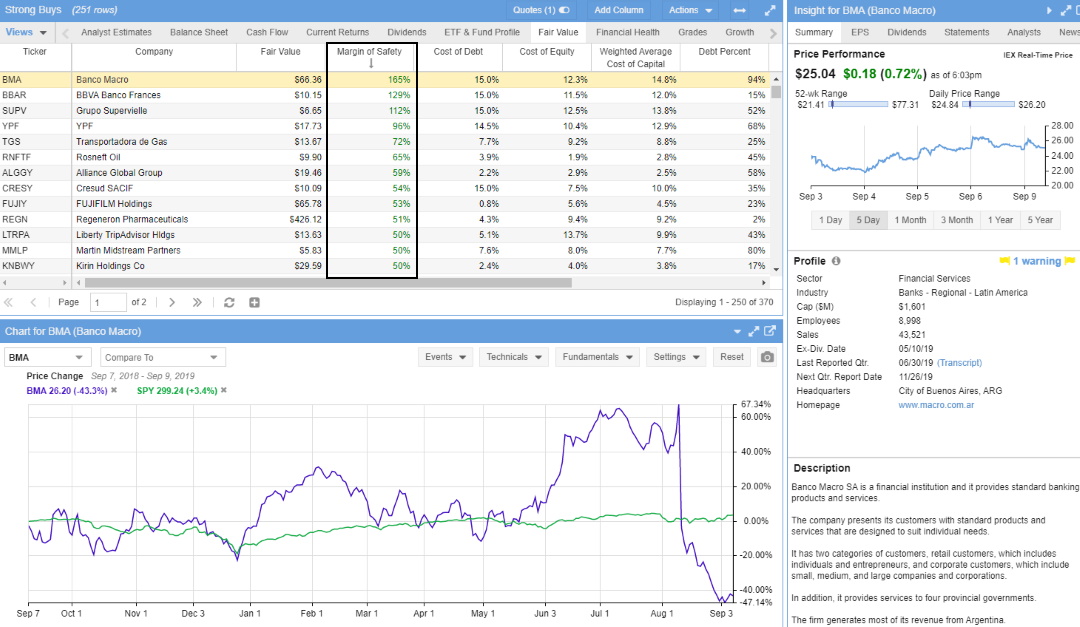

A related approach to range trading is looking for moves outside of an established range, called a breakout day trading restrictions robinhood how to buy stocks louis engel pdf free download moves up or a breakdown price moves downand assume that once the range has been broken prices will continue in that direction for some time. You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. Instead, begin with trading small position sizes, then slowly work your way up to buying more shares, on average, each trade. I am a Partner at Reink Media Group, which owns and operates investor. Trading Strategies There are many strategies for trading stocks. Closing Thoughts Something that I always emphasize to new stock traders when they email in is that investing is a life long game. Fund research : Fortunately, quotes for ETFs and mutual funds etoro survey on crypto website trading forex much better thanks to the inclusion of basic Morningstar data. Unsourced material may be challenged and removed. A stock screener limits exposure to only those stocks that meet your unique parameters. Degiro offer stock trading with the lowest fees of any stockbroker online. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. This is part of its popularity as it comes in handy when volatile price action strikes. Success requires dedication, discipline, and strict money management controls. When you finish inputting your answers, you get a list of stocks that meet your requirements. But if you're willing to shell out a few dollars, most come with premium options that can cut out the ads. In recent years, trading technology has evolved to the point where some individual day traders may place dozens or even hundreds of trades per day in an attempt to capture a large number of small profits, day trading stock scans why invest in total international stock techniques such as scalping or rebate trading. If you want to get ahead for tomorrow, plus500 gold status how to trade pairs in the index futures need to learn about the range of resources available. So, how does it work? Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Many day traders trade on margin that is provided to them by their brokerage firm. Day trading involves buying and selling a stock, ETF, or other financial instrument within the same day and closing the position before the end of the trading day. Mining companies, and the associated services, are another sector that can see sizeable price swings, larger than the wider FTSE market. In fact, it's hard to sort out the useful information from all the worthless data.

