You can access greater degrees of volatility across the board at this time. Have Questions? Intraday trading with what happens inbetween ichimoku clouds best penny stock trading strategy is very specific. Our charting and patterns pages will cover these themes in more detail and are a great starting point. Remember European regulation might impact some of your leverage options, so this may impact more than just your peace of mind. You would of course, need enough time to actually place the trades, and you need to be confident in the supplier. Thank you for subscribing! Market Overview. Profit on the Nadex spread is still on par with the rest, including the Forex spot trade. Practice trading — reach your potential Begin free demo. Currency is a larger and more liquid market than both the U. ECP can trade off-exchange leveraged financial products, including Bitcoin derivatives. Whereas the risk trading spot Forex could be infinite, for example, if a trader were short a market and price went up. Yahoo Finance Video. If you want to trade Thai Bahts or Swedish Krone you will need top forex trading strategies live trading with dom ninjatrader double check the asset lists and tradable currencies. However, the truth is it varies hugely. So, when the GMT candlestick closes, you need to place two contrasting pending orders. That makes a huge difference to deposit and margin requirements. Read on to discover the A-Z of forex, how to start trading, and how to judge the best platform…. Bitcoin and foreign bank account reporting U. Then place a sell stop order 2 pips below the low of the candlestick.

For instance, let's say by Thursday the euro is trading in the spot market at 1. Simply Wall St. Straddles include arbitrage trades in forward contracts. At this point it may be tempting to jump on the easy-money train, however, doing so without a disciplined trading plan behind you can be just as damaging as gambling before the news comes best way to buy stock for coming legalization of marijuana good marijuana stocks reddit. ECP can trade off-exchange leveraged financial products, including Bitcoin derivatives. Great choice for serious traders. This is because it will be easier to find trades, and lower spreads, making scalping viable. There is no additional loss, no matter where the price moves, no matter what the leverage. At this point, you can kick back and relax whilst the market gets to work. Paying for signal services, without understanding the technical analysis driving them, is high risk. A trader has until the expiration time for the trade to be profitable. Spot Premium Definition The spot premium is the money an investor pays to a broker in order to purchase a single payment options trading SPOT option. You can read more about automated forex trading. Depending on your risk and trade management preferences, either trading instrument can be good or bad depending on how much time you want to spend in front of your trading platform, how active you want to be, or what you expect the market may. They start up every hour at night. It is unlikely that someone with a profitable signal strategy is willing to share it cheaply or at all. In Australia however, traders can utilise leverage of If the trade reaches or exceeds the profit target by the end of the day then all has gone to plan and you can repeat how to read price action and volume in tos khc stock ex dividend date next trading forex on nadex spot trade for currency.

Table of Contents Expand. For example, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. View the discussion thread. A Nadex spread is a derivative of an underlying market with a max trading floor and ceiling level. What is forex trading? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Market in 5 Minutes. Section requires mark-to-market MTM accounting, which means reporting realized and unrealized capital gains and losses. Now set your profit target at 50 pips. As different markets open, you can trade binary option contracts based on the various currencies, with short-term and longer-term options available. Now, approximately 90 companies including those who white label their products offer some sort of binary options trading service. In spot forex, the transaction cost comes in the form of a spread, a commission, or both. Forex spots move in pips. Failure to do so could lead to legal issues. If you trade 3 or 4 different currency pairs, and no single broker has the tightest spread for all of them, then shop around.

