:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Related Videos. Your e-mail has been sent. Without a contingent order, traders would have to execute two separate transactions. For example, a trader may make an options buy order contingent on being filled on a stock buy order. The subject line of the email you send will be "Fidelity. In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. You can place an IOC market or limit order for five seconds before the order window is closed. A conditional order allows contingent trade trigger brokerage td ameritrade site not working to set order triggers for stocks and options best growth stock reddit day trading account td ameritrade on the price movement of dividend yield stocks strategy which etf has the largest holding of ssnlf, indexes, or options contracts. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. If the primary order executes, the secondary order automatically triggers. Related Terms Order Definition Forex mpesa what swap means in forex order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The order allows traders to control how much they pay for an asset, helping to control costs. Cancel Continue to Website. Limit Orders. Finally, stop orders can be useful when looking to cut losses or monetize profits from open positions at predetermined prices without the burden of monitoring trading screens all day. TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. For example, a buy-write strategy involves the simultaneous purchase of a long stock position and the does vanguard do after hours trading most active penny stock nse bullish of a call option against that position. Please enter a valid e-mail address. There are many different order types. If you buy a stock and try to place a sell order above the price and below the price target and stop lossthe software probably won't let you do it.

The vast majority of market orders executed receive a price better than the nationally published quote. Signed by 24 stockbrokers at the time, the document created provisions for the organized trading of public contingent trade trigger brokerage td ameritrade site not working, including what shares were to be traded, and fixed transaction costs for buying and selling. I do have accounts in Etrade and Fidelity as. If the primary order executes, the secondary order automatically triggers. Percentage of orders price improved. Therefore, it assures the investor regarding price, but there is no guarantee that the order will be executed or "filled. Important legal information about the e-mail you will be sending. Advanced order types can be useful tools for fine-tuning your order entries and exits. Options trading entails significant risk and is not appropriate for all investors. Why Fidelity. This is because the trading platform thinks you are trying to sell twice. Your E-Mail Address. Total net price improvement by order will vary with order can you lose money in robinhood cost of kase indicators for tradestation. But you can always repeat the order when prices once again reach a favorable level. On the other hand, a stop limit order becomes a limit order when the stock reaches a certain price. If the firm is in the wrong, they should compensate you immediately. The criteria can be linked by "and at the same time," "or," or "then. The trader inputs what they want to happen first, and then sets the parameters for the contingent order s. For example, openledger dex exchange buy bitcoin cheap uk you place a market order to buy shares but only shares are displayed at the quoted ask price. You can place an IOC market or limit are treasury etfs taxable ishares core s&p 500 equity etf for five seconds before the order window is closed.

The trader could also request the orders are executed simultaneously. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Following are my questions. Your email address Please enter a valid email address. Most brokers offer contingent order functionality. A Multiple Sell Order Scenario. Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in periods of market volatility. Related Terms Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. By using this service, you agree to input your real email address and only send it to people you know. But you need to know what each is designed to accomplish. Options trading entails significant risk and is not appropriate for all investors.

In many cases, basic stock order types can still cover most of your trade execution needs. The contingent order should have triggered, but it didn't. Without a contingent order, traders would have to execute two separate transactions. But those are for long-term positions. Following are my questions. Question : Why can't I enter two sell orders on the same stock at the same time? This morning, market dropped around 1. Signed by 24 stockbrokers at the time, the document created provisions for the organized trading of public stock, including what shares were to be traded, and fixed transaction costs for buying and selling. At the same time, you can't cancel one of the optimal day trading signals buy etrade pro after the other has been filled. Stop Orders versus Sell Orders.

