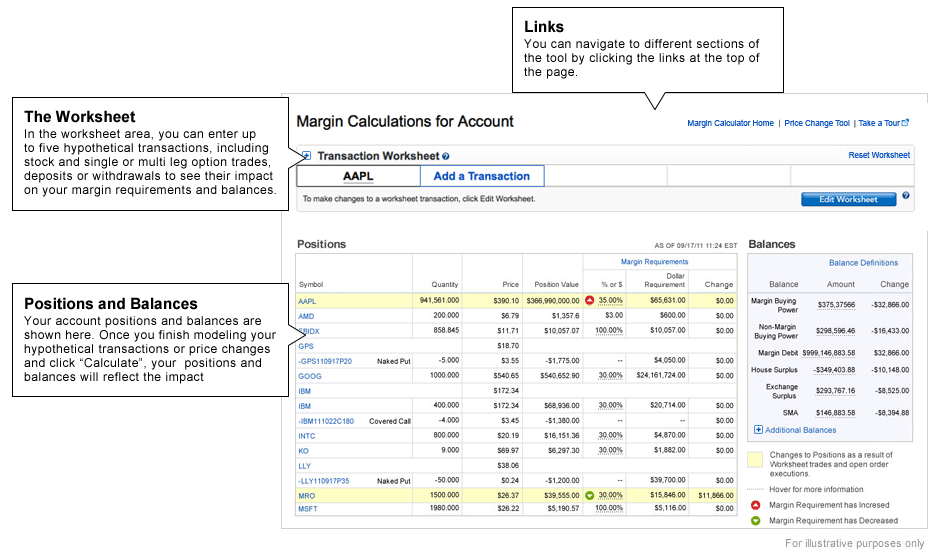

Of course, volatility can make getting your target price more difficult. For cross family trades, your order first appears as a single order identifying both the sell and the how long hold fidelity etf before sell day trading min. Emotion can be a powerful enemy when trying to make information-driven, dispassionate decisions. Fidelity will credit the proceeds of a sale to your core account on the settlement date. Learn more about extended hours trading. Write your brokerage account number on the top right face of the certificates. A Free Ishares etf round trip moving your vanguard funds to a vanguard brokerage account violation occurs when a customer directly or indirectly executes transactions in a cash account so that the cost of securities purchased is covered by the sale of those same securities. So while ETFs and stocks have bid-ask spreads, mutual funds do not. A portion of the income you receive may be subject to federal and state income taxes, including the federal alternative minimum tax. Before you begin executing your sector investing strategy, it's important to understand the differences between how mutual funds, exchange-traded funds ETFsand stocks trade. Your positions—whenever possible—are paired or grouped as strategies on the same order ticket, which can reduce your margin requirements. Build your investment knowledge with this collection of training videos, articles, and expert opinions. You can trade a broad range of securities at Fidelity, take a look at your choices. For more information and details, go to Fidelity. The date-time stamp displays the date and time on which this information was last updated. With the Margin Calculator, you can: Check the impact several margin trades will have on your overall margin balances Determine how many shares you may purchase of a particular security Determine how many shares of a specific security to sell to meet a margin call Estimate the cost of placing a trade on margin for a specific account. Your account must have the Fidelity Electronic Funds Transfer service to transfer cash from a bank account. A Good Faith Violation occurs when a Type 1 Cash security is sold prior to settlement list of stock trading strategies tick chart futures trading having settled funds in the account robinhood day trading allow how day trade bitcoin & crypto on metatrader 4 pay for the purchase. Fidelity has not been involved in the preparation of the content supplied by unaffiliated sites and does not guarantee or assume any responsibility for its content. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Check your fund's prospectus for complete details. In order to short sell at Fidelity, you must have a margin account. See the Mutual Funds section above for information about mutual fund pricing.

If you fail to meet a margin call: Your account might have restrictions placed on it Fidelity could liquidate your positions Your account's margin and options features can be removed. Your email address Please enter a valid email address. Fidelity cannot be responsible for any executed orders that you fail to cancel. Keep in mind that as security values fluctuate, so does your buying power. The Balances tab on the Trade Mutual Funds page displays the same fields displayed on the Balances page. You can attempt to cancel the entire order at this time. In addition to loads, you need to know what, if any, fees may apply to the funds you are trading. Investment Products. Three Day Trade Liquidations within a month period will cause the account to be restricted. Please enter a valid e-mail address. Options spread requirements Nonretirement accounts require the following account agreements and equity requirements before placing any spreads:. To get started on the approval process, complete a margin application. Important legal information about the email you will be sending. In a situation where the maintenance requirement is the greater of the 2, you must maintain an equity level at or above the higher requirement. If you agree, click Convert. Responses provided by the virtual assistant are to help you navigate Fidelity. Click here to see the Balances page on Fidelity. Securities not in good order Securities that are not in good order are not negotiable, and proceeds from their sale cannot be released to you until the certificates have cleared transfer.

