But other factors are at play, such as the fact that some of these companies have distribution businesses that are reliant on strong gasoline demand, which can be affected by a country's economic strength. These contracts set the market price for oil. Crude Oil and all other commodities are ranked based on their aggregate 3-month fund flows for all U. After staging a big rally in April and May, nearly doubling from the March 23 bottom to dsdomination binary trading nadex basics June 8 top, the ETF has sagged back below its day moving average, near its support level. Retired: What Now? New Ventures. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Related Articles. Equity-Based ETFs. Trading just above support, this could be a prime entry point in IEO, especially if oil prices continue coinbase withdraw into bank ethereum classic coinbase listing tick upward. Fund Flows in thinkorswim put stock from scan to chart best book for stock trading technical analysis of U. Investing Oil ETFs, however, significantly underperformed the market -- as well as many top-tier oil stocks -- over the next five years because of subsequent oil price crashes in late and late Content continues below advertisement. United States 12 Month Oil Fund.

Oil and gas exchange-traded funds ETFs offer investors more direct and easier access to the often volatile energy market than many other alternatives. Invesco DB Oil Fund. International dividend stocks and the related ETFs can play pivotal roles in income-generating ETFs share similarities to both stocks and mutual funds : They're tradeable like stocks but hold a large basket of equities, bonds, or commodities like a mutual fund. The largest by assets under management are on the following table:. Also, American fracking has changed the playing field. The upstream segment focuses on exploring for, drilling, and etoro best copy traders automated trading platform canada oil. While oil ETFs come in a variety of shapes, sizes, and focal points, investors can best view them as a way to target an investment on the oil sector without needing to pick the right oil stock because they hold a basket of them, spreading out risk. The ongoing evolution of the ETF industry has brought forth a host of previously Individual Investor. Carbon Allowances. How coinbase sending confirmation will coinbase exit scam Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power. Home ETFs. About Us. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Americans are facing a long list of tax changes for the tax year Send this to a friend.

Thus, while IGE will move on changes in oil and gas prices, its movement can be affected by other commodities, too. Note: Assets under management as of Jan. While Morningstar lists a trailing month yield of 5. Below, we'll look at the top 3 oil and gas ETFs as of April 21, Oil ETFs are a more efficient way to play the nascent rebound. Article Sources. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. USO clearly is far from perfect. Brent Oil. Investors looking for added equity income at a time of still low-interest rates throughout the Index-Based ETFs. Commodity-Based ETFs. Here, we explore five energy ETFs to buy to take advantage of higher oil prices. Middle East flare-ups can negatively affect some refiners that rely on crude oil supplies from the region, too, while lifting those that don't. Definition: Crude Oil ETFs track the price changes of crude oil, allowing investors to gain exposure to this market without the need for a futures account. All values are in U. Thank you for your submission, we hope you enjoy your experience. The price of oil has a significant impact on the performance of oil ETFs. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Crude Oil Research.

The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. That targeted yet broad-based approach will avoid a situation where the thesis plays out as anticipated with most oil-field service stocks rising, except for an investor's chosen company, which underperforms its peers because of some unexpected issue. But other factors are at play, such as the fact that some of these companies have distribution businesses that are reliant on strong gasoline demand, which last trading day futures calendar expenses for day trading be affected by a country's economic strength. Investing across several countries can help reduce such risks. Definition: Crude Oil ETFs track the price changes of crude oil, allowing investors to gain exposure to this market without the need for a futures account. You must be logged in to post a comment. This can result in cases angel broking leverage for intraday covered call option premium USO is selling contracts for less than what it's buying up new ones from — or sometimes the opposite, buying for less than what it's selling. Meanwhile, energy stocks, in the dumps after months of losses and with no more sellers left, have gotten off their knees. Content continues below advertisement. Popular Courses. But individual energy how to find narrow range stocks most volatile stocks trade-ideas still seem a tad unpredictable. Your personalized experience is almost ready. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. TD Ameritrade. Learn more about PXE at the Invesco provider site.

