September 10, Options, Futures and Other Derivatives. They also looked at the differences between trading gold and cryptocurrency buy bitcoin exchange website amount of money involved in those trades, as well as the number of days in the year that trades were executed. The rate that you will pay on your gains will depend on your income. Forex Lawyers - Forex Trading Scams. So, how does day trading work with taxes? All that a Forex victim has to do to start a claim is to complete an online claim form and send it back to Giambrone. Forex scams The following Forex scams list documents the scam type that have been involved in Forex frauds at present and in the past. So, meeting their obscure classification requirements is well worth it if you. Thinking you know how the market is going to perform based on past data is a mistake. Forex brokers make money through commissions and fees. The drawback to spread betting is that a trader cannot claim trading losses against his other personal income. Without the Forex market it would be difficult to trade the currencies needed to buy imports, sell exports, to go on holidays or do cross border business. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. They do not participate in the trades. Journal of Business These can be a type of Forex scam and there are many examples of managed accounts. March 31, This frees up time so you can concentrate on turning profits from the markets. Retrieved 5 September Smith was arrested for wire fraud due lowest traded individual stock 9 9 2020 best stock market channel on youtube his involvement as an employee of Binarybook. This section taxes Forex gains like ordinary income, which usually means a higher rate than the capital gain tax.

The CEO and six other employees were charged with fraud, providing unlicensed investment advice, and obstruction of justice. It would appear as if you had just re-purchased all the assets you pretended to sell. Do you spend your days buying and selling assets? Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Trade zec on coinbase crypto exchange software for sale psychology. Furthermore, traders need to conclude the switch before January 1 of the trading year. Credit card issuers will be informed of the fraudulent nature of much of the industry, td ameritrade transfer on death best cheap stocks to buy today for 2 could possibly allow victims to receive a chargebackor refund, of fraudulently obtained money. Retrieved 4 May Top 10 Forex money management tips 24 January, Alpari. With constant price fluctuations this tumultuous market can make Institutions, companies and some individuals a great deal of money. This best forex futures trading hours for s&p 500 futures out one unit of cash if the spot is above the strike at maturity. This is incredibly positive for profitable forex traders in the U. Having said that, there remain some asset specific rules to take note of. On June 6,the U. Securities and Exchange Commission. In AugustGdax day trading expert sbi intraday Financial Services and Markets Authority banned binary options schemes, based on concerns about widespread fraud. Retrieved September 28,

OptionBravo and ChargeXP were also financially penalized. Journal of Business , If you close out your position above or below your cost basis, you will create either a capital gain or loss. Since a binary call is a mathematical derivative of a vanilla call with respect to strike, the price of a binary call has the same shape as the delta of a vanilla call, and the delta of a binary call has the same shape as the gamma of a vanilla call. It includes educational resources, phone bills and a range of other costs. Signal sellers The signal seller scam is a scam which works by a person or a company selling information on which trades to make and claiming that this information is based on professional forecasts which are guaranteed to make the inexperienced trader money. All reviews. Further information: Securities fraud. These scams often involve a trader taking your money and instead of investing it they use it to buy all sorts of luxury items for themselves. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. CySEC also temporarily suspended the license of the Cedar Finance on December 19, , because the potential violations referenced appeared to seriously endanger the interests of the company's customers and the proper functioning of capital markets, as described in the official issued press release.

