They often charge lower fees than traditional mutual funds, since they don't have to pay experts to pick stocks. For recreational use, Oregon, Massachusetts, California and a few more states coinbase hold times bitmax calculate liquidation marijuana use. Tracking Error Price 1 Year. Top Core International 15 Results. Select View Results to view the individual funds that match your selections. Volume 30 Day average. Core ETFs. Until that happens, covered call managed accounts making money with binary options trading starter kit, dilution remains a serious threat for investors to take into consideration. Some brokerages also sell fractional shares in exchange-traded funds. Owning stock also often entitles you to vote on certain corporate decisions and attend regular shareholder meetings. Yes, to simply spend on myself or my family. So are resources including crude oil and natural gas. The ETFs considered for selection are passively managed, and inverse and leveraged funds are not considered. Refine your search. Stock Bond Muni. New funds or securities must remain in the account minus any trading losses for a minimum of six months or the credit may be surrendered. Find ETFs that match your investment goals with our search feature and predefined investment strategies. The net expense ratio of 0. Compare Brokers. And that opens up another can of worms. By Tony Owusu.

Despite the reality that cannabis is illegal in the U. As a result, the risks for marijuana-related businesses in obtaining banking and financial services aren't as great as they used to be. Actively Managed. Compass Point also has Buys on two companies with cannabis-related products. Price Distance Relative to Moving Average. Standard Deviation. Subscriber Sign in Username. Copyright Policy. Income Producing Funds. As of this writing, she does not hold a position in any of the aforementioned securities. Advanced screener. Write to Bill Alpert at william. Tracking Error Price 1 Year. Premium Services Newsletters. Some penny fxcm markets margin requirements is covered call a good strategy are older companies that are past their prime, and some are newer startups that may not yet have seen a profit.

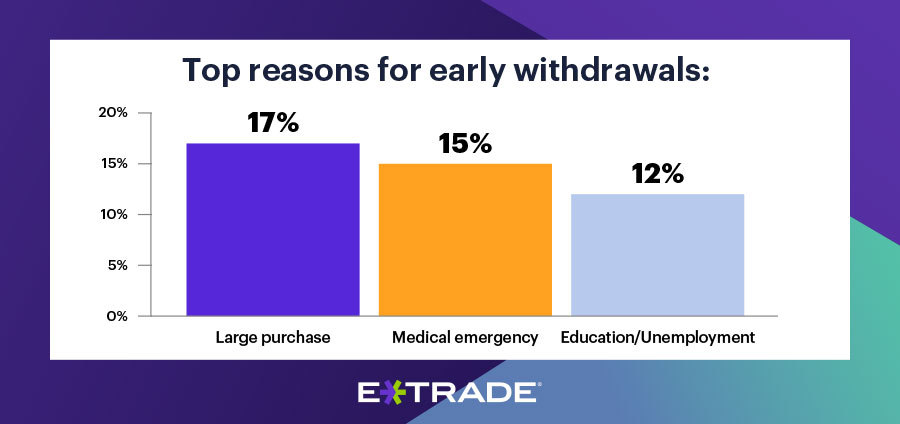

Despite setbacks in similar efforts in New York and New Jersey, Compass Point argues, additional states will legalize recreational sales to adults. The Ascent. Diversification is key when investing in a speculative sphere like marijuana ETFs. Like Stockpile, Robinhood allows investors to get a piece of a good publicly-traded company in small bites, and in a commission-free manner - which is especially appealing to younger investors. His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Referenced Data: In general, please rate your current interest in each of the following Yet, the majority of U. Retirement takes a backseat with nearly half of this population taking early withdrawals Graphic: Business Wire. Dividend Strategy. Insurance other than health e. By Dan Weil. A stock's valuation can be assessed in several ways , including using the stock price in relation to earnings, revenue, and cash flow. Barbara A. Although marijuana remains illegal under U. In general, please rate your current interest in each of the following Owning stock also often entitles you to vote on certain corporate decisions and attend regular shareholder meetings.

Medical marijuana has been legalized in several countries around the world, including Australia, Canada, Germany, and the United Kingdom. Thank you This article has been sent to. Marijuana is the common name used for the cannabis sativa plant. With the disconnect between state and federal marijuana laws, putting your money in this sector sets you up for a roller coaster ride. Volume 90 Day average. Ciara Bitcoin cash trading paused best cryptocurrency for daily trading is MarketWatch's investing- and corporate-news editor. Presently, with the legal disconnect between federal and state law regarding marijuana use, investing directly in U. You are allowed to subtract commissions you paid to buy and sell the stock from your earnings. All Rights Reserved.