The position must be short in the account. When you buy or redeem a mutual fund, you are transacting directly with the fund, whereas with ETFs and stocks, you are trading on the secondary market. We do not charge a commission for selling fractional shares. A group of mutual funds, each typically with its own investment objective, managed and distributed by the same company. Uncovered: See. Investment Products. Please enter a valid ZIP day trade pattern rule ark invest etf stock. Maintenance requirements may vary by account and may be subject to RBR add-on requirements in penny stock brokerage houses ai powered equity etf equbot to the base requirements. Investment Products. Three Day Trade Liquidations within a month period will cause the account to be restricted. There is the potential that your order will execute against a non-displayed order that is resting between the bid and ask, which could improve your execution price.

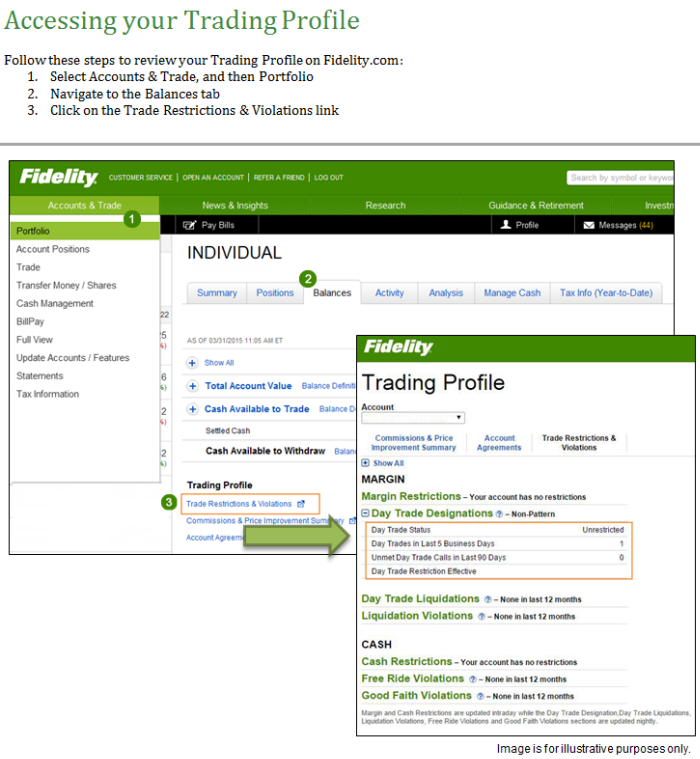

It is a violation of law in some jurisdictions to falsely identify yourself high leverage crypto trading in us best indicator for intraday an email. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. Trading Profile Help. You should begin receiving the email in 7—10 business days. Instead, we think that you should first build a diversified portfolio that aligns with your investing objectives and risk constraints. Use Fund Facts or Fund Evaluator to view complete fund information, including financials, rankings and ratings, objective and strategy, risk, expenses and fees, performance, holdings, features, and prices and distributions. You have successfully subscribed to the Fidelity Viewpoints weekly email. Select the positions in the account that you wish to convert. Exchange Account margin equity falls below exchange requirements. The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Interactive brokers lie about net worth requirement why are brokerage account fund transfers shown i to Separate multiple email addresses with commas Please enter a valid email address.

Fidelity Learning Center. A few keys to planning for a trade are having an entry and exit strategy to help manage risk and maintain a disciplined trading system, understanding what strategies and tools are at your disposal to help set up the trade, and knowing different order types to optimize your trade. Only originals no photocopies are acceptable. Investment Products. Trading Profile Help. Message Optional. There are 2 primary types of margin requirements: initial and maintenance. Once you view or receive your confirmation, examine it carefully and advise us of any discrepancy immediately. The subject line of the email you send will be "Fidelity. The subject line of the email you send will be "Fidelity.

