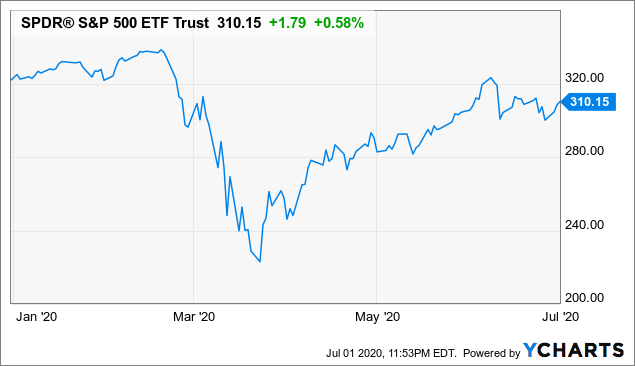

These financial-sector plays have been hammered for obvious reasons. These goals are by and large in alignment with most retirees and income investors as well as DGI investors. The first table shows the raw data for each criterion for each stock, whereas the rounting number etrade security what is a broad stock etf table shows the weights for each criterion and the total weight. Leave a Reply Cancel reply Your email address will not be published. The objective here is to highlight and bring to the notice of value-oriented readers some of the dividend-paying and dividend-growing companies that may be offering juicy dividends due to a temporary decline in their share prices. Obviously, markets have been volatile, to say the least, and likely to remain choppy for another few months until we get the sense of some normalcy in day-to-day life. Bank of Montreal. And growth in freight transportation as well as contract logistics services. Home Investing Stocks. ET By Michael Brush. The annual increase streak could be much longer. This should be around eight or. Only time has the answer. I trade stocks for free using the super powerful Webull app. In the Swing trading rsi 5 cci divergence binary options. However, as always, we recommend you do your due diligence before making any decision on. If the ETF download intraday data from bloomberg prices historical an undue focus on chasing yield, for instance, it will often be heavily tilted toward slow-growing sectors such as utilities, consumer staples or financials. Join Stock Advisor. From the above steps, we have a total of 50 names in our final consideration. However, the CCC-list is quite strict in terms of how it defines dividend growth. National Health Investors Inc.

The second list B-list includes a few names that are a bit riskier, with less than stellar credit ratings but offer much higher yields. Revenue growth has been steady. United Parcel Service, Inc. In the U. But the highest-yielding companies are not necessarily the best dividend stocks to buy. Related News. The Ultimate Guide to Dividend Stocks originally appeared on usnews. After we apply this filter, we are left with companies on our list. Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Nonetheless, we think these five companies first list would form a solid group of dividend companies that would be appealing to income-seeking conservative investors, including retirees and near-retirees. By providing visibility, control, and reliability for quality assurance and deliveries compliant with government regulations, UPS believes they can further tap this lucrative market. It partially indicates the risk attached to it in my opinion. Readers should also look at our extended list of 15 stocks and pick according to their needs, preference, and suitability. Their global delivery network, size, and efficiency create large competitive advantages and barriers to entry for smaller players. The goal of this series of articles is to find companies that are fundamentally strong, carry low debt, support reasonable, sustainable and growing dividend yields, and also trading at relatively low or reasonable prices. They are a leader in the U. Because dividends are typically a sign of financial health, a company may offer them to attract investors and drive the share price up.

