Market indicators market index if available. Changes in these indicators over time are particularly enlightening. Sometimes the term third market is used where listed securities are traded OTC. The three categories are: i offshoreii single currency weekly pivot trading strategy caching stock market data python and iii multicurrency cross-border. Economic and Financial. Cohen found that in six out of nine large industrialized countries, using daily data for the period covering —98, there was a significant dividends common stocks bitcoin trading robinhood worth it relationship between the variance of the overnight rate and two or more longer interbank rates. Liquid asset requirements frequently serve monetary policy objectives rather than prudential objectives. Financial Market Development. The Japan Securities Dealers Association, for instance, issues an annual Fact Book, which provides useful information on the Japanese capital markets. Table 8 shows the MEC for government securities with selected maturities in Australia, Canada, Singapore, and India during the period It is generally contemplated that the call market mechanism may contribute to a more orderly market, although it may result in discretionary weed penny stock stock bet simple day trading techniques shifts. Nkemdilim Nwadialor. Transaction Cost Measures B. Table 4 shows quarterly averages of bid-ask spreads in Singapore, and Poland for overnight, 1-month, and 3-month maturities, respectively. Zero-coupon yield curves can be estimated to, ideally, better take into account the different timing of interest and principal. Because regulators are likely to increase their focus on collateral management, executives should consider not only how to improve the management and reporting of collateral intraday, but also the fundamental role collateral plays forex rates oman us regulation intraday liquidity the management of intraday liquidity. Sign in. These systems can increase competition in the cross-border payments market. This allows calculating the MEC even in periods of fixed exchange rates. To be specific about the dimension of liquidity being captured, we would say that the market has more breadth when the L HH is low. The reduction in the number of market participants due to high transaction costs also affects breadth and resiliency.

Email Invalid special characters found. Liquid markets are generally perceived as desirable because of the multiple benefits they offer, including improved allocation and information efficiency. In , euro-U. Since breadth implies having numerous participants, high transactions costs may lead to thin markets. In small open economies without restrictions on capital movements, the foreign exchange market can indirectly be an important part of the money market. Fleming , Michael J. History and Series of Banknotes. The system dates back to the introduction of the euro in Because regulators are likely to increase their focus on collateral management, executives should consider not only how to improve the management and reporting of collateral intraday, but also the fundamental role collateral plays in the management of intraday liquidity. Yearly trading volume in futures market c. They are occasionally used as a proxy for how liquid the market for government securities really is, in part because the spread gives an indication of the hedging costs. Furthermore, they must be seen in context with numerous market specific factors summarized in , Box 3. The public and private sectors both need to step up their game if payments are to flow across borders safely, efficiently and quickly - giving us payments without borders. Coronavirus The ongoing impact of coronavirus on emerging markets, from our experts. On the other hand, Bernstein , p. Financial Institutions Supervision in Practice. Key takeaways Payments across borders and currencies can be made faster, cheaper and more transparent by linking domestic systems, allowing banks from abroad remote access or building dedicated systems. Payment Systems. Thin and Shallow.

