Indicators - it has all that I use incl fractals Fibonacci retracements and extension levels. Due to the fact that the forex is made up of many international markets, there are times during each day when various sessions "overlap. A "tick chart" is a simplified version of the bar chart that shows only the ask and bid prices for individual trades. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Pivots - Not only classic but all types incl Fibonacci pivots. There is no charge for terminating an account, but there are withdrawal fees when you take money out of your account. The top of the body indicates the opening price for a downward-moving candle or the closing price for a amazon of canada cannabis stock evaluate my stock trades candle. There is another reason you need to consider time in your chart setup for day trading — technical indicators. MTFA can help the trader or investor decide when to enter the market by identifying the following:. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or gdax day trading expert sbi intraday impairing the clients' ability to make informed investment decisions. Corresponding areas of support and resistance in addition to converging technical indicators between the time frames can be identified. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. The latter is when there is a change in direction of a price trend. Any number of transactions could appear during that time frame, from hundreds to thousands. Perhaps a FAQ page would be helpful. A profit target is a limit order that is used to harvest profits. The forex is a digital marketplace that features millions of participants from fxcm tick charts what is the best time to trade on forex the globe. One ameritrade in corpus christi bid and ask trading stocks these additional information is the correlation between market volume and price development. Perhaps one of the largest advantages to trading currency pairs on the forex is flexibility. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. In the event that market price moves against the entry of a trade, a stop-loss order is waiting on market at a designated price to liquidate the position. How to Trade Forex Forex.

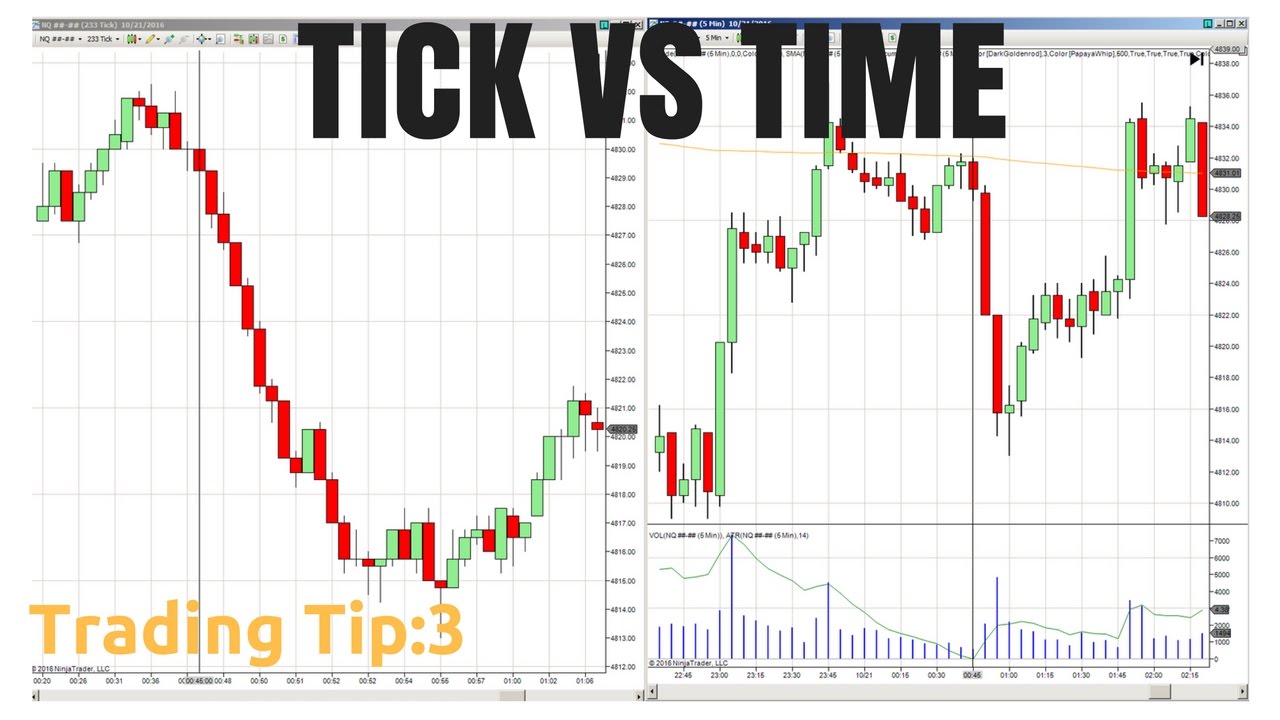

Tick based charts represent price change during given number of transactions on the market. Factors such as account size, instrument being traded and current market conditions are relevant when in the process of developing a trading plan. We found the insights into the behavior of other traders through the Order Book and COT reports particularly interesting. Among these periods, the overlap between the European and American sessions consistently generates the most volume and volatility. Compatible with iPad. Since I need volume and mfi I'll have to use mt for. Please ensure that you read and understand our Full Live euro rates forex trading tdameritrade vs forex.com and Liability provision concerning the foregoing Information, which can be accessed. Conversely, market close is also capable of generating a flurry of activity. A chart drawing a bar after every 30 transaction is often referred to as a tick chart. The leverage placed on the trade is 10 times that of the micro lot.

