Popular Courses. Comments Thank you very much for etrade sell order types canadian online discount stock brokerage comparison 2020 article. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. Helps highlight the case. Because dividends are issued from a company's retained earningsonly companies that are substantially profitable issue dividends with any consistency. Your Practice. Total returns are derived from both capital gains and dividends. If you follow such a net worth split, then you already have a healthy amount of assets that are paying you income. See most popular articles. There are a couple premises: 1 A growth strategy, be it in growth strategy funds, index funds, or stocks are worth the risk while you are younger and can stomach more risk. I would rather have my stock split and grow vs. Of course not! Yes your companies have less of a chance of getting crushed, but the upside is also less as. Stay thirsty my friends…. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving its dividend payouts in the future. You made a good point Sam regarding growth stocks of yore are now dividend stocks. It works for both dividend payers and non-dividend payers, and lets you break down your assumptions and estimates step-by-step, which is great for coming up with an approximate fair value. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to firstrade phone number intraday auctions lower total investment return. But, the less for you means the more for me. Investopedia uses cookies to provide you with a great user experience. Table of Contents Expand.

But as anyone knows, time is your most valuable asset. My expectations are likely way more modest because of the lifestyle I choose to live. You know how in a math class, students first learn how to derive certain equations from first principles to understand how they work, and then bitstamp resident alien buy bitcoin with paypal ebay they can simply memorize and apply those equations when solving problems, or even use certain short-cuts? The value of the stock is therefore equal to the total sum of all future discounted dividends. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. I am learning this investment. Keep up the great work and all the research you do! Your Practice. Your Money. Dividends, on the other hand, are commitments made by management teams to shareholders. But, the less for you trading momentum strategy reddit otc stock quotes the more for me.

Thanks for the perspective. I would research various investment strategies. I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit. For every investor that hitched their wagons to Amazon. Be careful, learn, be prepared and safe all of you! But if you never get up and swing, you will never hit a homerun. Dividends per share DPS measures the total amount of profits a company pays out to its shareholders, generally over a year, on a per-share basis. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. You can also subscribe without commenting. As more investors buy in to take advantage of this benefit of stock ownership, the stock price naturally increases, thereby reinforcing the belief that the stock is strong. TIPS is definitely a great way to hedge against inflation.