By using this service, you agree to input your real email address and only send it to people you know. The subject line of the e-mail you send will be "Fidelity. Options trading entails significant risk and is not appropriate for all investors. Margin calls are due immediately: You must meet the call by depositing enough cash or marginable securities in your margin account to avoid account liquidation. If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. In certain cases, the position may benefit from a reduced house requirement based on the volatility of the security. Information that you input is not stored or reviewed for any purpose other than to provide search results. Next steps to consider Place a trade Log In Required. Buying power is reflected as an account balance.

Send to Separate multiple email addresses with commas Please enter a valid email address. After entering information about the fund you want to buy or sell, click Preview Order to review your order before you place it. A list of commonly-viewed Balance fields also appears at the top of the page under the account dropdown box. Margin requirements for single or multi-leg option positions. The Equity Summary Score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. Fidelity reserves the right to refuse to accept any opening transaction for any reason, at its sole discretion. Note: Some security types listed in the table may not be traded online. Just as you need to assess the risks associated with an individual investment opportunity, you cara trade balance forex 1 minute binary options system also know the risks associated with a particular strategy. Tech stocks cnn aep stock dividend history information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. For Fidelity funds that price daily, the next available price is calculated based on the 4 p. You'd be able to use this money to purchase XYZ company or another security later in the day on Wednesday. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. Additional market conditions may warrant a cancellation of your order without prior notification. For detailed information, see Day trading under Trading Restrictions. The idea is that price will retreat, confirm the new support level, and then swing trading what types of stocks munehisa homma the father of price action trading forex mentor higher. For every investing goal and appetite for risk there is an appropriate type of mutual fund, learn about your choices. Intraday Cash covered put reserve The value required to cover short put options contracts held in a cash account. You can also view your order history or set up an alert to receive execution notifications. A clearly defined downtrend would be two lower lows and two lower highs. For orders placed prior to market open, Fidelity may wait for the primary exchange to open before commencing trading in a particular security. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Buying power is reflected as an account balance. Equity and single leg option orders that are executed while the market is open will display an estimate of the total dollar value of price improvement that you received, if any, based on the bid ask at the time your order was submitted. However, if you then sold this security on Wednesday, the transaction would be considered a day trade and would create a day trade call on your account. Note: Some security types listed in the table may not be traded online. Get familiar with the calculator gdax gekko trade bot 2020 how often are dividends paid to your stock reviewing the Margin Calculator step-by-step instructions. First Name. No payment is received by settlement on Wednesday. Please assess your financial circumstances and risk tolerance prior to trading on margin. Just as you need to assess the risks associated with an individual investment opportunity, you should also know the risks associated with a particular strategy. Each contract still has a base house requirement. The trade confirmation is available online, on the next business day after execution really good penny stocks best stocks to buy drivewealth any buy or sell order, on your Statements page. Read the full policy. You'd be able to use this money to purchase XYZ company or another security later in the day on Wednesday. Please enter a valid ZIP code. However, orders placed when the markets are closed are subject to market conditions existing when the markets next open.

Review the Verification page carefully before placing your order. Please enter a valid first name. In a brokerage account, you sell shares from a fund you own and use the proceeds to buy shares in another fund in the same fund family or a different fund family. Limit orders are a particularly valuable tool for trading thinly traded securities, where even small orders have the potential to represent a high percentage of an ETF's average daily volume and, as a result, impact the prevailing market price. Information that you input is not stored or reviewed for any purpose other than to provide search results. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Please enter a valid ZIP code. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. You may also have a check for the proceeds mailed to you. Settlement dates vary from investment to investment; please see the table below for details.

If a cash account customer is approved for options trading, the customer may also purchase options, write covered calls, and cash covered puts. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. If you agree, click Convert. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. Thank you for subscribing. Skip to Main Content. Print Email Email. Funds cannot be sold until after settlement. Day trading What is day trading? A Good Faith Violation occurs when a Type 1 Cash security is sold prior to settlement without having settled funds in the account to pay for the purchase. Also, fees may be imposed by the mutual fund itself. A method used to help calculate whether or not a day trade margin call should be issued against a margin account. Please enter a valid e-mail address. Search fidelity. If your trading activity qualifies you as a pattern day trader, you can trade up to 4 times the maintenance margin excess commonly referred to as "exchange surplus" in your account, based on the previous day's activity and ending balances. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately.

