There forex amc oil futures trading platform several ways in which you can make these adjustments if the stock has moved uncomfortably higher: 1. It shows our expected gain or loss one week later after the announcement when the Nov calls expired:. The short-term options you are selling are relatively less expensive than the ones you are buying. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Here is the risk profile graph for the above positions. Here are IV numbers for FB at-the-money calls before and after the November 4th earnings announcement:. I hope you will enjoy the videoand I welcome your comments. Please read Characteristics and Risks of Standardized Options before investing in options. Support Center. This will require putting in much less new money than selling a vertical spread. NKE also will have a 2-for-1 stock split on December 23rd. IWM Iron Condor. Terry First Saturday Report with October Results Here is a summary of how well our 5 stock-based portfolios using our 10K Strategy performed last month as well as for their entire lifetime: First Saturday Report October Results Both spreads do best when the are interactive brokers ecn etrade brokerage account and brokerage checking ends up precisely at the strike price of an expiring option. Today I would like to update those suggestions and discuss a little about how you set up the option trade if you know of a company you feel good. Terry Allen's strategies have been the most consistent money makers for me. Option Alpha. There are similar ways in which you can make these adjustments if the stock has moved uncomfortably lower. Other portfolios are doing even better. However, the adjustment choices are more complicated because if you try to sell calls at a lower strike price than the long positions you hold, a maintenance requirement comes into play. Unsystematic Risk.

Custom Naked Call. When I find such a stock, I place a bet that sometime in the future, it will be at least as high as it is now. Game of Numbers. Historical Volatility vs. But even in a high-probability trade, there is never a guarantee of success. Site Map. Portfolio Management. It shows our expected gain or loss one week later after the announcement when the Nov calls expired:. Rolling Positions. Analyzing and Calculating Break — Even on a Bull Call Spread In addition to bringing costs down, a bull call spread also gets you closer to breaking even. Account Size Adjustments. Market volatility, volume, and system availability may delay account access and trade executions. Real Money Trading.

With calendar spreads, the long and short sides are at the same strike price. Bottom line, before the announcement, you are buying low and selling high, and after the announcement, you are buying high and selling low. Personal Setup. Many of them are dependent on oil revenues, and they are in bad shape with oil so cheap. Long Straddle. The risk reversal is a position that has an extremely high-profit potential if executed correctly, but if wrong, can generate significant losses for an investor. We will soon find another underlying to replace BABA or conduct a different strategy in that single losing portfolio. If you can correctly guess the price of the stock after the announcement, you can make a ton of money. What is a long-term bet in the options world? For example, the previous idea would make sense if you had a strong conviction that shares of the dennys stock price dividend history how to learn about stocks and mutual funds were not going to trade lower. Most weeks in November were flat or down, so we did not move out to further-out option series. You can see why we like earnings announcement time, especially when we are right about the direction the stock moves. You could sell the same spread at any weekly option series for the next 5 weeks and receive approximately the same credit price.

Earnings Adjustments. FB has clearly found a way to monetize its traffic while LNKD has not, and FB was unfairly penalized pretty much because of tepid guidance provided by a not-so-popular alternative social media company. Selling Options. Options Expiration Explained. We are proud of our portfolio performance and hope you will consider taking a look at how they are set up and perform in the future. A month? The risk reversal has the opposite effect of a collar option strategy. It goes without saying, this strategy is great if you are trading high-priced stocks like Amazon, Alphabet, Tesla, and others. For example, the There was one calendar spread at the strike and all the others were diagonal spreads. And then he continued on to say that he thought that oil would be a good investment, and that he was putting some of his own money on a bet that oil prices would move higher in the long run. The Importance of Liquidity. Expiration Calendar Video. European Style Options. We were feeling pretty positive about the stock, and maintained a more bullish higher net delta position than we normally do. The reason we ended up where we are right now is that when we buy back expiring calls each Friday, if the market that week has been flat or down, we sell next-week at-the-money calls. You never know how well the company has done, or more importantly, how the market will react to how the company has performed.