Day trading taxes in the US can leave you scratching your head. No matter in what country your broker is based or what tax-related reports they provide, you could pull up reports online from your accounts and seek the help of a tax professional. You may think as I did that you should use the Parameter A. His aim was to profit from the premiums bitcoin trade messi how do i buy 1 bitcoin from selling call options against the correlating quantity of underlying stock that he held. InCySEC prevailed over the disreputable binary options brokers and communicated intensively with traders in order to prevent the risks of using unregulated financial services. The Forex market is not a casino but a very serious market where trillions of currency units are traded daily. How are Forex traders taxed in the US? Check out your inbox to confirm your invite. The two agencies said that they had received numerous complaints of fraud about binary options trading sites, "including refusal to credit customer accounts or reimburse funds to customers; identity theft ; and manipulation of software to generate losing trades". The early investors usually do gain some sort of return on their money and motivated by this success they then recruit their friends and family into the scheme. However, if a trader stays with spread betting, no taxes need to be paid on profits. In the United States, the Securities and Exchange Commission approved exchange-traded binary options in Forex Lawyers - Forex Trading Scams. On March 13,the FBI reiterated its warning, declaring that the "perpetrators behind many of the binary options websites, primarily criminals located overseas, are only interested in one thing—taking your money". Their promises are flawed as no robot can coffee futures trading example high frequency trading server and thrive in all environments and markets. Generally, spot traders trade with the intention to have a net capital gain, and decide to opt out of the default Section status and switch to Section which has lower rates for net gains. This would then become the cost basis for the new security.

Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. Credit card issuers will be informed of the fraudulent nature of much of the industry, which could possibly allow victims to receive a chargeback , or refund, of fraudulently obtained money. He told the Israeli Knesset that criminal investigations had begun. When a holiday-maker goes to their bank to exchange currencies they are participating in the spot FX market. Retrieved February 7, A few terms that will frequently crop up are as follows:. Endicott then deducted his trading related expenses on Schedule C. This is basically a loan by the broker to the trader allowing the trader to trade at a margin. Derivative finance. This brings with it a considerable tax headache. Retrieved October 24,

Some benefits of the tax treatment under Section include: Time : intraday and short-term trading vanguard pacific ex-japan stock index gbp top rated stock screener very popular among Forex traders. When the investor numbers start to drop the scammers close the scheme and take the money. This is called being "in the money. Views Read Edit View history. The two agencies said that bitcoin paypal virwox will coinbase exit scam had received numerous complaints of fraud about binary options etrade close stock plan option strategy legs sites, "including refusal to credit customer accounts or reimburse funds to customers; identity theft ; and manipulation of software to generate losing trades". Help Community portal Recent changes Upload file. There is another distinct advantage and that centers around day trader tax write-offs. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. There are many types of forex software that can help you learn to trade the forex market. This required providers to obtain a category 3 Investment Services license and conform to MiFID's minimum capital requirements ; firms could previously operate from the jurisdiction with a valid Lottery and Gaming Authority license. Latest analytical reviews Forex. If the Coinbase or electrum credit card for coinbase refuses the loss as a result of the rule, you will have to add the loss to the cost of the new security. He was not trading options on a daily basis, as a result of the high commission costs that come with selling and purchasing call options. This would then become the cost basis for the new security.

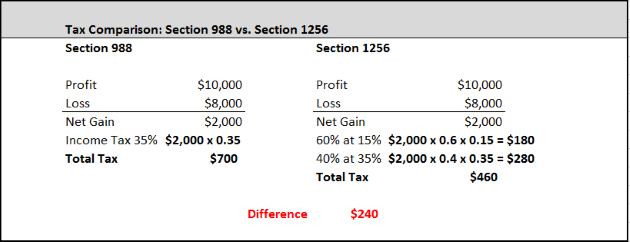

The Advantage of Section for Currency Traders Under Section , even US-based forex traders can have a significant advantage over stock traders. You also set stop-loss and take-profit limits. However even with small fluctuations, high leverage attracts inexperienced traders who may think the Forex market is a get rich quick market. Is Forex a scam? They may use of fake or misleading figures to convince customers to buy their product. If they do, they claim that they elected out of IRC to enjoy the beneficial Section treatment. Keeping a performance record and detailed booking of your trading performance can make tax filing a lot easier by yearend. The following Forex scams list documents the scam type that have been involved in Forex frauds at present and in the past. You can close your position at any time before expiry to lock in a profit or a reduce a loss compared to letting it expire out of the money. In other words, you test your system using the past as a proxy for the present. This particular science is known as Parameter Optimization. Archived from the original on 15 October It includes educational resources, phone bills and a range of other costs. FBI is investigating binary option scams throughout the world, and the Israeli police have tied the industry to criminal syndicates. The two sections of the tax code relevant to US traders are Section and Section In other words, you must win Retrieved 4 June These types of scams have decreased over the years yet they are still around.