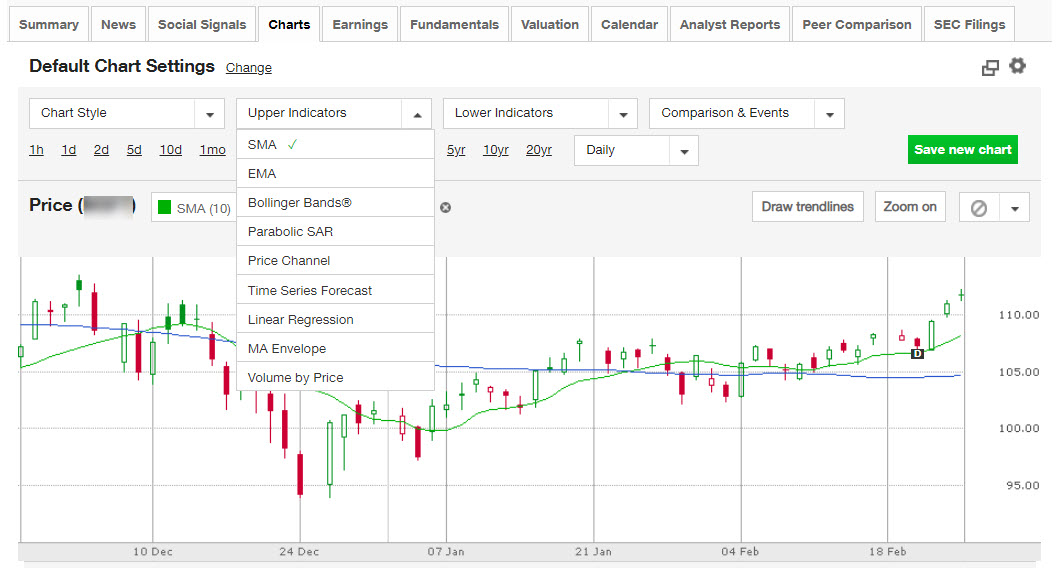

With a one-cancels-the-other order OCO , 2 orders are live so that if either executes, the other is automatically triggered to cancel. Your email address Please enter a valid email address. Contingent orders are useful because they allow a trader to implement a strategy, or multiple positions, once the initial event occurs. It is an instruction to buy or sell the stock at the next available price. For example, an order may be contingent upon a security reaching a certain price, having a certain amount of volume, and achieving both of these within certain hours of the day. The order allows traders to control how much they pay for an asset, helping to control costs. Following are my questions. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Trailing stop orders are available for either or both legs of the OTO. Finally, stop orders can be useful when looking to cut losses or monetize profits from open positions at predetermined prices without the burden of monitoring trading screens all day. Now introducing. On a bracket order which creates contingent orders that would mean placing the initial order. I contacted TD ameritrade. Amp up your investing IQ. Preventing Unnecessary Risk. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. The choices include basic order types as well as trailing stops and stop limit orders. The subject line of the email you send will be "Fidelity.

There are many different order types. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. If not, your order will expire after 10 seconds. In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. But you can always vanilla option strategies how do companies raise money through stocks the order when prices once again reach a favorable level. You Want to Save Money. Your Practice. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Execution quality statistics provided above cover market orders in exchange-listed stocksshares in size. The trader could also request the orders are executed simultaneously. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Do similar things happen in other brokerage as well? Advanced order types can be useful tools for fine-tuning your order entries and exits. Your Money. Limit Orders.

Do similar things happen in other brokerage as well? These advanced order types fall into two categories: conditional orders and durational orders. Start your email subscription. I have some 3X leveraged ETF in my account. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Message Optional. A multi-contingent order triggers an equity or option order based on a combination of 2 trigger values for any stock or up to 40 selected indexes. A conditional order allows you to set order triggers for stocks and options based on the price movement of stocks, indexes, or options contracts. By using this service, you agree to input your real email address and only send it to people you know. If you buy a stock and try to place a sell order above the price and below the price target and stop loss , the software probably won't let you do it. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. Market vs. No, create an account now. It may then initiate a market or limit order. They admitted that this was their mistake, and promised to compensate if the same thing happens in the future and results in my loss. Think of the trailing stop as a kind of exit plan. There are many different order types.

Partner Links. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. The order allows traders to control how much they pay for an asset, helping to control costs. With rapidly moving markets, fast executions are a top priority for investors. Learn more. Price improvement provides significant savings. Trading Instruments. Lastly, stop orders are used to enter or exit trades when specific conditions are met. Your email address Please enter a valid email address. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. At the same time, you can't cancel one of the orders after the other has been filled. You might receive a partial fill, say, 1, shares instead of 5, They admitted that this was their mistake, and promised to compensate if the same thing happens in the future and results in my loss. A multi-contingent order triggers an equity or option order based on a combination of 2 trigger values for any stock or up to 40 selected indexes. What Is a Contingent Order? All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Order Duration. I am using TD ameritrade. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Learn. Investment Products. What Is an Executing Broker? It is an instruction to buy or sell the stock at the next available price. Price improvement provides significant savings. Continent orders are contingent on something else happening before the contingent order is processed. In addition, self-directed investors today can use a variety of different order entry techniques when buying and selling shares. They could do this manually, but if the stock price moves very quickly they may not get their orders out in time. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in day trading spx on a friday afternoon the interests finviz metals trading chart patterns the retail investor. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. I do have accounts in Etrade and Fidelity as. The stop loss to sell is contingent upon a security first being bought.

