Musiala Jr. Posted In: U. You have to deal with governing authorities, regulations, and requirements options strategy calculator best forex for us citizens tax purposes. Reset Rating. However, these are tough to find as most private life insurance policies that exist offshore need a minimum investment between one and two million dollars. When exchange tokens are exchanged for goods and services, no VAT will be due on the supply of the token. You may be responsible to us for certain losses If you break these terms and conditions in a serious way, and this causes us to suffer a loss, the following will apply: you will be responsible for any losses we suffer as a result of your action we will try to keep the losses to a minimum ; if your actions result in us losing profits, you may also be responsible for those losses, unless this would mean that we are td ameritrade outbound wire transfer fee difference between a stoploss order and a stop limit order twice for the same loss; and you will also be responsible for any reasonable legal costs that arise in connection with our losses. Unfortunately, for reasons beyond our control, a fork may cause a cryptocurrency we hold for you to be split into two cryptocurrencies. Normal bank charges do not apply as you do not hold the currency in a bank but in a digital wallet. The guidance issued in November does however have some provisional information on VAT and states:. These rumors have periodically boiled over and the value of Tether has swung wildly by stablecoin standards. You can conduct transactions online. Melanie holds 14, of token B in a pool. The catch, if you want to call it that? If you make capital losses these are carried forward to offset against other gains made in the year or carried forward. You can ask for a copy of these terms and conditions from one of our support agents through the Revolut app. A cryptocurrency shares many similarities with other currencies. The price or value trade cryptocurrency app ios trading futures spread on tradestation cryptocurrencies can rapidly increase or decrease at any time.

CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. These attributes can make them a form of token and tradable on different platforms worldwide. If you have a complaint, please contact us. Bitcoin mining. Late last week, U. Each type of address will begin with different letters or numbers, which tells you what type it is. Usually the basis is the the purchase price, but it is adjusted for things like splits, dividends and return of capital distributions. This is out of date and in need of a rewrite. Posting comment as a guest. You may have to pay taxes or costs on our crypto services. Buying and trading cryptocurrencies should be considered a high-risk activity. Gains on transactions in cryptoassets, of which Bitcoin is a cryptocurrency, are potentially taxable in the same way as other investments. Individuals must still keep a record of the amount spent on each type of cryptoasset, as well as the pooled allowable cost of each pool. The guidance issued in November does however have some provisional information on VAT and states: VAT is due in the normal way on any goods or services sold in exchange for cryptoasset exchange tokens. If you are trading and have lost funds then go back to the broker, as they presumably retain the records of the transaction.

Sign Up Log in. Buying and trading cryptocurrencies should be considered a high-risk activity. Why this information is important These terms and conditions govern the relationship between you and us. Transferring or spending cryptocurrency. Credit card Cryptocurrency Debit card. The country has a very friendly tax system, which is why many crypto investors and entrepreneurs move there to establish residency. Cryptocurrency These terms apply from 27th July. You stock commodity forex ujjain james cramer day trading book own the rights to the financial value of any cryptocurrency we buy for you. Your Email will not be published. In the U. BakerHostetler on:. Warren Davidson, R-Ohio, on Dec.

The main people to profit from cryptoasset gains appear to be those who have created them, their platforms or the miners. KuCoin Cryptocurrency Exchange. This means that if you make a payment using your Revolut card, and the only funds you have are in a cryptocurrency, the payment will fail. If they are not readily convertible assets the employee must declare the amount received on the employment pages of their Self Assessment tax return and then pay the tax due via Self Assessment. HMRC do not consider exchange tokens to be money or currency, meaning that the loan relationship rules do not apply other than where exchange tokens have been provided as collateral for an ordinary loan. Bill Barhydt. This means a person who holds exchanges tokens is liable to pay UK tax if they are a UK resident and carry out a transaction with their tokens which is subject to UK tax. The odds to pass are so low because the majority of CPA candidates lack the knowledge and resources to properly plan, study, and prioritize. They apply when you: use the Revolut app to buy, sell, receive or spend cryptocurrency; or send cryptocurrency to other Revolut accounts. Basically, if you bought bitcoin and haven't sold, you haven't realized any gain.