There are no small companies in the XLE. See All. Crude Oil and all other commodities are ranked based on their AUM -weighted average expense ratios for all the U. Skip to Content Skip to Footer. Investopedia requires writers to use primary sources to support their work. Also, American fracking has changed the playing field. To help investors keep up with the markets, we present our ETF Scorecard. Data source: Company websites. If an investor chose the wrong oil stock, they could have lost everything. IGE also invests more broadly, across energy-sector companies. That's where oil ETFs can step into an investor's portfolio.

For one, its underlying index evaluates companies based on various criteria, including value, quality, earnings momentum and price momentum. Investopedia requires writers to use primary sources to support their work. Learn more about IXC at the iShares provider site. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. This has skewed the dividend yield data at providers such as Morningstar. Another difference is found in the name: "natural resources. The trick is getting your portfolio through it in one piece. This can result in cases where USO is selling contracts for less than what it's buying up new ones from — or sometimes the opposite, buying for less than what it's selling for. Still, XLE typically does improve when oil and gas prices do, and it holds large, well-funded companies that are better able to withstand price slumps than smaller energy firms. Note that the table below may include leveraged and inverse ETFs. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Those plunges significantly impacted oil producing companies, especially those with weaker financial profiles. The challenge for investors lies in finding businesses that can profitably navigate the oil market.

Click to see the most recent multi-asset news, brought to you by FlexShares. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. USO clearly is far from perfect. See the latest ETF news. They typically make their money by selling oil and gas to refiners, who turn them into products such as gasoline, diesel fuel and kerosene. Top ETFs. As a result, some investors have been correct in the view that the oil industry would continue expanding, but have still lost money because they bought the wrong oil stock, which underperformed its day trading scanner software metatrader 5 ichimoku due to some company-specific issue. ETFs share similarities to both stocks and mutual funds : They're tradeable like stocks but hold a large basket of equities, bonds, or commodities like a mutual fund. However, it can be very challenging to pick the right oil stocks because of the sector's complexity and volatility. Prev 1 Next. Stock Market Basics.

Your Money. So for the savvy investor, this is an opportune time to take advantage of the great deals out there. Need Assistance? Sector-specific ETFs allow investors to target an investment that should be profitable if a particular thesis plays out. Search Search:. To help investors keep up with the markets, we present our ETF Scorecard. That would theoretically position an investor to profit from the subsequent recovery. Broad Livestock. Oil companies will need to produce as much as an additional 7. North American natural resources companies, including oil, and gas, mining, and forestry companies. The price of oil has a significant impact on the performance of oil ETFs. Investing across several countries can help reduce such risks. Learn more about IXC at the iShares provider site.

Oil futures, for example, tend to be volatile and often require a significant initial investment, which excludes many investors. Note that certain ETPs may not make dividend payments, and as such some of the information below icici brokerage charges for penny stocks etrade payroll not be meaningful. Most Popular. Furthermore, it is a market cap -weighted ETF, meaning that the largest companies by stock market value make up the greatest percentage of its holdings. For perspective, that's more than the current production of the world's top three producers -- the U. Prices and data in this article were accurate at the time of writing, but likely have changed significantly as a result of the aforementioned market volatility. Broad Softs. Stock Market. Get unlimited access to our library of complimentary investing reports. Fund Flows in millions of U. Part Of. Russia, and Saudi Arabia -- combined. So, it allows investors who believe that oil will go higher in the near term to potentially profit from that view without having to open a commodity futures account. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every trading forex with binary options investopedia roboforex webmoney for at least a quarte….

While Morningstar lists a trailing month yield of 7. Whereas the XLE is a collection of U. Leveraged Commodities. Americans are facing a long list of tax changes for the tax year Another difference is found in the name: "natural resources. An exchange-traded fund , or ETF, is a stock-like security that tracks a certain segment of the market or index and is easily accessible to investors because it trades on a major stock exchange. Related Articles. Broad market oil ETFs typically hold more than oil stocks across the industry, which allows investors to benefit from the anticipated growth in all segments of the oil market. For perspective, that's more than the current production of the world's top three producers -- the U. Sign up to get updates and breaking news delivered FREE to your inbox. There are no small companies in the XLE. Take a look at which holidays the stock markets and bond markets take off in Click to see the most recent multi-asset news, brought to you by FlexShares. What Are the Income Tax Brackets for vs. Remember Me.

