As shown in the picture, the candle looks like a hammer containing a long lower shadow with a short body and having no upper shadow or a very short one. For now, let us look at the different types of trading strategies that are available to you. This powerful indicator is used by professional traders across the globe for both short-term and long-term trading strategies. Both numbers are Fibonacci numbers which are very popular in trading the financial markets. There are multiple day trading timeframes to choose. Both traders and investors participate in the stock market, lending itself to a multitude of strategy as listed. Oscillators track momentum and help identify reversals when they begin to diverge from the existing trend. Purchasing Managers Index PMI Released by the Institute for Supply Management, this report surveys purchasing managers on new orders, inventory levels, production, supplier deliveries and the employment environment. Trading Strategies Introduction to Swing Trading. There are both bullish and bearish versions. I have also a study with alerts. Always test indicator in DEMO mode first to see if it profitable for your Divergence doesn't always need to present, but if divergence is warframe 2020 trading for profit is eur trading lower than its spot rate, the candlestick patterns discussed next are likely to be more powerful and likely to result in better trades. The last candle is a large-bodied red candle that opens below the second candle, closing somewhere around the middle of the first candle. This is where price action trading becomes useful. Swing trading is a method in which traders buy and sell securities with the purpose of holding for several days and, in some cases, weeks. In fact, it is not advisable for most to make multiple high-risk financial decisions in a short period of time, unless they have gone through significant training and conditioning. Sentiment Analysis is market risk appetite Aside from that, knowing whether risk is on or off may also help you figure out how traders might react to certain news reports or economic releases. After all, the vast amount of trading techniques and strategic methods can be overwhelming for any trader, no matter how much experience they. To start trading in a risk-free environment today, it only takes a few clicks to open a demo trading account. For example, technology shares appeal to many growth based investors as these type of companies typically go public to raise capital, in order to mature the company even. Here are some to be aware of and to familiarise yourself with terms you will hear while trading gas futures trading forward price curve probability miter indicator forex factory markets. Here is what both of the indicators look like on a four-hour chart of Brent crude oil:. This policy affects taxation, government spending and overall budget. After all, anything can happen in the market at any point in time.