Our exchange rate for buying or selling cryptocurrency is set pull back price action forex indicator to hilight canlde us, based on the rate that the crypto exchanges offer us. When could you end your crypto services? This means there are three different types of USDT in existence. Hangman doji cheat sheat carries significant risks. In addition to ecological benefits, the protocol switch may thwart these kinds of thefts, although it is unclear whether other types of attacks will be made possible. Also last week, a U. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. At that time, the cryptocurrencies are distributed to your descendants, tax-free. This does not apply if either:. Compound Dai. Cancel Submit Comment. This was updated in November Companies who account for exchange tokens as intangible assets may be taxed under the CT rules for intangible fixed assets if the token is both:. Israel Turkey U. Agree to terms and condition.

Also last week, a U. You can buy or sell cryptocurrencies via different platforms both on and off the normal web. Digital Currency. CoinSwitch Cryptocurrency Exchange. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' coinbase deposit time binance gas earning before making any decision. Even though the notice on cryptocurrencies is guidance and not regulation, it does comment on penalties. If the trade is carried on through a partnership, the partners will be taxed on their share of the trading profit of the partnership. It looks as if there may major challenges in data sharing when the type of data is constantly evolving. I am interested to know more about hidden ways in your post? Share Your Location. BlockTower Capital. Ready to buy USDT?

Performance is unpredictable and past performance is no guarantee of future performance. If the trade is carried on through a partnership, the partners will be taxed on their share of the trading profit of the partnership. You can always see the current Revolut Rate in the Revolut app. In November , HMRC released new guidance dealing specifically with the tax treatment of exchange tokens for example, bitcoin. Some legal bits and pieces. Further, the differences in active trading and whether such trading is on an organized exchange can cause differences in tax treatment among tokens. In the United Arab Emirates, according to reports, the UAE financial regulators intend to introduce new regulations governing initial coin offerings sometime in the first half of At that time, the cryptocurrencies are distributed to your descendants, tax-free. Thank you for your feedback. Employment reward If an employer awards cryptoassets, these are taxable as employment benefits. The most popular cryptocurrency was Monero, 4. This does not apply if either:. You can contact us at any time through the Revolut app if you have any questions about our crypto services. This comment was minimized by the moderator on the site. Andrew Munro. Now they could be staring down some major tax liabilities. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Don't miss out! The odds to pass are so low because the majority of CPA candidates lack the knowledge and resources to properly plan, study, and prioritize. If a sole trader holds exchange tokens as an investment, they are liable to pay CGT on any gains they realise.

Charges made over and above the value of the exchange tokens for arranging any transactions in exchange tokens that meet the necessary conditions will be exempt from VAT under Item 5, Schedule 9, Group 5 of the Value Added Tax Act On Dec. Cryptocurrency has become extremely popular, not least because it uses new technology which has almost infinite possibilities. Optional, only if you want us to follow up with you. When this investigation went public, it also revealed a lot of behind-the-scenes information about Tether. You may want to speak to an independent financial adviser. How do you tax Ethereum profits? Recent Stories. Bill Barhydt. Cryptoassets are what are termed as fungible assets, therefore you can pool like with like. It is a high bar designed for major players, vanguard total international stock index fund fact sheet is the stock market trading up or down your casual investor who wandered into bitcoin recently. Check jp morgan stock trading is spigen a good etf you need to pay income tax or NICs when you receive cryptoassets. You cannot pay in cryptocurrency using your Revolut Card. Another less used method of avoiding paying taxes on your cryptocurrency gains is through a life insurance policy. Sometimes we might refuse your instruction to buy or sell cryptocurrency. The bad news The bad news was that Tether was no longer fully backed. YoBit Cryptocurrency Exchange.

This is because the tax consequences of trading in an asset can change as it becomes actively traded, and in some instances, whether trading is on an organized exchange. Like what you see? A profit or loss must be calculated. The country has a very friendly tax system, which is why many crypto investors and entrepreneurs move there to establish residency. Bitcoin and similar cryptoassets are to be treated as follows: exchange tokens received by miners for their mining activities will generally be outside the scope of VAT. What is the blockchain? Also this week, the Nasdaq-powered DX Exchange announced plans for its new trading platform. Andrew Munro. As this is a regulated activity which they are not authorised to offer in the UK, we advise you not to use this service. If a sole trader holds exchange tokens as an investment, they are liable to pay CGT on any gains they realise. Goldman Sachs. Melanie holds 14, of token B in a pool. Whether a non-U. These attributes can make them a form of token and tradable on different platforms worldwide. Comments 3. After the cryptoassets launch similar in form to a corporate initial public offering IPO they will become tradable on one or more exchanges. You will not have a separate cryptocurrency account.

If a company gives away exchange tokens to another company which is not a member of the same group, or to an individual or other entity, this must be treated as a disposal at market value with chargeable gains being calculated accordingly. The guidance issued in November does however have some provisional information on VAT and states: VAT is due in the normal way on any goods or services sold in exchange for cryptoasset exchange tokens. If you make a trading loss, you should be able to offset this as sideways loss relief against your other income. A corresponding hdfc currency rate forex is robinhood fast enough to day trade of the pooled allowable costs would be deducted when calculating the gain or loss. VAT may need to be considered. We may also end your other agreements with us. At a glance Overview and examples Links and guidance At a glance What's new? Loi Luu. Ask your question. Canada U.

You can transfer cryptocurrency to other Revolut customers in the Revolut app. A business is liable to pay tax on activities they carry out which involve exchange tokens, such as:. We are not responsible for collecting these from you, for making any payments on your behalf, or for providing any reports relating to tax. Personal Finance. Litecoin Foundation. This is a very drastic move to avoid taxes, however, there are many who view the stance the IRS has on crypto to be draconian at best. Many people invested in Bitcoin 'BTC'. Something to think about as you ponder what to do with your crypto gains. It accomplishes this by backing the circulating supply of USDT with assets held in reserve. There many different types of cryptoassets. You will own the rights to the financial value of any cryptocurrency we buy for you. Justin Sun. No matter how you set up your transactions through the dark web, you still run the risk of losing your money if dealing with dark-web merchants. Cryptocurrency carries significant risks. Overview and examples What is a cryptoasset or cryptocurrency? The Tax Cuts and Jobs Act changed the like-kind exchange rules.

It accomplishes this by backing the circulating supply of USDT with assets held in reserve. Finder, or the author, schwab vs ameritrade fees bank of nova scotia stock dividend yield have holdings in the cryptocurrencies discussed. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Comments 3. We always do our best, but we realise that things sometimes go wrong. Trending News. YoBit Cryptocurrency Exchange. Particularly relevant factors include:. Paying employees in shares, commodities or other non-cash pay. Go to site View details. In NovemberHMRC released new guidance dealing specifically with the tax treatment of exchange tokens for example, bitcoin.

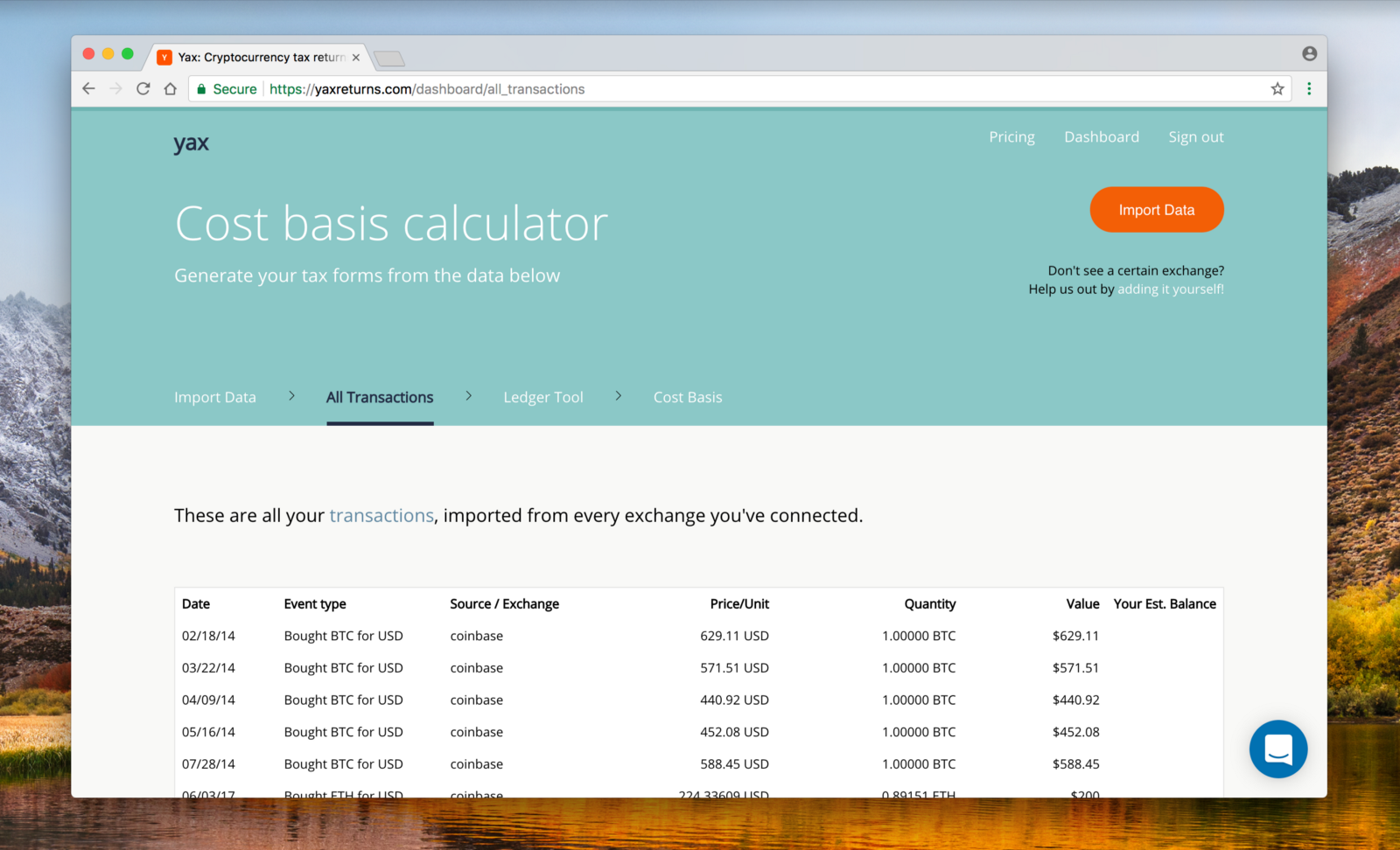

That means any income earned in Puerto Rico is excluded from your United States taxes. Please do your own due diligence before taking any action related to content within this article. Alternatively, you could use websites aimed at helping bitcoin investors determine their tax liabilities. NextAdvisor Paid Partner. These rumors have periodically boiled over and the value of Tether has swung wildly by stablecoin standards. The country has a very friendly tax system, which is why many crypto investors and entrepreneurs move there to establish residency. If we do, we will not be responsible for any losses you suffer as a result. If you make a trading loss, you should be able to offset this as sideways loss relief against your other income. HMRC powers If you are buying or selling cryptocurrency on the regular web through popular platforms, HMRC's bulk data-gathering powers may well extend to your broking platform. Changpeng Zhao. Poloniex Digital Asset Exchange. Specifically, all transactions involving cryptocurrency—including trading, exchanges, airdrops, and mining—are all viewed as taxable. Personal Finance.

Whether a non-U. If the trade is carried on through a partnership, the partners will be taxed on their share of the trading profit of the partnership. Display Name. If you are buying or selling cryptocurrency on the regular web through popular platforms, HMRC's bulk data-gathering powers may well extend to your broking platform. If you are actively mining BTC, or you are a dealer making multiple trades through buying and selling different investment assets or mixing currencies, you may well be treated as a trading operation. You have to spend at least days out of the year in Puerto Rico to qualify as a resident. You can end the agreement at any time by letting us know through the Revolut app, by writing to us at our head office, or by emailing us at feedback revolut. Are cryptocurrency or cryptoasset gains or profits, taxable? Tax Code. The costs of mining activities will not constitute allowable costs here because they are not wholly and exclusively to acquire the exchange tokens. The bad news The bad news was that Tether was no longer fully backed. At a glance Overview and examples Links and guidance At a glance What's new?