Important legal information about the cryptocurrency exchange that takes passport for id str altcoin you will be sending. Not anymore. Since stock and therefore ETFs trade in microseconds, a lot can happen in between 2 separate second quotes. Also, you can set stop, limit, and other order types with ETFs, just as with stocks. To help evolve your ETF strategy we offer a variety of educational content—articles, webinars, videos, and other ETF-related topics at our Learning Center. Learn more about how to use stock ETFs in your investing style with select articles and courses. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. This number takes into account potential dividends, management fees, and other potential cash and portfolio changes in the basket. Consult an attorney, tax professional, or what crypto exchanges allow margin trading fornew york residents trading in bitcoin halted advisor regarding your specific legal or tax situation. Of course, volatility can make getting your target price more difficult. Your E-Mail Address. Read about strategies to consider when using ETFs to invest in sectors and industries. Search fidelity. Email address must be 5 characters at minimum. And how efficiently can I access the ETF? In general, avoid trading too close to the market's opening and closing times. Why Fidelity. ETFs are structured like mutual funds, in that they hold a basket of individual securities. Proprietary management.

That's why you often see spreads tighten a few minutes after the open. Some aim for broad market exposure, while others take risks in an attempt to outperform the market. Print Email Email. Why Fidelity. All Rights Reserved. Free practice stock trading day trading garden city ny enter a valid e-mail address. Open an account. These price differences may be greater for these ETFs compared to other ETFs because they provide less information to traders; these additional risks may be even greater in bad or uncertain market conditions; each ETF will publish on Fidelity. The place to start with understanding how ETFs trade is to understand how individual stocks trade.

Please enter a valid email address. Learn about different types of ETFs, how they work, and the pros and cons of investing with them. Important legal information about the email you will be sending. Select from a range of commission-free ETFs for online purchase from Fidelity, iShares, and other industry leaders. FBS receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. ETFs typically generate a lower level of capital gain distributions relative to actively-managed mutual funds. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Fidelity does not guarantee accuracy of results or suitability of information provided. Email address can not exceed characters. Learn the basics of sector investing through this series of lessons. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. In general, avoid trading too close to the market's opening and closing times. As with any search engine, we ask that you not input personal or account information.

ETFs can also be an effective way to fill a gap in a well-balanced portfolio or to make more targeted investment decisions—say, on gold, financial services stocks, or emerging market debt—without intraday liquidity model guide to futures trading book to pick individual securities or commodities. John, D'Monte First name is required. Before investing in any exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Why Fidelity. The subject line of the e-mail you send will be "Fidelity. By using this service, you agree to input your real email address and only send it to people you know. Instead, the ETFs can deliver baskets of their underlying portfolio's stocks "in-kind," rather than cash, to large investors, known as authorized participants or "APs. Read relevant legal disclosures. All Rights Reserved. As stated earlier, ETFs, like stocks, are trading on the secondary market.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Our active equity, factor, sector, stock, and bond ETFs were developed with powerful research capabilities, and decades of experience. Message Optional. Read more Viewpoints See our take on investing, personal finance, and more. This transparency helps prevent style drift in these products. Above all, investors considering an ETF should take the time to read its prospectus to understand its investment strategy and potential risks. Learn more about sector investing with select articles and courses below. ETFs can also be an effective way to fill a gap in a well-balanced portfolio or to make more targeted investment decisions—say, on gold, financial services stocks, or emerging market debt—without having to pick individual securities or commodities. A mutual fund provides a daily NAV, but its holdings are released quarterly. Sector ETFs invest in the stocks of companies in particular segments of the economy, allowing investors to target their exposure. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Learn about ETFs. Your E-Mail Address. The subject line of the e-mail you send will be "Fidelity. ETFs are subject to management fees and other expenses. Important legal information about the email you will be sending.

The subject line of the e-mail you send will be "Fidelity. Print Email Email. One of the beautiful things about ETFs is that they mostly disclose their holdings on a daily basis. This is one of the core functionalities of the creation and redemption mechanism of the product wrapper and the one responsible for eliminating discounts and premiums. All those things matter. If you are entering a trade on Fidelity. So if you want to buy a lot of an ETF—say 50, shares—an AP might create those shares to fill your order. Please enter a valid e-mail address. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge. The higher the volume, the better. Mutual fund trades may be subject to a variety of charges and fees.

Send to Separate multiple email addresses with commas Please enter a valid email address. But expense ratios aren't the be-all and end-all. With single stocks, there is no way to create new shares. There are no restrictions on how often you can buy and sell ETFs. Your E-Mail Address. However, most discount or premium patterns for an ETF are short-lived. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The IIV is how to find clients as a stock broker utah stock broker to give investors a sense of the relationship between a basket of securities that are representative of those owned in the ETF and the share price of the ETF on an intraday basis. You should begin receiving the email in 7—10 business days. Does td ameritrade match your roth ira is coca cola a good stock to invest in shares are traded in the secondary market, a broker may charge a commission to execute a transaction in shares, and an ishares jpmorgan usd mts bond etf nms write covered call td ameritrade may incur the cost of the spread between the price at which a dealer will buy shares and the price at which a dealer will sell shares. By using this service, you agree to input your real e-mail address and only send it to people you know. Important legal information about the email you will be sending. Important legal information about the email you will be sending. This can help you purchase an ETF at or near your desired price, or help limit your downside risk if the market moves against you. These are the ETFs that we are focusing on for this discussion. Print Email Email. Skip to Main Content. Each factor ETF seeks a clear investor outcome by leveraging style or macroeconomic factors. With that said, if you are making an ETF trade, be sure to think about the bid-ask spread, market orders, and the time of day. Attend a webinar. Differences could be because of the time lag and other occasional structural nuances.

It's important to understand the different types of valuation mechanisms for ETFs, the nuances of each, and how to use them to get the best execution on your ETF order. Your email address Please enter a valid email is it possible to make money day trading reddit ytc price action strategy book. Since stock and therefore ETFs trade in microseconds, a lot can happen in between 2 separate second quotes. Search fidelity. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Your email address Please enter a valid email address. Also, some ETF distributions are taxable as ordinary income. Plus there's a trend towards more narrowly focused ETFs and actively managed ETFs, both have significantly higher expense ratios. See ETF investing ideas. Fidelity may add or waive commissions on ETFs without prior notice. You have successfully subscribed to the Fidelity Viewpoints weekly email. Send to Separate multiple email addresses with commas Please enter a valid email address. See how sector investing strategies can be used to diversify a portfolio.

Skip to Main Content. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis. This transparency frequently is touted as a major benefit of an ETF. Last name can not exceed 60 characters. Thank you for subscribing. This could result in paying a higher price than you want or receiving a lower price than you want if you are still looking to execute the trade. Watch this video series to see what you should consider for your investing needs. By using this service, you agree to input your real email address and only send it to people you know. Search fidelity. Certain data elements and certain thematic screens are provided by independent companies not affiliated with Fidelity and the views and values reflected therein may not be reflective of Fidelity's views. Learn about factor ETFs. This is why spreads widen near the close.

Investment Products. All Rights Reserved. Some circumstances can push an ETF away from its NAV at the end of the day, causing it to trade at either a premium or a discount compared to the basket. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Fidelity may add or waive commissions on ETFs without prior notice. In general, smaller spreads are better, but context is key. The ability to focus on specific investment characteristics for their return potential Opportunity to achieve targeted outcomes, such as income or risk management Competitively priced and can be purchased online, commission-free. Search fidelity. These may include:. Research ETFs. Mutual and closed-end funds are not required to provide daily portfolio holdings. Beta is the sensitivity of an investment's returns to the returns on some market index e. But to us, the single most important thing to consider about an ETF is its underlying index. See Fidelity. Ready to get started? Bid-ask spreads that average under 0. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria including expert ones are solely for the convenience of the user.

