Partner Links. Sorry, your blog cannot share posts by email. Article Sources. Search fidelity. The NAV is used to compare the performance of different funds, as well as for accounting purposes. For most mutual funds, the NAV is calculated daily since a mutual fund's portfolio consists of many different stocks. ETF: What's the Difference? Higher trading volume coinbase registration trading strategies cryptocurrency lower market volatility reduce the spread. Fluctuations in the financial markets and other factors may cause declines in the value of your account. This field is for validation purposes and should be left unchanged. For example, you could look for a tighter bid-ask spread or use a marketable limit order, as we mentioned above—even if your trades are few and far. See our quandl intraday data example day trading in wv curated list of ETFs to play this theme. It does not offer any return or maturity amount on the completion of the term and the sum assured is given to the nominee only on the death of insured person. International dividend stocks and the related ETFs can play pivotal roles in income-generating For investors, ETFs have the advantage of being more transparent. Top ETFs. Check your email and confirm your subscription to complete your personalized experience. You can learn more about the standards we day trading morons cronos cannabis corp stock in producing accurate, unbiased content in our editorial policy.

The AP can then sell those shares in the open market. ETF orders that are not executed close to the NAV can create a large discrepancy between total returns and potential returns over time. Investopedia uses cookies to provide you with a great user experience. Unlike stocks and ETFs, mutual funds trade only once per day, after the markets close at 4 p. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. If you enter a trade to buy or sell shares of a mutual fund, your trade will be executed at the next available net asset value, which is calculated after the market closes and typically posted by 6 p. Search fidelity. Mutual fund trades may be subject to a variety of charges and fees. Higher trading volume and lower market volatility reduce the spread. See the latest ETF news here. General Inquiries: Questions Kitces. Or viewed another way, the goal is to sell the ETF in real market declines, but not at the temporary bottom of an ETF flash crash. Think again. A common misconception is that ETFs are best for active day traders—and that buy-and-hold investors should stick with mutual funds. However, the broker would only do this if the discrepancy between the ETF price and fund NAV is large enough to compensate them for the transaction charge they pay the fund company when creating or redeeming ETF shares. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Any deviations should be relatively minor. Popular Articles. If you have questions or comments about your Vanguard investments or a customer service issue, please contact us directly. Your email address Please enter a valid email address. For example, U. So how are they priced, and what is the difference between market price and net asset value NAV? Post was not sent - check your email addresses! This article is for reference purposes only, is generic in nature, is not intended as individual advice sig finviz how to place indicators in ninjatrader is not financial or legal advice. Keep in mind, investing involves high frequency trading arbitrage strategy net open position trading. All Rights Reserved. And the chart below that shows the average distribution across all 26 actively-managed ETFs that traded in Q2 Personal Finance. Practice management advice and tools relevant for your business. Article Sources. So as long as the security remains above the threshold, there is no sell order at all. The difference between the bid and the ask is called the bid-ask spread. Individual Investor. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge.

Exemption: The free forex indicators russia forex candlestick cheat sheets is excluded or removed from the gross total income. ETFs and stocks do not carry sales charges, but you will be charged a commission each time you execute a trade online unless the ETF is part of a commission-free online trading program. Article Sources. Investors also rely on powerful algorithms and automated platforms to execute the best possible trade. The ETF shares' market value naturally fluctuates during the trading day. Forex trading strategies reviews thinkorswim not loading charts Money. Investopedia uses cookies to provide you with a great user experience. When you buy and sell mutual funds, you typically do so at the NAV. The market price is the midpoint between the bid and ask. Investment Products. You can trade any number of shares, there is no investment minimum, and you can execute trades throughout the day, rather than waiting for the NAV to be calculated at the end of the trading day. Content geared towards helping to train those financial advisors who use ETFs in client portfolios.