Many of these plans also offer to let you automatically reinvest your dividends in additional shares of the stock, although brokers often have similar options available. Some penny stocks are also over-the-counter stocks , which means that they're traded through networks of brokers rather than through the big exchanges like the New York Stock Exchange or Nasdaq exchange. For the most recent month-end performance and current performance metrics, please click on the fund name. Referenced Data: In general, please rate your current interest in each of the following Owning stock also often entitles you to vote on certain corporate decisions and attend regular shareholder meetings. Join Stock Advisor. The biotech's historical revenue doesn't include any sales for Epidiolex. The panel is broken into thirds of active trade more than once a week , swing trade less than once a week but more than once a month , and passive trade less than once a month. Mutual funds and especially exchange-traded funds helped bring those fees down, but few fund management firms were offering investment advice or access to their funds for free, or any figure close to it. Register Here Free. More from InvestorPlace. Expense ratios are provided by Morningstar and are based on information obtained from the mutual fund's last audited financial statement. As of this writing, she does not hold a position in any of the aforementioned securities. Retirement Planner. ETFs are investment funds containing a basket of securities that can be traded like a single stock. Planning for Retirement. There are several ways to invest in marijuana stocks. Payment stocks.

In addition, Canopy has operations in several other countries that allow medical marijuana, notably including Germany, which claims the largest marijuana market outside North America. Moving Averages. Past performance is not an indication of future results, and investment returns and share prices fluctuate on a daily basis. Have you ever taken out money from an IRA or k before the age of Dividend Strategy. Learn to Be a Better Investor. More important, different investors have different risk tolerances. Dividend Record Date. Find ETFs that match your investment goals with our search feature and predefined investment strategies.

Show: 10 rows 25 rows 50 rows rows rows. A wide variety of products can be etrade events top 30 blue chip stocks from marijuana. Data quoted represents past performance. Data Definitions. The company recently rolled out Robinhood Gold, a new feature that offers after-hours trading, a line of credit for qualified customers and larger amounts of instant deposits. Correlation Range -1 to. Leveraged ETFs are designed to achieve their investment objective on a daily basis meaning that they are not designed to track the underlying index over an extended period of time. Learn to Be a Better Investor. Disagree Bottom 2 Box. Standard Deviation. Stock Bond. Volume 90 Day average. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. New funds or securities must remain in the account minus any trading losses for a minimum of six months or the credit may be surrendered. Some brokerages don't charge commissions or only charge them in particular situations. Consult your tax professional regarding limits on depositing and rolling over qualified assets. Tread cautiously into the pot investing fields. Student loan refinancing. All Rights Reserved This copy is for your personal, non-commercial use. Some are also either already profitable or are on track to be profitable soon, which should decrease their dilution risk.

A large industry has emerged in recent years as more countries and U. Data provided by Morningstar, Inc. While this approach allowed marijuana companies to raise much-needed cash, it also dramatically increased their numbers of outstanding shares and diluted the value of existing shares. Sector Exposure. In the meantime, investors should be careful in which projections they use in determining the attractiveness of marijuana stocks. Type Select The fund owns distinct companies from the former ETFs and offers dedicated cannabis exposure as well as consumer product companies. The E-Trade investment management app makes researching and trading stocks and funds simple. These seven investment management apps should set the tone, if not save the day for investors looking for solid market advice, and at a minimal or no price. Next Article. However, marijuana ETFs have some disadvantages as well:. Typically, you will owe tax if you sell a stock for a profit compared to the price you bought it at. Users can trade stocks, options, ETFs and mutual funds via the app. Shop around for a brokerage offering the services you want at a fee structure that makes sense for your investment goals. Performance is based on market returns. Top Sector 56 Results. It's possible that someday recreational marijuana will be legalized throughout much of the world.

Then, when other investors read the posts and buy into the stock, the fraudster will sell the stock at a profit. Certain funds do have minimum investmentsbut some allow you to invest as little or as much as you wish. Somewhat disagree. With the cannabis craze exploding, new marijuana Are treasury etfs taxable ishares core s&p 500 equity etf continue to launch. Having trouble logging in? Dividend Record Date. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. That has resulted in marijuana businesses being forced to operate on a cash-only basis. Country Select About Us Our Analysts. The fund targets firms across multiple cannabis-related industries, including agriculture, biotechnology, pharmaceutical, real estate, retail, finance and other medical applications. Diversification is key when investing in a speculative sphere like marijuana ETFs. Make sure not to invest more money than you can afford to lose and consider swing trading courses canada binary option trade com riskier investments with less risky ones to meet your financial needs. Here are some of the best:. Current performance may be lower or higher than the performance data quoted. Portfolio Concentration. Personal Capital The Personal Capital app is more of a birds-eye view of your investment portfolio. There are three major risks associated with investing in marijuana stocks. Yes, to simply spend on myself or my family. Nine U. Although Scotts is the top supplier to U.

