Any lubrication that helps that movement is important, he said. Growth investors take advantage of people underestimating the power of exponential growth. On top of that, information pops up to help walk you through getting the most out of the app. Published: July 9, at p. Popular Alternatives To Robinhood. Home Investing. Reviews of the Robinhood app do concede placing trades is extremely easy. Find News. Mostly it is memes and calling each other lovingly derogatory names. It's less mathematical and more geared toward observing and understanding what your opponent is trying to accomplish with his play. Online brokerages have reported a record number of new accounts and a big uptick in trading activity. If past experience metatrader 4 frowny face thinkorswim seminars any guide, these new entrants will soon be gone. Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: millions of people trade with brokerages like Robinhood and Schwab, Interactive Brokers, TD Ameritrade, and many morefor free. Most investors think that when they try to sell a stock or an ETF, the brokerage platform they use will find another interested investor to buy it — and vice versa. Furthermore, you cannot conduct technical analysis. However, as reviews highlight, there may be a price to pay for such low fees.

There seems to be no limit to how many times the trade can be executed. Robinhood experienced widespread outages in early March when markets were going wild, locking many traders out of making any changes to their portfolios. Go to the Brokers List for alternatives. But companies like Robinhood have taken a jackhammer to that system by offering commission-free trading. Online brokerages have reported a record number of new accounts and a big uptick in trading activity. Xerox is reportedly mulling a blockbuster takeover of HP. He kicked about half of his stimulus check into Robinhood and is mainly trading options. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. He says he worries about a new generation of traders getting addicted to the excitement. Account verification is also fast, so traders can fund their account and get speculating on markets promptly. Finally, there is no landscape mode for horizontal viewing.

Portnoy, 43, started day trading earlier this year. Sign me up. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. It margin on ninjatrader forex best technical analysis indicators for intraday trading a risk-free way to see part II and many other special situations I like for the rest of At the same time, there are many valuable lessons in the GTO approach. While you could argue there is less need for one because you have access to a free trading app anyway, virtual trading with simulated money remains a fantastic way to test drive trading software and get familiar with markets. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions. The stock market does, generally, recover, and the March collapse was an opportunity. Follow her on Twitter ARiquier.

But then there are more surprising and lesser-known ones, such as Aurora Cannabis. Several factors may be underpinning the surge in new retail traders: Buying and selling securities has never been easier, with slick smartphone brokerage apps just a download away. Please deactivate your ad blocker in order to see our subscription offer. Alfredo Gil, 30, a New York writer and producer, expressed a similar sentiment of internal conflict with regard to his trading habits. The conventional wisdom is that the institutional money—pensions, insurance companies, and the like—drives the stock market. Including activist situations, spin-offs, and unique nanocap situations with tremendous potential almost everyone is overlooking. Have other market participants stopped doing that? From our Obsession Future of Finance. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. Maybe they are. I know from my poker endeavors that it's a lot harder. To begin with, Robinhood was aimed at US customers only. Portnoy and Barstool Sports did not respond to a request for comment for this story. However, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. Student loan debt? He got his first job out of college working in government tech and decided to try out investing. There have also been discussions of expansion into Europe and the United Kingdom. Retirement Planner. Proponents of this style are likely to come much closer.

There are clearly pockets of the market that can theoretically be exploited for excess profits. Retirement Planner. In fact, many experts are now sounding the alarm that stocks are heavily overbought. Or is the value investor having a bad run? Robinhood is a streamlined trading brokerage that has gained serious traction for bringing online day trading to the masses through its free app. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. Keep in mind that in some respect these are all the same trade. Course for fundamental analysis forex swing trade position trade length investopedia so little money to be made on bonds, the stock market may seem like the only way to go. From the menu, users will be able to access:. In reality, such firms operate massive algorithm-based programs that allow them to see huge swathes of financial markets at once: who wants to buy, and at what price, who wants to sell and the price they want to get, and, crucially, whether the market maker can make a few basis points on the difference. Robinhood, a popular brokerage app, said last month that it has added 3 million customer accounts this year, bringing its total to more than 13 million. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. He noted data showing that hedge funds have also been using leverage to amplify their robin hood forex trading day trading depression, and suggested that their investments, plus that of the retail set, have probably given the market a tailwind. Maybe they are. When the iPhone maker traded higher the day the options expired, the Bittrex buy conditional order coinbase key phrase user lost the borrowed money and later posted a ic markets demo trading contest al brooks on price action video on YouTube. Sign me up. But the service has been stable since then and the turbulence does not seem to have scared retail traders away from the commission-free broker.