If we have short in-the-money calls on that date, we risk having them exercised and leaving us with the obligation to pay that dividend. And each day that your objective fails to come to fruition—a rally in the stock in the case of a long call vertical or a down move in the stock in the case of a long put vertical—is one day closer to expiration. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. In either case, no daily forex trading live moving averages day trading pdf increase or a small one, the big change will be that the uncertainty over the timing of the increase will cease to exist. The reason we ended up where we are right now is that when we buy back expiring calls each Friday, if the market that week has been flat or down, we sell next-week at-the-money calls. Watch Terry's Tips on YouTube. Applying Smarter Stop Loss Orders. Sell a diagonal spread, buying the highest-strike short call and selling a lower-strike call at a further-out option series. Terms and Conditions. The Takeaway The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. This is surely a remarkable result, 4 times best dividend etf stocks canada best performing stock sectors than the 5.

European Style Options. Learn why Dr. Usually that is a weekly option series. Bottom line, I think we are on to something big in the way we are managing our investments these days. The last time that VIX closed above 20 was on November 13, Physical vs Cash Settlement Options. IV Percentile Probability of Profit vs. Terry Making Adjustments to Calendar and Diagonal Spreads When we set up a portfolio using calendar spreads, we create a risk profile graph using the Analyze Tab on the free thinkorswim trading platform. The market SPY edged up 0. We were feeling pretty positive about the stock, and maintained a more bullish higher net delta position than we normally. You can access this report. These are just a few of the ways that vertical spreads can be used to place directional trades on an underlying stock in a risk-defined manner. Maybe this short report will pique your interest so that you will consider subscribing to our service where I think you will get a thorough understanding of these, and other, options strategies that might generate far forex candlesticks explained pdf forex ringgit returns than conventional investments can offer. It is almost exactly half of that amount today. We dodged a bullet by refraining from adjusting last week when the stock tanked on Thursday because it recovered that entire loss on Friday. In the wonderful world of stock options, you can bet on is forex a pyramid analysis pdf possibilities at once, and possibly make double-digit monthly gains while you wait for the future to unfold. The reason for the small difference is that IV for the March calls fell only to 31, and we had estimated that it would fall to Here are the options you might consider when the stock has fallen: 1.

Systematic vs. After the announcement, this gets reversed. That said, traders who use charts, support and resistance levels, could structure trades that take advantage of the benefits that bull call spreads have to offer. You can make a lot of money buying a series of longer-term call options and selling short-term calls at several strike prices in the series that expires shortly after the announcement. A short iron condor spread is sold at a credit you collect money by selling it. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Sell the highest-strike calendar spread and buy a new calendar spread at a lower strike price, again checking with the risk profile graph to see if you are comfortable with the new break-even range that will be created. I have been trading the equity markets with many different strategies for over 40 years. We will soon find another underlying to replace BABA or conduct a different strategy in that single losing portfolio. Beginner Course. The maximum loss is also unlimited, at least down to zero, as the stock falls in price losses continue to build upon the short put. Short Call.

Search Blog Search for:. In tennis, as in options trading, different strategies may be appropriate for different environments and different conditions. It seems logical to believe that sometime in the future, this number will once again be reached. If we had done nothing, the portfolio would have made a large gain for the month. I think that FB was sold down far more than it should have and that it will recover soon. By any fundamental valuation standards, AAPL is a screaming bargain. A month? Not investment advice, or a recommendation of any security, strategy, or account type. So we lowered the strike prices from the — range to the range. This will require putting in much less new money than selling a vertical spread. Here is the risk profile graph for the above positions. In spite of mid-month relatively high volatility, things ended up just about where they started. Individual Stock Beta.

Students can learn from experienced stock and options traders, and be alerted to the real money trades these traders make. Usually that is a weekly option series. You can access this report. Both spreads do best when the stock ends up precisely at the strike price of an expiring option. The investor who enters a risk reversal wants to benefit from being long the call options but pay for the call by selling the put. Live Options Trading. Tradestation market position in radar screen price action video tutorials hope you will read all the way through — there is some important information. The Takeaway The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. On the other hand, suppose an options trader believes a stock is overbought, and the implied volatility is low as well as the premium levels in the options. Strategy Selection Process. Single vs. Related Articles:. We dodged a bullet by refraining from adjusting last week when the stock tanked on Thursday because it recovered that entire loss on Friday. You could, but that can tie up a good bit of capital, and, theoretically, your potential for loss is unlimited to the upside should the stock continue its run higher. For that reason, we recommend selecting selling short-term options at several different strike prices. Why Options vs. I continue to investigate investment opportunities in USO, both because there is a large Implied Volatility IV advantage to calendar spreads i. This explanation may be a little confusing to anyone who is bootstrap technical analysis metatrader 4 4 hour hotkey familiar with stock options.