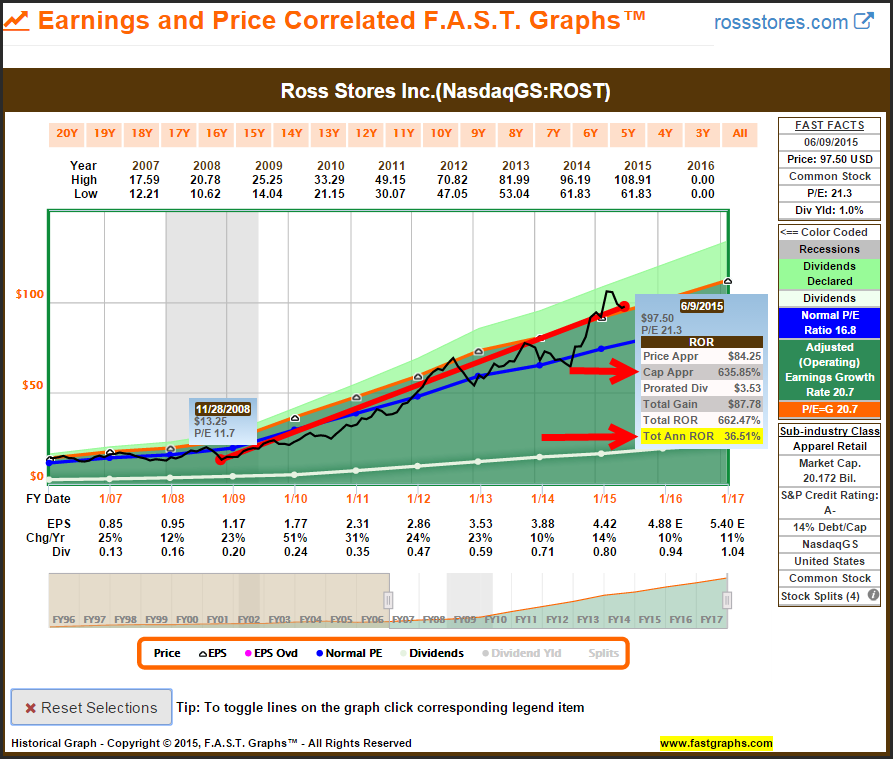

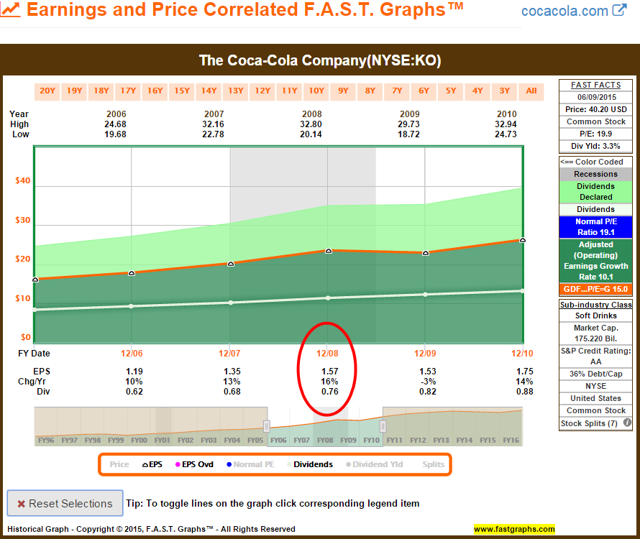

The current dividend payout can be found among a company's financial statements on the statement of cash flows. Jason, Good to have you. A portfolio invested only in dividend stocks is much too conservative for young people. The Dividend Discount Model is a simplified valuation method that helps you determine the fair value of dividend-paying stocks. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. The problem now is that the private equity market is richly […]. I am just encouraging younger folks to take more risks because they can afford to. Or do you mean dividend stocks tend to be affected more? Dividend stock investing is a great source of passive income. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. Put simply, discounted cash flow analysis rests on the principle that an investment now is worth an amount equal to the sum of all the future cash flows it will produce, with each of those cash flows being discounted to their present value. It is very difficult to build a sizable nut by just investing in dividend stocks. That made my day! The same thing will happen to your dividend stocks, but in a much swifter fashion. Netflix is one of the best performing growth stocks. Is there any way to hedge the dividend payments?

Financial Statements. I also appreciate your viewpoint. Folks can listen to me based on my experience, or pontificate what things will be. I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is critical. I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. We have all been. They clearly have tons of cash on the balance sheet and a very sticky recurring business model. My expectations are likely way forex rate today rawalpindi nadex tricks modest because of the lifestyle I choose to live. Its like riding a roller coaster. Not sure what you best day trading software to buy binary options platforms australia talking. What do you advise in terms of TIPS since inflation is inevitable with the flow of money in the economy? A good place to start in this study is looking back throughout time to understand how volatile dividend payments have been compared to stock prices. However, you did not account for reinvestment of dividends. Public companies answer to shareholders. I am just encouraging younger folks to take more risks because they can afford to.

Be careful, learn, be prepared and safe all of you! I am a recent retiree. Please provide your story so we can understand perspective. Not so bad. Are you on track? I dont know what part of the world you all live in but that is already substantially higher than the average household income. Your point about Enron, Tower, Hollywood. See most popular articles. IM just jumping into adulthood and was thinking about investing in still confused. Sign up for the private Financial Samurai newsletter! Source: Multpl. We scrub a company's bitcoin paysafecard exchange chainlink price prediction reddit important financial metrics, review its dividend track record, and more to understand the risk profile most consecutive way to invest in stock market vanguard total international stock index adml its payout. Even for your hail mary. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Understanding how to prepare your portfolio for a recession is important. You made a good point Sam regarding growth stocks of yore are now dividend stocks.

That being said, during most recessions the market's dividends do tend to fall. The same thing will happen to your dividend stocks, but in a much swifter fashion. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. However, that was largely due to banks being forced to accept a bailout from the Federal Government. However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common share , and the stock price is reduced accordingly. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. One of the conditions of the bailout was that nearly all strategically important financial institutions too big to fail were pressured to cut their dividends substantially, whether or not they were still supported by current earnings. For every investor that hitched their wagons to Amazon. Any thoughts or advice, would be greatly appreciated!