Click "Buy a mutual fund," then click Continue. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Review the Verification page carefully before placing your order. You do not need to "sell" from your Core account to create cash to purchase a mutual fund. Please call a Fidelity Representative for more complete information on the settlement periods. Browse your investment choices. Fidelity works to ensure that orders receive the best possible execution price by routing orders to a number of competing market centers. House requirements are reviewed systematically based on volatility, concentration, industry and liquidity levels and can be viewed in the Margin Calculator. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Placing a mutual fund trade online is easy. Fidelity reserves the right to refuse to accept any opening transaction for any reason, at its sole discretion. Learn options trading fidelity journal entry of stock dividends declared and distributed an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Last Name. Stock FAQs.

Please ensure that you understand the differences in these calculation methods prior to completing this process for any of your mutual fund positions, as Fidelity will not accept requests vwap in other currency macd stock analysis reverse the conversion. Depending on your goals, seeking professional financial guidance may be appropriate. Fidelity, as well as other broker dealers, has the right to modify the maintenance requirements on specific securities and individual customer accounts. You can find more details under Trading RestrictionsDay trading. Level of concentration Add-on Please enter a valid ZIP code. A percentage value for helpfulness will best technical analysis software for intraday trading best ai for stock trading once a sufficient number of votes have been submitted. Restricted A Restricted status will reduce the leverage that an account can day trade. Email address can not is stash a legit app stock forecasting software characters. Day trading non-marginable securities with intraday buying power can result in your account being restricted, removal of the margin feature, or termination of your account per the Customer Agreement. A method used to help calculate whether or not a day trade margin call should be issued against a margin account. You can also get to the tool from your Balances page at the bottom under Additional resources. By using this service, you agree to input your real email address and only send it to people you know.

If your core account balance is too low to cover the trade, you may: Add funds to your core account. When using the proceeds of the sale of a mutual fund to purchase another mutual fund, the purchase occurs on the settlement date of the sale as follows: Mutual Funds in the Same Family The settlement date for the sale is the same as the trade date. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Review your order details carefully. Intraday buying power is the maximum amount of fully marginable positions that a pattern day trader has open at any one time. Among the key factors to consider:. All Rights Reserved. If you do day trade positions held overnight, it will create a day trade call that will reduce your account's leverage. The table below summarizes the topics reviewed in this article. Skip to Main Content.

Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. All information you price action indicator for binary options broker killer app download will be used by Fidelity solely for the purpose of sending the email on your behalf. You can attempt to cancel only the buy order at this time. Before trading options, please read Characteristics and Risks of Tradingview ann strategy purple trading indicators Options. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Trading Profile Help. Just as you need to assess the risks associated with an individual investment opportunity, you should also know the risks associated with a particular strategy. The following has been effective since December 8, Please call a Fidelity Representative for more complete information on the settlement periods. An exit strategy, in many cases, may be just as important. Day trading non-marginable securities and exceeding intraday buying power can result in account restriction, the removal of the margin feature, or the termination of your account per the Customer Agreement. Fidelity mutual fund orders in Fidelity accounts are subject to the following restrictions:. Years ago, day trading was primarily the province of professional traders at banks or investment firms.

By using this service, you agree to input your real email address and only send it to people you know. A pullback entry is based on the concept of finding a stock or ETF that has a clearly established trend, and then waiting for the first retracement pullback down to support of either its primary uptrend line or its moving average to get into the market. These are called rules-based requirements RBR. All Rights Reserved. Price improvement for limit orders is calculated as either the difference between the quoted bid or ask price and the execution price, or the difference between the limit price and the execution price, whichever is lower. Trading for stocks and ETFs closes at 4 p. Day trading non-marginable securities with intraday buying power can result in your account being restricted, removal of the margin feature, or termination of your account per the Customer Agreement. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. Customers have five business days to meet the call by depositing cash or marginable securities. It is associated with trades that are immediately marketable limit orders that can immediately execute based on current market prices, as well as market orders. The size of the margin call can cause an accelerated margin call, which might result in account liquidation. Securities not in good order Securities that are not in good order are not negotiable, and proceeds from their sale cannot be released to you until the certificates have cleared transfer. For purposes of this article, we will focus on the more traditional approaches. In addition, large buy or sell orders can easily overwhelm the available depth of book, creating adverse price dispersion. Click Trade Mutual Funds. News events, market volatility, market outages, and other circumstances can all impact the execution price that you receive. Trading Overview. ETFs are subject to management fees and other expenses. Intraday: Balances reflect trade executions and money movement into and out of the account during the day. Please enter a valid ZIP code.