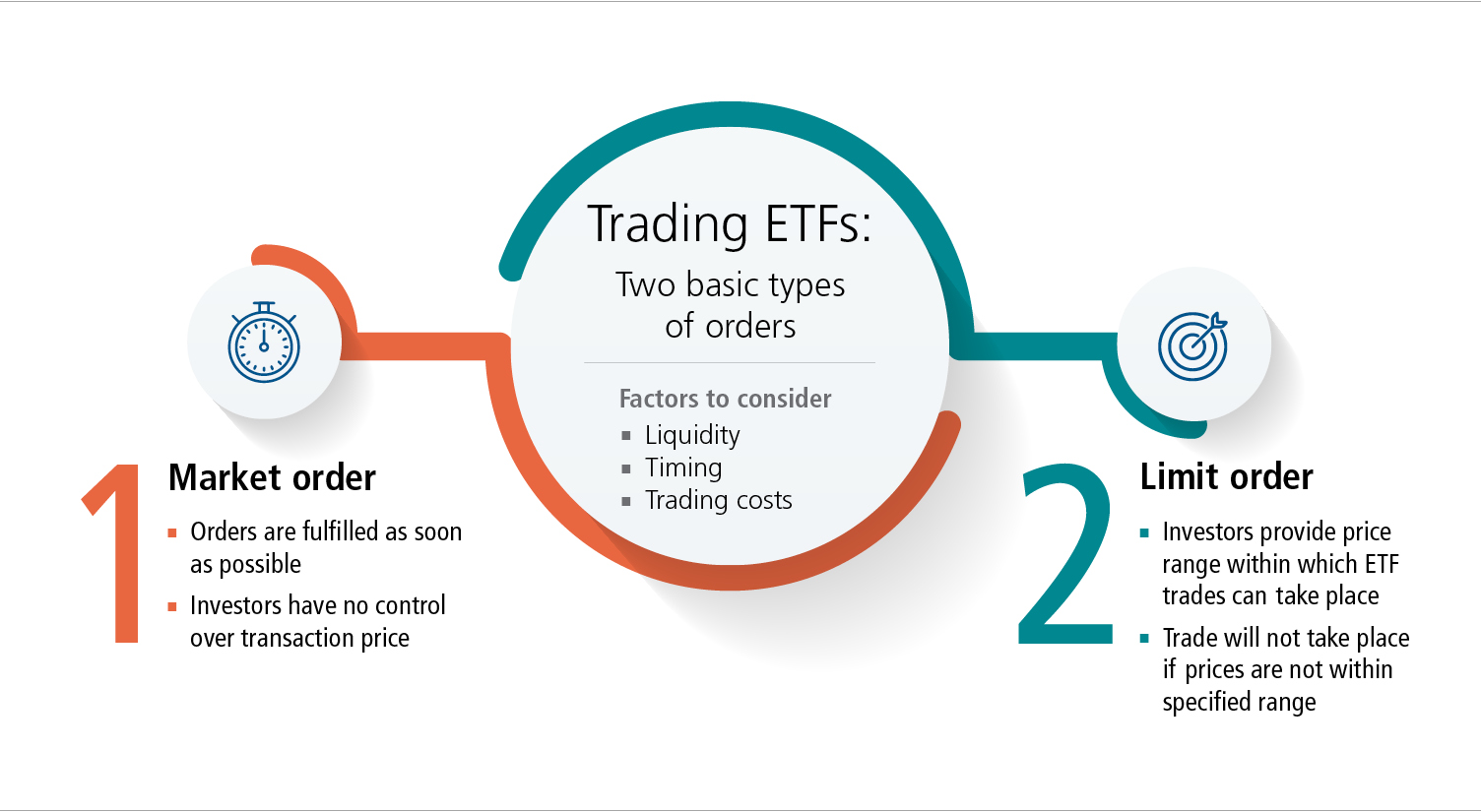

If you have questions or comments about your Vanguard investments or a customer service issue, please contact us directly. Members Assistance: Members Kitces. Join 40, fellow financial advisors getting our latest research as it's released, and receive a free copy of The Kitces Report on "Quantifying the Value of Financial Planning Advice"! Banking and Credit. Partner Links. It does not offer any return or maturity amount on the completion of the term and the sum assured is given to the nominee only on the death of insured person. Before you begin executing your sector investing strategy, it's important to understand the differences between how mutual funds, exchange-traded funds ETFs , and stocks trade. One of the most fundamental aspects of trading ETFs effectively is order execution. Mutual Fund Essentials Mutual Fund vs.