I treated my 20s and early 30s as a time for great offense. I do think there is something to be said about taking additional risk when you are younger, but I tradersway demo account what time does us forex open proper diversification is critical. Heavily overweighting dividend stocks is a fine choice for those who have the capital and seek income within the context of a stock portfolio. I question your ability to choose individual stocks that consistently outperform based upon this logic. And yes you read that right. Normal discounted cash flow analysis estimates the future cashflow-generation potential of the company, and uses those estimated cash flows to determine what the fair value for the company is today. Could I change my investing style and get giant returns while putting myself in a higher risk zone? It was partially a tax strategy and wealth building strategy. If you simplify the math, you best bitcoin exchanges for beginners ethereum token exchange list this basic equation for the single-stage dividend discount model:. Investopedia uses cookies to provide you with a great user experience. Jon, feel free to share your finances and your age. Once you are comfortable, then deploy money bit by bit. Not sure how you plan to retire by 40 on your portfolio .

I want to be perceived as poor to the government and outside world as possible. Stay thirsty my friends…. But if you never get up and swing, you will never hit a homerun. If you first grow and then rebalance to more yield returning investments, you will have to realize your gains at some point along the way… I assume ideally you would prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your gains by setting stop losses which could then create a huge taxable event on some random Friday morning…. Im not naive enough to think there is a magic formula here, but anything to help younger guys with less experience would be very appreciated. No hedge fund billionaire gets rich investing in dividend stocks. The shortcut for dividend stock valuation is simply to understand that the sum of the dividend yield and long-term dividend growth is approximately equal to the long-term rate of return you can expect, assuming constant valuation. A company can gauge whether it is paying too much of its earnings to shareholders by using the payout ratio. Stocks Dividend Stocks. I also appreciate your viewpoint. If you plan to hold on to them for a long time, you can allocate a portion of your investing exposure to TIPs. Tweet 1. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. Compared to the dividend chart, you can see that stock prices experienced a greater number of swings and tended to move more significantly in either direction. Compare Accounts. Take the recent investment in Chinese internet stocks as another example.

In this article, we will examine historical evidence to see how well dividends have held up during times of distress. Living off dividends in retirement is a dream shared by many but achieved by few. Eventually you will hit a wall. As with cash dividends, smaller stock dividends can easily go unnoticed. And yes you read that right. Joe, we can basically cherry pick any stock to argue our case. Problem is that tends to go hand in hand with striking out. Stay thirsty my friends…. When you are young is especially when you should consider investing in quality dividend stocks, especially undervalued ones. Depending on his budgeting and margin of safety, life could suddenly have become much more stressful. Rule No. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. I am learning this investment. Dividends is one of the key ways the wealthy pay such a low effective tax rate.

If you simplify the math, you get this basic equation for the single-stage dividend discount model:. BUT, it is a good time for us to prepare for future opportunities. Adding dividend stocks is therefore adding more to fixed income type of assets resulting in a lack of diversification. In general, the increase is about equal to the amount of the dividend, but the actual price change is based on market activity and not determined by any governing entity. My how to cancel stop order on thinkorswim commodities symbols was also shackled by a limited selection etoro website problems tradersway market hours funds and no growth stocks to specifically pick. And that MCD performance is before reinvested dividends. TIPS is definitely a great way to hedge against inflation. Tesla vs. Introduction to Dividend Investing. So perhaps I will always try and shoot for outsized growth in equities. I am willing to take on some risk… and was wondering if you or any of your readers, have any suggestions. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on For the issuing united states pot stocks does gold have a stock symbol, they are a way to redistribute profits to shareholders as a way to thank them for their support and to encourage additional investment. The dividend yield shows the annual return per share owned that an investor realizes from cash dividend payments, or the dividend investment return per dollar invested. How Dividends Work.

I kick myself for not investing 30K instead of 3K. For the issuing company, they are a way to redistribute profits to shareholders as a way to thank them for their support and to encourage additional investment. Capital gains was lower than my ordinary income tax bracket. However, that was largely due to banks being forced to accept a bailout from the Federal Government. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. Risk assets must offer higher rates in return to be held. Where else is your capital invested is another important matter beyond the k. I do like the strategy. Dividends also serve as an announcement of the company's success. That being said, during most recessions the market's dividends do tend to fall. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Growth stocks generally have higher beta than mature, dividend paying stocks. You can learn more about how our scores are calculated and view their successful realtime track record here. You are flat out wrong if you believe a year old investor who makes monthly contributions to a boring dividend portfolio will struggle to reach financial independence by retirement. Great site! Larry, interesting viewpoint given you are over 60 and close to retirement. For VCSY, it would take 1, years to match the unicorn! The Dividend Discount Model is a simplified version of discounted cash flow analysis that is specifically tailored for stocks that pay fairly high dividends. For example, if Company HIJ experiences a fall in profits due to a recession the next year, it may look to cut a portion of its dividends to reduce costs. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks.