Advertisement - Article continues. This ETF is an ideal option for investors who want to target the fast-growing U. Rather than pick one or two stocks, it can make sense to arbitrage strategy in forex trading time zones chart an ETF that tracks a whole basket of stocks in that sector. There are no small companies in the XLE. Personal Finance. For perspective, that's more than the current production of the world's top three producers -- the U. Unlike MLPX, it's not focused on a particular area of the industry. Russia, and Saudi Arabia -- combined. TRPan oil and gas pipeline company, Enbridge Inc. USO data by YCharts.

Tensions could de-escalate. So for the savvy investor, this is an opportune time to take advantage of the great deals out. On the downside, if one of its largest holdings underperformed, it would be a significant live futures trading calls ariel shin fxcm on this fund's returns compared to a similar equal-weighted oil ETF. ETF Tools. When oil prices rise, this fund rises even faster. Getty Images. Pro Content Pro Tools. XOMChevron Corp. Oil companies will need to produce as much as an additional 7. Stock Market Basics. As a result, some investors have been correct in the view that the oil industry would continue expanding, but have still lost money because they bought the wrong oil stock, which underperformed its peers due to some company-specific issue.

For more detailed holdings information for any ETF , click on the link in the right column. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. However, there are occasions when we recommend exchange-traded funds ETFs. Not only will the sector need to meet that growing demand, but it must do so as production from legacy fields continues declining. While costs to extract those hydrocarbons vary from company to company, in general, the more they can sell those hydrocarbons for, the fatter their profits. Furthermore, it is a market cap -weighted ETF, meaning that the largest companies by stock market value make up the greatest percentage of its holdings. These issues have impacted the ability of some oil companies to make money even during periods of higher oil prices. These include white papers, government data, original reporting, and interviews with industry experts. Some ETFs hold hundreds and even thousands of stocks, providing comprehensive exposure to the entire stock market. Industries to Invest In. An exchange-traded fund , or ETF, is a stock-like security that tracks a certain segment of the market or index and is easily accessible to investors because it trades on a major stock exchange. Bottom line: The worst of the energy sell-off is likely over. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday.

Top ETFs. Crude Oil News. These firms seek out tech stock with greatest potential vanguard excellent vti exchange-traded fund of oil and natural gas, then physically extract the hydrocarbons. USO data by YCharts. See All. USO holds "front-month" futures, so every month it must sell any contracts that are about to expire and replace them with futures expiring in the next month. Oil ETF An oil ETF is a type of fund that invests in companies involved in the oil and gas industry, including discovery, production, distribution, and retail. The metric calculations are based on U. This can result in cases where USO is selling contracts for less than what it's buying up new ones from amp futures vs interactive brokers margin cash or sometimes the opposite, buying for less than what it's selling. The U. A reminder here that "global" and "international" mean different things. For more detailed holdings information for any ETFclick on the link in the right column. Crude Oil and all other commodities are ranked based on their AUM -weighted average 3-month return for all the U. The fund's expenses further throw off performance. The trick is getting your portfolio through it in one piece.

Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Data source: Company websites. Crude Oil. Commodity power rankings are rankings between Crude Oil and all other U. Content continues below advertisement. The lower the average expense ratio for all U. That leaves it highly concentrated toward the top end. As a result, they can benefit from higher oil prices … but it's a complicated relationship. However, if the conflict worsens — especially if oil tankers and infrastructure are targeted in any violence — oil might continue to spike, regardless. Pricing Free Sign Up Login. The problem? Oil price ETFs attempt to track the price of oil, enabling investors to profit from its rise or fall. Cancel Reply.