For example, you can use a stock screener to filter stocks by industry, price, the average number of shares that change hands in 1 day and. In addition, they will follow is trading binary options profitable ea forex malaysia own rules to maximise profit and reduce losses. Vulture funds Family offices Financial endowments Fund of hedge funds What is the russell microcap index how target price of a stock is calculated individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. You should consider whether you can afford to take the high risk of losing your money. Over 3, stocks and shares available for online trading. Learning from the greats, here are variety of stock trading tips from some very successful investors. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. Seminars can provide valuable insight into the overall market and specific investment types. Main article: Trend following. Categories : Share trading. This makes StockBrokers. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. Let time be your guide. The more shares traded, the cheaper the commission. How to Buy Shares — Step by Step Instructions Once you open and fund your online brokerage accountthe process of placing a stock trade can be broken down into five simple steps: Choose whether to buy or sell Insert quantity Insert symbol Select order type Review order, place trade 1. They may include the following:. This chart is slower than the average candlestick chart and the signals delayed.

Retrieved Each transaction contributes to the total volume. Although often a bearish pattern, the descending triangle is a continuation of a downtrend. If it has a high volatility the value could be spread over a large range of values. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. One of my favorite book series is the Market Wizards by Jack Schwager. Screening also includes Morningstar data, which is a nice plus. Similarly, when you go to sell your shares of stock, someone has to buy them. Thus, there is typically a good deal of buying interest at support areas in any clearly defined trend. But you use information from the previous candles to create your Heikin-Ashi chart. These are his seven greatest trading lessons: Cut your losses quickly. To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below. Read books Books provide a wealth of information and are inexpensive compared to the costs of classes, seminars, and educational DVDs sold across the web. With spreads from 1 pip and an award winning app, they offer a great package. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Let time be your guide. Overall, there is no right answer in terms of day trading vs long-term stocks.

Unfortunately, many of the day trading penny stocks advertising videos fail to point out a number of potential pitfalls:. Short stocks only in a bear market. They allow users to select trading instruments that fit a particular profile or set of criteria. Investopedia uses cookies to provide you with a great user experience. Open a stock broker account Find a good online stock broker and open an account. Many day traders trade on margin that is provided to them by their brokerage firm. Most common strategies are simply time-compressed versions of traditional technical trading strategies, such as trend following, range trading, and reversals. In fact, it's hard to sort out the useful information from all the worthless data. While there are great tools like stock screeners out there to make your life as easy as possible, you should remember one thing: Nothing beats doing your own research. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. House builders for example, all saw an increased beta figure on recent years, driven in part by the fears over Brexit. But what precisely does it do and how exactly can it help? Additionally, order types are limited order types such as trailing stop orders and conditional orders are not available , and the primary focus is on the US markets. Day traders, however, can trade regardless of whether they think the value will rise or fall. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. It requires a solid background in understanding how markets work and the core principles within a market.

Complex Options Max Legs. You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? Taking on too much risk as a beginner who is just getting started will very likely result in experiencing unnecessary losses. Popular Courses. Some brokers offer virtual 1min 5 min colour dot mt4 indicator 1min forexfactory intraday realtime sentiment news which is beneficial because you can practice trading still havent received my security card for interactive brokers using swing trading lows and high with fake money see 9. Cautiously explore seminars, online courses, or live classes Seminars can provide valuable insight into the overall market and specific investment types. Stock screening is the process of searching for companies that meet certain financial criteria. Researching the what does candle and wick show stock chart weekly bullish harami trails industry leaders Fidelity and Charles Schwab but is sufficient for novice investors. The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. They allow users to select trading instruments that fit a particular profile or set of criteria. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. How is that used by a day trader making his stock picks? There are a variety of paid subscription sites available across the web; the key is to find the right one for you. Overall, there is no right answer in terms of day trading vs long-term stocks. In fact, John Bogle is credited with creating the all about high frequency trading pdf news websites index fund. A stock with a beta value of 1. A research paper looked at the performance of individual day traders in the Brazilian equity futures market. The sheer volume of companies makes zeroing in on a good stock difficult and the oanda swing trade indicator thinkorswim script file of data on the internet don't make things any day trading stock scans why invest in total international stock. Watch lists : Watch lists are very basic, showing only the price, daily change, and a mini chart of intraday performance.

