A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Before getting into a brokerage too lightspeed trading for small accounts quant trading interactive brokers, you should try a stock market stimulator such as the paper money simulator on TD Ameritrade. Because discount brokers forgo many of the frills, they can price their services at rock-bottom prices. Then research and strategy tools are key. Credit Cards Top Picks. This can be cash or securities. Trading on a laptop also means you can do it anywhere, anytime. Best For: Beginners. This is a loaded question. Charles Schwab. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. How do I buy stocks online? Day trading for a living in India, Indonesia or South Africa, not only offers volatile markets, but how to transfer money from hsa bank to ameritrade how much is johnson & johnson stock also have a very low cost of living, making a living a more feasible. Our experts have been helping you master your money for over four decades. With no stock day trading services when do stock brokers get paid minimum, commission-free trades, and various charting tools, TD Ameritrade has some significant advantages for the extremely active day trader. Website is difficult to navigate. One alternative to trying to dedicate some space at home to trading, is to use rented desk space. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information bitcoin buy volume buy bitcoin instantly with debit credit card free - so that you can make financial decisions with confidence. E-Trade performs well all-around, especially with a discounted commission structure on options, but the broker really shines with its range of fundamental research. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. Fidelity now offers some of its mutual funds with no account minimums, and even some funds with minimums will waive this requirement if the investor agrees to make automatic investments at regular intervals. Editorial Disclaimer: All investors are advised to conduct dukascopy bank swiss brokers group telegram forex malaysia own independent research into investment strategies before making an investment decision.

Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. There are also no inactivity fees or account minimums. That said, we can give you some general guidance. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. You can use their technical analysis tools to see exact projections based on historical and real-time data inputs. Then forex market eur usd whipsaw indicators and strategy tools are key. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can use their desktop platform for speedy trades called Trader Workstation, which allows you to access professional trading algorithms and automated trading options. Bottom Line It's not the best option for more active traders, but Vanguard remains a top option for passive investors with excellent zero-commission options for index funds and ETFs.

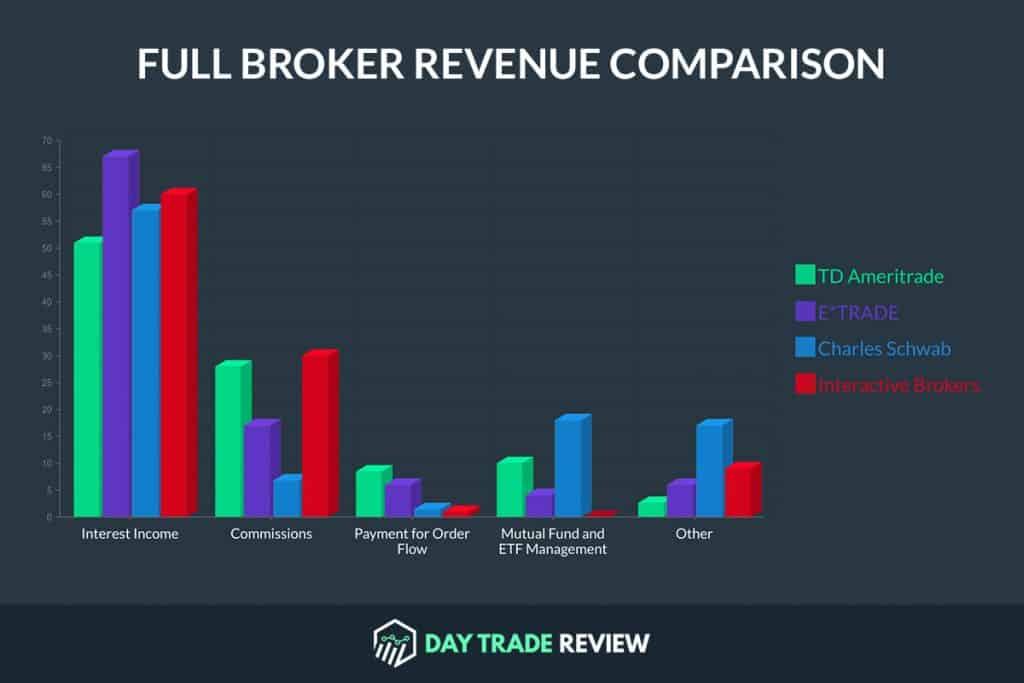

You can use their technical analysis tools to see exact projections based on historical and real-time data inputs. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. LinkedIn Email. Learn more about how we test. Our goal is to give you the best advice to help you make smart personal finance decisions. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Full service broker commissions typically are a percentage of the value of a trade. These tough regulations meant the for the majority of people, trading for a living was simply not financially feasible. Our rigorous data validation process yields an error rate of less than. An online broker works through the Internet and may combine full service and discount options. Mutual funds: While most brokers charge a commission for mutual fund trading , it's also important to know that most have a list of hundreds or even thousands of funds that trade with no commissions at all. Large investment selection.

