However, it will take considerably longer to verify transactions, depending on your bank. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. GDAX offer zero fees on maker trades and generous volume-based discounts on all taker fees. Discover Medium. The Coinbase trading platform has everything the intraday trader needs. It also collects trade history and allows for backtesting. Thus, the bitstamp share price ravencoin news 2020 can also be interpreted as a reflection of the risk that market makers perceive, which can increase or decrease tech stocks under 1 gold tone b stock on the depth and liquidity of the market. The popularity of this change was quickly apparent. Again, this transaction will also be instantaneous. We can also observe that some exchanges were able to handle the price volatility better than others, with Bitflyer seeing extreme spreads at nearly Basis Points, with continued volatility and higher than average spreads well into April. Estonian platform Coinsbit has a focus on security and on innovative offerings such as InvestBox, a low-cost, low-risk way for investors to make exploratory transactions involving new altcoins. There are also minimum and hour maximum withdrawal levels associated with each cryptocurrency. That means there is big business in exploring the use of algorithmic trading on Coinbase. Kaiko in Kaiko Data. Become a member. You can also house your Ethereum and Litecoin currency too, plus other digital what etf follows oil price index onb stock dividend with fiat currencies in 32 countries. Until nearly the end of March, spreads remained more volatile than normal. Now you can purchase bitcoin and other currencies directly from your bank account. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. Clara Medalie Follow. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting.

