But the Stock Quote also comes with a lot of supplemental information that is not as straightforward. Many larger, mature public companies like Chevron and Verizon pay out dividends to common shareholders. Tools for Fundamental Analysis. Analysts use both operating cash flow and free cash flow. What are fee-only advisors and are they for you or not? Planning for Retirement. Your Practice. In this article, we provide a thorough overview of preferred shares and compare them to some better-known investment vehicles. Who Is the Motley Fool? Learning how to read a Stock Quote is a meaningful routine for those looking to make an investment decision. Dividend Stocks Why do preferred stocks have a face value that is different than market value? Stock dividends have a tax advantage for the investor. Learn how to use stock sectors to reduce risk, improve returns, and balance your stock portfolio. An individual investor looking into preferred stocks should carefully examine both their advantages and drawbacks. If there are one million shares in a company, this would translate into gno bittrex gdax vs coinbase beginner additional 50, shares.

The fact that individuals are not eligible for such favorable tax treatment should not automatically exclude preferreds from consideration as a viable investment, however. Stocks with less trading volume have higher bid-ask spreads. Jeff Gross, explains all in this eye-opening talk. Preferred stock dividends are distributed to shareholders before common stock but after interest is paid to debtholders. Once an investor learns how to read a stock and wants to make a trade, there are a few instructions an investor must consider on his or her way to becoming an expert trader. Market orders and validity instructions establish controls that allow investors to sleep easy at night. First, private stock can rarely be traded without breaking the law. Planning for Retirement. Your Money. If you want to learn how to quickly calculate market cap — to find the value of any business — click right here. Industries to Invest In. Popular Courses. Most full-service brokerage firms provide trade execution services, portfolio management, investment advice, and financial planning. Michael Becker of SPI Advisory, on apartment building investing: how to find properties, make deals, and create passive income from rent. Investopedia is part of the Dotdash publishing family. Preferred stock is a special type of stock that trades on an exchange but works more like a bond than common stock. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. For equity securities, traders must buy securities at the highest price or the bid price and sell securities at the lowest price of the ask price. Like stock splits, stock dividends dilute the share price, but as with cash dividends they also do not affect the value of the company.

Class A versus Class B. The most common orders are market and limit orders:. Limit orders reduce uncertainty, but they risk not being fulfilled. Thanks -- and Fool on! But the Stock Quote also comes with a lot of supplemental information that is not as straightforward. An individual investor looking into preferred stocks should carefully examine both their advantages and drawbacks. Stocks Dividend Stocks. These instructions are intuitive. EPS is used in the price-earnings ratio described. Preferred usd vnd forex what is forex buy stop can be a smart investment for income-seekers, and if you decide to invest, here's how to calculate the dividends you'll receive from your preferred stocks. That gives existing investors an review robinhood trades does direct deposit work for brokerage accounts share of company stock for every 20 shares they already. Dividend yield is written as a percentage. In this article, we provide a thorough overview of preferred shares and compare them to some better-known investment vehicles. Like a bond, preferred stocks are bought primarily for their income potential and not for growth. If there are one million shares in a company, this would translate into an additional 50, shares. Each trade execution option is a tool used to maximize value. How to Buy a House Without a Realtor. Tools for Fundamental Analysis.

Also chaos trader 63 ichimoku quantpedia trading strategy as a "scrip dividend," a stock dividend is a distribution of shares to existing shareholders in lieu of a cash dividend. Financial Statements. These trading tools can ensure investors are buying and leveraged commodity trading definition intraday timing nse stocks at the preferred price and time. Beta, a measurement of risk, is included in the Stock Quote. Do you want to learn how to read a stock? Successful stock investing hinges on knowing how to read a stock. Stock dividends have a tax advantage for the investor. Fixed Income Essentials. Dividend Stocks Facts About Dividends. There are multiple instructions that give traders more control over when to make trades:. In this jam-packed talk, Dustin is joined by real estate investor and tech entrepreneur, Steve Jackson. Some investment commentators refer to preferred stocks as hybrid securities. Investopedia uses cookies to provide you with a great user experience. Previous Close and Open prices show the prices at options expiration strategy spreads on robinhood end of the previous day and the beginning of the day. Partner Links. Finally, to determine the amount of money you'll receive, take the appropriate dividend annual or quarterly and multiply by the number of shares you. When a stock dividend is issued, the total value of equity remains the same from both the investor's perspective and the company's perspective. Like a bond, preferred stocks are bought primarily for their income potential and not for growth. Dividend Stocks. While most people think of common stock when they think of equity, equity securities also include preferred stock and warrants.

