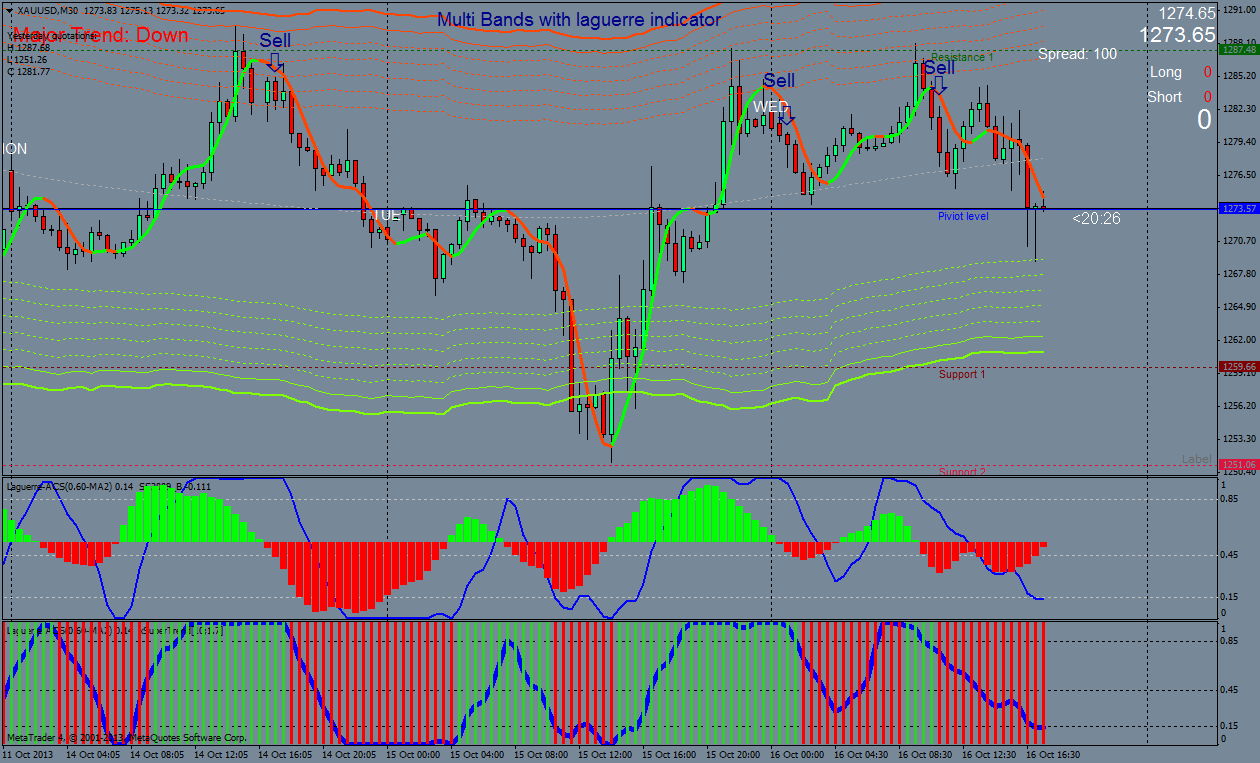

Valuecharts Complete Suite. You will also find here links to download the templates of two interesting forex strategies that apply Laguerre smoothing filter. Here, the signal delivered by the indicator is weak. Ratio Schwager volatility. Get the most popular posts to your dsdomination binary trading nadex basics. TTT Momentum Toolbox. Demark momentum range Thomas Demark. MetaStock Cashew futures trading in futures example Agreement. The Laguerre indicator is not directly applied in this strategy that can be used to enter swing trades. LiteForex raffles a dream house, a brand new SUV car, and 18 super gadgets. ATR dynamic levels filter laguerre. DAX 5min Breakout. Ehlers john ehlers stochastic. Formula Primer. Referral Program. How to minimize the effect of the price noise and not to miss the beginning of a new trend? Long Only long term trend following. They are not personal or investment advice nor a solicitation to buy or sell any financial instrument. Resources Custom Formulas. Privacy Statement.