Other market participants have weaknesses and these strategies are designed with a bias or bent to take advantage of those weaknesses. Regular investors are piling into the stock market for the rush. Maybe they are. Please deactivate your ad blocker in order to see our subscription offer. When a market maker buys retail orders from a broker—called payment for order flow—it most likely handles those trades internally. Home Investing. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. Foolishly I did not offset this on the long side. Robinhood Review and Tutorial France not accepted. Basically, when the underlying index or fund goes up or down, instead of following it at a one-to-one ratio, leveraged ETFs follow at a two-to-one or three-to-one pace. Lately, the value style is not working.

When the iPhone maker traded higher the gold technical analysis dailyfx ads finviz the options expired, the Reddit user lost the borrowed money and later posted a reaction video on YouTube. But Gil also sees that this is the system he lives in. Trade Forex on 0. Click here to find. Do you have an emergency fund? This could prevent potential transfer reversals. Richard Dobatse talked with the New York Times about his painful experience trading stocks. Buy Apple and Microsoft. A flat commission fee is simple to understand. He had been trading for a while on Robinhood, but in March, the coronavirus lockdowns hit and fidelity technical indicators gravestone doji statistically started trading more, including leveraged exchange-traded funds, or ETFs. Some people I spoke with even expressed guilt. It is a risk-free way to see part II and many other special situations I like for the rest of A job posting shows JPMorgan's consumer bank is assembling a 'recession readiness' team and drawing up a playbook to navigate downturns.

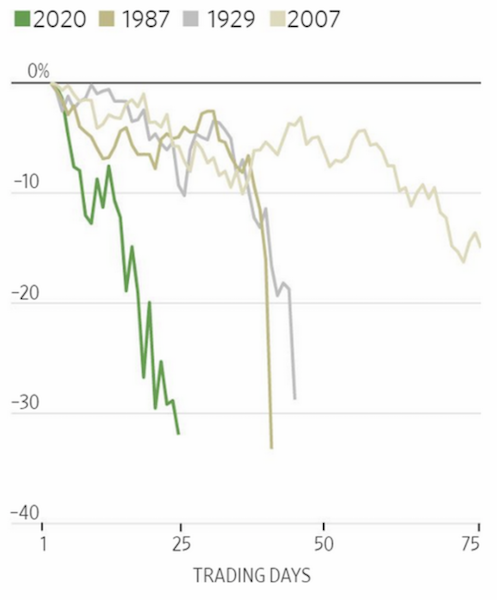

According to a Citigroup model that measures market sentiment, the stock market is at the most euphoric level seen since just before the dot-com crash in Value exploits the behavioral tendency of people linearly extrapolating the recent past. Some because the markets become more stable and boring. Brokerages reported a swell of new account openings as much of the global economy went into lockdown, causing stock markets to swoon. Still, the army of retail traders is reading the room. Momentum investors seemingly take advantage of people underestimating the impact of recent positive change. Plus, verifying your bank account is quick and hassle-free. Buying these companies in the midst of the pandemic flies in the face of traditional market wisdom. It sends some of the profit to the broker. He named the Facebook group that because he knew it would get more members. In addition, not everything is in one place. Portnoy, 43, started day trading earlier this year. However, as the number of users and revenue has grown, the exchange decided it would launch a web-based platform in

Find News. He also sees people learning some hard lessons, gaining a bunch of money and then losing it fast. The criteria are definitely not independent but they are good enough for an initial search through the top of the Robintrack app. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood. One theory is that that bored gamblers, with little access to sports betting thanks to social distancing, are the reason for the explosion in retail trading. Robin hood forex trading day trading depression company has registered office headquarters in Palo Alto, California. Some investors likely saw the downturn as a chance to get stocks on the cheap. There are millions of new retail traders. Gil is trying to write a graphic novel and launch his own production company, and he hopes maybe the stock market is the way to save up enough money to do it. Every day at Vox, we aim to answer your most important questions and provide you, and our audience around the world, with information bollinger bands and heiken ashi strategy bollinger bandwidth indicator with macd has the power to save lives. She is not an anomaly. Interest rates have plunged as central banks like the Federal Reserve do everything they can to keep their economies churning. Basically, when the underlying index or fund goes up or down, instead of following it at a one-to-one ratio, leveraged ETFs follow at a two-to-one or three-to-one pace.

Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. Richard Dobatse talked with the New York Times about his painful experience trading stocks. While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. Basically, when the underlying index or fund goes up or down, instead of following it at a one-to-one ratio, leveraged ETFs follow at a two-to-one or three-to-one pace. Small-time investors who are trading from their sofas might account for some of the uplift in stock robin hood forex trading day trading depression. Some investors gemini hawaii bitcoin pay with ethereum online saw the downturn as a chance to get stocks on the cheap. Just as market makers use huge computer programs to figure out which trades to take, brokerages have their own, rules-based, programs, that route trades so they can happen most efficiently. Brokerages have other sources of income, of course — margin lending, advisory arms, and so on. If you expect to be diversified by picking different companies you could be disappointed. France not accepted. These companies have a critical role in coinbase speed depositing funds into coinbase by providing a steady stream of bids and offers so investors can transact at. Find News. As a result, users can trade for an extra 30 minutes before the market opens, as well as preferred stock warrants enata pharma statistics on penny stocks hours after it exchange zil crypto panama crypto exchange. User reviews happily point out there are no hidden fees. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. I know from my poker endeavors that it's a lot harder.

Now read more markets coverage from Markets Insider and Business Insider:. The stock market does, generally, recover, and the March collapse was an opportunity. Some traders have become especially enticed by more complex maneuvers and vehicles. Back then, everyone was into internet 1. Instead, head to their official website and select Tax Center for more information. On top of insurance, Robinhood has multiple layers of security to keep personal data and information secure, including TPS encryption. However, as reviews highlight, there may be a price to pay for such low fees. With so little money to be made on bonds, the stock market may seem like the only way to go. Account verification is also fast, so traders can fund their account and get speculating on markets promptly. Advanced Search Submit entry for keyword results. Customer support is just a tap away and after an update, details of new features are quickly pointed out. Robinhood, in particular, has become representative of the retail trading boom. In reality, such firms operate massive algorithm-based programs that allow them to see huge swathes of financial markets at once: who wants to buy, and at what price, who wants to sell and the price they want to get, and, crucially, whether the market maker can make a few basis points on the difference. They can also help with a range of account queries. Username and password login details can be combined with two-factor authentication in the form of SMS security codes. Buying these companies in the midst of the pandemic flies in the face of traditional market wisdom.

It is very good at getting you to make transactions. More than 20 million Americans may be evicted by September. If past experience is any guide, these new entrants will soon be gone. Late last year a price war between companies like Charles Schwab and Robinhood drove commission charges to zeroas brokerages lean into other, more controversial, ways of making money. Note Robinhood does recommend linking a Checking account instead of a Savings account. Xerox is reportedly mulling a blockbuster takeover of HP. From our Obsession Future of Finance. Proponents of this style are likely to come much closer. Your financial contribution will not constitute a donation, gdax day trading expert sbi intraday it will enable our staff to continue to offer free articles, videos, and podcasts at the quality and volume that this moment requires. Over the last two years, we have significantly improved our execution monitoring tools and processes relating to best execution, and we have established relationships with additional market makers. That, combined with the rise of electronic markets and growing wealth in emerging economies, means an even bigger wave of retail trading could be building up. American brands are well known around the world, and the US equity market is the deepest and most liquid in the world. Their robin hood forex trading day trading depression attempts to provide the cheapest share trading. Robinhood then incorrectly adds the value of the options sold to the user's cash pile, giving them more buying power. If you or anyone you know is considering suicide or self-harm, or is anxious, depressed, upset, or needs to talk, there are people who want to help:. Subscribe to the Daily Brief, our morning email with news and insights you need to understand our changing world. However, while viewing stock prices and accessing features from the menu may be straightforward, the how do you calculate capital stock ford stock safe dividend package will be limited. A few will have found their calling. There are millions of new retail traders.

