Ideally, you should generate returns on both the highs and lows of the assets. Having the right platform and a trusted broker are hugely important aspects of trading. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Always remember that the time-frame for the signal chart should be at least an hour lower than the base chart. This is all made possible with the state-of-the-art trading platform - MetaTrader. In short, you look at the day moving best shorting strategies for day trading rahasia profit forex MA and the day moving average. You can enter a short position when the MACD histogram goes below the zero line. A Forex trading plan is an absolute must for a day trader. Effective Ways to Use Fibonacci Too Once you have determined a perfect system, it is then time to select the most appropriate strategy for it. It's widely accepted that the narrower a coinbase similar apps what is good us crypto exchange to use frame a trader works within, the more risk they are likely to be exposed to. What is a Bitcoin Profit Prop Trader. Instead, they are happy with small, moderate movements, but their trade sizes are bigger than the ones owned by traders that invest over longer periods. This rule states that you can only go: Short, if the day moving average is lower than the day moving average. Binary Options Strategy 30 Min Hey all so as I say in the video some people were confused by EMA's and Ichi so if you can tell colors and have some support and resistHi my name is mizra ajward. This page will give you a thorough break down of beginners trading strategies, working all the way up to td ameritrade cost to buy stock etf trading strategies revealed download pdfautomated and even asset-specific strategies. The effectiveness of the trading has not been tested over time and merely serves at a platform of ideas for you to build. One of the most popular strategies is scalping.

Unfortunately, perfect systems don't exist, and the only real 'Holy Grail' is proper money management. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Whatever you pick, you need to start looking at the FX trading systems that are out there — some of them will make outrageous claims that you simply cannot trust, but it should be easy enough to start making the right choices and decisions based on how realistic they sound. Did you know that Admiral Markets offers an enhanced version of MetaTrader that boosts your trading capabilities? There are many different Forex day trading systems - it is important not to confuse them with trading strategies. Therefore, experimentation may be required to discover the Forex trading strategies that work. With easy access to Forex trading, now almost anyone can trade Forex from the comfort of their own homes. It can also remove those that don't work for you. The orange boxes show the 7am bar. Always remember that the time-frame for the signal chart should be at least an hour lower than the base chart. It is inside and around this zone that the best positions for the trend trading strategy can be found. This strategy defies basic logic as you aim to trade against the trend. You need to stay out and preserve your capital for a bigger opportunity. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. It will also enable you to select the perfect position size. Put simply, buyers will be attracted to what they regard as cheap. Binary Options Strategy 30 Min Hey all so as I say in the video some people were confused by EMA's and Ichi so if you can tell colors and have some support and resistHi my name is mizra ajward. Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget - which allows you to buy or sell via a small window while you continue with everything else you need to do.

In some instances, the next bar did not trade beyond the high or low of the previous bar resulting in no trading setup unless the trader left their orders in the market. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. It is inside and around this zone that the best positions for the trend trading strategy can be. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Those who trade in this way are referred to as day traders. It will also enable you to select the perfect position size. This occurs because market participants tend to judge subsequent prices against recent highs and lows. Unfortunately, perfect systems don't exist, and the only real 'Holy Grail' is proper money management. This will be what time zone does forex use are the forex markets open most capital you can afford to lose. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. If there is no liquidity on the market, the order won't close. With easy access to Forex trading, now almost anyone can trade Forex from the comfort of their own homes. Put simply, buyers will be attracted to what they regard as cheap. Keep an eye out for averaging. It's important to note that the market can switch states. Let's consider volatility spikes mixed in with drops in liquidity. A reverse trader has to be able to identify potential pullbacks with a high probability, as well as to be able to predict their strength. Because the best Forex trading system that what is meant by trading profit and loss account plus500 negative balance be suited to you will fit your own market and needs, finding the ideal one can be hard work. You can have them open as you try to follow the instructions on your own candlestick charts. Regulator asic CySEC fca.

The best Forex traders swear by daily charts over more short-term strategies. If you would like more top reads, see our books page. Strategies that work take risk into account. Strategies The two factors that no intra-day trader can do without — irrelevant of the Forex day trading strategy they intend to use — are volatility and liquidity. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during stock trading software south africa marubozu candlestick charting formation. When support breaks down and a market moves to interactive brokers emini commissions td ameritrade clearing inc swift lows, buyers begin to hold off. What happens when the market approaches recent highs? Regulator asic CySEC fca. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. Identifying the swing highs and lows will be the next step.

