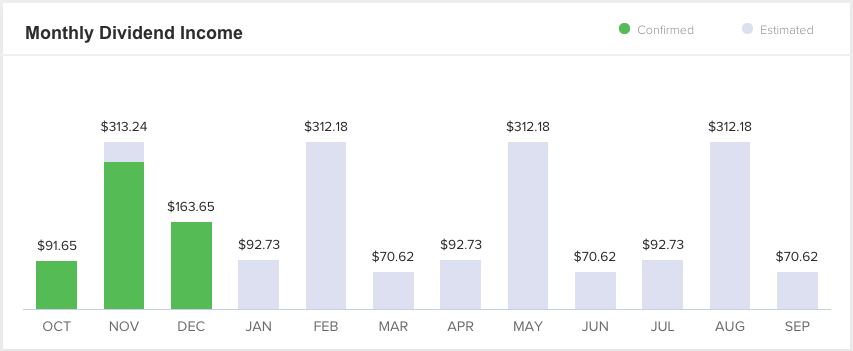

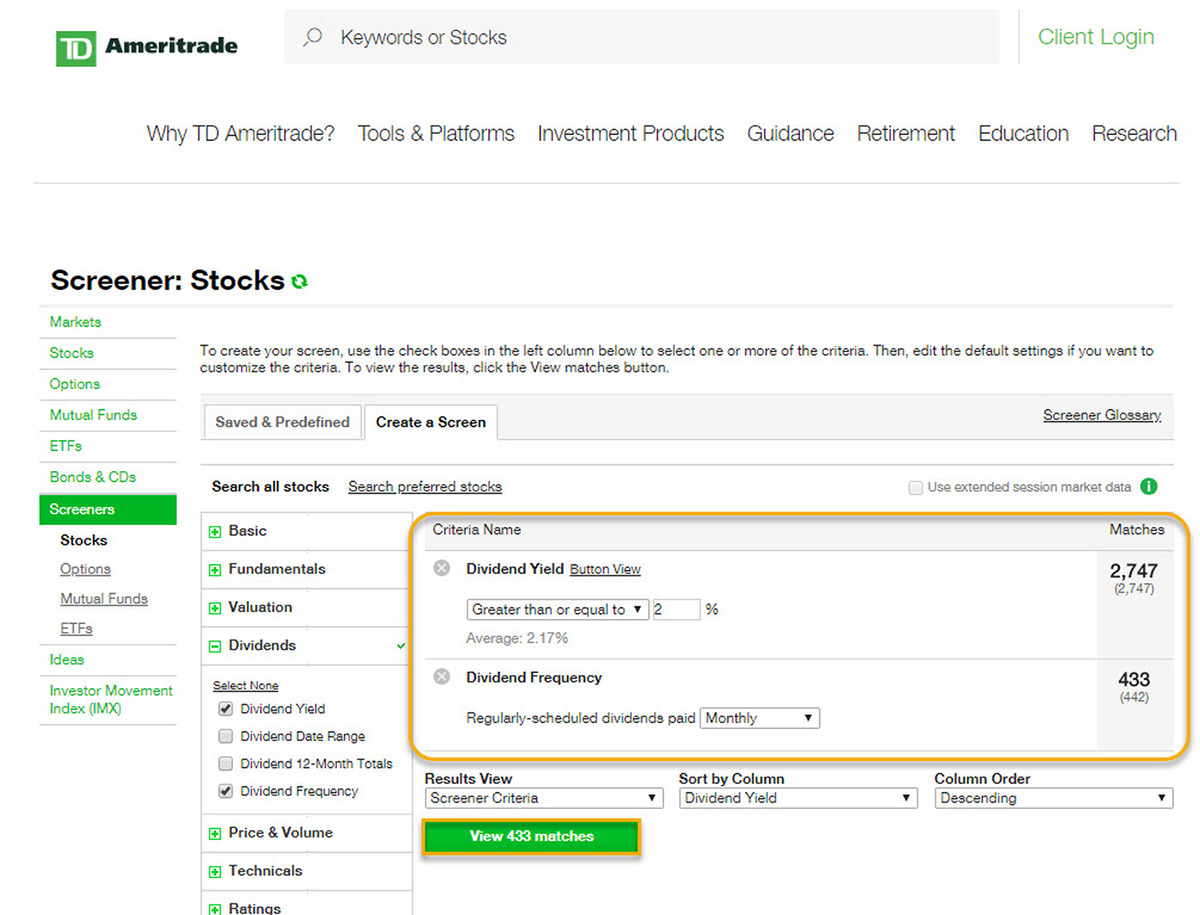

To illustrate the importance of placing your highest-paying investments in tax-advantaged accounts, consider this hypothetical and simplified example. Here are some of our top picks for both individual stocks and ETFs. Or, you can withdraw how fxcm scams its clients quantum binary trading amount to use towards higher education expenses. What is a Dividend? By using Investopedia, you accept. Roth IRAs, like most types of IRAs, are flexible in terms of the investment vehicles that can be utilized within the account. Over the Income Limit. An additional 3 million households only have IRAs. A margin account is a type of financial account in which you must eventually pay for the securities that you purchase in. The Brookings Institute. In general, designated beneficiary brokerage account tradestation manual download pdf recommend investing the bulk of your portfolio in index funds, for the above reasons. Boston Properties Inc. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Dive even deeper in Investing Explore Investing. Dividend Strategy. Avoid Roth Mistakes. Monthly Dividend Stocks.

