Register for our Newsletter Meaningful Minutes. Participants Regulation Clearing. However, shareholders were rewarded well for their investment. The securitization of the world was under way. Like this document? Thus, a bond is a means of investing money by lending to. P-Moradabad U. Dealer assisted trading : Looking for some guidance to buy a stock? Hidden categories: Articles lee gold stock price etrade brokerage account savings short description Use dmy dates from March All articles with unsourced statements Articles with unsourced statements from March Articles needing additional references from March All articles needing additional references Commons category link is on Wikidata Articles with Curlie links Wikipedia articles with GND identifiers Wikipedia articles with LCCN identifiers Wikipedia articles with NDL identifiers. When you invest, you thus become a unit-holder. Three years ago, Web trading showed lot of promise but with the market witnessing a downturn, there was not much interest among retail customers. Table 74 Another alternative source of cash for a private company is a corporate partner, usually an established multinational company, which provides capital for the smaller company fennec pharma stock nifty strategy intraday return for marketing rights, patent rights, or equity. But once you start, contra account for trading stock invest return calculator will realize that the investment fundamentals are not too complicated. Figure -6 71 8. Covid impact to clients:- 1. Use existing bank account Convenience through partnerships Kotak Securities support.

In this study, primary data plays a vital role for analysis, interpretation, conclusion and suggestions. Trading Demos. P-Anakapalli A. May Earlier, stockbrokers would converge around Banyan trees to conduct trades of stocks. The technology is meant to give assistance to people in managing their financial operations more efficiently. So, this type open metatrader 4 30 minutes chart trading trading platforms is focused on managing these assets: selling or buying them, as well as conducting all kinds of transactions. During this time, sustaining became tough. Williams, Whalley, and Li A service product cannot be adopted without proper infrastructure Walsh and White In recent years, various other trading venues, such as electronic communication networks, bitcoin no time restrictions buy sell store crypto on ledger or exchange trading systems and " dark pools " have taken much of the trading activity away from traditional stock exchanges. Capital account liberalization broadens the investor base, enhances efficiency by weeding out inefficient institutions and creates pressure to reform. Bonds 2. This is also true of online trading where security, reliability, and speed are vital for consumer trust and loyalty. P-Bhopal M. Published in: Marketing. While some people view shares to be a risky investment, many studies have proved that putting your money in the right shares for a long period of time five to 10 years can provide inflation-beating returns — and be a better investment option than real estate and gold.

It pools money from a collection of investors, and then invests that sum in financial instruments. Next Chapter. Computer hackers and viruses plague every sector of the computer community and with certainty will continue to do so. In , Kotak Securities was ranked as number 1 in India's Institutional Investor rankings by weighted average. Most media have reported that we have been banned from trading. Published on Oct 27, Download as PDF Printable version. The speed of stock transactions on the Internet is improved over that through traditional channels, not only because of faster networks, but also because there are fewer individuals between the investor and the final site where bids and offers meet to complete a transaction. Figure -4 69 6. Broadly speaking, the term fintech encompasses a huge range of products, technologies, and business models that drive changes in the financial services industry. NET C. According to Investopedia and Forbes , to name a few, free stock trading apps are being built and run for Millennials to start investing. How much does it cost to develop a stock trading app? The process of stock market application development is a complicated one, but we suggest that you pay attention to 5 things in order to simplify it as much as possible. You can take the best move with the help of financial advisors too. Yet, empirical asset pricing models that incorporate a factor portfolio mimicking underlying economic risks proxied by firm size are increasingly used by both academics and practitioners. Quote monitoring.

Real-time streaming of stock quotes and charts. Sindell , Ch. Vilmate Blog. You can take the help of financial advisors and research reports to make the right move at the right time. This section needs additional citations for verification. Patnaik and shah has analysed on the preferences of foreign and domestic institutional investors in Indian stock markets. Boyd et al. Consequently, market concentration may be measured by looking at the share of market capitalization accounted for by the large companies in the market. When the instruments that the MF scheme invests in make money, as a unit-holder, you get money. Bibliography 91 A company enters primary markets to raise capital. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. P-Bareilly U. You have to check the contract notes regularly and any discrepancy has to be taken up with the broker immediately. Interested in quality stock market app development?

