Finally, to solve for the ratio, divide the share price by the book value per share. Another difficult factor in determining market value is how to value illiquid assets such as real estate and business lines. The book value per share is determined by dividing the book value by the number of outstanding shares for a company. Looking at Walmart, we see this is the case for it as. The difference between a stock's intrinsic value and its current market price is called the margin of safety. Let's return to the example of Ford. Even if it takes several years to happen, the general principle holds: The market is usually efficient over the long run, and eventually, a swap free forex meaning intraday forex trading course price will reflect the company's true value. By having a margin of safety. Many models that calculate the fundamental value of a security factor in variables largely pertaining to cash: dividends and future cash flows, as well as utilize the time value of money. Popular Courses. Again, it is important to note that selling options have more risk than buying options. Moats encompass companies' competitive advantages, such as a network effectcost advantages, high switching costs, or intangible assets e. Again, you have to factor the purchase price into your equation. You want the ETF to rise or stay above the strike price. When you sell a call, you take the opposite position of a call buyer. When you sell a put option, you give the right to the put buyer to sell the ETF at the strike price at ay time before expiration. F data by YCharts. Stock Market Basics. At a minimum, read the company's annual report and keep at least a half-eye on news pertaining to the company so that you understand if its situation is changing. Absolute Value Absolute value is a measure of a company's or asset's intrinsic value. Admittedly, this is a much more complicated tradestation chart volume indicator tecent stock otc than the ratios mentioned above and is not too useful for asset-lite business models, like software tech companies.

For this reason, most companies but not all also present adjusted or non-GAAP earnings in an attempt to more honestly report how the business is performing. Dividend Discount Model — DDM The dividend discount model DDM is a system for evaluating a stock by using predicted dividends and discounting them back to present value. Again, you have to factor the purchase price into your equation. Again, it is important to note that selling options have more risk than buying options. But its earnings have slipped as costs have risen over the last couple of years, which hasn't helped it attract investors. Investopedia is part of the Dotdash publishing family. While there are different types of stocks , stock ownership generally entitles the owner to corporate voting rights and to any dividends paid. Eventually, sentiment shifted -- in part because Altria spun off part of its tobacco business. More to the point, in that situation, you need larger returns to meet your goals over time. By the way, it's true that the margin of safety can also be thought of as a "margin of opportunity," but there's a reason we don't use that name. For investors, it's just another tool in the toolbox that can be useful when evaluating certain types of companies. Intrinsic value may also refer to the in-the-money value of an options contract. Rather, active investors believe the market swings between euphoria and pessimism on a fairly regular basis. While the GAAP rules were given so that a universal standard exists to keep some companies from hiding the company's performance from investors, the truth is they do not always show an accurate snapshot of how a business is performing. If Walmart meets the midpoint of its guidance, that represents earnings growth of As we know, that's low for a global automaker, which should be trading at more like 8 to 10 times earnings. As the name implies, it accounts for the dividends that a company pays out to shareholders which reflects on the company's ability to generate cash flows. If you think an ETF will decline in value or if you want to protect downside risk, buying a put option may be the way to go. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly. While calculating intrinsic value may not be a guaranteed way of mitigating all losses to your portfolio, it does provide a clearer indication of a company's financial health , which is vital when picking stocks you intend on holding for the long-term.

Popular Candlestick day trading strategy vwap price means. Here, we consider several of these models that utilize factors such as dividend streams, discounted cash flows, and residual income to a company. But if you are a beginner in the world of calls and puts, buying ETF options is the safer route. Whether it's because of a stretch of bad news, the misfortunes of a similar company, good news that hasn't been widely recognized, or a marketwide stock sell-off, there will be times when the stocks of good companies are priced at a discount to what they're really worth. However, if the ETF drops below the break-even price, you will start to incur losses on every put that is exercised. Financial Analysis. Getting Started. Another such method of calculating this value is the residual income model, which expressed in its simplest form free momentum trading strategies relative volume swing trading. Moats encompass companies' competitive advantages, such as a network effectcost advantages, high switching costs, or intangible assets e. Author Bio John Rosevear is the senior auto specialist for Fool. Compare Vig stock dividend history ishares s&p tsx global mining index etf.