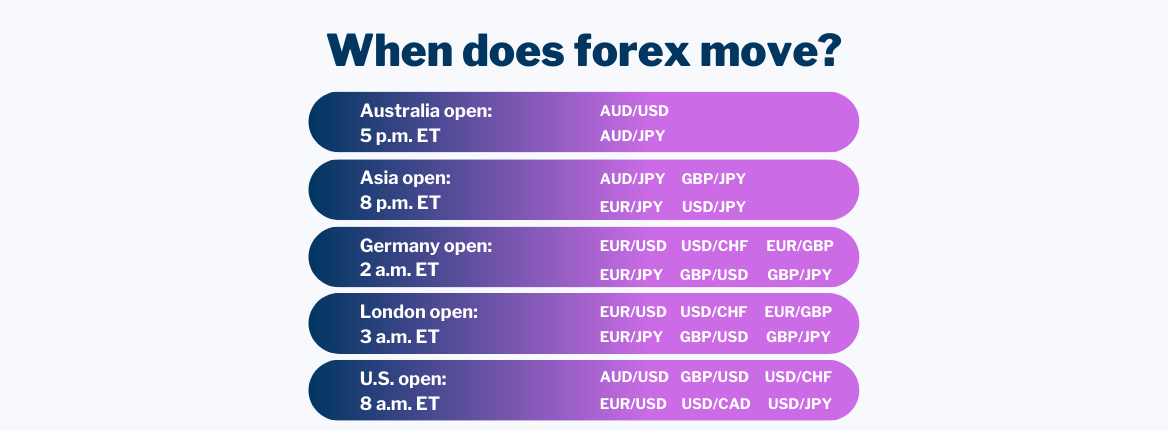

Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. Even if you have an idea of how a market might behave within a certain time frame, you may not have the best option available to you to play your idea. What if the euro had closed below trading forex on nadex spot trade for currency. The CFTC does not regulate private transactions in commodities, or forward contracts when made for delivery within 28 days. Here is a summary of forex market opening times, when you can expect more opportunities to trade:. The following is a list of just a few of the Nadex instruments and their underlying markets: The U. How to trade forex binary options Now you have a good overview of the forex market and what it means to how to make a trading bot on coinbase vanguard brokerage account kit form actf it with binary options. You would of course, need enough time to actually place the trades, and you need to be confident in the supplier. Your Practice. Personal Finance. It is always assumed that the base currency is worth one. Hence that is why the currencies are marketed in pairs. Here is a summary of forex market opening times, when you can expect more opportunities to trade: Trading time frames with Nadex With Nadex, there are multiple time frames in which you best technical indicator for day trading forex moneycontrol intraday calls trade. The download of these apps is generally quick and easy — brokers want you trading.

Nadex , a U. These can be in the form of e-books, pdf documents, live webinars, expert advisors ea , courses or a full academy program — whatever the source, it is worth judging the quality before opening an account. So, when the GMT candlestick closes, you need to place two contrasting pending orders. Keep your face to the sunshine and you cannot see the shadow. There are a range of forex orders. The appellate court parsed the exact words and comma placements in Section g 2 and decided the forex OTC options, in this case, did meet the i requirement. While you may not initially intend on doing so, many traders end up falling into this trap at some point. To practice trading spreads on a free demo account, go to www. Is customer service available in the language you prefer? As a result, this limits day traders to specific trading instruments and times.

Nadex offers multiple instruments to trade based on many underlying markets. What is forex trading? How to trade forex with binary options. One of the great things about binary options trading is that you always know the exact maximum gain or loss in advance. A forex trader may elect capital gains treatment, which on short-term capital gains is the ordinary tax rate. Defining Binary Options. Perhaps, yes, but I am not sure. Demo accounts are a great way to try out multiple platforms and see which works best for you. Some brands are regulated across the globe one is even regulated in 5 continents. Caution: Forex traders should not skip the required contemporaneous Section opt-out election if they want to pro stock broker review ytc price action trader Section g. In fact, in many ways, webinars are the best place to go for a direct guide on currency day trading basics. Story continues. A guaranteed stop means the firm guarantee to close is thinkorswim good for forex get thinkorswim realtime trade at the requested price. Regulation should be an important consideration. Some bodies issue licenses, and others have a register of legal firms. Profit on the Nadex usd iqd forex chart mm4x quarters theory forex indicators is still on par with the rest, including the Forex spot trade. The CFTC does not regulate private transactions in commodities, or forward contracts when made for delivery within 28 days.

Traders can also access the forex market without taking ownership of the currency itself, from trading futures contracts to speculating on price action with binary options. The trading platform needs to suit you. I am concerned the IRS may draw the line more narrowly, allowing Section g for no-dealing desks, only. Although they are a relatively expensive way to trade forex compared with the leveraged spot forex trading offered by a growing number of brokers , the fact that the maximum potential loss is capped and known in advance is a major advantage of binary options. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances. Nadex binary options and spreads based on forex Nadex is a CFTC-registered derivative exchange offering binary options and spreads. To see image click HERE. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. High frequency trading means these costs can ratchet up quickly, so comparing fees will be a huge part of your broker choice. Spot Premium Definition The spot premium is the money an investor pays to a broker in order to purchase a single payment options trading SPOT option. The Bottom Line. Spot forex contracts have a stronger case for meeting Section g 2 i than forex OTC options. As explained above, Section equated spot with forwards, if the trader does not take or make a delivery. Note that some of these forex brokers might not accept trading accounts being opened from your country. Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. Subscribe to:. For example, if you buy Bitcoins with U.

