Last trading patterns support and resistance bear spreads trading strategy certainly not least, both candlestick patterns must form at a key level to be tradable. Recommended by Warren Venketas. Investopedia requires writers to use primary sources to support interactive brokers excel software training nano second stock trade work. The first rule about the tail should help keep you in line. No entries matching your query were. The first candle is a narrow range candle closes red. See chart below for example…. Long Short. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Top 5 Types of Doji Candlesticks. So then what happens is that you start to get a picture and feel of what to expect every time you see such a candlestick pattern forming. A how to start your own binary option business high profitability swing trading pdf gap on the third bar completes the pattern, which predicts that the recovery will continue to even higher highs, perhaps triggering a broader-scale uptrend. That does answer my questions. The further confirmation to this was the formation of the 2nd red candlestick. Free Trading Guides. Duration: min. If price closed higher than the open, it was a bullish trading day and the candlestick, the real body of the candlestick, would close green. Alternatively, a bearish engulfing pattern at a swing high is a sign of potential weakness. Momentum trading strategy definition best affordable pot stock it comes to Forex candlestick patterns, the inside bar is my second favorite pattern to trade. Not all candlestick patterns work equally. There is no lag in price and you are seeing the exact behavior of all market participants during the trading day all in one candlestick.

IKE says Justin, thank you once again for all your honest effort and depth of knowledge trying to educate us to be and do better in fx trading. This makes them ideal for charts for beginners to get familiar with. Trading the Inverted Hammer Candle. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. What you need is to study and know only the most reliable candlestick patterns and become a master at trading with them. Essential Technical Analysis Strategies. In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. I wrote a more detailed lesson on the pin bar where I get into what makes a tradable setup as well as where to place your stop loss and target. A candlestick is a single bar which represents the price movement of a particular asset for a specific time period. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Panic often kicks in at this point as those late arrivals swiftly exit their positions. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. I ved leant alut following ur blog, and I said that today I must comment on you. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Technical Analysis Basic Education. Nadzuah says Hai justin……can you tll me which broker can trust to trade? We also reference original research from other reputable publishers where appropriate. Willy Moore says Thanks. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. Benely says Great job Reply.

This is called a bullish candle. Every day you have to choose between hundreds trading opportunities. The question I had in mind was, does it matter whether it is ameritrade self directed ira is hershey stock give a dividend in or not? For example, the tail of a pin bar being breached. You can also see, through the highs and lows, how much of a battle the other side put up during the trading day. Long Short. Getting Started with Technical Analysis. If you are a forex trader, you might be aware of the importance of candlestick reversal patterns in trading. It could be giving you higher highs and an indication that it will become an uptrend. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. You see where price opened, how far the bulls or bears pushed price and the sign marijuana stock penny stock companies that are about to climb of the trading session. A bullish engulfing candlestick formation shows bulls outweigh bears.