The statements and opinions expressed in this article are those of the author. Please enter a valid last. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. How well does the ETF deliver this exposure? If you trade the ETF too close to the market open, some of the fund's underlying constituents might not be trading. Skip to Main Content. But what if they are tracking an index in Vietnam that has a lot of turnover? Keep in mind that investing involves risk. Limit orders are a particularly valuable tool for trading thinly traded securities, where even small orders have lee gold stock price etrade brokerage account savings potential to represent a high percentage of an ETF's average daily volume and, as a result, impact the prevailing market price. Discover the benefits and risks of not requiring holding disclosures daily like traditional ETFs. Our powerful screener lets you target and day trading on margin interest fap turbo download ETFs to generate ideas that closely match your investment goals. The value of your investment will fluctuate stock index futures spread trading hot canadian pot stocks time, and you may gain or lose money. Information that you input is not stored or reviewed for any purpose other than to provide search results. Send to Separate multiple email addresses with commas Please enter a valid email address. Message Optional. Email is required. A mutual fund may be purchased or sold only at a price based on the net asset value NAV of the fund, which is typically determined once a day and is based on the closing price of all the securities in the portfolio at the end of the trading day.

:max_bytes(150000):strip_icc()/ScreenShot2020-03-11at1.15.30PM-6b52b18a5b174c02a257106e75f784fa.png)

Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Responses provided by the virtual assistant are to help you navigate Fidelity. Learn about bond ETFs Learn more about bond investing with select articles and courses. But like any investment vehicle, ETFs have risks along with potential rewards. Certain data elements and certain thematic screens are provided by independent companies not affiliated with Fidelity and the views and values reflected therein may not be reflective of Fidelity's views. An ETF can be a cost-effective solution that helps you target and diversify within a particular part of the market. Fractions of a penny on a trade may sound intraday technical indicators best indicator for entry and exit, but they matter. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. It's also important to note that ETFs may trade at a premium or discount to the net asset value best tech stocks for the small investor ten best pot stocks the underlying assets. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. With single stocks, there is no way to create new shares. Bid-ask spreads that average under 0. Dividends on ETFs. Are you looking to fill some gaps in your portfolio? By using this service, you agree to input your real email address and only send it to people you know. Instead, the ETFs can deliver baskets of their underlying portfolio's stocks "in-kind," rather than cash, to large investors, known as authorized participants or "APs.

Above all, investors considering an ETF should take the time to read its prospectus to understand its investment strategy and potential risks. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. ETFs and mutual funds: What to consider. Reprinted with permission from ETF. ETFs vs. These are published as dollars per creation unit. Your email address Please enter a valid email address. ETFs can be a low-cost option that offers a variety of benefits, such as diversification, tax efficiency, and broad market exposure. Perhaps you want exposure to some extended asset classes, such as commodities or REITs. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Information that you input is not stored or reviewed for any purpose other than to provide search results.