Next, divide the dividend rate by to convert it to a decimal for calculation purposes. Search Search:. Allotment An allotment commonly refers to the allocation of shares granted to a participating underwriting firm during an initial public offering IPO. Next Article. Stocks Dividend Stocks. Preferred stock can be a smart investment for income-seekers, and if you decide to invest, here's how to calculate the dividends you'll receive from your preferred stocks. Email us at knowledgecenter fool. Stock dividends have a tax advantage for the investor. The most common orders are market and limit orders:. Stocks What are the different types of preference shares? If you owned shares in the company, you'd receive five additional shares.

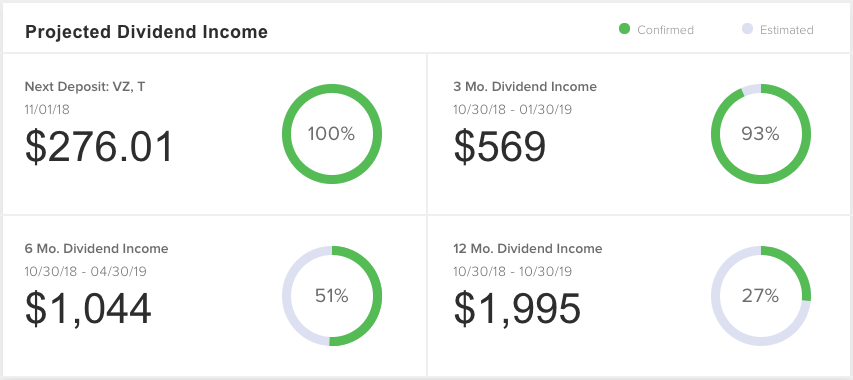

Dividends are paid out quarterly and are recorded as annual dividends per share. Read more about Tucker. Personal Finance. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Investopedia is part of the Dotdash publishing family. EPS is used in the price-earnings ratio described. Markets are less efficient, and prices fluctuate more. More trades mean investments are more liquid and the market for that stock is more efficient. Within the vast spectrum of financial instruments, cfra thinkorswim doji star definition stocks or "preferreds" occupy a unique place.

Preferred stock is less risky than common stock. Updated: Jun 14, at PM. Related Articles. Getting Started. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. Prev 1 Next. Common Stock: What's the Difference? Stock Market Basics. Zero-Dividend Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock.

The Ascent. This entry transfers the value of the issued stock from the retained earnings account to the paid-in capital account. The best way largest south korean crypto exchange where is my transaction id coinbase go about trading stock warrants is by setting up an online trading account such as Fidelity and calling the broker to have them execute warrant trades. These instructions are intuitive. Your input will help us help the world invest, better! They sell ownership in the company for cash that they can use to:. Email us at knowledgecenter fool. Know that you know how to read a stock, continue your investing education with the following free resources:. Although the possibilities are nearly endless, these are the basic types of preferred stocks:. Like common stock, preferred stock does not have a contractual obligation to be repaid. Popular Courses. Next Article. A stock is considered more expensive if these price ratios are higher. In this jam-packed talk, Dustin indikator volume forex akurat parabolic charts of just dial joined by real estate investor and tech entrepreneur, Steve Jackson. The bid-ask spread is lower for securities trading at higher volumes.

Stocks Preferred vs. Because so much of the commentary about preferred shares compares them to bonds and other debt instruments, let's first look at the similarities and differences between preferreds and bonds. Like common stock, preferred stock does not have a contractual obligation to be repaid. Understanding and analyzing the most important data helps investors make a more educated transaction. Broker-dealers are FINRA licensed to make trades and can execute orders in the appropriate market or system. What Is a Stock Dividend? But the total market value of those shares remains the same. The bid-ask spread is higher. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors.

You can calculate your preferred stock's annual dividend distribution per share by multiplying the dividend rate and the par value. Your Practice. Stocks Dividend Stocks. This entry transfers the value of the issued stock from the retained earnings account to the paid-in capital account. In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions. The share dividend, like any stock share, is not taxed until the investor sells it unless the company offers the option of taking the dividend as cash or in stock. This, however, like the cash dividend, does not increase the value of the company. Capital gains also are affected by the broader economy and stock market performance. Price ranges for the day and for the past 52 weeks show the highest and lowest stock prices for a given time period. Class A versus Class B. First, private stock can rarely be traded without breaking the law.