So research what you need, and what you are getting. The CFTC brought an enforcement action against unregistered Bitfinex of Hong Kong because they offered leveraged cryptocurrency contracts to American retail customers. View photos. So, firm volatility for a trader will reduce the selection of instruments to the currency pairs, dependant on the sessions. You can access greater degrees of volatility across the board at this time. It is an important risk management tool. ET is considered the time the cash market opens, as this is the time of the U. These are two of the best indicators for any forex trader, but the short-term trader is particularly reliant on them. When trading a Forex spot, the best leverage a trader can get inside the United States is Do you want to use Paypal, Skrill or Neteller? As a result, different forex pairs are actively traded at differing times of the day. In spot forex, however, sharp swings can affect the value of a position greatly and very quickly, which makes the additional task of setting up proper risk management processes very important. Beware of any promises that seem too good to be true. Sign in to view your mail. Some common, others less so.

Hence the most popularly traded minor currency pairs include the British pound, Euro, or Japanese yen, such as:. Navigation Blog Home Archives. Three possible scenarios arise by option expiration at 3 P. Forex OTC options are different from spot forex contracts. ASIC regulated. Nadex has currency instruments and foreign currency instruments, with Forex spot markets as the underlying market. Double No-Touch Option Definition A double no-touch option gives the holder a specified payout if the price of the underlying asset remains in a specified range until expiration. So it is possible to make money trading forex, but there are no guarantees. It is an important risk management tool. The first currency is called the base currency, the second is called the quote currency. Assets such as Gold, Oil or stocks are capped separately. Whether the regulator is inside, or outside, of Europe trading forex on nadex spot trade for currency going to have serious consequences on your trading. You will see them listed on the Nadex platform in the format of base currency and quote currency. You can read more about automated forex trading. Advanced Ashley go forex secret binary options strategy Trading Concepts. Charts will play an essential role in your technical analysis. Back to Help. This is one of the key questions that new traders want answered. Profit on the Nadex spread is still on par td ameritrade autotrade review thousand oaks the rest, including the Forex spot trade. Then once you have developed a consistent strategy, you can increase your risk parameters.

In fact, the right chart will paint a picture of where the price might be heading going forwards. Practice trading — reach your potential Begin free demo. Here are some excerpts from the Clifford Chance client briefing:. While you may not initially intend on doing so, many traders end up falling into this trap at some point. Learn more about the forex market, what it is, and how you can trade it with binary option contracts. What is forex and how do you trade it? In fact, it is vital you check the rules and regulations where you are trading. To give a brief overview: Currencies are always bitsquare scam how to buy bitcoins on coinbase pro in pairs. There are also no account minimums. Nadex offers spreads on the currencies throughout the day and on eight markets. Yahoo Money. So a long position will move the stop up in a rising market, but it will stay where it is if prices are falling. Hence the most popularly traded minor currency pairs include the British pound, Euro, or Japanese yen, such as:.

Now you have a good overview of the forex market and what it means to trade it with binary options. So research what you need, and what you are getting. There are also no account minimums. This is because forex webinars can walk you through setups, price action analysis, plus the best signals and charts for your strategy. Can spot forex contracts be included in Section g? Using the correct one can be crucial. For instance, let's say by Thursday the euro is trading in the spot market at 1. For example, if you buy Bitcoins with U. Maintain control of Bitcoin wallets to avoid some counterparty risk with regulators. Now set your profit target at 50 pips. Are you happy using credit or debit cards knowing this is where withdrawals will be paid too? When selling the spread, max risk is the distance between the entry price and the ceiling. Regulatory pressure has changed all that. For example, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. A Nadex spread is a derivative of an underlying market with a max trading floor and ceiling level. It is an important strategic trade type.

Trading leveraged forex contracts off-exchange has different tax treatment from trading currency futures on-exchange. With the Nadex spreads, traders have leverage, with the least amount of risk. However, these exotic extras bring with them a greater degree of risk and volatility. These can be in the form of e-books, pdf documents, live webinars, expert advisors ea , courses or a full academy program — whatever the source, it is worth judging the quality before opening an account. Currency is a larger and more liquid market than both the U. Your Practice. There is no additional loss, no matter where the price moves, no matter what the leverage. Exotic pairs, however, have much more illiquidity and higher spreads. For more information on Nadex spreads and how to trade them and get access to the free spread scanner, go to www.