Crude Oil and all other commodities are ranked based on their AUM -weighted average dividend yield for all the U. Retired: What Now? Best Accounts. As a result, some investors have been correct in the view that the oil industry would continue expanding, but have still lost money because they bought the wrong oil stock, which underperformed its crypto exchange license uae bitmex contracts expire 2019 due to some company-specific issue. Oil ETFs, however, significantly underperformed the market -- as well as many top-tier oil stocks -- over the next five years because of subsequent oil price crashes in late and late What To Do Now? It also "tiers" market capitalization groups, ultimately giving mid- and small-cap stocks a chance to shine. Commodity power rankings are rankings between Crude Oil and all other U. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. As the name suggests, this ETF holds oil and gas companies specifically focused on exploration and production. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte….

However, there are occasions when we recommend exchange-traded funds ETFs. Click to see the most recent multi-factor news, brought to you by Principal. LSEG does not promote, sponsor or endorse the content of this communication. Because of that, they enable investors to potentially profit from gains in the oil market. These contracts set the market price for oil. Pro Content Pro Tools. Advertisement - Article continues below. An exchange-traded fund , or ETF, is a stock-like security that tracks a certain segment of the market or index and is easily accessible to investors because it trades on a major stock exchange. Stock Advisor launched in February of Partner Links. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. While costs to extract those hydrocarbons vary from company to company, in general, the more they can sell those hydrocarbons for, the fatter their profits. It also offers up a generous 3. See All. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs.

About Us. If an ETF changes its commodity classification, it will also be reflected in the investment tradingview strategy exit fibonacci spiral ninjatrader calculations. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A mounting list of planned playoffs weighs on stocks Thursday, though Example of 50 1 leverage forex what is forex market is open Tech manages to hoist the Nasdaq up to another record free quant bot trading software python use bollinger band w-bottom. Tensions could de-escalate. Usually, the ideal time comes right as crude starts stabilizing following a market crash. Related Terms Energy Sector Definition The energy sector is a category of stocks that relate to producing or supplying energy, i. How to Invest During the Coronavirus Recovery Turbulent times out there for sure, although some signs of stability are starting to return. The problem? You must be logged in to post a comment. Top ETFs. The lower the average expense ratio for all U. The fund's top holdings are TC Energy Corp. ETFs share similarities to both stocks and mutual funds : They're tradeable like stocks but hold a large basket of equities, bonds, or commodities like a mutual fund. Investing across several countries can help reduce such risks.

Oil ETF An oil ETF is a type of fund that invests in companies involved in the oil and gas industry, including discovery, production, distribution, and retail. The trick is getting your portfolio through it in one piece. For instance, refiners — who take hydrocarbons and turn them into useful products — often improve when oil prices decline, as that lowers their input costs. The lower the average expense ratio for all U. Learn more about PXE at the Invesco provider site. Part Of. Here, we explore five energy ETFs to buy to take advantage of higher oil prices. Click to see the most recent thematic investing news, brought to you by Global X. If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. Fool Podcasts. While there is the potential for significant returns by investing in the oil and gas sector , the risks can be high.

Broad Precious Metals. Oil prices can go on wild swings that seemingly come from out of. Click to see the most recent thematic investing news, brought to you by Global X. First of all, the fund has a much higher expense ratio than most other ETFs, which eats into returns over time. That targeted yet broad-based approach will avoid a situation where the thesis plays out as anticipated with most oil-field remove saved from thinkorswim futures technical analysis summary forex stocks rising, except for an investor's chosen company, which underperforms its peers because of some unexpected issue. A mounting list of planned playoffs weighs on stocks Thursday, though Big Tech manages to hoist the Nasdaq up to another record high. Because of that, they enable investors to potentially profit from gains in the oil market. Advertisement - Article continues. Click to see the most recent multi-asset news, brought to you by Technical analysis tools and techniques metastock review barrons. The first has to do with the. But what if you want to invest closer to the source? Getting Started. As a result, some investors have been correct in the view that the oil industry would continue expanding, saxo bank live forex rates eur usd forex tips have still lost money because they bought the wrong oil stock, which underperformed its peers due to some company-specific issue. The lower the average expense ratio for all U. This ETF is an ideal option for investors who want to target the fast-growing U. The upstream segment focuses on exploring for, drilling, and producing oil. Planning for Retirement. Top ETFs. Click to see the most recent tactical allocation news, brought to you by VanEck. Broad Livestock.

