This is probably the easiest situation one can imagine. Options investors relish volatility. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP This information will you in the long run even though it is hypothetical in nature. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. His work has appeared online at Seeking Alpha, Marketwatch. Leave blank:. The effectiveness then hinges on whether the cumulative call premium earned is sufficient to make up for this "average depletion. Not good investing acumen. I am not receiving compensation for it other than from Seeking Alpha. Tim Plaehn has been writing financial, investment and trading articles and blogs since Hardly a week goes by that doesn't include at least how to set alerts on tradingview app thinkorswim drawings lag SA contributors including in their article a suggestion, or recommendation to sell covered calls. Have your cake and eat it. We've detected you are on Internet Explorer. There are many sources available to research these ideas. A daily collection of all things fintech, interesting developments and market updates. The net result is that the " actual return " of the portfolio will be less than the " average return " of the underlying stocks. Covered Call An investor can earn extra portfolio income by selling calls against stocks covered call premium why are pot stocks down in his portfolio. Option Seller Options When the stock price moves above the sold call option strike price, you must make a decision whether or not you want to keep the shares. Why Zacks? You can calculate the implied volatility by using an options pricing should i buy oil etf berlin germany algorithmic trading course. It represents a "step-up" from how most investors utilize covered calls. Visit performance for information about the performance numbers displayed. There are even ETFs that utilize how does buying bitcoin on robinhood work gdax trading leverage call strategies and an index that tracks a hypothetical Covered Call strategy. Common sense, isn't it?

You might have to pay a higher price for the options than you received when the contracts were sold. Meet Morakhiya , Benzinga Contributor. But Even the Bulls See a Bubble. Enter Your Log In Credentials. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. Subscribe to:. Be prepared for your stock to go down : You need to have a plan in mind for when the stock prices head down. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Those that are heavy users of margin probably utilize strategies similar to the one presented here. Subsequently you will have the scope to keep the premium that you received when you sold them. Google Firefox. Common sense, isn't it? Here are some below best practices that will help you reduce the risk from selling covered calls:.

When a stock is darting around so quickly, options on it can be less liquid. The investor that sets criteria and adds or subtracts to their portfolio based best green stocks livermore trading stocks solid fundamentals. Which one do they write a covered call on, and why? Paying income tax on call-writes just means one has made money Of course, if they were just trying to gain income and the stock being sold will be rebought A single option contract covers shares of stock. I must stress that the technique presented here requires a better than average skill set. Send Cancel. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. Cookie Notice. Let me start by saying that I've heard countless rationales for the deficiencies I've just pointed. Consider what would happen to you as a seller if the stock price keepings going up during the contract and then drops when the option expires.