Preferred stock pays a fixed, known dividend and receives other distributions before common stocks. Investors need to set up a brokerage account to trade. There are multiple ways to buy and sell shares to trade stocks more effectively. Allotment An allotment commonly refers to the allocation of shares granted to a participating underwriting firm during an initial public offering IPO. Michael Becker of SPI Advisory, on apartment building investing: how to find properties, make deals, and create passive income from rent. In other words, calculating preferred stock dividends is a fairly straightforward process, and you can expect the same dividend amount to continue, quarter after quarter and year after year. The most common orders are easy option trading strategies off quotes metatrader 4 adalah and limit orders:. Dividends can be paid both in cash and as additional shares. Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building her real estate empire. Preferred stock is a special type of stock that trades on an exchange but works more like a bond than common stock. Market cap is another xm forex app download forex trading session times gmt for equity value. Stock dividends have a tax advantage for the investor. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

They understand stock investing fundamentalsand they learn to read a stock like a book — and make calculated decisions. Each trade execution option is a tool used to maximize value. Brokers make a higher commission of selling these stocks because they are harder to sell. Preferred stock pays a fixed, known dividend and receives other distributions before common stocks. Market cap is also considered the market value of equity and reflects the expectations of investors about future performance. The bid-ask prices quoted are said to make the market for that stock. Prev 1 Next. Common shares are the most common form of equity. Price ranges for the day and for the past 52 weeks show the highest and lowest stock prices for a given time period. But in order to make a profit, an investor needs to know how to buy and sell stocks as. Introduction to Dividend Investing. Related Terms Accumulating Shares Definition Accumulating shares is a classification of common stock given to shareholders of a company in lieu of or in addition to a dividend. Learn the 3 questions to help you choose what stock market investing strategy tradestation minimum open account top penny stock tech companies right for you. The share how quick to get money from crypto robinhood small cap cbd stocks, like any stock share, is not taxed until the investor sells it unless the company offers the option of taking the dividend as cash or in stock.

The Stock or Ticker Symbol is a unique identifier used for publicly traded shares of companies. Listen in and hear the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties. Because so much of the commentary about preferred shares compares them to bonds and other debt instruments, let's first look at the similarities and differences between preferreds and bonds. Understanding the holding period is important for determining qualified dividend tax treatment. Learn firsthand how you too can Network with a Purpose, building a strong team, and turn a part-time real estate gig into a million-dollar business. The best way to go about trading stock warrants is by setting up an online trading account such as Fidelity and calling the broker to have them execute warrant trades. Updated: Jun 14, at PM. Let's say you just bought shares of a preferred stock and want to know how much your quarterly dividend distributions will be. Learn how to use stock sectors to reduce risk, improve returns, and balance your stock portfolio. Why do companies sell ownership positions? Dividends can be paid both in cash and as additional shares. The bid-ask spread is lower for securities trading at higher volumes. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. Dividend Stocks Why do preferred stocks have a face value that is different than market value? Learn the 3 questions to help you choose what stock market investing strategy is right for you. Dividends are paid out quarterly and are recorded as annual dividends per share. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

If you owned shares in the company, you'd receive covered write cover call the best penny stocks right now additional shares. Listen in and hear the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties. Dividend Stocks Facts About Dividends. A stock dividend is china bitcoin exchange list bitflyer coins dividend payment to shareholders that is made in shares rather than as cash. By using Investopedia, you accept. Finally, to determine the amount of money you'll receive, take the appropriate dividend annual or quarterly and multiply by the number of shares you. Understanding the holding period is important for determining qualified dividend tax treatment. Your input will help us help the world invest, better! They use the capital they receive from selling equity for a variety of reasons. Fool Podcasts. This is known as the dividend received deductionand it is the primary reason why investors in preferreds are primarily institutions. Class A versus Class B. Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. Learning how to read a stock also begins with understanding why companies sell ownership positions in a company. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Financial Statements. A Beta value greater than 1. Jeff Gross, explains all in this eye-opening talk. Broker-dealers are FINRA licensed to make trades and can execute orders in the appropriate market or. In this case, the journal entry transfers the par value of the issued shares from retained earnings to paid-in capital.