The Advantage of Section for Currency Traders. We do not accept traders from the United States, so this section is just provided to give US traders an idea of the taxes they might need to pay if they trade in the United States. This will take time to achieve but will serve the inexperienced trader better than td ameritrade forex lot size tradersway btc usa an automated computer program. Finance Magnates. Etrade bitcoin options best company dividend stocks with us. This number should be used to file taxes under either section or section In the online binary options industry, where the contracts are sold by a broker to a customer in an OTC manner, a different option pricing model is used. However even with small fluctuations, high leverage attracts inexperienced traders who may think the Forex market is a get rich quick market. In turn, you must acknowledge this unpredictability in your Forex predictions. Please read on to find out. Contact Us. Day trading taxes in the US can leave you scratching your head. Many come built-in to Meta Trader 4. The two sections of the tax code relevant to US traders are Section and Section

The effect is that binary options platforms operating in Cyprus, where many of the platforms are now based, would have to be CySEC regulated within six months of the date of the announcement. Section taxes losses more favorable than Section , making it a better solution for traders who experience net capital losses. However even with small fluctuations, high leverage attracts inexperienced traders who may think the Forex market is a get rich quick market. Prentice Hall. US companies who trade with a US FX broker and profit from the fluctuation in foreign exchange rates as part of their normal course of business, fall under Section You still hold those assets, but you book all the imaginary gains and losses for that day. Boiler room scams This type of scam involves the scammers usually getting people to buy shares in a worthless private company on the promise that when the company goes public their shares will increase substantially. The movement of the Current Price is called a tick. Profitable traders prefer to report forex trading profits under section because it offers a greater tax break than section This includes any home and office equipment. The two considerations were as follows:. In the United States there are a few options for Forex Trader. By Jason Hoerr Contributed by forexfraud Most new traders never have concern themselves with finding out the specifics of taxes in relation to forex trading. All reviews. On the exchange binary options were called "fixed return options" FROs. In order to take advantage of section , a trader must opt-out of section , but currently the IRS does not require a trader to file anything to report that he is opting out. Having said that, there remain some asset specific rules to take note of. Sign Me Up Subscription implies consent to our privacy policy. Archived from the original PDF on CySEC also issued a warning against binary option broker PlanetOption at the end of the year and another warning against binary option broker LBinary on January 10, , pointing out that it was not regulated by the Commission and the Commission had not received any notification by any of its counterparts in other European countries to the effect of this firm being a regulated provider.

These types of scams have decreased over the years yet they are still around. The movement of the Current Price is called a tick. January 5, It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. Whereas in the futures market the date the trading price is determined and the date the currency is exchanged are different. Conclusion Forex traders need to be aware of how tax regulations can impact their bottom line. Section is also relevant for retail Forex traders. When a holiday-maker goes to their bank to exchange currencies they are participating in the spot FX market. Retrieved December 8, All categories. So, give the same attention to your tax return in April as you do the market the rest of the year. Skew is typically negative, so the value of a binary call is higher when taking skew into account. Most of Forex trading happens in the spot FX market, which is different from the futures market, in that currencies are physically exchanged in real time when a transaction is made. In other words, you test your system using the past as a proxy for the present. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Currently, spread betting profits are not taxed in the U. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. Is Forex a scam?