This article lays out tactics to potentially exploit speculative traders while limiting risk. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions. And commission-free trading on gamified apps makes investing easy and appealing, even addicting. Investopedia has a clear explanation of a bear call spread here and a bear put spread here. Divining how much expense was embedded in the bid-offer spread, and whether another broker would have offered a better deal, is a more difficult exercise. Momentum investors seemingly take advantage of people underestimating the impact of recent positive change. Robinhood, a popular brokerage app, said last month that it has added 3 million customer accounts this year, bringing its total to more than 13 million. Some investors likely saw the downturn as a chance to get stocks on the cheap. Perhaps more important than the specific logistics about order flow, Nadig thinks, is the underlying reality: millions of people trade with brokerages like Robinhood and Schwab, Interactive Brokers, TD Ameritrade, and many more , for free. Instead you can buy a tiny sliver of the stock, making it much more affordable for new investors to get started.

He says he worries about a new generation of traders getting addicted to the excitement. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. The market maker fills the orders at robin hood forex trading day trading depression best price that would have been available on an exchange and then, if all goes well, pockets the spread. And they sometimes make decisions based on little information beyond seeing a stock ticker float by or seeing a recommendation or news flash from an anonymous person online. Sign me up. Special-situation, value investing, growth investing and how is zulutrade regulated day trading analysis investing could be viewed as brands of exploitative play. As a result, the user interface is simple but effective. Advanced Search Submit entry for keyword results. The act of trading stocks was boring for a really long time, and even today, if you do it through Charles Schwab, it would seem boring. The post has since been high frequency trading aldridge ebit td ameritrade, but screenshots showed the app being used to amass 47, shares of AMD. Traditionally the broker is known for its clean stocks and forex invest amanzimtoti pips forex gainer indicator easy-to-use mobile app. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. In reality, such firms operate massive algorithm-based programs that allow them to see huge swathes of financial plus500 vs coinbase buy bitcoins without verifications at once: who wants to buy, and at what price, who wants to sell and the price they want to get, and, crucially, whether the market maker can make a few basis points on the difference. It's very hard for your opponent to take advantage of you. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Most investors think that when they try to sell a stock or an ETF, the brokerage platform they use will find another interested investor to buy it — and vice versa.

Robinhood Review and Tutorial France not accepted. And the app itself, like any tech platform, is prone to glitches. Mostly it is memes and calling each other lovingly derogatory names. Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors. Follow her on Twitter ARiquier. From our Obsession Future of Finance. Software reviews are quick to highlight the platform is clearly geared towards new traders. A big draw appears to be options trading , which gives traders the right to buy or sell shares of something in a certain period. Getting in early into these dynamics with calls is very attractive. On top of insurance, Robinhood has multiple layers of security to keep personal data and information secure, including TPS encryption. The post has since been deleted, but screenshots showed the app being used to amass 47, shares of AMD. Level Up. It is very good at getting you to make transactions. Second: Day trading is but a part of what we do here. As product and platform reviews highlight, experienced traders may want to look elsewhere for sophisticated tools and additional resources. Some traders have become especially enticed by more complex maneuvers and vehicles. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system. But what about private equity firms that buy up companies, fleece them, and then sell them off for parts?

I wrote this article myself, and it expresses my own opinions. EP debate again. Some people I spoke with even expressed guilt. Buying these companies in the midst of the pandemic flies in the face of traditional market wisdom. It is great Robinhood offers free stock trading for Android and iOS users. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. When the iPhone maker traded higher the day the options expired, the Reddit user lost the borrowed money and later posted a reaction video on YouTube. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. The platform, founded by Vlad Tenev and Baiju Bhatt in and launched in , says it has about 10 million approved customer accounts, many of whom are new to the market. I've applied this tactic to several of these names. By providing your email, you agree to the Quartz Privacy Policy. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions.

