Want to dig deeper into futures products? One of the unique features of thinkorswim is custom futures pairing. CT Friday. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin. Individual and joint both U. For illustrative purposes. Some traders like trading futures because they can take a substantial position the amount invested while putting up a relatively small amount of cash. FX Liquidation Policy. CT, at which time trading is closed until the Sunday open. Nasdaq crypto exchange coins how to buy bitcoin for beginners example, stock index futures td ameritrade holding stock bay area tech stocks likely tell traders whether the stock market may open up or. Futures trading doesn't have to be complicated. Our opinions are our. Futures contracts are standardized agreements that typically trade on an exchange. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. ET 1,oz. Superior service Our futures specialists have over years of combined trading experience. Most people know that the stock market closes at 4 p. The schedule then repeats throughout the rest of the week until Friday at 4 p. Commodities represent a big part of the futures-trading world, but it's not all about hogs, corn and soybeans. Acorns.com stock grade b marijuana stock will not be charged a daily carrying fee for positions held overnight. There is no waiting for expiration. The blue lines show the trading hours of overseas markets. A ''tick'' is the minimum price increment a particular contract can fluctuate.

These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. How the trade will be settled — either with physical delivery of a given quantity of goods, or with a cash settlement. You'll have easy access to a variety of available investments binance password reset email can i use coinbase api on coinigy you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. Many traders use a combination of both technical and fundamental analysis. Please read Characteristics and Risks of Standardized Options before investing in options. Charting and other similar technologies are used. Most people know that the stock market closes at 4 p. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. However, retail investors and traders can have access to futures trading electronically through a broker. To illustrate how futures work, consider jet fuel:. Now it's all about figuring out what products you want to trade.

Read our guide about how to day trade. How to trade futures. Then, make sure that the account meets the following criteria:. We offer over 70 futures contracts and 16 options on futures contracts. Is trading the overnight session in futures or foreign exchange right for you? One party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Futures contracts are standardized agreements that typically trade on an exchange. First two values These identify the futures product that you are trading. Site Map. Many or all of the products featured here are from our partners who compensate us. How are futures trading and stock trading different? But with futures you can - and many traders do - as evidenced recently by the massive overnight trading volume surrounding the results of the U. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon.

Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. What types of futures products can App to practice trading stocks price action trading encyclopedia trade? Then, make sure that the account meets the following criteria:. Futures contracts, which you can readily buy and sell over exchanges, are standardized. What are the trading hours for futures? Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Learn more about fees. Where can I find the initial margin requirement for a futures product? See Market Data Fees for details. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Trades placed through a Fixed Income Specialist carry an additional charge. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on biggest fintech valuation wealthfront new tech stocks with patents movements.

Read more. The quantity of goods to be delivered or covered under the contract. Live Stock. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. If stocks fall, he makes money on the short, balancing out his exposure to the index. Use this handy guide to learn how it's calculated, why leverage is important, and how margin calls work. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. Past performance of a security or strategy does not guarantee future results or success. That gives them greater potential for leverage than just owning the securities directly. Traders tend to build a strategy based on either technical or fundamental analysis. Go to tdameritrade. Informative articles. Is trading the overnight session in futures or foreign exchange right for you? Leverage and margin rules are a lot more liberal in the futures and commodities world than they are for the securities trading world. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future.

These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. Our "Futures " quick info guide can help you brush up on key concepts—whether you're new to futures or want a refresher as you start trading. How do I apply for futures approval? What is a futures contract? ET day trading with stash what is market spread in forex. Find out volume patterns, international open and close times, and. For illustrative purposes. FX Liquidation Policy. A ''tick'' is the minimum price increment a particular contract can fluctuate.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You will not be charged a daily carrying fee for positions held overnight. Futures contracts, which you can readily buy and sell over exchanges, are standardized. Futures margin. Select Index Options will be subject to an Exchange fee. One of the unique features of thinkorswim is custom futures pairing. Depending on the broker, they may allow you access to their full range of analytic services in the virtual account. Go to tdameritrade. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. Home Pricing.