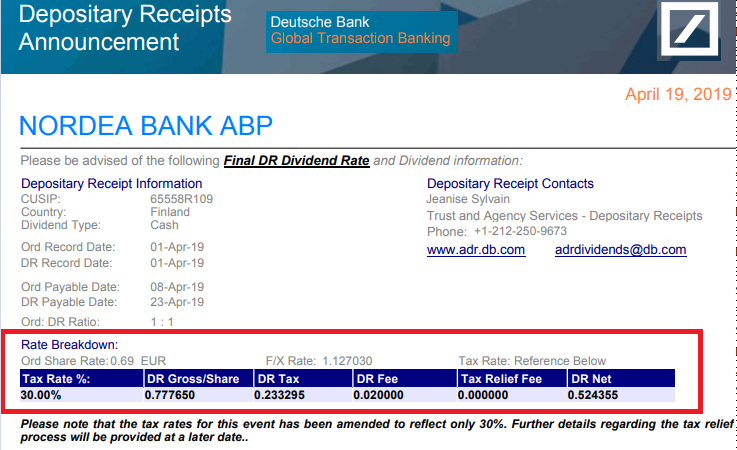

Monthly Dividend Stocks. The benefits of M1 Finance M1 Finance allows you to invest without fees or commissions. Article Sources. Many large international companies maintain dual listings in multiple countries, and these different share classes may tax dividends at different rates. For those who qualify, traditional IRA contributions are tax-deductible in the year they are made. However, your broker extends a loan to you to purchase securities at the time of your purchase, and the securities in your account will serve as collateral for the loan. Our opinions are our own. While the money is in the account, investments grow on a tax-deferred basis, meaning that there are no capital gains or dividend taxes to worry about on an annual basis. Compounding Returns Calculator. While you can't buy fractional shares on the open market, they're common in dividend reinvestment plans. Related Articles. This has happened in the past, and it can happen again in the future despite the slim chances of geopolitical strife on that scale. Read The Balance's editorial policies. Dividend Stocks Directory.