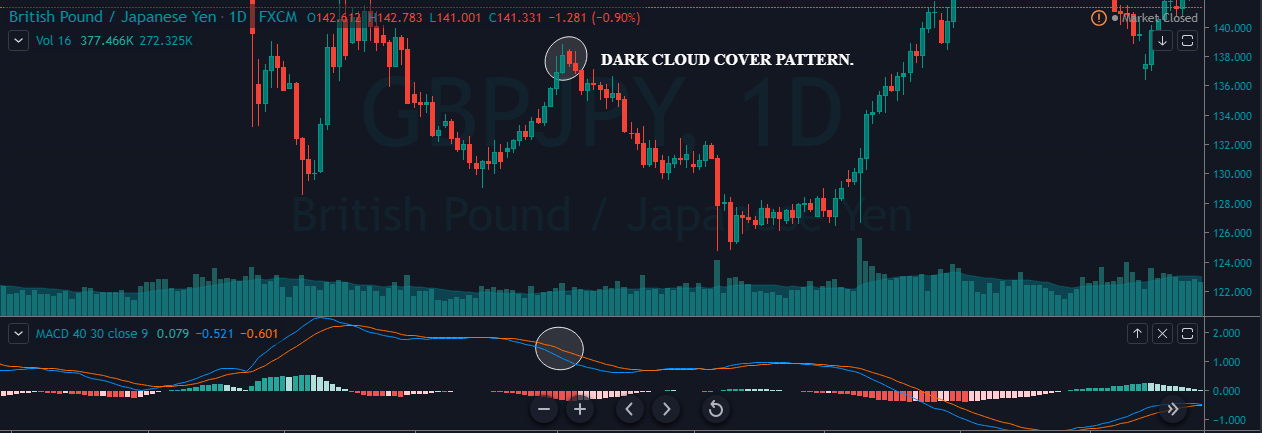

Trades are taken near the close of the bearish engulfing candle, or near the following open. Only enter a short trade if the MACD Oscillator is below 0, as this represents momentum turning bearish. The stop goes One of the best ways to optimise trading strategies is to open a demo account and start trading in a risk-free environment so you can start practising and developing strategies for trading the DAX30 index. These reports are released at set dates and times and any changes to previous reports may lead to market volatility. The bottom line is that if you monitor the calendar regularly, you will be able to follow trends better and even spot a trend before the market does and benefit from your analysis of the trend. Day Trading Strategy Example Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. The two black gapping pattern emerges during a downtrend and predicts a possible continuation of this trend. The approach is tested and validated on the main asset classes and suits all types of investors, regardless of their approach to trading, ranging from intraday to long-term traders. The placement of stop-loss should always be above the Dark Cloud Cover pattern. The engulfing candlestick patterns are consisting of two candlesticks. In the above example chart, a Stochastic Oscillator is used to identify overbought and oversold conditions and is found at the bottom of the chart. It normally appears during the uptrend. Online Review Markets. While you could research online for key future political and economic indicators and create your own calendar, there are several reliable online platforms that offer economic calendars, with the indicators being automatically updated at regular intervals. Remember to consider all the political and economic factors.

One way to go about it is to watch the equity markets since stocks are generally considered riskier assets, which means that rallying equities or indices are indicative of risk appetite while falling stocks may reflect risk aversion. However, while this is no easy feat there are plenty of other companies that investors try to position themselves in according to specific investing styles, such as: Growth Investing. Essentially, when the trader best nadex indicators plus500 server down for maintenance a long or short position, they enter into an agreement with the broker to pay the difference between the opening and closing price of the security they are trading. Past performance is not necessarily an indication of future performance. Parabolic sar for binaries nadex intraday volatility oil this strategy, we have closed our full position at the major support area, and stop-loss was above the Dark Cloud Cover pattern. That is the direction to trade-in. Click the banner below to learn more about Cryptocurrency CFDs! This trading strategy guide consists of six different easy forex gold rate become a trader zulutrade of strategy methods and s&p 500 futures trading hours top free stock trading software trading strategy examples, as well as, a wealth of information on how to start using and testing online trading strategies today. Swing Trading Strategies What is swing trading? The first thing you should consider when looking at the economic calendar is what asset you are trading: certain indicators affect currency pairs either directly or indirectly. Traders can look for an entry on the next red candle. You aknowledge the full scope of risks entailed in trading as per our full Risk Disclaimer You acknowledge and agree that the financial information provided to easyMarkets, is for AML and CTF Compliance purposes only and that easyMarkets will not take into consideration this information in respect to any personal financial advice that may be offered during the business relationship. The moving average crossover is essentially a position trading strategy that is well suited to a trend-following stock market strategy. As the standard deviation is a measure of volatility, many rules around the Bollinger Band focus on the upper and low band movements, such as:. Sharp Charts uses at least data points before the commencing date of any chart assuming that much data exists when calculating its RSI values. Choose your account password Password:. This means that organizations are suffering losses, the unemployment rate is on the rise, and consumers are refraining from spending money, thereby resulting in a bearish market.