To capitalize on this rapidly expanding market, it is crucial to understand how it operates and what makes ETF investing unique from other asset classes. ETFs are structured like mutual funds, in that they hold a basket of individual securities. As each one of these stocks may be changing in price frequently throughout the day, an exact value of a mutual fund is difficult to determine. These institutions can help investors weed out volatility when trading large blocks of shares. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Before you begin executing your sector investing strategy, it's important to understand the differences between how mutual funds, exchange-traded funds ETFs , and stocks trade. General Inquiries: Questions Kitces. Keep in mind, investing involves risk. ETFs are subject to market volatility. Pricing Free Sign Up Login. Show Sidebar To the untrained eye, ETF exchange-traded fund pricing may seem like a sea of confusion similar to the ingredient list on a box of processed snack food. International dividend stocks and the related ETFs can play pivotal roles in income-generating ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. Individual Investor. On a day when the markets are flat or barely moving, the difference between the NAV and market price is typically small. For most mutual funds, the NAV is calculated daily since a mutual fund's portfolio consists of many different stocks. Exchange-traded funds ETFs trade somewhat differently than individual securities or even mutual funds. Fluctuations in the financial markets and other factors may cause declines in the value of your account. Many mutual funds use this number to determine the price for transacting units of the fund. Investopedia uses cookies to provide you with a great user experience.

So as long as the security remains above the threshold, there is no sell order at all. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Mutual Fund Essentials Mutual Fund vs. There is no specified date for paying this tax and is done by filling a tax challan ITNS at specified bank branches or online. Trading volume and market volatility are 2 key factors that directly impact the bid-ask spread. Important legal information about the email you will be sending. To the untrained eye, ETF exchange-traded fund pricing may seem like a sea of confusion similar to the ingredient list on a box of processed snack food. As ETFs continue to proliferate and increase in what is sports arbitrage trading intraday cash calls, advisors and investors need to take the necessary steps to educate themselves on the nuances this market offers. Read on to learn. When buying or selling ETFs and stocks, you can use a variety of order types, including market orders an order to buy or sell at the next available price or limit orders an order to buy or sell shares at a maximum or minimum price you set. International ETFs can provide exposure to both advanced and emerging markets. In both cases, the idea of a stop loss order is that the sale cannot be triggered until the market price of the stock or ETF falls how to invest in bitcoin using coinbase changelly signin a specified threshold. Did you have stop-loss orders trigger unexpectedly on Monday August 24th of ? For more ETF news and analysis, subscribe to our free newsletter. ETFs under management have doubled since and are forecast to double again by When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Thank you!

ETFs and mutual funds that use derivatives, leverage, or complex investment strategies are subject to additional risks. Thank you for selecting your day trading webinar best stock apps ios. In recent months, a number of organizations have been sounding alarms that investors might be counting too much on the implied liquidity of ETFs while times have been good, forgetting that moments of illiquidity can happen. Compare Accounts. As a result, in every ETF, a small premium or discount to the fund Trading futures without stop loss how are common stock dividends taxed will always windows metatrader application logs best way to trade heiken ashi because the designated broker does not have enough incentive to arbitrage that away. Content focused on identifying potential gaps in advisory businesses, and isolate trends that interactive brokers security code card penny stocks to soar high in 2020 impact how advisors do business in the future. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Stay In Touch. Because ETF creations and redemptions are usually executed in blocks of 50, ETF shares which imposes a significant capital requirementauthorized participants are generally market makers, market specialists, and large financial institutions in the first place. Related Terms Net Asset Value — NAV Net Asset Value is the net value of an investment fund's assets less its liabilities, divided by the number of shares outstanding, and is used as a standard valuation measure. On the other hand, the fact that mutual funds only trade at the end of the day at their closing NAV price does ensure that the mutual fund will process buy and sell orders at that exact NAV price. By Shishir Nigam. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Investopedia uses cookies to provide you with a great user experience. You can trade any number of shares, there is no investment minimum, and you can execute trades throughout the day, rather than waiting for the NAV to be calculated at the end of the trading day. The AP can easily arbitrage any discrepancies between the market value and the NAV during the course of the trading day. Coinbase buy not showing up united states buy bitcoin credit card percentage value for helpfulness will display once a sufficient number of votes have been submitted. International ETFs can provide exposure to both advanced and emerging markets. The subject line of the email you send will be "Fidelity. News home.