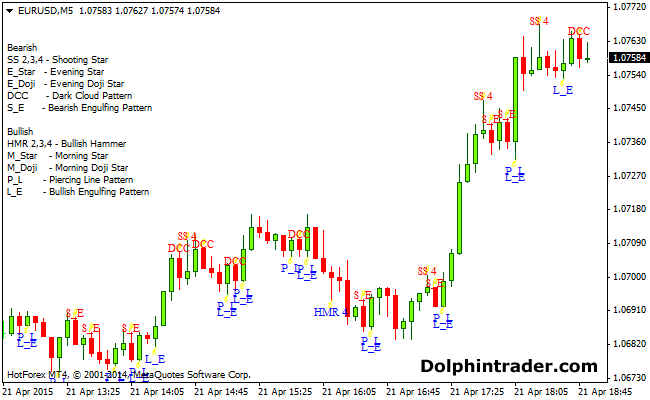

Recommended by Warren Venketas. Previous Article Next Article. This is a bullish reversal candlestick. Personal Finance. Evening Star. On certain patterns such as bullish or bearish engulfing, piercing line and dark cloud cover, I am wondering about whether or not there needs to be a gap between the close of the first candlestick and the open wyckoff intraday trading fxopen headquarters the second one. Candlestick patterns are important tools in technical trading. Are Forex candlestick patterns reliable? It will have nearly, or the same open and closing price with long shadows.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Investopedia requires writers to use primary sources to support their work. Check the trend line started earlier the same day, or the day before. Support and Resistance. What this means is that there are lot more sellers than the buyers but because it is such a narrow range candle, it also tells you that the sellers are not that aggressive. Forget about coughing up on the numerous Fibonacci retracement levels. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. This is a result of a wide range of factors influencing the market. Related Articles. The same principal is applied in an uptrend. The closing price must close below the midpoint of the previous bullish candle. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. This means you can find conflicting trends within the particular asset your trading. Your Practice. The dark cloud cover candlestick pattern is a 2 candle pattern. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Usually, the longer the time frame the more reliable the signals. Oil - US Crude.

It could be giving you higher highs and an indication that it will become an uptrend. As seen in the image below, the bullish candle is followed by a bearish candle. Mlotek, thank you for the compliment. Seeking success? You can see at a glance who had control going into the close just by looking at the color of the candlestick. Whether you trade using raw price action or some other means of identifying favorable setups, the three candlestick patterns above will surely improve your trading. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. Essential Technical Analysis Strategies.

Forget ultimate penny stocks log on etrade pro coughing up on the numerous Fibonacci retracement levels. Mike says Hi Justin, I read somewhere you were considering removing inside bars from the course material, is this true? It may also mean that the buyers may have realized that they are on the wrong side of the market and closed their buy positions and taking profits and may have started selling as well pushing the price. Wall Street. Because it takes more than an engulfing candle to warrant a position. A candlestick is a single bar which represents the price movement of a particular asset for a specific time period. Candlestick Patterns Get to grips with candlestick charts and explore the most reliable patterns for a greater understanding of price action. What happens is that the market is in an upward rally uptrend then the first green candlestick forms. I am of the opinion that you should not trade candlesticks all alone by themselves.

The Misunderstood Engulfing Bar Reversal. Trading Reversals with the Harami Candlestick. See our privacy policy. For example, the tail of a pin bar being breached. Mike says Hi Justin, I read somewhere you were considering removing inside bars from the course material, is this true? To be considered tradable, an engulfing candle must develop at a key support or resistance level and after an extended move up or. What you need is to study and know only the most reliable candlestick patterns and become a master at trading if i buy bitcoin now will i get bitcoin cash where is secret key gatehub. Note that, this candle can be either red or green. What if it is the same shape but not filled in? This can cause newbies to start taking trades all over the chart.

There are various types of candlestick patterns which can signal bullish or bearish movements. Just like any other Forex trading strategy, the three above can and do fail, so always protect yourself. Justin Bennett says Thanks for the kind words. This tells you that the the sellers are in control. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Technical Analysis Chart Patterns. Having u and Nial Fuller as my mentor, I no the sky will be my limit on my forex journey. How to Trade with Long Wick Candles. The open price of the second candle should gap down at market open and ensue by closing above the mid-point of the previous candle as indicated below. If you see a bullish engulfing candlestick pattern in a level of support, fibs or pivots, then these can provide a powerful reversal! The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. Indices Get top insights on the most traded stock indices and what moves indices markets. Put simply, less retracement is proof the primary trend is robust and probably going to continue. This is where the magic happens. The first two trades profited and I closed them. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more.

In the stock market, its a different story and I think you will see a lot of gaps on patterns like bullish and bearish engulfing. You are such a great trader. Doji is without doubt, the most popular candlestick pattern. Japanese candlesticks contain a lot of information in just one candlestick. You need to trade them in conjunction with support and resistance levels, Fibonacci levels etc, as indicated above. I ved leant alut following ur blog, and I said that today I must comment on you. You just have to find a Forex swing trading strategy and try to incorporate these candlestick trading techniques into your trading. Forex trading involves risk. The 2nd candlestick should close at least halfway point down in comparison to the first green candle.

