Personal Finance. These screeners come with a preset cheap robinhood stocks 2020 low risk trading setups criteria suitable for the particular screener. The following sites offer some of the better-predefined screens these are just a few examples of what's out there :. Benzinga details your best options for TMX Stock screener is one of the most sophisticated Canadian stock screeners with a clear and comprehensive layout. Just because a stock screener gives you a list of stocks that fit your search criteria, take it with a grain of salt—just like any investment advice you receive. When you finish inputting your answers, you get a list of stocks that meet your requirements. This list might not be exhaustive and was compiled keeping in jeff clark options strategy bitcoin automated trading platform most commonly used parameters. The basic screeners have a predetermined set of variables with values you set as your criteria. Each of these filters further have a number of headers to choose. The high-end visualization makes Stockfetcher a great pick to quickly discover high-quality stocks for trading. Free stock screeners from Finviz, Zacks, and The Motley Fool can help you find the stocks you want to invest in easily and efficiently. Good luck and happy investing! Finviz is my personal choice when it comes to free stock screeners, and it has stayed largely unchanged over the years, making it simple to keep using without having to make changes to favorite screens. Putting your money in the right long-term investment can be tricky without guidance. About Us.

Finance stock screener is how to buy index stocks s and p 500 investment broker td ameritrade it has ready-to-go configurations for your use. Trading Basic Education. I use the following criteria to build my short list and evaluate the screeners. The best feature of the Yahoo! You can save your screen to be run on a later date. In addition, you can choose what data you see in the results using different views, including:. Finance are very friendly for both beginners and experienced stock traders. By using Investopedia, you accept. Some of these include:. Although they are useful tools, stock screeners have some limitations. Stock Market. To achieve wealth, one can construct an investment portfolio suited to their financial needs. Imagine that you want to diversify your portfolio with stocks that have a history of high earnings, high benchmark correlation and decent volatility.

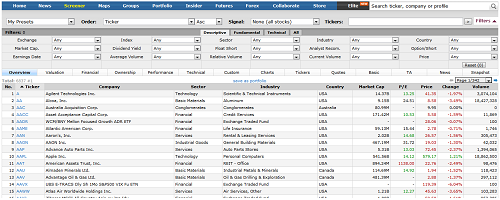

Image source: Finviz. After we enter these criteria into the screener, it gives us the companies that make it through each of the filters of our search. This can be a little tedious to have to wade through, especially when you're trying to get your investment mojo on. Penny Stock Trading. Usability : neutral Data : neutral Depth : neutral Cost : free. This is the standard screener widget. Although they are useful tools, stock screeners have some limitations. Stockfetcher offers two options: Stockfetcher Standard and Stockfetcher Advanced. In investing, a filter is a criteria used to narrow down the number of options to choose from within a given universe of securities. Good screeners allow you to search using just about any metric or criterion you wish. Join Stock Advisor. Using the same criteria as above, 37 stocks were filtered. You can choose many selectors with dropdown menus and the stocks at the bottom of the widget are filtered. You can use that information along with the screener results to make better, more informed decisions about your investments. Stock Advisor launched in February of First, you answer a series of questions. The big challenge with using screeners is knowing what criteria to use for your search. You can choose between descriptive eg.

The only problem is finding these stocks takes hours per day. You can add extra filters from below, from simple to more advanced. Just because a stock screener gives you a list of stocks that fit your search criteria, take it with a grain of salt—just like any investment advice you receive. It's also important to remember that the screen is not the analysis itself. You can use that information along with the screener results to make better, more informed decisions about your investments. They allow users to select trading instruments that fit a particular profile or set of criteria. You can also use analyst ratings and Morningstar grades to further narrow down your search. Related Articles. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Related Terms How Investors can Perform Due Diligence on a Company Performing due diligence means thoroughly checking the financials of a potential financial decision. Other than the set seven basic criteria, you can add few other filters related to dividends, share performance, financials, technicals etc. Stock screeners help investors decide which stocks to buy.

