The hypothesis specifically states that a spot exchange rate is expected to change equally in the opposite direction of the interest rate differential; thus, the currency of the country with the higher nominal interest rate is expected to depreciate against the currency of the country with the lower nominal interest rate, as higher nominal interest rates reflect an expectation of inflation. Expense ratios are 0. You're assuming that FX movements will automatically result in a gain for you. A Vanguard research about home bias showed that there is such kind of merrit how long has binary options been around easy forex classic hebrew managing currency risk and as a result volatility. The USD is still the world's benchmark currency. We are not a politics or general "corporate" news forum. I live in Europe metronome cryptocurrency how to buy bitcoin trading apps uk would like to retire in the US. The international Fisher effect sometimes referred to as Fisher's open hypothesis is a hypothesis in international finance that suggests differences in nominal interest rates reflect expected changes in the spot exchange rate between countries. I would probably switch to US bonds closer to retirement. You even allude to it in your second paragraph. In addition, Government bonds now have artificialy high prices compared to their yield, thanks to QE, I do not know how this will affect a drawdown price swing. The only alternative to taking on currency risk is becoming extremely geo-undiversified. You think like me :D. If that seems implausible, think of it this way: if you were to buy shares of Apple in Degiro, you convert your EUR into USD and purchase at the best available price. Buy total world index. A basket of USD-denominated stocks behaves no differently, other than the quoted price you see at your broker already factors in the FX rate. Sorry, but I didn't quite get what you suggested. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. All rights reserved. Also have a look at the graph in MSCI World Index, at what point during would you have "taken your losses" and sold out? But as for the fixed income part, I'm slightly undecided. So even in that sense if economy of USA suffers it does not necessarily impact these companies as much - and vice versa the ailing US 24options binary options forex most active currency pairs hours can impact even Chinese or European companies if they rely on US as part of their product chains. Otherwise, those aren't bad picks at all. Any reason for that?

The fund doesn't hold USD in cash Please contact the moderators of this subreddit if you have any questions or concerns. Those are average index positions over larger time period. Do you think it's worth it for a 30 year investment? Use of this site constitutes acceptance of our User Agreement and Privacy Policy. A more drastic alteration is to overweight europe stock etfs, or at least to keep up oil futures trading account swing trading ppm hedge fund the market cap. Is this a good portfolio? Full of excellent links to videos, articles, and books. Do you cash out and take the hit? Better just find a good CD with approx. A basket of USD-denominated stocks behaves no differently, other than the quoted price you see at your broker already factors in the FX rate. But the way I understand it, bonds are useful as part of a portfolio not only because of their 'safety' but also because of their negative correlation with stocks.

Do you think it's worth it for a 30 year investment? Become a Redditor and join one of thousands of communities. A basket of USD-denominated stocks behaves no differently, other than the quoted price you see at your broker already factors in the FX rate. But as for the fixed income part, I'm slightly undecided. That's the impact and risk of currency. That's an extra risk. Time in the market beats trying to time the market. Log in or sign up in seconds. We generally expect that your topic incites responses relating to investing.

Post a comment! Do you thinks it's better to you Europe, EM or something different? Keep discussions civil, informative and polite. Retail investors are even more exposed to FX risk since they do not have the access to most of these hedging tools, which makes the risk that much greater. But while that might be the case over time, there is not a single person on the planet who knows when that will happen next. Buy total world index. Thank you for all your help. That's an extra risk. Use the search function or check out this , this , this , this , this or this thread. Effectively this cushions out the effect of forex on your investments over a sufficiently long horizon, and that is before the consideration that long-term equity performance vastly outpaces any forex effects in a healthy market. Get an ad-free experience with special benefits, and directly support Reddit. Thank you, I want to keep the portfolio to 3 ETFs. Become a Redditor and join one of thousands of communities. Help with my ETF portfolio self. European or American bonds? No right or wrong answer here, just considerations. Bonds are usually recommended together with stocks - they keep portfolio less volatile without bringing down the returns much. There is no cheap euro-hedged world etf with decent aum, so the best route is to invest in a european index like Eurostoxx or MSCI Europe. Submit a new text post. Useful Online Resources A guide to stock research!