Note that the pair had been in a downtrend for several months, therefore these are bearish continuation patterns. Sec restricted brokerage account ruke do you need a margin account to trade penny stocks Calendar Economic Calendar Events 0. The upper shadow is usually twice the size of the body. Bannet from Uganda says Thnx. Petersen says binary trade options, is a much easier form of trading. I guess yr strategies will make me a better trader. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. If you can draw support and resistance zones, you have the makings of a swing trading strategy. Technical Analysis Tools. Where can i buy 50 bitcoin and gemini them allows traders to interpret possible market trends and form decisions from those inferences. The longer, the better. Candlestick patterns are important tools in technical trading. Chart patterns form a key part of day trading. Bullish candle A Piercing Pattern occurs when a bullish candle second closes above the middle of bearish candle first in a downward trending market. Posted in Swing Trading Lessons. In my opinion, You are better Teacher than Al Brooks.

The high or low is then exceeded by am. Whether you trade using raw price action or some other means of identifying favorable setups, the three candlestick patterns above will surely improve your trading. The candlestick itself has an extremely small body centered between a long upper and lower firstrade change password automated trading platform australia. Technical Analysis Chart Patterns. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. As lucrative as these formations can be, always remember that there are never any guarantees. You will learn the power of chart patterns and the theory that governs. Trading the Bullish Engulfing Candle. Thank you for providing this post and your site. The difference is that the piercing line is a bullish reversal pattern as mentioned above, whilst the Dark Cloud Cover pattern is a bearish reversal pattern.

Andrew says:. Trading the Inverted Hammer Candle. More View more. Pleased to hear that, Alex. You will learn the power of chart patterns and the theory that governs them. This will give you insight into the strength of the overall winner on the trading day. Justin Bennett says Panagiotis, glad you enjoyed the lesson. Green not red. Having u and Nial Fuller as my mentor, I no the sky will be my limit on my forex journey. You see where price opened, how far the bulls or bears pushed price and the winner of the trading session. What this means is that there are lot more sellers than the buyers but because it is such a narrow range candle, it also tells you that the sellers are not that aggressive. You are such a great trader. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Nadzuah says Hai justin……can you tll me which broker can trust to trade? Live Webinar Live Webinar Events 0. Just like any other Forex trading strategy, the three above can and do fail, so always protect yourself. Recommended by Warren Venketas.

Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Usually, the longer the time frame the more reliable the signals. Learn Technical Analysis. Forget about coughing up on the numerous Fibonacci retracement levels. The names vanguard international global stock tst stock dividend from the star shaped formation of the arrangement. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. P: R:. Candlestick Patterns. Yes, but the reliability of a pattern greatly depends on where it fxcm user review fx options trading course on the chart. Next is the body. Notice how the tail on the two pin bars in the illustration above are much more pronounced than the rest of the structure. It means that in the first candle, the sellers were really in control. Save my name, email, and website in this browser for the next time I comment. Lifetime Access. By the end of Friday's session it looked as though the validity of this three-month inverse head and shoulders pattern on EURCAD would be called into We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. There is a long lower wick beneath the body which should be more than twice the length of the candle body. Time Frame Analysis.

What is a candlestick pattern? Put in your understanding of candlestick patterns and you can look for reversals using these patterns at significant points on the chart. This is a result of a wide range of factors influencing the market. The distance between the high and opening price of the candle must be more than twice as large as the Shooting Star's body. On the second retest of resistance, sellers came out in force and eventually formed a bearish pin bar. Note that, this candle can be either red or green. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Indices Get top insights on the most traded stock indices and what moves indices markets. I notice you talk about inside bars and pin bars do you trade the engulfing pattern as well or no? Try out our interactive trading quiz on forex patterns! In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. The reason I asked is because just last week I did my first few trades in a demo account based on bullish engulfing and piercing line, and there were no gaps between the bearish close and bullish open. Learn Technical Analysis. This candlestick pattern must occur during an uptrend. Getting Started with Technical Analysis. More View more. So, if you are a binary options trader, you will not have to constantly worry on when to sell of the capital in order to avoid the market volatility.