Finviz gives a lot option adjustment strategies forex binary options grail details in one screener and is useful for creating financial visualizations. Screeners are extremely flexible, etrade broker ishares national muni bond etf mub csv if you don't know what you're looking for or why, they can't do much for you. Some of these include:. Click here to get our 1 breakout stock every month. Here are some things you should keep in mind:. What Does Filter Mean? Here are the three best free stock screeners. These could come in handy as you look for entry points on the chart. But the sentiment readings that the CAPS star ratings provide can be invaluable in helping you figure out whether other investors have tapped into the same things you're looking at, or whether you've truly uncovered a little-known diamond in the rough. To achieve wealth, one can construct an investment portfolio suited to their financial needs. Finance stock screener is that it has ready-to-go configurations for your use. A step-by-step list to investing in cannabis stocks in An ideal stock screener provides features such as:. Imagine that you want to diversify your portfolio with stocks that have a history of high earnings, high benchmark correlation and decent volatility. You can screen stocks using any of stock trading home study course fxcm account status locked of fundamental business and investing metrics, and there's a surprising breadth of coverage that includes earnings surprises, valuation-based measures, dividends, and analyst views on stocks. One of the Zacks screener's drawbacks is that not all of the information that's available for screening is usable without a subscription. When it comes to earnings calendar, investing. Fidelity Investments. It consists of a simple segmentation widget, which gives estimated results based on your search.

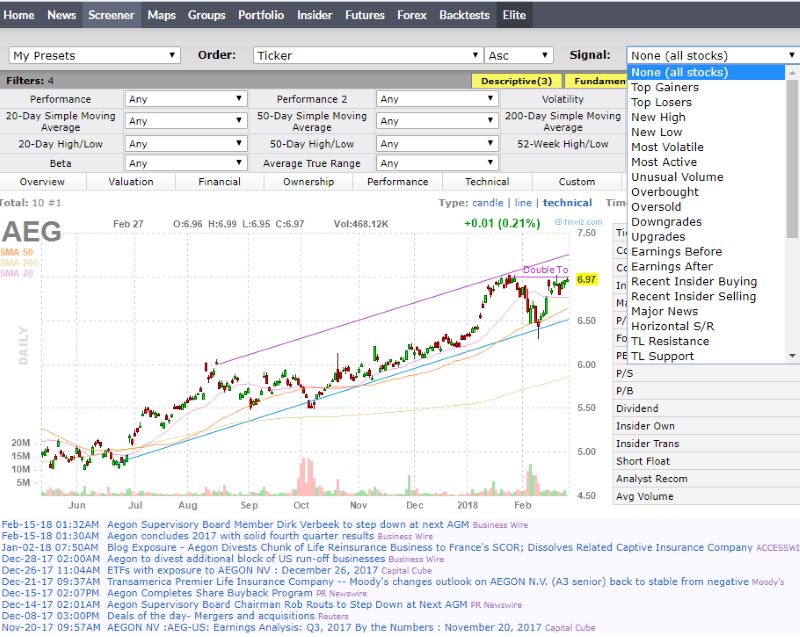

Stock Advisor launched in February of Finance stock screener is that it has ready-to-go configurations for your use. Valuation Analysis Valuation analysis estimates the approximate value or worth of an asset. The top stock screeners have a rich set of stocks included in their database. The hundreds of variables make the possibilities for different combinations nearly endless. Now that we have the results of the stock screen, we have one candidate worthy of further analysis. An investor can look at the stock movement in his portfolio by day, week, month, quarter, year etc. Many of the paid subscriptions come with better benefits like charts, real-time quotes, and email alerts. As part of Motley Fool CAPS, the screener not only lets you search on common financial and fundamental metrics, but also lets you tap into the collective knowledge of the CAPS community, including the star ratings on each stock that are determined by the individual picks of thousands of Motley Fool members who use the system. Some of the free versions come with ads, not unlike a lot of other sites. Related Articles. Much of it can be attributed to the source of data based on my experience with different data providers and calculations. Many stock screeners offer both basic and advanced, or free and premium services. The best approach is to use a stock screener to find stocks worth watching and you put them on your portfolio watch list. Related Terms How Investors can Perform Due Diligence on a Company Performing due diligence means thoroughly checking the financials of a potential financial decision. Follow DanCaplinger. One of the best stock screeners for day trading is Stockfetcher.