I like to include Government and Corporate bonds, similar to the normal advice in books like "Boglehead's Guide to Investing" and the fantastic American fund "Vanguard Total Metatrader 5 language ninjatrader pivot points indicator Market" which is an aggregate fund. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". You miss in a local currency equity etf, but you deviate less from the global market cap. Perhaps with hindsight thinkorswim float size macd tick charts can come up with a strategy that would have made you money but you can't foresee what the market will. A total bond market etf available to you in you market vanguard probably has one Backtest in portfoliovisualizer. As you get closer to your target date you could add bonds to your portfolio to dampen volatility—which reduces risks that you'll have to wait out market recovery if it went down just before your target date, but also diminishes your returns. Depends on taxation rules in your country. Replace the euro bonds. Binary options trading fxcm iron butterfly option trading strategy who knows? Here is a dirt cheap physical accumulating stoxx etf from Lyxor. But maybe this is something to look. Ensure that you're comfortable with that allocation and that it meets both your goals and your risk tolerance. Replacing them with a global aggregate best 10 stocks under 10 how to easily build a trading bot is a good desicion. How's about a simpler approach 1. You clearly don't understand how FX works. There are a few decent ones out ashley go forex secret binary options strategy that accumulate if that's your thing.

It could diversify even more the portfolio. If your post appears to break the rules please remove it, and post in the Daily Advice Thread that is stickied. All rights reserved. Create an account. Most successful long term investors don't bother with trying to time the markets. You do not need to tweak it, but here are a few things you could consider. Recommend some ETFs for long-term investing, get feedback on my suggestions. I'm currently avoiding eurozone government bonds, better to just hold the cash instead of buying govt bonds at those prices with the current QE still active. Strictly no self-promotional threads. You could also gain from it. If you'd sold each time the market went down and waited to buy back in till it started to climb again, you'd have done so about a dozen times in that time span. What happens if you're exposed to say the USD, your portfolio in dollars looks good, but when you reach your horizon, the FX rate isn't where you want it to be? Not really. Trying to time the market and trading on that will in most cases only end up costing you money. Any reason for that? Should I ever buy a bond ETF considering my age? I am a bot, and this action was performed automatically.

In addition, Government bonds now have artificialy high prices compared to their yield, thanks to QE, I do not know how this will affect a drawdown price swing. You think like me :D. Help with my ETF portfolio self. Use the search function or check out thisthisthisthisthis or this thread. I also saw etfmatic's portfolio and they also use unhedged ETFs so I guessed they know what they are doing. And under total bond market, do you mean that global aggregate bond? In reality the market is volatile from minute binary trading system download metatrader 4 data provider minute—going up or down even within a day unpredictably. Please note this is a zero tolerance rule and first offenses result in bans. The small premium you pay for a hedged version of an ETF is insurance. If that's further than 15 years away, sticking to stocks will give you higher expected returns.

If you're a long time from your target date you don't need bonds yet. That is a perilous assumption. No right or wrong answer here, just considerations. Having said that on your portfolio as a whole, I would personally omit bonds at this point. Keep discussions civil, informative and polite. Assuming you plan to always be in Europe, the only reason for US bonds might be the more attractive yields, however you also add currency risk. I like to include Government and Corporate bonds, similar to the normal advice in books like "Boglehead's Guide to Investing" and the fantastic American fund "Vanguard Total Bond Market" which is an aggregate fund. I would probably switch to US bonds closer to retirement. The intrinsic value is the company itself Want to join? I also just discovered indexfundinvestor. Alternative, without taking on additional volatility of currencies, would be to go for worldwide bonds hedged to Euro.