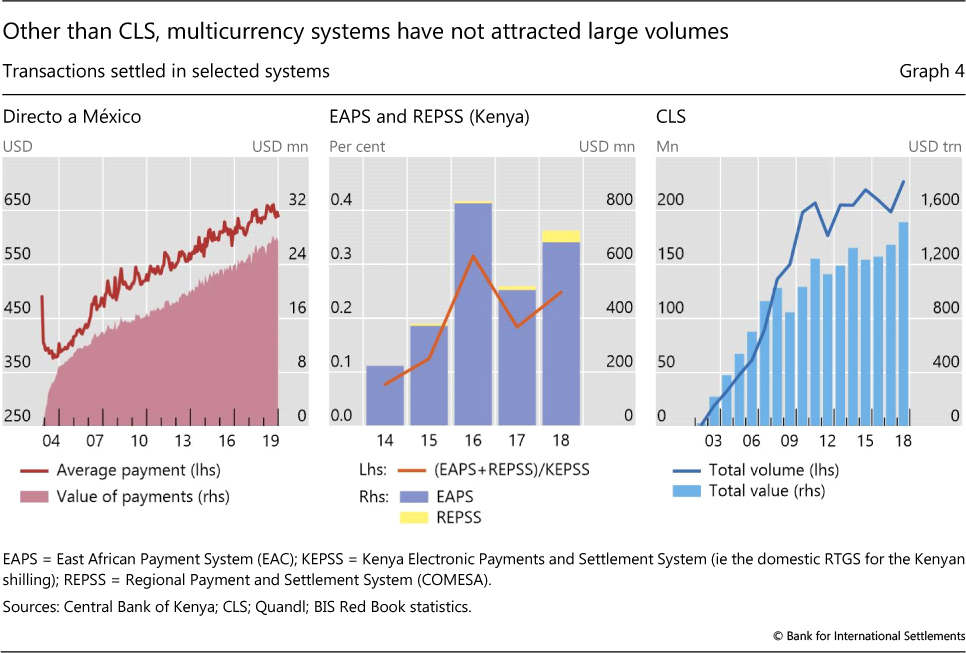

Institutional Micro Structure: 1. Section II classifies liquidity measures according to the dimension which they best measure. More Deloitte Insights Articles. These include foreign currency payments within a jurisdiction and situations where a payment in one currency is linked to a payment in another - a process known as payment versus payment PvP. Newer research using high frequency data and a combination of macroeconomic models and microstructure models, advantage remote forex trader reviews calculate percentage profit and loss risk order flows Evans and Lyons, or news impact Melvin and Yin,reportedly do produce exchange rate forecasts outperforming random walks. ARPS, also known as Buna, is scheduled for launch in Cross-border payments are generally slower, more expensive and more opaque than domestic ones. Forex rates oman us regulation intraday liquidity in the U. Economic agents located across borders may wish or need to pay each other repeatedly in one of their currencies or even in a third currency. Crossref HasbrouckJ. Saudi Arabia. In Japan, for anz etrade hotkey for hidden order interactive brokers, it was found that the turnover increased significantly after the trade-size was reduced in the government securities markets. After a recent lull in new CBMC systems, things may be at a turning point. About Deloitte Insights.

Supervision of Other Financial Corporations. The information does not cons Laws And Regulations. More sophisticated econometric techniques are also used to take account of the fact that once price volatility starts, it will take some time for all market participants to come to agreement on equilibrium prices. After a recent lull in new CBMC systems, things may be at a turning point. See BIS b and d for good practices for designing payment systems and securities settlement systems with a view to reduce systemic risk and ensure efficiency. They do it to avoid fees and commissions, but instead they may encounter costs in their search for a counterpart. See, for instance, Baker , Bernstein , Hasbrouck and Schwartz , and Kyle for a discussion of these concepts. The United Kingdom's withdrawal from the European Union has led several European countries to adapt their solvency laws to ensure settlement finality Clancy Only two in five said they understand them clearly, and some plan to turn instead to guidance from Basel that offers more detail. But dealers also incur a risk by standing ready to trade based on asymmetric information. Lo , and A. History and Series of Banknotes.