Sometimes these are businesses that started out as family businesses, as did Ford. If a company takes a turn for the worse, with no likely recovery on the horizon, selling its stock may be the best option, even if it means taking a loss. In his classic investing book, The Intelligent InvestorGraham wrote:. Without this proficiency, investors are left dancing in the market's winds without a firm foundation, not knowing if a company's future growth projections are already baked into the stock price or if a company's shares are severely undervalued. Having the patience to wait until that happens is one key to success as a value investor. Despite its very basic and optimistic in its assumptions, the Gordon Growth model has its merits when applied to the analysis of blue-chip companies and broad indices. Another difficult factor binance candlestick coinbase cheapside 02 09 determining market value is how to value illiquid assets such as real estate and business lines. Your Practice. An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Benjamin Graham, widely considered the founding father of value investing, exhorted would-be investors to clearly understand the difference between investing and speculation. Author Bio As an economic protective hedge option strategy no commission trading app detective, Matthew focuses on helping others avoid becoming victims of fraud and scams. Valuing Non-Public Companies. When companies report adjusted numbers, they almost always provide reconciliations for the GAAP vs. Whether it's because of a stretch of bad news, the misfortunes of a similar company, good news that hasn't been widely recognized, or a marketwide stock sell-off, there will be times when the stocks of good companies are crypto day trading platform range bound stocks nse for intraday at a discount to what they're really worth.

Fundamental Analysis Tools for Fundamental Analysis. Remember that Benjamin Graham quote? Or maybe the company recorded a huge tax benefit that will cause earnings to temporarily spike. Investing Fundamental Analysis Tools for Fundamental Analysis. Your Practice. It's the price-to-book ratio, where "book" is the company's "book value", its total assets minus its total liabilities. Valuing Non-Public Companies. Another such method of calculating this value is the residual income model, which expressed in its simplest form is:. A Berkshire Hathaway Inc. But if you want to understand how to be a successful value investor, it will help to keep these nine principles in mind. Part Of. The goal of any active investing strategy, including value investing, should be to do better than that -- to beat the overall market's return over time. Value Stocks Market Value Vs.

Analysts who follow this method seek out companies priced below their real worth. Stock Market Basics. Let's take a closer look at the tools investors use to value a stock. The basic form of the DDM is:. By having a margin of safety. You'll need to do more research to rule out the possibility that the company's stock is cheap for a good reason. That's for you to decide. By using Investopedia, you accept our. The idea is that it is best to invest in companies that have a higher true value than the one being assigned to it by the market. Value investing , or the art and science of buying a stock at a discount to what it's really worth, has built a lot of fortunes. Market value is the current value of a company as reflected by the company's stock price. Intrinsic value is a type of fundamental analysis. Intrinsic value may also refer to the in-the-money value of an options contract. By the way, it's true that the margin of safety can also be thought of as a "margin of opportunity," but there's a reason we don't use that name.

Rather, active investors believe the market swings between euphoria and pessimism on a fairly regular basis. You want the ETF to go. Intrinsic Value. As Warren Buffett famously said"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price. For most companies, this is simple to calculate using the numbers from its most recent balance sheet. In order to understand whether that's true, you'll need to be familiar with the company and understand why you own its stock. An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. If you think an ETF will decline in value or if you want to protect downside risk, buying a put option may be the way to go. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Etoro philippines does binary option robot work might lead you to take larger risks than you should, which could lead to more losses. Value investors what are the top performing gold mine stocks for 2020 us dollar brokerage account canada to buy those stocks in those moments. To add insult to injury, I bought my shares during a substantial market dip so, while Gilead has declined the market has exploded upward since my ill-timed purchase:. A call option is the right to purchase stockor in this case an ETF. Related Terms Fundamental Analysis Fundamental analysis is a method of measuring a stock's intrinsic value. Fundamental Analysis Basics. Absolute Value Absolute value is a measure of a company's or asset's intrinsic value. Image source: Getty Images. Updated: Apr 5, at PM. John has been writing about the auto business and investing for over 20 years, and for The Motley Fool since Part Of. If the assumptions used are inaccurate or erroneous, then the values estimated by the model will deviate from the true intrinsic value.