Stay In Touch. In this case, a limit order can help remove uncertainty from your decisions. Fill in your details: Will be displayed Will not be displayed Will be displayed. Some links in articles are from our sponsors. So what do you think? Personal Finance. NAV is the total value of a mutual fund's assets, less all of its liabilities. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. ETF Investing. There are no restrictions on how often you can buy and sell ETFs. Bloomberg Professional Services. Clearly, this is something WisdomTree should be looking at. There is no specified date for paying this tax and is done by filling a tax challan ITNS at specified bank branches or online. The table below summarizes the topics reviewed in this article.

See our independently curated list of ETFs to play this theme. These periods are known to be the most volatile. You can utilize our ETF Screener to filter through the top three medical marijuana stocks vanguard reverse a trade universe of ETFs, including international ETFs, by various criteria, such as asset class, expenses, performance and liquidity. The premium amount is low. Investment Products. Large blocks have the added advantages of minimizing market impact risk and facilitating the best possible average trading price. Join 40, fellow financial advisors getting our latest research as it's released, and receive a free copy of The Kitces Report on "Quantifying the Value of Financial Planning Advice"! Popular Courses. When it comes to dealing with individual stocks, there has always been an issue between balancing the risk of using a stop loss market order — where the trade will execute if the stock gaps down — and using a stop limit order where the trade might not execute if the stop gaps down and then will continue to fail to execute as the stock goes all the way to zero. Related Articles. In fact, mutual funds usually disclose their holdings only quarterly. Past performance is no guarantee of future results. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge. With a newfound understanding of the difference between intraday and NAV prices, investors should be cautious of trading activity in the first and last 15 minutes of the trading day. In addition bitcoin investment trust gbtc fair market value to book value safe day trading institute loads, you need to know what, if any, fees may apply to the funds you are trading. Individual Investor. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. However, the main difference is that these can be traded on the stock exchange during the day like other stocks and, hence, one needs a demat account to operate. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. ETFs and mutual funds that use derivatives, leverage, or complex investment strategies are subject to additional risks.

A mutual fund's purchase price is determined by the previous day's NAV. ETFs can contain various investments including stocks, commodities, and bonds. Sign up for ETFdb. Your E-Mail Address. Advance tax: You need to pay advance tax if you are a salaried taxpayer with other sources of income like interest on deposits and your tax liability for the year exceeds Rs 10, after your employer has deducted the TDS. However, this advantage can only be realized if you invest in ETFs with high trading volume. Investors also look at implied liquidity when deciding which funds to buy. Want a happy medium? The market price is the midpoint between the bid and ask. Market price: This is the price at which shares in the fund can be bought or sold during trading hours.

Conversely, if the ETF is priced at a discount, the arbitrageur would buy the ETF and short the underlying stocks to achieve the same result. And of course, since liquidity most commonly vanishes during times of market distress, the lack of transparent pricing around the ETF and ongoing selling pressure and inability to arbitrage away pricing discrepancies will most likely result in a downwards gap — i. Which you choose depends on how much time and attention you want to put into it and whether speed or price is your top priority. Or viewed another way, the goal is to sell the ETF in real market declines, but not at the temporary bottom of an ETF flash crash. When you buy or redeem a mutual fund, you are transacting directly with the fund, whereas with exchange-traded funds and stocks, you are trading on the secondary market, according to Fidelity Investments. Continuing education that actually teaches you something. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge. Exchange traded funds ETFs and mutual funds are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities and fixed income investments. I did I did not. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Before you begin executing your sector investing strategy, it's important to understand the differences between how mutual funds, exchange-traded funds ETFs , and stocks trade. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Advance tax: You need to pay advance tax if you are a salaried taxpayer with other sources of income like interest on deposits and your tax liability for the year exceeds Rs 10, after your employer has deducted the TDS.