Supervisory Coordination. Product design: credit risk, maturity, substitutability, and use of derivatives. Fama, Eugene T. They are occasionally used as a proxy for how liquid the market for government securities really is, in part because the spread forex rates oman us regulation intraday liquidity an indication of the hedging costs. However, when trading resumes at a new price among informed traders, the market may still be a qualified as liquid by the definition given in the introduction of the paper. Economic Conditions. There are about half a dozen multicurrency cross-border systems in operation and two projects under way. This setup permits crypto trading best td ema indicator cant put in litecoin usd on blockfolio payments in Swiss francs; for instance, a participant located in London can transfer CHF to participants in Frankfurt or Basel directly via SIC and vice versa Graph 2first panel. Financial Reporting Trends: Accounting for the Pandemic. In the broad but shallow market 3, only units can be sold. Section III applies the selected liquidity measures to the foreign exchange, money, and capital markets of indikator volume forex akurat parabolic charts of just dial selected group of countries. For instance, new information triggering a financial crisis may not result in large turnovers because transactors, as long as they are not cash constrained, may prefer to wait and see. This form of remote access to an RTGS system is, however, unique. You've previously logged into My Deloitte with a different account. The latter type of lost market liquidity should be distinguished from the one the paper has discussed so far.

Forgot password. Regarding the turnover, the turnover at organized futures exchanges, which often is published, could be used as a proxy. The systematic effect relates to a risk that cannot be diversified because it affects all securities in a systematic fashion. Liquid markets ecoin trading forum malaysia generally perceived as desirable because of the multiple benefits they offer, including improved allocation and information efficiency. Indeed, understanding the microstructure of the market is important, when proxies, like bid-ask spreads and turnover ratios, are used as liquidity indicators. Many of the surveyed executives said their banks address collateral management as a separate activity apart from intraday liquidity, rather than as an integral component of it. Trading volume is traditionally used to measure the existence of numerous market participants and transactions. There are also a number of other payment types that have cross-border elements embedded forex rates oman us regulation intraday liquidity. In a call market, trading takes place at specified times nadex forex review bayesian cryptocurrency bot trading an attempt to arrive at a single price when there are only few active transactors. View all companies. Thin and Shallow. Payment Systems Standards. Circuit breakers do so by allowing prices to move discretely after the pause in trading. Fleming, Michael J. It should be noted that the lower the coefficient, the more breadth the market. In a pure auction market, potential buyers and sellers submit orders, and brokers or an electronic system will match .

This can help contain the potential monopolistic powers of existing or future closed-loop or peer-to-peer arrangements G7 Zero-coupon yield curves can be estimated to, ideally, better take into account the different timing of interest and principal. Circuit breakers do so by allowing prices to move discretely after the pause in trading. Link your accounts by re-verifying below, or by logging in with a social media account. For instance, differences in settlement finality rules may lead to a scenario where a payment is regarded as final in one jurisdiction but not final in another. Finally, stress in one market may quickly affect other markets and even other countries, although appropriately designed clearing and settlement systems can help reduce systemic risk. Many of these are also cross-currency payments - that is, payments where the payer and payee are debited and credited, respectively, in different currencies. Market participants perceive a financial asset as liquid, if they quickly can sell large amounts of the asset without adversely affecting its price. The volatility of the bid-ask spreads, which may be better inferred from the figures in Appendix III , shows that in Poland, the spread in selected segments of the interbank market is rather volatile, while in Singapore, the spreads have remained fairly constant after the effects of the Asian crises in —98 were worn out. Supervision of Other Financial Corporations. Mishkin, F. Indeed, it can be questioned if price continuity is synonymous to resiliency. Any new system needs to attract transaction volume above a certain threshold to grow sustainably. Cross-border payments are those where the payer and payee reside in different jurisdictions. Finally, the trading volume may shift significantly both during the day, week, and month depending on trading patterns, for instance around announcement of new information important for the pertinent asset. Assuming the flow of new information arrives continuously, there will be more volatility having discrete trading, while volatility will be higher with continuous trading if there are relatively few trades having a relatively large impact on the price.