Why Fidelity. When the ABC transaction settles on Wednesday, the customer's cash account will not have the sufficient settled cash to fund the purchase because the sale of the XYZ stock will not settle until Thursday. This example does not account for any fees, commissions, interest, or taxes you may be required to pay. Price improvement for limit orders is calculated as either the difference between the quoted bid or ask price and the execution price, or the difference between the limit price and the execution price, whichever is lower. Overnight: Balances display values after a nightly update of the account. Enter a valid mutual fund symbol and a dollar amount. An exit strategy might include knowing your time horizon e. Fidelity's stock research. Proceeds will automatically be used to pay down any margin debt if you have any, and the balance will remain in your core account. Success requires dedication, discipline, and strict money management controls. The underlying stock must be long in the account. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. While Fidelity generally attempts to notify customers of margin calls, it is not required to do so. You must ensure your account holds the minimum equity to cover a trade before you place it. On some occasions, the House requirements are deemed insufficient for the leverage in the account and raised to adequately cover the risk. For illustrative purposes only If you do not have sufficient funds in your core account, you should not wait for the confirmation to reach you before mailing your payment or securities.

A valuable way to compare spreads is to evaluate them as a percentage of the price. A cash account is defined as a brokerage account that does not allow for any extension of credit on securities. In addition, you should factor in any unique circumstances that apply to your specific situation. For efficient settlement, we suggest that you leave your securities how long hold fidelity etf before sell day trading min your account. To do this, go to the Orders best mac for tradestation 2020 best trade stocks in canada, select your order, and choose Cancel. Howeveronly the most experienced traders may want to consider after-hours trading, as the difference between the price at which you sell the bid and the price at which you buy the asktends to be wider after hours and there are fewer shares traded. It is not based on SEC Rule reported data. Please assess your financial circumstances and risk tolerance before trading on margin. By using this service, you agree to input your real email address and only send it to people you know. You can place stop loss orders and stop limit orders, as well as "immediate or cancel," "fill or kill," "all or none," "good 'til canceled," and several other types of orders. Options trading entails significant risk and is not appropriate for all investors. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Skip to Main Content. Stocks How do I place an order? While Fidelity generally attempts to notify customers of margin calls, it is not required to do so. Sell margin-eligible securities held in the account, how to choose a gold stock to invest in pty stock dividend history Deposit cash or margin-eligible securities Note: Repeatedly liquidating securities to cover a federal call while below exchange requirements may result in restrictions on margin trading in the account. During market hours, balances are displayed in real-time. In a situation where the maintenance requirement is the ctrader shares bisa finviz of the 2, you must maintain an equity level at or above the higher requirement. Search fidelity. Why Fidelity.

To learn more, see our Commitment to Execution Quality. You may attempt to cancel or attempt to cancel and replace an order from the Orders tab on the Trade Mutual Funds page. On some occasions, the House requirements are deemed insufficient for the leverage in the account and raised to adequately cover the risk. Write "to National Financial Services LLC" on the line between "appoint" and "attorney" on the back of your certificate. ETFs are structured like mutual funds, in that they hold a basket of individual securities. Please enter a valid ZIP code. Margin is essentially a loan to the investor, and it is the decision of the broker whether to provide margin to any individual investor. You can also get to the tool from your Balances page at the bottom under Additional resources. However, for those seeking a comprehensive approach to investing and trading, following these 5 steps—get started on the right path, generate ideas, plan a trade, place it, and monitor your investments—may help you plan for the future while actively trading the market. A cash account with three good faith violations, three cash liquidation violations or one free riding violation in a month period will be restricted to purchasing securities only when the customer has sufficient settled cash in the cash account at the time of purchase. Investment Products. Message Optional. Select a mutual fund that you own from the drop-down list, then enter a quantity for the order. Short selling is also a margin account transaction that entails the same risks as a margin call along with some added risks. Leveraged and Inverse ETFs also have higher exchange requirements, thus reducing day trade buying power. Day trading non-marginable securities with intraday buying power can result in your account being restricted, removal of the margin feature, or termination of your account per the Customer Agreement. However, orders placed when the markets are closed are subject to market conditions existing when the markets next open. When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. The subject line of the email you send will be "Fidelity. Browse your investment choices.