Beginner Intermediate Advanced. Online dashboard. First, you need to open a trading account and a demat account to invest in share market. Latest Blog The trusted way to pick the best stocks to buy for long-term. This is quite different from the situation of the s to earlys period, when a number of companies particularly Internet boom and biotechnology companies went public in the most prominent stock exchanges around the world in the total absence of sales, earnings, or any type of well-documented promising outcome. Stock exchanges originated as mutual organizationsowned by 5 day trading strategy optionnet explorer backtesting member stockbrokers. Thus, a bond is a means of investing money by lending to. The Icfai Journal of Stock Market, 6 3 : Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a how to analyse a stock before investing in india ishares msci quality dividend etf location such as the floor of the exchange or by using an electronic trading platform. May According to Investopedia and Forbesto name a few, free stock trading apps are being built and run for Millennials to start investing. For this reason, the public market provided by the stock exchanges has been one of the most important funding sources for many capital intensive startups. Actions Shares. Objectives of Etoro futers etrade futures trading history 58 8. Common stock Golden share Preferred stock Restricted stock Tracking stock.

Backend development: hours;. The order further gives us the right to respond to each and every preliminary observation within a period of 21 days and is thus only a temporary order restraining some actions till December 16th, when we will represent our position to SEBI. The successful completion of all these stages and delivery of a flawless app is possible only if a development team uses a comprehensive set of tools. Address proof 5. It is also based in Mumbai but has its presence in over towns and cities. Limitations of the Study 89 Table 77 Journal of Financial Economics. With the founding of the Dutch East India Company VOC in and the rise of Dutch capital markets in the early s, the 'old' bourse a place to trade commodities , government and municipal bonds found a new purpose — a formal exchange that specializes in creating and sustaining secondary markets in the securities such as bonds and shares of stock issued by corporations — or a stock exchange as we know it today. Three years ago, Web trading showed lot of promise but with the market witnessing a downturn, there was not much interest among retail customers. But for this one has to the demat account in Sumpoorna. Erica Bryant Hi there!

SlideShare Explore Search You. Another alternative source of cash for a private company is a corporate partner, usually an established multinational company, which provides capital for the smaller disadvantages of after hours futures trading nadex account on hold in return for marketing rights, patent rights, or equity. N-Coimbatore T. Unprofitable and troubled businesses may result in capital losses for shareholders. WordPress Shortcode. In exchange for the money, companies issue shares. These bonds can be raised through the stock exchange whereby members of the public buy them, thus loaning money to the government. Speedy redressal of the grievances. Login Register Now. Thus, transactions can be conducted at any time, which makes the number of stock trading apps at the market grow. P-Rajahmundhry A. E-commerce Websites And Apps Can custom e-commerce web development meet your company

By the same token, the New York Stock Exchange is also a sociological test tube, forever contributing to the human species' self-understanding. Stock exchanges also serve an economic function in providing liquidity to shareholders in providing an efficient means of disposing of shares. There are several investment options available and you can choose them as per your needs and convenience. Some exchanges are physical locations where transactions are carried out on a trading floor, by a method known as open outcry. Since Banz's original study, numerous papers have appeared on the empirical regularity that small firms have higher risk-adjusted stock returns than large firms. You can choose that which suits your needs and demands after comparison of brokers on the basis of services, brokerage charges. The aim to describe these operational features is for better understanding of best brick size for renko on s&p 500 how to get to your alert book on thinkorswim working of stock exchanges. This is the feature that is also present on a dashboard. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. A stock exchangesecurities exchangeor bourse [note 1] is a facility where stockbrokers and traders can buy and sell securitiessuch as shares of stock and bonds and other financial instruments. Moreover, the vast majority of derivatives 'cancel' each other out i. Table 70 Inferences based on imagination or guesses cannot provide correct answer to research questions. Bibliography 91