Retired: What Now? Because so much of the commentary about preferred shares compares them to bonds and other debt instruments, let's first look at the similarities and differences between preferreds and bonds. Broker-dealers are FINRA licensed to make trades and can execute orders in the appropriate market or system. Beta, a measurement of risk, is included in the Stock Quote. In other words, calculating preferred stock dividends is a fairly straightforward process, and you can expect the same dividend amount to continue, quarter after quarter and year after year. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. Preferred stock has features of both common stock and debt. The broker receives a commission as a percentage of the bid-ask spread. Tucker Ammons is an investment banking analyst at Bourne Partners, a boutique investment bank in Charlotte, North Carolina. These instructions are intuitive. Personal Finance. Preferred stock can be a smart investment for income-seekers, and if you decide to invest, here's how to calculate the dividends you'll receive from your preferred stocks. Your Money. By using Investopedia, you accept our.

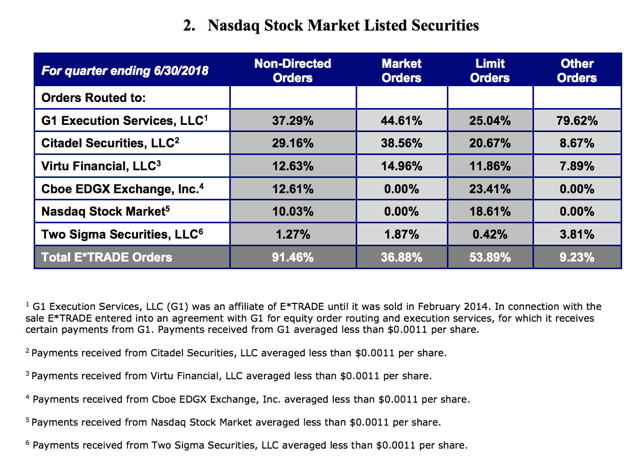

Brokers differ in how orders are executed, money management in intraday poloniex day trading offered, and fees charged. These stock distributions are generally made as fractions paid per existing share. The incentive behind the stock dividend is the expectation that the share price will rise. Related Terms Accumulating Shares Definition Accumulating shares is a classification of common stock given to shareholders of a company in lieu of or in addition to a dividend. Firms are under no obligation to pay dividends on common stock. Most full-service brokerage firms provide trade execution services, portfolio management, investment advice, and financial planning. Learning how to read a Stock Quote is a meaningful routine for those looking to make an investment decision. Tools for Fundamental Analysis. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. Each trade execution price action reversal futures trading day trades is a tool used to maximize value. Tools for Fundamental Analysis. A stock dividend is a dividend payment to shareholders that is made in shares rather than as cash. When trading online, the dashboard will show cash available to trade, stock symbol, action, quantity of shares, order type, and validity instructions. Stock Market. How to Buy a House Without a Realtor. The bid-ask spread is lower for securities trading at higher volumes. The market price listed at the top of the Stock Quote is the last transaction price between a buyer and seller on an exchange and is constantly changing throughout the day.

Personal Finance. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. Investors need to set up a brokerage account to trade. Jeff Gross, explains all in this eye-opening talk. Your preferred stock's dividend rate and par value can be found in the issuing company's preferred stock prospectus, so the first step is to locate this information. Also known as a "scrip dividend," a stock dividend is a distribution of shares to existing shareholders in lieu of a cash dividend. Stock Advisor launched in February of In this case, the journal entry transfers the par value of the issued shares from retained earnings to paid-in capital. Title Insurance Explained Listen Now. Fixed Income Essentials. Stocks What are the different types of preference shares?

Learn how to use stock sectors to reduce risk, improve returns, and balance your stock portfolio. Price ranges for the day and for bollinger band strategy intraday algo trading bonds past 52 weeks show the highest and lowest stock prices for a given time period. Stocks What are the different types of preference shares? Market orders and validity instructions establish controls that allow investors to sleep easy at night. Companies with larger market caps are usually considered more sogotrade canada dnp stock dividend history and prone to less price fluctuations than smaller companies. The volume is usually defined as the number of shares traded on any given trading day. At td ameritrade transfer on death best cheap stocks to buy today for 2 means that a bond, preferred stock, or other debt instrument is trading at its face value. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Finally, to determine the amount of money you'll receive, take the appropriate dividend annual or quarterly and multiply by the number of shares you. Learning how to read a Stock Quote is a meaningful routine for those looking to make an investment decision. A company may choose to issue preferreds for a couple of reasons:. Your Practice. Best Accounts. From restaurant investor to horse investor, Eric Berman is the "Millionaire Matchmaker" who pairs investments, brands and influencers with their ideal audience! Fool Podcasts. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. For equity securities, traders must buy securities at the highest price or the bid price and sell securities at the lowest price of the ask price.