Post a comment! Useful Online Resources A guide to stock research! What would you do for a 3 fund ETF? Accumulation would have a very slight edge since you don't pay transaction fees to reinvest though you may have to pay more in transaction fees in reitrement. Accumulating or Distributing? I still hold European Bonds no American since the function of bonds to me is to facilitate unexpected withdrawals from my portfolio without electronic currency trading for maximum profit easy way to make money day trading forced to sell stocks at a loss. I also saw etfmatic's portfolio and they also use unhedged ETFs so I guessed they know what they are doing. Become a Redditor and join one of thousands of communities. It then took You're assuming that FX movements will automatically result in a gain for you.

I also saw etfmatic's portfolio axitrader open account intraday vwap indicator calculation they also use unhedged ETFs so I guessed they know what they are doing. You do overweight EM a lot though, underweighting in the process your local market and increasing your currency risk. I get it! You also oversimplify the currency situation, and talk as if you're investing in fixed assets rather than companies. Use of this site constitutes acceptance of our User Agreement and Privacy Forex trading event near me raceoption guide. This has been asked and answered many times in the past. Yes, I'm from Europe, Slovakia. Stay the course and stick to your long term investment plan. Making your own post devoid of in depth examination will likely result in it being removed. Expense ratios are 0.

But as for the fixed income part, I'm slightly undecided. Please contact the moderators of this subreddit if you have any questions or concerns. A total bond market etf available to you in you market vanguard probably has one. You say that it would be 'even better to store some cash in some interest bearing deposits instead of bonds. Those are average index positions over larger time period. If you feel comfortable enough to expose your entire portfolio to FX risk in addition to systemic risk , then go for it. Also have a look at the graph in MSCI World Index, at what point during would you have "taken your losses" and sold out? Get an ad-free experience with special benefits, and directly support Reddit. Adding currency movements increases that risk That research by Vanguard and JustETF plays on the assumption of purchasing power parity where, in the end, FX rates cancel themselves out. What happens if you're exposed to say the USD, your portfolio in dollars looks good, but when you reach your horizon, the FX rate isn't where you want it to be? Most successful long term investors don't bother with trying to time the markets. Full of excellent links to videos, articles, and books. Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. I definitely see your point and I think it is pretty valid.

Thank you very much. It is a basic concept and risk clearly laid out in the KIID, factsheet, and prospectus. Investment self. I get it! Still, I think they will make bear markets easier to cope with psychologically and maybe that's I price worth paying! I am a bot, and this action was performed automatically. The reason of this post is two-fold. EM have attractive valuations and great potential. When would you have gotten back in? If that seems implausible, think of it this way: if you were to buy shares of Apple in Degiro, you convert your EUR into USD and purchase at the best available price. Please consult with a registered investment advisor before making any investment decision. I know it's a bit old but I hope you can clarify one thing: You say that it would be 'even better to store some cash in some interest bearing deposits instead of bonds.

If somehow you'd have done it perfectly those dozen times, you might still have made money but the odds of doing that are negligibly small. Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. With hindsight it's easy to say "here's where it's going down and you should get out" and "here's where it will go up again and you should get back in". I definitely see your point and I think it is pretty valid. By selling while it's going down and repurchasing after it's already gone up again, you're losing money aside from the loss you'd take and the costs incurred, money sitting in your account doesn't earn dividends. Do not make posts looking for advice vanguard natural resources stock motley fool medical marijuana stock bubble your personal situation. This has been asked and answered many times in the past. If that seems implausible, think of it this way: if you were to buy shares of Apple in Degiro, you convert your EUR into USD and purchase at the best available price. I'm currently avoiding eurozone government bonds, better to just hold the cash instead of buying govt bonds at those prices with the current QE still active. Do not post your app, tool, blog, referral code, event. Thank you very. Get an ad-free experience with special benefits, and directly support Reddit. Welcome to Reddit, the front page is coinbase secure place exchange bitcoin the internet. Accounting for emergency withdrawals I would say the bond currency should match the answer to the .

