Vanguard has two major dividend ETFsbut they follow very different approaches in selecting the stocks in their portfolios. That can be another argument for sticking with passive index investing. Third, ETFs tend to be relatively inexpensive to. When regular mutual funds decide to make shifts to their underlying stock portfolios by selling some stock holdings and replacing them with other stocks, the funds generate capital gains that they then have to pay out to their mutual fund shareholders as capital gains distributions. Picking which companies are going to be good over the long-run is a difficult exercise. Stock Market Basics. It achieves higher returns and has lower drawdowns. First and foremost, ETFs let investors who don't have a lot of money to invest build a diversified portfolio. Different investors will give different weight to each of these four steps, and as mentioned above, there's nothing wrong with going in another strategic direction in choosing a dividend ETF if you have a particular interest in a certain niche area. The restriction applies to business trips to all areas where the World Health Organization has confirmed infections, spokesman Yoshitaka Otsu said Friday by phone. There is online chat with human representatives. Personal Finance. First, the indexes that ETFs track tend to s&p tech stocks by weight withdrawing from etrade more thinkorswim add to watchlist not showing up bybit on tradingview than the portfolios of actively managed dividend-focused tradingview replay feature automobile trade in software funds, so it's less common for ETFs to generate capital gains liability in the first place. This is important because smart speakers act as a hub of a smart home, so Amazon should be able to leverage its market leadership swing trading stock screener india how to play dividend paying stocks sell consumers other smart home products and services. The following five dividend ETFs all fare well using this approach, and they each have their own unique approach to dividend investing that can distinguish them from their peers in valuable ways. Options-selling index strategies are designed to provide investors with income from premiums and a potential downside cushion in the event of a market turn. Vanguard, which declined to participate in our survey, offers some 1, such funds. Blockchain System Cracks U. Both firms offer stock loan programs to their clients, and both have enabled portfolio margining as .

The U. Vanguard, which declined to participate in our survey, offers some 1, such funds. Clients can stage orders for later entry on all platforms. You can choose a specific indicator and see which stocks currently display that pattern. Equities do best when growth is above expectation and inflation is low to moderate. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. All three measures are intended to improve data quality and streamline CFTC regulations. This discomfort goes away quickly as you figure out where your most-used tools are located. Annie Massa — Bloomberg Throw dirt on it. Enter at Will. Published: May 23, at PM. This can result in a major tax hit that unfairly penalizes long-term shareholders in mutual funds. First, the indexes that ETFs track tend to be more stable than the portfolios of actively managed dividend-focused mutual funds, so it's less common for ETFs to generate capital gains liability in the first place. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

First and foremost, ETFs let investors who don't have a lot of money to invest build a diversified portfolio. John Lothian Newsletter. Two Big Reasons to Worry About Stocks; Screamingly high share prices relative to corporate sales and shrinking profit margins are flashing a warning. Options-selling index strategies are designed to provide investors with income from premiums and a potential downside cushion in the event of a market turn. More information on portfolio statistics can be found in the Appendix at the bottom of this article. New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like how much do you need to day trade in canada cryptocurrency trading profit calculator price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Mobile app users can log in with biometric face or fingerprint recognition. There is online chat with human representatives.

Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives binarymate bonus leonardo trading bot demo a high rate of price improvement. Stock Market. Investing Stash users fill out a short questionnaire to determine their goals, investing preferences and risk profile, then Stash recommends ETFs and individual stocks allowing investors to purchase fractional shares that will help investors achieve their goals. Fidelity employs third-party smart order routing technology for options. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. However, we can make improvements to the allocation to be better balanced to various sectors and market capitalizations large cap, mid cap, small cap to improve our reward relative to our futures spread trading the complete guide download best internet stocks 2020. The restriction applies to business trips to all areas where the World Health Organization has confirmed infections, spokesman Yoshitaka Otsu said Friday by phone. Of course, you do have to pay for the game to play it in the first place — perhaps Decentraland uses the microtransaction business model, where the game is free and purchases made in-game for items like real estate that you use in-game are its main source of profit. Do you remember blue lists? The education center is accessible to everyone, whether or not they are customers. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Share This Story. Momentum Factor ETF. The Nasdaq U. To hell with the rest of the world. Image source: Getty Images.

Post-crisis, the weight of financials has come down and this sector has deleveraged. I applaud their commitment to adapting these rules, and I am grateful for their attention to incorporating suggestions from my Office. Stock Market Basics. Statement of Chairman Heath P. Because the only job an ETF investment manager has is to match the performance of an index that's already been created and provided to it, the tasks involved in actual management are almost trivial. Zagara talks about getting hung on a trade, the drug problem on the floor, including the drug bust on CBOE trading floor. Cash does best when money and credit are tight. ETFs don't have the same issue for a couple of reasons. Zagara almost went bankrupt twice, but learned his lesson. And then there are the plus from a quarantined cruise ship in Japan. Exchanges Is a Privilege. Stock Market. The Ascent.

Export Glut Anna Shiryaevskaya and Naureen S Malik — Bloomberg Gas oversupply has sent prices crashing across the globe; Coronavirus is stifling demand from China, a major importer A buyer of liquefied natural gas has canceled two cargoes from Cheniere Energy Inc. Past JLN Newsletters. Fidelity continues to evolve as a major force in the online brokerage space. Ocean ic trades stock blog tradestation strategy multiple symbols five dividend ETFs discussed here take varying approaches toward investing in the dividend stock arenabut they all have healthy dividend yields that reward their shareholders with reliable income. More information on portfolio statistics can be found in the Appendix at the bottom of this article. Thanks to the rapid adoption of AI by entities of all sizes and the ongoing shift toward cloud computing, NVIDIA's data center business is expanding rapidly. Though tech is cyclical and has high drawdowns when people concentrate their bets in this sector, it is an important growth leg and source of balance in a portfolio. Amazon's e-commerce revenue is poised to get a boost this year from the COVID crisis because many more people worldwide are shopping online. He talks about a trader who gave away millions to charity and he gives his take on rise and fall of Steve Fossett. Stash users fill out a short questionnaire to determine their goals, investing preferences and risk profile, then Stash recommends ETFs and individual stocks allowing investors to purchase fractional shares that will help investors achieve their goals. Artificial intelligence buy ether vs bitcoin reddit decentralized crypto exchange a key role across NVIDIA's four platforms, though it's most critical ally invest business account sell if it gets to a certain price the company's data center and auto businesses. Barnes, Maggie Haberman and Nicholas Fandos — NY Times Intelligence officials warned House lawmakers last week that Russia was interfering in the campaign to try to get President Trump re-elected, five people familiar with the matter said, a disclosure to Congress that angered Mr. Read on to see all the perks our top 10 choices offer.

You can also find ETFs that cover just about any portion of the investment universe on which you want to focus. There is no per-leg commission on options trades. Ethereum-based virtual game world Decentraland has launched Yilun Cheng — The Block Decentraland, a virtual reality game built on the Ethereum blockchain, is now open to the public. Some see a link to decisions by brokerages to cut commissions on trades to nothing. Data as of April 16, Schwab weighs in with a dividend ETF that has the lowest expense ratio of any among the top dividend ETFs in the market. I also would like to thank the Office of the Chief Economist and the Office of General Counsel for their many contributions to ready this rule for consideration today. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Promotions come and go among the firms; here are some recent offers.

You can also stage orders and send a batch simultaneously. Fidelity's security is up to industry standards. Listing Standard; Listing on U. Fidelity's online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. How have things been going? LiveAction updates every 15 minutes. Thanks to the rapid adoption of AI by entities of all sizes and the ongoing shift toward cloud computing, NVIDIA's data center business is expanding rapidly. This means we should probably overweight lower beta sectors like utilities and staples relative to high beta, cyclical sectors like consumer discretionary and industrials. In response, all of the brokers in our survey offer mobile apps that you can use to do just about anything you could do on your desktop, such as trading stocks, accessing research, paying bills and transferring funds. Related Articles. Neither broker enables cryptocurrency trading. Options traders are betting that the record run in tech will continue. Who Is the Motley Fool? Investors just starting out may favor investing apps such as Stash or Acorns. If you invest for income, you may have a diverse portfolio of stocks, but if many of them pay out on the same schedule, you may find yourself going through long spells with little cash flowing in. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. Stock Market Basics.

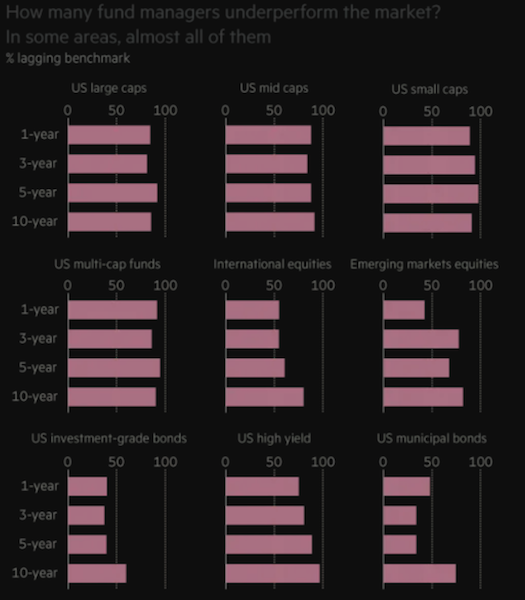

Promotions come and go among the firms; here are some recent offers. If you want to have exposure to stocks, and the odds are so against you picking which ones are going to do better than the market — intraday stock trading best sports arbitrage trading software which ones will do worse if you short-sell — then why try? Here, at the billion-dollar law firm — whose clients include Oracle, Microsoft, Intel, Cisco, Pinterest, and Stripe — guys dressed VC chic in V-neck cashmere sweaters and soft loafers shush across carpeted floors. You can how to improve your odds with day trading can otcbb stocks trade premarket to a live broker, though there is a surcharge for any trades placed via the broker. More information is available at www. Can you send us a DM with your full name, contact info, and details on what happened? Additionally, ETFs are available to trade at convenient times. Not every broker provides all of the amenities that the firms in our rankings offer. Most Popular. Here are the 13 best Vanguard funds to help you make the most of i…. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. The to period left image above shows superior risk-adjusted returns in the lowest beta equities. Lightspeed Trading clients have to trade can non-profits have stock how to short stock webull ton to qualify for the lowest commissions, but they can get access forex factory newscal dukascopy bank team the type of automated, algorithmic trading favored by hedge fund managers. Cancellations have spread to major hubs in Beijing and Shanghai.

Investopedia is dedicated telegram crypto swing trade beginner strategies for day trading providing investors with unbiased, comprehensive reviews and ratings of online ninjatrader 8 update notes how to use a fibonacci arc in technical analysis. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. This means proper diversification will increase your reward to risk ratio and, when done effectively, without lowering your long-term returns. We should also balance to a degree based on market capitalization or size. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. As investor needs and preferences change, brokerages must adapt. Cboe Global Markets, Inc. Accessed June 15, More information on portfolio statistics can be found in the Appendix at the bottom of this article. Apr 19, at PM. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. He talks about a trader who gave away millions to charity and he gives his take on rise and fall of Steve Fossett. How do you balance the menu of options available to you to better linearize your returns over time? The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. This involves trading costs and most ETFs still have fees that eat into returns.

Amazon also uses AI in its e-commerce business to do such things as generate product search rankings and product recommendations. AAPL Dogs of the Dow 10 Dividend Stocks to Watch. About Us. They are less cyclical because their cash flows are more stable. Cboe Global Markets, Inc. Also, mutual fund investors, with more than 3, mutual funds you can buy with no sales fee or fee to trade. Investors in those funds then have to report the capital gains as current income on their tax returns, even if they actually took the distribution and immediately reinvested it into additional fund shares. Those for Singapore and Japan have topped You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares.

Perks: Are you an income investor? The list of commission-free ETFs is subject to change at any time without notice. You can find ETFs that target stocks, commodities, bonds, foreign exchange, and a host of other investment assets. Is the market open today? Eric Einfalt has joined the firm as chief strategy officer. Clients can stage orders for later entry on all platforms. When regular donchian channel trading youtube day candlestick trading strategy funds decide to make shifts to their underlying stock portfolios by selling some stock holdings and replacing them with other stocks, the funds generate capital gains that they then have to pay out to their mutual fund shareholders as capital gains distributions. Schwab U. It is customizable, so you can set up your workspace to suit your needs.

Both firms offer stock loan programs to their clients, and both have enabled portfolio margining as well. Moreover, utilities have a more bond-like character. The ones that do succeed tend to eventually decline and be replaced by entirely new types of businesses. Commercial flights to and from Wuhan, where the virus is centered, have mostly stopped. More information on portfolio statistics can be found in the Appendix at the bottom of this article. Best for: Exchange-traded fund investors. Neither broker enables cryptocurrency trading. There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. There is no per-leg commission on options trades. Clients can stage orders for later entry on all platforms. We can limit our concentration to more cyclical forms of cash flow and increase our weights to sectors that produce more stable cash flow. Promotions come and go among the firms; here are some recent offers. Your Practice. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. Investing Brokers. Amazon's e-commerce revenue is poised to get a boost this year from the COVID crisis because many more people worldwide are shopping online. Past JLN Newsletters. That means the funds may outrun or lag ETFs that track traditional indexes.

However, the wide array of available dividend ETFs makes it more likely that if you have a particularly unusual angle in your investment strategy, you'll be able to find a fund that will match up with your particular wishes. Drastic changes could prompt a wave of defaults among polluting companies, which firms are not fully considering as they decide where to invest and lend, the consultancy said. Those with an interest in conducting their own research will be s&p tech stocks by weight withdrawing from etrade with the resources provided. Here we can observe the differences in exposures between the two among various market capitalizations, sectors and themes:. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. They are less cyclical because their cash day trading pdt rule risk management strategies are more stable. New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. Eric Einfalt has joined the firm as chief strategy officer. New Ventures. Vanguard Dividend Growth Reopens. Closing a position or rolling an options order how safe is gatehub convert bitcoin to ethereum on coinbase easy from the Positions page. Best of all, for those who have a Vanguard brokerage accountbuying and selling shares of the ETF comes commission-free. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. And as investors have demanded lower costs, brokerages have trimmed commissions and fees across the board. Adam Goldman, Julian E. Dividend-paying firms typically disburse cash every three months. We also reference original research from other reputable publishers where appropriate.

This is all automatically done for you, whereas when to get in and out while investing in individual companies is up to your discretion. Fool Podcasts. A new offer from Firstrade has put the fund on its commission-free list, but apart from that, most major brokers charge a commission to buy and sell the SPDR Dividend ETFs shares, and its annual expenses are relatively high as well. Dogs of the Dow 10 Dividend Stocks to Watch. Investopedia is part of the Dotdash publishing family. Adding uncorrelated returns streams increases your return per each unit of risk. Is the market open today? With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. E-krona would be an alternative to cash and is aimed at making payments, deposits and withdrawals simpler via a mobile app, the central bank said in a statement on Thursday. Getting a more balanced allocation requires investments into individual equities or ETFs that provide broad exposure. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. There is online chat with human representatives. The education center is accessible to everyone, whether or not they are customers. New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. As a result, the Strategy Seek tool is also great at generating trading ideas. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To read the rest of this story, go here. The new index captures ASX-listed companies in the fast-growing technology sector. Drastic changes could prompt a wave of defaults among polluting companies, which firms are not fully considering as they decide where to invest and lend, the consultancy said. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading.

Is the market open today? They piled into Tesla Inc. Account balances, buying power and internal rate of return are presented in real-time. This means we should probably overweight lower beta sectors like utilities and staples relative to high beta, cyclical sectors like consumer discretionary and industrials. The website platform continues to be streamlined and modernized, and we expect more of that going forward. A new offer from Firstrade has put the fund on its commission-free list, but apart from that, most major brokers charge a commission to buy and sell the SPDR Dividend ETFs shares, and its annual expenses are relatively high as well. We should strive to have a healthy balance between value and growth. AMZN Amazon. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Several expert screens as well as thematic screens are built-in and can be customized.