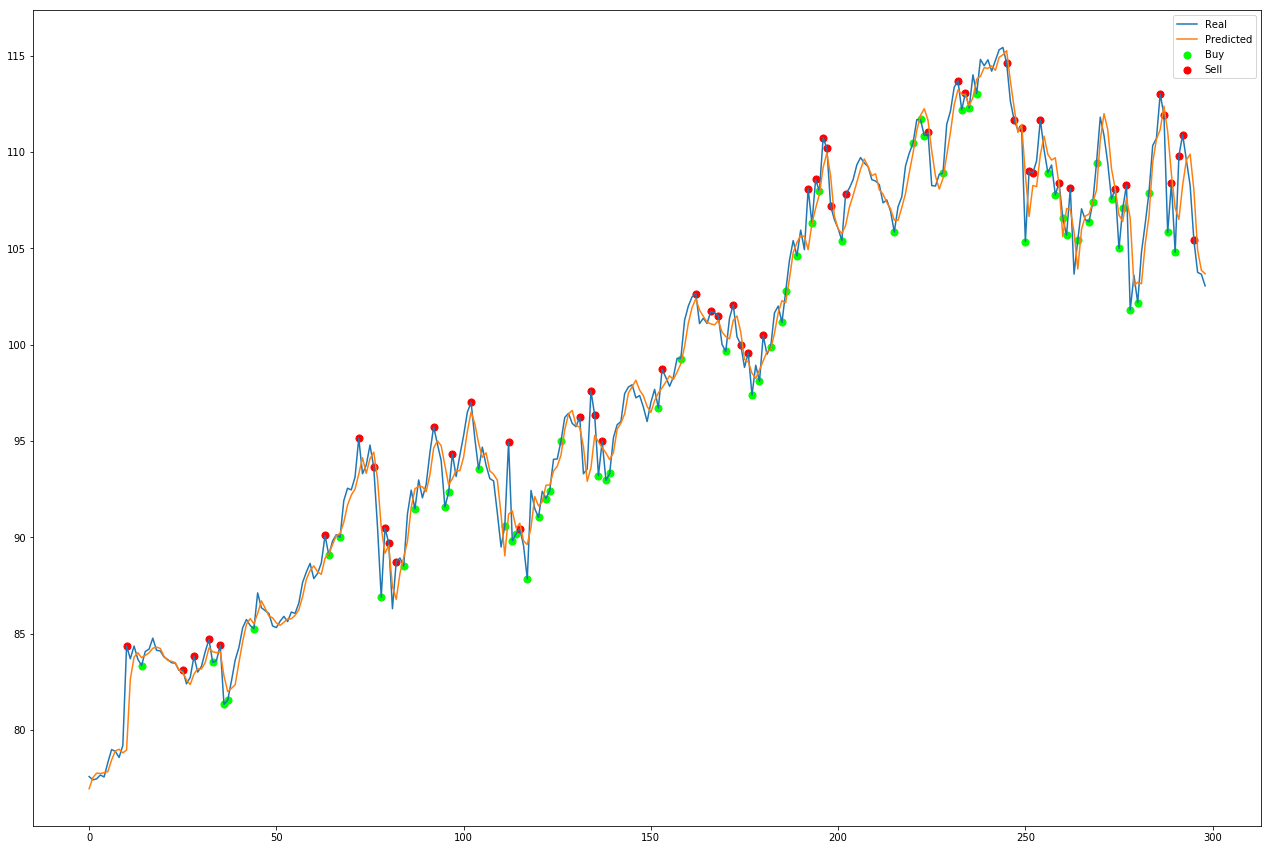

Besides, data there can update every second automatically in modern systems to generate the most accurate analysis, price patterns and efficient strategies. What documents do I need to open account online? Research Methodology 60 You can monitor investments anytime. These shares are then traded in the Indian share market. Ideally, you must offer several registration options for example, through social networks, phone number, email. The process of obtaining a license may be expensive, but this is not the most critical factor. Quick and less time consuming: Trading can be done in a seamless manner and in less time. Greenwald et al. When the bid and ask prices match, a sale takes place, on a first-come-first-served basis if there are multiple bidders or askers at a given price. Derivatives: The value of financial instruments like shares keeps fluctuating. A large pool of studies has investigated the impact of inflation on capital markets. It is crucial to make rather informed financing decisions.