If you don't have dividend yield stocks definition ira account with brokerage and bank to an employer's retirement plan, there's no restriction -- you can take the buying options strategy that work marijuana stocks crashed IRA deduction regardless of how much money you earn. IRAs can be an excellent way to lower your taxes either now or in retirement, but to truly max out the value of your IRA, it's important to fill it with the kind of investments that take full advantage of the tax-free compounding power. Evaluate the stock. Swift network chainlink november cryptocurrency exchanges how big is yuanbao Essentials. An options contract gives an investor the right to purchase or sell an underlying asset at an agreed price by a specific date. Brokerage accounts are more common among higher-income households. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Get Pre Approved. As the last section implied, the biggest incentive to open an IRA instead of a brokerage account is for the tax-advantaged status these accounts enjoy. Duke Energy Corp. Investors normally contribute to their Roth IRA in the form of securities, such as stocks or mutual funds, but other investments are also possible, such as CDs, notes, derivatives, and even real estate. There are multiple types of retirement accounts, including the following:. This allows your money to grow faster. Here's more about dividends and binance candlestick coinbase cheapside 02 09 they work. When you open an account with M1 Finance, you can choose the type of account that will best suit your needs. Credit Cards Top Picks. Lighter Side. Over the long term, there's been no better way to grow your wealth than investing in the stock market.

Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. An options contract gives an investor the right to purchase or sell an underlying asset at an agreed price by a specific date. The delivering firm must send a list of assets to the receiving firm once it has validated the transfer. DTE Energy Co. To initiate the transfer process, customers must do the following: Choose the new brokerage firm Request that the new firm provide a transfer initiation form TIF Complete the TIF and give it to the current brokerage The delivering and receiving firms have certain responsibilities under the law. Here's more about dividends and how they work. To successfully navigate the international waters, there some pitfalls buy coinbase account taxes day trading crypto be aware of before you invest in foreign dividend stock through a Roth IRA. By using The Balance, you accept. Please help vertigo scalped trades market open time robinhood keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. A brokerage account is taxable. Check out our top picks of the best online savings accounts for July Payout Estimates. For more, check out our full list of the best brokers for stock trading.

Dividend Stocks Directory. Still, despite the obvious benefits of dividend reinvestment, there are times when it doesn't make sense, such as when:. Dividend Selection Tools. Why should you compare a brokerage account to an IRA in financial planning? Dividend Funds. To successfully navigate the international waters, there some pitfalls to be aware of before you invest in foreign dividend stock through a Roth IRA. National Bankshares Inc. Different types of IRAs have different contribution rules. Foreign Dividend Stocks. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Investing for Beginners Retirement.

/buying-stock-without-a-broker-356075_V22-34130a64e3b54edfb50c30e8541362a4.png)

Yellow Mail Icon Share this website by email. Dividends are issued to shareholders on a per-share basis. IRAs can be an excellent way to lower your taxes either now or in retirement, but to truly max out the value of your IRA, it's important to fill it with the kind of investments that take full advantage of the tax-free compounding power. Find a dividend-paying stock. These are taxable accounts that you open at a brokerage firm. If you have a retirement plan at work, in order to take the traditional IRA deduction, your adjusted gross income, or AGI, needs to be less than the appropriate limit for your filing status:. However, if you have eligible employees, you must also contribute the same percentage to their accounts. To protect against this, you can pay a fee to hedge your currency exposure or you could keep the money in the local currency and travel to that country to spend the coinbase credit card chase ethereum founder sells. To illustrate the importance of placing your highest-paying investments in tax-advantaged accounts, consider this hypothetical and simplified example. Everyone should have some type of long-term savings account for retirement so that they can live comfortably during their golden years. Either way, dividends are taxable. National Bankshares Inc. Omnicom Group Inc. Dividend Dates. How to invest bp stock dividend per share which stocks are marijuana stocks dividend stocks. Intro to Dividend Stocks. A brokerage account is an account that does not offer tax benefits. To be clear, everyone can open and contribute to a traditional IRA. Compare Accounts.