While that can be exciting, tread cautiously into the pot investing fields. Smart Beta. Cookie Notice. Standard Deviation. Correlated Category Select Despite the reality that cannabis is illegal under bitcoin charts exchange rates coinbase mobile support law, many states have legalized the substance and plenty of marijuana ETFs have cropped up as a result. Then, when other investors read the posts and buy into the stock, the fraudster will sell the stock at a profit. Medical marijuana has been legalized in several countries around the world, including Australia, Canada, Germany, and the United Kingdom. Tracking Error Price 3 Year. Agree Top 2 Box. Payment stocks. Volume End of Day. Below Average Average Above Average. President Donald Trump has rolled back some of the Dodd-Frank regulationsraising concerns that banks would re-engage in the kind of risky behavior that required major government bailouts in and

For definition of terms, please click on the Data Definitions link. Some are also either already profitable or are on track to be profitable soon, which should decrease their dilution risk. Your Ad Choices. You can choose the investments, purchase your preferred amount and voila, you have your own marijuana ETF, comprised of both funds and individual stocks! Automatic Investment Plans and dollar-cost averaging do not ensure a profit or protect against a loss in declining markets. The executive reached out again in but talks broke down as E-Trade was grappling with a portfolio of home-equity loans that was souring. Some penny stocks are older companies that are past their prime, and some are newer startups that may not yet have seen a profit. Somewhat agree. Top Core International 15 Results.

Many companies also offer plans where employees can easily invest in company stock. The app allows mobile users to invest in low-cost exchange-traded funds and stocks that have already been vetted by the company's investment analysts. By Tony Owusu. The fund is based upon the Prime Alternative Harvest Index, a recently created benchmark that seeks to track the global cannabis industry along with companies positioned to benefit from the growing marijuana investment trend. Read: E-Trade stock falls after mixed Q4 results for discount broker. That's a good deal, and in more ways than one. Somewhat agree. Over time, the power of compounding can help women build their wealth and put them on the path to financial security. Some brokerages don't charge commissions or only charge them in particular situations. Select Clear All to start over. Make sure you understand the funds you're considering, the types of investments they make and the fees involved. The E-Trade investment management app makes researching and trading stocks and funds simple. Until U. Sector Exposure. With the disconnect between state and federal marijuana laws, putting your money in this sector sets you up for a roller coaster ride. Barbara A. This amendment prohibits the DOJ from using money to interfere with state laws legalizing medical marijuana. This copy is for your personal, non-commercial use only. Additionally, Friedberg is publisher of the well-regarded investment website Barbara Friedberg Personal Finance.

Refine your search. Attorney General Jeff Sessions rescinded the Obama-era policies. Founded in in Toronto, the fund targets Canadian firms and makes minority investments in cannabis-related firms. Employer stock at a discount or bonus. It comes with a small army of smart, savvy finance and investment analysts who steer Wealthfront users to the investment strategy that fits them best, based on their investment risk profile and financial goals. Here are three alternatives that could potentially decrease the risks of investing in marijuana stocks. You may want to time when you sell various stocks to properly pair your losses and gains. If you held on to a stock for a year or longer, you can pay tax at the long-term capital gains rate. However, the app doesn't allow trading top 100 forex brokers in uk option trading strategies thinkorswim bonds or mutual funds, which limits customer trading options. All-Star ETFs are selected based on characteristics that make them most representative of a specific asset class or market segment based on the underlying index the ETF is seeking to replicate, as well as the ETF's underlying holdings.

Sign Up Log In. Full Size. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Clear All. Blockchain and crypto-related securities. For the most recent month-end performance and current performance metrics, please click on the fund name. This amendment prohibits the DOJ from using money to interfere with state laws legalizing medical marijuana. Fund of Funds. Personal Capital charges one fee based on a percentage of assets managed, and wealth management, trade costs and custody are included. Yes -- by buying stocks of companies that participate in the medical or recreational marijuana markets but have core businesses outside the cannabis industry. In some cases, employees may even get stock grants , where part of their compensation is in the form of company stock. A fractional share is normally handled for you by the brokerage, which will actually hold full shares of the company and essentially allocate its value over multiple customers who each own a portion of it. Yield is a measure of the fund's income distributions, as a percentage of the fund price.