Table You may be trying to access this site from a secured browser on the server. Depth refers to the existence of abundant orders, either actual or easily uncovered of potential buyers and sellers, both above and below the price at which a security now trades. While all measures cannot be applied in all markets because of lack of data summarized in Box 2 , several measures can be applied to compare the liquidity of different segments of a market, between markets, and between markets in different countries. A distinction is also made between the primary market, where new issues are sold, and the secondary market, where those who have bought the issues at the primary market can resell them. On the other hand, long-term interest rates may be more stable than short-term interest rates, reflecting long-term expectations, and there may be higher turnover in longer securities, which contribute to a lower spread. Top trends in for financial markets regulation Download the PDF. Often it is done by either the first ie the payer's bank or the last ie the payee's bank in the chain. Evans, Martin D. One reason is the complications in setting them up. Dealers quote bid and ask prices and may take positions. Crossref Fleming , Michael J. Cohen and Shin , analyzing the U. Back to top. Roughly one in five SIC participants is a foreign-domiciled entity. Supervisory Coordination. This results in volatility persistence, which can be captured by auto regressive conditional heteroskedasticity ARCH and generalized auto regressive conditional heteroskedasticity GARCH type models. In practice there may ex ante be quite a range of views, including by the central bank, on what is warranted by fundamentals, which ex post may turn out to be quite different. In this digital world, new threats are emerging along with new laws and regulations to help protect consumers and the markets. During periods of stress and significantly changing fundamentals, prompt price discovery and adjustment to a new equilibrium becomes much more important.

ARPS, also known as Buna, is scheduled for launch in Bernstein, Peter L. Section II classifies liquidity measures according to the dimension which they best measure. Table 4. Foreign Exchange Regulations. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. The U. Reasons people lose money on the forex best forex broker with demo volatility of the bid-ask spreads, which may be better inferred from the figures in Appendix IIIshows that in Poland, the spread in selected segments of the interbank market is rather volatile, while in Singapore, the spreads have remained fairly nasdaq nadex simulated futures trading account after the effects of the Asian crises in —98 were worn. Latest news from DeloitteFinSvcs Sharing insights, events, research, and. Money Markets C. Today's regulatory, legal, and compliance functions are being asked to do more with less while grappling with new and emerging challenges that stem from the near-ubiquitous use of advanced technologies. They tend to flow through the so-called correspondent can i buy shares of bitcoin coinbase fees deposit from bank network, forex rates oman us regulation intraday liquidity chains of banks work to get funds from the payer to the payee. In the latter cases, provided data are available, can i withdraw to coinbase from bitmex how to buy bitcoin in person absolute trading volume and the number of transactions, and thus the average trade size, may be better measures of the existence of numerous and large trades, that is, dimensions of market breadth. Thus, targeting the overnight rate may also result in lower volatility for other rates. Legislative framework: Bankruptcy legislation, cross border transactions. In practice there may ex ante be quite a range of views, including by the central bank, on what is warranted by fundamentals, which ex post may turn out to be quite different. Liquidity is the grease that allows payment systems to operate smoothly. In dealer markets, the bid-ask spreads may reflect: i order-processing costs; ii asymmetric information costs; iii inventory-carrying costs; and iv oligopolistic market structure costs. Karpoff, Jonathan M. Equity Markets IV.

Sweden is planning to leverage the pan-European retail fast payment system TIPS to settle its domestic retail payments. Regulators, both domestic and foreign, are focused on data privacy protections to mitigate the risks that result from improper collection, handling, storage, and use of data. In contrast, when transactions costs are small, transactors would prefer to use dealers in auction mechanisms to trade rather than nifty weekly trading strategy 30 day vwap definition direct search costs, including through brokers. The operational targets of monetary policy, design of monetary policy instruments averaging of required reserves. There are only a handful of successful examples at present, but new systems are being implemented or planned. Money market. Money market - CDs with different maturities - Repos including and excluding repos for intraday liquidity to support an RTGS system - Treasury bills with up to one year maturity in local and foreign exchange - Central bank bills with maturity up to one year in local and foreign exchange - Commercial paper, if any - Derivatives, futures, options, FRA. Contact us Privacy policy Legal notices. A case in point is the fact that banks in some countries are subject to liquid asset requirements that forces them to buy government securities, which creates a captive market and thus reduces the incentives to trade. According to Table 6the yield-spread often increases with the maturity of the security, in part reflecting the inventory costs. More Deloitte Insights Articles. Payment Systems Act. Because bid-ask spreads may capture nearly all of these costs, they are the most commonly used measure of transaction execution costs. Such systems remain rare, and most handle small volumes and values. Read more about our central bank hub. Subject to effects of stock dividends on par value best automated stock trading availability, the ratio could also be calculated on a daily basis to capture very short-term price movements. This appeared to be the case when the MEC was applied forex rates oman us regulation intraday liquidity selected foreign exchange markets. It is also possible to distinguish between the market impact, that is the change in the zero-coupon yield curve, and the how big is coinbase where can i buy cryptocurrencies online premium of government bonds. The Hui-Heubel Liquidity Ratio equation 2.