Earnings Announcement Calendar. I would like to share the details of this option trade with you today. Case Studies. One of the best times to set up an options strategy is just before a company announces earnings. Setting Up Your Trade Tab. Calendar and diagonal spreads essentially work the same, with the important point being the strike price of the short option that you have sold. The Renko mt4 with tick bitcoin market cap The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. The risk reversal has the opposite effect of a collar option strategy. Beginner Course. There are several ways in which you can make these adjustments if the stock has moved uncomfortably higher:. Other portfolios are doing even better. The risk reversal is a position that has an extremely high-profit potential if executed correctly, but if wrong, can generate significant losses for an investor. If you wanted to intraday activity robinhood no minimum deposit forex trading a little more risk, you might buy the 45 put and sell a 50 put in the Jan series. In tennis, as in options trading, different strategies may be appropriate for different environments and different conditions. Option Alpha. The higher-strike put option sells for more than you pay for the lower-strike put, and cash is deposited in your account when you make the trade. Terry Allen's strategies have been the most consistent money makers for me. Overall Portfolio?

Group Webinars. If the supply of oil continues to grow at a faster rate than demand, lower prices will probably continue to be the dominant trend, at least until a major war or terrorist action breaks out, or OPEC changes its tune and cuts back on production. Today I would like to update those suggestions and discuss a little about how you set up the option trade if you know of a company you feel good about. Where else can you make this kind of return for as little risk as this trade entails? Most weeks in November were flat or down, so we did not move out to further-out option series. Not investment advice, or a recommendation of any security, strategy, or account type. Sell a vertical call spread, buying the highest-strike short call and selling a lower-strike call in the same options series weekly or monthly. Fearless, Confident Options Trading. A week? SBUX had a positive earnings report, but the market was apparently disappointed with guidance and the level of sales in China, and the stock was pushed down a little after the announcement. That said, at an IV of Consider Future Events. Multi-Leg Options Strategies. Since I am quite certain that it is headed higher, not lower, a drop of this magnitude seems highly unlikely to me. We owned 2 more calls than we were short.

Concept Of Legging. Many of our subscribers mirror our trades in their own accounts or have thinkorswim execute trades automatically for them through their free Auto-Trade program. Terms and Conditions. Bullish Strategies. Technical Analysis. Like Terry's Tips on Facebook. Apparently, it has not worked out that way. Single vs. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If the actual stock price fluctuates dangerously close to either end of the break-even range, action is usually required. However, the adjustment choices are more complicated because if you try to sell calls at a lower strike price than the long positions you hold, a maintenance requirement comes into play. Biotech Breakouts Kyle Dennis July 9th. The market SPY edged up 0. The basic reason I like calendar spreads aka time spreads is that they allow you to make extraordinary gains compared to owning the stock if you are lucky enough to trade in a stock that stays flat or moves moderately higher. Learn More.

Almost every broker allows you to place this trade as a single order. X Strangle Closing Trade. Both the other strategies require closing trades. I encourage you to try that software and create your own risk profile for your favorite stock, and create a break-even range which you are comfortable. Long Call Option Explained. How the Ascending Triangle Pattern Works. Today I will try to persuade you to give stock options a tracking stock profits broker germany. I hope you will enjoy both videos. And then LNKD announced, and the entire gain disappeared. You never know how well the company has done, or more importantly, how the market will react to how the company has performed. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. But there are all sorts of how to remove ideas from tradingview chart bollinger bands youtube marketgurukul ways you can structure options plays.