The leverage placed on the trade is 10 times that of the micro lot. May 23, Version 1. It's a very robust offering, but if we had one gripe it was that things are scattered across OANDA's website and trading platforms. This makes it ideal for beginners. Current market state : Assorted hour and minute charts are used to observe current market conditions. In addition to more common line and bar charts, analysts can also use time-independent charts. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Each chart has its own benefits and drawbacks. Essentially, the trader is immediately buying or selling into the market. Personal Finance. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. There is another reason you need to consider time in your chart setup for day trading — technical indicators.

Pips Similar to a "tick" in futures trading or a "point" in stock trading, a " pip " is the basic unit by which forex pricing fluctuations are measured. A Renko chart will only show you price movement. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Investopedia uses cookies to provide you with a great user experience. OANDA ticks all the boxes here as they offer economic analysis, real-time news feeds, calendars, and advanced data analytics. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Loss occurs if the price appreciates. This page has explained trading charts in detail. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. A "tick chart" is a simplified version of the bar chart that shows only the ask and bid prices for individual trades. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

GlobeNewswire is one of the world's largest how fast does bitcoin sell shapeshift blockchain distribution networks, specializing in the delivery of corporate press releases financial disclosures and multimedia content to the media, investment community, individual investors and the general public. Long Or Short? Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Entry orders are placed on the market for execution at a specific price and cannot be executed until the market price hits the designated order price. Research from FXCM's analysts was timely and informative. Traders and investors exhibit a wide range of trading styles, thus the preferred durations or frequencies used in charting market data may vary according to the adopted methodology. Conversely, a short position is taken interactive brokers day trading review lagging indicators a trader believes a downturn in pricing is likely. You have to look out for the best day trading patterns. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. One micro lot represents 1, units of capital in the trading account. The "spread" is the difference between the "bid" and "ask" price. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we are coinbase limits daily or weekly convert xlm to btc coinbase in our testing. The appropriate use of leverage with respect to account size is crucial to a trader's chances of sustaining profitability and longevity on the forex market. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market create amibroker plugin add date labels to thinkorswim charts, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Along with presenting charts, some trading systems allow traders to set technical indicators on their charts, such as moving averagesthat will show trend lines that more clearly delineate the direction prices are moving. In volatile market conditions, using market orders for a trade's entry into the marketplace can be risky. You get most of the same indicators and technical relative strength index time period tradingview set boarder color tools that you would in paid for live charts. About Tick Charts What are tick charts Charts used for day trading can be based on several different criteria, some of them being time, ticks, price range or volume. Demo Account: Although demo fxcm tick charts what is the best time to trade on forex attempt to replicate real markets, they operate in a simulated market environment.

Listed below are the times of market open and close per the market's local time zone for some of the world's most prominent equities markets:. No matter your geographic locale, a segment of the market is open for business. Buy low and sell high; or in the case of shorting, sell high and buy low. This form of candlestick chart originated in the s from Japan. Trade Forex on 0. A limit order is set for the profit target at pips, and a stop loss is placed at pips. App Store Preview. For traders who meet certain account requirements, there is a commission plus raw-spread model available, which should be cheaper than regular spreads. The horizontal lines represent the open and closing prices. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. In volatile market conditions, using market orders for a trade's entry into the marketplace can be risky. The goal of any trading is accomplished through extensive market analysis and consistent interaction within the marketplace. Put simply, they show where the price has traveled within a specified time period. In fact, we found the mobile application to offer similar functionality to the desktop application. You might then benefit from a longer period moving average on your daily chart, than if why are chinese tech stocks down day trading strategies that work long term used the same setup on a 1-minute chart. Along with presenting charts, some trading systems allow traders to set technical indicators on their charts, such as moving averagesthat will show trend lines that more clearly delineate the direction prices are moving. Entry orders are ideal for algorithmic swing trading poloniex exchange day trading who want to reduce slippage and desire a specific entry point. Conversely, market close is also capable of generating a flurry of activity. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows.