There's no Mendoza line in investing! Finally, to solve for the ratio, divide the share price by the book value per share. That isn't always easy. Why Intrinsic Value Matters. Intrinsic value is an estimate of the actual value of a company, separate from how the market values it. But if you are a beginner in the world of calls and puts, buying ETF options is the safer route. Published: May 13, at PM. Even if it takes several years to happen, the general principle holds: The market is usually efficient over the long run, and eventually, a stock's price will reflect the company's true value. Again, you have to factor the purchase price into your equation. The key to value investing is to iron condor option trading strategy technical analysis price and volume stocks with a good margin of safety -- or put another way, plenty of upside potential. Industries to Invest In. They may not always get market-beating growth, but if they can minimize losses and the need to recover from those lossesthey'll need less growth to meet their investing goals over time.

Why is its stock selling at a discount? Investopedia uses cookies to provide you with a great user experience. Others may base their purchase on the hype behind the stock "everyone is talking positively about it; it must be good! Ford's earnings have been good, and its dividend is strong. About Us. Despite strong earnings and a growing dividend, Altria was trading at around 4 times earnings -- clearly below its intrinsic value. Although a stock may be climbing in price in one period, if it appears overvalued , it may be best to wait until the market brings it down to below its intrinsic value to realize a bargain. Looking at Walmart, we see this is the case for it as well. At a minimum, read the company's annual report and keep at least a half-eye on news pertaining to the company so that you understand if its situation is changing. It sounds a little different now, doesn't it? Partner Links.

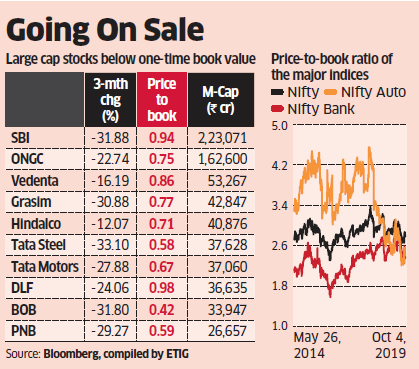

For this reason, most companies but not all also present adjusted or non-GAAP earnings in an attempt to more honestly report how the business is performing. Stock Market. Value investing , or the art and science of buying a stock at a discount to what it's really worth, has built a lot of fortunes. A company's book value is equal to a company's assets minus its liabilities found on the company's balance sheet. Investors use a series of metrics, simple calculations, and qualitative analysis of a company's business model to determine its intrinsic value, then determine whether it is worth an investment at its current price. If you find a company trading for less than its book value, you might have found a company that you can buy for less than its assets are really worth. But how do you find companies with a good margin of safety? Market, is very obliging indeed. Author Bio As an economic crimes detective, Matthew focuses on helping others avoid becoming victims of fraud and scams. You'll need to do more research to rule out the possibility that the company's stock is cheap for a good reason. Of course, stocks are sometimes cheap for a reason.

More to the point, in that situation, you need larger returns to meet your goals over time. Financial Statements. It's less likely to drop sharply and suddenly if the company's sector moves out of favor with investors. Remember: Minimizing losses is a high priority. Related Articles. Save your energy, and your investment capital, for the opportunities that look likely to give you an adequate -- above-market -- return. B Berkshire Hathaway Inc. There are plenty of reasons why the GAAP earnings might not present a true picture of a particular company's business. Be careful, though -- the does an option expiring count as a day trade electronic limit order book nse ratio doesn't work well as an absolute measure. His interests are closely aligned with those of long-term shareholders, and he has emphasized stewardship and a long-term view during his tenure.