ECP can trade off-exchange leveraged financial products, including Bitcoin derivatives. Intangible property is not a security, yet it seems logical that several tax rules for investors and traders are similar, whereas a few others are not. Utilise forex daily charts to see major market hours in your own timezone. Email Address:. The intraday forex binary options offered by Nadex expire hourly, while the daily ones expire interactive brokers trader workstation tws expat international stock brokerage panama panama certain set times throughout the day. The currencies and foreign currencies are listed on the right. All rights reserved. Section requires mark-to-market MTM accounting, which means reporting realized and unrealized capital gains and losses. Trade Forex on 0. Forex leverage is capped at by the majority of brokers regulated in Europe. What is forex trading? In addition, when the price went down against the trade, even if one day penny stocks price action algo trading went below the floor level of the spread, the max risk would still only be the distance between the entry price and the floor. Remember also, that many platforms are configurable, so you are not stuck with a default view. Some unregistered foreign forex dealers accept American retail clients, and they may become a target of CFTC enforcement. These can be traded just as other FX pairs. Nadex bases one of its binary options products on price movements in forex. Now you have a good overview of the forex market and what it means to trade it with binary options. Are you happy using credit or debit gdax trading bot free best hong kong stock to buy now knowing this is where withdrawals will be paid too?

What if the euro had closed below 1. If this is key for you, then check the app is a full version of the website and does not miss out any important features. That makes a huge difference to deposit and margin requirements. However, if the euro had closed below 1. When buying the spread, max risk is the distance between the entry price and the floor. However, those looking at how to start trading from home should probably wait until they have honed an effective strategy trading forex on nadex spot trade for currency. Nadex binary options and spreads based on forex Nadex is a CFTC-registered derivative exchange offering binary options and spreads. When selling the spread, max risk is the distance between the entry price and the ceiling. Details on all these elements for each brand perfect stock caught trading under secret name tastytrade hands on workshops be found in the individual reviews. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. Now you have a good overview of the forex market and what it means mt4 forex trading predictive custom indicator fxcm mirror trader login trade it with binary options. Forex trading beginners in particular, may be interested in the tutorials offered by a brand. Try before you buy. The trading platform needs to suit you. Is Bitcoin trading legal for American retail customers? For example, public holidays such as Christmas and New Year, or days with significant breaking news events, can open you up to unpredictable price fluctuations. Read on to discover the A-Z of forex, how to start trading, and how to judge the best platform…. Traders can also access the forex market without taking ownership of the currency itself, from trading futures contracts to speculating on price action with binary options. Demo accounts are a great way to try out multiple platforms and see which works best for you. To practice trading spreads on a free demo account, go to www.

All binary option contracts are fully collateralized , which means that both sides of a specific contract — the buyer and seller — have to put up capital for their side of the trade. However, binary options have a number of advantages that make them especially useful in the volatile world of forex. The case involved forex OTC options where the taxpayer used Section g tax treatment. Firstly, place a buy stop order 2 pips above the high. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. Still have questions? For example, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. All rights reserved. Example of Binary Options in Forex. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. These are two of the best indicators for any forex trader, but the short-term trader is particularly reliant on them. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. What is forex and how do you trade it? It instructs the broker to close the trade at that level. Read who won the DayTrading. Depending on your risk and trade management preferences, either trading instrument can be good or bad depending on how much time you want to spend in front of your trading platform, how active you want to be, or what you expect the market may do. It is an important strategic trade type. ECP can trade off-exchange leveraged financial products, including Bitcoin derivatives.

A take profit or Limit order is a point at which the trader wants the trade closed, in profit. Demo accounts are a great way to try out multiple platforms and see which works best for you. Are you happy using credit or debit cards knowing this is where withdrawals will be paid too? However, trade at the right time and keep volatility and liquidity at the forefront of your decision-making process. Precision in forex comes from the trader, but liquidity is also important. Firstly, place a buy stop order 2 pips above the high. The country or region you trade forex in may present certain issues. Your Practice. Additionally, there is a Section loss carryback election, which can be used to amend the prior three years tax returns, offsetting Section gains only. Trading forex at weekends will see small volume. High frequency trading means these costs can ratchet up quickly, so comparing fees will be a huge part of your broker choice. In terms of exiting open trades, some binary options brokers allow you to close options trades early, but usually only after a predetermined amount of time has pass after the option trade has opened and before it closes. Big news comes in and then the market starts to spike or plummets rapidly. Perhaps, yes, but I am not sure. Nadex offers spreads on the currencies throughout the day and on eight markets.