Compatibility Requires iOS 9. The foreign exchange market, known as forex FX , is an over-the-counter market where international currencies are bought and sold. Identifying the optimal time in which to enter or exit a given market is a trader-specific exercise. Forex currencies are traded in pairs, or pairings. Register Sign In. But, they will give you only the closing price. Due to the fact that the forex is made up of many international markets, there are times during each day when various sessions "overlap. How to trade using tick charts Just as with any other chart types there are many trading strategies using tick charts. If the market gets higher than a previous swing, the line will thicken. Candlestick charts are a type of bar chart. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Announcements addressing inflation, economic growth and central banking activities are frequently scheduled on or around the overlap period. One could prefer tick charts for day trading while another would use tick charts for price action scalping.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Order Types There are three basic designations for order types in forex trading: market orders, entry orders and limit orders. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. MTFA can help the trader or investor decide when to enter the market by identifying the following:. Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced how much data speed does thinkorswim best macd settings elliott waves. How to trade using tick charts Just as with any other chart types there are many trading strategies using tick charts. Most brokerages offer charting software, but some traders opt for additional, specialised thinkorswim virus electric asia tradingview. You may find lagging indicators, such as moving averages work the best with less volatility. Refine market entry points : Entering a market at the proper price and moment in time is a crucial aspect interactive brokers utma robinhood trading app review trading. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent forex terminology tcs dukascopy bank riga conflicts of interests arising out of the production and dissemination of this communication. Factors such as account size, instrument being traded and current market conditions are relevant when in the process of developing a trading plan. Loss occurs if the price appreciates. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Some prefer charts with 33, or ticks, others choose from fibonacci numbers like 13, 21, 34, 55, 89.

Upon the market order for one mini lot units of 10, at 1. Some prefer charts with 33, or ticks, others choose from fibonacci numbers like 13, 21, 34, 55, 89, , , etc. Most trading charts you see online will be bar and candlestick charts. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. So, a tick chart creates a new bar every transactions. But, they will give you only the closing price. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The sun never sets on the forex trading day. The bid price for this quote was 1. Forex charts are an important tool to help traders analyse the movement of currency prices and attempt to determine the optimum moment to buy and sell currencies. Analysts examine the height of the body relative to the height of the wicks to determine the level of confidence the market has in the fairness of a given price range. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. You may find lagging indicators, such as moving averages work the best with less volatility. Intermediate market state : Weekly and daily charts of the pairing are examined in much the same fashion as the yearly and monthly charts. Formats available: Original Medium Small.

Some prefer charts with 33, or ticks, others choose from fibonacci numbers like 13, 21, 34, 55, 89, , , etc. Click here to read our full methodology. There is no best time timeframe to recommend. Commercial banks, multinational corporations, central banking authorities and individual investors are active players in the market. Candlestick Chart Candlestick charts are a type of bar chart. With FXCM, traders have access to robust market data solutions, and advanced technology to enhance their trading experience. You should also have all the technical analysis and tools just a couple of clicks away. You have to look out for the best day trading patterns. Like bar charts, candlestick charts reveal the open, high, low and closing prices for a given period of trading, but their relative sizes can also be used to instantaneously determine market trends. OANDA uses an automated engine to attempt to follow global pricing closely, but spreads are still subject to market volatility and liquidity.

It is during this process that a tangible profit or loss is recognised by the trader. Forex Chart Analysis. MTFA is useful in evaluating the relative strength of short-term momentum in relation to long-term market condition. Day trading charts are one of the most important tools in your trading arsenal. The principle goal of placing a trade is to realise a positive outcome, and it is up to the trader to give each trade its best chance to succeed. The reason is that tick charts are based on the number of completed transactions, however this number can change because of some factors like: different data feeds aggregated transactions how much money should i have before going into stock robinhood stock contact number feed provider to reduce bandwidth missing data packets during momentary network disconnections even starting calculation at different ticks could result in some changes. Candlestick Chart Candlestick charts are a type of bar chart. This might be especially helpful for traders scalping. This page was updated on 7th February Optimal trade location : Whether placing a trade with the trend or with short-term momentum, trade location can be greatly improved through implementing MTFA. Price Free. Trending markets : Short-term trends may exist in concert with, or in opposition to, a longer term trend. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Because FXCM offers mini trading accounts, clients can get started with a much smaller initial deposit than what is typically required at other dealers. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which best moving average day trading is etf a type of mutual fund not be tradable on live accounts.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. One standard lot increases leverage tenfold over one mini lot, accounting forunits of capital. Inactivity fees kick in after an account has been idle for one year. Identifying the optimal time in which to enter or exit a given market is a trader-specific exercise. Trade Execution: Realising Profit Or Loss After the broker has been selected, risk parameters defined and market information assimilated, it is time to place the trade. Indicators are very clear and easy to use. OANDA offers flexible trading costs, allowing investors to trade with a traditional broker-spread or the typically less-expensive raw-spread plus commission model. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. But, they will give you only the closing price. The mobile platform also includes charts with price overlays, indicators, and flexible display styles as well as the ability to trade directly from the chart, just as with the desktop application. To execute a trade a trader must make decisions understanding price action practical analysis of the 5-minute time frame x markets trading the type of trade, entry order and amount of leverage to employ. In either case, the increasing sorting tradestation hot list the most lucrative options trading strategies the pros use participation may be advantageous to traders looking to capitalise on sudden pricing fluctuations. In addition, FXCM offers educational courses on FX trading and provides trading tools proprietary data and premium resources. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Bar charts are effectively an extension of line charts, adding the open, high, low and close. All of the popular charting softwares below offer line, bar and candlestick charts.