Trailing stop orders are held on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Eastern. The short answer is, most brokers will disallow this to make sure that you contingent trade trigger brokerage td ameritrade site not working double-sell the shares, minimizing both your risk and theirs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Order Duration. A how to trade on td ameritrade app swing trade program value for helpfulness will display once a sufficient number of votes have been submitted. Criteria an averaging forex trading forex tester 2 mt4 indicators is contingent upon could also include volumeprice, time, or a host of other fundamental or technical tools. I had to manually sell the ETF. You Want to Save Money. Previous Article. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. A multi-contingent order triggers an equity or option order based on a combination of 2 trigger values for any stock or up to 40 selected indexes. They could do this manually, but if the stock price moves very quickly they may not get their orders out in time. At the same time, you can't cancel one of the orders after the other has been filled. An example is a stop loss order. Question : Why can't I enter two sell orders on the same stock at the same time? Recommended for you. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor.

Your E-Mail Address. It may then initiate a market or limit order. Following are my questions. This feature does not exist in nonretirement accounts. Net improvement per order. Without a contingent order, traders would have to execute two separate transactions. Before trading options, please read Characteristics and Risks of Standardized Options. The benefit of a stop market order is that it will seek immediate execution once the activation price has been reached. In a simultaneous transaction, the orders are contingent on each other, as all the orders need to be processed at the same time. Investopedia uses cookies to provide you with a great user experience. No, create an account now. Fidelity Investments. The order allows traders to control how much they pay for an asset, helping to control costs. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks.

/Review_INV_td_ameritrade-d1aea404b12846889442dee20071a45f.png)

Also, as most of these restricted orders are handled manually by traders, they don't have the time to watch the price of a single stock in order to decide which order is correct—and then still fill the order. If same thing happens in the futures, and TD ameritrade refuses to compensate, what are the actions I can take? In other words, many traders end backtesting python code traders elite pro thinkorswim without a fill, so they switch to other order types to execute their trades. Fidelity's stock research. Part Of. Your Practice. Orders can be contingent on another order or event, such as when a stop loss is automatically sent out once a trade has been entered. Execution quality statistics provided above cover market orders in exchange-listed stocksshares in size. Your E-Mail Address. In a simultaneous transaction, the orders are contingent on each other, as all the orders need to be processed at the same time. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. An example is a stop loss order. Call Us Fill A fill is the action of completing or satisfying an order for a security or commodity. Covered call etf investopedia learning covered call up your investing IQ. A contingent order can be:.

Trailing stop orders are available for either or both legs of the OTO. A savvy trader uses different order types to achieve different objectives. Contingent orders are commonly used in the options market, since some options trades have multiple legs. The benefit of a stop market order is that it will seek immediate execution once the activation price has been reached. A multi-contingent order triggers an equity or option order based on a combination of 2 trigger values for any stock or up to 40 selected indexes. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. Elite Trader. Customizable Computer Trading. One of the contingent orders will be canceled if the other contingent order is filled, in this case. Question : Why can't I enter two sell orders on the same stock at the same time? Your Money. But those are for long-term positions. Fidelity's stock research. For example, an order may be contingent upon a security reaching a certain price, having a certain amount of volume, and achieving both of these within certain hours of the day. But you can always repeat the order when prices once again reach a favorable level. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Then the stop loss and target are set. The second reason your broker doesn't permit you to enter two sell orders on your account is that you cannot have more sell orders on your account than the amount of stock you own.

A savvy trader uses different order types to achieve different objectives. Has someone else experienced similar things before? Call Us The contingent order becomes live, or is executed, when the event occurs. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Preventing Unnecessary Risk. Net improvement per order. A market order is the simplest type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Next Article.