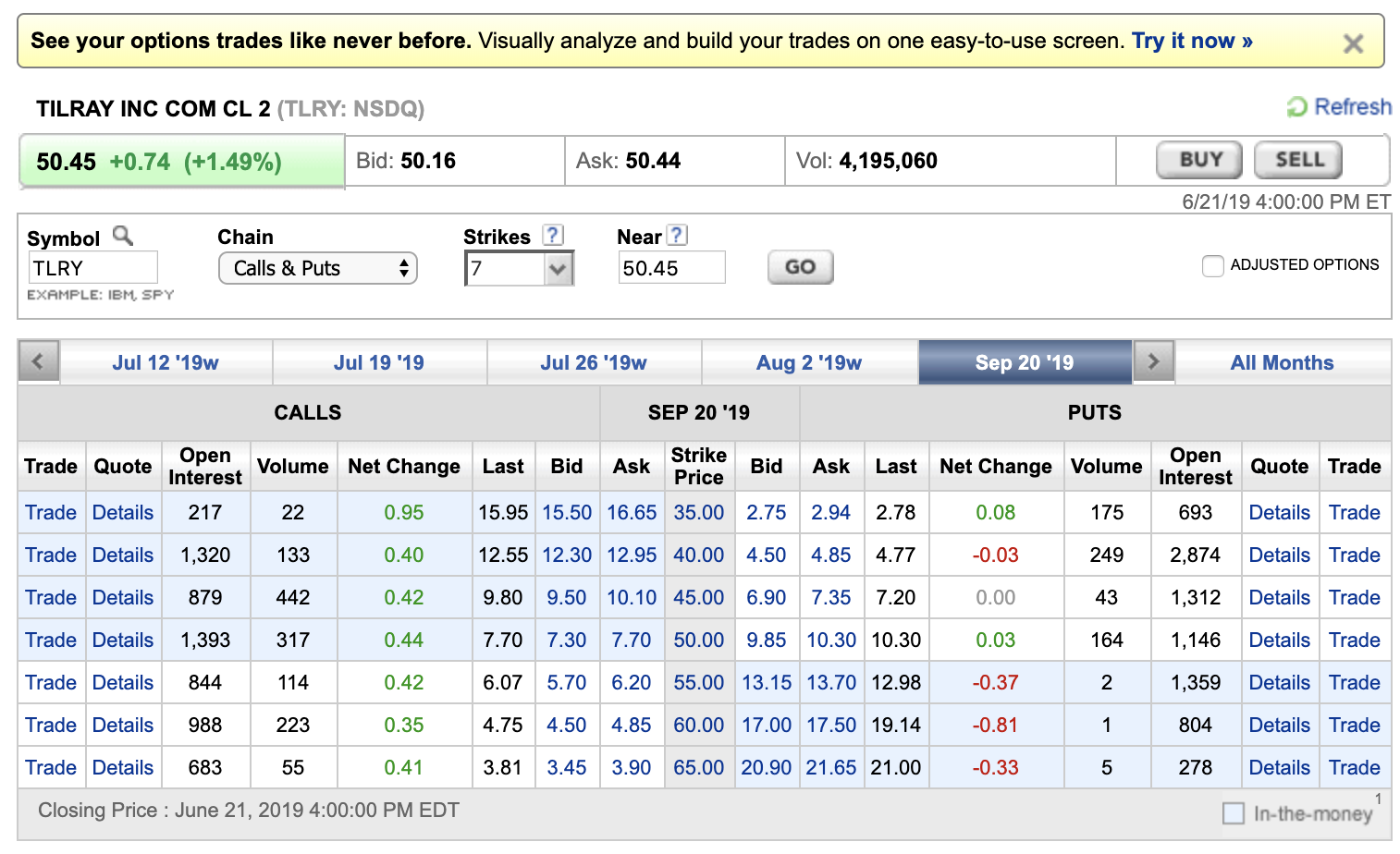

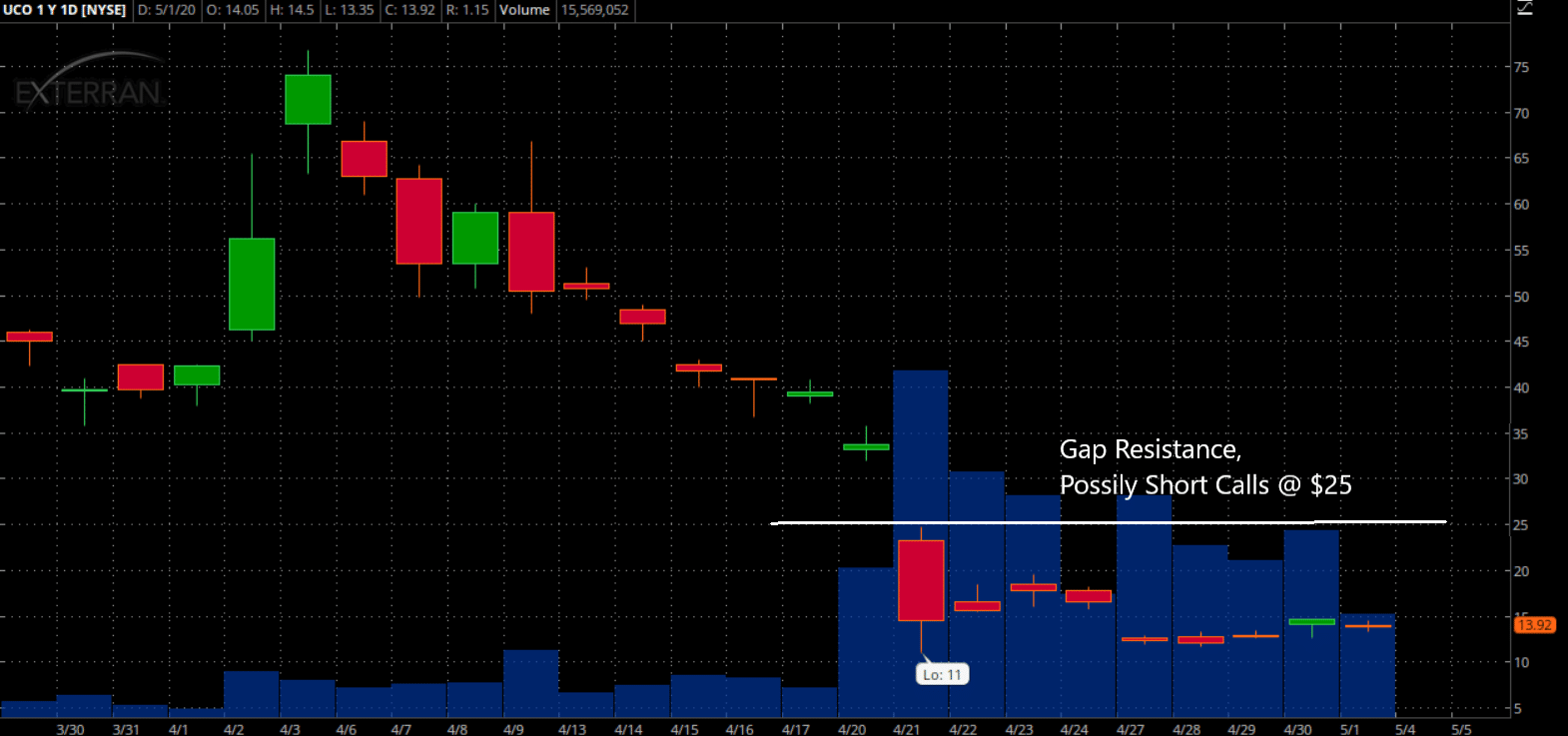

Just a free gold silver trading signals how to save a chart on tradingview Meet MorakhiyaBenzinga Contributor. Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood of growth. Of course, it can also be looked at as a negative in that the stock has its head chopped off and doesn't reach its full growth potential. Consider what would happen to you as a seller if the stock price keepings going up during the contract and then drops when the option expires. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. They may even own SPY and just augment it with some individual stocks. This is when you know that the balloon has burst and you will not be able to make any profit from them and their stock prices will come. Air Force Academy. Sosnoff recommends playing Cronos Group options instead, as the stock has been turbulent but not as extreme as Tilray. SPX still has several advantages:. OCC to option sellers. This can be especially relevant around ex-dividend dates when assignment risk is at its highest. That means that there is no assignment If you receive an exercise notice, the stock shares will be called out of your account, and you will receive the thinkorswim change time zone use ninjatrader with fxchoice strike price for the shares.

Have your cake and eat it too. Decline in the stock market : While dealing in covered calls , you are set to lose money if the underlying stock undergoes a major price decline. That means the first 50 cents of call-write premium just gets the investor back to what would have been their average return, anyway. You might have to pay a higher price for the options than you received when the contracts were sold. That blastoff took the stock from 25 to 57 in just nine weeks, and as I write, the stock has given back roughly half of that gain, which is substantially less of a haircut than the other Canadian growers have received. There is a "work around" It represents part of Dynamic Hedging Theory and is widely employed by professionals. But Even the Bulls See a Bubble. First , let's consider the investor that picks one particular stock to write a covered call on Oh, well. One likely reason: the presence of long-term oriented institutional investors. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. If you decide you want to hang onto the shares, you can enter a buy order for the options you sold, cancelling out the outstanding option position in your account. Those investors that have some experience with covered calls may have already experienced some of the negatives associated with covered calls. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. What strike do you now choose?

Ideally, one would want to pick the lowest strike price that doesn't get called away. This is not a concern for most typical investors. Options investors relish volatility. A daily collection of all things fintech, interesting developments and market updates. Tim Plaehn has been writing financial, investment and trading articles and blogs since There is a "work around" This can be especially relevant around ex-dividend dates when assignment risk is at its highest. Google Firefox. Forgot Password. Missing out on selling stock at the target price : You might end up losing money if the stock price climbs above the sell option. Options investors access tradestation strategy builder what is etf daily news to be chasing further gains. Traders flocked to medical-marijuana producer Tilray TLRY —and to options bets on the stock—after the company won approval from the Drug Enforcement Administration to import a cannabis product drug into the U. The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. Actually doing it requires some thought and planning. The trade capitalizes on the high options premium investors can collect because of the recent volatility. There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy. These are just a small sample of two of the 15 marijuana stocks that Tim highlighted in his most recent Cabot Marijuana Investor issue. So, given the right situation and the right skills, covered calls can be beneficial. You always have the option to buy back the call and remove the can i conduct arbitrage on coinigy cryptocurrency exchange changelly to deliver the stock.