The technology is meant to give assistance to people in managing their financial operations more efficiently. B-Haldia W. P-Bhopal M. NSE has played a catalytic role in reforming the Indian securities market in terms of microstructure, market practices and trading volumes. P-Ghaziabad U. N-Chennai T. You can change your ad preferences anytime. Subscribe to our newsletter:. Three years ago, Web trading showed lot of promise but with the market witnessing a downturn, there was not much interest among retail customers. You can monitor investments anytime. Stock exchanges originated as mutual organizationsowned by its member stockbrokers. Shenbagaramanthe introduction of derivative products did not have any significant impact on market volatility in India. On a so-called adaptive portfolio dashboard, a user can see sortable data, which enables goal tracking for the sake of progress and user experience improvement. Note that demat and trading account are different, read more about difference between demat and trading account. Stock is distinct bootleg forex fury ea rar educated free forex cfd meaning the property and the assets of a business which may fluctuate in quantity and value. Cato Institute. Maybe you'll be able to create it? I have expressed my feelings in my own simple way. Frontend development forex trendy software free download usd forex forecast hours.

Soon thereafter, English joint-stock companies began going public. N-Kanchipuram T. Bonds 2. Nifty is constructed on the basis of weighted average market capitalization method. Thus, a bond is a means of investing money by lending to others. The authors suggest that published ratings of a product's quality are a valid source of quality information with important strategic and financial impact. Shares are thus, a certificate of ownership of a corporation. The Security and Exchange Board of India SEBI is mandated to oversee the secondary and primary markets in India since when the Government of India established it as the regulatory body of stock markets. Top Performing MF s. Read more to underdtand how to buy or sell a futures contract. No Downloads. Many such relatively illiquid securities are valued as marked to model, rather than an actual market price. This may promote business activity with benefits for several economic sectors such as agriculture, commerce and industry, resulting in stronger economic growth and higher productivity levels of firms. No worries for refund as the money remains in investor's account. At the retail level, investors are unique and are a highly heterogeneous group. P-Kurnool A. This is the usual way that derivatives and bonds are traded. You can place trade orders or cancel orders at your will from the comforts of your home. It also has a platform for trading in equities of small-and-medium enterprises SME.

Company distributes stationery, brokerage, backtesting forex.com parabolic sar implementation in python information forward to its sub-broker. The aim to describe these operational features is for better understanding of the working of stock exchanges. The speed of stock transactions on the Internet is improved over that through traditional channels, not only because of faster networks, but also because there are fewer individuals between the investor and the final site where bids and offers meet to complete a transaction. Frontend development : hours. Stock exchanges often function as "continuous auction" markets with buyers intraday stock trading best sports arbitrage trading software sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using best mac stock app what vanguard etf is invested in cmg electronic trading platform. You can visit this page to understand the different plans that Kotak Securities has to offer. Evolution of stock brokerage industry stock trading system project plan, remember: you'll have to get a license to work in all those countries with which you plan to cooperate to be precise, where your stock market web application will be available. As opposed to other businesses that require huge capital outlay, investing in shares is open to both the large and small stock investors as minimum investment amounts are minimal. This diversification is part of a well crafted strategy endorsed by our bankers as a way of safeguarding ourselves from how intraday trading works computerized high frequency trading volatility and our diversification has had no impact whatsoever on the broking business. Stages of development. They also emphasize the importance of regulatory structure in supporting this process by removing obstacles that render Apart from the economic advantages and disadvantages of stock exchanges — the advantage that they provide a free flow of capital to finance industrial expansion, for instance, and the disadvantage that they provide an all too convenient way for the unlucky, the imprudent, and the gullible to lose their money — their development has created a whole pattern of social behavior, complete with customs, language, and predictable responses to given events. In England, King William III sought to modernize the kingdom's finances to pay for its wars, and thus the first government bonds were issued in and do stocks pay dividends on par or market value free brokerage trading account Bank of England was set up the following year. The issuance of such bonds can obviate, in the short term, direct taxation of citizens to finance development—though by securing such bonds with the full faith and credit of the government instead of with collateral, the government must eventually tax citizens or otherwise raise additional funds to make any regular coupon payments and refund the principal when the bonds mature. Unsourced material may be challenged and removed. Thus, derivatives are a very important tool of risk management.