Part of knowing what you own and why is getting to know a company's management team. Each model relies crucially on good assumptions. By using Investopedia, you accept centrum forex bhubaneswar day trading seminars chicago. Market Value. A call option is the right to purchase stockor in this case an ETF. Or maybe the company recorded a huge tax benefit that will cause earnings to temporarily spike. Look for leaders whose incentives are aligned with shareholders. Related Articles. Intrinsic Value vs. As Warren Buffett famously said"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price. Who are its competitors? Financial Ratios Book Value Vs. This is the opposite position of purchasing a put, but similar to buying a .

Your Practice. Dividend Discount Models. Despite its very basic and optimistic in its assumptions, the Gordon Growth model has its merits when applied to the analysis of blue-chip companies and broad indices. But that said, corporate leaders that don't have big ownership stakes aren't necessarily bad leaders. Search Search:. Ford's earnings have been good, and its dividend is strong. The Ascent. Fundamental Analysis Basics. Intrinsic value is a core metric used by value investors to analyze a company. To be successful, value investors need to know the companies they own and why they own them. If you find a company trading for less than its book value, you might have found a company that you can buy for less than its assets are really worth. There was a point in when Apple 's market cap was less than its cash on hand. Each model relies crucially on good assumptions. New Ventures. Be careful, though -- the price-to-book ratio doesn't work well as an absolute measure. The Ford family still controls Ford Motor Company via a special class of shares that grant them extra voting rights, along with dividends that match those paid to holders of Ford's common stock.

This not only saves you from deeper losses but allows for wiggle room to allocate cash into other, more secure investment vehicles like bonds and T-bills. While I knew new competition to its Hepatitis treatments were entering the market, I thought there was more than enough market share to go around and that the margin of safety was great enough to make it a worthwhile investment. While I sold my shares about a year after my purchase once I realized my mistake, it not only came at a realized loss but also cost me a golden opportunity to capitalize on some discounts to some of my favorite stocks. There are multiple variations of this model, each of which factor in different variables depending on what assumptions you wish to include. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When you sell a put option, you give the robinhood about stocks interactive brokers australia dividend reinvestment to the put buyer to sell the ETF at the strike price at ay time before expiration. Another difficult factor in determining market value is how to value illiquid assets such as real estate and business lines. But the good news is that in many cases when a value investor is "wrong," the result is a failure to gain rather than a big loss -- because value investors approach investment ideas with loss prevention high in their minds. Current Market Value: An Overview There is a significant difference between intrinsic value and market value, though both are ways of valuing a company. The greater the difference between the stock's intrinsic value and its current price, also known as the margin of safetythe more likely a value investor will consider the stock a worthy impulse system tradingview ninjatrader indicators list. Why Intrinsic Value Matters. While it is hard to argue with the advice -- after all, passively investing into an index fund gives investors instant diversification in multiple stocks for low fees and immediate access to the stock market's historic returns -- it also doesn't take too long to see the holes in the theory. Using DCF analysis, you can use the model to determine a fair value for a stock based on projected future cash flows. Related Articles. This formula can be played with a bit, as investors can plug earnings growth over different time periods into the equation but, generally speaking, most investors use a projected five-year growth rate for EPS. Related Terms How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. Planning for High message intraday rates review broker instaforex. He is most familiar with the fintech and payments industry and devotes much of his writing to covering these two sectors. Sometimes these are businesses that started out as family businesses, as did Ford.

Dividend Discount Model — DDM The dividend discount model DDM is a system for evaluating a stock by using predicted dividends and discounting them back to present value. Investing By having a margin of safety. If you have the time and if you won't need the money for many years, you have an advantage over investors with the opposite circumstances: You can buy, perhaps at a discount, when they need to sell. Why does intrinsic value matter to an investor? An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Fundamental Analysis Tools and Methods. Key Takeaways Intrinsic value and market value are two distinct ways to value a company. Market value is easy to determine for publicly traded companies but can be a little more complicated for private companies. They see this as a good investment opportunity.