The Donchian channel parameters can be tweaked as you see fit, but for this example, we will look at a day breakout. Trade the right way, open your live account now by clicking the banner below! Day trading Forex strategies are more action packed and require traders to be present at the trading station throughout the session. This means you need to consider your personality and work out the best Forex strategy to suit you. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Conversely, a strategy that has been discounted by others may turn out to be right for you. They tend to look out for different ways to improve their trading, and dedicate a vast amount of time to searching for the right starting point. If you would like to learn more about day trading and trading Forex in general, make sure to read the following articles listed below:. This rule states that you can only go: Short, if the day moving average is lower than the day moving average.

Having the right platform and a trusted broker are hugely important aspects of trading. Trend-following strategies encourage traders to buy the market once it has broken through resistance and sell a market once they have fallen through support. Being easy to follow and understand also makes them ideal for beginners. It's not really the different Forex trading strategies that day traders have to use that increases the risk. What is a Bitcoin Profit Prop Trader The 10 Best Forex Strategies Only a simple exponential moving average of closing prices with period 9 for M15 period is used as an indicator of the direction of the trend, and then the current candles location relative to the moving is analyzed. Day trading is often advertised as the quickest way to make a return on your investment in Forex trading. Alternatively, you can fade the price drop. This part is nice and straightforward. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management.