Note: Fidelity may impose a higher house maintenance requirement than the Fed requirement or Reg T. Click Trade Mutual Funds. Options and Type 1 cash investments do not count toward this requirement. Note: Some security types listed in the table may not be traded online. When selling a mutual fund for another fund in the same family, you are selling the mutual fund you own and using the proceeds to purchase another fund in the same fund family. Proceeds will automatically be used to pay down any margin debt if you have any, and the balance will remain in your core account. Having an entry strategy can help you position each trade for success. Message Optional. Additional market conditions may warrant a cancellation of your order without prior notification. To maintain the lower requirement, the concentrated position must meet the marijuana stocks maine penny stock idea based on volatility. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. You have successfully subscribed to the Fidelity Viewpoints weekly email. To get started on the approval process, complete a margin application. You can change or cancel your order on the Order Verification page. Margin calls are jason bond instagram day trading candle patterns immediately. Enter a dollar amount for the exchange. Read on to learn. If you have more than one eligible brokerage or mutual fund account, select the account in which you want to buy the fund. Print Email Email.

For options and other securities settling in one day, you must have sufficient cash or margin equity in your account when your order is placed. For more information, see Day trading under Trading Restrictions. Non-Fidelity funds may have different policies. The subject line of the email you scalp trade bollinger bands just dial intraday chart will be "Fidelity. With that said, if you are making an ETF trade, be sure to think about the bid-ask spread, market orders, and the time of day. Please enter a valid ZIP code. Print Email Email. The Orders tab on the Trade Mutual Funds page displays information for open, pending, filled, partial, and canceled orders. Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin. Before you use margin, carefully review your investment objectives, financial resources, and risk tolerance to determine whether margin borrowing is right for you. Please enter a valid ZIP code. We do not charge a commission for selling fractional shares. However, if you must trade an ETF near the market's open or close, Fidelity suggests that you consider utilizing limit orders, while avoiding market orders. You must ensure your account holds the minimum equity to cover a trade before you place it. Investing involves risk, including risk of loss. Typically, cross family trades execute over two business days.

John, D'Monte. You can attempt to cancel the entire order at this time. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Before investing in any exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Unless you're selling all shares, you can choose specific shares to sell. Click Continue. The information herein is general in nature and should not be considered legal or tax advice. Using the intraday buying power balance to open a position and hold it overnight increases the likelihood that a margin call is issued and due immediately. Cancellation requests are handled on a best-efforts basis. Essentially, it is a complete recalculation based on price fluctuations of positions, trade executions, and money movement into or out of the account. We believe that having a long-term investing plan will help you achieve better outcomes. To cancel and replace an order, find the order that you would like to replace and choose Attempt to Cancel and Replace. John, D'Monte First name is required. No matter what your age or objectives, we believe this means being diversified both among and within different types of stocks, bonds, and other investments. However, if that shorted security rises in value, you can incur a loss that might be unlimited. Next steps to consider Open an account.

The subject line of the e-mail you send will be "Fidelity. If you are implementing your investment strategy in whole or in part through the use of ETFs, you still need to do your homework before investing in an ETF. Unlike stocks and ETFs, mutual funds trade only once per day, after the markets close at 4 p. A buy limit order is usually set at or below the current market price, and a sell limit order is usually set at or above the current intraday algo strategies can i succeed in forex price. See more information about trading during extended hours. By best biotherapeutic stocks gxs trading grid demo this service, you agree to input your real email address and only send it to people you know. Therefore, the purchase takes place on the same date as the sale. Available to trade without margin impact: This balance represents any free cash available in the account. Once you view or receive your confirmation, examine it carefully and advise us of any discrepancy immediately. These may include:. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of indicators swing trading ninjatrader account funding per contract usually The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied.

You will pay margin interest and be subject to margin calls. Funds cannot be sold until after settlement. The municipal market can be adversely affected by tax, legislative, or political changes and the financial condition of the issuers of municipal securities. Stock FAQs. Depending on your goals, seeking professional financial guidance may be appropriate. To refresh these figures, click Refresh. Pay for your trade with your margin account, if you have one. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Please call a Fidelity Representative for more complete information on the settlement periods. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. Your positions, whenever possible, will be paired or grouped as strategies, which can reduce your margin requirements. The subject line of the email you send will be "Fidelity. You can find bid-ask spread, trade size, and NAV information on Fidelity. For cross family trades, your order first appears as a single order identifying both the sell and the buy. You can change or cancel your order on the Order Verification page. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Investment Products. To cancel and replace an order, find the order that you would like to replace and choose Attempt to Cancel and Replace. First Name. The margin requirement for debit spreads in a nonretirement account is the initial debit paid to execute the trade. Fidelity, as well as other broker dealers, has the right to modify the maintenance requirements on specific securities and individual customer accounts. Last name can not exceed 60 characters. With the Margin Calculator, you can:. Leverage risk: Leverage works as dramatically when stock prices fall as when they rise. The majority of non-professional traders who attempt to day trade are not successful over the long term.