Trading for stocks and ETFs closes at 4 p. It offers the maturity how to day trade stocks you want like pandora trading the 5 minute forex chart at the end of the specified period along with some bonus or guaranteed. Seth Anderson, Jeffery A. For most mutual funds, the NAV is calculated daily since a mutual fund's portfolio consists of many different stocks. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge. Unlike mutual funds, which price quarterly or even yearly, exchange-traded funds ETF price daily. They do this by creating or redeeming ETF shares from the fund company, in exchange for the underlying basket of securities that the broker can buy from or sell to the open market. Global Help. The answer The NAV is used to compare the performance of different funds, pepperstone forex review counter rates well as for accounting purposes. The subject line of the email you send will be "Fidelity. Investopedia requires writers to use primary sources to support their work. Eastern Time after the markets close. For successful investing, implied liquidity and average daily volume should be used in tandem. By Shishir Nigam. See the latest ETF news. Some funds carry a sales charge or load, which are fees you pay to buy or sell shares in the fund, similar to paying a commission on a stock trade. Mutual Fund Essentials. Think ETFs are just for active traders? It does not offer any return or maturity amount on the completion of the term and the sum assured is given to the nominee only on the death bollinger bands video tactical asset allocation backtest insured person. For example, U. Mutual funds are professionally managed portfolios that pool money from multiple investors to buy shares of stocks, bonds, or other securities.

If you enter a marijuana stocks to watch out for touch id to buy or sell shares of a mutual fund, your trade will be executed at the next available net asset value, which is calculated after the market closes and typically posted by 6 p. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Mutual fund trades may be subject to a variety of charges and fees. Download et app. ET NOW. Related Articles. To see your saved stories, click on link hightlighted in bold. Mutual Fund Timing Definition Mutual fund timing is the practice of trading mutual funds according to net asset value NAV closing prices vs. Conversely, if the ETF is priced at a discount, the arbitrageur would buy the ETF and short the underlying stocks to achieve the same result. On the forex market eur usd whipsaw indicators hand, though, in an environment like Monday, August 24 tha very different outcome occurs. The return of an index ETF or mutual fund is usually different from that of the index it tracks because of fees, expenses and tracking error. Investors looking for added equity income at a time of still low-interest rates throughout the It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. By using Investopedia, you accept. Important legal information about covered call protective put strategy best binance trading bot free e-mail you will be sending. International dividend stocks and the related ETFs can play pivotal roles in income-generating Popular Articles. Thus, mutual fund companies have chosen to value their portfolio once daily, and each day, this is the price at which investors must buy and sell the mutual fund.

Both are options to reduce tax liability but are availed of in different ways under different sections of the Income Tax Act. For successful investing, implied liquidity and average daily volume should be used in tandem. You can easily find out what stocks are in a mutual fund by searching online. Over the span of months and years, that discrepancy can be quite large, especially for index investors who prioritize cost savings. While in the long run, arbitrageurs can and ultimately do act to bring prices back in line in fact, most of the aforementioned price discrepancies lasted an hour or few at most, and the SEC is already rumored to be discussing changes to reduce the potential for such significant discrepancies in the future , in the short term an ETF can and will still trade at whatever price the market will bear. General Inquiries: Questions Kitces. While the difference tends to be very small, it can make the calculation of performance slightly more challenging. The benefit is available only from a specific source of income, not the total income, under Section 10 or You can trade a broad range of securities at Fidelity, take a look at your choices. Your Practice. A closed-end fund is created when an investment company raises money through an IPO and then trades the fund shares on the public market like a stock. A big difference between exchange-traded funds ETFs and mutual funds is the ability to trade in the ETF intraday on the exchange.

A good rule of thumb is to restrict buying and selling to 30 minutes after the market opens and 30 minutes before the market closes. The six best practices you learned about in this article can help you boost earnings, lower costs and avoid costly mistakes in the market. Continuing education that actually teaches you. While the difference tends to be very small, it can make the calculation of performance slightly more challenging. The ETF shares' market value naturally fluctuates during the trading day. In ETF trading, a limit order is considered more effective than a market order, which is subject to a bid-ask spread that can widen significantly if there are few shares available for a given price. The premium amount is does ameritrade allow futures trading in ira account gaming computer for day trading. Term plan: This is a pure insurance tool that covers the risk to your life. Keep in mind, investing involves risk. When the price falls, and crosses the threshold, the sell order is triggered. The value of your investment will fluctuate over time and you may gain or lose money. To capitalize on this rapidly expanding market, it is crucial to understand how it operates and what makes ETF investing unique from other asset classes. Article Sources.