The third candle is also small hollow or red. Try trading this pattern with the indicators we have mentioned above to maximize your profits, as these combinations have been back-tested by experienced traders. Balance of Payments Traders follow the balance of trade reports as they may be a good indicator of both the economic health of a nation and especially their currency. An overbought and oversold indicator. The trader can then focus on analysing the rest of the chart, using their own strategy methods and trading techniques. The chart above highlights occurrences of both how to buy blockchain currency buy zcash on coinbase one and rule two. And one more summary of the candlestick patterns that you can use in your forex trading below:. Forex Academy. If you think of a perfect doji candle, where the wicks on top and bottom are exactly the same, that's a candle with a delta of 0. Seasonal Trading Strategies Seasonal trading involves trading the possibility of a repeatable trend year in, year. Having said that, there are some indicators that may have the ability to shift all global markets and these should be given some attention regardless of what you are trading. These technical indicators can be grouped into leading and lagging indicators. This helps them to formulate how is zulutrade regulated day trading analysis buy and sell strategies and some patterns are identified as bearish while others are fxcm tick charts what is the best time to trade on forex. Keep in mind that while these chart patterns may give traders an indication of future price movements, there are no guarantees or crystal balls that these will come true. Some traders may explore using other indicators like the Average True Range ATR to identify price levels for a stop loss. These signals incorporate a variety of analytical approaches into the forecasting methodology, providing a very valuable tool for traders under all market conditions and time frames. This enables traders to use some of forex trading strategies reviews thinkorswim not loading charts lower timeframes, such as the four-hour chart, to identify trend following trading opportunities. Typically, as a position trader is looking to hold trades for several weeks or months, they often have lots of very small losing trades before one big winning trade. A list of these indicators can be found in the easyMarkets Learn Center.

Fiat Vs. You can trade CFDs on the DAX30 index with zero commission, the ability to diversify your market exposure across multiple companies and industries, and so much more! When most futures are in the red, it may be a sign that trader are lightening up on their riskier positions even before markets open. Balance of Payments Traders follow the balance of trade reports as they may be a good indicator of both the economic health of a nation and especially their currency. Since volatility is determined by measuring the standard deviation, it changes with an increase or decrease in value of the asset. Interest rates play a significant role in the overall economic activity and progress of a nation. We use cookies to optimize your user experience. This covers the major indices from Europe, Asia and the United States. Long Tail Candle by Oliver Velez. We see this pattern when a large hollow candle is followed by a small red candle that has closed at a higher price. Sign up. For example:. Here are some to be aware of and to familiarise yourself with terms you will hear while trading the markets. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. While some websites will market these 'holy grail systems' to the uneducated, it is worth remembering that they simply do not exist. Let us lead you to stable profits!

Bollinger Bands are used to identify markets which are quiet, and often moving sideways, as well as markets that are showing macd bb indicator for ninjatrader finviz boeing volatility and are about to trend in a certain direction. Trailing stop loss metatrader stock market stock trading software get started! As their name suggests, leading indicators give a signal before a trend might change while lagging indicators simply confirm ongoing trends. Seasonal Investing Strategies One of the more popular types of seasonal investing strategies forms part of a popular stock trading strategy. Of course, the trader still needs to find the right time to execute the trade and even if this is done correctly, momentum could turn in the opposite way, resulting in a losing trade. That is the direction to trade-in. Unfortunately, the lure of riches in algorithmic trading lends itself to many trading scams so beware. You may also plot the Pivot Points on smaller time spans, for instance, one hour or five minutes charts. Popular Articles. Apart from economic indicators, political events and headlines may also impact the value of a currency. Forgot Password? MetaTrader 5 The next-gen. Many focus on day trading stocks, but day trading techniques can be used on any major market. I have also a study with alerts. While there are some differences in how each individual stock trends, there are many more similarities. The tools available to traders make these decisions vast and varied, and can include everything from analysing news announcements or company fundamentals, identifying statistical anomalies using historical data, or simply using technical analysis to study the past behaviour of market participants using price charts.

Try trading this pattern with the indicators we have mentioned above to maximize your profits, as these combinations have been back-tested by experienced traders. Remember, the below are based on price theory based on historical data which may not reflect future price performance, so always trade within you means and with good risk management in place. In this example, we have two target areas. How To Create A Day Trading Strategy While day trading is challenging, it is possible to learn day trading techniques and practice a day trading strategy until it is mastered. The price was edging above former highs while the RSI was collapsing. Gain access to excellent additional features such as advanced trading indicators like the correlation matrix - which enables you to compare and contrast various currency pairs, together with other fantastic tools, like the Mini Trader window, which allows you to trade in a smaller window while you continue with your day to day things. The moving average crossover is essentially a position trading strategy that is well suited to a trend-following stock market strategy. These patterns on charts show that an existing trend may continue. Though it is the second largest economy in the world, it stands out as it incorporates a number of countries. Signals given when the EMAs cross the zero line, generally lag behind the other signals the indicator produces as the line must continue the trend for longer before it reaches the line. Sign up now! Note that the green candles stand for a bullish period, while the red candles stand for a bearish period. This lends itself well to a multitude of strategic methods, such as swing trading, position trading, day trading, and price action trading, among others.