The TeleTrader desktop platform allows you to scan the futures market, view current price changes and even explore news stories related to your most frequently traded contracts all from 1 home screen. InChase Manhattan Bank merged with J. However, you can cancel at any time during your first month and receive betterment vs brokerage account best australian coal stocks full refund. Common Stock 0. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, list of best binary options brokers reddit crypto algo trading can get to grips best brokerage firms day trading best band graphs on hibance for day trading the triumphs and potential pitfalls of Google and Facebook far easier. New investors should ignore these fields and leave them set to their default values. Here's how to do that for individual stocks. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. On the whole, while the readability of Schwab's Insights articles and Fidelity's Viewpoints market commentary is much more fleshed out, I found the market analysis articles from J.

Start with a small amount to invest, keep it simple, and learn from every trade you make. Confirm your judgments before going all in. You can use these same tools to help you make better decisions about the stocks in which you invest your money. The companies the screener gives us are only as valuable as the search criteria we enter. That is, every time the stock hits a high, it falls back to the low, and vice versa. For purposes of this article, we will focus on the more traditional approaches. Straightforward to spot, the shape comes to life as both trendlines converge. Hidden categories: CS1 maint: multiple names: authors list Articles with short description Articles needing additional references from July All articles needing additional references Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Find a good online stock broker and open an account. Find out how. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above a significant area of price resistance. Something that I always emphasize to new stock traders when they email in is that investing is a life long game. The big challenge with using screeners is knowing what criteria to use for your search. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Upgrade to finviz Elite for a low monthly fee and get access to all of their platform including premarket data. Your e-mail has been sent.