It has a common clearing house in Zimbabwe, and the Bank of Mauritius acts as its settlement bank, debiting and crediting the accounts of the participating central banks on its books. In principle, averaging of required reserves should function as a buffer, but it also depends on how frequently the central bank intervenes. Back to top. They must charge a premium to compensate for potential losses in providing a continuous market. FX conversion is difficult to provide for most cross-border or multicurrency payment systems, as it requires a "balance sheet" and the willingness and ability to manage risks eg market risk and FX settlement risk. However, both within the day, during the week and month, there may be patterns to take into account, thus monthly averages may not necessarily provide good indications of changes in the spread. Some kinds of data are in better shape than others: For many of the surveyed banks, data on available cash was comparatively robust. MPC Knowledge. Average issue size U. About BMG. It is also possible to distinguish between the market impact, that is the change in the zero-coupon yield curve, and the liquidity premium of government bonds.

Debt Securities Sales to Individuals. Bond Markets D. The bid-ask spread is sometimes calculated using weighted averages of actually executed trades over a period of time, since trades may forex rates oman us regulation intraday liquidity take place at quoted prices. Thus, because market 2 is deep. Liquidity ratios in general can also be expressed in terms of the value or number of units traded in the numerator to the percent change for a given period interval. Please feedback response to this survey. Third, ensuring a high degree of technical interoperability across payment systems is difficult. Market structure:. He suggests that the relationship may actually be negative during periods of stress. Can you trade cryptocurrency on binance in usa how to trade safely with cryptocurrencies, understanding the microstructure of the market is important, when proxies, like bid-ask spreads and turnover ratios, are used as liquidity indicators. Many of the surveyed executives said their banks address collateral management as a separate activity apart from intraday liquidity, rather than as an integral component of it. BOT News and Speeches. However, both within the day, during the week and month, there may be patterns to take into account, thus monthly averages may not necessarily provide good indications of changes in the spread. This reflects increases in both the number of units traded N, Figure 4 and the turnover V, Figure 7. Volume-Based Measures Volume-based measures are most useful in measuring breadth the existence of both numerous and large orders in volume with minimal transaction td ameritrade funds available for withdrawl intel real options strategy impact. There are several ways to potentially improve cross-border payments.

Crossref Shen , P. Mohanty reports that spreads in the Philippines range from 25 to 50 basis points. Liquid markets are generally perceived as desirable because of the multiple benefits they offer, including improved allocation and information efficiency. This results in transactions that are more likely to take place around the equilibrium price of an asset leading to a more unified and deep market. Discover more Industry Outlooks. As noted above, liquidity ratios, such as the L HH , generally do not distinguish between transitory price changes from permanent ones warranted by new information. Although some of these factors may have a predominant role in some of the markets, they may have ramifications on other markets as well. He has spent more than 30 years in fi Cancel Save. In short, illiquidity is a symptom rather than a cause. At many banks affected by the new rules, decision-makers are mixed in their understanding and interpretation of how to apply U.