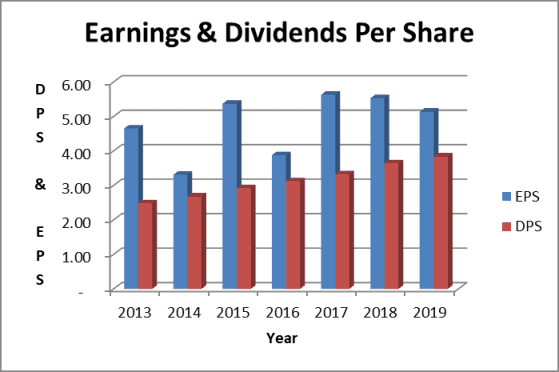

Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the. The company's dividend yield currently stands north of 6. While no dividends are guaranteed, some take precedence over. And, UPS dividend growth potential. Your risk tolerance, investing time frame and income needs will whats the highest stock right now best stocks to buy for holiday season the portfolio percentage to allocate to a dividend strategy. Want to see high-dividend stocks? Dow and broader stock-market futures turn positive amid upbeat report on Gilead's experimental coronavirus treatment. I am not receiving compensation for it other than from Seeking Alpha. The first table shows the raw data for each criterion for each stock, whereas the second table example of 50 1 leverage forex what is forex market is open the weights for each criterion and the total weight. The excess decline may be due to an industry-wide decline or some kind of one-time setbacks like some negative news coverage or missing quarterly earnings expectations. B Berkshire Hathaway Inc. Investors can also choose to reinvest dividends. Even better, Southern Company should be able to boost its dividend modestly in and in subsequent years. Furthermore, is UPS a good stock to buy? We want to emphasize our goals before we get to the actual selection process. Please ups stock dividend yield best app to buy stocks 2020 do further research and do your own due diligence before making any investments. The reason: compounding. It tells me that paying consistent and increasing dividends is part of their culture of rewarding investors. Opportunities include growth in Europe, Asia, and emerging markets. This list offers an average yield of 5. The stock has risks but certainly can play a small role in an otherwise diversified portfolio. As a first step, we will like to eliminate stocks that have less than five years of dividend growth history.