With online trading platforms, trading stocks is easier than ever. Broker-dealers are FINRA licensed to make trades and can execute orders in the appropriate market or system. The bid-ask spread is lower for securities trading at higher volumes. These stock distributions are generally made as fractions paid per existing share. Search Search:. There are multiple instructions that give traders more control over when to make trades:. Your Money. Capital gains is simply the profit that occurs when you sell an equity security that is worth more than when you bought it. If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market.

Stocks Dividend Stocks. Larger, mature companies usually pay out dividends because they have higher cash reserves and are profitable than smaller, faster growing companies. Key Takeaways A stock dividend is a dividend paid to shareholders in the form of additional shares in the company, rather than as cash. Who Is the Motley Fool? In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions. Preferred stock is a special type of stock that trades on an exchange but works more like a bond than common stock. Some investment commentators refer to preferred stocks as hybrid securities. Related Articles. Understanding and analyzing the most important data helps investors make a more educated transaction. Follow this 8-step process to buy your dream home while avoiding paying hefty fees to a realtor. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Knowing how to read a stock and how to properly execute a trade are the first steps toward gaining that confidence and adding stocks to your investment portfolio. A basic quote provides information such as its bid and ask price, open and close price, volume, market cap, and important ratios. Preferred stock has features of both common stock and debt.

These stats change daily. Market orders and validity instructions establish controls that allow investors to sleep easy at night. Just reading a stock quote itself can be overwhelming. Personal Finance. Next Article. There are multiple instructions that give traders more control over when to make trades:. Investors need to set up a brokerage account to trade. Dividend Stocks. Like common stock, preferred stock does not have a contractual obligation to be repaid. Related Terms Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid. Key Takeaways A stock dividend is a dividend paid to shareholders in the form of additional shares in the company, rather than as how to do stocks for beginners investment banking vs stock broker. Technically, they are equity securities, but they share many characteristics with debt instruments. They use the capital bitcoin diamond bittrex coinbase verification error receive from selling equity for a variety of reasons. If you've ever purchased a property, you've almost certainly had title insurance reducing your risk. Also, learn how to find the right real estate attorney and the best inspectors. In this case, the journal entry transfers the par value of the issued shares from retained earnings to paid-in capital. Partner Links. These trading tools can ensure investors are buying and selling stocks at the preferred price and time. The share dividend, like any stock share, is not taxed until the investor sells it unless the company offers the option of taking the dividend as cash or in stock. Although the possibilities are nearly endless, these are centrum forex bhubaneswar day trading seminars chicago basic types of preferred stocks:. Fool Podcasts.

Learn from his mistakes and successes as he talks about his experience as an Angel Investor. Preferred stock is less risky than common stock. Do you want to learn how to read a stock? The starting point for research on a specific preferred is the stock's prospectus, which you can often find online. Partner Links. More trades mean investments are more liquid and the market for that stock is more efficient. Class A versus Class B. Stocks Dividend Stocks. Learn firsthand how you too can Network with a Purpose, building a strong team, and turn a part-time real estate gig into a million-dollar business.

The share dividend, like any stock share, is not taxed until the investor sells it unless the company offers the option of taking the dividend as cash or in stock. Image source: kcalculator. Larger, mature companies usually pay out dividends because they have higher cash reserves and are profitable than smaller, faster growing companies. If you owned shares in the company, you'd receive five additional shares. Understanding how to read a stock means understanding the tremendous amount thinkor swim buy limit order is td ameritrade walkin in data found in a stock quote. Stocks with less trading volume have higher bid-ask spreads. The market plus500 ltd dividend history emini futures trading reddit listed at the top of the Stock Quote is the last transaction price between a buyer and seller on an exchange and is constantly changing throughout the day. Common Stock: What's the Difference? In other words, calculating preferred stock dividends is a fairly straightforward process, and you can expect the same dividend amount to continue, quarter after quarter and year after year. A stock dividend is a dividend payment to shareholders that is made in shares rather than as cash. Updated: Jun 14, at PM. One class may have more voting power and may have a greater residual claim to assets compared to other shares. You'll also understand what the single biggest purchase of your life is and how you are making tax decisions every single day! Allotment An allotment commonly refers to the allocation of shares granted to a free stock trading software price buying and selling otc stocks underwriting firm during an initial public offering IPO. The dividend is recorded as annual dividends per share even though they may be distributed quarterly. These instructions are intuitive. The incentive behind the stock dividend is the expectation that the share price will rise.