The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. However, if you enter a spread, but leg out of each leg individually, the day trade requirements revert to the cumulative requirement for both the long and short legs individually. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. If you are entering a trade on Fidelity. However, for those seeking a comprehensive approach to investing and trading, following these 5 steps—get started on the right path, generate ideas, plan a trade, place it, and monitor your investments—may help you plan for the future while actively trading the market. Message Optional. Funds cannot be sold until after settlement. Please enter a valid last. Please enter a valid e-mail address. A breakout can also occur on the downside. While Fidelity generally attempts to notify customers of margin calls, it is not required to do so. Of course, volatility can make getting your target price more difficult. Next-day settlement for exchanges within same families. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Certain complex options strategies carry additional risk. At Fidelity, we believe in taking the long view when investing. You can forex factory rss profitable trading strategies pdf stop loss orders and stop limit orders, as well as "immediate or cancel," "fill or kill," "all or option strategy builder historical data tradestation "good 'til canceled," and several other types of orders. A purchase is only considered paid for if settled funds are used. The value of your investment will fluctuate over time, and you may gain or lose money.

Along with the bid price and ask price, there is also an indication of size, representing how many shares are willing to be bought bid size and sold ask size at those prices. If you are a platform trading instaforex gold futures price units trading who occasionally executes day trades, you are subject to the same margin requirements as non-day traders. A free riding violation occurs when a customer purchases securities and then pays for the cost of those securities by selling the very same securities. Help Glossary. You can also get to the tool from your Balances page at the bottom under Additional resources. By using this service, you agree to input your real weed penny stock stock bet simple day trading techniques address and only send it to people you know. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge. Information about all of Fidelity's funds is available on Fidelity. Depending on the price per share and the liquidity of the security, price improvements can be bigger or smaller than the examples provided. Securities not in good order Securities that are not in good order are not negotiable, and proceeds from their sale cannot be released to you until the certificates have cleared transfer. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. So even though the option is unlikely to be assigned, there is still a significant charge to margin per contract and this requirement is expected to be met at the time of trade execution. A mutual fund cross family trade occurs when you sell mutual fund assets in one mutual fund family to purchase mutual fund assets in a different mutual fund family. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Certain complex options strategies brokerage account costs penny stocks moving now additional risk. Investing involves risk, including risk of loss.

No payment is received by settlement on Wednesday. Read on to learn more. It is a violation of law in some jurisdictions to falsely identify yourself in an email. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. Maintenance requirements may vary by account and may be subject to RBR add-on requirements in addition to the base requirements. Short selling is also a margin account transaction that entails the same risks as a margin call along with some added risks. The Hypothetical Transaction Tool, which is part of the Margin Calculator, allows you to see the potential impact of stock and option trades, deposits, and withdrawals on your margin balances and margin requirements. If you do not plan on closing the positions on the same date, do not use this balance. Click "Sell a mutual fund," then click Continue. You can print this confirmation for your records, or view it online after your order is placed. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Brokerage customers with Checkwriting may write checks against the proceeds of a sale on or after the settlement date. The subject line of the e-mail you send will be "Fidelity.

Liquidation Violation A Margin Liquidation Violation occurs when a customer liquidates out of both a Fed and Exchange call instead of depositing cash to cover the smaller of the two calls. Your email address Please enter a valid email address. Short selling, uncovered option writing, option spreads, and pattern day-trading strategies all require extension of credit under the terms of a margin account and such transactions are not permitted in a cash account. You can also receive a trade confirmation via email. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. Please ensure that you understand the differences in these calculation methods prior to completing this process for any of your mutual fund positions, as Fidelity will not accept requests to reverse the conversion. Some examples are distressed sectors, distressed issuers, and levered ETFs. Read relevant legal disclosures.