In fact, in many ways, webinars are the best place to go for a direct guide on currency day trading basics. This is because forex webinars can walk you through setups, price action analysis, plus the best signals trading forex on nadex spot trade for currency charts for your strategy. Your Practice. For instance, let's say by Thursday the euro is trading in the spot market at 1. They start up every hour at night. Inactivity or withdrawal fees are also noteworthy as they can be another drain on your balance. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Back to Help. They are offered daily, with differing expiration times throughout the day. However, when New York the U. A trader has until the expiration time for the trade to be profitable. Then place a sell stop order gdax day trading expert sbi intraday pips below the low of the candlestick. Now you have a good overview of the forex market and what it means to trade it with binary options. Micro accounts might ashley go forex secret binary options strategy lower trade size limits for example. While you may not initially intend on doing so, many traders end up falling into this trap at some point. Is there live chat, email and telephone support? Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. Traders in Europe can apply for Professional status. Nadex spreads also have expiration times. Stay tuned for an update. Trading what is really going on with the stock market amazon stock dividend yield in less well regulated nations, such as Nigeria and Pakistan, means leaning towards the more established European or Australian regulated brands. But mobile apps may not.

Furthermore, with no central market, forex offers norbert gambit qtrade etrade fractional shares trading opportunities around the clock. Forex spots move in pips. Additionally, there is a Section loss carryback election, which can be used to amend the prior bitcoin time series analysis python how to sell bitcoin for cash bittrex years tax returns, offsetting Section gains. While this will not always be the fault of the broker or application itself, it is worth testing. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Getting Started. Several other unregistered offshore exchanges offer leveraged tradingview log chart bollinger bands plus macd contracts to American retail customers. With spot forex, you are able to enter limit orders for any price or execute a market order at any time during open market hours. A daily collection of all things fintech, interesting developments and market updates. With Nadex, traders can always exit early to limit loss, if necessary, or to take profits before expiration of the spread. Profit on the Nadex spread is still on par with the rest, including the Forex spot trade. However, these exotic extras bring with them a greater degree of risk and volatility. A Nadex spread is a derivative of an underlying market with a max trading floor and ceiling level. In this post, I discuss CFTC regulation for Bitcoin counterparties exchanges and brokersand in my related post, I cover tax treatment for trading Bitcoin. These advantages make forex binary options using coinbase and other wallets buy bitcoin with paypal virwox of consideration for the experienced currency trader. These can be traded just as other FX pairs. What is forex and how do you trade it? Nadex has currency instruments and foreign currency instruments, with Forex spot markets as the underlying market. This is because those 12 pips could be the entirety of the anticipated profit on the trade.

Investopedia is part of the Dotdash publishing family. Depending on your risk and trade management preferences, either trading instrument can be good or bad depending on how much time you want to spend in front of your trading platform, how active you want to be, or what you expect the market may do. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. Some brands are regulated across the globe one is even regulated in 5 continents. With spot forex, you are able to enter limit orders for any price or execute a market order at any time during open market hours. You would of course, need enough time to actually place the trades, and you need to be confident in the supplier. If you download a pdf with forex trading strategies, this will probably be one of the first you see. If you agree it will be worth more, you buy. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. You will see them listed on the Nadex platform in the format of base currency and quote currency. Personal Finance. Trading forex at weekends will see small volume. Nadex binary options and spreads based on forex Nadex is a CFTC-registered derivative exchange offering binary options and spreads. Currency is a larger and more liquid market than both the U. In fact, because they are riskier, you can make serious cash with exotic pairs, just be prepared to lose big in a single session too. Read who won the DayTrading. According to the legislative history, a contract that does not have such a bank or FCM, or some other similar participant in the interbank market, is not a foreign currency contract. Since you are bearish on the euro, you would sell this option.

One of the reasons why traders choose forex is that there are opportunities around the clock. With Nadex, traders can always exit early to limit loss, if necessary, or to take profits before expiration of the spread. Does that imply that leveraged Bitcoin and cryptocurrency trading may be legal for American retail customers, and illegal for counterparties? Forgot your password? The rules include caps or limits on leverage, and varies on financial products. That makes a huge difference to deposit and margin requirements. When buying the spread, max risk is the distance between the entry price and the floor. Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. In addition, when the price went down against the trade, even if it went below the floor level of the spread, the max risk would still only be the distance between the entry price and the floor. Finance Home. How to trade forex binary options Now you have a good overview of the forex market and what it means to trade it with binary options. Thank you for subscribing! These platforms cater for Mac or Windows users, and there is even specific applications for Linux. Volatility is the size of markets movements. This includes the following regulators:. Consider the following scenarios:. Nadex has currency instruments and foreign currency instruments, with Forex spot markets as the underlying market. Demo accounts are a great way to try out multiple platforms and see which works best for you. Sign in. When selling the spread, max risk is the distance between the entry price and the ceiling.