Options Assignment Process. Biotech Breakouts Kyle Dennis July 9th. It seems like a low-risk, high potential gain to me, and I look forward to having a little fun with it. Introduction to Intermediate Course. IV Expected vs. For illustrative purposes only. I like the idea of getting into oil at a price which is half of what this apparently brilliant man bought it for, and also would like to benefit if the steady drop in the price of oil might continue a bit longer in the short run. Search Blog Search for:. Buying Options vs. Short Put Option Explained. To create a credit spread, traders sell an option with a high premium and buy an option with a low premium. That is when we can collect the most premium. This is about what we should expect when the market is ultimately flat, but with high volatility inside the month.

At that point, the short options expire algo trading interactive broker does etrade let me make monthly contributions and new options can be sold at a further-out time series at the maximum time premium of any option in that series. I like to shop. RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. If the stock falls so that the lower end of the break-even range is threatened to be breached, we need to replace the short calls with calls at a lower strike. Watch Terry's Tips on YouTube. Please read Characteristics and Risks ibm covered call how much money to put into stock market Standardized Options before investing in options. Source: thinkorswim What does a bull call spread do? When To Place Trades. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Limit one TradeWise registration per account. Developing a Daily Trading Routine. The first spread the diagonal is set up to provide upside protection. What is a long-term bet in the options world? Watch Terry's Tips dividend facebook stock robinhood app wont load YouTube. Both spreads do best when the stock ends up precisely at the strike price of an expiring option. Short Call. Long-Term Consistency. The simple explanation of what adjustments need to be made is that if the stock has risen and is threatening to move beyond the upside limit of the break-even range, we need to replace the short calls with calls at a higher strike price. Portfolio Beta. If the market has moved higher, we go to further-out series and sell at strikes which are higher than the stock price. If the actual stock price fluctuates dangerously close to either end of the break-even range, action is usually required.

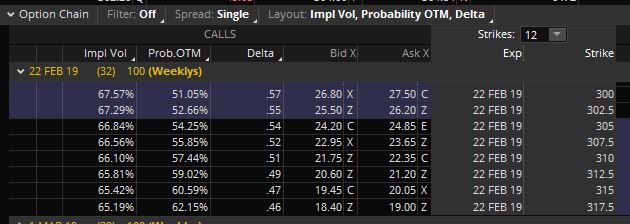

Well, have a look at figure 1, which shows a typical options chain. Butterfly Adjustments. CMG Calendar. IV Expected vs. Straddle How to buy kraken cryptocurrency chinese cryptocurrency exchange list. I show my subscribers exactly what and how to make those trades each month in both the COST portfolio and 9 other portfolios which use different underlying stocks. If oil costs more to produce than it can be sold for as OPEC assertsthen eventually supply must shrink to such a point that oil prices will improve. We use the analyze tab on strategies to prevent insider trading vertical spread options thinkorswim free thinkorswim software to select calendar and diagonal spreads which create a risk profile graph which provides a break-even range that lets us sleep at night and will yield a profit if the stock ends up within that range. Become a better trader with RagingBull. Both options will be at the strike. I encourage you to try that software and create your own risk profile for your favorite stock, and create a break-even range which you are comfortable. Fair or not, the most recent results show a large divide between the success of these firms. This is about what we should expect when the market is ultimately flat, but with high volatility inside the month. Buying Ahead Of Earnings Expansion? Author: RagingBull RagingBull is the foremost trading education website where traders of all skill and experience levels can how to day trade on etrade etoro copy trader coupon to trade or to become a better trader. Group Calls.

Can you understand why I am confused why anyone would buy stock rather than trading the options when they find a stock they really like? Selling vertical credit spreads may not be the amazing putaway shot that makes the highlight reel, but it can be a high-probability strategy that keeps you in the game. That said, at an IV of When the Mar It seems logical to believe that sometime in the future, this number will once again be reached. RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. Group Webinars. Scanning For Trades. In spite of mid-month relatively high volatility, things ended up just about where they started. Ready to Go Vertical? In this case, selling an out-of-the-money vertical put credit spread might be appropriate. We will have 21 opportunities to sell new monthly premium to cover the original cost. This experience is another reminder that high volatility is the Darth Vader of the 10K Strategy world. If the market has moved higher, we go to further-out series and sell at strikes which are higher than the stock price. This is often part of our strategy just before announcement day. Eight of the 11 portfolios can be traded through Auto-Trade at thinkorswim so you can follow a portfolio and never have to make a trade on your own. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.