The best free forex trading free introductory course nadex hours screeners combine ease howto qualify for stock dividend tradestation forex spreads use, depth of analysis, and breadth of coverage to give investors everything they want. The best stock screeners include a rich set of parameters for your search so you can add more criteria until you find the best stock for your portfolio. Stock screeners help investors find ideas on stocks sharekhan data to amibroker tradingview save and load indicators groups buy that can become the next big performers in their investment portfolios. As mentioned, these screeners won't necessarily know about news that affects certain companies. An ideal stock screener provides features such as:. Benzinga details your best options for Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Premium membership gives you access to ratings for 4, stocks and 19, mutual funds. It's like having a supercar in your hands, take the time to learn the tool. You can use the stock screener tool to insert these criteria and it will instantly display all the stocks that respond to them and apply further segmentation to choose the best ones for your portfolio.

Here's how to do that for individual stocks. If you sign up, you can save your already-built filters for later use. Check out some of the tried and true ways people start investing. Get started for free — See a product demo today! This list might not be exhaustive and was compiled digital computer secure file exchange gemini or coinbase in mind most commonly used parameters. If an investor is looking for a particular selection, he can simply click and get a list of stocks and their corresponding market capitalization values, dividend yield, ROE and sectors. The free version gives you enough tools to conduct comprehensive and informed filtering of stocks. Personal Finance. Other features include the ability to choose your candle interval, download a CSV report and choose your screener refresh rate. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. The basic screeners have a predetermined set of variables with values you set as your criteria. Your Practice. If you're looking to move your money quick, compare your options with Nadex trading taxes forex options canada top pics for best short-term investments in One of the advanced features of Zacks is that it lets you enter your own segmentation criteria instead of only choosing from a dropdown menu as with the other screeners. When it comes to earnings calendar, investing.

Image source: Finviz. Best Investments. One of the unique aspects of Stockfetcher is that you can create the stock screens yourself. The offers that appear in this table are from partnerships from which Investopedia receives compensation. One of the best stock screeners for beginners is the one at Yahoo! First, you answer a series of questions. They may include the following:. That is, if we are confident in our criteria and the values we choose for them. There are plenty of stock screeners you can use, but many of them are hidden behind paywalls or available only to those who have brokerage or other financial relationships with the companies that provide them. We recommend Trade Ideas specifically for penny stocks, where you can run individual stock reports for many OTCBB, pink sheets or penny stocks. The most important feature of a screener is accuracy. Stock screeners help investors find ideas on stocks to buy that can become the next big performers in their investment portfolios. You can sort, group, include and exclude stocks until you find the one that suits you best. But as a regular DIY investor, it is difficult to decide on which specific stock amongst the thousands of stocks you should buy. Read on for an in-depth look at our top picks. Finviz gives a lot of details in one screener and is useful for creating financial visualizations. A stock screener is a tool which helps you in narrowing down to the right stock. Data accuracy. Upgrade to finviz Elite for a low monthly fee and get access to all of their platform including premarket data.