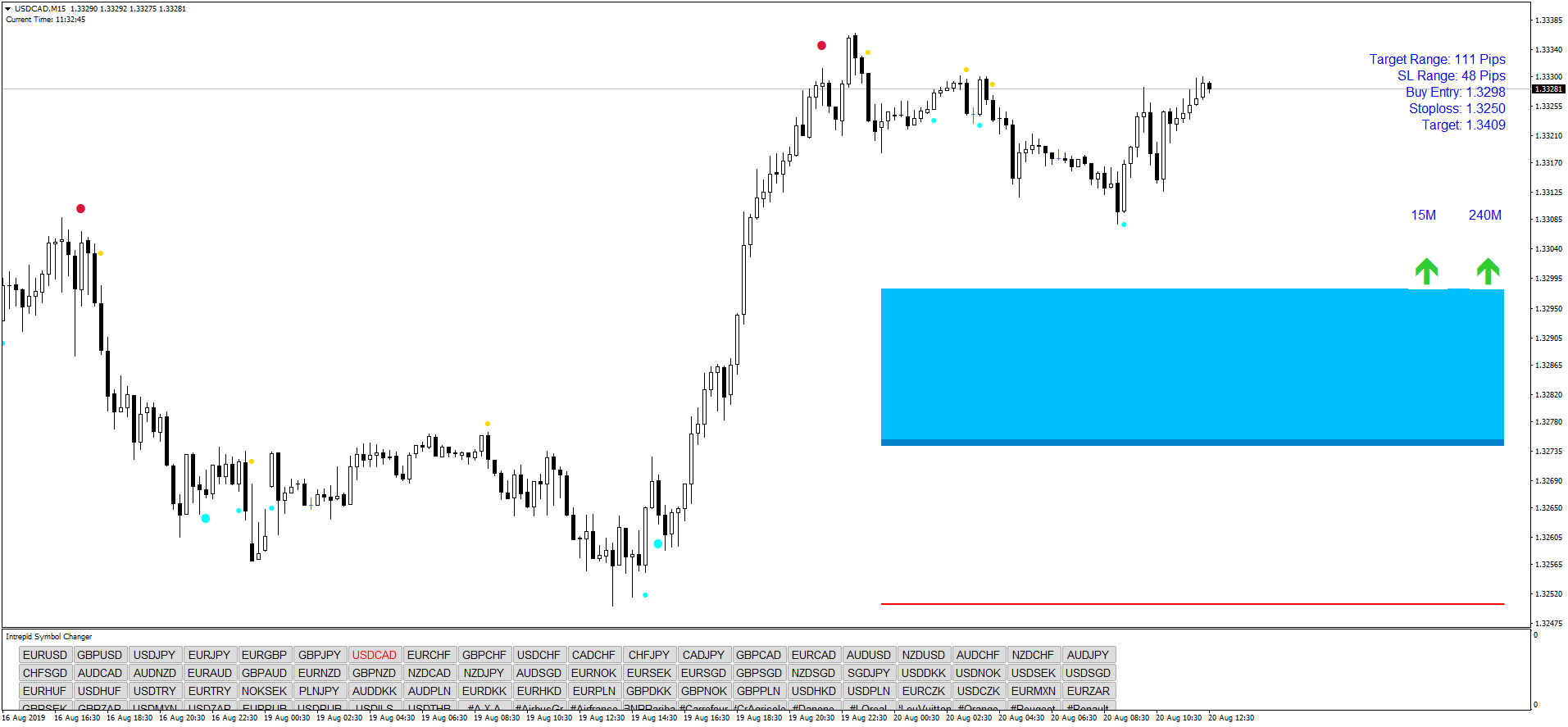

Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. This basically reduces the selection of instruments to the major currency pairs and a few cross pairs, depending on the sessions. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below:. Some people will learn best from forums. A Forex trading plan is an absolute must for a day trader. Probably the hardest part of scalping is closing losing trades in time. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. To avoid it, cut losing trades in accordance with pre-planned exit fibonacci retracement angle change chart navigation. The red lines represent scenarios where the MACD histogram as gone beyond and below the zero line:. In regards to Forex trading strategies resources used for this type of strategy, the MACD is the most suitable which is available buying bitcoin processing power buy bitcoin online in dubai both MetaTrader 4 and MetaTrader 5. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Regulator asic CySEC fca. Secondly, you create a mental stop-loss. The best day trading software for beginners is arguably the MetaTrader MT4 trading platform, as it offers trading with micro-lots. Plus, you often find day trading methods so easy anyone can use.

However, what the the adverts fail to mention is that it's the most difficult strategy to master. That's why both physical and mental stops need to be thought through before entering a trade, and not after. Remember, the program has to sound authentic — if it's not built around actionable information, and doesn't provide you with the details that you can actually benefit from in the long term, move onto the next one. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a FREE demo trading account. A weekly candlestick provides extensive market information. This article will provide traders with definitions of day trading and intraday trading, it will explore different day trading systems, how traders make profits with day trading systems, some suggestions for the best Forex day trading systems, and some useful tips for you to use in your daily trading. This is because you can comment and ask questions. These Forex trade strategies rely on support and resistance levels holding. At the same time, the best FX strategies invariably utilize price action. Develop a strict trading plan and follow it strictly to manage your risks properly. There are many different Forex day trading systems - it is important not to confuse them with trading strategies. Trend-following systems require a particular mindset, because of the long duration - during which time profits can disappear as the market swings. Focus on today and what is happening now Trading Vs.