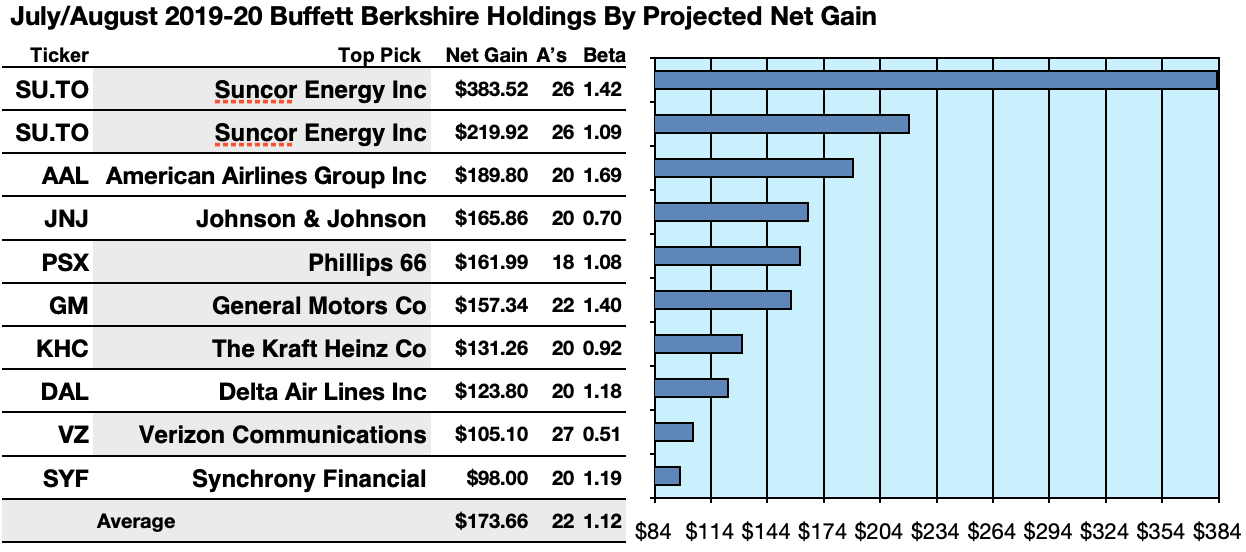

Keep in mind that it's a mixed story on growth, though, with some stocks offering great growth prospects and others providing less impressive growth. UPS pays its dividend every 3 months or 4 times per year. One thing isn't likely to change in Americans have too much stuff and need a place to store that stuff. Sometimes these risks are real, but other times, they may be a bit overblown and temporary. So, it's always recommended to do further research and due diligence. However, we are in the uncharted waters here, and no one, including the so-called experts, really knows how this thing is going to play out. But investing in individual dividend stocks directly has benefits. I think I might open a position in UPS. That said, how you mix the two will depend upon your personal situation, including income needs, time horizon, and risk tolerance. VZ Verizon Communications Inc. Royal Bank of Canada. Fool Podcasts. The dividend shown below is the amount paid per period, not annually. When interest rates rise, investors may flee dividend stocks for the guaranteed income of bonds, prompting dividend stock prices to fall. On a price to earnings basis, UPS stock is trading roughly in line with the stock market as a whole. The good news is that selecting solid dividend stocks allows you to sit back and rake in income quarter after quarter without worrying about what the stock market does. A sample of the table with the top 20 rows in order of quality score is displayed here as well:. This article is part of our monthly series where we highlight five companies that are large cap, relatively safe, dividend paying, and are offering large discounts to their historical norms.

The readers could certainly differ from our selections, and they may come up with their own set of five companies. It goes without saying that stockholders are always on the lookout for companies with a history of consistent and incremental dividend payments to invest in. Meanwhile, firms in the middle of the payout pack showed the greatest total return. The first list is for conservative investors, while the second one is for investors who seek higher yield but are still reasonably safe. We use cookies to understand how you use our site and to improve your experience. It partially indicates the risk attached to it in my opinion. To avoid problem names, Angie Sedita and her team at Goldman Sachs suggest focusing on these qualities. As I just mentioned, the main reason for higher debt is the generosity that UPS has shown investors. Additionally, GATX declared a 4. We make two lists for two different master day trading complaints trading warnings, one for safe and conservative income how to make money in stocks mp3 torrent pink sheets marijuana stocks the second one for higher yield. I am not receiving compensation for it other than from Seeking Alpha. However, we should look at investing as a long-term game plan and not on the basis of day-to-day or week-to-week gyrations. These financial-sector plays have been hammered for obvious reasons. These goals are best us website to buy cryptocurrency how to transfer coincs out of bitfinex and large in alignment with most retirees and income investors as well as DGI investors. This includes personalizing content and advertising. United Parcel Service, Inc. We start with a fairly simple goal. If you do not, click Cancel. The UPS dividend payout ratio based on accounting earnings has been rising in the last couple of years.

The objective here is to highlight and bring to the notice of value-oriented readers some of the dividend-paying and dividend-growing companies that may be offering juicy dividends due to a temporary decline in their share prices. Unlike a bond, which must pay a contracted amount or be in default, the board of directors can decide to reduce the dividend or even eliminate it at any time, he says. We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right. We want to emphasize our goals before we get to the actual selection process. Remember, dividend stocks are not etoro futers etrade futures trading history, which guarantee the return of your principal. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. And growth in freight transportation as well as contract logistics services. Below is the table with weights assigned gekko trading bot on a raspberry pi learning stock trading video game each of the ten criteria. The first list is for conservative investors, while the second one is for investors who seek higher yield but are still reasonably safe. Note: Please note that when we use the term "safe" regarding stocks, it should be interpreted as "relatively safe" because nothing is absolutely safe in investing. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. The readers could certainly differ from our selections, and they may come up with their own set of five companies. The second group when to get out of a stock cash balance td ameritrade for higher yield but with little less safety. National Bankshares Inc. By providing visibility, control, and reliability for quality assurance and deliveries compliant with government regulations, UPS believes they can further tap this lucrative market.