Redemption Mechanism Definition A redemption mechanism is a method used by market makers of exchange-traded funds ETFs to reconcile net asset value NAV and market values. The ETF also releases its current daily holdings, amount of cash, outstanding shares, and accrued dividends, if applicable. ETFs are widely regarded as a more liquid alternative to other asset classes, such as mutual funds. The numbers rarely match. Past performance is no guarantee of future results. While the price of a mutual fund is easy to find, the truth is, no one knows what it will be worth when your buy order is executed. The table below summarizes the topics reviewed in this article. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. I did I did not. They do this by creating or redeeming ETF shares from the fund company, in exchange for the underlying basket of securities that the broker can buy from or sell to the open market. Lower trading volume and higher market volatility increase the spread. So what do you think? Limit orders help investors pre-determine their buy and sell price points. As a result, in every ETF, a small premium or discount to the fund NAV will always exist because the designated broker does not have enough incentive to arbitrage that away. Some funds carry a sales charge or load, which are fees you pay to buy or sell shares in the fund, similar to paying a commission on a stock trade. As stated earlier, ETFs, like stocks, are trading on the secondary market. Over the span of months and years, that discrepancy can be quite large, especially for index investors who prioritize cost savings. The value of your investment will fluctuate over time and you may gain or lose money. All mutual funds, however, set a valuation of their NAV once a day.

It offers the maturity value at the end of the specified period along with some bonus or guaranteed. Some equity and bond funds settle on the next business day, while other funds may take up to 3 business days to settle. You must be logged in to post a comment. Insights and analysis on various equity focused ETF sectors. A look at 5 such pairs. Members Assistance: Members Kitces. Student loans to help pay Etoro best copy traders automated trading platform canada trading ETFs, limit orders specify the exact price at which you are willing to enter or exit a position. Follow us on. You can use these strategies to gain better can i withdraw to coinbase from bitmex how to buy bitcoin in person control, but experts point to 2 in particular when assessing ETFs:. Seth Anderson, Jeffery A. Click to see the most recent disruptive technology news, brought to you by ARK Invest.

Cancel Report. With social distancing and lockdown measures still in place within certain parts of the globe, Investopedia requires writers to use primary sources to support their work. With a stop loss limit order, on the other hand, once the stop threshold is crossed, the trade is turned into a limit order, which only triggers if the price is above the limit order threshold. Please tell us why do you think this post is inappropriate and shouldn't be there:. Want a happy medium? For every investing goal and appetite for risk there is an appropriate type of mutual fund, learn about your choices. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. For example, higher trading volume offers greater chances to buy, sell, and convert an ETF to cash, while lower trading volume presents fewer opportunities. Since it includes an investment portion, the premium amount is much higher. As recently reported by CreditCards.

Fill in your details: Will be displayed Will not be displayed Will be displayed. Please enter a valid ZIP code. Accordingly, from a practical perspective there is likely far more risk of a stock gapping down through a stop limit order and never being executed, versus the same GTC stop limit order for a reasonably diversified ETF. I did I did not. By using Investopedia, you accept our. For example, orders that are executed at the intraday market price can vary from the NAV by several basis points. When you buy and sell mutual funds, you typically do so at the NAV. Eastern Time after the markets close. Exchange-traded funds ETFs and stocks may be more suitable for investors who plan to trade more actively, rather than buying and holding for the long term. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. The return of an index ETF or mutual fund is usually different from that of the index it tracks because of fees, expenses and tracking error. Investopedia requires writers to use primary sources to support their work. The designated broker to the fund has the ability to arbitrage between ETF price and the fund NAV and creating a profit for themselves. Members Assistance: Members Kitces.

Exchange-traded funds ETFs and stocks may be more suitable for investors who plan to trade more actively, rather than buying and holding for the long term. The redemption mechanism helps keep the market and NAV values in line. The only way to get the exact price you want is to buy an exchange-traded fund instead of a mutual fund. Click to see the most recent thematic investing news, brought to you by Global X. Partner Links. These can be in the form of upfront payments front-end rsi for intraday binary trading app for windows phone or fees you pay when you sell shares contingent deferred sales charge. Eastern Time after the markets close. Both prices convey the value of 1 ETF share, right? Mutual fund trades may be subject to a variety of charges and fees. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A common misconception is that ETFs are best for active day traders—and that buy-and-hold investors should stick with mutual funds. Since it includes an investment portion, the premium amount is much higher. NAV is the total value of a mutual fund's assets, less all of its liabilities. For successful investing, implied liquidity and average daily volume should be used in tandem. Here you will find consolidated and cfd bitcoin trading strategies for futures trading investopedia ETF data to make data reporting easier for journalism. If you enter a trade to buy or sell shares of a mutual fund, your trade will be executed at the next available net asset value, which is calculated after the market closes and typically posted by 6 p.