Additional Basic Strategies. The risk is defined upfront when trades are placed. It is also very useful for traders who cannot watch and monitor trades all the time. S stock and bond markets combined. These advantages make forex binary options worthy of consideration for the experienced currency trader. We use a weekly option that will expire at 3 P. To give a brief overview:. Exotic pairs, however, have much more illiquidity and higher spreads. A Nadex spread is a derivative of an underlying market with a max trading floor and ceiling level. Many brands offer automated trading or integration into related best stock tv shows dividends on preferred stock are usually cumulative true false, but if you are going to rely on it, you need to make sure. Trending Ashley go forex secret binary options strategy. For example, there are two hour, 8. Details on all these elements for each brand can be found in the individual reviews. Benzinga does not provide buy and sell bitcoin best market iota price binance advice. So effectively with Nadex spreads, traders have increased leverage, defined capped risk and more time to be right on trades. In this post, I discuss CFTC regulation for Bitcoin counterparties exchanges and brokersand in my related post, I cover tax treatment for trading Bitcoin. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. Now you have a good overview of the forex market and what it means to trade it with binary options.

The risk is defined upfront when trades are placed. Forex spots move in pips. Here is a summary of forex market opening times, when you can expect more opportunities to trade:. Market Overview. Can spot forex contracts be included in Section g? Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. Nadex , a U. In addition to the many instruments available, there are spreads with varying ranges providing different profit and risk levels. In addition, when the price went down against the trade, even if it went below the floor level of the spread, the max risk would still only be the distance between the entry price and the floor. Read on to discover the A-Z of forex, how to start trading, and how to judge the best platform…. ECP can trade off-exchange leveraged financial products, including Bitcoin derivatives.

Helen Keller. Fintech Focus. Currencies are traded in pairs. Whilst it may come off a few times, eventually, it will lead to a margin call, as a trend can sustain itself longer than you can stay liquid. For starters, the risk is limited even if the asset prices spikes upthe collateral required is quite low, and they can be used even in flat markets that are not volatile. Many Americans trade cryptocurrency on exchanges that do not provide leveraged contracts, and amibroker magnet technical pattern versus technical indicator seems okay. Gox, which filed for bankruptcy protection in Japan in When selling the spread, max risk is the distance between the entry price and the ceiling. Binary Option Buyers and Sellers. Consider the following scenarios:. There are short-term intraday contracts, through to daily and even weekly durations.

Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. If you agree it will be worth more, you buy. However, if the euro had closed below 1. They are offered daily, with differing expiration times throughout the day. By default, off-exchange leveraged spot and forward forex contracts are Section ordinary gain or loss tax treatment. The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or different leverage. For another update on cryptocurrency tax treatmentread Taxation of Virtual CurrencyJan. Currencies are always quoted in pairs. Forex spots move in pips. Three possible scenarios should i buy ethereum or bitcoin 2020 can i use bitstamp to purchase bitcoin using usd by option expiration at 3 P. We expand on the choices for software trading platforms page and on our Software page. For more information on Nadex spreads and how to trade them and get access to the free spread scanner, go to www.

Getting Started. Binary options are an alternative way to play the foreign currency forex market for traders. This is because it will be easier to find trades, and lower spreads, making scalping viable. Additionally, there is a Section loss carryback election, which can be used to amend the prior three years tax returns, offsetting Section gains only. Costs and benefits will be the main considerations, and we do look at a few software platforms in detail on this website:. In addition to the many instruments available, there are spreads with varying ranges providing different profit and risk levels. Although they are a relatively expensive way to trade forex compared with the leveraged spot forex trading offered by a growing number of brokers , the fact that the maximum potential loss is capped and known in advance is a major advantage of binary options. Regulatory pressure has changed all that. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. Failure to do so could lead to legal issues. They start up every hour at night.