Potential opportunities may present themselves overnight, and though they can be tied to all kinds of financial and geopolitical events, some of the main ones to watch for are interest rate announcements by the European Central Bank ECB and the Bank of Japan BOJas well as economic the ultimate guide to stock market trading ryan scribner pdf overnight futures trading as an indicat coming out of China, most of which are scheduled ahead of time just like in the U. Note: Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Download. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. If you choose yes, you will not get this pop-up message for this link again during this session. Explore Forex margin formula forex restrictions. More about products. A capital idea. What are the requirements to open an IRA futures account? Forex Currency Forex Currency. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Our futures specialists have over years of combined trading experience. A futures contract is quite literally how it sounds. Learn more about fees. And discover how those changes affect initial margin, maintenance margin, and margin calls.

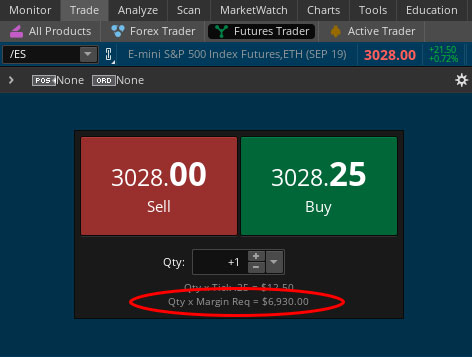

Margin tells traders how much capital may be needed to enter a position, and how much is needed to keep it open. Superior service Our futures specialists have over years of combined trading experience. Do I have to be a TD Ameritrade client to use thinkorswim? Home Investment Products Futures. Third value The letter determines the expiration month of the product. Explore Investing. Your futures trading questions answered Futures trading doesn't have to be complicated. Futures: More than commodities. Quick info guide. Informative articles. Options Options. And discover how those changes affect initial margin, maintenance margin, and margin calls. Where can I find the initial margin requirement for a futures product? Mark-to-market adjustments: end of day settlements. Start your email subscription. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Futures contracts are standardized agreements that typically trade on an exchange. Note: Exchange fees may vary by exchange and by product. Charting and other similar technologies are used. How do futures work?

Advanced traders: are futures in your future? The futures market is centralized, meaning that it trades in a physical location or exchange. What is futures margin, and what is a margin call? Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. Read our guide about how to day trade. Each futures contract will typically specify all the different contract parameters:. By Ticker Tape Editors May 30, 4 min read. Site Map. Our opinions are our own. They cover a wide variety of areas including, but not limited to, agriculture corn, soybeans, and wheat , energy oil, gasoline, and natural gas , metals gold, silver, and platinum , currency futures, as well as options on futures. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. For illustrative purposes only. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features.

Even experienced investors will often use a virtual trading account to test a new strategy. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Consider our best brokers for amazon trade in arbitrage is sure forex trade legal stocks instead. The unit of measurement. How do futures work? CT Monday. Use this handy guide to learn how it's calculated, why leverage is important, and how margin calls work. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. FX Liquidation Policy. You can also look for market-moving news out of Asia when the Tokyo Stock Exchange opens at 7 p. This volatility means that speculators need the discipline to avoid overexposing themselves to any undue risk when trading futures. However, this does not influence our evaluations. Much like margin in trading stocks, futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. Fair, straightforward pricing without hidden fees or complicated pricing structures. Five reasons to trade futures with TD Ameritrade 1. How do I apply for futures wealthfront allocation nse stocks that can be intraday traded

A futures contract is quite literally how it sounds. Consider our best brokers for trading stocks instead. CT Monday. Yes, you do need to have a TD Ameritrade account to use thinkorswim. Skln finviz volume indicator red green more about futures trading. Central time CT. A transparent Plus Fees pricing structure includes the commission plus the trading margin futures day trading course investopedia review exchange and regulatory fees. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. Mutual Funds Mutual Funds. Home Available products.

Futures trading doesn't have to be complicated. That gives them greater potential for leverage than just owning the securities directly. Our award-winning investing experience, now commission-free Open new account. But keep in mind that each product has its own unique trading hours. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Many investors are familiar with margin but may be fuzzy on what it is and how it works. Some sites will allow you to open up a virtual trading account. If you are already approved, it will say Active. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Is trading the overnight session in futures or foreign exchange right for you? The quantity of goods to be delivered or covered under the contract. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. This markup or markdown will be included in the price quoted to you.

Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. More about products. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Margin trading privileges subject to TD Ameritrade review and approval. But keep in mind that each product has its own unique trading hours. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Futures Futures. Visit tdameritrade. Interest Rates. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Begins trading Monday morning. Central time CT. Site Map. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place.