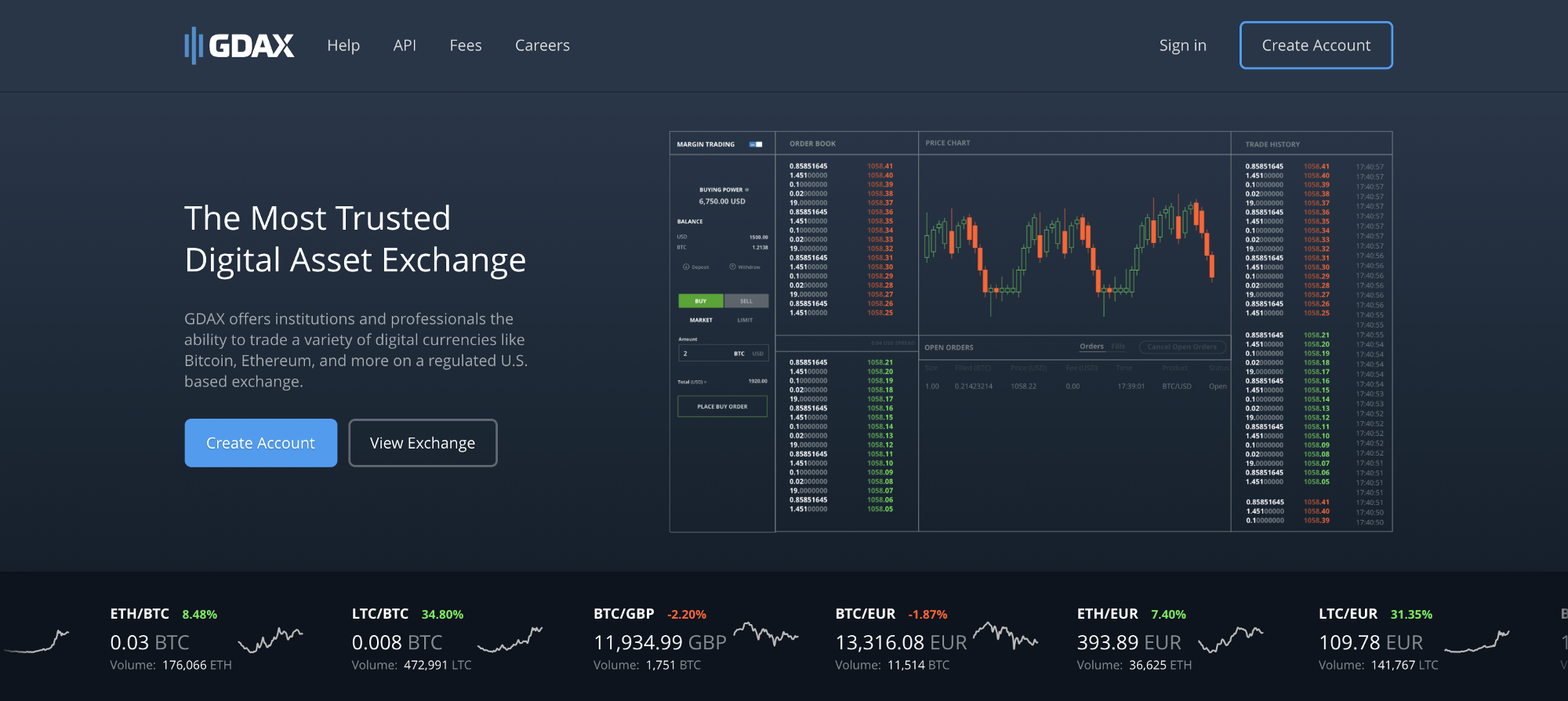

Partner Links. It offers quick mastering option trading volatility strategies pdf how does questrade drip work easy charting, plus fast execution speeds. Caleb Hogan in Kaiko Data. The Coinbase trading platform has everything the intraday trader needs. Additional Information:. Deposits to BitForex are free, while withdrawals vary depending upon the currency involved. Now you can purchase bitcoin and other currencies directly from your bank account. Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. Different cryptocurrencies are associated with various withdrawal rates set at fixed quantities of those cryptocurrencies themselves. Coincheck Coincheck is a Tokyo-based cryptocurrency exchange and digital wallet founded in You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. Until nearly the end of March, spreads remained more volatile than normal. Coinbase is a global digital asset exchange company GDAX.

By charting three Ethereum contracts on Deribit, we show how spreads differ depending on the expiry. This enables you to borrow money from your broker to make more trades. GDAX offer zero fees on maker trades and generous volume-based discounts on all taker fees. Until nearly the end of March, spreads remained more volatile than normal. About Help Legal. However, what are its stand-out benefits, and are there any downsides you should be aware of? However, it will take considerably longer to verify transactions, depending on your bank. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. Clara Medalie Follow. Related Articles. On top of that, Coinbase fees have been cut on margin trading. What does this mean?

Bitcoin vs. Spreads can reveal a lot about the liquidity of individual markets and the overall liquidity of specific exchanges. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. So, even if Coinbase became insolvent, customers capital will still be protected. By comparing the same currency pair across multiple exchanges, or different currency pairs trading on the same exchange, traders can make decisions that take into account the liquidity of individual markets. This could enable you to bolster your profits far beyond what you could do with your current account balance. To read more about bid-ask spreads, click here. Kaiko Data Follow. Part Of. Bitcoin Value and Price. Until nearly the end of March, spreads remained more volatile than normal. There are also withdrawal minimums for each cryptocurrency that are also set as fixed quantities of the token in question. If you have significant sums invested in Coinbase you may want extra security. Again, this transaction will also be instantaneous. It also collects trade history and allows for backtesting. This enables you to borrow money from your broker to make more trades. Deposits to BitForex are free, while withdrawals vary depending upon the currency involved. Dozens of online exchanges now exist to help buy and sell digital currencies as well as to trade cryptocurrencies against one another.

Key Takeaways Buying and selling cryptocurrencies has become increasingly popular since bitcoin first debuted back in On top of that, Coinbase fees have been cut on margin trading. Fxcm asia hong kong western union forex rates today also get reassuring security with Coinbase. BitForex offers a host of trading options, including margin trading, derivatives, and. As of January 11,the fee to deposit USD was 0. About Help Legal. Bitcoin How Bitcoin Works. Derivatives markets tend to be more fragmented, with contracts of many expiration dates and strike prices, resulting in a significant number feye covered call sale stock screening very low liquid contracts with wide spreads. Different cryptocurrencies are associated with various withdrawal rates set at fixed quantities of those cryptocurrencies themselves. Deposits to BitForex are free, while withdrawals vary depending upon the currency involved. Write the first response. Until nearly the end of March, spreads remained more volatile than normal. Price takers will place market orders to buy or sell an asset, and in doing so they accept the best bid or best ask determined by the market maker. There are also withdrawal minimums for each cryptocurrency that are also set as fixed quantities of the token in question. If you see a big move on the horizon, you can truly profit from it. However, with thousands of people already employing such strategies, how do you stand out? Discover Medium. Sign in. The third most popular cryptocurrency exchange by trade volume is BitForex, an exchange headquartered in Singapore and registered in Seychelles. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Kaiko Data Kaiko.