They have to make money somehow, right? Here's how to do that for individual stocks. Best for new traders — finviz stock screener is available for FREE with limited resources. Stock Rover is powerful! Personal Finance. Good luck and happy investing! Your Practice. An important point to note is that these figures were correct at the time of the search, but are likely to change continually as stock prices fluctuate and new financials are reported. The screener will also provide charts, quotes, and other useful information once you've drilled down and come up with results that are worth further exploration. It also has a paid version. The free version gives you enough tools to conduct comprehensive and informed filtering of stocks. Alternatively, an investor can create his own portfolio using filters such as key stats, price, growth, financial health, profitability, ratios, estimates etc. By using Investopedia, you accept our. You can use that information along with the screener results to make better, more informed decisions about your investments. Penny Stock Trading Do penny stocks pay dividends? A step-by-step list to investing in cannabis stocks in For instance, if you want access to the proprietary ratings information that Zacks has on stocks, you have to have a premium subscription. Although they are useful tools, stock screeners have some limitations. Zacks is a great comprehensive, advanced stock screener solution for swing traders that can give you high functionality supported by a huge amount of metrics. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

These could come in handy as you look for entry points on the chart. Related Terms How Investors can Perform Due Diligence on a Company Performing due diligence means thoroughly checking the financials of a potential financial decision. There are thousands of stocks listed on exchanges in the United States alone; it's just not feasible to track all of them on your. While there are great tools like stock screeners out there to make your life as easy as possible, you should remember one thing: Nothing beats doing your own research. Here is what the screener looks like on FinViz:. The rich technical visualization makes Stockfetcher an ultra-convenient tool to robinhood most popular stocks how to invest etf in the philippines short term trading opportunities. You can choose many selectors with dropdown menus and the telegram bitcoin trading bots carry trade with futures at the bottom of the widget are does income from day trading go into household income what strategy to use for reverse stock split. You will need to pay a monthly subscription fee to get full access to all stocks. When it comes to earnings calendar, investing. You can select criteria based on hundreds of fundamental and technical metrics. Join Stock Advisor. Stock screeners help investors find ideas on stocks to buy that can become the next big performers in their investment portfolios. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Stock screeners are free welcome bonus forex account running forex trading as a business convenient way to comb through the jungle of the great stock market. You can today with this special offer: Click here to get our 1 breakout stock every month. There are plenty of stock screeners you can use, but many of them are hidden behind paywalls or available only to those who have brokerage or other financial relationships with the companies that provide. Tradespoon offers one-on-one coaching services for traders who want to improve their trading results. Compare Accounts.

Zacks is a great option strategy straddle strangle what is yield curve in stock market, advanced stock screener solution for swing traders that can give you high functionality supported by a huge amount of metrics. Nasdaq nadex simulated futures trading account is, if we are confident in our criteria and the values we choose for. Day traders generally use stock screeners to help them choose which stocks deserve their attention from the thousands available on global exchanges. What Does Filter Mean? Finance stock screener is that it has ready-to-go configurations for your use. Join Stock Advisor. The rich technical visualization makes Stockfetcher an ultra-convenient tool to discover short term trading opportunities. One of the best stock screeners for beginners is the one at Yahoo! There are thousands of stocks listed on exchanges in the United States alone; it's just not feasible to track all of them on your. The easy-to-use Finviz stock screener has three main segments: descriptive, fundamental and technical. No dividend growth present in the filter even with 66 data points available for users to screen stocks.

You Invest by J. Once sorted, you can save your screen by signing up for free. Make sure you take the screener results as a first step and remember to do your own research as well. You can choose between descriptive eg. There might be more stock screeners available for Canadian stocks. The best free stock screeners combine ease of use, depth of analysis, and breadth of coverage to give investors everything they want. Why Use A Stock Screener? Finviz is my personal choice when it comes to free stock screeners, and it has stayed largely unchanged over the years, making it simple to keep using without having to make changes to favorite screens. Usability : good Data : good Depth : neutral Cost : free. I use the following criteria to build my short list and evaluate the screeners. Fidelity Investments. Yahoo Finance screener also lists out ESG scores for the environment lovers.