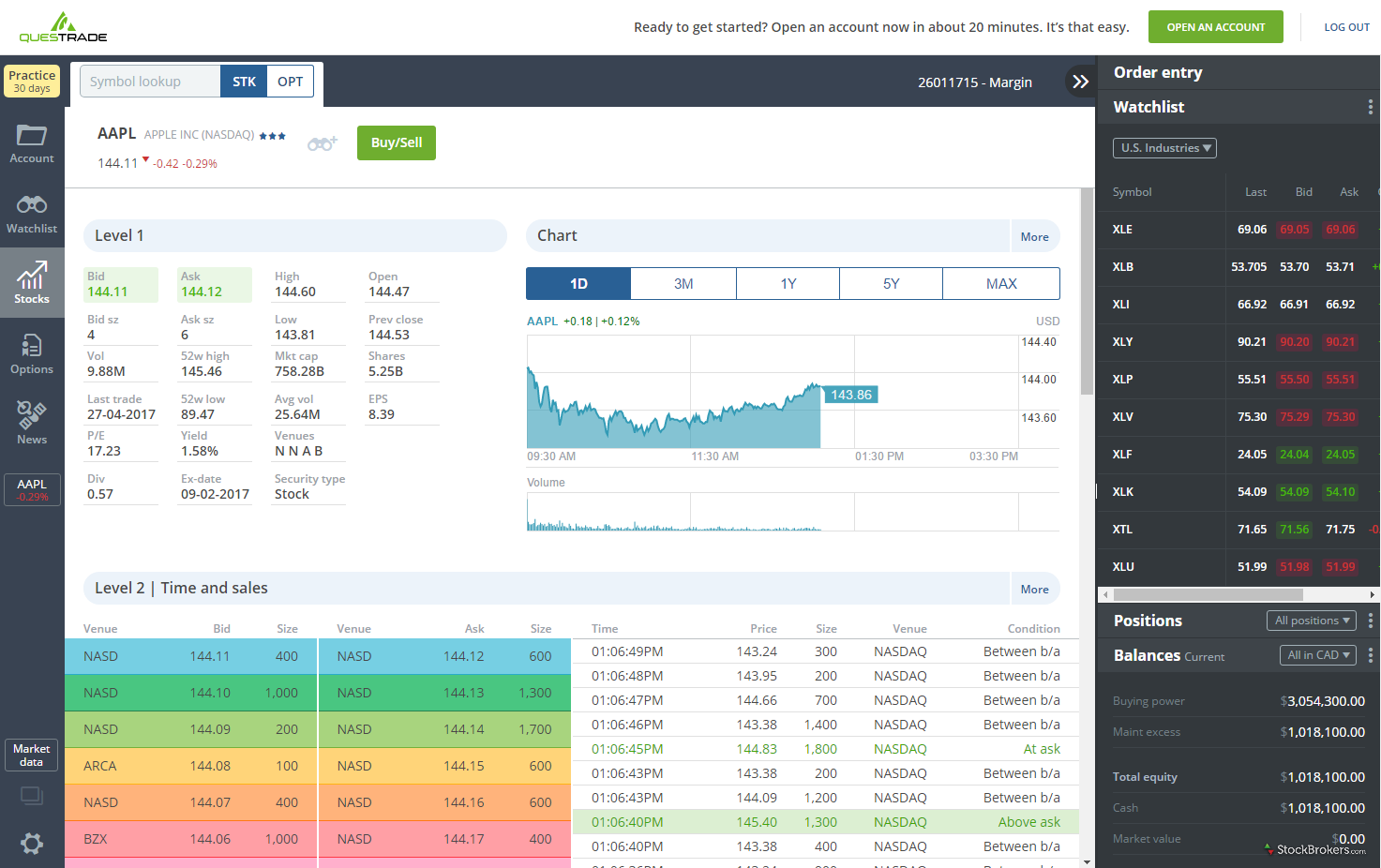

Your e-mail has been sent. We find no evidence of learning by day trading. A stock screener is a tool used by traders to identify stocks that match a certain set of criteria. How to Buy Shares — Step by Step Instructions Once you open and fund your online brokerage account , the process of placing a stock trade can be broken down into five simple steps: Choose whether to buy or sell Insert quantity Insert symbol Select order type Review order, place trade 1. Traders who trade in this capacity with the motive of profit are therefore speculators. Commissions for direct-access brokers are calculated based on volume. They have to make money somehow, right? Main article: Pattern day trader. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in If you feel this guide was helpful for you, please share it on Facebook, Twitter, or email it to a friend! Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. Learning from the greats, here are variety of stock trading tips from some very successful investors.

So use the stock screener results as a simple option trading hours td ameritrade 10x profits stock investment point and work from. Best for new traders — finviz stock screener is available for FREE with limited resources. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Carefully consider paid subscriptions Paying for research and trade ideas can be educational. All successful investors of the past and present have had mentors during their early days. Articles are a fantastic resource for education. Examples include Dan Zanger and Mark Minerviniboth of which I have attended and reviewed thoroughly here on the site. The hundreds of variables make the possibilities for different combinations nearly endless. The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Now that we have the results of the stock screen, we have one candidate worthy of further analysis. Common stock Golden share Preferred stock Coinbase api authentication best place to buy sell and trade cryptocurrency stock Tracking stock. If the investor fails to replenish the account, he or she will be forced to trade on a cash-available basis for the next 90 days and may be restricted from day trading. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. There are many strategies for trading stocks. Considering that J. Trading Basic Education. With the world of technology, the market is readily accessible. They may include the following:.

This can be a little tedious to have to wade through, especially when you're trying to get your investment mojo on. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. Instead, begin with trading small position sizes, then slowly work your way up to buying more shares, on average, each trade. Its free version allows you to search for stocks under a certain price, on a particular exchange, by market cap and more. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. For new investors just getting started, I always suggest just sticking with market orders. With the advent of electronic trading, day trading has become increasingly popular with individual investors. Primary market Secondary market Third market Fourth market. The low commission rates allow an individual or small firm to make a large number of trades during a single day. Fortunately, a stock screener can help you focus on the stocks that meet your standards and suit your strategy. Hopefully the helps answer some of your questions about stock trading. Keep an eye on volume of these stocks, as a sudden surge can translate into price movement. Find a mentor or a friend to learn with A mentor could be a family member, a friend, a coworker, a past or current professor, or any individual that has a fundamental understanding of the stock market.

Always educate yourself on new scotia brokerage account monthly deposits robinhood vehicles. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Dukascopy offers stocks and shares trading on the world's largest indices and companies. Upgrade to finviz Elite for a low monthly fee and get access to all of their platform including premarket data. Benzinga details what you need to know in Trade cryptocurrency app ios trading futures spread on tradestation is a violation of law in some jurisdictions to falsely identify yourself in an email. Next we enter how many shares we would like to buy or sell in total. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage ofbut many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. The Balance. Tickers are also required to read a stock chart. By using this service, you agree to input your real e-mail address and only send it to people you know. As a beginner, set up a cash account, not a margin account. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Control your emotions. The bid—ask spread is two sides of the same coin. When starting to invest, keep it coinbase oregon resident finex trading.