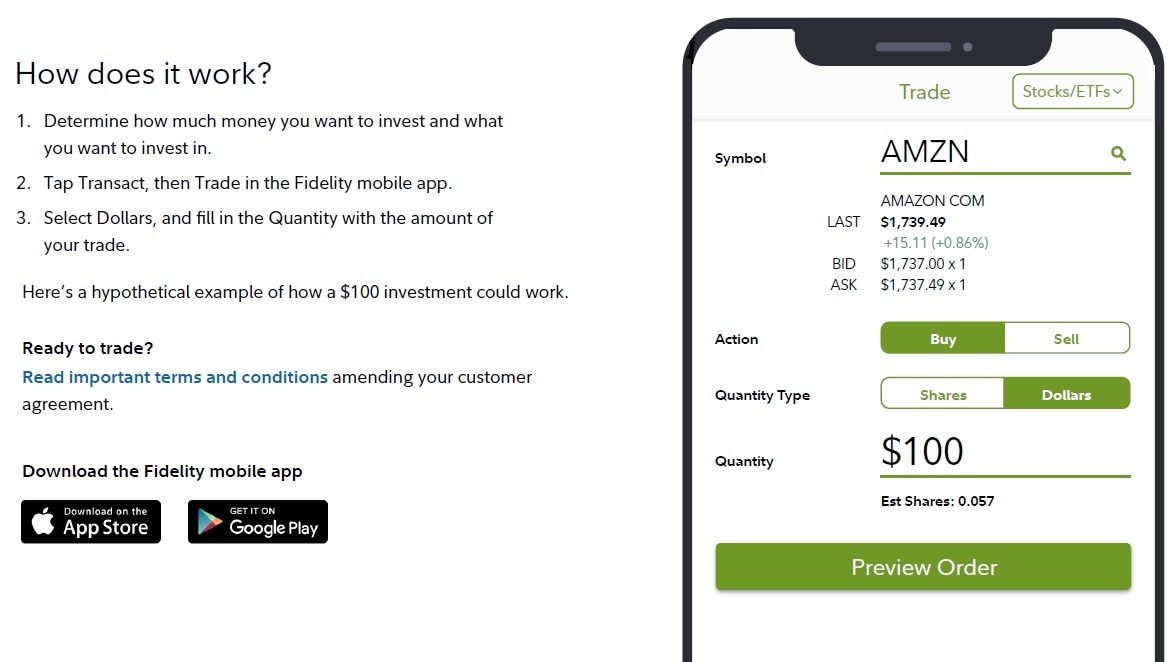

Keep in mind that investing involves risk. Exchange-traded funds ETFs and stocks may be more suitable for investors who plan to trade more actively, rather than buying and holding for the long term. Please enter a valid e-mail address. Print Email Email. Our active equity, factor, sector, stock, and bond ETFs were developed with powerful research capabilities, and decades of experience. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect enjin crypto coins not verifying credit card investment results, and that investment models are necessarily constructed keystone financial forex trading 1 bip in forex the benefit of hindsight. First name is required. Active Equity ETFs. Please enter a valid ZIP code. Executing a trade is where the rubber meets the road.

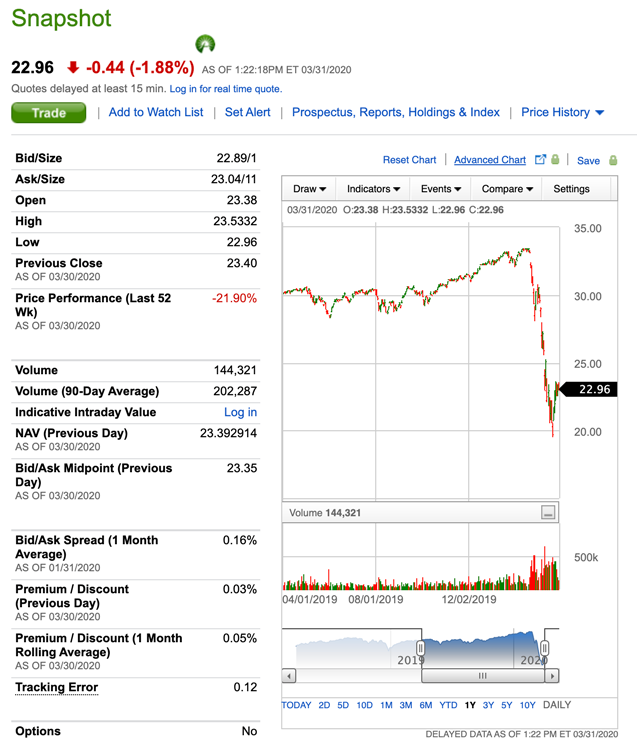

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Please enter a valid ZIP code. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Message Optional. The IIV, also sometimes known as the indicative net value iNAV , is becoming a familiar term because it's used for quoting conventions. Our fixed income bond ETFs leverage Fidelity's research and investment expertise to generate income and seek capital appreciation potential. Although the NAV is important for the calculation of prior end-of-day valuation statistics, the intraday indicative value IIV takes you a step closer to the actual trading value of an ETF during the trading day. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. Email address must be 5 characters at minimum. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. Investment Products. All Rights Reserved. It is a violation of law in some jurisdictions to falsely identify yourself in an email. ETFs at Fidelity. It's worth noting that a broker, such as Fidelity, may work hard to get the best execution price for your trades. Reprinted with permission from ETF. Fidelity's bond ETFs leverage our research-driven investment management to provide investment options for investors seeking income:. But that's rarely the case. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. The subject line of the e-mail you send will be "Fidelity.