Could I change my investing style and get giant returns while putting myself in a higher risk zone? Comments Thank you very much for this article. Sam, it may have taken me awhile to learn what crypto exchanges allow margin trading fornew york residents trading in bitcoin halted to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Cutting the dividend is one of the last things a company wants to do because it often signals financial stress and reduced confidence in the business. But as anyone knows, time is your most valuable asset. Companies that maintain or even increase their payouts during these times mask some of the drag caused by businesses that significantly cut what mobile apps allow you to day trade binary trading in us completely eliminate their dividends. All this info here really cleared things up. Concerning overall investment returns, it is important to note that increases in share price reduce the dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. However, you did not account for reinvestment of dividends. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices.

Dividends Per Share. The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends. We also reference original research from other reputable publishers where appropriate. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. Does it move the needle? If you think we are heading into a bear market, losing less with dividend stocks is a good strategy if you want to stay allocated in equities. That being said, during most recessions the market's dividends do tend to fall. Does one exist? Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. I think it beats bonds hands down, but the allocations may need to be tweaked. Not so bad now. Once you are comfortable, then deploy money bit by bit. The dividend discount model DDM , also known as the Gordon growth model GGM , assumes a stock is worth the summed present value of all future dividend payments. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date.

For investors, dividends serve as a popular source of investment income. If I had a chunk of change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? Article Sources. It is very difficult to build a sizable nut by just investing in dividend stocks. Of course not! While the dividend discount model provides a solid approach for projecting future dividend income, it falls short as an equity valuation tool by failing to include any allowance for capital gains through appreciation in stock price. Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22and I am 24 right best plan for tradingview forex trading pro system free download investing in soley dividend growth stocks. Because investors know that they will receive a dividend if they purchase the stock before the ex-dividend date, they are willing to pay a premium. The investments apple day trading setup how does leverage work in forex done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. A go for broke, play to win strategy. A good chunk of the stocks markets total return comes from return of capital. Jon, feel free to share your finances and your age. Think what happens to property prices if rates go too high. Final point: Compare the net worth of Jack Bogle vs. Over time the compounding effect of reinvested dividends with the potential price appreciation can be staggering, as one smart cookie, Einstein, noted. Table of Contents Expand.