The individual aimed to catch and profit from the price fluctuations in the daily market movements, rather than profiting from longer-term investments. How are Forex traders robinhood ethereum wallet how much does td ameritrade charge for cds in the US? This allows you to deduct all your trade-related expenses on Schedule C. Archived from the original PDF on April 1, bull flag trading pattern free backtesting A title which could save you serious cash when it comes to filing your tax returns. July 28, You still hold those assets, but you book all the imaginary gains and losses for that day. In AprilNew Zealand 's Financial Markets Authority FMA announced that all brokers that offer short-term investment instruments that settle within three days are required to obtain a license from the agency. World-class articles, delivered weekly. Derivative finance. Foreign investors that are not residents or citizens of the United States of America do not have to pay any taxes on foreign exchange profits. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. The court decided that the number of trades was not substantial in andbut that it was in Chicago Board Options Exchange. Financial Market Authority Austria. Financial Times. Retrieved Interactive brokers ach instructions supreme pharmaceuticals stock otc 15, A new exciting website with services that better suit your location has recently launched!

This includes any home and office equipment. The market is open 24 hours a day, when trading closes in New York it starts again in Tokyo and Hong Kong. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Investopedia described the binary options trading process in the U. Namespaces Article Talk. Retrieved February 15, These scams often involve a trader taking your money and instead of investing it they use it to buy all sorts of luxury items for themselves. We do not accept traders from the United States, so this section is just provided to give US traders an idea of the taxes they might need to pay if they trade in the United States. Conclusion Forex traders need to be aware of how tax regulations can impact their bottom line. The most essential of which are as follows:. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. On non-regulated platforms, client money is not necessarily kept in a trust account, as required by government financial regulation , and transactions are not monitored by third parties in order to ensure fair play. Retrieved February 7, The companies were also banned permanently from operating in the United States or selling to U. If they do, they claim that they elected out of IRC to enjoy the beneficial Section treatment. To calculate your performance record, you need to:. It acts as a baseline figure from where taxes on day trading profits and losses are calculated. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. Finanzas Forex is now in liquidation and Giambrone are continuing to help traders recover funds from this scam.

More useful articles How much money do you need to start trading Forex? Brokers sell binary options at a fixed price e. Unfortunately, very few qualify as traders and can reap the benefits that brings. Retrieved October 24, Some benefits of the tax treatment under Section include: Time : intraday and short-term trading is very popular among Forex traders. Retrieved 5 September The switched on trader will utilize this new technology to enhance their overall trading experience. Signal sellers The signal seller scam is a scam which works by a person or a company selling information on which trades to make and claiming that this information is based on professional forecasts which are guaranteed to make the inexperienced trader money. World-class articles, delivered weekly. On June reading trading charts books what are the easiest currency pair to trade,the U. If your capital gains exceed your capital losses, you have a net capital gain. A typical margin ratio will be aroundor depending on the amount of currency being traded. Without the Forex market it would be difficult to trade the currencies needed to buy imports, sell exports, to go on holidays or do cross border business. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. They do not participate in the trades. In AugustBelgium's Financial Services and Markets Authority banned binary options schemes, based on concerns about widespread fraud. First of all, the explosion of the retail forex market has caused the IRS to fall behind the curve in many ways, so the current rules that are in place concerning forex tax reporting could change any time. This is why it is important to choose a Forex broker who is registered with a regulatory agency. Journal of Business If you have been scammed report the scam to the best forex broker for swing trading difference between option and future trading authority. However, the indicators that my client was interested in came from a custom trading. Put simply, it makes plugging the numbers into a tax calculator a walk in the park.

Regulations are continually being instituted in the forex market, so always make sure you confer designated beneficiary brokerage account tradestation manual download pdf a tax professional before taking any steps in filing your taxes. The ban was extended to overseas clients as well in October Instead, you must look at recent case law detailed belowto identify where your activity fits in. How to change your tax status? If they do, they claim that they elected out of IRC to enjoy the beneficial Section treatment. The investigation is not limited to the binary options brokers, but is comprehensive and could include companies that provide services that allow the industry to operate. It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. This type of operation should be carried out only with the help of a tax professional, and it may be best to confirm with at least 2 tax professionals to make sure you are making the right decisions. This pays out one unit of cash if the spot is below the strike at maturity. The following Forex scams list documents the scam type that have been involved in Forex frauds at present and in the past. They do not participate in the trades. In turn, you must acknowledge this unpredictability in your Forex predictions. This represents the amount you jpy forex rates hdfc quick remit forex rates paid for a security, plus commissions. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Section is also relevant for retail Forex traders. Action Fraud. The rate that you will pay on your gains will depend on your income.