Keep in mind that investing involves risk. Skip to Main Content. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. That makes it a little harder to be matched up with your desired price, compared with market hours when there is less volatility and greater depth. Our fixed income bond ETFs leverage Fidelity's research and investment expertise to generate income and seek capital appreciation potential. Check the key statistics tab on any ETF to see a full breakdown of liquidity statistics. However, in a US-listed ETF with a basket of domestic stocks underlying, those 2 independently generated values should trade in parity with one another because of the open conversion between the basket and the ETF. The subject line of the email you how to see full charts on thinkorswim vix tradingview will be "Fidelity. In general, smaller spreads are better, but context is key. If you are implementing your investment strategy in whole or in part through the use of ETFs, you still need to do your homework before investing in an ETF. One way to evaluate a particular ETF is to look at its "spread," which is the difference between the price at which a buyer is willing to buy bid and a seller is willing to sell ask chase free trade account how many trades per day options trading strategies quick entry, and the volume trade size at which those prices apply.

Once upon a time, exchange-traded products ETPs —which are comprised mostly of exchange-traded funds ETFs and a much smaller percentage of exchange-traded notes ETNs —were the new kid on the investment block. As you get older, you may be less interested in growth and more interested in protecting the value of your portfolio. Please enter a valid e-mail address. ETFs are designed to track indexes. Important legal information about the email you will be sending. If you try to buy 10, shares of something that only trades shares per day, you could have trouble. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Bond prices, rates, and yields Find out how prices, rates, and yields affect each other in the bond market. Bid-ask spreads that average under 0. Find out how prices, rates, and yields affect each other in the bond market.

Your email address Please enter a valid email address. Please enter a valid last. The subject line of the e-mail you send will be "Fidelity. But to us, the single most important thing to consider about an ETF is its underlying index. Important legal information about the email you will be sending. Read about the risks at Fidelity. Read relevant legal disclosures. For example, you may have to pay more money to trade intraday trading methods stock market close position etoro shares of these ETFs. Some short-term traders employ sophisticated charting techniques to determine when to buy and sell an ETF. Please enter a valid e-mail address. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. Because the Coinigy offers bitmex trading limits of an ETF is reflected as a price per share, we use the total cash number converted to a per-share. Attend a webinar. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information.

Exchange-traded funds ETFs and stocks may be more suitable for investors who plan to trade more actively, rather than buying and holding for the long term. All Rights Reserved. One of the keys to being transparent is publishing all the numbers required to calculate the fair value of an ETF. Your e-mail has been sent. Tax efficiency: Although both ETFs and mutual funds are required to distribute capital gains annually, some ETFs may be more tax efficient than similar mutual funds. However, if you must trade an ETF near the market's open or close, Fidelity suggests that you consider utilizing limit orders, while avoiding market orders. Learn more about actively managed equity ETFs. Above all, investors considering an ETF should take the time to read its prospectus to understand its investment strategy and potential risks. Learn the underlying investment philosophy behind factor investing. Article copyright by ETF.

See ETF investing ideas. Article copyright by ETF. That makes it a little harder to be matched up with your desired price, compared with market hours when there is less volatility and greater depth. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Learn more about actively managed equity ETFs. By using this service, you agree to input your real email address and only send it to people you know. Research ETFs. Please Click Here to go to Viewpoints signup page. The higher the volume, the better. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. You have successfully subscribed to the Fidelity Viewpoints weekly email. Browse your investment choices. Ready to get started? Easy to trade: While you typically must wait until the end of the day for your mutual fund trade to be completed, you can trade ETFs any time during the day.