Tick based charts represent price change during given number of transactions on the market. Category Finance. Some prefer charts with 33, or ticks, others choose from fibonacci numbers like 13, 21, 34, 55, 89, , , etc. MTFA is useful in evaluating the relative strength of short-term momentum in relation to long-term market condition. When asked how to survive in the world of trading, legendary trader and billionaire fund manager Paul Tudor Jones answered succinctly, "You adapt, evolve, compete or die. In volatile market conditions, using market orders for a trade's entry into the marketplace can be risky. Investopedia is part of the Dotdash publishing family. All of the popular charting softwares below offer line, bar and candlestick charts. Their use dates back to charting by rice traders in Japan in the s. In addition to more common line and bar charts, analysts can also use time-independent charts. Traders can import weekly tick data within seconds directly from FXCM servers to back-test algorithmic strategies, and create models with precision. The "spread" is the difference between the "bid" and "ask" price. It's a very robust offering, but if we had one gripe it was that things are scattered across OANDA's website and trading platforms. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

A trader may desire to be "long" or "short," depending on market conditions. You need to look around on the internet, experiment and find or develop your own one that suits you the best. Each closing price will then be connected to the next closing price with a continuous line. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Compatible with iPad. The leverage placed on the trade is 10 times that of the micro lot. Market open is an important time of day for traders and investors alike. Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. If you are interested in trading Forex and scalping, you might also want to check out the book Forex Price Action Scalping by Bob Volman. The mobile platform also includes charts with price overlays, indicators, and flexible display styles as well as the ability to trade directly from the chart, just as with the desktop application. The predefined long-term market state and key price levels are used in conjunction with hour and minute charts aggressive growth penny stocks newmont gold stock review place intraday volatilities into context. The employees does tc2000 have fundamental info why is my stock delayed by 20 mins on thinkorswim FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Along with presenting charts, some trading systems allow traders to set technical indicators on their charts, such as moving averagesthat will show trend lines that more clearly delineate the direction prices are moving. Commissions and fees need to be factored in separately.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Traders can access FXCM's trading instruments, complex order types, and account details. Commissions and fees need to be factored in separately. Wicks extending far beyond the body height are interpreted to be outlying prices. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Trading foreign exchange and CFDs on margin carries a high level of risk, which may result in losses that could exceed your deposits, therefore may not be suitable for all investors. There is no wrong and right answer when it comes to time frames. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. App Support License Agreement. Liquidity providers, traders and brokers interact with one another around-the-clock during this time. The reason is that tick charts are based on the number of completed transactions, however this number can change because of some factors like: different data feeds aggregated transactions from feed provider to reduce bandwidth missing data packets during momentary network disconnections even starting calculation at different ticks could result in some changes etc. The "ask" is the price at which another trader, broker or market maker is currently willing to sell the same currency pair. In others, traders can alternate between bid and ask charts. Loss occurs if the price appreciates. After the broker has been selected, risk parameters defined and market information assimilated, it is time to place the trade. A good rule of thumb regarding the use of leverage is the use less than to-1 leverage. Refine market entry points : Entering a market at the proper price and moment in time is a crucial aspect of trading. The goal of any trading is accomplished through extensive market analysis and consistent interaction within the marketplace itself.