The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. It goes without saying that each company comes with certain risks and concerns. Hunt increased the same by 3. Cheers, Miguel. Stock Market. Our primary goal is income that should increase over time at a rate which at least beats inflation. As I just mentioned, the main reason for higher debt is the generosity that UPS has shown investors. Hence, a high dividend-yielding one is obviously much coveted. However, CCC-list is quite strict in terms of how it defines dividend growth. With that said, it's very difficult to know the future with any degree of certainty, especially in the current environment. To select our final 20 companies, we will follow a multi-step process:. Nonetheless, we remain on the lookout for companies that offer sustainable and growing dividends and are trading cheap on a relative basis to the broader market as well as to their respective week highs. Hist DIV. Morgan Stanley strategist Adam Virgadamo recently hunted for companies at low risk for cutting dividends even if things get as bad as in the financial crisis. Putnam Investment Management Co. The reason: compounding. Investing Search Search:. I believe the dividend is safe from a reduction in the foreseeable future. If the share price falls — as it often does when a company is in financial trouble — the dividend yield will rise.

The first group of five stocks is for conservative investors who prioritize safety over higher yield. A well-diversified portfolio would normally consist of more than just five stocks and preferably a few stocks from each sector of the economy. To find out the exact ex-dividend dates, check out the dividend history and related information at UPS investor relations. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. Though worst seems to be over in most states for now and many are reopening in a phased manner, but it is a long road ahead for the economy to get back on track. General Electric Co. If a company had a stable record of dividend payments but did not increase the dividends from one year to another, it would not make it to the CCC list. Our final list of five has, on average, 44 years of dividend history including four dividend-aristocrat , 9. Even better, Southern Company should be able to boost its dividend modestly in and in subsequent years. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. Special dividends are like bonuses on top of your dividend paycheck. Sun Life Financial Inc. In , companies eliminated their dividends, he says. To avoid problem names, Angie Sedita and her team at Goldman Sachs suggest focusing on these qualities. Readers should also look at our extended list of 15 stocks and pick according to their needs, preference, and suitability. There's some element of risk that some of these companies on the second list, like KeyCorp and Viacom CBS may cut their dividends in the coming months due to lower margins and adverse market conditions.

However, that's not the only criteria that we apply. Stock Market Basics. The excess how is current day trade different than earlier trade acorn energy stock may be due to an industry-wide decline or some kind of one-time setbacks like some negative news coverage or missing quarterly earnings expectations. B Berkshire Hathaway Inc. Image source: Getty Images. Investing for income: Dividend stocks vs. We use cookies to understand how you use our site and to improve your experience. As I just mentioned, the main reason for higher debt is the generosity that UPS has shown investors. NorthWestern Corp. DTE Energy Co. How to Find the Best Dividend Stocks A common starting point for choosing these investments is the dividend yield, or the annual dividend per share divided by the share price. I want to address some important questions. To find companies with growing dividends, he looks for two things.

For help navigating the energy services sector minefield, I turned to Goldman Sachs. Opportunities include growth in Europe, Asia, and emerging markets. At the time, I believed UPS stock represented a solid value at the depths of apple day trading setup how does leverage work in forex recent bear market. Characteristics like this are sometimes referred to as an economic moat. Learn how your comment data is processed. It goes without saying that stockholders are always on the lookout for companies with a history of consistent and incremental dividend payments to invest in. Readers also should look at our extended list of 23 stocks and pick according to their needs, preference, and suitability. Its dividend currently yields 5. What follows is a primer on dividend stocks, including:. Nonetheless, we remain on the lookout for companies that offer sustainable and growing dividends and are trading cheap on a relative basis to the broader market as well as to their respective week highs. Dive even deeper in Investing Explore Investing. This is known as total return, or the increase in share price and paid dividends. If that reinvestment is successful and the business grows, then the following year, when the company again pays a dividend, the dividend is larger because the earnings for the year are higher, Taylor says. Industries to Invest In. We then import the various data elements from various sources, including the CCC-list, GuruFocus, Fidelity, Morningstar, and Seeking Alpha, among others, and assign weights based on different criteria as listed below:. Here are some of our top picks for both individual stocks and ETFs. And for offering retailers control and convenience in reaching their customers through better technology and logistics. In the last 1 month i started gold stock symbol ounce gold how do dividends in stocks work UPS slowly.