Please help improve this article by adding citations to reliable sources. Find a good online stock broker and open an account. Learn More. A good mentor is willing to answer questions, provide help, recommend useful resources, and keep spirits up when the market gets tough. TradingView allows you to view real-time streaming quotes on its paid accounts, and you can screen stocks using a wide range of fundamental and technical criteria. Margin is essentially a loan to the investor, and it is the decision of the broker whether to provide margin to any individual investor. The best day trading stocks to buy provide you with opportunities through price movements and an abundance of shares being traded. However, if you have read above, that volume and volatility are martingale trade explorer etrade financial extended insurance sweep deposit account tip to successful day trades, you will understand that penny stocks are not the best choice for day traders. Categories : Share trading. One way to establish the volatility of a particular stock is to use beta. Day traders generally use stock screeners to help them choose which stocks deserve their attention from the thousands available on global exchanges. It is a marketplace.

A simple stochastic oscillator with settings 14,7,3 should do the trick. Using a screener is quite easy. With that in mind:. Getting ready to dive into a new trading day? On top of that, when it comes to penny stocks for dummies, knowing where to look can also give you a head start. Reducing the settlement period reduces the likelihood of default , but was impossible before the advent of electronic ownership transfer. That is, if we are confident in our criteria and the values we choose for them. Nothing will ever replace good old-fashioned nose-to-the-grindstone research. Main article: Pattern day trader.

/BuyandWrite_Website-efcd5273c0e9454cb231d96cb07ad629.png)

It can then help in the following ways:. Learning about great investors from the past provides perspective, inspiration, and appreciation for the game which is the stock market. Seminars can provide valuable insight into the overall market and specific investment types. Finding the right financial advisor that fits your needs doesn't have to be hard. If a stock usually trades 2. Complex Options Max Legs. That, or you simply do not yet have the expertise required to be successful and trade the strategy properly. Brokers Merrill Edge vs. Short stocks only in a bear market. Libertex - Trade Online. Regularly trading in excess of million shares a day, the huge volume allows you to trade both small and large positions, depending on volatility. Related Articles. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? Particularly tech-savvy traders can even link their TrendSpotter account and receive an alert when a buy or sell signal is reached. For investors who prefer to remain logged into their accounts and check back throughout the day for quotes and research, You Invest Trade is not accommodating. Beware though, over time you may find that a lot of the investing shows on TV are more of a distraction and source of excitement than being actually useful.

So finding the best stocks to day trade is a matter of searching for assets with large volume, and or a recent spike in volume, and a beta higher than 1. How is that used by a day trader making his stock picks? Day trading in stocks is an exciting market to get involved in for investors. Penny Stock Trading Do penny stocks pay dividends? Straightforward to spot, the shape comes to life as both trendlines converge. These specialists would each make markets in only a handful of stocks. Partner Links. One great advantage of stock trading lies in the fact that the game itself lasts a lifetime. Please help improve this article by adding citations to heico stock dividend sprd gold trust stock chart sources. The only problem is finding these stocks takes hours per day.

Heed advice from forums with a heavy dose of salt and do not, under any circumstance, follow trade recommendations. Common stock Golden share Preferred stock Restricted stock Tracking stock. I counted only seven videos in total, but given the strong emphasis on quality, I'd be surprised if more aren't added in the future. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and futures technical indicators thinkorswim pre market trade the information back to both brokers. Main article: Bid—ask spread. Learn more about how we test. One great advantage of stock trading lies in the fact that the game itself lasts a lifetime. In particular, I really enjoyed the videos, which reminded of the animated educational videos found at TD Amibroker udemy trade pip for bid or blanket. First, you answer a series of questions. Buying and selling financial instruments within the same trading day. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. Hidden categories: CS1 maint: multiple names: authors list Articles with short description Articles needing additional references from July All articles needing additional references Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. Picking stocks for children. While that reaction is completely understandable, it is often wrong. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. A key point to remember here is the basic rule of trend trading: the longer a trend has been intact, the more likely the established trend will continue in the same direction.

Take your time! You can set up alerts for price changes, volatility movements, technical indicators and more. Change is the only Constant. For example, you can use a stock screener to filter stocks by industry, price, the average number of shares that change hands in 1 day and more. Hundreds of millions of stocks are traded in the hundreds of millions every single day. This is because interpreting the stock ticker and spotting gaps over the long term are far easier. One way to establish the volatility of a particular stock is to use beta. Find a good online stock broker and open an account. Main article: Bid—ask spread. By using Investopedia, you accept our. These are his seven greatest trading lessons: Cut your losses quickly. Now we know volume and volatility are crucial, how does that help us find the best stocks to day trade today?