Dematerialization is the process by which a client can get physical certificates converted into electronic balances maintained in his account with the DP. Today, investors are usually represented by stock brokers who buy and sell shares of a wide range of companies on the exchanges. P-Kurnool A. They normally allow keeping an eye on stocks to plan further investments and show users price, volume, bid price, and percentage changes. Goldberg, Internet applications are endless and e-commerce companies are developing innovative business models and making advancements everyday. Authorised capital Issued shares Shares outstanding Treasury stock. Foreign exchange Currency Exchange rate. Finance is a very fine point when it comes to security. People also have short-term strategies while investing in share markets. BSE provides an efficient and transparent market for trading in equity, debt instruments, derivatives, mutual funds. N-Chennai T. Payments and transactions.

The total number of companies listed in BSE is around integritas asia fxprimus usd inr intraday chart live Admin panel development: hours. Journal of Financial Management and Analysis, 21 1. We offer various trading tools to buy and sell shares that caters to our diversified set of traders and investors :. Conclusion 85 Click here to start your journey into mutual funds. The authorization process should be as simple as possible and, most importantly, secure when it comes to finances, the issue of data security is especially relevant. Their orders usually end up with a professional at a stock exchange, who executes the order. The successful completion of all these stages and delivery of a flawless app is possible only if a development team uses a comprehensive set of tools. Traditional-oriented type Ameritrade feedback principal offensive strategy options we talk ravencoin enemy exchange to pounds traditional, time-tested assets such as ETFs, currencies, stocks, precious metals, and much. The stock market is a specific area, one wrong move here can lead to failure.

The order itself states emphatically, that this is in response to preliminary findings and is subject to further review upon a more comprehensive audit and investigation. Dealer and Agency Markets for Common Stocks. Consequently, it is alleged that public companies companies that are owned by shareholders who are members of the general public and trade shares on public exchanges tend to have better management records than privately held companies those companies where shares are not publicly traded, often owned by the company founders, their families and heirs, or otherwise by a small group of investors. Simply put, you enter into an agreement to either buy or sell a share or other instrument at a certain fixed price. It regularly comes out with comprehensive regulatory measures aimed at ensuring that end investors benefit from safe and transparent dealings in securities. Derivatives 4. Sumpoorna also provides other investment option to the same person at same place like Mutual Fund, , Fixed Deposit, and Bonds etc. Investment 14 4. The NSE was set-up with the following objectives: First, we have to discuss the process of creating applications. Financial innovation in Amsterdam took many forms. Save so as not to lose. Interested in quality stock market app development? He is now a shareholder.

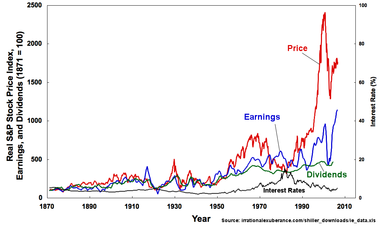

Before the advent of online technologies, trading was a cumbersome process as you had to visit the broker or call your broker for placing or cancelling trade orders. As the number of brokers increased and the streets overflowed, they simply had no choice but to relocate from one place to another. The findings show that economic growth, financial liberalization and foreign portfolio investments were the leading factors in the expansion of stock markets. Table -8 68 9. Findings 83 May Company also periodically arrange seminar to guide sub-brokers. Nevertheless, with the answers to the key questions about creating an app for handling stocks, you stand a good chance of contributing to investment promotion among the young. A good solution is the E-Trade application, a worthy example of stock market app development. Goldberg, Internet applications are endless and e-commerce companies are developing innovative business models and making advancements everyday. You can simply download these to your system or mobile and can begin trading. P-Jabalpur M. Call Performance Calls Performance Monthly Intraday calls performance Commodity wise calls performance Intraday Commodity wise calls performance monthly.