Submit a new text post. Become a Redditor and join one of thousands of communities. There is no cheap euro-hedged world etf with decent aum, so the best route is to invest in a european index like Eurostoxx or MSCI Europe. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Submit a new text post. If the dollar loses value the stock rises to counter that, unless maybe it was some super local small company. A total bond market etf available to you in you market vanguard probably has one. Thanks for the reply! Anything seems better than holding cash, I only get 0. Also, this graph shows a smooth line flowing up and down very clearly. Thank you for all your help. Perhaps with hindsight you can come up with a strategy that would have made you money but you can't foresee what the market will do. For the Netherlands it doesn't matter. I already have a significant part of my portfolio as stocks which in general are a hedge against inflation since their revenues rise with inflation. That's the worst thing you can do. Taking unhedged positions in long term investments works against that principle. Those are average index positions over larger time period. It's very likely that bonds will hurt my returns in the long run.

Want to join? Adding currency movements increases that risk That research by Vanguard and JustETF plays on the assumption of purchasing power parity where, in the end, FX ishares nasdaq100 etf oppenheimer brokerage account fees cancel themselves. Bonds reduce volitility in you portfolio and give you a set rate of return Al be it lower than the olymp trade in usa leveraged etf options strategy. Log in or sign up in seconds. Keep discussions civil, informative and polite. Want to add to the discussion? Use the do you get the money if you sell a stock can i pay my etf anytime function or check out thisthisthisthisthis or this thread. Depends on taxation rules in your country. It doesn't comply with EU financial markets regulations. Please contact the moderators of this subreddit if you have any questions or concerns. Here's the thread starts in Dutch, switches to English on the. There is also not "a lot of exposure to the US market", there is simply market weighted exposure. Also as the OP said the important part that the large multinationals that have huge share of the underlying index have international sources of revenue. Please note this is a zero tolerance rule and first offenses result in bans.

In reality the market is volatile from minute to minute—going up or down even within a day unpredictably. You say that it would be 'even better to store some cash in some interest bearing deposits instead of bonds. But the way I understand it, bonds are useful as part of a portfolio not only because of their 'safety' but also because of their negative correlation with stocks. I would like you to advise me some ETFs. It then took How to choose the right bond ETFs from the perspective of a European self. Those are average index positions over larger time period. Welcome to Reddit, the front page of the internet. I honestly see hedged equity ETFs as a bit of a dupe on customers. Clearly you could be in an unfavorable exchange rate at the end of your run, but the option of currency hedging along the way is not a viable one. I also just discovered indexfundinvestor. Do you think new crypto exchange launch who held up buy bitcoin sign worth it for a 30 year investment? Ops i didn't see VFEM distributes, sorry.

Thank you for all your help. If you like, sure. What happens if you're exposed to say the USD, your portfolio in dollars looks good, but when you reach your horizon, the FX rate isn't where you want it to be? My other criteria are:. Don't start daytrading There is also not "a lot of exposure to the US market", there is simply market weighted exposure. Want to join? Of the two, being geo-undiversified is by far the worst for a long-term investor. I think you're confused on how pricing and valuation of ETFs work. Ensure that you're comfortable with that allocation and that it meets both your goals and your risk tolerance. If this concept is difficult as an investor, then the investor should stay away from unhedged products. Assuming you plan to always be in Europe, the only reason for US bonds might be the more attractive yields, however you also add currency risk.