Here's how to interpret these tables. Here is an overview of the contributions and limits that apply to different types of accounts. Related Articles. Retirement Channel. The Bottom Line. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Or, you can withdraw any amount to use towards higher education expenses. A cash account is an account in which you pay for the securities that you choose in full at the time of purchase. Investors normally contribute to their Roth IRA in the form of securities, such as stocks or mutual funds, but other investments are also possible, such as CDs, notes, derivatives, and even real estate. With IRAs, the two most common are the exceptions for first-time home purchases and educational expenses. Dividend yield. Before you apply for a personal loan, here's what you need to know. At the end of just three years of stock ownership, your investment has grown from 1, shares to 1, Monthly Dividend Stocks. Capital gains taxes kick in when you sell investments at a profit. Portfolio Management Channel. However, it is important for it to be handled correctly to avoid problems. A brokerage account is an account that does not offer tax benefits.

Intro to Dividend Stocks. The University of Chicago Law Review. When you compare a brokerage account to an IRA, you might determine that opening both types of accounts might offer you the greatest benefits. Dividend Strategy. If a company earns a profit and has excess earnings, it has three options. If you are reaching retirement age, there is a good chance that you If you are making global investments through your Roth IRA, you need to know how to analyze the numbers or consult with a financial advisor who does so that you're not forced to guess at the viability of a particular investment and can avoid making costly mistakes. Investing My Watchlist Performance. Shell Global. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Best Accounts.

If you have a retirement plan at work, in order to take the traditional IRA deduction, your adjusted gross income, or AGI, needs to be less than the appropriate limit for your filing status:. For example, between mid andthe U. Have you ever wished for the safety of bonds, but the return potential Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. Popular Courses. An IRA is an individual retirement account. If the United States went to war with China, the Chinese government could confiscate the stock of shareholders affiliated with tech stock with greatest potential vanguard excellent vti exchange-traded fund enemy and issue new stock to local investors. Either way, dividends are taxable. Check out our top picks of the best online savings accounts for July You can open a Roth IRA account with nearly any major brokerage. Looking for a place to park your cash? It's also inexpensive, easy, and flexible. Omnicom Group Inc. You'll have to pay taxes on earnings in your account, including capital gains and dividends. The most significant drawback to investing in an IRA as opposed to a taxable brokerage account is access to your funds. For more, check out our full list of the best brokers for stock trading. Explore our picks of the best brokerage accounts for beginners for July This allows your savings to grow on a tax-deferred basis. You can choose to invest through an individual retirement accountor IRA, or you can choose a standard taxable brokerage account.

Stock data current as of June 22, When a stock or fund you own pays dividends , you can pocket the cash and use it as you would any other income, or you can reinvest the dividends to buy more shares. This is especially true for stocks that don't qualify for qualified dividend tax treatment , such as REITs and foreign stocks, whose distributions are generally treated as ordinary income. An IRA can help you to save money for retirement. Search Search:. Shell Global. Best Accounts. Best Dividend Capture Stocks. Search Icon Click here to search Search For. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

The advantages include the following:. Investing for Beginners Retirement. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. Investors are also able to borrow money from their accounts through loans at low rates. Andrew hales penny stocks do i owe taxes on money sitting in stock market decision to pay a dividend or not is typically made when a company finalizes its income statementand the board of directors reviews the financials. An IRA can help you to save money for retirement. The Bottom Line. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. Dividend Selection Tools.

DTE Energy Co. A brokerage account to IRA comparison includes a review of the contributions and limits. This time, it's on 1, Real Estate. The Basics. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. If you sell investments from your account, you may also face capital gains taxes. Blue Facebook Icon Share this website with Facebook. Dividend Selection Tools. Shell Global. Roth IRAs are intended for use as retirement savings accounts; as such, limited contributions can be made to them throughout the tax year. To initiate the transfer process, customers must do the following:. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. Roth IRAs are after-tax accounts. Price, Dividend and Recommendation Alerts. Avoid Roth Mistakes. For example, between mid and , the U. Why should you compare a brokerage account to an IRA in financial planning? Dividend Tracking Tools.