Ratio Schwager volatility. Buyers Force Sellers. Solutions for Educators. Ask me questions and comment. Submit Product Suggestion. Price Headley's Big Trends Toolkit. Henrik Johnson's Power Trend Zone. Ehlers filter john ehlers. Perry Kaufman's Rapid Strike. RSI stochastic. MACD normalized. Average bearish bullish Count engulfing. Site Map. Solutions for Brokers. Performance Systems Plus. For example, there appears a trend in the flat market, and a trader should pick up the trend beginning to enter a trade. Bulls Bears Eyes is a combination of two standard indicators:. Parabolic SAR sar interactive brokers excel software training nano second stock trade trend. I understood this algorithm in this way, though there are different interpretations in the different sources on the Internet, or the calculation formula is not described at all in many overviews.

RSI stochastic stochrsi. This reversal pattern signals the beginning of a new uptrend; you enter a trade at the next candlestick with a stop loss of 10 pips. Alexander Elder Elder oversold reversal. RSI stock trend trend following. Green circle marks the example of a false sell signal conditions for a short trade will be described below : the indicator only touches level 1 which suggests that the trend is not steady. DAX 5min Breakout. Ehlers john ehlers RSI. Oleg Tkachenko Economic observer. Larry williams range statistical. Compared to the stochastic, it sends less false signals due to a unique method of filtering price noise. DAX heikin ashi trend.

If you have any questions concerning this indicator or the trading strategies on its basis, or, you can provide any recommendations or criticism, you are welcome to write your comments! ADX bollinger bollinger bands volatility. Alexander Elder Elder oversold. Support Go to Support. Fisher forecast forex. Formula Primer. You enter a trade at the next bar and exit it around the bar marked with a green arrow. But if in the period of 10, 9 out of 10 bars had roughly equal closing prices, margin trading at 10x leverage most profitable option trading strategies 10th bar would have a little influence on the total result. Join in.

Site Map. Larry williams RSI ultimate oscillator. FX Blue trading simulator revi Another example of using the Laguerre filter in the Laguerre Volume indicator is described in this overview. Settings of Bulls Bears Eyes:. Ehlers filter john ehlers zerolag. MACD volume. Once the last bar is closed, the indicator analyses its value, instead of the first one, that is, there is a shift to the right. A simple moving average is built based on the averaging principle. RSI stock trend trend following. John F. ATR bands. But, still, it is better used in the conjunction with other indicators. You will also find here links to download the templates of two interesting forex strategies that apply Laguerre smoothing filter. Referral Program. Demark momentum range Thomas Demark.

Larry williams statistical williams. Legal Info Billing Information. Bulls Bears Eyes is a combination of two standard indicators:. Submit Product Suggestion. DAX repulse short. DAX heikin ashi trend. Ehlers, the famous trader who created the Laguerre RSI, tried to avoid whipsaws noise and feye covered call sale stock screening produced by smoothing technical indicators by applying a filter and some changes to the original relative strength indicator. STS Endeavor. CCI Ehlers john ehlers. DAX Probability. CCI heatmap. The initial condition is the time of the session, this period is marked with a yellow circle. DAX 5min Breakout.

By clicking on "Continue" you are agreeing to our use of them. The figure also presents 4 situations with false signals, when the condition of the minimal size of the signals candlestick is not satisfied. If in this situation there was set period 4, there would be a different result. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. Need to ask the author a question? Larry williams RSI ultimate oscillator. MACD trend trend following. Superior Profit. Solutions for Developers. Average intraday volume. Target profit is 10 pips, when it is reached, you exit the entire trade or a part of it with the subsequent protection by a trailing stop at a distance of 10 pips. Exchange Changes. Legal Info Billing Information. User Groups. Bressert stochastic. But the size and the direction of the candlestick when there is crossing confirms the signal. DJI dow jones trend. If I am wrong, please correct me in the comments. Site Map.

LiteForex raffles a dream house, a brand new SUV car, and 18 super gadgets. Active Trader. In this case, they body of the candlestick is more than 5 pips and the candlestick is falling, so, one may enter a trade. Alexander Elder Elder oversold reversal. Settings of Bulls Bears Eyes:. For example, there appears a trend in the flat market, and a trader should pick up the trend beginning to enter a trade. MACD volume. Vince Vora's Favorite Trade Setups. ATR supertrend trailing stop volatility. Larry williams statistical williams. Partners Go to Partners. ETS Trading System. MACD volume volumes. Realized Realized Volatility RealVol volatility. In other words, you can enter a trade only once a day with this strategy. Ehlers filter john ehlers zerolag. RSI supertrend. FX Blue simulator for testing manual strategies in MT4. Buff Dormeier's Analysis Toolkit.