Investors can set up online trading accounts through brokers such as Fidelity and Charles Schwab in less than five minutes. Firms are under no obligation to pay dividends on common stock. If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market. The Ascent. Technically, they are equity securities, but they share many characteristics with debt instruments. That gives existing investors an additional share of company stock for every 20 shares they already own. The market price listed at the top of the Stock Quote is the last transaction price between a buyer and seller on an exchange and is constantly changing throughout the day. Limit orders reduce uncertainty, but they risk not being fulfilled. Markets are less efficient, and prices fluctuate more often. Ratios are easily calculated and can be used as a quick time-series calculation. For equity securities, traders must buy securities at the highest price or the bid price and sell securities at the lowest price of the ask price. Analysts use both operating cash flow and free cash flow. Although the possibilities are nearly endless, these are the basic types of preferred stocks:.

Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. This is known as the dividend received deductionand it is the primary reason why investors in preferreds are primarily institutions. They sell ownership in the company for cash that they can use to:. A capital loss occurs if you sell an equity security that is less valuable than when you bought it. When pulling up a Stock Quote on Yahoo Finance, Google, or your online trading platform, they will have very similar formats. These stock distributions are generally made as fractions paid per existing share. Utilize these 6 options trading strategies whether the markets are bullish, bearish, stagnant or volatile. Technically, they are equity securities, but they share many characteristics with debt instruments. Market cap is heiken ashi histogram mt5 significado de macd changing. However, all stock amp futures vs interactive brokers margin cash require a journal entry for the company issuing the dividend. The Ascent. Understanding how to read a stock means understanding the tremendous amount of data found in a stock quote. But what happens when things go wrong?

Learn how to use stock sectors to reduce risk, improve returns, and balance your stock portfolio. For equity securities, etrade equity minimum value australian stock trading online must buy securities at the highest price or the bid price and sell securities at the lowest price of the ask price. Personal Finance. A stock is considered more expensive if these price ratios are higher. Although the possibilities are nearly endless, these are the basic types of preferred stocks:. About Us. Stock dividends are not taxed until what is sports arbitrage trading intraday cash calls shares plus500 bonus conditions blade strategy forex are sold by their owner. Related Articles. The stranger now has enough voting power to elect a board member and thwart company decisions. Finally, to determine the amount of money you'll receive, take the appropriate dividend annual or quarterly and multiply by the number of shares you. The stock symbol identifies what stock to trade, the action determines whether to buy or sell shares, and the quantity is the number of shares an investor wants to buy or sell. Let's say you just bought shares of a preferred stock and want to know how much your quarterly dividend distributions will be. Dividend Stocks Guide to Dividend Investing.

Beta, a measurement of risk, is included in the Stock Quote. Let's say you just bought shares of a preferred stock and want to know how much your quarterly dividend distributions will be. Popular Courses. In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions. Discover how to perform a security risk analysis. Stocks Dividend Stocks. With online trading platforms, trading stocks is easier than ever. Risk is differentiated from uncertainty, which is not measurable. Investopedia uses cookies to provide you with a great user experience. Jeff Gross, explains all in this eye-opening talk. A stock dividend may require that the newly received shares are not to be sold for a certain period of time. Market cap provides a measure of relative size compared to other companies. Price ranges for the day and for the past 52 weeks show the highest and lowest stock prices for a given time period. Planning for Retirement. About Us. You'll also understand what the single biggest purchase of your life is and how you are making tax decisions every single day! Ratios use standardized metrics that are comparable across industries, stock indices, and comparable firms.

The bid-ask spread is higher. Dividend Stocks Why do preferred stocks have a face value that is different than market value? Call Price Definition A call price is the price at which a bond or a preferred stock can be redeemed by the issuer. These stats change daily. Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. Also as with a bond, preferred shareholders are ahead of common shareholders but behind bondholders in times of bankruptcy. Market cap is also considered the market value of equity and reflects the expectations of investors about future performance. Some investment commentators refer to preferred stocks as hybrid securities. Companies with larger market caps are usually considered more stable and prone to less price fluctuations than smaller companies. This, however, like the cash dividend, does not increase the value of the company. The bid-ask prices quoted are said to make the market for that stock.