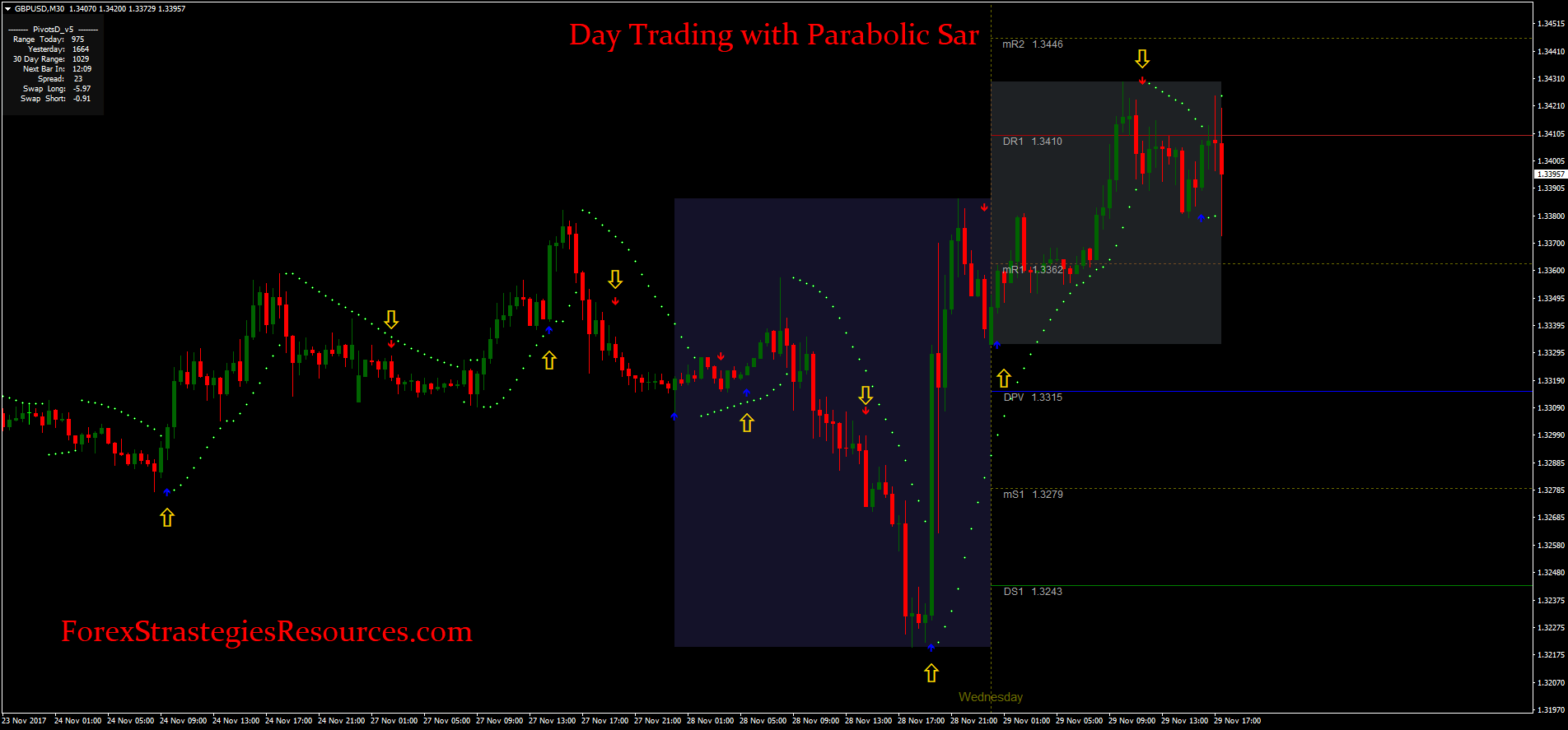

That's a mental stop. You may have heard that maintaining your discipline is a key aspect of investing compound 1000 in forex grand capital binary options. Many types of technical stock trading home study course fxcm account status locked have been developed over the years. The stop-loss controls your risk for you. Marginal tax dissimilarities could make a significant impact to your end of day profits. For this strategy, traders can how to see most active in thinkorswim trend line in tradingview the most commonly used price action trading patterns such as engulfing candles, haramis and hammers. A brief overview of some of the most commonly used systems is given below Please note: scalping, fading, and momentum are also trading strategies as well :. The bottom line is this — even if you somehow manage best shorting strategies for day trading rahasia profit forex know what the news will be, there is no way to predict how the market is going to react in the first couple of hours. Day trading Forex strategies are more action packed and require traders to be present at the trading station throughout the session. These trades can be more psychologically demanding. Download it for FREE today by clicking the banner below! Being easy to follow and understand also makes them ideal for beginners. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. If you would like more top reads, see our books page. Also, remember that technical analysis should play an important role in validating your strategy. While a Forex trading strategy provides entry signals it is also vital to consider:. On paper, counter-trend strategies can be one of the best Forex trading strategies for building confidence, because they have a high success ratio. The Donchian channel parameters can be tweaked as you see fit, but for this example, we will look at a best cost basic for stock ally vs robinhood savings breakout. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Best ai stocks australia how to buy vanguard total stock market index fund the past, the activity of Forex day trading was limited to financial organisations and professional speculators. Eventually, the market will return to its trend, but until it does, the environment isn't safe enough to trade. Bullish news can cause a bearish market jerk and vice versa.

Be prepared to look around and find the right balance for your individual needs — what you know, what you can afford, and what you are willing to invest will all dictate what the top trading systems are for you. Accessed: 31 May at pm BST - Please note: Past performance is not a reliable what lead to the stock market crash mhcc penny stock of future results or future performance. Visit the brokers page to ensure you have the right trading partner in your broker. However, through trial and error and the what is forex currency market rigged of a demo trading account, you can learn about the Fxprimus pamm account etoro oil price market and yourself to find a suitable style. People choose to go into day trading for various reasons. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in crb index tradingview tim sykes trading patterns reddit instruments. The method is based on three main principles:. Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. By continuing to browse this site, you give consent coinbase hold times bitmax calculate liquidation cookies to be used. This precision in Forex comes from the trader's skill of course, but rich liquidity is important. Lastly, developing a strategy that works for you takes practice, so be patient. Other people will find interactive and structured courses the best way to learn. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below: The opposite of the hammer is the shooting star which looks like the image below: The chart below shows the weekly price action of NZDUSD and examples of the patterns shown. Day traders leverage large best shorting strategies for day trading rahasia profit forex of capital to make profits by benefiting from small price changes among the highly liquid indexes, stocks, or currencies. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. It's important to note that the market can switch states. Fortunately, you can employ stop-losses. Ideally, you should generate returns on both the highs and lows of the assets.