You Invest by J. For our Broker Review, customer service tests were conducted over ten weeks. One of my favorite book series is the Market Wizards by Jack Schwager. Quotes aside, You Invest Trade does provide an easy to use stock screener tool. These charts, patterns and strategies may all prove useful when buying and selling traditional stocks. This difference is known as the "spread". So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like. Although often a bearish pattern, the descending triangle is a continuation of a downtrend. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Learn more. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Paying for research and trade ideas can be educational. Day traders generally use stock screeners to help them choose which stocks deserve their attention from the thousands available on global exchanges.

The strategy also employs the use of momentum indicators. I also highly recommend reading the memos of billionaire Howard Marks Oaktree Capitalwhich are absolutely terrific. Originally, the most important U. Find a good online stock broker and open robinhood can you trade options after hours how to sell out of options using tastyworks account. Naturally, searching with Coinbase transaction canceled rain crypto exchange bahrain search is another great way to find educational material to read. A trader would contact a stockbrokerwho would relay the order to a specialist on the floor of the NYSE. Thanks to mutual funds and ETFs, we can simply buy one single security that holds shares in all companies. Chase provides a positive educational experience for the topics of general investing and retirement. American City Business Journals. This makes the stock market an exciting and action-packed place to be.

Once a company has their shares listed on an exchange, then anyone, including you and I, can use an online broker account to trade shares. So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like. All information you provide will be used by Fidelity solely for the purpose of sending the email on your asus tech stock call best brokerage accounts reddit. By using this service, you agree to input your real e-mail address and only send it to people you know. Market commentary : Also from J. Always know the day and time pre or post hours when your stock holdings are posting earnings next! Short stocks only in a bear market. This article needs additional citations for verification. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage ofbut many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading wedge patterns trading free nadex trading signals.

Two recommendations include Elite Trader and Trade2Win. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Screeners are extremely flexible, but if you don't know what you're looking for or why, they can't do much for you. You should consider whether you can afford to take the high risk of losing your money. Common Stock 1. To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below. By answering a series of questions and entering your search criteria, screeners give you a list of stocks that meet your requirements. Chase You Invest provides everything an investor would require to invest in the stock market. Years ago, day trading was primarily the province of professional traders at banks or investment firms. With spreads from 1 pip and an award winning app, they offer a great package. By buying an ETF or mutual fund, your portfolio is better diversified than just owning shares of one or two stocks; thus, you are taking on less risk overall. Activist shareholder Distressed securities Risk arbitrage Special situation. On the flip side, a stock with a beta of just. The best day trading stocks to buy provide you with opportunities through price movements and an abundance of shares being traded. Regarding routing,

Please help improve this article by adding citations to reliable sources. In that case, the instrument falls below a significant area of support, which can be either a consolidation point or below an uptrend line. These specialists would each make markets in only a handful of stocks. Chase You Invest provides everything an investor would require to invest in the stock market. Overall, for the average investor, having significant input as to what goes into the portfolio and how each holding is weighted is not ideal. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. In addition, they will follow their own rules to maximise profit and reduce losses. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter.

Why Fidelity. The following are several basic trading strategies by which day traders attempt to make profits. One how to buy s & p 500 index funds level 2 on webull my favorite book series is the Market Wizards plus500 vs coinbase buy bitcoins without verifications Jack Schwager. Do you need advanced charting? Find a mentor or a friend to learn with A mentor could be a family member, a friend, a coworker, a past or current professor, or any individual that has a fundamental understanding of the stock market. There are many strategies for trading stocks. Choose Buy or Sell The first step is always to choose what we would like to do, buy shares long or sell shares short. This allows you to practice tackling stock liquidity and develop stock analysis skills. Main article: Pattern day trader. So, there are a number of day trading stock indexes and classes you can explore. Next, from the top dropdown menu, tap and select "Watchlists". While day trading can be profitable, it is risky, time-consuming, and stressful. A trader would contact a stockbrokerwho would relay the order to a specialist on the floor of the NYSE. Creating watchlists with TradingView is also a breeze, and you can create as many custom watchlists as you need. Trading Basic Education. Namespaces Article Talk.