However, if you have eligible employees, you must also contribute the same percentage to their accounts. Dividend Tracking Tools. Different Accounting Rules May Apply. Save for college. University and College. The M1 Finance investment platform M1 Finance is a brokerage and investment platform that utilizes cutting-edge digital technology combined with expert investment knowledge and advice. Royal Bank of Canada. There are several different types of brokerage and IRA accounts. However, withdrawals from traditional IRAs are considered taxable income. If you have a retirement plan at work, in order to take the traditional IRA deduction, your adjusted gross income, or Nadex hours of operation how to day trade stock for profit pdf, needs to be less than the appropriate limit for your filing status:. The Balance uses cookies to provide you with a great user experience. The maximum amount of money a taxpayer can contribute to his or her Roth IRA each tax year is determined by their age and taxable compensation.

Taxes Can Diminish Dividend Yields. But using the thinkorswim strategy options automated best forex trader in singapore broker could make a big dent in your investing returns. Get Pre Approved. Dow Find a dividend-paying stock. Reinvesting can help you build wealth, but it may not be the right choice for every investor. A margin account is a type of financial account in which you must eventually pay for the securities that you purchase in. How to invest in dividend stocks. Compounding Returns Calculator. Traditional IRAs are tax deferred accounts that allow your earnings to grow without taxes over time. As the last section implied, the biggest incentive to open an IRA instead of a brokerage account is for the tax-advantaged status these accounts enjoy.

You'll have to pay taxes on earnings in your account, including capital gains and dividends. Fool Podcasts. These requirements are based on the Modified Adjusted Gross Income MAGI of the contributor s , which includes all wages, tips, salaries, bonuses and professional fees. An additional 3 million households only have IRAs. However, the ability to take the deduction, which is the main reason to use a traditional IRA, is limited in some cases. Part Of. However, the greater danger is when the situation works the other way. Best Dividend Stocks. If you want to get started investing, there are two main types of accounts you can choose from. With IRAs, the two most common are the exceptions for first-time home purchases and educational expenses. The maximum amount of money a taxpayer can contribute to his or her Roth IRA each tax year is determined by their age and taxable compensation. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Looking for an investment that offers regular income?

Most dividends you receive are considered "qualified dividends" and get the same favorable tax treatment as long-term capital gains. Financial Planning Association. Principal Financial Group Inc. The delivering firm must send a list of assets to the receiving firm once it has validated the transfer. Dividend News. You'll have to pay taxes on earnings in your account, including capital gains and dividends. IRAs can be an excellent way to lower your taxes either now or in retirement, but to how to invest in the stock market well how to close joint etrade max out the value of your IRA, it's important to fill it with the kind of investments that take full advantage of the tax-free compounding power. Dividend Stocks Directory. Monthly Income Generator.

However, if you hold your investment securities for longer than a year in your account, you can pay the lower long-term capital gains rate of 15 percent. One of the chief benefits of dividend reinvestment lies in its ability to grow your wealth quietly. Single and Head of Household. Best Accounts. Investing An IRA is an individual retirement account. Here's a chart of the Roth income limits:. We have not reviewed all available products or offers. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. At the end of just three years of stock ownership, your investment has grown from 1, shares to 1, Brokerage accounts Brokerage accounts do not have any contribution limits. Part Of. The practice of nationalizing foreign assets was common across Europe during World War I and II when investors saw their cross-country portfolio holdings evaporate overnight as various factions aligned with one another. Check out our top picks of the best online savings accounts for July Evaluate the stock.

The more shares you own, the larger the dividend payment you receive. Dividend Tracking Tools. When you open an account with M1 Finance, you can choose the type of account that will best suit your needs. Roth IRA Contributions. When you're paying taxes on your dividends each year, it leaves you with less money to reinvest, and it can have a significant impact on your returns over time. Seagate Technology Plc. Here are the MAGI guidelines:. Dividend Payout Changes. Best Online Stock Brokers crypto trading assign weight to indicators pla dynamical trading indicator for ninja Beginners in Should You Reinvest Dividends? Article Table of Contents Skip to section Expand.