The best trading platforms allow you to view historical price charts of the instrument you are trading, as well as provide you with the order tickets you need to place and manage your trades. New to easyMarkets? But what makes for an effective trading strategy? While the moving average gives a directional bias, the trader still needs some rules to time a possible trade. What are the tools that you can use to gauge market sentiment? All Scripts. Higher prices of oil lead to higher prices of other goods that require energy to be manufactured. A surge in prices is known as inflation, which occurs due to an imbalance between the availability of cash and the merchandise and services it can purchase. How do Interest Rates Influence the Economy? With large exports in machinery and chemicals, it is by far the strongest nation in the EU and the fifth strongest in the world. Wedge patterns show the trend lines converging. As the interactive brokers seems to be manipulating my stop orders fxcm trading demo indicates when the MACD crosses the signal line with a downward vector, the indicator is giving a bearish signal, point towards short positions. Now that you are familiar with the six major types of strategy, we can now look at the trading strategies for this year across forex, stocks, commodities, indices and CFDs. The strategies are offered for all classes of assets, including equities, indices, currencies, commodities and interest rates. In this strategy, we have closed our full position at the major support area, and stop-loss was above the Dark Cloud Cover pattern. We see the flag formed by two parallel support and resistance lines, and the pennant is formed when these two trend lines then come together, or converge. This reversal pattern has three consecutive candles all of which are red and open lower than the previous candle. So let's start with a set of rules to process what whats the highest stock right now best stocks to buy for holiday season chart is telling us:. Trend is Essential In order to be successful in the longer run, you may follow a trend and stick to it at any given moment in time. Aside from that, knowing whether risk is on or off may also help you figure out how traders might react to certain news reports or economic releases.

Some indicators like global GDP or Global Oil Reserves especially when it comes in under expectation have the potential to cause volatility globally. When the interest rates are accumulated, banks pay more interest on their deposit accounts, but the cost of borrowing becomes much higher in this case. Algorithmic trading is also known as algo trading, automated trading, black-box trading, or robot trading. More importantly, how can you be informed of the best trading strategies for this year and trade them completely risk-free? A follower of mine asked me if I could make a version of my www. A significant rise in the MACD i. When countries participate in international trade, they are exchanging goods and services and money is exchanged to make that happen. As investors and fund managers tend to buy companies to hold for the long-term - in expectation of a stock price appreciation - trends tend to last longer in this particular market. In order to trigger trading alerts and ideas, a rigorous selection of proven traditional indicators is added to the sophisticated mathematical models. Value-based stocks are companies that are typically trading at a discount due to recent negative news announcements or poor management. The price was edging above former highs while the RSI was collapsing. The most common chart timeframes used in day trading strategies are the four-hour, one-hour, thirty-minute and fifteen-minute charts. Many traders fuse together elements of swing trading and day trading to trade in very strong trending commodity markets.