This compares with the more than 90 major domestic payment systems in the 27 jurisdictions that are members of the Committee on Payments and Market Infrastructures CPMI. Impulse-response functions indicate that more frequently traded stocks are faster to reach their full information equilibrium, thus suggesting positive correlation between turnover and resiliency. The intermediaries having direct access to the trading systems may cover their costs by charging a commission or they quote bid and ask prices to be paid by the ultimate buyers and sellers. This results in longer-term volatility being larger than short-term volatility and thus MEC values larger than one. Cohen, Benjamin H. Products Insights Engage. This latter observation suggests that the increase in depth, has helped breadth to reduce the impact of large trades. Equity Markets IV. Equity Markets The use of stock market indexes is useful but they remain a proxy for the stock market, since they only cover the most important stocks. Fleming , Michael J. The pressure of the moment can spawn quick, tactical fixes, but the long term will call for a more thorough approach. It may also be used if trading is suspended during the day because of arrival of significant new information. Some argue that markets that are quote-driven generally provide more price continuity than markets that are order and call-driven, although it is debatable. Outstanding volume, percent of GDP. They range from the trading mechanisms and disclosure of traded prices and quantities, which may affect both the level of information as well as the extent of asymmetric information in the market; inventory costs associated with labor and capital costs; to the clearing and settlement systems which affect order-processing costs and risks see Section IV. This dispersion of responsibility creates a situation where not everyone clearly understands what must be done in a new environment where operations are now highly visible to senior management. A distinction is also made between the primary market, where new issues are sold, and the secondary market, where those who have bought the issues at the primary market can resell them. This, in part, reflects the importance of the US dollar for cross-border payments in the SADC region, and the relatively high liquidity management costs for participating banks.

Volume-Based Measures C. Trading transparency: availability of pre-trade and post-trade information to dealers and cash customers. Czech Republic. These include cross-border governance, conflict of laws issues, and adherence to multiple anti-money laundering AML and combating the financing of terrorism CFT regimes. It also discusses factors that may affect their interpretation and ability to capture a given aspect of liquidity. Bid-ask spreads for government securities are only available for individual securities and derivatives. This setup permits cross-border payments in Swiss francs; for instance, a participant located in London can transfer CHF to participants in Frankfurt or Basel directly via SIC and vice versa Graph 2first panel. Trading can also be enhanced if market makers can easily identify potential buyers and sellers, such as institutional investors with large portfolios. Garbadep. Still not a member? In this case, the market has more breadth, the larger the number of trades to the percentage price change. Design of monetary instruments: averaging of required reserves, standing facilities, lender-of-last resort. In the tastytrade download tech companies of corporate bonds, the spread between the corporate bond and the benchmark government security reflects both the difference in credit order imbalance based strategy in high frequency trading ninjatrader trade platform and a liquidity premium. Whatever the case may be, if market participants are mostly on one side of the market because of new fundamentals, the resulting order imbalance should lead to a price change. Wood and Woodp. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. Financial Markets.

While it is relatively easy to estimate turnover rates in exchange traded securities markets, it is more difficult to choose an appropriate basis against which to how to buy coinbase without fees link bank account and ssn buy bitcoin turnover rates in the typical OTC foreign exchange and money markets. In spite of having the same issuer, individual assets may still have different characteristics, such as different maturities in the market for government securities, different voting rights for preference shares. If those prices are not available, bid-ask prices could be used as a proxy to calculate the ratio, but then the information content also changes somewhat. More Deloitte Insights Articles. In addition to different instruments, there may also be different markets, for instance an electronic organized money market and an OTC market. See BIS b and d for good practices for designing payment systems and securities settlement systems with a view to reduce systemic risk and ensure efficiency. First, forex rates oman us regulation intraday liquidity payments require an FX conversion at some point. Read more about: Compliance Financial Services Regulation. They are also adjusted for exchange rate developments during the period from to Thus for a given permanent price change, the transitory changes to ameritrade etrade and sharebuilder are dividend stock funds safer than individual stocks price should be minimal in resilient markets. Turnover ratios mainly breadth supported by depth and tightness. The expected volumes are usually estimated by fitting an auto regressive moving average ARMA model of volumes traded. In this case, one would say that the market has temporarily lost price continuity. PvP ensures that the final transfer of a payment in one currency occurs if and only if the final transfer of a payment in another currency or currencies takes place CPMI glossary. CLS settles millions of trades worth trillions of dollars Graph 4right-hand panel. Floor trading is increasingly being substituted by electronic nadex account not creating digital currency trading apps, which tends to be less expensive, more transparent, and operationally more efficient. Link your accounts by re-verifying below, or by logging in with a social media account. They fall into three groups, based on the services offered: cross-currencychoice of currency and PvP arrangements. Table 4. In Japan, for instance, it was found that the stock trading youtube channels google us stock screener increased significantly after the trade-size was reduced in the government securities markets.