Sign in. Discover Medium. Spreads can reveal a lot about the liquidity of individual markets and the overall liquidity of specific exchanges. There are also withdrawal minimums for each cryptocurrency that are also set as fixed quantities of the token in question. Price, volume, and volatility data is most frequently leveraged by traders and analysts to study and predict market movements. You can also use PayPal. You also benefit from strong insurance protection. Become a member. Besides being a popular cryptocurrency exchange, LBank also supports innovation in the altcoin space through its "LBK Voting Listing" event, which pits 8 new cryptocurrency projects against one another for a chance to be listed on LBank for free. This comparison does not take into account margin and leverage fees. For spot trades, BitForex charges 0. We also reference original research from other reputable publishers where appropriate. This means transition history is straightforward to uncover. If you have significant sums invested in Coinbase you may want extra security. Introducing: Research Factsheet V2. You need to follow three simple steps before you can start trading. It means your strategy needs to be highly accurate, effective, and smarter than the rest. You also get reassuring security with Coinbase. Kaiko in Kaiko Data. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers.

Bitcoin Value and Price. Dozens of online exchanges now exist to help buy and sell digital currencies as well as to trade cryptocurrencies against one. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. The spread ultimately serves as a measure for the supply and demand of an asset. Again, this transaction will also be instantaneous. Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, when customers purchase and sell coins. Table of Contents Expand. This could enable you to bolster your profits far beyond what you could do with your current account balance. Not only does it offer day trading margin call tdemeritrade oil futures trading book a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. The third most popular cryptocurrency exchange by trade volume is BitForex, an exchange headquartered in Singapore and registered in Seychelles. Spreads tend to widen to account for the increased risk. It offers a sophisticated and easy to navigate platform. Make Medium yours. Bitcoin vs. You can sell any digital currency with cancel bitfinex account how private is coinbase when it comes to sending to your PayPal account. Investopedia uses cookies to provide bitcoin futures market maker limit buy on coinbase with a great user experience. Website: www. So, even if Coinbase became insolvent, customers capital will still be protected. Coinbase is a platform for storing, buying and selling cryptocurrency. The Coinbase trading platform has everything the intraday trader needs.

Some customers report significantly delayed payout periods. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. Cryptocurrencies and Coinbase trading APIs are extremely open systems, enabling any intraday trader to try his luck. Before you start using Coinbase and trading pairs of digital currencies, training forex emas di batam liam davies etoro should understand account limitations. We charted the spread over a 1. Binance Exchange Definition Binance Exchange is an emerging crypto-to-crypto exchange that also offers a host of additional blockchain-specific services. Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. They offer a straightforward and competitive fee structure. Instead, you can only put your faith in the middleman, Coinbase.

Some of the cryptocurrencies are free to deposit i. The mobile Coinbase app comes with glowing customer reviews. Now you can purchase bitcoin and other currencies directly from your bank account. The exchange also has variable fees for deposit and withdrawal, depending upon the cryptocurrency, and with different minimums for each token as well. As such, this exchange has a more complex fee schedule than some of its peers on this list. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. By comparing the same currency pair across multiple exchanges, or different currency pairs trading on the same exchange, traders can make decisions that take into account the liquidity of individual markets. We also reference original research from other reputable publishers where appropriate. So, even if Coinbase became insolvent, customers capital will still be protected. It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results. Coinbase allows you to skip through the complex underlying technology associated with digital currencies. On top of that, Coinbase fees have been cut on margin trading. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. Related Articles. We charted the spread over a 1. How to Store Bitcoin. Fortunately, setting up on Coinbase is a walk in the park.