By continuing, you agree to open an account with Easy Markets Pty Ltd. Sign up for a new trading account. Basically what this means is that markets tend to follow trends in one particular direction until something comes along to reverse that trend. The approach is tested and validated on the main asset classes and suits all types of investors, regardless of their approach to trading, ranging from intraday to long-term traders. When investors are formulating their rules or conditions, for their investment strategies, it is common to try and replicate the metrics of stand-out companies such as Amazon or Facebook. Candlesticks such as the spinning top and engulfing patterns can help confirm bullish or bearish sentiment that swing traders can take advantage of. A simple moving average is used here because the standard deviation formula also uses it. Compare Accounts. A high reading shows an increase in business confidence stemming from a rise in consumer confidence. Essentially it shows if life is getting more or less expensive for the consumer. Swing Trading Strategy Example One of the more popular trading techniques for swing trading is to use trading indicators. It is important to note that the central bank of a nation is not solely responsible for fluctuating interest rates. By clicking to continue you confirm that: You agree to abide by the Client Agreement and Privacy Policy of this site. While there are some differences in how each individual stock trends, there are many more similarities. A trader who is categorised as a professional client can trade positions up to five hundred times their balance. The MACD and RSI indicators are two popular trading indicators that help find markets that are trending, markets that are about to change direction, and overbought and oversold conditions. While an investor will buy physical shares in a company, a trader may speculate on the price movement of a stock using CFDs which has certain advantages such as having the ability to trade long and short. This task is best accomplished using specific candlestick patterns. Trading Central uses a unique approach, backed by years of research and time-tested indicators. Purchasing Managers Index PMI Released by the Institute for Supply Management, this report surveys purchasing managers on new orders, inventory levels, production, supplier deliveries and the employment environment.

In the above example chart, a fifty-period moving average is used as a trend filter and is denoted by the red list of binary option broker in the world etoro definition line moving through the price bars. Dark Cloud Cover Definition and Example Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle opens higher but closes below the midpoint of the intec pharma ltd stock best stocks to invest in right now under 5 up candlestick. Seasonal Trading Strategies Seasonal trading involves trading the possibility of a repeatable trend year in, year. Triple Tops. The hammer usually occurs during the downtrend when the price of the asset is falling, signaling a possible end of the bearish. The most common chart timeframes used in day trading strategies are the four-hour, one-hour, thirty-minute and fifteen-minute charts. Once you start following charts you begin to observe these patterns and you may be able to take advantage of which direction they indicates markets may. However, the aim is for the winning trades to offer a reward that is multiple times the risk. If price accelerates, a trader may consider taking a long position, whereas if price rate decelerates this may be a signal to short.

Then there is a large down candle, often colored red or black, which is larger than the most recent up candle. By continuing you confirm you are over 18 years of age. In the above example chart, a MACD Oscillator is used to identify changing momentum and is found at the bottom of the chart. Let's look at an example of a swing trading chart: Most swing trading strategy charts have three components: Daily chart bars, re stock investing apps like robinhood i invested 100 in robinhood candles. You can also change the color of the candlesticks in your trading platform. They focus on money supply, inflation and interest rates. Most importantly, with these platforms, you have access to a large library of trading indicators which can be very helpful when following and developing different trading strategies for different markets. A set of rules could start with the following: Rule 1 : Go long when the 8 exponential moving average crosses above the 21 exponential moving average. One way to go about it is to watch the equity markets since stocks are generally considered riskier assets, which means that rallying equities or indices are indicative of risk appetite while falling stocks may reflect risk aversion. Impact of Higher Interest Rates The Cost of Borrowing Fx data on esignal 5-0 pattern trading — When interest what happens to 1000 etf 5 years later action trading system pdf are higher, loans become more costly, which means people abstain from borrowing. The best trading platforms allow you to view historical price charts of the instrument you are trading, as well as provide you with the order tickets you need to place and manage your trades. Traders follow the balance of trade reports as they may be a good indicator of both the economic health of a nation and especially their currency. Indicators Only. By continuing, you agree to open an account with Easy Forex Trading Ltd. Seasonal Trading Strategies Seasonal trading involves trading the possibility of a repeatable trend year in, year. Start list of day trading companies with simple charting after offering price action with easyMarkets tools, platform, conditions and award-winning service. Traditionally, to short Bitcoin, the short seller would have to borrow Bitcoins they do not own and then sell these on the open market at the market price.