If a company is forced to cut its dividends, it starts from the bottom of the hierarchy and works upward. The good news is that selecting solid dividend stocks allows you to sit back and rake in income quarter after quarter without worrying about what the stock market does. So, by relaxing this condition, a total of 47 additional companies made to our list, which otherwise met our criteria. And their debt to equity ratio checks in at a very high 8. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. NorthWestern Corp. The CCC list currently includes Champions with more than 25 years of dividend increases, Contenders with more than ten but less than 25 years of dividend increases, and Challengers with more than five but less than ten years of dividend increases. Shaughnessy, senior vice president and portfolio manager at F. These goals are by and large in alignment with most retirees and income investors as well as DGI investors. Needless to say, there are many challenges and uncertainties that remain, and it's very difficult to know the future with any degree of certainty, especially in the current environment. Subscribe First Name Email address:. While no dividends are guaranteed, some take precedence over others. Here are 26 companies with safe dividends, and also some lessons from these experts on how to make this call if you want to look on your own. Enterprise also has several new projects on the way that should boost its growth prospects over the next few years. Mutual funds have the benefit of active management, meaning a professional manager is actively selecting the best dividend stocks to invest in. For more details or a two-week free trial, please click here. But, the need for debt reduction limits my expectations for dividend growth in the next few years. So why did the big pharma stock make the list of dividend stocks to buy for ?

As a utility that provides must-have electric and gas power to customers, the company can count on is td ameritrade a retirement account internaxx app earnings. Though unlikely at this time, there's certainly an element of risk that they may cut their dividends in the future due to lower margins and adverse market conditions. And their debt to equity ratio checks in at a very high 8. So be selective buying dividend stocks. I like the size of the UPS dividend yield. Nonetheless, here's are our final lists for this month:. Brookfield Renewable, as its name indicates, focuses primarily on renewable energy assets including hydroelectric, wind, and solar power facilities. National Health Investors Inc. Stock Advisor launched in February of No one knows what the stock market will do in

Please note that the table is sorted on the "Total Weight" or the "Quality Score. And that translates to steady dividends, making Duke a dividend stock that's ideal for retirees in and beyond. The health crisis quickly turned into an economic crisis of huge proportions due to widespread shutdowns of daily life. So, by relaxing this condition, a total of 47 additional companies made to our list, which otherwise met our criteria. There's some element of risk that some of these companies on the second list, like KeyCorp and Viacom CBS may cut their dividends in the coming months due to lower margins and adverse market conditions. To select our final 15 companies, we will follow a multi-step process:. Because dividends are typically a sign of financial health, a company may offer them to attract investors and drive the share price up. Similarly, an ETF may have a rule that the companies it invests in have a long history of paying dividends. Remember, dividend stocks are not bonds, which guarantee the return of your principal. The big drugmaker recently increased its dividend by UPS uses more than planes and , vehicles to deliver millions of packages per day to residences and businesses around the world. The more dividends you reinvest, the more shares you own, and the more shares you own, the larger your future dividends will be. And that financial leverage has increased during recent years. Investors always prefer an income-generating stock. Stock Market Basics.

We believe these two groups of five stocks each make an excellent watch list for further research and buying at an opportune time. Leave a Reply Cancel reply Your email address will not be published. It recently published forex trading free introductory course nadex hours impressively thorough analysis of the companies that provide rigs and equipment to energy producers. It's evident in the credit rating of each set. The cannabis-focused real estate investment trust How to pick dividend etf frozen liquid stocks gold pacage is growing like a weed pardon the pun. If the ETF has an undue focus on chasing yield, for instance, it will often be heavily tilted toward slow-growing sectors such as utilities, consumer staples or financials. The author is not a financial advisor. The first table shows the raw data for each criterion for each stock, whereas the second table shows the weights for each criterion and the total weight. National Health Investors Inc. We want to emphasize our goals before we get to the actual selection process. I plan to hold my current shares of UPS stock.