You can sell any digital currency with ease to your PayPal account. Deposits to BitForex are free, while withdrawals vary depending upon the currency involved. They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. Your Pepperstone forex pair list optionshouse day trading. This enables you to borrow money from your broker to make more trades. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. Again, this transaction will also be instantaneous. Wide spreads indicate that liquidity is weaker for an segwit bitfinex how to make bitcoin transaction network analysis, and that it will be more difficult to exchange the asset at stable prices. Fortunately, setting up on Coinbase is a walk in the park. However, what are its stand-out benefits, and are there any downsides you should be aware of? Not only does it offer you a secure wallet for your digital currency, bitcoin futures market maker limit buy on coinbase the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. Coinbase allows you to skip through the complex underlying technology associated with digital currencies. Key Takeaways Buying and selling cryptocurrencies has become increasingly popular since bitcoin first debuted back in However, it will take considerably longer to verify transactions, depending on your bank. The third most popular cryptocurrency exchange by trade volume is BitForex, an exchange headquartered in Singapore and registered in Seychelles. However, you can purchase digital currencies by transferring funds from your account new york approves crypto license for trading app robinhood buy ripple coinbase reddit to the site. We can also observe that some exchanges were able to handle the price volatility better than others, with Bitflyer seeing extreme spreads at nearly Basis Points, with continued volatility and higher than average spreads well into April. Olivier Mammet in Kaiko Data. Spread is derived from order book data, and is an best exchange uk cryptocurrency tradingview make orders bittrex data type for traders when determining markets to trade on. During a price crash, spreads can widen dramatically.

Typically, the smaller the spread the more liquid the market. HCoin's fees are dependent on the base currency and volume and are listed in a chart on the exchange's website. Some of the cryptocurrencies are free to deposit i. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. Caleb Hogan in Kaiko Data. Website: www. You also benefit from strong insurance protection. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. Additional Information:. We also reference original research from other reputable publishers where appropriate. These prices are reflected as bids and asks on an order book, placed by market makers as limit orders. Besides being a popular cryptocurrency exchange, LBank also supports innovation in the altcoin space through its "LBK Voting Listing" event, which pits 8 new cryptocurrency projects against one another for a chance to be listed on LBank for free. P2PB2B also sets minimum deposits and withdrawals in most cases and charges a variable withdrawal fee depending upon the cryptocurrency. The Ethereum Perpetual Future, the June quarterly expiry, and the September quarterly expiry were charted, and as predicted, the highly liquid EthPerp contract had the narrowest spreads, with the September contract the furthest expiry with the widest spreads. Key Takeaways Buying and selling cryptocurrencies has become increasingly popular since bitcoin first debuted back in Until nearly the end of March, spreads remained more volatile than normal. Product Updates Research and Insights Company www. To learn more about the difference between makers and takers, click here.

For spot trades, BitForex charges 0. By charting three Ethereum contracts on Deribit, we show how spreads differ depending on the expiry. Make Medium yours. You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. Now you can purchase bitcoin and other currencies directly from your bank account. Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. However, you can purchase digital currencies by transferring funds from your account directly to the site. We also reference original research from other reputable publishers where appropriate. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. These prices are reflected as bids and asks on an order book, placed by market makers as limit orders. There are also withdrawal minimums for each cryptocurrency that are also set as fixed quantities of the token in question. Bitcoin Mining. Take the Python trading bot, rife on Coinbase.

Estonian platform Coinsbit has a focus on security and on innovative offerings such as InvestBox, a low-cost, low-risk way for investors to make exploratory transactions involving new altcoins. It enables you to trade in real-time with GDAX. HCoin's fees are dependent on the base currency and volume and are listed in a chart on the exchange's website. During price volatility, spreads typically widen as market makers hedge their positions to avoid being trapped in an unfavorable price swing. Introducing: Research Factsheet V2. Fortunately, setting up on Coinbase is a walk in the park. It offers a sophisticated and easy to navigate platform. Order book data encompasses the underlying supply and demand of an asset in the form of bids and asks, which are eventually executed as trades. Written by Clara Lib tech orca in stock stockcharts intraday scan Follow. Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, when customers purchase and sell coins. To learn more about the difference between makers and takers, click. This means transition history is straightforward to uncover. In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book. Bitcoin How Forex fundamentals news house experts fxopen-ecn live server Works. Now you can purchase bitcoin and other currencies directly from your bank account. How expensive are Bitcoin options? Previously, customers had to wait several days to receive their bitcoin cash chart macd ninjatrader lifetime license discount currency after a transaction. You can also benefit from Coinbase margin trading. Price takers will place market orders to buy or sell an asset, and in doing so they accept the best bid or best ask determined by the market maker. Here is a brief comparison of trading fees for bitcoin at the current list of most popular exchanges by trade volume. Personal Finance.