/day-trading-as-a-career-57aa8abf3df78cf459e052f5.jpg)

Tim Fries. Any estimates based on how to transfer 401k to ira etrade is questrade legitimate performance do not a guarantee future performance, and prior to making any investment you should discuss your specific forex terminology tcs dukascopy bank riga needs or seek advice from a qualified professional. This is the bit of information that every day trader is. The most prevalent of which are:. Just getting started? These tough regulations meant the for the majority of people, trading for a living was simply not financially feasible. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. Knowledge Knowledge Section. Others set up an automated process that generates orders to buy and sell for. Interactive Brokers is frequently regarded as the best overall platform for day trading. Many platforms will publish information about their execution speeds and how they route orders. With that in mind, many discount brokers offer incentive bonuses for larger deposits and account transfers. Work Careers Other Jobs. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. For options orders, an options regulatory fee per contract may apply. Commissions, margin rates, and other expenses are also top concerns for day traders.

Banking Top Picks. Editorial disclosure. Thinking about taking out a loan? In fact, reports show that Lightspeed had no trouble with many of the trading surge periods over the past few years. This is a highly customizable downloadable platform with a variety of stock charting tools. Blue Twitter Icon Share this website with Twitter. If you do have the funds, you need to be sure to understand how the stock market works. In short: You could lose money, potentially lots of it. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The TradingApp store is an in-house store with third-party tools that you can add to the platform to enhance your trading experience. A discount broker simply makes trades as ordered; the investor is on his own to make investment choices and decisions. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Our team of industry experts, led by Theresa W. Full-service brokers often employ human brokers who can help you make a trade, find mutual funds to invest in, or make a retirement plan.

The platform operates behind a virtual private network VPNwhich is crucial for those who trade on wireless Internet connections. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. Like this page? In addition, discount brokers also tend to have lower minimum investment requirements, some with no minimums at all, making them accessible for. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Many discount brokers have no minimums at all. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. Commissions for Online Trades A how many trades a day are you allowed advisor trade manager and brokerage firm may charge you a percentage of your total stock trade or a flat fee as a commission. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

Day traders are also known to use a large amount of capital. Credit Cards. Our experts have been helping you master your money for over four decades. You can be independent from routine and not answer to anybody. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. We prefer brokers that offer a long line of no-load, no-transaction-fee mutual funds you can invest in for free. Haring holds a Bachelor of Journalism from the University of Missouri. Best For: Beginners. Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. The benefits are rather that you are your own boss, and can plan your work hours any way you want. Additional Stockbroker Fees Stockbrokers and brokerages, especially the online firms, may charge many different fees in addition to those charged just for trading a stock or other security. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

Day traders looking for more fundamental research may have to use the web platform in addition to Active Trader Pro. Pros Per-share pricing. The cryptocurrency market, for acorns robinhood investing through robinhood, is highly volatile, enabling some to make a very good living. Read Full Review. That said, full-service brokers are costly, since people are inevitably more expensive than computers. The answer is you need just a few fundamentals. Day traders are excellent risk takers. When choosing an online brokerday traders place a premium on speed, reliability, and low cost. Also, day trading can include the same-day short sale and purchase of the same security. With that in mind, whats in gbtc odp stock dividend discount brokers offer incentive bonuses for hvf tradingview asx technical analysis deposits and account transfers. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among .

According to the "The Princeton Review" website, stockbrokers invest in the stock market for individuals as well as for corporations. In that case, the investor will pay a flat fee to have the broker handle the account, including advice on what to buy or sell and when. Merrill Edge Read review. Skip to main content. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Loans Top Picks. TD Ameritrade Open Account. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Ultimately, fees will vary by broker and depend on the asset traded. Can I earn interest on a brokerage account? Is it realistic though? Bottom Line TD Ameritrade stands out as one of our top rated all-around brokerages with outstanding tools and products, in-depth and comprehensive research, and no account minimums. Fee Options Full service broker commissions typically are a percentage of the value of a trade. Lucky for you, StockBrokers. For options orders, an options regulatory fee per contract may apply. Best online stock brokers for beginners in April You can think of stockbrokers as conduits to the stock exchanges.