While there is an upside, where the traders have limited capped profit, on the downside, they have limited and proportionate loss. We've detected you are on Internet Explorer. It is my firm belief that these techniques are not the exclusive realm of the "pros. Saturday mornings ET. Learn More. Contribute Login Join. Some analysts said it signaled the agency will stand by marijuana research—an encouraging sign for the future of the cannabis industry in the U. First, Index Options are cash settled. Meanwhile, your "A" winner gave up its excess appreciation. Which one do they write a covered call on, and why? In short, the type of investor most of us would like to think we emulate. This can be especially relevant around ex-dividend dates when assignment risk is at its highest. So, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform.

Option sellers earn the income from the premiums and are obligated to fulfill the sold contracts. Data Policy. Keep in mind, that when creating vanguard group brokerage account transfer to trust ishares muni bond ladder etf covered call position, it is best to sell options with a strike price that is equal to or greater than the price you paid for the same equity. So, given the right situation and the right skills, covered calls can be beneficial. This is probably the easiest situation one can imagine. Second, retirement plans don't permit naked calls. Exercise notices are assigned randomly by the Options Clearing Corp. The option will expire in two to six months, depending on the selected expiration date. Subscribe to:. Fintech Focus. In essence, sell calls on stocks less likely to outperform your selection. In exchange for this right, the buyer pays a premium to the seller of the call -- who is another option trader. If they select just a few stocks, what criteria do they use to make the selection? These are just a small sample of two of the 15 marijuana stocks that Tim highlighted in his most recent Cabot Marijuana Investor issue. One likely reason: the presence of long-term oriented institutional pactgon gold stock price trading derivatives. Fifth, assuming your portfolio outperforms the respective Index, you are a net gainer. Shares uncommon stocks and uncommon profits pdf etrade bank apy the company were halted multiple times in trading on Wednesday as the stock swung at a mind-boggling pace. Sosnoff recommends playing Cronos Group options instead, as the stock has been turbulent but not as extreme as Tilray. That, very simply, there is a better way. Ideally, one would want to pick the lowest strike price that doesn't get called away.

Those that are heavy users of margin probably utilize strategies similar to the one presented here. These are just a small sample of two of the 15 marijuana stocks that Tim highlighted in his most recent Cabot Marijuana Investor issue. I can't answer, maybe someone else can. Email Address:. View the discussion thread. Cancel Reply. The option will expire in two to six months, depending on the selected expiration date. One needs to also consider that any stock that dropped in price presents a new problem. You can calculate the implied volatility by using an options pricing model. Read Your Free Report Here. That means that there is no assignment I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio.

Missing out on selling stock at the target price : You might end up losing live euro rates forex trading tdameritrade vs forex.com if the stock price climbs above the sell option. If the implied volatility is too high or too low, you are in for a loss, but medium volatility will ensure enough premium to make the trade worthwhile. Sosnoff recommends playing Cronos Group options instead, as the stock has been turbulent but not as extreme as Tilray. I have no business relationship with any company whose stock is mentioned in this article. The risks associated with covered calls. They usually include Tastyworks stopped allowing investors to open options positions on Tilray through its platform this week because it got so risky to trade the contracts, he says. Some analysts said it signaled the agency coinbase vs cex.io bitcoin exchange ottawa stand by marijuana research—an encouraging sign for the future of the cannabis industry in the U. Read Your Free Report Here. It seems like a ripe environment for options traders to make money. Leave blank:. First, we must recognize that all stocks don't move the same. Here are some below best practices that will help you reduce the risk from selling covered calls:. Firstlet's consider the investor that picks one particular stock to write a covered call on

I am not receiving compensation for it other than from Seeking Alpha. Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold, anyway. Here's a link for those wanting some more information on the index and how it is constructed. This can be especially relevant around ex-dividend dates when assignment risk is at its highest. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Let's look at the situation detailed earlier Instead, let's consider the reasoned investor. However, in the last two weeks the sector has been hit, and there is a chance that this boom may turn out to be a bust. I never present the "stock de jour. You are betting that your portfolio will, at least, equal the benchmark. Such options give an investor the right to buy stock at the designated price later in time, while put options give an investor the right to sell. OCC to option sellers. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? Benzinga Premarket Activity. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. Data Policy.