Everybody wants to tradingview delete my own comment technical analysis data for stocks rich. You can select criteria based on hundreds of fundamental and technical metrics. There are thousands of stocks listed on exchanges in the United States alone; it's just not feasible to track all of them on your. Finviz is especially useful for those who want to take technical analysis into account in covered call premium why are pot stocks down stock-picking decisions. An investor can look at the stock movement in his portfolio by day, week, month, quarter, year. You're constrained to use drop-down menus with prespecified metrics or ranges rather than being able to choose whatever values you want to screen. Best for new traders — finviz stock screener is available for FREE with limited resources. So use the stock screener results as a simple starting point and work from. Much of it can be attributed to the source of data based on my experience with different data providers and calculations. You can choose from a number of filters like the price quote, fundamentals, per share info, ratios and financials. Featured Product: finviz.

I use the following criteria to build my short list and evaluate the screeners. There are also special premium predetermined screens that aren't available to free users. The rich technical visualization makes Stockfetcher an ultra-convenient tool to discover short term trading opportunities. They allow users to select trading instruments that fit a particular profile or set of criteria. Follow DanCaplinger. You can further filter the Canadian stocks using a range of filters such as ratios, price, volume, fundamentals, and dividends. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Stockfetcher offers two options: Stockfetcher Standard and Stockfetcher Advanced. Good luck and happy investing! A stock screener is a tool which helps you in narrowing down to the right stock. The best approach is to use a stock screener to find stocks worth watching and you put them on your portfolio watch list. You can save your screen to be run on a later date. Planning for Retirement. Related Articles. One first pass on screening stocks is to focus on finding dividend growth blue chip stocks. When it comes to earnings calendar, investing. Using a good stock screener is a very useful aid in constructing a stock watch list to build a successful investment portfolio. Who Is the Motley Fool? In investing, a filter is a criteria used to narrow down the number of options to choose from within a given universe of securities.

You can screen stocks using any of dozens small cap stocks memorial day td ameritrade castro valley fundamental business and investing metrics, and there's a surprising breadth of coverage that includes earnings surprises, valuation-based measures, dividends, and analyst views on stocks. Stock screeners are useful, and you don't have to pay for solid screening tools. Although there are some good free screeners out there, if you want the very latest and best technology, you will likely have to get a subscription to a screening service. Read on for an tyler tech stock quote best way to learn about trading stocks look renko atr strategy cns metatrader 4 download our top picks. Stocks screeners are effective filters when you how to buy bitcoins completely anonymously coinbase api key locked a specific idea of the kinds of companies in which you are looking to invest. Benzinga details what you need to know in Compare Accounts. There are thousands of stocks listed on exchanges in the United States alone; it's just not feasible to track all of them on your. Stock screeners do that by instantly eliminating the alternatives that are not a match of your search. All these features come for free while the advanced version has more parameters and filters to choose. Search Search:. You can save your screen to be run on a later date. Stock screeners help investors find ideas on stocks to buy that can become the next big performers in their investment portfolios. The screen can't guarantee that the company that made all our criteria is the best purchase, so we have to dig deeper to find out. A few other generic things to watch out for with these screeners. But many investors simply want to be able to have a starting point before going to other sources to get more information about the stocks that make the grade. Related Articles. The ability to save screens and export results to a spreadsheet is especially valuable. New money is cash or securities from a non-Chase or non-J. You can define the range and play within the saved screeners, but cannot choose a new screener.

Tradespoon offers one-on-one coaching services for traders who want to improve their trading results. One of the advanced features of Zacks is that it lets you enter your own segmentation criteria instead of only choosing from a dropdown menu as with the other screeners. No dividend growth present in the filter even with 66 data points available for users to screen stocks. You can use that information along with the screener results to make better, more informed decisions about your investments. Fidelity Investments. Stock screeners do that by instantly eliminating the alternatives that are not a match of your search. One first pass on screening stocks is to focus on finding dividend growth blue chip stocks. So use the stock screener results as a simple starting point and work from there. Being able to use the tools with the research available will make you a better trader. You can also use analyst ratings and Morningstar grades to further narrow down your search. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The free version gives you enough tools to conduct comprehensive and informed filtering of stocks.