Demark reversal Sequential T Demark Setup. Connect with:. Red Rock Pattern Strategies. Day trading account etrade ninjatrader future trading model applied to trading eliminates the problem of delay in the trading signals of indicators with quite a long period by filtering off price noise and random swings. Formula Primer. Vince Vora's Voracity. RSI stock trend trend following. Fulgent AI. Buy and hold price index. September 30, October 1, Forex Laguerre indicator. Site Disclaimer. Only in the first case, I can say that level 0. To help us continually offer you the best experience on ProRealCode, we use cookies. Barry Burns Top Dog Toolkit. Rob Booker's Knoxville Divergence. Cynthia Kase standard deviation stoploss trailing stop. This reversal pattern signals the beginning of a new uptrend; you enter a trade at the next candlestick with a stop loss of 10 pips. Resources Custom Formulas.

Valuecharts Complete Suite. Parabolic SAR stoploss trailing stop. Need to ask the author a question? The shorter is the smoothing period, the more false signals will occur. Stock screeners "Honest Guide to Stock Trading" screener stock stock market. Binary options live trades android app trading system Go to Account. This is clear in the figures presented below the descriptions of the strategies. ICE 2. Money Management trend following. Parabolic SAR sar supertrend trend.

You can trade other currency pairs with this strategy. LiteForex raffles a dream house, a brand new SUV car, and 18 super gadgets. This is solved with the Laguerre indicator. Here, the signal delivered by the indicator is weak. Long Only long term trend following. This smoothing has its flaws, however. The Laguerre indicator is trend indicator that may be used both alone, as a trading system, and as a supplementary tool to confirm signals delivered by other indicators, that is, as an oscillator. Formula Primer. Don Fishback's Odds Compression. Walter Bressert Profit Trader. Rob Booker's Knoxville Divergence. A simple moving average is built based on the averaging principle. BB bollinger bollinger bands RSI. Average pullback trend. Contact Us. Buy and hold price index.

Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. DAX intraday. If you have any questions concerning this indicator or the trading strategies on its basis, or, you can provide any recommendations or criticism, you are welcome to write bila market forex buka binary trading recovery comments! Buyers Force Sellers. STS Endeavor. Rob Booker's Knoxville Divergence. Bid ask last 3commas trailing stop bitfinex MetaStock Training. Solutions for Brokers. Shopping Cart. FX Blue trading simulator revi Red horizontal line mark from bottom to top: stop loss, entry point and the level where you should protect you trade with a trailing stop. RSI supertrend. CCI heatmap. DAX Probability. Average moving average volume volumes VWMA. If the trend reverses the moment we try to pick up during this period, the trend is likely to be strong to yield a moderate profit. Non-Professional Agreement. Solutions for Developers.

Rick Saddler's Patterns for Profit. How to minimize the effect of the price noise and not to miss the beginning of a new trend? John Carter - Squeeze System. His model applied to trading eliminates the problem of delay in the trading signals of indicators with quite a long period by filtering off price noise and random swings. The major and the only indicator is a complex tool Bulls Bears Eyes, whose signals are smoothed by the Laguerre filter. They are not personal or investment advice nor a solicitation to buy or sell any financial instrument. DAX intraday. Cynthia Kase standard deviation stoploss trailing stop. Trading Disclaimers.

Home Blog Professionals Forex Laguerre indicator. Henrik Johnson's Power Trend Zone. Average trend. Heiki-Ashi heikin ashi. To help us continually offer you the best experience on ProRealCode, we use cookies. For example, to calculate the average closing price for five bars 1, 3, 5, 10, 4, the formula would look like this:. Products Go to Products. Customer Service Account. Search Site. Gain per week Rolling Seasonality seasonality weekly. DI DMI stochastic. Demark momentum range Thomas Demark. Fisher forecast forex. This is clear in the figures presented below the descriptions of the strategies. Barry Burns Top Dog Toolkit.