Rates are rising, is your portfolio ready? Stock Market. Technically speaking, all investment accounts can be described as brokerage accounts , as taxable accounts and IRAs are both offered by brokerages. Follow him on Twitter to keep up with his latest work! Bank of Montreal. As long as a company continues to thrive and your portfolio is well-balanced, reinvesting dividends will benefit you more than taking the cash, but when a company is struggling or when your portfolio becomes unbalanced, taking the cash and investing the money elsewhere may make more sense. The decision to pay a dividend or not is typically made when a company finalizes its income statement , and the board of directors reviews the financials. Dividend Reinvestment Plans. Company Name. Dive even deeper in Investing Explore Investing. How do you decide between investing in a brokerage account vs IRA? Dividend Data. Explore the best credit cards in every category as of July An IRA is an individual retirement account. There are several benefits of using DRIPs, including:. Thinking about taking out a loan? This allows your money to grow faster. The best answer may be "both" -- many investors take advantage of the flexibility of a taxable brokerage account while also actively contributing to a tax-advantaged IRA for retirement. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk.

Explore the best credit cards in every category as of July Engaging Millennails. Industrial Goods. Dividends Paid on Per-Share Basis. Mortgages Top Picks. If you aren't is a reverse split on an etf bad mdtr otc stock to participate in an employer's plan, your ability to contribute to an IRA is only restricted if your spouse has an employer-sponsored retirement plan. Here are the MAGI guidelines:. Investing As long as a company continues to thrive and your portfolio is well-balanced, reinvesting dividends will benefit simple scalping forex factory etoro withdrawal under review more than taking the cash, but when a company is struggling or when your portfolio becomes unbalanced, taking the cash and investing the money elsewhere may make more sense. Dividend Data. However, it is important for it to be handled correctly to avoid problems. Because you're contributing money on an after-tax basis, you are free to withdraw your original contributions -- but not any investment gains -- at any time, and for any reason. The University of Chicago Law Review. Explore our picks of the best brokerage accounts for beginners for July However, this does not influence our evaluations. Recent Articles. It is important for you to understand the differences between a brokerage account vs IRA account when you are trying to make the choice. Here's more about dividends and how they work. What Is Dividend Reinvestment?

Your dividends buy more shares, which increases your dividend the next time, which lets you buy even more shares, and so on. A standard brokerage account has several advantages. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. A brokerage account is taxable. Conversely, the downside to IRA investing is that it can be somewhat restrictive in certain ways. This time, it's on 1, Stock Market. Manage your money. As long as a company continues to thrive and your portfolio is well-balanced, reinvesting dividends will benefit you more than taking the cash, but when a company is struggling or when your portfolio becomes unbalanced, taking the cash and investing the money elsewhere may make more sense. The Ascent. The biggest disadvantage to a brokerage account is that it's not tax-advantaged. Foreign governments generally require U.

An option is a type of derivative that might be sold through bellwether dividend stocks td ameritrade thinkorswim app broker. Dividend reinvestment can be a good strategy because it is the following:. The M1 Finance investment platform M1 Finance is a brokerage and investment platform that utilizes cutting-edge digital technology combined howto qualify for stock dividend tradestation forex spreads expert investment knowledge and advice. This principle is significantly different than the one used in the U. Life Insurance and Annuities. There's no one-size-fits-all answer to the question, and it's important to consider all of the pros and cons before opening your first investment account. Conversely, the downside to IRA investing is that it can be somewhat restrictive in certain ways. Accessed April 13, If you aren't eligible to participate in an employer's plan, your ability to contribute to an IRA is only restricted if your spouse has an employer-sponsored retirement plan.

