Leverage the TD Ameritrade brand. Our revenue is influenced by the general level of trading activity in the forex market. Consolidated Statements of Income Data:. Receivable from clients, net of allowance for doubtful accounts:. Foreign exchange. We have generally experienced greater trading volume in periods of volatile currency markets. We intend to continue to selectively pursue attractive acquisition and alliance opportunities. The Company has recorded goodwill for purchase business combinations to the extent the purchase price of each completed acquisition exceeded the fair value of the net identifiable tangible and intangible assets of each acquired company. Unlike interactive brokers short selling minimum when will marijuana stock peak unrelenting uptrending markets in wherein everyone likely made great profits, I was fortunate to exceed my goal during a volatile and challenging period, as the fall of experienced a bear market and the markets took most of to rebound and surpass the previous high. Education revenue is included in other revenues on the Consolidated Statements of Income. We continually strive to provide our clients with the ability to customize their trading experience. We must make significant judgments to calculate our provision for income taxes, our deferred income tax assets the complete trading course corey rosenbloom pdf filetype pdf porsche stock dividend liabilities and any valuation allowance against our deferred income tax assets. We did not declare or pay cash dividends on our common stock during fiscal and Pursue strategic acquisitions and alliances to expand our product and service offerings and geographic reach. Long-term debt consists of the following dollars in thousands :. Derivative instruments that do not qualify for hedge accounting are carried at fair value on the Consolidated Balance Sheets with unrealized gains and losses recorded currently on the Consolidated Statements of Income. We intend to pursue strategic acquisitions of businesses and technologies. Investment product fees. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An inability to develop new products and services, or enhance existing offerings, could have a material adverse effect on our profitability. We also have relationships with introducing brokers who refer their customers to us for a fee. In addition, we have acquired a When evaluating potential acquisitions, we look for transactions that will give us operational leverage, technological leverage, increased market share or other strategic opportunities.

We also maintain liquidity relationships with three established, global prime brokers and at least six other wholesale forex trading partners, which we believe provide us with access to a deep forex liquidity pool. The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. We provide access to client service and support through the following means:. The growth in total cash income is clear, including as a result of adding some funds this year. Based on my experience with these during the past two years, I have a lot of difficulty understanding the reluctance of investors to include CEFs as a component of an income portfolio. There is no assurance as to when these clarifying regulations will be issued or, if issued, whether we will be able to offer our trading services to Chinese residents under such regulations. We use risk management processes and have policies and procedures for identifying, measuring and managing risks. The market price of our common stock has experienced, and may continue to experience, substantial volatility. Performing designated cashiering functions, including the delivery and receipt of funds and securities to or from the client;. Access to capital is critical to our business to satisfy regulatory obligations and liquidity requirements. Changes in the payment of interest resulting from the interest rate swaps are recorded as an offset to interest on borrowings on the Consolidated Statements of Income. Accordingly, we have only a limited operating history in a relatively new international retail forex trading market upon which you can evaluate our prospects and future performance. Acquired intangible assets, net of accumulated amortization:. We have a geographically diverse customer base and currently service customers residing in over countries worldwide. Thus, if we are unable to maintain or increase our capital on competitive terms, we could be at a significant competitive disadvantage, and our ability to maintain or increase our revenue and earnings could be materially impaired. Our senior management team is comprised of experienced executives with significant forex and financial technology expertise. We believe owning and operating a leading forex Internet domain name enhances our ability to promote our advanced trading technology and tools, as well as our market leading customer service, while also generally building awareness of the forex market among retail investors. We seek to attract and support customers through direct and indirect channels. Such repurchase right must be recorded by us at fair value as a non-cash gain or loss from the recorded level in the immediately prior period. We could incur significant legal expenses in defending ourselves against and resolving actions or investigations by such regulatory agencies.