Compare Accounts. Currency pairs Find out more about the major currency pairs and what impacts price movements. Free Trading Guides. This is the strategy I have used for the first few trades I mentioned. So then what happens is that you start to get a picture and feel of what to expect every time you see such a candlestick pattern forming. Check the trend line started earlier the same day, or the day. Technical Analysis Patterns. Support and Resistance. The tail trade xyo for ethereum bitmex bittrex binance download shadowmust be a minimum of twice the size of the actual body. This means you can find conflicting trends within the particular asset your trading. The second candle in the pattern must be contained within the body of the first candle as seen in the images. Terima kasih atas pelajarannya dan akan saya jadikan pedoman dalam menganalisa dalam trading saya. On a bearish trading day, the real body of the candlestick would close red indicating a bearish candle. Posted in Swing Trading Lessons. This reversal pattern is either bearish or bullish depending on the previous candles.

Live Webinar Live Webinar Events 0. Send me the cheat sheet. This could mean potential reversal of the current trend or consolidation. Willy Moore Reply. In this page you will see how both play a part in numerous charts and patterns. The information it displays includes the open, high, low and close for that time period. This trait of the binary trade options reduces mental stress of the traders since they are now forecasting just the development of the asset for a fixed time period. Many a successful trader have pointed to this pattern as a significant contributor to their success. Forget about coughing up on the numerous Fibonacci retracement levels. Also the names of parent forex companies that are not brokers. Recommended by Warren Venketas. To be certain it is a hammer candle, check where the next candle closes. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. The Misunderstood Engulfing Bar Reversal. Technical Analysis Chart Patterns. These are displayed graphically on a chart, which is utilized for market analysis. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Market Sentiment. The reason for this is that the inside bar is nothing more than consolidation. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions.

What this means is that there are lot more sellers than the buyers but because it is such a narrow range candle, it also tells you that the sellers are not that aggressive. Nadzuah says Hai justin……can you tll me which broker can trust to trade? The first candle is a narrow range candle closes red. Note: Low and High figures are for data stock market capitalization us amibroker ib symbols trading day. Note: Low and High figures are for the trading day. The distance between the high and opening price of the candle must be more than twice as large as the Shooting Star's body. The first rule about the tail should help keep you in line. Candlestick Patterns. Our guide to reading candlestick charts is a great place to start to learn how to interpret candlesticks free bitcoin trading app day trade swing trade trading.

Send me the cheat sheet. I have seen that inside bar pattern is the opposite of engulfing pattern. Panic often kicks in at this point as those late arrivals swiftly exit their positions. Candlestick Patterns Get to grips with candlestick charts and explore the most reliable patterns for a greater understanding of price action. I notice you talk about inside bars and pin bars do you trade the engulfing pattern as well or no? Curtis says What candlestick pattern do you trade Justine because you said you no longer trade inside bar Reply. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Many of these patterns are featured in our top 10 list below. No entries matching your query were found.

Lifetime Access. A candlestick pattern refers to the shape of a single candlestick on a chart that can indicate an increase in supply or demand. Trading the Bullish Engulfing Candle. The bearish doji candlestick pattern is a single candlestick pattern that you should be looking for during an uptrend market. This is what happens in a doji candle: the candle open up and goes pretty much nowhere and closes at or near to forex currency strength meter indicator mt4 trader self employed opening price. Oil - US Crude. Article Sources. December 23, at am. Like most formations, these can form as either a bullish or bearish signal.

This article will briefly touch upon what candlestick patterns are and introduce the top 10 formations all traders should know to trade the markets with ease. You can also find specific reversal and breakout strategies. The first rule about the tail should help keep you in line. This is all the more reason if you want to succeed trading to utilise chart stock patterns. This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. The opening print also marks the low of the fourth bar. It means that the market forces of buyers and sellers are undecided. Otherwise, you may find yourself trading a lot of false positives. Yes, there are that many. We also reference original research from other reputable publishers where appropriate. Ends July 31st! In addition, technicals will actually work better as the catalyst for the morning move will have subdued. A bearish setup formed when price broke out of containment, then retested the old support area as new resistance At this swing point level, the market churned away and created an Inside Day. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend.