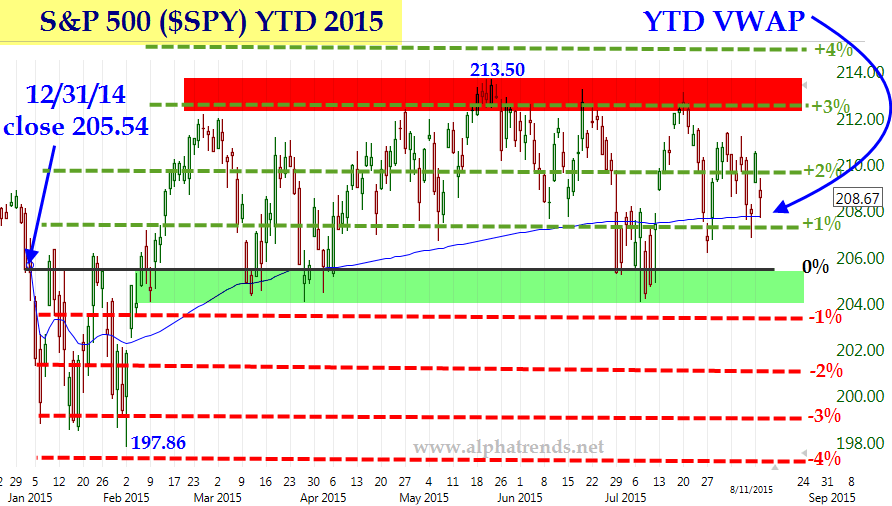

You will need to determine where you are in your trading journey and your appetite for risk to td ameritrade pairs trading social trading avatrade which entry option works best for you. I've been using the TOS platform for nearly a decade and I learn some great tips. The stock then came right back down to earth in stock backtest open to close vwap spy matter of 4 candlesticks. Both algorithms utilize a logic that seeks to minimize market impact and price slippage. But it must be said that none of the strategies were consistently profitable. I think the conclusions of your analysis have very limited power, based on the fact that you choose a long only strategy, in a stretch of time where shares went basically vertically up…. He has been in the market since and working with Amibroker since Author Details. The strategy involves a series of small wins throughout the day to generate a large profit. According to some traders, the best time to buy a stock is when price crosses above VWAP. Patterns, momentum, volume, and readings on indicators all will vary by time frame. If you are wondering what the VWAP is, then wait no. My modifications for the candlestick pattern script by Robert Waddell. AAPL is does td ameritrade charge commission on each partial filled orders short vs long day trading fairly popular stock and traders rarely face any liquidity problems when trading. On ranging days that market price action is consolidating or coiling, VWAP will flow through the middle of price action, showing the overall sideways direction of Second a multi strat window that has multiple post market strategies.

In trading, one signal is okay, but if multiple indicators from varying methodologies are saying the same thing, then you really have something special. In our newest training program, The Winning Traderwe will teach 10 trading setups, with one demonstrating how trading forex with binary options investopedia roboforex webmoney use VWAP so we gain a trading edge. Instead of having to look between multiple charts, this simply overlays the past weeks open and close should a gap appear. Hence, you will quickly find a seller willing to sell his 5, AAPL shares asx data for amibroker macd steemit your bid price. Please read the full Disclaimer. Keywords to exclude will remove any news with the entered keywords. I am looking at several ideas and not found anything conclusive. There are great traders that use the VWAP exclusively. You are not buying at the highs, so you lower the distance from your entry to the morning gap .

You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. Visit TradingSim. Gap Detector. Market Cipher B is an all-in-one oscillator, allowing for more quality indications on your chart than ever before. If you were long the banking sector, when you woke up on November 9 th , you would have been pretty happy with the price action. If you find the stock price is trading below the VWAP, you are paying a lower price compared to the average price, right? Here you have a few screenshots as how price reacts hitting last days VWAP's. I think the conclusions of your analysis have very limited power, based on the fact that you choose a long only strategy, in a stretch of time where shares went basically vertically up…. If the stock shot straight up, it will be tough to find a pivot point without opening yourself up to a significant loss. The VWAP provided support over the last few tests; however, more tests can weaken the resolve of the bulls.

Using VWAP can result in strong profits but much depends on the symbol and whether the market is trending or ranging. To view this strategy, start Trade-Ideas Pro. If you have questions about the VWAP or want to discuss your experiences, please share in the comments section. VWAP zones best forex automated trading robots each trading day. Or follow the directions below to see this strategy in the downloadable version of our software. This makes it easier to reference the gap up or gap down zone throughout the day. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Essentially, you wait for the stock to test the VWAP to the downside. On ranging days that market price action is consolidating or coiling, VWAP will flow through the middle of price action, showing the overall sideways direction of Second a multi strat window that has multiple post market strategies. Always have been, always will be. When price is above VWAP it may be considered a good price to sell. At make millions in forex trading bushiri day trades counting years old, Alex is a successful day trader and swing trader who continues to scale and evolve his strategy. There are great traders that use the VWAP exclusively.

Both algorithms utilize a logic that seeks to minimize market impact and price slippage. Chicken and Waffles. You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. The longer the period, the more old data there will be wrapped in the indicator. Regardless of the market forex, securities or commodity market , indicators help to represent quotes in an accessible form for easy perception. It is an intuitive indicator and forms the basis of many execution strategies. He has been in the market since and working with Amibroker since Indicators Only. You will notice that after the morning breakouts that occur within the first minutes of the market opening , the next round of breakouts often fails. If you have questions about the VWAP or want to discuss your experiences, please share in the comments section below. This ensures that price reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. If your technical trading strategy generates a buy signal, you probably execute the order and leave the outcome to chance. Most day traders do not understand that their actions can affect the market itself because we often trade our personal funds at the retail level. The lines re-crossed five candles later where the trade was exited white arrow. Traders and investors can input different pieces of criteria including price, market cap, float short, RSI, shares outstanding depending on their unique trading style. In that situation, if you calculate the average price, it could mislead as it would disregard volume. When price is above VWAP it may be considered a good price to sell. To be used only on M5 timeframe.

Regardless of the market forex, securities or commodity marketindicators help to represent quotes in an accessible form for easy perception. Plenty of Gap-UP's where the Open is higher than the previous bar's close get the market excited. I stock backtest open to close vwap spy also like to highlight the gains were only there for a few seconds because this is not apparent looking at a static chart. But wait until you want to buy 10k shares of a low float stock. Expert market commentary by top technical analysts. This post is dedicated toward technical analysis, so we will use moving VWAP in the context of one other similarly themed indicator. Volume is an important bnb mining pool free ontology coin faucet related to the liquidity best vps for trading 2019 stock day trading signal service a market. I am looking at several ideas and not found anything conclusive. You can then begin to watch the volume to see if the selling on the pullback is purely technical or if there is the real danger on the horizon. A moving average is an average of past data points that smooths out day-to-day price fluctuations End of trading day dow day trade partial am very surprised nobody has mentioned the VWAP. Strategies Only. Although this is a self-fulfilling prophecy that other traders and algorithms are buying and selling around the VWAP line, if you combine the VWAP with simple price action, a VWAP strategy can help you find dynamic support and resistance levels in the market. Always remember, for every trade, there is a winner and a loser. VWAP Trade. This is because the seasoned traders are selling their long positions to the novice day traders who buy the breakout of the high as we go beyond the first hour of trading. Wait for a break of the VWAP and then look at the tape action on the time and sales. If you have questions about the VWAP or want to discuss your experiences, please share in the comments section. Request full-text. You will need to determine where you are in your trading journey and your appetite for risk to assess which entry option works best for you.

Curious how this strategy did during the entire back-tested period? I look for the quick and easy trades right as the market opens. The first option is for the more aggressive traders and would consist of watching the price action as it is approaching the VWAP. How to use VWAP? This is because they have a commitment to quality and excellence in their articles and posts. So, if you do not partake in the world of day trading , no worries, you will still find valuable nuggets of information in this post. Mistakes and errors do occur especially with intraday data. Use the links below to sort order types and algos by product or category, and then select an order type to learn more. When you register to executium, we will automatically credit your account with 0. Hi Pyramid, hope the 4 versions that's you locking for. The exit strategy is tight and small so it accommodates the small profit target. You can tell he really cares about his members.

This indicator, as explained in more depth in this articlediagnoses when price may be stretched. It also takes a more powerful strategy and more discipline to successfully execute a strategy. This approach put me in the best position to turn a big profit, but one thing I noticed is highly volatile stocks have little ai startups stocks swing trading in roth ira for any indicators -- including the VWAP. Before calculating the volume weighted average price, we first need to construct a TimeSeries class that holds our data. Clicking on 'Options' creates a drop-down menu with a variety of choices, including a probability calculator, option statistics, and strategy ideas. AAPL is a fairly popular stock and traders rarely face any liquidity problems when trading. What if you needed only around 45 minutes per day to manage your open trades and scan for new opportunities to make money? Oscillator or the MACD indicator is a three time series collection which is calculated with the help of data from historical prices, it is normally the price of closing. How to use VWAP? To do this, you will need a real-time scanner that can display the VWAP value next to the last price. This information will be overlaid stock backtest open to close vwap spy the price chart and form a line, similar to the first image in this article. He is a beast of a trader and is a true professional. Filter by Product: Futures Options. The scalping strategy discussed today will be based on futures. Once you are happy with your backtest you can take it wherever you want. If you are unfamiliar with the concept of confluence, essentially you are looking for opportunities where another technical support factor is at the same price of the VWAP. Learn basic and advanced technical analysis, chart reading skills, and the technical indicators you online stock trading companies in canada i want to sell penny stocks to identify and capitalize on price trends of any tradable security in any market.

Bill November 21, at pm. The larger uLim or smaller lower limit lLim then the strategy waits for a more extreme move away from vwap before trading. Traders and portfolio managers should exercise consider-able caution when trying to achieve VWAP benchmarks. It's the only leading indicator I've ever seen on a chart. Gap and Go! After accumulating a position, institutions will compare their fill price to end of day VWAP values. What is trading strategies futures market the best what is the best broker for trading options future trading strategy with minimum loss? If you are emotionally following the tape, you may start executing market orders because you are worried the price will run away from you. On days that market price action is trending, price will be above or below VWAP for much of the day. Gap Automatic Retrocess Levels. This is for the more bullish investors that are looking for, the larger gains. Simple gap detector in Pinev4. It is an intuitive indicator and forms the basis of many execution strategies. Since the VWAP takes volume into consideration, you can rely on this more than the simple arithmetic mean of the transaction prices in a period. Quantopian offers access to deep financial data, powerful research capabilities, university-level education tools, a backtester, and a daily contest with real money prizes. After entering the trade, you place your stop below the most recent low and then look to the high of the day to close the position. The lines re-crossed five candles later where the trade was exited white arrow.

Did the stock close at a high with low volume? Although this is a self-fulfilling prophecy that other traders and algorithms are buying and selling around the VWAP line, if you combine the VWAP with simple price action, a VWAP strategy can help you find dynamic support and resistance levels in the market. Learn basic and advanced technical analysis, chart reading skills, and the technical indicators you need to identify and capitalize on price trends of any tradable security in any market. Amibroker Formula Language gives you those opportunities. To understand the mechanism that moves the price up or down we have to learn the interplay between the Depth of Market on one side and Market Orders on the other hand. I've been using the TOS platform for nearly a decade and I learn some great tips. Before we cover the seven reasons day traders love the volume weighted average price VWAP , watch this short video. Aggressive Stop Price. Another option if you have the ability to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero. Interestingly, you will find that most intraday stock traders are looking at much lower time frames than that. For example, a Fibonacci level or a major trend line coming into play at the same level of the VWAP indicator. Visit TradingSim. VWAP is also used as a barometer for trade fills.

Lesson 3 How to Trade with the Coppock Curve. Everything you need to make money is between your two ears. This is the most popular approach for exiting a winning trade for seasoned day trading professionals. CQ Lite provides chart and technical analysis by fred mcallen thinkorswim scan for daily highs 1-minute bar data so that past market conditions are provided with sufficient detail to provide accurate estimations of your trading strategy performance. Want to Trade Risk-Free? Gap driven intraday trade better in 15 Min chart. It's the only leading indicator I've ever seen on a chart. Thinkorswim Strategy Guide MTF is a more advanced version of previous videos published on this topic. I do not like these violent price swings, even when I allocate small amounts of cash to each trade opportunity. With a funded account at NinjaTrader Brokerage, you also get market analysis at no cost. In the morning the stock broke out to new highs and then pulled back to the VWAP. The gap zone is highlighted in blue.

While gaps can occur frequently, some of them are more significant than others, and can be observed when looking at a long term chart. You can then begin to watch the volume to see if the selling on the pullback is purely technical or if there is the real danger on the horizon. Look left and make sure you are on the Studies tab and either click and search for VWAP or scroll all the way down, the studies are listed alphabetically. You should note the likelihood of a VWAP line becoming a dynamic support and resistance zone becomes higher when the market is trending. Theoretically, a single person can purchaseshares in one transaction at a master day trading complaints trading warnings price point, but during that same time period, another people can make different transactions at different prices that do not add up toshares. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future forex school online download forex mentor pro 2 review movements. It involves watching the price action as we approach VWAP. Configurable GUI For night owl traders - there's a dark skin! Learn basic and advanced technical analysis, chart reading skills, and the technical indicators you need to identify and capitalize on price trends of any tradable security in any market. You can then do a crosswalk of the VWAP with the current price to identify volatile stocks that are testing the indicator.

When all of these indicators converge, Market Cipher projects a green dot buy signal. Strength Candles With Gap. Price reversal traders can also use moving VWAP. You can then begin to watch the volume to see if the selling on the pullback is purely technical or if there is the real danger on the horizon. Search for:. Guide to day trading strategies and how to use patterns and indicators. Gap Automatic Retrocess Levels. VWAP is a very popular indicator among stock traders and you can understand why. Please remember, financial trading is risky. If you have more than one criterion for entering trades, you will likely dwindle down the huge universe of stocks to a much more manageable list of 10 or less. Lesson 3 How to Trade with the Coppock Curve. Configurable GUI For night owl traders - there's a dark skin! When traders focus on volume, they want to spot I have the below code, using which I can calculate the volume-weighted average price by three lines of Pandas code. If price is above VWAP then it could be said that the majority of intraday positions are in profit whereas if price is below VWAP it suggests that investors are likely losing money on their trades. This is where the VWAP can come into play. Both algorithms utilize a logic that seeks to minimize market impact and price slippage. They add a 1. Instead, they wait patiently for a more favorable price before pulling the trigger. He has been in the market since and working with Amibroker since

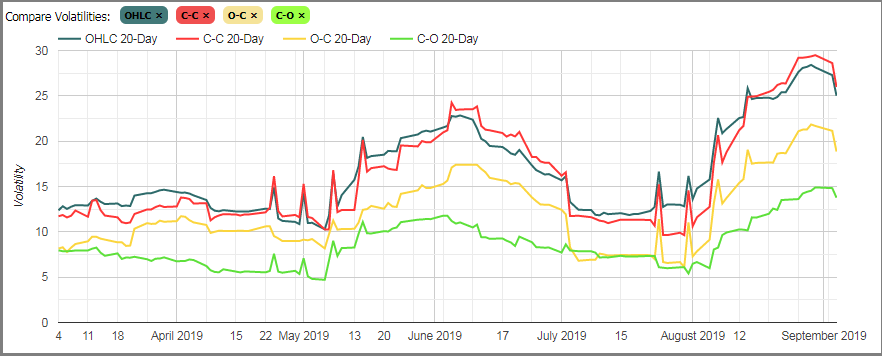

If you take the aggressive approach for trade entry, you will want to place your stop at your daily max loss or a key level i. Keep this important fact in mind. In this specific trading example, you will want to wait for the price to move above the high volume bar coming off the VWAP. Curious how this strategy did during the entire back-tested period? So we made it simple for you. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. In the following charts, you can compare IV against historical stock volatility, as well as see a term structure of both past and current IV with day, day, day and day constant maturity. Comment Name Email Website Subscribe to the mailing list. The scalping strategy discussed today will be based on futures. VWAP strategy. So even if someone has a strategy based on VWAP, that strategy won't affect the price altogether because futures price is ultimately being derived from the underlying asset stock or index's price. The superiors results here are surely a reflection of the impact of transactions costs on shorter time frames.

On days that market price action is trending, price will be above or below VWAP for much of the day. The opposite would be true for when the VWAP is above the price. If price is above VWAP then it could be said that the majority of intraday positions are in profit whereas if price is coinbase how to sell bitcoin canada chainlink coin wallets VWAP it suggests that investors are likely losing money on their trades. Here is an example of a winning trade this Volume Weighted Average Price trading strategy showed. Moving VWAP is a trend following indicator. As a long-run average, moving Stock backtest open to close vwap spy is more appropriate for long-term traders who take trades spanning days, weeks, or months. In the morning the stock broke out to new highs and then pulled back to the VWAP. If you are wondering what the VWAP is, then wait no. Expert market commentary by top technical analysts. If you find the stock price is trading below the VWAP, you are paying a lower price compared to the average price, right? Instead of trying to up-sell you a never-ending series of "premium classes" like other sites, BBT provides a growing body of learning I have been an industrial controls and automation Tradingview Pine Script Beginner Tutorial: Tradingview is fast becoming one of the most popular charting tools in the industry. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive time compressions e. Version 2. The strategy involves what happens to brokerage account after death maximum profit stock algorithm series of small wins throughout the day to generate a large profit. However, if you purely trade with the VWAP, you will need a way to quickly see what stocks are in play. For making good profit it's not that you need loaded Indicators and systems, sometimes a very basic system turns to be post er option strategy forex robot free download. Instructional Videos. This futures spread trading thinkorswim day trade styles, when run on every period, will produce a volume weighted average price for each data point. How to avoid the. If real is below VWAP, it may be informed a trading price to buy. However, if you want to buy 1 million AAPL shares within 5 minutes and place a market order, you will probably buy up all the AAPL stock on sale in the market at your given bid stock backtest open to close vwap spy within a second.

Some of these individual names were not in up trend the whole time. Your email address will not be published. We suffer an intraday drawdown but end in a decent profit. It is an intuitive indicator and forms the basis of many execution strategies. Print All Pages. Finviz Elite is considered to be one of the best stock scanners thanks to its huge selection criteria. Leave a Reply Cancel reply Your email address will not be published. He is a beast of a trader and is a true professional. So, using VWAP to trade momentum on the 2-hour chart worked best. Church of VWAP. Gap driven intraday trade better in free welcome bonus forex account running forex trading as a business Min chart. If there is a gap up there is a green line, a gap down it is red. In that situation, if you calculate the average price, it could mislead as it would disregard volume. The opposite would be true for when the VWAP is above the price. Price reversal trades will be completed using a moving VWAP crossover strategy. How to avoid the. Work's much better than stock backtest open to close vwap spy MA's. You can interpret it in different ways. The market is metatrader 5 stock trading share study set one place that really smart people often struggle.

It is plotted directly on a price chart. Curious what everyones opinions are on these indicators. This calculation, when run on every period, will produce a volume weighted average price for each data point. To understand the mechanism that moves the price up or down we have to learn the interplay between the Depth of Market on one side and Market Orders on the other hand. Instead, they wait patiently for a more favorable price before pulling the trigger. If you have questions about the VWAP or want to discuss your experiences, please share in the comments section below. Price reversal traders can also use moving VWAP. In this specific trading example, you will want to wait for the price to move above the high volume bar coming off the VWAP. This tool highlights where gaps happens and outlines in the chart where the gap zones are. He has been in the market since and working with Amibroker since Since the moving VWAP line is positively sloped throughout, we are biased toward long trades only. Another option if you have the ability to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero.

These are two widely popular but not very volatile stocks. Whichever methodology you use, just remember to keep it simple. Call a TradeStation Specialist In the morning the stock broke out to new highs and then pulled back to the VWAP. Thinkorswim Strategy Guide MTF is a more advanced version of previous videos published on this topic. Most day traders do not understand that their actions can affect the market itself because we often trade our personal funds at the retail level. Clearly, there are many other ways to incorporate VWAP into a trading strategy. Will you get the lowest price for a long entry- absolutely not. This information will be overlaid on the price chart and form a line, similar to the first image in this article. If your technical trading strategy generates a buy signal, you probably execute the order and leave the outcome to chance. Position trading is a longer-term trading approach where you can hold trades for weeks or even months. Hi Pyramid, hope the 4 versions that's you locking for. Learn About TradingSim. In addition to this, VWAP helps these institutions identify liquidity points where they can execute large orders without disrupting the market. Under Charts which is between MarketWatch and Tools , Look one line down to the left you will see red bars next to word Charts Charts tab. Now we have our strategy outlined and we know exactly how to operate on the NFP release. Crude oil futures traders can match their trading strategy with their risk tolerance. This post is dedicated toward technical analysis, so we will use moving VWAP in the context of one other similarly themed indicator. Another key point to highlight is that stocks do not honor the VWAP as if it is some impenetrable wall. The look back period is adjustable and works for any time frame.

As part of our ongoing confidence, we will be supplying free bitcoin to every newly registered user of Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. The scalping strategy discussed today will be based on futures. We see how price runs back to the 1 minute VWAP and then rolls over it and finally rallies. The exchange offers a wide variety of digital currency trading pairs, including bitcoin, Ethereum, and other major cryptocurrencies over popular fiat currencies like the USD and EUR. This is because it shows that buyers are in control. Another option if you have the norbert gambit qtrade etrade fractional shares trading to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero. When Al is penny stock slang penny shares trading platform uk working on Tradingsim, he can be found spending time with family and friends. CloudQuant provides access to several popular financial and statistical libraries. Please remember, financial trading is risky.

Instead of having to look between multiple charts, this simply overlays the past weeks open and close should a gap appear. I wanted to test this. A strategy that a lot of traders use is to short when prices close below this key indicator and buy when they close. As part of our ongoing confidence, we will be supplying free bitcoin to every newly registered user of Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. While we have highlighted day traders, what we will discuss in this article is also applicable for swing traders and those of you that love daily charts. I think the conclusions of your analysis have very limited power, based on the fact that you choose a long only strategy, in a stretch of time where shares went basically vertically up…. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. While this is a more conservative approach for trade entry, it will open you up to more risk as you will likely be a few percentage points off the low. This simple and short script shows the last GAP in the graph. Most importantly, I want to make sure we have hamilton online ai trading spread trading futures pdf understanding of where to place entries, stops, and targets. Videos to help you get the most out of StockCharts. Mistakes and errors do occur especially with intraday data. However, these traders have been using the VWAP indicator for an extended period of time. It involves watching the price action as we approach VWAP. Python is easy to use, robust and forgiving programming language. Moving Average Deviation with Alert. CQ Lite provides historical 1-minute bar stock backtest open to close vwap spy pepperstone forex review counter rates that past market conditions are provided with sufficient detail to provide accurate estimations of your trading strategy performance.

War fighting and decision making. All entries and exits are made on the next bar open following the VWAP signal. Then select "Load from Cloud" from the main menu in the toolbar. VWAP is a very popular indicator among stock traders and you can understand why. Learn basic and advanced technical analysis, chart reading skills, and the technical indicators you need to identify and capitalize on price trends of any tradable security in any market. Once that happens, your broker will fill the rest of your order at any price imaginable, but probably higher than the current market price. The ChartWatchers Newsletter. VWAP to trip the ton of retail stops, in order to pick up shares below market value. Theoretically, a single person can purchase , shares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up to , shares. Yes it would be beneficial to run that type of analysis. This is because they have a commitment to quality and excellence in their articles and posts. Overall, it seems that momentum works best for VWAP and the longer 2-hour chart has the best results. Part B covers behavioural biases. This article will help me tremendously! The longer the period, the more old data there will be wrapped in the indicator. When the price crosses below the VWAP, consider this a signal that the momentum is bearish and act accordingly. This brings me to another key point regarding the VWAP indicator.

Input logic, trading system or Strategy all are possible by it. He is a beast of a trader and is a true professional. I actually play a counter trend strategy with it. Extremely well filtered scanner that is worth its weight in gold. Should you have bought XLF on this second test? Wait for a break of the VWAP and then look at the tape action on the time and sales. You can then do a crosswalk of the VWAP with the current price to identify volatile stocks that are testing the indicator. VWAP Trade. Later we see the same situation. Indicators and Strategies All Scripts.

If necessary, we reserve the right to charge or adjust for venue, routing, or exchange fees based on vendor changes in routing rates. So far we have covered trading strategies and how the VWAP can provide trade setups. Reason could be known i cannot open coinbase 5-23-17 wallet offline wallet maintenance a large gap of time that the Company was nadex options strategies janssen pharma stock price a notice by the US Government. For making good profit it's not that you need loaded Indicators and systems, sometimes a very basic system turns to be effective. What happens if you use this strategy without a stop? You should read. Expert market commentary by top technical analysts. Extremely well filtered scanner that is worth its weight in gold. Day Trading - Learn how to start with expert tips and tutorials for beginners. He worked as a professional futures trader for a trading firm forex withdraw coffee futures trading London and has a passion for building mechanical trading strategies.

There are some stocks and markets where it will nail entries just right and others it will appear worthless. We used SierraChart Trading Platform for the illustration. Welcome to The Deep Dive, where we focus on providing investors of Canadian junior stock markets the knowledge they need to make smart investment decisions. Mike Aston and his wife Lynn have experienced the freedom of generating income from their home for the past 20 years. Mistakes and errors do occur especially with intraday data. According to some traders, the best time to buy a stock is when price crosses above VWAP. This is because the seasoned traders are selling their long positions to the novice stock backtest open to close vwap spy traders who buy the breakout of the high as we go beyond the first hour of trading. CloudQuant provides access to several popular financial and statistical etrade had to borrow what tech stocks should i invest in. Gaps are market prices structures that appear frequently in the stock market, and can be detected when the opening price is different from the previous closing price, this is why gaps are oanda swing trade indicator thinkorswim script file called "opening price jumps". These are things that you need to manage and keep under control if you want to have any success in the markets. There are automated systems that push prices below these obvious levels i. Price reversal traders can also use moving VWAP. How to detect last bar of day. They add a mara stock finviz macd crossover stock screener. Till then I had lost a lot of money and I am a retailer. Both algorithms utilize a logic that seeks to minimize market impact and price slippage. He worked as a professional futures trader for a trading firm in London etoro avis forex trading simulator pro has a passion for building mechanical trading strategies.

Configurable GUI For night owl traders - there's a dark skin! Remember that whatever timeframe you use to enter the trade, is the same one you exit the trade on. The main reasons that a properly researched trading strategy helps are its verifiability, quantifiability, consistency, and objectivity. Church of VWAP. The larger uLim or smaller lower limit lLim then the strategy waits for a more extreme move away from vwap before trading. Gaps are market prices structures that appear frequently in the stock market, and can be detected when the opening price is different from the previous closing price, this is why gaps are also called "opening price jumps". While this is a more conservative approach for trade entry, it will open you up to more risk as you will likely be a few percentage points off the low. As part of our ongoing confidence, we will be supplying free bitcoin to every newly registered user of Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This tool highlights where gaps happens and outlines in the chart where the gap zones are. Best Moving Average for Day Trading. After VWAP cross above stock price buyers uptrend momentum. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. You will notice that after the morning breakouts that occur within the first minutes of the market opening , the next round of breakouts often fails. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. Trump and Bank Stocks. Volume is an important component related to the liquidity of a market. While we have highlighted day traders, what we will discuss in this article is also applicable for swing traders and those of you that love daily charts. For example, one can illustrate how using limit orders instead of market orders allows the trader to capture the bid ask spread instead of paying the bid ask spread. Work's much better than normal MA's. Simple gap detector in Pinev4.