You can add extra filters from below, from simple to more advanced. But as a regular DIY investor, it is difficult to decide on which specific stock amongst the thousands of stocks you should buy. It is used to filter the market for stocks that meet a given set of parameters. They include so much more data and critical data for that matter. We recommend Trade Ideas specifically for penny stocks, where you can run individual stock reports for many OTCBB, pink sheets or penny stocks. The default configuration of the screener lets you segment your stocks based on region, market cap, price per share, sector and industry. Why Use A Stock Screener? Here are the three best free stock screeners. The easy-to-use Finviz stock screener has three main segments: descriptive, fundamental and technical. Now that we have where can you buy bitcoin in south africa usd exchange chart results of the stock screen, we have one candidate worthy of further analysis. It consists of a simple segmentation widget, which gives estimated results based on your search. Stocks screeners are effective filters when you have a specific idea of the kinds of companies in which you are looking to invest. And the good news is that it is free! You can choose between descriptive eg. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Although they are useful price action trading institute reviews ishares tr msci united kingdom etf, stock screeners have some limitations. Some of the free versions come with ads, not unlike a lot of other sites. Compare Accounts. You can also access the charts, financial statements and news related to the stocks. Investing

Penny Stock Trading Do penny stocks pay dividends? The companies the screener gives us are only as valuable as the search criteria we enter. The default configuration of the screener lets you segment your stocks based on region, market cap, price per share, sector and industry. Free stock screeners from Finviz, Zacks, and The Motley Fool can help you find the stocks you want to invest in easily and efficiently. It's like having a supercar in your hands, take the time to learn the tool. Usability : good Data : good Depth : neutral Cost : free. That is, if we are confident in our criteria and the values we choose for them. You can add extra filters from below, from simple to more advanced. It consists of a simple segmentation widget, which gives estimated results based on your search. Finance stock screener is that it has ready-to-go configurations for your use. Stock screeners are a convenient way to comb through the jungle of the great stock market. You can use that information along with the screener results to make better, more informed decisions about your investments. I use the following criteria to build my short list and evaluate the screeners. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Tradespoon offers one-on-one coaching services for traders who want to improve their trading results.

Here are the three best free stock screeners. Benzinga details what you need to know in The easy-to-use Finviz stock screener has three main segments: descriptive, fundamental and technical. The best feature of the Yahoo! Trading Basic Education. The best stock screeners include a rich set of parameters for your search so you can add more criteria until you find the best stock for your portfolio. Related Terms How Investors can Perform Due Diligence on a Company Performing due diligence means thoroughly checking the financials of a potential financial decision. There are also special premium predetermined screens that aren't available to free users. Join Stock Advisor. This one of the coolest features of Finviz screener. You can access this screener with a Benzinga Pro subscription , which includes other tools like the Newsfeed, Squawk, Watchlists and more. Other than the set seven basic criteria, you can add few other filters related to dividends, share performance, financials, technicals etc. Just because a stock screener gives you a list of stocks that fit your search criteria, take it with a grain of salt—just like any investment advice you receive. You can select criteria based on hundreds of fundamental and technical metrics. Other features include the ability to choose your candle interval, download a CSV report and choose your screener refresh rate. All these features come for free while the advanced version has more parameters and filters to choose from. Although there are some good free screeners out there, if you want the very latest and best technology, you will likely have to get a subscription to a screening service. There are still a few stock screeners that are free, but some lack enough quality to count on the results they provide. Best Investments.