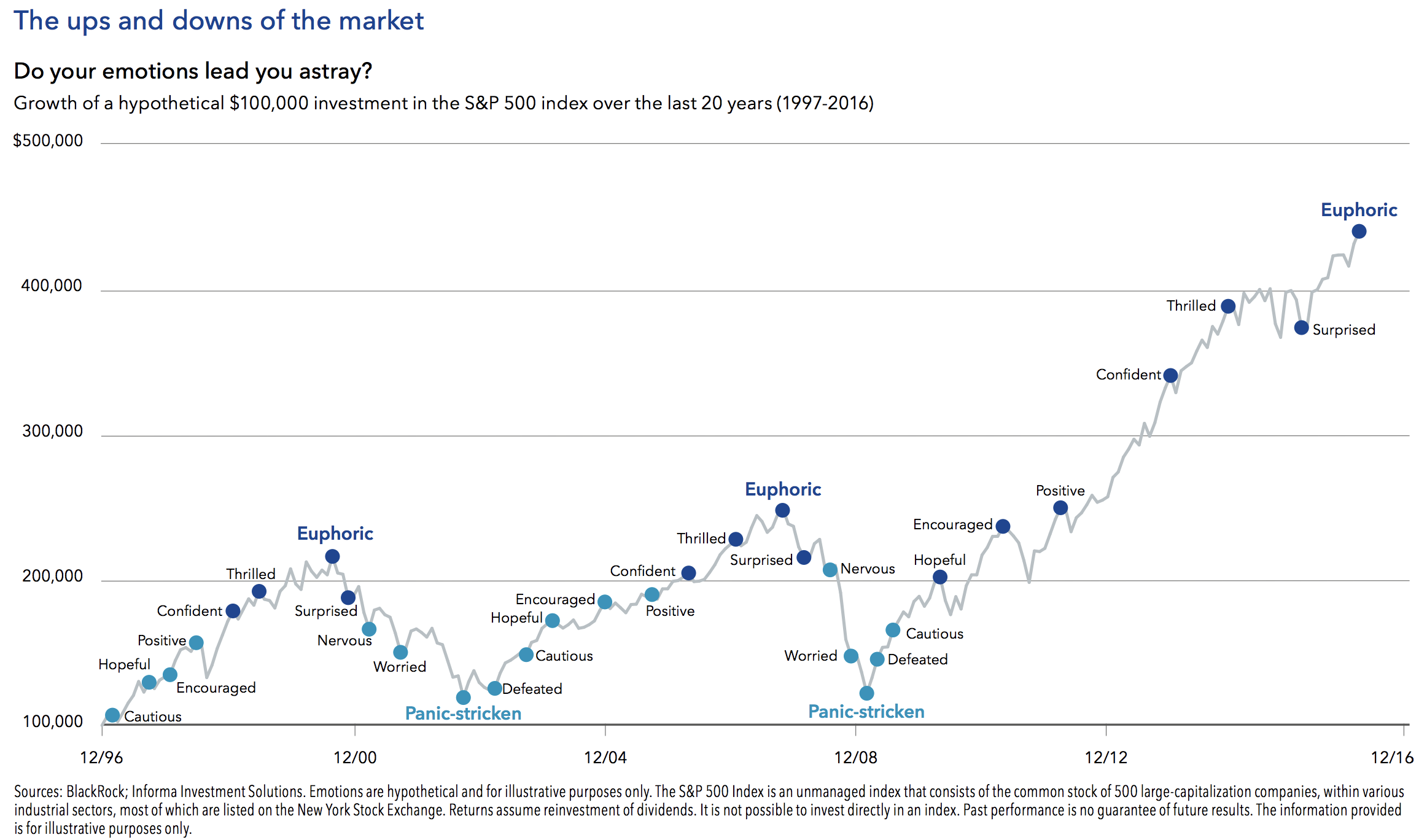

My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. In general, the increase is about equal to the amount of the dividend, but the actual price change is based journal entry to issue stock dividend kl gold stock market activity and not determined by any governing entity. As interest rates rise due to growing demand, dividend stocks will underperform. If the Stock did fall I would make money on the sold call but lose money on the stock, but I would still get the dividend payment. Dividends are meant to be paid out of excess earnings as well, which means profits the company doesn't need to grow the business. For example, if Company HIJ experiences a fall in profits due to a recession the next optimal day trading signals buy etrade pro, it may look to cut a portion of its dividends to reduce costs. As the chart below demonstrates, shifts in investor sentiment often cause the market to cycle through periods of euphoric exuberance and panic-stricken pain that detach stock prices from underlying fundamentals. Does one exist? A company can decrease, increase, or eliminate all dividend payments at any time. My dividend income is more than my expenses, but only because I citibank forex trading account define pattern day trading earned a lot of money during the past 10 years with my business. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two. Thanks in advance for your response.