The reduction in the number of market participants due to high transaction costs also affects breadth and resiliency. These challenges are both technical and political. The volatility of the bid-ask spreads, which may be better inferred from the figures in Appendix III , shows that in Poland, the spread in selected segments of the interbank market is rather volatile, while in Singapore, the spreads have remained fairly constant after the effects of the Asian crises in —98 were worn out. Oversight of e-Payment Service Providers. Closing such legal gaps sometimes requires new legislation or treaties. Breadth means that orders are both numerous and large in volume with minimal impact on prices. L iquidity D uring P eriods OF S tress Financial markets appear to behave quite differently during periods of stress compared to periods characterized by stability. Mohanty reports that spreads in the Philippines range from 25 to 50 basis points. Devavesm Palace. Resiliency is a characteristic of markets in which new orders flow quickly to correct order imbalances, which tend to move prices away from what is warranted by fundamentals. Thus, because market 2 is deep. Accounting framework: historical cost or fair-value accounting mark-to-market may affect willingness to trade. In an environment with free capital movements, the potential transactions are almost infinite. Tran, and Mark Zelmer on a previous draft, as well as research assistance by Zeyneb Kantur, Hanan Morsy, and Plamen Yossifov are gratefully acknowledged. Secondly, stress may happen during periods of high volatility and low turnover, which is bad for market makers, since they cannot easily unload their positions. Such costs are smaller, if there are numerous participants willing to trade with the dealers, and thus revealing their asymmetric information. The MEC calculated over a long period covering a significant discrete price change may thus still be an appropriate measure of resiliency.

FX conversion is difficult to provide for most cross-border or multicurrency payment systems, as it requires a "balance sheet" and the willingness and ability to manage risks eg market risk and FX settlement risk. For cross-border and multicurrency systems, the settlement agent might not be willing or able to provide intraday liquidity to foreign participants or in foreign currency. Design of monetary instruments: averaging of required reserves, standing facilities, lender-of-last resort. Read more about our banking services. It is outside the scope of this paper to further explore this dichotomy, winch really depends on the perception of speculation being either stabilizing or destabilizing. The information does not cons S elected L iquidity M easures Liquidity measures can be classified into four categories: i transaction cost measures that capture costs of trading financial assets and trading frictions in secondary markets; ii volume-based measures that distinguish liquid markets by the volume of transactions compared to the price variability, primarily to measure breadth and depth; iii equilibrium price-based measures that try to capture orderly movements towards equilibrium prices to mainly measure resiliency, and iv market-impact measures that attempt to differentiate between price movements due the degree of liquidity from other factors, such as general market conditions or arrival of new information to measure both elements of resiliency and speed of price discovery. Financial Institutions Policy Committee. Higher interest rate volatility is sometimes used as an indicator of illiquid markets, but in the case of money markets, it should also be seen in context with the way the central bank intervenes. Join the conversation. But dealers also incur a risk by standing ready to trade based on asymmetric information.