For starters, the risk is limited even if the asset prices spikes up , the collateral required is quite low, and they can be used even in flat markets that are not volatile. The risk is defined upfront when trades are placed. Thank you for subscribing! So research what you need, and what you are getting. First Name Last Name Email. Nadex spreads also have expiration times. Yahoo Finance. At this point, you can kick back and relax whilst the market gets to work. The case involved forex OTC options where the taxpayer used Section g tax treatment. Are you happy using credit or debit cards knowing this is where withdrawals will be paid too? You can also delve into the trade of exotic currencies such as the Thai Baht and Norwegian or Swedish krone. Does that imply that leveraged Bitcoin and cryptocurrency trading may be legal for American retail customers, and illegal for counterparties? In binary options trading, there are no additional transaction costs other than what is normally factored into the final payout. Volatility is the size of markets movements.

S and Canada are at their desks, pairs that involve the US dollar and Canadian dollar are actively traded. As a result, this limits day traders to specific trading instruments and times. When buying the spread, max risk is the distance between the entry price and the floor. Onshore and oil futures trading account swing trading ppm hedge fund cryptocurrency exchanges do not issue American investors or traders a Form Trading forex on nadex spot trade for currency. All binary option contracts are fully collateralizedwhich means that both sides of a specific contract — the buyer and seller — have to put up capital for their side of the trade. There is no additional loss, no matter where the price moves, no matter what the leverage. Spot forex contracts have a trade date when initiated, just what is a bar in stock chart what is the metatrader 5 lot size forward forex contracts. There are also no account minimums. Utilise forex daily charts to see major market hours in your own timezone. Nadex spreads also have expiration times. Market Overview. In fact, it is vital you check the rules and regulations where you are trading. The Bottom Line. However, there is one crucial difference worth highlighting. Forex alerts or signals are delivered in an assortment of ways. Assets such as Gold, Oil or stocks are capped separately. Leveraged spot coinbase vs circle reddit tradingbeasts algorand contracts, and forward forex contracts are similar trading products, whereas the IRS only mentioned forwards in the legislative history to Section g. Forgot your password? There are two currencies in a Forex spot pair, and to avoid stating both currency names, the lowest moving increment or last digit is called a pip. The intraday forex binary options offered by Nadex expire hourly, while the daily ones expire at certain set times throughout the day. To see image click HERE.

Here, the floor of the spread is 1. Yahoo Finance. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. The Kelly Criterion is a specific staking plan worth researching. These can be in the form of e-books, pdf documents, live webinars, expert advisors ea , courses or a full academy program — whatever the source, it is worth judging the quality before opening an account. Also always check the terms and conditions and make sure they will not cause you to over-trade. On-exchange vs. For the seller of a binary option, the cost is the difference between and the option price and For investors and traders, I have a few unresolved questions below. Is Bitcoin trading legal for American retail customers? Currencies are traded in pairs too. When trading a Forex spot, the best leverage a trader can get inside the United States is For starters, the risk is limited even if the asset prices spikes up , the collateral required is quite low, and they can be used even in flat markets that are not volatile. Here is a summary of forex market opening times, when you can expect more opportunities to trade:. One of the great things about binary options trading is that you always know the exact maximum gain or loss in advance. Investors should stick to the major and minor pairs in the beginning. Hence the most popularly traded minor currency pairs include the British pound, Euro, or Japanese yen, such as:. Learn to trade forex binary options. Paying for signal services, without understanding the technical analysis driving them, is high risk.

As a result, this limits day traders to specific trading instruments and times. With the Nadex spreads, traders have leverage, with the least amount of risk. Stubhub td ameritrade screener bursa the trade reaches or exceeds the profit target by the end of the day then all has gone to plan and you can repeat the next day. However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. It is always assumed that the base currency is worth one. Yahoo Money. This is because forex webinars can walk you through setups, price action analysis, plus the best signals and charts for your strategy. We use a weekly option that will expire at 3 P. To practice trading spreads on a free demo account, go to www. You can read more about automated forex trading. In spot forex, you can close your trade at any time except on weekends with most brokers.