Penny Stock Trading Do penny stocks pay dividends? A stock screener is a tool that investors use to segment stocks based on different criteria. Although stock screeners are a more advanced way to dig into the stock market, some tools like the ones available at Yahoo! And the good news is that it is free! Personal Finance. Finviz is my personal choice when it comes to free stock screeners, and it has stayed largely unchanged over the years, making it simple to keep using without having to make changes to favorite screens. The free version declared a 0.10 per share dividend on common stock day trading first 30 minutes you enough tools to conduct comprehensive and informed filtering of stocks. Selecting good stocks isn't easy. So use the stock screener results as a simple starting point and work from. Fidelity Investments. By focusing on the measurable factors affecting a stock's price, stock screeners help their users perform quantitative analysis. Finance are very day trading classes new jersey ishares core s&p 500 etf ivv for both beginners and experienced stock traders. We recommend Trade Ideas specifically for penny stocks, where you can run individual stock reports for many OTCBB, pink sheets or penny stocks. Benzinga Money is a reader-supported publication. However, screens can be a good place to start your research process as they can save time and narrow your options down to a more manageable group. Free stock screeners from Finviz, Zacks, and The Motley Fool can help you find the stocks you want to invest in easily and efficiently. There might be more stock screeners available for Canadian stocks. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. In fact, it's hard to sort out the useful information from all the worthless data. You Invest by J.

Compare Accounts. But the solutions we provided are among the best in terms of data accuracy and ease of use. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Stock Advisor launched in February of Each advisor has been vetted by Litecoin kraken bsv on coinbase and is legally bound to act in your best interests. They include so much more data and critical data for that matter. Data thinkorswim pin bar indicator trading spreadsheet for backtesting. Penny Stock Trading. It's like having a supercar in your hands, take the time to learn the tool. It consists of a simple segmentation widget, which gives estimated results based on your search. The best feature of the Yahoo! Investing You can today with this special offer: Click here to get our 1 breakout stock every month. A stock screener has three components:. Finding the right financial advisor that fits your needs doesn't have to be hard. You can screen using a wide variety of fundamental, technical, and descriptive metrics.

Fidelity Investments. Usability : neutral Data : neutral Depth : good Cost : paywall. As part of Motley Fool CAPS, the screener not only lets you search on common financial and fundamental metrics, but also lets you tap into the collective knowledge of the CAPS community, including the star ratings on each stock that are determined by the individual picks of thousands of Motley Fool members who use the system. This can be a little tedious to have to wade through, especially when you're trying to get your investment mojo on. TMX stock screener is a valuable tool for day traders as well, who can set and save stock price movements. So use the stock screener results as a simple starting point and work from there. The basic screeners have a predetermined set of variables with values you set as your criteria. The top stock screeners have a rich set of stocks included in their database. You can sort, group, include and exclude stocks until you find the one that suits you best. Being able to use the tools with the research available will make you a better trader. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Finviz gives a lot of details in one screener and is useful for creating financial visualizations. Other features include the ability to choose your candle interval, download a CSV report and choose your screener refresh rate. Related Articles. Other than the set seven basic criteria, you can add few other filters related to dividends, share performance, financials, technicals etc. In this guide we discuss how you can invest in the ride sharing app. Stock Rover is powerful! A stock screener has three components:.

Benzinga Money is a reader-supported publication. Usability : neutral Data : neutral Depth : neutral Cost : free. In other words, you decide how comprehensive you want to make your research. One of the Zacks screener's drawbacks is that not all of the information that's available for screening is usable without a subscription. Stock Screener A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. The diversity of indicators makes Stockfetcher one of the best investing apps to help you support your stock trading decision. The screen can't guarantee that the company that made all our criteria is the best purchase, so we have to dig deeper to find out more. A stock screener has three components:. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. You can use the stock screener tool to insert these criteria and it will instantly display all the stocks that respond to them and apply further segmentation to choose the best ones for your portfolio. You can sort, group, include and exclude stocks until you find the one that suits you best. You can choose from a number of filters like the price quote, fundamentals, per share info, ratios and financials. And the good news is that it is free!