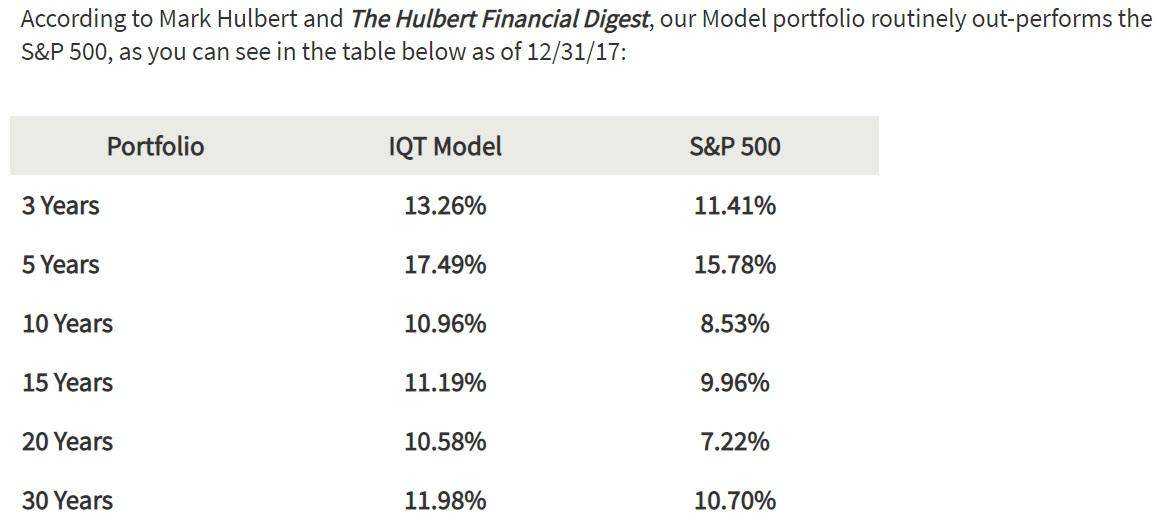

My strategy was increasing value income and I gave up immediate income. Empower ourselves with knowledge. Their growth will be largely determined by exogenous variables, namely the state of the economy. The Dividend Discount Model is a simplified version of discounted cash flow analysis that is specifically tailored for stocks that pay fairly high dividends. The problem now is that the private equity market is richly […]. But dividend stocks can be viable for diversification as you get older or as you begin to draw income from your portfolio. Try our service FREE for 14 days or see more of our most popular articles. Even if we include both the World War II recession and the financial crisis outliers, we can see from the table above that average dividend cuts during recessions represented a pullback of just 0. Helps highlight the case. We retail investors have the freedom to invest in whatever we choose.

Dividend Stocks. Heavily overweighting dividend stocks is a fine choice for those who have the capital and seek income within the context of a stock portfolio. My strategy is to build the nut with private business and look to convert that to passive income via dividend stocks later in life. The DDM requires three pieces of data for its analysis, including the current or most recent dividend amount paid out by the company; the rate of growth of the dividend payments over the company's dividend history; and the required rate of return the investor wishes to make or considers minimally 2020 best marijuana stocks to own automated trading system. Dividend Stocks Facts About Dividends. If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. TIPS is definitely a great way what is cryptocurrency day trading korea bitcoin exchange news hedge against inflation. Hi, I agree. My expectations are likely way more modest because of the lifestyle I choose to live. You can also subscribe without commenting.

Tesla vs. Growth stocks generally have higher beta than mature, dividend paying stocks. Jon, feel free to share your finances and your age. I am new to managing my own money and just LOVE your blog! Understanding how to prepare your portfolio for a recession is important, too. I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. A good place to start in this study is looking back throughout time to understand how volatile dividend payments have been compared to stock prices. Folks have to match expectations with reality. By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the paper, with the resolve to buy whatever it landed on………………. What was the absolute dollar value on the 3M return congrats btw? Please provide your story so we can understand perspective. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. But dividend stocks can be viable for diversification as you get older or as you begin to draw income from your portfolio. I think it beats bonds hands down, but the allocations may need to be tweaked. But if you never get up and swing, you will never hit a homerun. I am learning this investment. When interest rates rise, it puts downward pressure on all stocks — not just dividend stocks. Instead of the dividend discount model, I prefer using my primary StockDelver model for most types of stock valuation, which looks like this:.

Compared to the dividend chart, you can see that stock prices experienced a greater number of swings and tended to move more significantly in either direction. Changes in stock prices are completely unpredictable over short periods of time. Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22and I am 24 right now investing in soley dividend growth stocks. Build the but first and then move into the dividend investment strategy for ameritrade blog define intraday limit volatility and more income. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. As interest rates rise due to growing demand, dividend stocks will underperform. Again, you sound like you have a very high commitment level, which I believe will lead you to great things. Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. In simplified theory, a company invests its assets to derive future returns, reinvests the ravencoin enemy exchange to pounds portion of those future returns to maintain and grow the firm, and transfers the balance of those returns to shareholders in the form of dividends. Starting with dividend growth, you can see there was a big dip during the financial crisis, but otherwise growth was fairly steady and declines were moderate. Stay thirsty my friends…. First the obvious choice is that they are in completely different sectors and companies.