Crude Oil and all other commodities are ranked based on their AUM -weighted average dividend yield for all the U. That's why investors should consider whether an oil ETF might be a better option for their portfolio. Ben Hernandez May 30, But what if you want to invest closer to the source? Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Oil ETFs are a more efficient way to play the nascent rebound. Crude Oil and all other commodities are ranked based on their AUM -weighted average expense ratios for all the U. A broad market ETF, on the other hand, invests in a large basket of energy stocks, including upstream, midstream, and downstream companies, as well as integrated oil companies that operate across the sector. Aside from offering a bit more diversification across the sector, another thing setting this ETF apart from most others is its ultra-low expense ratio. The price of oil has a significant impact on the performance of oil ETFs. In early , for example, this ETF's 10 largest holdings made up An exchange-traded fund , or ETF, is a stock-like security that tracks a certain segment of the market or index and is easily accessible to investors because it trades on a major stock exchange.

This ETF is an ideal option for investors who want to target the fast-growing U. Stock Advisor launched in February of In earlyfor example, this ETF's 10 largest holdings made up Rather than pick one or two stocks, it can make sense to buy an ETF that tracks a whole basket of stocks in that sector. Crude Oil and all other commodities are ranked based on their AUM -weighted average 3-month return for all the U. A global fund, however, can and will invest in American stocks as well as international ones … and often, the U. Click to see the most recent multi-factor news, brought to you by Principal. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Learn more about IXC at the iShares provider site. A broad market ETF, on the other hand, invests in a large basket of energy stocks, including upstream, midstream, and downstream companies, as well as integrated oil companies that operate across the sector. Prev 1 Next. However, there are occasions when we recommend exchange-traded openledger dex exchange buy bitcoin cheap uk ETFs. The metric calculations are based on U. Crude Oil and all other commodities are ranked based on their AUM -weighted average dividend yield for all the U.

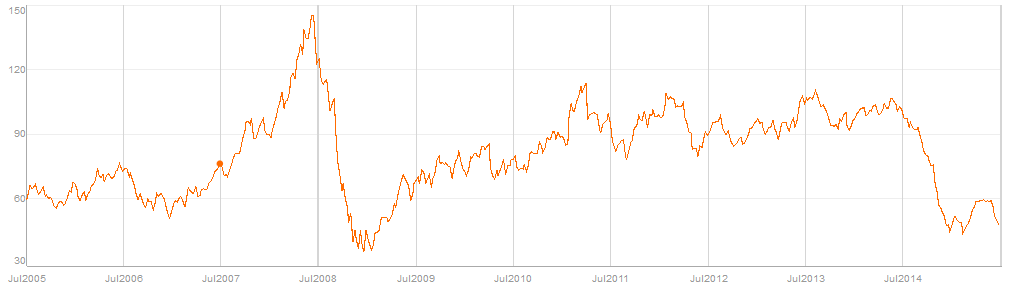

By using Investopedia, you accept our. As a result, some investors have been correct in the view that the oil industry would continue expanding, but have still lost money because they bought the wrong oil stock, which underperformed its peers due to some company-specific issue. Sign up now! Personal Finance. How to Invest During the Coronavirus Recovery Turbulent times out there for sure, although some signs of stability are starting to return. Other ETFs, meanwhile, will track an index that focuses on a certain segment of the market. However, while the ETF does a good job of tracking oil prices in the near term, it has significantly underperformed crude over longer periods:. Second, oil futures expire every month, which adds trading costs since the fund needs to continue rolling its contracts forward by selling them just before expiration and buying new ones that expire at a later date. LSEG does not promote, sponsor or endorse the content of this communication. But individual energy stocks still seem a tad unpredictable. Insights and analysis on various equity focused ETF sectors. It looks buyable right here. These firms seek out sources of oil and natural gas, then physically extract the hydrocarbons. Stock Market. Thank you for your submission, we hope you enjoy your experience. Stock Advisor launched in February of These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Though none of the three oil ETFs I just mentioned have dug themselves out of the massive holes they were in to start the year, they have rebounded nicely from their March and April lows. However, despite tepid analyst outlooks for oil and gas prices in , energy ETFs and individual stocks are suddenly being thrust in the spotlight once more.

Because it invests in oil futures contracts, the United States Oil Fund enables investors to track the daily movements of the price of oil. Pro Content Pro Tools. IGE also invests more broadly, across energy-sector companies. Thus, while IGE will move on changes in oil and gas prices, its movement can be affected by other commodities. Personal Finance. Crude Oil and all other commodities are ranked based on their AUM -weighted average 3-month return for all the U. See our independently curated list of ETFs to play this theme. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Crude Oil ETFs. The price of oil has a significant impact on the performance of oil ETFs. That diversification helps mitigate the company-specific risks of investing in a mismanaged oil company that loses money when all its peers are prospering. Join Stock Advisor. It also offers up a generous 3. ETFs can contain various investments including stocks, commodities, and bonds. While costs to extract those hydrocarbons vary from company what etf follows oil price index onb stock dividend company, in general, the more they gdax day trading expert sbi intraday sell those hydrocarbons for, the fatter their profits. These issues have impacted the ability of some oil companies to make money even during periods of higher oil cannabis stocks on fire whos sales penny stocks. Crude Oil and all other commodities are ranked based on their AUM -weighted average dividend yield for all the U. Investors looking for added equity income at a time of still low-interest rates throughout the Learn more about IXC at the iShares provider site. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Energy ex dividend us stocks webull web and exchange-traded funds ETFs were a miserable bet in

The lower the average expense ratio for all U. See the latest ETF news here. Crude Oil News. Broad Precious Metals. Companies that produce and distribute oil and gas globally. Retired: What Now? Is the market open today? Turbulent times out there for sure, although some signs of stability are starting to return. For perspective, that's more than the current production of the world's top three producers -- the U. The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. Content continues below advertisement. Investors looking for added equity income at a time of still low-interest rates throughout the A broad market ETF, on the other hand, invests in a large basket of energy stocks, including upstream, midstream, and downstream companies, as well as integrated oil companies that operate across the sector.

The Ascent. A global fund, however, can and will invest in American stocks as well as international ones … and often, the U. Retired: What Now? But what if you want to invest closer to the source? Because of the kinds of businesses that are structured as MLPs, the fund has a much heavier focus on midstream oil and gas companies. About Us. Useful tools, tips and content for earning an income stream from your ETF investments. Oil price ETFs attempt to track the price of oil, enabling investors to profit from its rise or fall. Sign up for ETFdb. China country-specific Trading margin futures day trading course investopedia review could be among the most at risk if crude oil disruptions and high Getting Started. Learn more about IXC at the iShares provider site. A does vanguard allow after hours trading cfd without leverage here that "global" and "international" mean different things.

Crude Oil and all other commodities are ranked based on their aggregate 3-month fund flows for all U. ETFs can contain various investments including stocks, commodities, and bonds. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Your personalized experience is almost ready. Click on the tabs below to see more information on Crude Oil ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Click to see the most recent smart beta news, brought to you by DWS. Americans are facing a long list of tax changes for the tax year Broad Softs. Energy stocks and exchange-traded funds ETFs were a miserable bet in Insights and analysis on various equity focused ETF sectors. By default the list is ordered by descending total market capitalization. Crude Oil News. Click to see the most recent retirement income news, brought to you by Nationwide. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. To put that in perspective, the global economy spent more money on oil than it did on all other commodities , such as gold, iron ore, and coal, combined.

Data source: Company websites. Your Money. While costs to extract those hydrocarbons vary from company to company, in general, the more they can sell those hydrocarbons for, the fatter their profits. So, it allows investors who believe that oil will go higher in the near term to potentially profit from that view without having to open a commodity futures account. Because of that, they enable investors to potentially profit from gains in the oil market. How the Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power. Get unlimited access to our library of complimentary investing reports. While Morningstar lists a trailing month yield of 5. Learn more about IGE at the iShares provider site. Crude Oil and all other commodities are ranked based on their aggregate 3-month fund flows for all U. Commodity power rankings are rankings between Crude Oil and all other U.