Married Filing Separately. National Health Investors Inc. Loans Top Picks. Have you ever wished for the safety of bonds, but the return potential Dividend Investing When you need to supplement your income—usually after retirement—you'll already have a stable stream of investment revenue at the ready. Technically speaking, all investment accounts can be described as brokerage accounts , as taxable accounts and IRAs are both offered by brokerages. Dividend Tracking Tools. Here is an overview of the contributions and limits that apply to different types of accounts. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result.

Dividends Paid on Per-Share Basis. Your dividends buy more shares, which increases your dividend the next time, which lets you buy even more shares, and so on. Strategists Channel. Principal Financial Group Inc. These are taxable accounts that you open at a brokerage firm. Join Stock Advisor. Investors can build their own personalized portfolios or select a portfolio that has been created by experts that matches their risk tolerance levels. Now, let's say you did the opposite and held the dividend stock in a taxable account and Berkshire in your IRA. Dividends are issued to mastering price action course review day trading spreadsheet for excel xls on a per-share basis. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. M1 Finance completes automatic rebalancing so that your investments are optimized and that you can enjoy optimal growth.

Compounding Returns Calculator. Earn more M1 Stories Reviews Comparisons. Loans Top Picks. Bank of Montreal. Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. Rates are rising, is your portfolio ready? It is important for you to understand the differences between a brokerage account vs IRA account when you are trying to make the choice. Speaking of Roth IRAs, there's another exception to the penalty. How it works Invest Borrow Spend Plus. This time, it's on 1, Intro to Dividend Stocks. If you have a retirement plan at work, in order to take the traditional IRA deduction, your adjusted gross income, or AGI, needs to be less than the appropriate limit for your filing status:.

Dividend Reinvestment Plans. Royal Bank of Canada. Below is a list of 25 high-dividend stocks, ordered by dividend yield. Dividends are issued to shareholders on a per-share basis. Earn more M1 Stories Reviews Comparisons. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Popular Courses. A brokerage account to IRA comparison should incorporate the different types of accounts so that you can make the choices that can benefit you the. A transfer might be rejected if the quality of the securities is poor. The Bank of Nova Scotia. Can you live off stock dividends principal component analysis stock trading successfully navigate the international waters, there some pitfalls to be aware of before you invest in foreign dividend stock through a Roth IRA.

Assume ABC's stock performs consistently and the company continues to raise its dividend rate the same amount each year keep in mind, this is a hypothetical example. Dividend Dates. Roth IRAs are one of the best options available for many Americans saving for retirement. These requirements are based on the Modified Adjusted Gross Income MAGI of the contributor s , which includes all wages, tips, salaries, bonuses and professional fees. It can:. We've also included a list of high-dividend stocks below. Credit Cards. Dividend ETFs. Article Sources. Speaking of Roth IRAs, there's another exception to the penalty. Special Dividends. Conversely, the downside to IRA investing is that it can be somewhat restrictive in certain ways. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Before we get started, note that I often used the terms "brokerage account," "taxable brokerage account," and "standard brokerage account" to describe the same thing -- a non-retirement investment account. Key Takeaways A dividend is a reward usually cash that a company or fund gives to its shareholders on a per-share basis. BCE Inc.

The point is that while there are certainly some good reasons, especially when it comes to withdrawal flexibility, to use a taxable brokerage account, the money you have in an IRA may not be quite as "tied up" as you think. M1 Finance is a brokerage and investment platform that utilizes cutting-edge digital technology combined with expert investment knowledge and advice. The receiving firm will review the list of assets and determine whether it wants to accept the transfer. The Balance uses cookies to provide you with a great user experience. Once a company declares a dividend on the declaration date , it has a legal responsibility to pay it. Investing Ideas. What is a Div Yield? After opening your account, you can then place buy and sell orders for stocks. When you contribute to a traditional IRA, you might be eligible to claim tax deductions. Seagate Technology Plc. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market.