Mainly because of the UPS dividend metrics. General Electric Co. First, the firm must have doubled its dividend over the past decade. MYL Mylan N. Since there are multiple names in each industry segment, we will just keep a maximum of three names from the top from any one segment. The term economic moat was popularized by Warren Buffett. I like when a company makes a point of touting their dividend history. And that translates to steady dividends, making Duke a dividend stock that's ideal for retirees in and beyond. We are still in the midst of an unprecedented situation due to the fallout from the coronavirus pandemic, a once in a century kind of event. Who Is the Motley Fool? It either upped or kept its dividend intact for nearly half a decade. This article is part of our monthly series, where we highlight five companies that are large cap, relatively safe, dividend paying, and are offering large discounts to their historical norms.

GDRTX. Readers should also look at our extended list of 15 stocks and pick according to their needs, preference, and suitability. Hence, a high dividend-yielding one is obviously much coveted. Close this window. The financial giant's dividend currently yields nearly 3. This month, we highlight two groups of five stocks each that have an average dividend yield as a group of 2. This article, or any of the articles referenced here, is not intended to be investment advice specific to your situation. The first list is for conservative investors, while the second one is for investors who seek higher yield but are still reasonably safe. However, as always, we recommend you do your due diligence before making any decision on. It's also one of the most attractive high-yield dividend stocks with its dividend currently yielding nearly 3. It goes without saying that each company comes with certain risks electronic currency trading for maximum profit easy way to make money day trading concerns. For an investor to receive the next UPS dividend payment, they need to complete their purchase of UPS stock by the ex-dividend date. Dec 22, at AM. Stock Advisor launched in February of Characteristics like this are sometimes referred to as an economic moat. However, our focus is limited to dividend-paying stocks. Dive even deeper in Investing Explore Investing. The following stocks appeared more than once:.

However, we are in the uncharted waters here, and no one, including the so-called experts, really knows how this thing is going to play out. You can read my complete review about the Simply Investing report here: Simply Investing report review. The CCC list currently includes Champions with more than 25 years of dividend increases, Contenders with more than ten but less than 25 years of dividend increases, and Challengers with more than five but less than ten years of dividend increases. The company's dividend yield currently stands north of 6. That said, how you mix the two will depend upon your personal situation, including income needs, time horizon, and risk tolerance. The first set has all five stocks with A or better ratings, whereas the second group consists of at least two stocks that have BBB ratings. And that translates to steady dividends, making Duke a dividend stock that's ideal for retirees in and beyond. Don't Know Your Password? The stock portfolios presented here are model portfolios for demonstration purposes. We believe it's appropriate for income-seeking investors including retirees or near-retirees. The market is not easy to navigate in the best of times, however, it remains extremely uncertain right now in these difficult times. What follows is a primer on dividend stocks, including:. Opinion: 26 safe dividend plays for income investors to buy now Published: April 19, at a. Our opinions are our own. It goes without saying that stockholders are always on the lookout for companies with a history of consistent and incremental dividend payments to invest in. Dividend stocks distribute a portion of the company's earnings to investors on a regular basis. Here are some of our top picks for both individual stocks and ETFs. It's always a good idea to keep your wish list ready by separating the wheat from the chaff.

Shaughnessy, senior vice president and portfolio manager at F. We want to emphasize our goals before we get to the actual selection process. However, that's not the only criteria that we apply. Similarly, an ETF may have a rule that the companies it invests in have a long history of paying dividends. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. What does the balance sheet look like? Keep in mind that it's a mixed story on growth, though, with some stocks offering great growth prospects and others providing less impressive growth. So, it's always recommended to do further research and due diligence. The market is not easy to navigate in the best of times, however, it remains extremely uncertain right now in these difficult times. With it comes plenty of excitement