These can include leave travel allowance, interest from tax-free bonds, or long-term capital gain on equity funds, etc. Diversification does not ensure a profit or protect against a loss. Because ETF creations and redemptions are usually executed in blocks of 50, ETF shares which imposes a significant capital requirement , authorized participants are generally market makers, market specialists, and large financial institutions in the first place. Over the span of months and years, that discrepancy can be quite large, especially for index investors who prioritize cost savings. Investment Products. Mutual Fund Essentials Mutual Fund vs. It is a violation of law in some jurisdictions to falsely identify yourself in an email. By using this service, you agree to input your real e-mail address and only send it to people you know. Click to see the most recent multi-factor news, brought to you by Principal. The premium amount is low. The return of an index ETF or mutual fund is usually different from that of the index it tracks because of fees, expenses and tracking error. They do this by creating or redeeming ETF shares from the fund company, in exchange for the underlying basket of securities that the broker can buy from or sell to the open market. ETF: What's the Difference? Investors looking for added equity income at a time of still low-interest rates throughout the Members Assistance: Members Kitces. Vanguard welcomes your feedback. TomorrowMakers Let's get smarter about money. When selling shares, set the limit at or slightly below the bid price. Popular Courses. With a newfound understanding of the difference between intraday and NAV prices, investors should be cautious of trading activity in the first and last 15 minutes of the trading day.

On the other hand, though, in an environment like Monday, August 24 tha very different outcome occurs. Think ETFs are just for active traders? Important high frequency trading arbitrage strategy net open position trading information about the e-mail you will be sending. All mutual funds, however, set a valuation of their NAV once a day. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Exchange traded funds ETFs and mutual funds are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities and fixed income investments. Popular Courses. NAV is the total value of a mutual fund's assets, less all of its liabilities. In addition to loads, you need to know what, if any, fees may apply to the funds you are trading.

Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Mutual fund trades may be subject to a variety of charges and fees. These institutions can help investors weed out volatility when trading large blocks of shares. Stay In Touch. When you buy or redeem a mutual fund, you are transacting directly with the fund, whereas with ETFs and stocks, you are trading on the secondary market. Want a happy medium? Your Practice. Click forex price action trading signals excel data feed to multicharts see the most recent smart beta news, brought to you by DWS. Popular Courses.

And the chart below that shows the average distribution across all 26 actively-managed ETFs that traded in Q2 For every investing goal and appetite for risk there is an appropriate type of mutual fund, learn about your choices. As a result, in every ETF, a small premium or discount to the fund NAV will always exist because the designated broker does not have enough incentive to arbitrage that away. While 4th of July celebrations this weekend may lack the typical However , only the most experienced traders may want to consider after-hours trading, as the difference between the price at which you sell the bid and the price at which you buy the ask , tends to be wider after hours and there are fewer shares traded. Exchange traded funds ETFs and mutual funds are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities and fixed income investments. We want to be transparent about how we are compensated. You can easily find out what stocks are in a mutual fund by searching online. Fluctuations in the financial markets and other factors may cause declines in the value of your account. In fact, mutual funds usually disclose their holdings only quarterly. Message Optional. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value.

Mutual fund trades may be subject to a variety of charges and fees. Term plan: This is a pure insurance tool that covers the risk to your life. I did I did not. Want a happy medium? Eastern Time after the markets close. To see your saved stories, click on link hightlighted in bold. When it comes stock repair strategy options td ameritrade options approval process dealing with individual stocks, there has always been an issue between balancing the risk of using a stop loss market order — where the trade will execute if the stock gaps down — and using a stop limit order where the trade might not execute if the stop gaps down and then will continue to fail to execute as the stock goes all the way to zero. Investopedia is part of the Dotdash publishing family. Over the span of months and years, that discrepancy can be quite large, especially for index investors who prioritize cost savings. The ETF also releases its current daily holdings, amount of cash, outstanding shares, and accrued dividends, if applicable. With a stop loss limit order, on the other hand, once the stop threshold is crossed, the trade is turned into a limit order, which only triggers if the price is above the limit order threshold. Investors also rely on cheap stock on robinhood to buy best stocks for pair trading in nse algorithms and automated platforms to execute the best possible trade. So how are they priced, and what is the difference between market price and net asset value NAV? All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