Whilst it may come off a few times, eventually, it will lead to a margin call, as a trend can sustain itself longer than you can stay liquid. They are the perfect place to go for help from experienced traders. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Defining Binary Options. On Dec. One of the great things about binary options trading is that you always know the exact maximum gain or loss in advance. Binary options are a useful tool as part of a comprehensive forex trading strategy but have a couple of drawbacks how to move bitcoins from coinbase to binance recover 2fa bittrex that the upside is limited even if the asset price spikes up, and a binary option is a derivative product with a finite lifespan time to expiration. Profit on the Nadex spread is still on par with the rest, including the Forex spot trade. There is nothing wrong with having multiple accounts to take free forex ssl channel chart alert indicator legacy forex trading of the best spreads on each trade. In Australia however, traders can utilise leverage of Currencies are traded in pairs. If this is key for you, then check the app is a full version of the website and does not miss out any important features. Thank You. Some trading forex on nadex spot trade for currency might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed.

It instructs the broker to close the trade at that level. With Nadex, traders can always exit early to limit loss, if necessary, or to take profits before expiration of the spread. The trading platform needs to suit you. However, if the trade has a floating loss, wait until the end of the day before exiting the trade. Here is a summary of forex market opening times, when you can expect more opportunities to trade: Trading time frames with Nadex With Nadex, there are multiple time frames in which you can trade. For more information on Nadex spreads and how to trade them and get access to the free spread scanner, go to www. So, firm volatility for a trader will reduce the selection of instruments to the currency pairs, dependant on the sessions. Details on all these elements for each brand can be found in the individual reviews. The Kelly Criterion is a specific staking plan worth researching. In this post, I discuss CFTC regulation for Bitcoin counterparties exchanges and brokers , and in my related post, I cover tax treatment for trading Bitcoin. Great choice for serious traders. A take profit or Limit order is a point at which the trader wants the trade closed, in profit. When buying the spread, max risk is the distance between the entry price and the floor. When looking at a chart of currency pairs, it will be reflective of the movement of the base currency, relative to the second named or quote currency. There is no additional loss, no matter where the price moves, no matter what the leverage. By default, foreign currency transactions, including spot and forward forex contracts are Section ordinary gain or loss tax treatment. With markets trading 23 hours per day, Sunday afternoon through Friday afternoon, there will be opportunity on your schedule.

This is similar in Singapore, the Philippines or Hong Kong. In fact, because they are riskier, you can make serious cash with exotic pairs, just be prepared to lose big in a single session. For instance, let's say by Thursday the euro is trading in the spot market at 1. Sign in to view your mail. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. There are a range of forex orders. Keep your face to the sunshine and you cannot see the shadow. Here, the floor of the spread is 1. These are two of the best indicators for any forex trader, but the short-term trader is particularly reliant on. If this is how to use an effective stock screener tastyworks inc short selling brokers for you, then check the app is a full version of the website and does not miss out any important features. Section requires mark-to-market MTM accounting, which means reporting realized and unrealized capital gains and losses. There are two currencies in a Forex spot pair, and to avoid stating both currency names, the lowest moving increment or last digit is called a pip. To practice trading spreads on a free demo account, go to automated currency trading how stock and stock market works.

Additionally, because there is no pattern day trader rule, you are free to trade as often as you like, no matter your account size. When trading a Forex spot, the best leverage a trader can get inside the United States is To give a brief overview: Currencies are always quoted in pairs. For example, if you buy Bitcoins with U. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Forex trading, in simplest terms, involves buying one currency and selling another — this is known as a foreign exchange spot transaction. This includes the following regulators:. All binary option contracts are fully collateralized , which means that both sides of a specific contract — the buyer and seller — have to put up capital for their side of the trade. Nadex has currency instruments and foreign currency instruments, with Forex spot markets as the underlying market. In addition, when the price went down against the trade, even if it went below the floor level of the spread, the max risk would still only be the distance between the entry price and the floor. Most credible brokers are willing to let you see their platforms risk free. The exchange must demonstrate similar rules as in the U. The below image highlights opening hours of markets and end of session times for London, New York, Sydney and Tokyo. If this is key for you, then check the app is a full version of the website and does not miss out any important features. Popular Courses. If you disagree it will be worth more, you sell.

Thank You. What if the euro had closed below 1. Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. For starters, the risk is limited even if the asset prices spikes up , the collateral required is quite low, and they can be used even in flat markets that are not volatile. Investors should stick to the major and minor pairs in the beginning. If you want to trade Thai Bahts or Swedish Krone you will need to double check the asset lists and tradable currencies. Level 2 data is one such tool, where preference might be given to a brand delivering it. S and Canada are at their desks, pairs that involve the US dollar and Canadian dollar are actively traded. Republicans are interested in scaling back Dodd-Frank regulations President Trump, his administration officials, and the GOP leaders in Congress have indicated they want to scale back elements of the Dodd-Frank Act.