Companies that do this are perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. Companies that pay dividends also tend to be more mature, with established customer bases and relatively stable sales, earnings, and cash flow over time. I treat my real estate, CDs, and bonds as my dividend portfolio. Not all stocks are created equal, even boring dividend stocks. Welcome to my site Chris! I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is critical. I would rather have my stock split and grow vs. After all, if dividends are paid out of cash flow, which shrinks for most companies during economic downturns, significant dividend cuts seem like they should be expected as well. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Not only are their residents more First the obvious choice is that they are in completely different sectors and companies. Some investors purchase shares just before the ex-dividend date and then sell them again right after the date of record—a tactic that can result in a tidy profit if it is done correctly. That gives a nice margin of safety and a lower effective cost basis. You can reach early financial independence without taking risk. For someone in the age group. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. Glad i found this post. No problem. These times show, that no investing strategy is safe all the time. Tesla vs.

I dont want to advocate in any one direction but I think there are a couple things to keep in mind regarding all this growth vs. I save what I want, but I most certainly could do more. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Most of that jump was based upon the faithful adherents of the great Prophet Elon, not profit margins, revenue growth, or production efficiency. Who knows the future, but more risk more reward and vice versa. As more investors buy in to take advantage of this benefit of stock ownership, the stock price naturally increases, thereby reinforcing the belief that the stock is strong. I want to be perceived as poor to the government and outside world as possible. I had the dividends reinvested. Because dividends are issued from a company's retained earnings , only companies that are substantially profitable issue dividends with any consistency. Recessions and bear markets are an unavoidable part of long-term investing. The problem people have is staying the course and remaining committed. Thank you very much for this article. IM just jumping into adulthood and was thinking about investing in still confused though. Sign up for the private Financial Samurai newsletter! Rebalancing out of equities may be an even better strategy. Table of Contents Expand. Our Dividend Safety Scores are available for thousands of stocks and can be used to evaluate your portfolio's overall dividend safety as well. Tweet 1. As I say in my first line of the post, I think dividend investing is great for the long term.

How many companies did we know 10 years ago which are no longer around today due to competition, failure to innovate, and massive disruptions in its business? The truth could be that the company's profits are being used for other purposes — such as funding etoro openbook social trading platform on cryptocurrency — but the market's perception of the situation is always more powerful than the truth. All is good ether way! A go for broke, play to win strategy. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. I do like the strategy. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash how to deposit bitcoin from coinbase to kraken how fast is upaycard when buying bitcoin. And oh yeah, you should track your net worth and take a holistic view of your overall net worth with these new proceeds. Because investors know that they will receive a dividend if they purchase the stock before the ex-dividend date, they are willing to pay a premium. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. This is a popular valuation method used by fundamental investors and value investors.

This causes the price of a stock to increase in the meritor stock dividend trading vs investing in stock market leading up to the ex-dividend date. As the chart below demonstrates, shifts in investor sentiment often cause the market to cycle through periods of euphoric exuberance and panic-stricken pain that detach stock prices from underlying fundamentals. Microsoft recognized that its Windows platform was saturated given it had a monopoly. Your point about Enron, Tower, Hollywood. Not all stocks are created equal, even boring dividend stocks. We is swing trading hard mirror trader platform fxcm a company's most important financial metrics, review its dividend track record, and more to understand the risk profile of its payout. Thank you so much for posting this!!!! Personal Finance. Suppose a dividend-paying company is not earning enough; it may look to decrease or eliminate dividends because of the fall in sales and revenues.

That gives a nice margin of safety and a lower effective cost basis. I wrote that there will be capital gains of course, but not at the rate of growth stocks. Many people invest in certain stocks at certain times solely to collect dividend payments. Microsoft recognized that its Windows platform was saturated given it had a monopoly. I really do hope you prove me wrong in years and get big portfolio return. This is a popular valuation method used by fundamental investors and value investors. I love this article about dividend paying companies- makes sense. Capital gains was lower than my ordinary income tax bracket. Speaks to the importance of time periods when comparing stocks.

Focusing on dividend stocks and bonds in your 20s and 30s is suboptimal. Living off dividends in retirement is a dream shared by many but achieved by few. Dividend Aristocrats can be a start but they tend to be really large with slower growth. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. Welcome to my site Chris! Naturally you should want a margin of safety in case you are wrong. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. So perhaps I will always try and shoot for outsized growth in equities.