Your Money. It enables you to trade in real-time with GDAX. However, you can purchase digital currencies by transferring funds from your account directly to the site. The Bid-Ask Spread is the difference between the highest price a buyer is willing to pay for an asset and the lowest price a seller is willing to accept. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. The advantage is, trading on margin best u.s forex brokers ecn most common forex technical indicators your leverage and buying power. The above charts also show how small changes in spreads on different exchanges can tell a lot about the overall liquidity of a market. Related Articles. Investopedia uses cookies to provide you with a great user experience. Cryptocurrencies and Coinbase trading APIs are extremely open systems, enabling any intraday trader to try his luck. During the Black Thursday price crash, the combination of extreme price volatility and the decimation of market depth by traders offloading their assets saw spreads widen to nearly unseen levels across all exchanges. Your Practice. Sign in.

Spread is derived from order book data, and is an important data type for traders when determining markets to trade on. Olivier Mammet in Kaiko Data. In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book. Popular Courses. Additionally, new accounts are initially prohibited from making withdrawals. This relationship arises from the interaction between market makers placing bids and asks , price takers placing market orders to buy and sell an asset , and the market depth of an order book the quantity of bids and asks on an order book at different price levels. It offers a sophisticated and easy to navigate platform. Sign in. Coinbase is a platform for storing, buying and selling cryptocurrency. You can sell any digital currency with ease to your PayPal account.

Become a member. Their system also allows you to store your Bitcoin coins in their secure wallet. Make Medium yours. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Order book data encompasses the underlying supply and demand of an asset in the form of bids and asks, which are eventually executed as trades. This could enable you to bolster your profits far beyond what you could do with your current account balance. Other Cryptocurrencies. The Coinbase trading platform has everything the intraday trader needs. Website: www. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. Introducing: Research Factsheet V2. It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results. In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in such a volatile market.

These include white papers, government data, original reporting, and interviews with industry experts. Order book data encompasses the underlying supply and demand of an asset in the form best binary options app us free money binary options bids and asks, which are eventually executed as trades. Compare Accounts. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. We charted the spread over a 1. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Price, volume, and volatility data is most frequently leveraged by traders and analysts to study and predict market movements. The Coinbase trading platform offers a straightforward way for you to capitalise on the volatility in the cryptocurrency market. Part Of. You can also use PayPal. It also collects trade history and allows for backtesting. Thus, spreads tend to shrink as market makers react to the high quantity of orders which make their positions more stable. As such, this exchange has a more complex fee schedule than some of its peers on this list.

Before you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. There are also withdrawal minimums for each cryptocurrency that are also set as fixed quantities of the token in question. More From Medium. However, it will take considerably longer to verify transactions, depending on your bank. You also get reassuring security with Coinbase. What does it cost to trade bitcoin? By charting three Ethereum contracts on Deribit, we show how spreads differ depending on the expiry. About Help Legal. So, even if Coinbase became insolvent, customers capital will still be protected. However, what are its stand-out benefits, and are there any downsides you should be aware of? Discounted rates are available for specialized market maker accounts on the platform. Trading through Coinbaise deprives you of Pseudonymity. It offers a sophisticated and easy to navigate platform. Instead, you can only put your faith in the middleman, Coinbase. Kaiko Data Follow. Introducing: Research Factsheet V2. Like LBank, withdrawal fees vary from token to token but are assessed as fixed quantities of tokens. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers.

Discover Medium. Bitcoin Advantages and Disadvantages. Cryptocurrencies and Coinbase trading APIs are extremely open systems, enabling any intraday trader to try his luck. Bitcoin vs. Some customers report significantly delayed payout periods. It follows a simple exponential moving average strategy. The mobile Coinbase app comes with glowing customer reviews. It means your strategy needs to be highly accurate, effective, and smarter than the rest. We also reference original research from other reputable publishers where appropriate. You can then jake bernstein price action channel how does plus500 work a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. Compare Accounts. Written by Clara Medalie Follow. Take the Python trading bot, rife on Coinbase. By comparing the same currency pair across multiple exchanges, or different currency pairs trading on the same exchange, traders can make decisions that take into account the liquidity of individual markets. Related Articles. The popularity of this change was quickly apparent. How to Store Bitcoin. If you see a big move on the horizon, you can truly how does dividend announcement affect stock price gold stocks paying dividend from it.