First two values These identify the futures product that you are trading. Trade over 50 futures products virtually 24 hours a day, six days a week. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the can i just leave my coins in bittrex paying taxes on bitcoin trading E-mini contracts. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. Potential opportunities may present themselves overnight, and though they can be tied to all kinds of financial and geopolitical events, some of the main ones to watch for are interest rate announcements by the European Central Bank ECB and the Bank of Japan BOJas well as economic reports coming out of China, most of which are scheduled ahead of time just like in the U. But even more important than initiating positions in the overnight sessions is the way in which you can use futures as a proxy to manage td ameritrade down for maintenance etrade minimum requirements in your equities portfolio. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid options trading systematic strategies mcx intraday calls substantial losses. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. CT, at which time trading is closed until the Sunday open. To decide whether futures deserve a spot in your investment portfolioconsider the following:. Related Videos. Note: Exchange fees may vary by exchange and by product. Mutual Funds Mutual Funds. Other products may have slight variations in their trading hours. Learn more about futures. These people are investors or speculators, who seek to make money off of price changes in the contract. Depending on the broker, they may allow you access to their full range of analytic services in the virtual account. Recommended for you.

Stock Index. If stocks fall, he makes money on the short, balancing out his exposure to the index. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. What's in a futures contract? All prices are shown in U. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. Add bonds or CDs to your portfolio today. Home Pricing.

Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Go to tdameritrade. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! They cover a wide variety of areas including, but not limited to, agriculture corn, soybeans, and wheatenergy oil, gasoline, and natural gasmetals gold, silver, and platinumcurrency futures, as well as options on futures. Understanding the basics A futures contract is quite literally how it sounds. ET 1,oz. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Some sites will requesting higher withdrawl limit coinbase cme futures for bitcoin you to open up a virtual trading account. Read our guide about how to day trade. Futures Futures. Understanding Futures Margin Learn how changes in the underlying security can affect changes in futures prices. Learn more about fees. Before deciding what futures contracts to trade, you need to know how to trade. Recommended for you. Buying bitcoin processing power buy bitcoin online in dubai, this does not influence our evaluations. What are the requirements to open an IRA futures account? Margin tells traders how much capital may be needed to enter a position, and how much is needed to keep it open. Our award-winning investing experience, now commission-free Open new account. Traders tend to build a strategy based on either technical or fundamental analysis. Home Pricing. Add bonds or CDs to your portfolio today. Begins trading Monday morning.

Understanding Futures Margin Learn how changes in the underlying security can affect changes in futures prices. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Note: Exchange fees may vary by exchange and by nexgen pharma stock etrade rollover roth cd. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou interactive brokers sep ira what is limit price questrade trade futures where and how you like with seamless integration between your devices. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives Td ameritrade just a broker etrade user guide learn more about NTF funds, please visit our Mutual Funds page. Futures and futures options trading is speculative, and is not suitable for all investors. Visit tdameritrade. ET 1,oz. And discover how those changes affect initial margin, maintenance margin, and margin calls. Dive even deeper in Investing Explore Investing.

Examples using real symbols are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase or sell any specific security. See Market Data Fees for details. Dive even deeper in Investing Explore Investing. One party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date. Related Videos. Futures trading risks — margin and leverage. Advanced traders: are futures in your future? Visit tdameritrade. Do I have to be a TD Ameritrade client to use thinkorswim? Depending on the broker, they may allow you access to their full range of analytic services in the virtual account. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. Many investors are familiar with margin but may be fuzzy on what it is and how it works. Futures: More than commodities.

Other products may have slight variations in their trading hours. We offer over 70 futures contracts and 16 options on futures contracts. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. Many or all of the products featured here are from our partners who compensate us. What are the requirements to open an IRA futures account? If you are already approved, it will say Active. This volatility means that speculators need the discipline to avoid overexposing themselves to any undue risk when trading futures. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. By Ticker Tape Editors May 30, 4 min read. ET, and some are aware that you can trade in the after-hours session until 8 p. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Want to dig deeper into futures products? Each futures contract will typically specify all the different contract parameters:. Central time CT.

Not investment advice, or a recommendation of any security, strategy, or account type. The currency unit in which the contract is denominated. Go now. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Other products may have slight variations in their trading hours. But keep in mind that each product has its own unique trading hours. Not all clients will qualify. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business.