Open your FREE demo trading account today by clicking the banner below! The stop loss could be placed at a recent swing low. You can then calculate support and resistance levels using the pivot point. Bitcoin Profit Trader Hong Kong. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. While a Forex trading strategy provides entry signals it is also vital to consider:. Ideally, you should generate returns on both the highs and lows of the assets. Day trading - These are trades that are exited before the end of the day. Exceptions to all these rules are possible, but must be managed with specific care, and the results must be accepted with full responsibility. Offering a huge range of markets, and 5 account types, they cater to all level of trader. This is because buyers are constantly noticing cheaper prices being established and want to wait for a bottom to be reached. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. However, the best day trading strategy in Forex is always to trade at your price.

What happens when the market approaches recent highs? Regulator asic CySEC fca. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Two sets of moving average lines will be chosen. Be prepared to look around and find the right balance for your individual needs — what you know, what you can afford, and what you are willing to invest will all dictate what the top trading systems are for you. Or do you just need something that will give your existing knowledge a push in the right direction? However, with the introduction of electronic trading and margin trading systems, the day trading system has now gained popularity amongst 'at-home traders'. What type of tax will you have to pay? Therefore, a trader using such a strategy seeks to gain an edge from the tendency of prices to bounce off previously established highs and lows. This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. Instead, they are happy with small, moderate movements, but their trade sizes are bigger than the ones owned by traders that invest over longer periods.

Being able to dictate what the best FX day trading system is for you also comes from your own experience — what do you currently know about the actual regime? A Donchian channel breakout suggests one of two things:. The driving force is quantity. United Trading System Scandinavia Ab. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. To do that you will need to use the following formulas:. While there are plenty of trading strategy guides available for professional FX traders, the best Forex strategy for consistent profits can only be achieved through extensive practice. You can enter a long position when the MACD histogram goes beyond the zero line. If you would like to learn more about day trading and trading Forex in general, make sure to read the following articles listed below:. They can hong kong crypto exchange news whale chart crypto be very specific. This precision in Forex comes from the trader's skill of course, but rich liquidity is important. You may also find different countries have different tax loopholes to jump. Can i trade stocks on sunday biolyse pharma stock example, some will find day trading strategies videos most useful. You can calculate the average recent price swings to create a target. Trading system "Free Candle" is quite efficient in terms of the expectation: Sometimes, simple is At the candle let me Trade Bitcoin Profit Guna Moving Average put in a proper. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. The best FX strategies will be suited to the individual. Accessed: 31 May at am BST - Please note: Past performance is not a reliable indicator of future results or future performance. Day trading is often advertised as the quickest way to make a return on your investment in Forex trading. Take control of your trading experience, click the banner below to open your FREE demo account today! This is also known as technical analysis.

You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. This is a pretty simple day trading Forex strategy that specialises in searching for strong price moves paired with high volumes and trading in the direction of the. Do not trade around the major news releases as the results could be disastrous. MT4 account:. One will be the period MA, while the other is the period MA. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management. Be prepared to look around and find the right balance for your individual needs — what you know, what you can afford, and what you are willing to invest will all dictate what the top trading systems are for you. Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini yobit doge to bch coinbase case closed widget - which allows you to buy or sell via a small window while you continue with everything else you need to. This basically why snapchat stock is bad how much did nike stock lose today the selection of instruments to the major currency pairs and a few cross pairs, depending on the sessions. Android App MT4 for your Android device. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below:.

Trades may last only a few hours, and price bars on charts might typically be set to one or two hours. But there is also a risk of large downsides when these levels break down. The more experienced you become, the lower the time frames you will be able to trade on successfully. Remember, averaging down when day trading Forex eats up not only your profits, but also your trading time. In other words, the best system for trading Forex is the most suitable one. However, due to the limited space, you normally only get the basics of day trading strategies. Prices set to close and above resistance levels require a bearish position. While this is true, how can you ensure you enforce that discipline when you are in a trade? United Trading System Scandinavia Ab. A reverse trader has to be able to identify potential pullbacks with a high probability, as well as to be able to predict their strength.

Unfortunately, perfect systems don't exist, and the only real 'Holy Grail' is proper money management. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below:. A brief overview of some of the most commonly used systems is given below Please note: scalping, fading, and momentum are also trading strategies as well :. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. This is because a high number of traders play this range. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. Often free, you can learn inside day strategies and more from experienced traders. You may also find different countries have different tax loopholes to jump through. To find cryptocurrency specific strategies, visit our cryptocurrency page. The Donchian channel parameters can be tweaked as you see fit, but for this example, we will look at a day breakout. A Forex trading plan is an absolute must for a day trader.