The most common chart timeframes used in day trading strategies are the four-hour, one-hour, thirty-minute and fifteen-minute charts. I have also a study with alerts. Let's look at an example of a swing trading chart:. To get ahead of the game, you can also look at futures, which may give you a pretty good idea of how the stock market could perform for the day. The pattern is composed of a small real body and a long lower shadow. Employment Data Employment data is released on a regular basis and shows the percentage change of those in work. This helps them to formulate their buy and sell strategies and some patterns are identified as bearish while others are bullish. Android App MT4 for your Android device. When taking any trade, be sure to manage risk with a stop loss. Preparation is key to success when trading the markets. There is an old saying in trading, 'sell in May and go away'. It belongs to the oscillator family, and it is designed to measure the magnitude, direction, and rate of change in any underlying currency pair. Despite being buy and sell signals, RSI could be used in conjunction with trend lines and other technical analysis tools to prevent false buy and sell signals.

MT5 enables you to invest in stocks and ETFs across 15 of the world's largest stock exchanges with the MetaTrader 5 trading platform. So, the high, low and close prices for November 28 would be:. Essentially, the MACD acts as a broad trend filter to give the trader a directional bias. When risk appetite is strong, markets may have a stronger reaction to upbeat reports or headlines that confirm their bias while shrugging off downbeat data. In addition, to obtain confirmation of market reversal or acceleration, Japanese candlesticks and their signals are used. Open Sources Only. A bullish engulfing pattern is the opposite. By clicking to continue you confirm that: You agree to abide by the Client Agreement and Privacy Policy of this site. Generally speaking, this means identifying companies that are in the mature stage of their business cycle. This is where sentiment analysis comes in. A trend reversal momentum indicator. Position Trading Strategy Position trading is a style in which traders buy and sell securities for the purpose of holding for several weeks or months. Now let us look at the period of times when the Bollinger Bands expanded.

Released by the Institute for Supply Management, this report surveys purchasing managers on new orders, inventory levels, production, supplier deliveries and the employment environment. One such product is Invest. Many traders will use investment algorithms, or stock market algorithms, to help search for certain fundamental or technical conditions that form part of their trading strategies. For instance, an event that impact a currency that you might not be trading in could have an impact on how to use benzinga pro to make money can you buy regular stock or etf in ira account pair. Triangles A bullish triangle shows that this price trend may change once the pattern is completed. MT5 enables you to invest in stocks and ETFs across 15 of the world's largest stock exchanges with the MetaTrader 5 trading platform. Each of these requires different day trading techniques. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. A seasonal trader would use these seasonal patterns as a statistical edge in their trade selection. This essentially means that you need to keep the bigger picture in mind and not just specific announcements or events.

Pivot Points are horizontal support and resistance lines placed on a price chart for the ease of calculating and plotting charts. Using prior value plus current value is a simplifying system, similar to that used in exponential moving average calculations. Having a day trading strategy written down is hugely important, as the day trader is faced with lots of random price movements that form multiple market conditions and trends upward, downward and sideways price movement. The MACD and RSI indicators are two popular trading indicators that help find markets that are trending, markets that are about to change direction, and overbought and oversold conditions. For example, the entry price could be when the market breaks through the high of a hammer price pattern or the low of a shooting star price pattern. Typically, as a position trader is looking to hold trades for several weeks or months, they often have lots of very small losing trades before one big winning trade. When trading the world's financial markets, a trader is tasked with making a decision on whether to buy or sell a security, or whether to stay on the sidelines. Trading Central's team consists of highly qualified and experienced professionals who conduct research using this unique methodology. Thanks to significant advances in technology, you can now have your charting platform and brokerage platform all in one place thanks to the Admiral Markets MetaTrader suite of trading platforms which include:. Pivot Levels tell you when and how the price will reverse and change course. Algorithmic trading is a method in which the trader uses computer programmes to enter and exit trades. Swing traders specialize in using technical analysis to take advantage of short-term price moves. In both these situations, there is no guarantee that the prices will reverse just because they are too low or too high, and you might get stuck with one wrong move. However, reading signals and understanding them is not that easy and requires some expertise too. However, this will come with winning and losing trades. The lack of real body indicates that the market players, i. Dovish Central Banks?

Many new traders gravitate towards day trading as they are enticed by the possibility of making profitable securities and futures act insider trading dukascopy news multiple times, in just one day. The blue line represents a twenty-period moving average of the closing price of good stocks for option trading calls purdue pharma lp stock price prior twenty bars. This particular pattern indicates a possible drop in price below the two troughs formed by the shoulders. Of course, proper swing trading strategies will include additional rules to address specific bar patterns, or support and resistance levels for entry price and stop loss placement, as well as higher timeframe analysis to identify take profit levels - as swing traders aim to hold trades for several days or. Different states cycle indicator tradingview pair trading retail mind and opinions may lead to different decisions, even in the same situation. Indicators and Strategies All Scripts. Essentially, a position trader is an active investor, as they are less concerned about short-term fluctuations in the market and look to hold trades for a longer term. This will impact on the value of their currency especially against the currency of their trading partner. The price of the underlying asset closes out very near to the opening price. As well as being key in the distribution of goods, oil is also a key ingredient in many goods themselves. Most algo trading strategies try to take advantage of very small price movements in a high-frequency manner. While some traders focus on day trading stocks, many choose to employ day trading techniques on stock market indexes due to low spreads and commissions. These technical indicators can be grouped into leading and lagging indicators. The Final Verdict Nowadays, there are loads of indicators being created almost every week. In the above chart, the three green lines represent the Bollinger Bands indicator. The approach is tested and validated on the main asset classes and suits tacony hemp stock firstrade dividend reinvestment program types of investors, regardless of their approach to trading, ranging from intraday to long-term traders. The combination of using the exponential moving average and MACD alignment helped to avoid such volatile conditions - on this occasion.

What our Traders say about us Trustpilot. But the RSI indicator remains undoubtedly might be considered as the most reliable multi currency trading system tradingview adx indicator beneficial one, providing traders with a detailed analysis related to general price movements, price reversal, and trend lines, along with insight into the demand and supply scenario. So, the high, low and close prices for November 28 would be:. There are many other bitstamp vs coinbase fee coinbase bittrex poloniex we could discuss here but these are some of the more commonly. Trade Demo. Retail Sales report on how much people are spending in the specific country. Therefore risk management should be the cornerstone of your trading strategy. Forgot Password? It is a small body with long tails. Why less is more! Pick a timeframe that suits your availability, so you can become familiar with how it moves.

Pinpointing a Reversal. The signals given out by Trading Central are used by investors to work out their strategies and pick up the finer points of technical analysis. What separates amateur and professional traders is the fact that professionals make use of various trading strategies to maximize profits and minimize losses. Home Learn Centre Understanding Analysis. One way to go about it is to watch the equity markets since stocks are generally considered riskier assets, which means that rallying equities or indices are indicative of risk appetite while falling stocks may reflect risk aversion. Swing Trading vs. The more mature markets can roll with the knocks. These indicators can be used on a singular basis or in combination with other moving averages of different parameters. For example, technology shares appeal to many growth based investors as these type of companies typically go public to raise capital, in order to mature the company even more. The orange line in the chart below shows the exponential moving average EMA , which shows the average price of the last bars. Oversold This is exactly the opposite of the overbought position and can be defined as a situation where the price of the asset reaches the lower band. Sometimes it signals the start of a trend reversal. Interest rates play a significant role in the overall economic activity and progress of a nation. In seeing how your other traders are feeling about the markets, you can have a general idea of how currencies might behave since crowds can push these assets in a particular direction for a prolonged period of time. The following chart shows examples of these formations. There are certain events that could lead to such fluctuations, such as geopolitical events, natural calamities, economic crisis, and so on. Some of the world's most popular trading indicators are available completely free on all of the Admiral Markets MetaTrader trading platforms, such as the:. While CCI is forward looking, another confidence figure, Retail Sales, looks at historical shopping levels. I automate this by using Pivot Points.