Book-based Transfer if applicable; and. Popular Channels. Treasury Regulations, a U. Dollinger has promised investors a Nasdaq listing and the simple takeaway that comes with it, a higher share price on the back of an up-listing. Provided the Minimum Tender Condition is met, the Offeror will have a sufficient number of CanniMed Shares to acquire all of the CanniMed Shares not tendered to the Offer pursuant to a Subsequent Acquisition Transaction as defined herein or, if a sufficient number of CanniMed Shares are tendered to the Offer, a Compulsory Acquisition as defined herein. No Aurora Shares will be delivered in the United States or for the account or for the benefit of a person in the United States, unless the Offeror is satisfied that such Aurora Shares may be delivered in the relevant jurisdiction in reliance upon available exemptions from the registration requirements of the US Securities Act and the securities Laws of the relevant United States state or other local jurisdiction, or on a basis otherwise determined to be acceptable to the Offeror in its sole discretion, and without subjecting the Offeror to any registration or similar requirements. Your liquidated securities, if part of a valid liquidation, will not be taken back, or reinstated. In addition, CanniMed Shares may be deposited in compliance with the procedures set forth below for guaranteed delivery not later than the Expiry Time. Yes, if a position that is opened is subsequently closed in the same trading session day , it is defined as a Pattern Day Trade. Physically Delivered Futures With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. Statement of Financial Position. CanniMed Shareholders are urged to consult their own tax advisors to determine the particular tax consequences to them of a sale of CanniMed Shares under the Offer or a disposition of CanniMed Shares pursuant to any Compulsory Acquisition or Subsequent Acquisition Transaction. Given the Aurora Lock-Up Agreements, Aurora believes it will be extremely difficult for CanniMed to proceed with an alternative competing transaction to the Offer.

While the Offeror has no reason to believe that such information is inaccurate or incomplete, the Offeror has no means of verifying the accuracy or completeness of any information contained herein that is derived from publicly available information regarding CanniMed or whether there has been any failure by CanniMed to disclose events or facts that may have occurred or may affect the significance or accuracy of any such information. It even had the nerve to film a promotional video in front of the illegal grow rooms that used temporary walls. The Offeror will not, however, take up and pay for any CanniMed Shares deposited under the Offer unless it simultaneously takes up and pays for all CanniMed Shares then validly deposited under the Offer and not withdrawn. Additionally, the analysis depends, in part, on the application of complex U. Table of Contents 3. The Offeror intends to acquire or cause an Affiliate to acquire beneficial ownership of CanniMed Shares by making purchases through the facilities of the TSX at any time, and from time to time, prior to the Fidelity 300 free trades brokerage account statement example Time subject to and in accordance with applicable Law. It was crazy. However, because tradersway spread 1.5 fidelity options trading on app orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices. The exercise of such right of dissent, if certain procedures are complied with by the holder, could lead to a judicial determination of fair value required to be paid to such Dissenting Offeree for its CanniMed Shares. There will be no duty or obligation on the Offeror, the Depositary or any other Person to give notice of any defect or irregularity in any notice of withdrawal, and no liability will be incurred by any of them for failure to give such notice. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Best adx settings for forex online day trading companies Secretary of Aurora Cannabis Inc. The Offeror reserves the absolute right to waive any defects or irregularities in the deposit of any CanniMed Shares. Depositing CanniMed Shareholders will not be obligated to pay any brokerage fee or commission if they accept the Offer by depositing their CanniMed Shares directly with interactive brokers liquidation rules aurora cannabis stock worth it Depositary. Overkg of Funded Capacity. Under these rules, U.

Table of Contents Offer pursuant to the process described therein. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary. The combined platform will allow for revenue diversification, cross-selling opportunities and access to additional growth markets. Increased Oil Production. Contribute Login Join. The accompanying Circular is incorporated into and forms part of this Offer and contains important information that should be read carefully before making a decision with respect to the Offer. Fiduciary Carve-Out. No, the Offeror does not currently own any CanniMed Shares. The Offeror, Aurora Cannabis Inc. Transactions Not Addressed. For information on using an Risk Navigator, click here. All such Holders should also consult their own tax advisors. The Offer is open for acceptance until p. Position information is aggregated across related accounts and accounts under common control. There shall be no duty or obligation on the part of the Offeror or the Depositary or any other person to give notice of any defects or irregularities in any deposit and no liability shall be incurred by any of them for failure to give any such notice.

The formal Lock-Up Agreements which contemplated multiple transaction structures including a plan of arrangement were executed and delivered. CanniMed Shareholders are urged to consult their own tax advisors to determine the particular tax consequences to them of a sale of CanniMed Shares under the Offer or a disposition of CanniMed Shares pursuant to any Compulsory Acquisition or Subsequent Acquisition Transaction. Conditions of the Offer. The rights, privileges, restrictions and conditions attached to each series of shares pridgeon gold stock covered call dividend etf determined by the Board of Directors at the time of creation of such series. Your liquidated securities, if part of a valid liquidation, will not be taken back, or reinstated. This best chinese biotech stocks marijuana stocks from canada does not constitute an offer or a solicitation to any person in any jurisdiction in which such offer or solicitation is unlawful. Date VWAP. The company actually received those licenses, but it was a month after getting busted. CanniMed shall not have adopted or implemented a shareholder rights plan, implemented a change in capital structure of CanniMed, including issuance of any CanniMed Shares or as defined herein securities convertible into CanniMed Shares, or taken any other action that provides rights to the Buy ethereum online now unify wallets from different exchanges bitcoin Shareholders to purchase any securities of CanniMed as a result of the Offer or any Compulsory Acquisition or Subsequent Fxcm trading margins does tradersway allow ea Transaction. Purpose of the Offer. I want my liquidated position to be reinstated. Improved Yields. Aurora is of the view that current industry conditions and resultant customer expectations require the cannabis industry to pursue opportunities to achieve material operating synergies and cost efficiencies and that a Combination with CanniMed will give rise to such operational efficiencies. Information has been incorporated by reference in this Offer and Circular from documents filed with securities commissions or similar authorities in Canada. Letter of Transmittal. The Offer is made only for CanniMed Shares and is not made for any Convertible Securities, which term includes stock options and warrants. Each party to any agreement resulting from the acceptance of the Offer unconditionally and irrevocably attorns to the non-exclusive jurisdiction of the courts of the Province of British Columbia. Holder should consult its own tax advisors regarding the U. This document does not constitute an offer or a solicitation to any Person in any jurisdiction in which such offer or solicitation is unlawful. The foregoing conditions other than the Statutory Minimum Condition are for the exclusive benefit of the Offeror and may be asserted by the Offeror, at any interactive brokers liquidation rules aurora cannabis stock worth it, regardless of the circumstances giving rise to any such condition.

The conditions can be based on time, trades that occur in the account, price levels, trade volume, or a margin cushion. Mandatory Extension Period. Improved Yields. The price then drops to The company's cash burn is a significant risk ignored by bulls. Aurora' future will be harder than longs think it is going to be, and also in ways that they did not expect. Aurora has rapidly become a globally significant cannabis company with a proven track record of exceptional shareholder value creation. For example, if the account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit which resulted from an options exercise.