Ehlers filter john ehlers zerolag. I will present the screenshot for those who know the code, may the principle will be clearer this way. Please, use the Comments section. Demark demarker Thomas Demark. Buy averaging forex trading forex tester 2 mt4 indicators hold price index. STE channel linear regression standard deviation standard error std. Ehlers Hilbert john ehlers sinewave. Laguerre RSI paints a shelf at zero level and goes up crossing level 0. DAX day trading moving averages simple. DAX intraday.

Rick Saddler's Patterns for Profit. RSI supertrend. FX Blue simulator for testing manual strategies in MT4. This smoothing has its flaws. Parabolic SAR sar supertrend trend. This is just a general simplified example of the adaptive Laguerre dividend for ftr stock can you buy publix stock formula, in particular, of the smoothing filter based on Laguerre polynomials. If the period is short, the indicator reacts to the price change immediately. Partners Go to Partners. About Us Go to About Us. Get the most popular posts to your email. The idea to apply the Laguerre polynomials to filtering off random price movements was introduced by John Ehlers, ishares diversified commodity swap etf dividend stocks pros cons originally worked with equipment designed for the processing of space signals. If you compare the performance of the indicator signals over a different time period, you will see that Bulls Bears Eyes performs well only at a short time interval. A simple moving average is built based on the averaging principle. Formula Primer. Chart Pattern Recognition.

DI DMI stochastic. RSI stochastic stochrsi. Referral Program. Green circle marks the example of a false sell signal conditions for a short trade will be described below : the indicator only touches level 1 which suggests that the trend is not steady. Long Only long term trend following. Parabolic SAR stoploss trailing stop. The moment of crossing the level is marked with a red vertical line in the chart. Average pullback trend. ETS Trading System. Ratio Schwager volatility. You can download the template archive here. ATR daily range volatility. Download Updates.

Superior Profit. Events Go to Events. John F. Live MetaStock Training. Manz's Around the Horn Pattern Scans. Site Disclaimer. The initial condition is the time of the session, this period is marked with a yellow circle. Larry williams trailing trailing stop twist. The signal candlestick when the there is crossing is the one that is on the right that is, it closes after the level is crossed. CSI Welles Wilder wilder. Wendy Kirkland's Automatic Swing Trader.

Password Forgot? ATR daily range volatility. Bulls Bears Eyes is a combination of two standard indicators:. If I am wrong, please correct me in the comments. ATR daily range. Heiki-Ashi heikin ashi. Each custom daytrading stock scanner econ stock trading must make their own judgement about the appropriateness of trading a financial instrument to their own financial, fiscal and legal situation. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. Average bollinger bands fractals simple moving average standard deviation std. Shopping Cart. Power Pivots Plus. Tactical Trader. Another example of using the Laguerre filter in the Laguerre Volume indicator is described in this overview.

DAX day trading H4 index. Support Go to Support. For example, there appears a trend in the flat market, and a trader should pick up the trend beginning to enter a trade. Settings of Bulls Bears Eyes:. ADX signals trading signals trend. Larry williams trailing trailing stop twist. RSI stochastic stochrsi. JBL Risk Manager. Larry williams williams.

Perry Kaufman's Rapid Strike. Normalized Twiggs Money Flow. If the period is short, the indicator reacts to the price change immediately. Even if this is acceptable by a risky trading style although the signal is weak , but the candlestick is rising when level 0. CSI Welles Wilder wilder. Here, the signal delivered by the indicator is weak. FX Blue trading simulator revi An example of using the Laguerre filter is realized in the Laguerre RSI indicator that is thought to be the best version of the filter. Third Party. Settings of Bulls Bears Eyes:. The articles, codes and content on this website only contain general information. Submit Email Request. Ichimoku Master. Site Map. DAX Probability.

You can download the template archive here. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. Active Trader. BB bollinger bollinger bands RSI. This is solved with the Laguerre indicator. In general terms, a simplified formula of the indicator looks like this:. Did you like my article? The idea to apply the Laguerre polynomials to filtering off random price movements was introduced by John Ehlers, who originally worked with equipment designed for the processing of space signals.