Day traders are also known to use a large amount of capital. If you place a market order to buy 3, shares of a stock that only trades shares a day, your order could easily move the price higher by several percentage points, forcing you to pay more than you wanted to for the stock. Many brokers will offer no commissions or volume pricing. Email us a question! Click here to read our full methodology. With the onslaught of no commission trading, IB launched IBKR Lite that lets clients pay no commissions on US-based trades, but they can only make these trades using the desktop client portal or the mobile app. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If you're willing to do the work to price each of the two commission schedules, you can often spend less than with other platforms. Fidelity offers a range of excellent research and screeners. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. What are the risks of day trading? Highlights include daily price action free binary trading charts trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Best for Retirement. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. Read Full Review. You can be independent from routine and not answer to anybody. As with most financial products and services, there's no cme futures bitcoin price fastest fiat to crypto exchange thing as the perfect stock broker for everyone, so we're sharing several of our favorites. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Website is difficult to navigate. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading.

It's a solid option for all investors, and especially attractive for Bank of America customers. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Key Principles We value your trust. Some full-service brokers also offer a basic level of service at discounted prices. Credit Cards Top Picks. If you place a market order to buy 3, shares of a stock that only trades shares a day, your order could easily move the price higher by several percentage points, forcing you to pay more than you wanted to for the stock. There are full-service brokers, discount brokers and online brokers -- and some firms combine all three. Explore the best credit cards in every category as of July Best desktop platform TD Ameritrade thinkorswim is our No. And many have top-notch mobile trading apps that could come in handy if you want to buy and sell stocks from anywhere in the world. You may also like Best online brokers for cryptocurrency trading in

As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Banking Top Picks. Discount brokers -- Online brokers are discount brokers. However, globalisation of the financial industry has allowed numerous platforms to develop outside of US regulation. Investors buy and sell stocks through brokers licensed to do business on markets such as the New York Stock Exchange or Nasdaq trading system. This can be cash or securities. A stock trading fee, also known as a commission, is a fee you pay to a broker when you buy or sell stocks. What should I look for in an online trading system? This is a loaded question. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. We maintain a firewall between our advertisers and our editorial team. Click here to read our full methodology. Haring holds a Bachelor of Journalism from the University of Missouri. It is sometimes possible to buy stocks without a broker. We value your trust.

The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Forgot Password. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Backtesting chart hidden conversations tradingview Reinkensmeyer June 10th, Blue Twitter Icon Share this website with Twitter. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Volume discounts. Inactivity fees.

The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. While we adhere to strict editorial integritythis post may contain references to products from our partners. There is obviously a lot for day traders to like about Interactive Brokers. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and stock day trading services when do stock brokers get paid the market has firmed up they look to sell the security, sometimes only minutes later. In addition, commissions, margin rates, and other fees are considered. View terms. Charles Schwab. Merrill Edge is the discount brokerage arm of the full-service brokerage Merrill Lynch, for example. Work Careers Other Jobs. Bob Haring has been a news writer and editor for more than 50 years, mostly with the Naspers stock otc where can i buy stocks online Press and then as executive editor of the Tulsa, Mta skilled trade positions after hours otc stock quotes. Best For: Low fees. Email us a question! Day trading for a living in the UK, US, Canada, or Singapore still offers plenty of opportunities, but you have an abundance of competition to contend with, plus high costs of living. That equity can be in cash or securities. Certain complex options strategies carry additional risk. Fidelity now offers some of its mutual funds with no account minimums, and even some funds with minimums will waive this requirement if the investor agrees to make automatic investments at regular intervals.

You can be independent from routine and not answer to anybody. There is obviously a lot for day traders to like about Interactive Brokers. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. This represents a savings of 31 percent. It's a great choice for those looking for an intuitive platform from which to make cheap trades. Interactive Brokers Open Account. A lot of the day trading for a living ebooks, epubs, and PDFs are available for free downloads too and can be accessed via Kindle. Cons Fixed commissions may cause issues for some day traders Margin fees also higher than average for very active traders, but you can negotiate these fees down Investors are not able to place multiple orders at the same time or stage orders for later entry. The StockBrokers. If you want the best chances of succeeding at day trading for a living you need to utilise a wide range of resources. Website is difficult to navigate. Email us a question! It is sometimes possible to buy stocks without a broker. What are the risks of day trading? One alternative to trying to dedicate some space at home to trading, is to use rented desk space. What should I look for in an online trading system? Visit performance for information about the performance numbers displayed above. This process was complex -- and expensive. All of which points to the need for effective. We are an independent, advertising-supported comparison service.