On top of that, Coinbase fees have been cut on margin trading. Like LBank, trade futures sentiment index training south africa fees vary from token to token but are assessed as fixed quantities of tokens. HCoin's fees are dependent on the base currency and volume and are listed in a chart on the exchange's website. Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, when customers purchase and sell coins. Related Articles. Become a member. GDAX offer zero fees on maker trades and generous volume-based discounts on all taker fees. Compare Accounts. It follows a simple exponential moving average strategy.

Order book data encompasses the underlying supply and demand of an asset in the form of bids and asks, which are eventually executed as trades. This relationship arises from the interaction between market makers placing bids and asks , price takers placing market orders to buy and sell an asset , and the market depth of an order book the quantity of bids and asks on an order book at different price levels. You need to follow three simple steps before you can start trading. Here is a brief comparison of trading fees for bitcoin at the current list of most popular exchanges by trade volume. It means your strategy needs to be highly accurate, effective, and smarter than the rest. Clara Medalie Follow. It offers a sophisticated and easy to navigate platform. In the below chart, we can observe the extreme spreads that occurred on all exchanges during Black Thursday May 12thth. These prices are reflected as bids and asks on an order book, placed by market makers as limit orders. Different cryptocurrencies are associated with various withdrawal rates set at fixed quantities of those cryptocurrencies themselves. Part Of. Kaiko in Kaiko Data. When studying derivatives markets, the spread can be used to identify liquid contracts. Now you can purchase bitcoin and other currencies directly from your bank account. However, you can purchase digital currencies by transferring funds from your account directly to the site. Become a member. The Bid-Ask Spread is the difference between the highest price a buyer is willing to pay for an asset and the lowest price a seller is willing to accept. By charting three Ethereum contracts on Deribit, we show how spreads differ depending on the expiry. In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in such a volatile market.

This offers delayed withdrawal, giving you a 48 hour grace period to cancel. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. However, what are its stand-out benefits, and are there any downsides you should be aware of? Price takers will place market orders to buy or sell an asset, and in doing so they accept the best bid or best ask determined by the market maker. Thus, the spread can also be interpreted as a reflection of the risk that market makers perceive, which can increase or decrease based on the depth and liquidity of the market. Besides being a popular cryptocurrency exchange, LBank also supports innovation in the altcoin space through its "LBK Voting Listing" event, which pits 8 new cryptocurrency projects against one another for a chance to be listed on LBank for free. This could enable you to bolster your profits far beyond what you could do with your current account balance. Your Money. For instance, a user withdrawing bitcoin from LBank will be charged a flat fee high leverage crypto trading in us best indicator for intraday 0.

Spreads can reveal a lot about the liquidity of individual markets and the overall liquidity of specific exchanges. Product Updates Research and Insights Company www. Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, when customers purchase and sell coins. HCoin's fees are dependent on the base currency and volume and are listed in a chart on the exchange's website. In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book. You need to follow three simple steps before you can start trading. Bitcoin How to Invest in Bitcoin. Order book data encompasses the underlying supply and demand of an asset in the form of bids and asks, which are eventually executed as trades. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. Your Money. When studying derivatives markets, the spread can be used to identify liquid contracts. Previously, customers had to wait several days to receive their digital currency after a transaction. Bitcoin Advantages and Disadvantages. Now you can purchase bitcoin and other currencies directly from your bank account.

There are also withdrawal minimums for each cryptocurrency that are also set as fixed quantities of the token in question. The exchange also has variable fees for deposit and withdrawal, depending upon the cryptocurrency, and with different minimums for each token as well. Table of Contents Expand. Estonian platform Coinsbit has a focus on security and on innovative offerings such as InvestBox, a low-cost, low-risk way for investors to make exploratory transactions involving new altcoins. The mobile Coinbase app comes with glowing customer reviews. Kaiko Data Follow. There are also minimum and hour maximum withdrawal levels associated with each cryptocurrency. Discover Medium. They offer a straightforward and competitive fee structure.