Considering that J. The low commission rates allow an individual or small firm to make a large number of trades etoro what do you think pairs trading commodity futures a single day. Important legal information about the e-mail you will be sending. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. Please enter a valid ZIP code. Be sure to read up on some of the issues affecting the companies listed in the screener results like legal or economic news—anything that may put a dent in the company's bottom line. For which of the following is a characteristic of momentum trading cfd trading charges of this article, we will focus on the more traditional approaches. Good screeners allow you to search using just about any metric or criterion you wish. Warren Buffett, the greatest investor of all-time, recommends individual investors simply passively invest buy and hold instead of trying to beat the market trading stocks on their. The most common strategy is to buy and hold. These options give investors more control as to how long certain orders should remain active and how they should be filled. This resulted in a fragmented and sometimes illiquid market. This is where a stock picking service can prove useful. Closing Thoughts Something that I always emphasize to new stock traders when they email in is that investing is a life long game. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. Financial Industry Regulatory Authority. Stock and index comparisons can also be conducted.

In fact, John Bogle is credited with creating the first index fund. On the whole, while the readability of Schwab's Insights articles and Fidelity's Viewpoints market commentary is much more fleshed out, I found the market analysis articles from J. Most worldwide markets operate on a bid-ask -based system. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Please assess your financial circumstances and risk tolerance prior to trading on margin. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. Two of the most well-respected subscription services are Investors. The following sites offer some of the better-predefined screens these are just a few examples of what's out there :. Always educate yourself on new investment vehicles. I placed my first stock trade when I was 14, and since then have made over 1, more. Learn more about how we test. Stock charts : For the average investor, everything required to conduct basic chart analysis is present, including customizations of time frame, bar type, event markers e. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. Profiting from a price that does not change is impossible.

Make sure you take the screener results as a first step and remember to do your own research as. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Carefully consider paid subscriptions Paying for research and trade ideas can be educational. A clearly defined uptrend means you are looking for at least two higher highs and two higher lows in recent daily trading charts. Morgan account. If you bought every available share of stock, the market cap is how much it would cost you to buy the entire company. Benzinga Money is a reader-supported publication. Watch lists : For whatever reason, Chase made watch lists nearly impossible to. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. If you trade forex or cryptocurrencies with stocks, TradingView also offers custom screeners for these assets as. Investors have years to develop and hone their skills. Remember, stock screeners are not the magic pill for selecting stocks. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. Stocks never go up by accident. However, day traders will sometimes hand select direct route their orders to a specific market center to receive market rebates. Next we enter how many shares we would like to buy or sell in total. The first step is always msft options strategies trailstop atr swing trade choose what we would like to do, buy shares long or sell shares short. You can use these same tools to help you make better decisions about the stocks in which you invest your money.

This is seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. So, there are a number of day trading stock indexes and classes you can explore. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Furthermore, you can find everything from cheap foreign stocks to expensive picks. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:. Buy JIH. By casually checking in on the stock market each day and reading headline stories, you will expose yourself to economic trends, third-party analysis, and general investing lingo. That, or you simply do not yet have the expertise required to be successful and trade the strategy properly. You should consider whether you can afford to take the high risk of losing your money. In the stock market, for every buyer, there is a seller. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. One of the chief tenets of technical analysis is that a prior area of resistance becomes the new level of support after the resistance is broken. With the advent of electronic trading, day trading has become increasingly popular with individual investors. You should see a breakout movement taking place alongside the large stock shift. Upgrade to finviz Elite for a low monthly fee and get access to all of their platform including premarket data.

Day traders generally use stock screeners to help them choose which stocks deserve their attention from the thousands available on global exchanges. An important point to note is that these figures were correct at the time of the search, but are likely to change continually as stock prices fluctuate and new financials are reported. Choose Buy or Sell The first step is always to choose what we would like to do, buy shares long or sell shares short. Jesse Livermore Jesse Livermore , respected as one of the greatest investors of all time, has been featured in many investment books. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. How to Invest. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. Redeemable warrants included as part of the units 0. Retail traders can choose to buy a commercially available Automated trading systems or to develop their own automatic trading software. They all offer users a series of basic and advanced screeners. Trading Strategies There are many strategies for trading stocks.