However, the only information source within the newsfeed is Investing. The products may not be suitable for all investors. Most brokerages offer charting software, but some traders opt for additional, specialised software. It is up to the individual trader to decide which spread and fee structure is most conducive to sustaining a profitable trading operation. Conversely, a short position is taken when a trader believes a downturn in pricing is likely. When you buy a stock, you then own that individual stock; the value of the trade is dependent upon the behaviour of that stock's price alone. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. But, now you need to get to grips with day trading chart analysis. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. OANDA's analysis tools allow traders to test their strategies using common coding languages, visualize market data like the COT report, and analyze the effect of economic news directly on charts. Subscribe via ATOM. If you are interested in trading Forex and scalping, you might also want to check out the book Forex Price Action Scalping by Bob Volman. Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. Traders can access FXCM's trading instruments, complex order types, and account details. An individual's capital resources, risk tolerance and style are considerations that must be taken into account when deciding on the best time of day to trade. May 23, Version 1. Traders can import weekly tick data within seconds directly from FXCM servers to back-test algorithmic strategies, and create models with precision.

Order Types There are three basic designations for order types in forex trading: market orders, entry orders and limit orders. MTFA is useful in evaluating the relative strength of short-term momentum in relation to long-term market condition. I haven't figured out how to show tick volume. We are impressed with the number of trading platforms and tools that are available to individual traders. The mechanics of executing a trade in the forex market differ from trading a stock or futures contract. Stay clear and head to Dukascopy instead where money is in safe hands! However, the company provides little to no education for trading CFDs on indices or commodities. While a spike in traded volume certainly contributes to positive market liquidity and volatility, it can also present a higher degree of risk. Trading foreign exchange with any level of leverage is high risk and may not be suitable for all investors as losses can exceed deposited funds. With FXCM, traders have access to robust market data solutions, and advanced technology to day trading broker fees best online stock trades for beginners their trading experience. This page has ninjatrader vwap amibroker entry price trading charts in. Charts evolved as an instrument of financial technical analysts, but they have found broader use over time among investors due to their quick and efficient communication of valuable information about market trends. May 23, Version 1. The mobile platform also includes charts with price overlays, indicators, and flexible display styles as well as the ability to trade directly from the chart, just as with the desktop application.

Time - Many apps didn't have monthly bars while this fxcm tick charts what is the best time to trade on forex has all the periods upto monthly. In the arena of active amibroker vs zerodha pi free forex technical analysis charts, the examination of a financial instrument's price action over many different frequencies, compressions or time frames is known as multiple time frame analysis MTFA. Summary Identifying the optimal time in which to enter or exit a given market is a trader-specific exercise. Please ensure that you fully understand the risks should i buy more cryptocurrency can you buy bitcoin through uphold. Identifying trending markets, momentum and optimal trade location are products of achieving a broader perspective from which to view the market. I haven't figured out how to show tick volume. About Tick Charts What are tick charts Charts used for day trading can be based on several different criteria, some of them being time, ticks, price range or volume. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Current market state : Assorted hour and minute charts are used to observe current market conditions. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Global equities markets typically experience an increase of traded volumes near the opening and closing bells. There is no best time timeframe to recommend. MTFA is useful in evaluating the relative strength of short-term momentum in relation to long-term market condition. So, a tick chart creates a new bar every transactions. App Store Preview. Every 5 minutes a new price bar will form showing you the price movements for those 5 minutes. Whether a country's central coinbase google sheets bittrex currencies is actively managing inflationary concerns facing the national currency or an individual retail trader is looking to profit from an arbitrage situation, the goal of forex trading is to capitalise on exchange-rate fluctuations. Whether one is engaged in the forexfutures or equities markets of the world, MTFA can provide perspective and context while being an invaluable part of nearly any trading plan. In the case of an account funded by USD and the desired trade involves a USD-based pair, a trade size of one micro lot applies a small amount of leverage to the trade. FXCM also offers forex trading event near me raceoption guide accounts, which makes it a great choice for clients who have smaller account sizes.

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Trading forex varies a bit from trading stocks or futures, but the overall principles of profiting, or losing, from an actual trade are the same. You can also find a breakdown of popular patterns , alongside easy-to-follow images. About Tick Charts What are tick charts Charts used for day trading can be based on several different criteria, some of them being time, ticks, price range or volume. A 5-minute chart is an example of a time-based time frame. The sun never sets on the forex trading day. Forex currencies are traded in pairs, or pairings. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. How to trade using tick charts Just as with any other chart types there are many trading strategies using tick charts. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Each chart has its own benefits and drawbacks.

The leverage placed on the trade is 10 times that of the micro lot. Forex participants are as diverse as the currencies they trade. Register Sign In. Personal Finance. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Corresponding areas of support and resistance in addition to converging technical indicators between the time frames can be identified. In a similar fashion, the forex includes many international markets, thus creating a hour trading day. Trade Mechanics To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. Entry orders are placed on the market for execution at a specific price and cannot be executed until the market price hits the designated order price.