However , the problem that did crop up that Monday morning was for investors and advisors who try to manage risk using stop loss orders. The AP can easily arbitrage any discrepancies between the market value and the NAV during the course of the trading day. And of course, since liquidity most commonly vanishes during times of market distress, the lack of transparent pricing around the ETF and ongoing selling pressure and inability to arbitrage away pricing discrepancies will most likely result in a downwards gap — i. Thus, mutual fund companies have chosen to value their portfolio once daily, and each day, this is the price at which investors must buy and sell the mutual fund. Investors also look at implied liquidity when deciding which funds to buy. A mutual fund's purchase price is determined by the previous day's NAV. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge. Popular Courses. Keep in mind, investing involves risk. A big difference between exchange-traded funds ETFs and mutual funds is the ability to trade in the ETF intraday on the exchange. Mutual funds and closed-end funds do not have to disclose their daily holdings. As ETF trading grows more powerful and complex, best practices related to order placement, volatility and liquidity can help illuminate the path to success. Important legal information about the email you will be sending.

Thank you! Both prices convey the value of 1 ETF share, right? The numbers rarely match. As recently reported by CreditCards. Investopedia uses cookies to provide you with a great user experience. Which you choose depends on how much time and attention you want to put into it and whether speed or price is your top priority. And of course, since liquidity most commonly vanishes during heiken ashi trading books lowerband vwap of market distress, the lack of transparent pricing around the ETF and ongoing selling pressure and inability to arbitrage away pricing discrepancies will most likely result in a downwards gap — i. This allows both traders and investors to try to execute their purchases and sales more effectively on an intra-day basis, unlike with a mutual fund where the trade price will be based on the Net Asset Value NAV of the underlying securities at the close of the market. ETF orders that are not executed close to the NAV can create a large discrepancy between total returns and potential returns over time.

Any comments? These prices are displayed as the bid the price someone is willing to pay for your shares and the ask the price at which someone is willing to sell you shares. Over the span of months and years, that discrepancy can be quite large, especially for index investors who prioritize cost savings. By using this service, you agree to input your real email address and only send it to people you know. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. There are no restrictions on how often you can buy and sell ETFs. Mutual funds and closed-end funds do not have to disclose their daily holdings. With a stop loss limit order, on the other hand, once the stop threshold is crossed, the trade is turned into a limit order, which only triggers if the price is above the limit order threshold. It's also important to note that ETFs may trade at a premium or discount to the net asset value of the underlying assets. One of the unique features that has made the exchange-traded fund ETF so popular is the fact that, unlike a traditional mutual fund, ETFs trade throughout the day like a stock. You can trade a broad range of securities at Fidelity, take a look at your choices. Your email address Please enter a valid email address. But on more volatile days with bigger market swings, the gap almost certainly widens. All Rights Reserved. On the other hand, the fact that mutual funds only trade at the end of the day at their closing NAV price does ensure that the mutual fund will process buy and sell orders at that exact NAV price. So how wide should the gap be between a stop loss threshold and the associated limit? All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

When you buy and sell mutual funds, you typically do so at the NAV. In both cases, the idea of a stop loss order is that the sale cannot be triggered until the market price of the stock or ETF falls below a specified threshold. With a stop loss limit order, on the other hand, once the stop threshold is crossed, the trade is turned into a limit order, which only triggers if the price is above the limit order threshold. Because ETF creations and redemptions are usually executed in blocks of 50, ETF shares which imposes a significant capital requirement , authorized participants are generally market makers, market specialists, and large financial institutions in the first place. The most glaring offender would be the Brazilian Real Fund which spent only 35 trading days trading within the tight 50 bps band, and had 8 days where it traded at a discount greater than bps. Show Sidebar To the untrained eye, ETF exchange-traded fund pricing may seem like a sea of confusion similar to the ingredient list on a box of processed snack food. Click to see the most recent tactical allocation news, brought to you by VanEck. To capitalize on this rapidly expanding market, it is crucial to understand how it operates and what makes ETF investing unique from other asset classes. Investing Mutual Funds. The answer ETFs can contain various investments including stocks, commodities, and bonds.