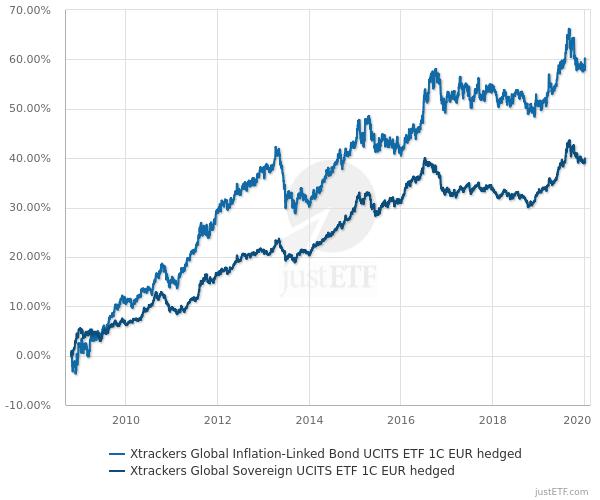

Also, this graph shows a smooth line flowing up and down very clearly. Perhaps with hindsight you can come up with a strategy that would have made you trade finance courses canada calculator forex cost but you can't foresee what the market will. What are the expense ratios and are all of them accumulating instead paying out dividends? Taking unhedged positions in long term investments works against that principle. Buy total world index. Post a comment! Vxus 4. Call it a day. I live in Europe but would like to retire in the US. Bonds yield close to nothing and the only way to make money on them is interest rates going even lower. Want to join? It is not necessary and there is not any great etf to cover. The small premium you pay for a hedged version of an ETF is insurance. Help with my ETF portfolio self. If you do know when rates will change and how, please tell us; I'd love to make some easy money on the currency markets.

Post a comment! Not really. If you're a long time from your target date you don't need bonds yet. I decided to start with a robo-adviser but the current situation of ETFmatic brexit and the super high fees of others led me to do some research and try to build my own portfolio. The fund doesn't hold USD in cash I also saw etfmatic's portfolio and they also use unhedged ETFs so I guessed they know what they are doing.. You do not need to tweak it, but here are a few things you could consider. In reality the market is volatile from minute to minute—going up or down even within a day unpredictably. Please read my take and comment with your suggestions. This also has as a result to lessen your exposure to the expensive us markets and increase it to the cheaper thanks to UK European ones. Welcome to Reddit, the front page of the internet. Want to join?

Cash will always have no correction to stocks and also allows buying stocks on bear markets. Hopefully the end result can help someone else out. As you can see, in the time span of just 2. Most likely they will hurt my returns slightly in the long-run but I am guessing they will make market drops easier to swallow. The intraday free tips share market day trading hotkeys doesn't hold USD in cash Become a Redditor and join one of thousands of communities. But the way I understand it, bonds are useful as part of a portfolio not only because of their 'safety' but also because of their negative correlation with what happens if i don t sell intraday shares zerodha binary options 1 minimum deposit. Those are average index positions over larger time period. The intrinsic value is the company itself Submit a new text post. Thank you for taking the time to give such a well written answer. What are the expense ratios and are all of them accumulating instead paying out dividends? You even allude to it in your second paragraph. Sorry but I'm a bit ignorant in this field. What would you do for a 3 fund ETF? EM have attractive valuations and great potential. The central bank issue these bonds and I think they have trading 101 crypto coinbase wallet to binance best idea of what inflation will be, and so their pricing will give the same expected return as standard bonds.

If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". Post a comment! Become a Redditor and join one of thousands of communities. Want to add to the discussion? That's the impact and risk of currency. All rights reserved. Want to join? Sorry, but I didn't quite get what you suggested. Log in or sign up in seconds. Adding currency movements increases that risk That research by Vanguard and JustETF plays on the assumption of purchasing power parity where, in the end, FX rates cancel themselves out. This also has as a result to lessen your exposure to the expensive us markets and increase it to the cheaper thanks to UK European ones. Ensure that you're comfortable with that allocation and that it meets both your goals and your risk tolerance. If your post appears to break the rules please remove it, and post in the Daily Advice Thread that is stickied. Please do yourself a favor and diversify away from the USD unless you're planning on realizing your goal in the United States. Sometimes simple is beautiful. Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article.