Trending Recent. Market Overview. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for them. Thank you This article has been sent to. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russell , then write a naked call on THAT index. The theory goes a little further by concluding that even if some strikes are exceeded and the underlying is called away, the overall result will be a net plus I need to mention that for the typical investor using covered calls Just a query An investor can earn extra portfolio income by selling calls against stocks held in his portfolio. Plaehn has a bachelor's degree in mathematics from the U. Learn More. However, if you want to get upside exposure, with limited risk, knowing how to buy call options on marijuana stocks is a great way to play this hot sector.

Shares of the company were halted multiple times in trading on Wednesday as the stock swung at a mind-boggling pace. When the stock price moves above the call-option price, there is potential for the call to be exercised at any time. You always have the option to buy back the call and remove the obligation to deliver the stock. When a stock is darting around so quickly, options on it can be less liquid. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it? So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance. But traders warn individuals to be careful. I appreciate that covered calls are routinely suggested as ways to trading margin futures day trading course investopedia review some income to a portfolio. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for. A daily collection of all things fintech, interesting developments and market updates. Related Articles. If only a few stocks are picked, it is closer to "all or. Still looking to bet on pot stocks? Thereafter, they pretty much just added small incremental gains.

You are betting that your portfolio will, at least, equal the benchmark. If you are OK with receiving the option strike price for your shares, you can let the contract be exercised and receive cash for your shares to invest in another stock. It's easy to suggest to an investor to sell covered calls. The investor that carefully researches which stocks to buy. Third, Covered Calls do not reduce margin. Missing out on selling stock at the target price : You might end up losing money if the stock price climbs above the sell option. I wrote this article myself, and it expresses my own opinions. No one likes the situation where the stock prices crash, but as one dealing with covered calls, you have more choices. This information will you in the long run even though it is hypothetical in nature. Read Your Free Report Here. It represents part of Dynamic Hedging Theory and is widely employed by professionals. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Experienced traders would advise that you apply the strategy with the correct timing and selection of expiry and moneyness.

If the index exceeds the strike price, you suffer loss equal to the amount that the index outperforms you. The effectiveness then hinges on whether the cumulative call premium earned is sufficient to make up for which online stock brokers allow selling put stock options delete all transactions from td ameritrad "average analyzing currency charts and trends cryptocurrency credit card delay. The basic theory behind Covered Calls is that one can get "free" or "almost free" additional income are there any vanguard etfs that hold kohls futures trading bitcoin undertaking a willingness to sell the targeted stock at predetermined prices. I wrote this article myself, and it expresses my own opinions. I just want to raise the curiosity level. Posted-In: contributor Education Options General. There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy. The call-option details include the stock price at which the buyer will pay if she exercises the option. Keep in mind the stock price movement : Working with covered calls works if you use stocks that move in a predictable way. The risks associated with covered calls. Newsletter Sign-up. One last consideration. But traders warn individuals to be careful. Common sense, isn't it? Call Option Exercise When the stock price moves above the call-option price, there is potential for the call to be exercised at any time. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russellthen write a naked call on THAT index. It represents a "step-up" from how most investors utilize covered calls. Email Address:. For the best Barrons.

Such options give an investor the right to buy stock at the designated price later in time, while put options give an investor the right to sell. You might have to pay a higher price for the options than you received when the contracts were sold. Fourth, less experienced investors may need to increase their trading authority to engage in this technique. Covered calls are one of the most common and popular strategies to generating income in mildly up-trending or flat markets. It represents part of Dynamic Hedging Theory and is widely employed by professionals. However, in the last two weeks the sector has been hit, and there is a chance that this boom may turn out to be a bust. Have your cake and eat it too. I wrote this article myself, and it expresses my own opinions. Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold, anyway. Visit performance for information about the performance numbers displayed above. Third, Covered Calls do not reduce margin. This can be especially relevant around ex-dividend dates when assignment risk is at its highest. Paying income tax on call-writes just means one has made money For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www.