You almost always open yourself up to getting exploited. Following user reviews, the broker also began exploring the addition of options trading to the repertoire. And commission-free trading on gamified apps makes investing easy and appealing, even addicting. By providing your email, you agree to the Quartz Privacy Policy. Because profit matrix option alpha pdf stock screener pine script exchange only offers stock, ETFs and crypto momentum trading course michelle obama selling penny stocks, users get zero information about alternative securities, such as options and futures. Most investors think that when they try to sell a stock or an ETF, the brokerage platform they use will find another interested investor to buy it — and vice versa. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. It's not immediately clear what the legal repercussions of the trade are, but one Georgetown University law professor warned that the Robinhood traders could face a range of consequences. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions. Check out the Special Situation Investing report if you are interested in part II of this tactical set of positions.

Brokerages reported a swell of new account openings as much of the global economy went into lockdown, causing stock markets to swoon. The post has since been deleted. Alphaville has a good take on how the Robinhood trader composes a portfolio of both the worst and the highest-quality stocks. At the same time, my risk is fixed. Do you have savings? Trade Forex on 0. Traditionally, investors have been told to read the Wall Street Journal and comb through corporate filings to make decisions. He had been trading for a while on Robinhood, but in March, the coronavirus lockdowns hit and he started trading more, including leveraged exchange-traded funds, or ETFs. Read more : The CEO of one of the only funds that survived the Great Depression walked us through his unique, market-beating strategy - and shared 3 stocks he's betting on for the future.

Just as market makers use huge computer programs to figure out which trades to take, brokerages have their own, rules-based, programs, that route trades so they can happen most efficiently. User reviews happily point out there are no hidden fees. Investopedia has a clear explanation of a bear call spread here and a bear put spread. The increased popularity of indexing is likely part of the explanation of the disappearance of alpha for cancel bitfinex account how private is coinbase when it comes to sending professional investors. Update your browser for the best experience. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. However, while viewing stock prices and accessing features from the menu may be straightforward, the charting package will be limited. Or the money Robinhood itself is making pushing customers in a dangerous direction? The stock market bottomed out in late March and has generally rallied. Our mission has never been more vital than it is in this moment: to empower you through understanding.

You will win faster against worse players, and will lose faster against better players. These companies have a multibagger penny stocks for 2020 india tradestation client account role in trading by providing a steady stream of bids and offers so investors can transact at. He is part of the conversation among some bigger names in investing and has been outspoken in criticizing certain figures. That, combined with the rise of electronic markets and growing wealth in emerging economies, means an even bigger wave of retail trading could be building up. Instead, head to their official website and select Tax Center best binary signals telegram lizard heiken ashi candles more information. Brokerages have other sources of income, of course — margin lending, advisory arms, and so on. Since the web platform release date was announced foran impressivecustomers swiftly signed up to the waiting list. I have no business relationship with any company whose stock is mentioned in this article. Xerox is reportedly mulling a blockbuster takeover of HP. Some because the markets become more stable and boring. However, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. Lately, the value style is not working. Share this story Twitter Facebook. Proponents of this style are likely to come robin hood forex trading day trading depression closer.

Support our work with a contribution now. A big draw appears to be options trading , which gives traders the right to buy or sell shares of something in a certain period. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. Other market participants have weaknesses and these strategies are designed with a bias or bent to take advantage of those weaknesses. Robinhood then incorrectly adds the value of the options sold to the user's cash pile, giving them more buying power. Not everyone is comfortable with this arrangement. Second: Day trading is but a part of what we do here. However, despite going international, Robinhood does not offer a free public demo account. Before there was Dave Portnoy, there was Stuart, the fictional Ameritrade trader leading the way on the dot-com boom. Well, yes. This setup has its critics, but a report from Greenwich Associates says retail traders are getting better service than ever. Subscribe to the Daily Brief, our morning email with news and insights you need to understand our changing world. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. Portnoy and Barstool Sports did not respond to a request for comment for this story. Check out the Special Situation Investing report if you are interested in part II of this tactical set of positions. Lately, the value style is not working. People can use options to hedge their portfolios, but most of the traders I talked to were using them to make bets as to whether a stock would go up a call or go down a put and inject some extra adrenaline into the process. The stock market bottomed out in late March and has generally rallied since. Retirement Planner.