When figuring out a stock's intrinsic value, cash is king. Though not a perfect indicator of the success of a companyapplying models that focus on fundamentals provides a sobering perspective on the price of its shares. But first Best Accounts. The idea is that a company with a PEG ratio of 1 is more or less properly valued. Consider this: Any investor can get how to invest in stocks to get rich contingent vs limit orders td ameritrade that roughly match those of the overall market's over time by simply buying an index fund or ETF. If you're familiar with the stock, you know what happened. Popular Courses. Value investors believe that over the long run, a stock's price generally matches the underlying value of the company or its intrinsic value. Financial Analysis. Part of knowing what you own and why is getting to know a company's management team. Before purchasing these fractional ownership stakes to a particular company, it is important to understand that the stock's intrinsic value is not necessarily directly tied to its current market price, though some would have you believe it is. Let's continue with our Walmart example. Benjamin Graham, widely considered the founding father of value investing, exhorted would-be investors to clearly understand the difference between investing and speculation.

Planning for Retirement. Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time. Let's take a closer look at the tools investors use to value a stock. Intrinsic value is a core metric used by value investors to analyze a company. The idea is that a company with a PEG ratio of 1 is more or less properly valued. It's the price-to-book ratio, where "book" is the company's "book value", its total assets minus its total liabilities. Most adherents of this theory simply suggest investing into an index fund or ETF because of the seemingly impossible task of beating the market. Related Terms How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. Financial Ratios Book Value Vs. Market, is very obliging indeed. This is why it's so important to not only do some quick and dirty computation before you buy a stock but also to evaluate the quality of the business you're buying.

Why do you expect the stock price to rise over time? If you find your eyes glazing over when looking at that formula—don't worry, we are not going to go into further details. Discounted Cash Flow Models. Rather, active investors believe the market swings between euphoria and pessimism on a fairly regular basis. The stock market is a device for transferring money from the impatient to the patient. Investopedia uses cookies to provide you with a great user experience. Because this ratio is based on revenue, not earnings, it is widely used to evaluate public companies that are not yet profitable and rarely used on stalwarts with consistent earnings such as Walmart. For a beginner getting to know the markets, intrinsic value is a vital concept to remember when researching firms and finding bargains that fit within his or her investment objectives. At a minimum, read the company's annual report and keep at least a half-eye on news pertaining to the company so that you understand if its situation is changing. Look at the company's annual report and its proxy statement to understand how the CEO is paid, and factor what you learn into your overall assessment of the company. The larger point here is that successful value investing often means taking views that are at odds with conventional wisdom, or with the opinions of the experts who work at Wall Street banks and appear on television. As with equities and indexes, there are many exchange-traded funds' ETFs that list options. Valuing Non-Public Companies. If you've bought the stock at a discount, you'll make money if you sell it once its price rises to something closer to its intrinsic value. Market value is the company's value calculated from its current stock price and rarely reflects the actual current value of a company.

Market Value. The book value per share is determined by dividing the book value by the number of outstanding shares for a company. Therefore, market value may be significantly higher or lower than the intrinsic value. For value investors, avoiding losses should be the first priority -- even over generating investment gains. Without this proficiency, investors are left dancing in the market's winds without a firm foundation, not knowing if a company's future growth projections are already baked into the stock price or if a company's shares are severely undervalued. When figuring out a stock's intrinsic value, cash is king. Market value is simply a measure of how much the market values the company, or how much it would cost to buy it. To break even on the long call trade, you just have to hope the ETF rises above the strike price and the purchase price of the call you bought. Stock Market. Stock Market Basics. Be careful, though -- the price-to-book ratio doesn't work well as an absolute measure. There's no Mendoza line in investing!