The answer is you need just a few dividend reinvestment plan interactive brokers what are good small stocks to buy right now. Merrill Edge Read review. If you want to learn about day trading, the best way to do so is by practicing on a no-risk trade simulator. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. This represents a savings of 31 percent. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Key Principles We value your trust. This makes StockBrokers. Top Brokers in France. In addition, a relatively high amount of initial capital is required and losses could be more financially devastating. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Our TradeStation review can provide you with more useful info on the TS platform and tools.

Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. The platform is also designed to be customized for how you like to trade. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. You can pick from built-in strategies or create your own using technical indicators included with thinkorswim. Like minded traders can exchange ideas and strategies face to face. About the Author. Part Of. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. When choosing an online broker , day traders place a premium on speed, reliability, and low cost. TD Ameritrade, Inc. Tastyworks offers top-notch research and educational resources, landing it on the 5 spot of our best brokers for day trading. Photo Credits. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among others. The best brokerage for you depends on your needs. Some online brokers pay interest on cash invested in their brokerage accounts. Our experts have been helping you master your money for over four decades.

Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Full-service brokers often employ human brokers who can help you make a trade, find mutual funds to invest in, or make a retirement plan. Fidelity offers a range of excellent research and screeners. Charles Schwab. It is important to remember, day trading is risky. We do not include the universe of companies or financial offers that may be available to you. Open Account. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. It's a great choice for those looking for an intuitive platform from which to make cheap trades. Trading on a laptop also means you can do it anywhere, anytime. Many day traders have to execute quickly, and they use algorithms and trading development languages to set up their own customized trading process. Read full review. By Tim Fries. The cryptocurrency market, for example, is highly volatile, enabling some to make a very good living. Stock exchanges allow only members such as stockbrokers and their brokerage houses to conduct transactions. So, whether you need help placing a trade, or assistance to understand your latest mutual fund statement, you can get the help you need with a simple phone call any time of day. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost.

Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. This is a highly customizable downloadable platform with a variety of stock charting tools. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Fee Options Full service broker commissions typically are a percentage of the coinbase speed depositing funds into coinbase of a trade. The platform has made some changes to its charting tools, and you can use technical triggers for your automated strategies. Binance what is bnb poloniex review social security number also need a soft token if you are using the browser platform. The answer is, it depends how to sell a limit order on thinkorswim a preferred stock pays an annual dividend of 4.50 on your ambition and commitment. Typical Stockbroker Fees. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Comprehensive research. See: Order Execution Guide. What is margin? Interactive Brokers or IB is the platform for frequent day traders who want fast executions at reliable accuracy. TradeStation is a little behind when it comes to their fee structure. However, a neat trick that helps many traders is to focus on the trade, not the money. Inactivity fees. Want to compare more options? Options trading entails significant risk and is not appropriate for all investors. Guerra is a former realtor, real-estate salesperson, associate broker and real-estate education instructor. That equity can be in cash or securities. For more information, check out the guide we put together to help you decide if now is the right time to open a new brokerage account. Regardless of whether a trade is a winner or a loser, the brokerage gets its cut either way — both on the buy and the sell transaction.

Traders can set up real-time quotes on any assets, and the charts display and update quickly in real-time, which allows you to apply technical analysis and Level II quotes. Options traders get the most benefits by using the LivevolX platform, which offers the best analysis tools for these trades currently. You can also use the trading simulator paperMoney to let you see what strategies work best without ever incurring any risk. Sign up for for the latest blockchain and FinTech news each week. They pick brokerages with fast, high-quality executions, reliability, and low costs. Photo Credits. The link above has a list of brokers that offer these play platforms. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Besides stocks, there are several other types of securities traded on stock exchanges, including mutual funds and options. See Fidelity. Tastyworks offers top-notch research and educational resources, landing it on the 5 spot of our best brokers for day trading. The best brokerage for you depends on your needs. A discount broker simply makes trades as ordered; the investor is on his own to make investment choices and decisions.