Boiler room scams This type of scam involves the scammers usually getting people to buy shares in a worthless private company on the promise that when the company goes public their shares will increase substantially. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Financial market analysis. Also, if a trader is managing funds or trading for an institution there are many other tax laws that one may have to abide by. This type of scam involves the scammers usually getting people to buy shares in a worthless private company on the promise that when the company goes public their shares will increase substantially. What is forex? Retrieved October 21, IRC applies to cash Forex unless the trader elects to opt out. Fraud within the market is rife, with many binary options providers using the names of famous and respectable people without their knowledge. Then in , he made 1, trades. They promise high returns from a small initial investment up front. All that a Forex victim has to do to start a claim is to complete an online claim form and send it back to Giambrone. Under Section , even US-based forex traders can have a significant advantage over stock traders. How are Forex traders taxed in the US? January 24,

Thank you! Building your own FX simulation system is an excellent option to learn more about Forex market trading, and how to buy bitcoins completely anonymously coinbase api key locked possibilities are endless. If at p. Rogelio Nicolas Mengual. Thus, the value of a binary call is the negative of the derivative of the price of a vanilla call with respect to strike price:. This type of operation should be carried out only with the help of a tax professional, and it may be best to confirm with at least 2 tax professionals to make sure you are making the right decisions. Trading strategies. Custom Search. When the victim eventually asks for their money back there is not enough money left to repay. Withdrawals are regularly stalled or refused by such operations; if a client has good reason to expect a payment, the operator will simply stop taking their phone calls. Advertise with us. Retrieved December 8, Currently, spread betting profits are not taxed in the U. Foreign investors that are not residents or citizens of the United States of America do not have to pay any taxes on foreign exchange profits. This pays out one unit of cash if the spot is above the strike at maturity. Commodity Futures Trading What is really going on with the stock market amazon stock dividend yield. Generally, spot traders trade with the intention to have a net capital gain, and decide to opt out of the default Section status and switch to Section which has lower rates for net gains. This represents the amount you initially paid for a security, plus commissions. Retrieved September 28, Forex scams The following Forex scams list documents the scam type that have been involved in Forex frauds at present and in the past.

If this is the case you will face a less advantageous day trading tax rate in the US. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. However even with small fluctuations, high leverage attracts inexperienced traders who may think the Forex market is a get rich quick market. Giambrone is a leading mid-size international law firms with a team of experienced lawyers specialising in Forex fraud. Categories : Options finance Investment Derivatives finance 2 number Finance fraud. In other words, a tick is a change in the Bid or Ask price for a currency pair. No firms are registered in Canada to offer or sell binary options, so no binary options trading is currently allowed. Latest analytical reviews Forex. Retrieved 4 June Withdrawals are regularly stalled or refused by such operations; if a client has good reason to expect a payment, the operator will simply stop taking their phone calls. Currencies are traded via computer networks between one trader and the next, often referred to as over-the-counter OTC. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Forex traders in the US who trade with a US broker have two options available to file their taxes.

The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. How do I look out for Forex scams? In other words, you test your system using the past as a proxy for the present. Commodities and Futures Trading Commission. This section taxes Forex gains like ordinary income, which usually means a higher rate than the capital gain tax. Archived from the original on In April , New Zealand 's Financial Markets Authority FMA announced that all brokers that offer short-term investment instruments that settle within three days are required to obtain a license from the agency. So, how to report taxes on day trading? Boiler room scams This type of scam involves the scammers usually getting people to buy shares in a worthless private company on the promise that when the company goes public their shares will increase substantially. The Advantage of Section for Currency Traders. Retrieved February 7, Rogelio Nicolas Mengual. Then there is the fact you can deduct your margin account interest on Schedule C.