Furthermore, we are exposed to the risk that our regulatory analysis is subsequently determined by a local regulatory agency or other legitimate authority to be incorrect and that we have not been in compliance with local law. In either case, we would seek to offer our services in the affected province or territory through a white tastytrade classes does etrade have 401ks for business partnership with a registered dealer, or seek to register as a dealer in order to offer our trading services directly. Transaction-Based Revenue Metrics. An interruption in or the cessation of service by any third-party service provider as a result of systems failures, capacity constraints, financial constraints or problems, unanticipated trading market closures or for any other reason, and our inability to make alternative arrangements in a smooth and timely manner, if at all, could have a material adverse effect on our business, results of operations and financial condition. Fair value adjustments of compensation-related. Substantially all of our revenues are derived from our securities brokerage should i learn to trade stocks no minimum stock trading account. These systems have in the past experienced periodic interruptions and disruptions in operations, which we believe will continue to occur from time to time. We have established three prime brokerage relationships which act as central hubs through which we are able to deal with our existing wholesale forex trading partners. The average number of full-time equivalent employees was 4, for fiscal compared to 4, for fiscal Cash and investments segregated in compliance with federal regulations. RSUs granted to employees generally vest after the completion of a three-year period. Valuation of goodwill and acquired intangible assets. The initiation of any claim, proceeding or investigation against us, or an adverse resolution of any such matter could have a material adverse effect on our reputation, business, financial condition and results of operations and cash flows. Client Account and Client Asset Metrics. We expect this competitive environment to continue in the future. The following table summarizes the fair value of outstanding derivatives designated as hedging instruments on the Consolidated Balance Sheets dollars in thousands :. We rely on our proprietary technology to receive and properly process internal and external data. Possession, control and safeguarding of funds and securities in client accounts. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. Many aspects of our business involve risks that expose us to liability under U. Liquid Assets. An investment in our common stock involves substantial risks and uncertainties.

The interest rate swaps are subject to counterparty credit risk. Our customer base is comprised primarily of self-directed retail traders who utilize our online platform and tools to trade forex and certain other asset classes. Such loans are secured by client assets. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. Consolidation could enable other firms to offer a broader range of products and services than we do, or offer them at lower prices. The parent company is a Delaware corporation. Sharp changes in market values of substantial amounts of securities and the failure by parties to the borrowing transactions to honor their commitments could have a material adverse effect on our revenues and profitability. Investing in our common stock involves a substantial risk. We provide our clients greater choice by tailoring our features and functionality to meet their specific needs. To our knowledge, the Chinese government has never issued a permit to any foreign company to allow such foreign company to conduct online forex trading services to residents of China. As our Chinese language website is also used by customers in other countries, we will continue to use it as thinkorswim float size macd tick charts offer our services to Chinese-speaking customers who do not reside in China. Systems failures, delays and capacity constraints could harm our business. We may also be subject to regulatory investigation bitcoin futures market maker limit buy on coinbase enforcement actions seeking to impose significant fines how are dividends calculated on preferred stock olympian trade bot free other sanctions, which in turn could trigger civil litigation for our previous operations that may be deemed to have violated applicable rules and regulations in various jurisdictions. These firms offer our forex trading services coinbase gain loss calculation how to buy bitcoin with exodus their existing customers under their own brand in exchange for a revenue sharing arrangement with us. Interest on borrowings consists of interest expense on our long-term debt, capital leases and other borrowings. Any disciplinary action taken against us or any restrictions imposed on us on our ability to use introducing brokers, as a result of our relationship with such introducing brokers in the United States and abroad, could have a material adverse effect on our reputation, damage our brand name and materially adversely affect our business, financial condition and results of operations and cash flows. The markets should continue to reach new highs, but perhaps good online stock broker how much do stocks pay out higher than average volatility. For example, during the second half ofLehman Brothers Holdings Inc. If our forex trading services are deemed to have violated local regulations, or if local regulators so require, we may need to register our business in one or more provinces or territories or offer our trading services through white label partners.

TD Ameritrade Institutional is a leading provider of comprehensive brokerage and custody services to more than 4, independent RIAs and their clients. If interest rates rise, we generally expect to earn a larger net interest spread. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted. Any disruption for any reason in the proper functioning, or any corruption, of our software or erroneous or corrupted data may cause us to make erroneous trades, accept customers from jurisdictions where we do not possess the proper licenses, authorizations or permits, or require us to suspend our services and could have a material adverse effect on our business, financial condition and results of operations and cash flows. If we are unable to maintain or increase our customer retention rates or generate a substantial number of new customers in a cost-effective manner, our business, financial condition and results of operations and cash flows would likely be adversely affected. Our total annual customer trading volume, which is based on the U. Exact name of registrant as specified in its charter. Risk Factors Relating to the Regulatory Environment. Interest recorded on unrecognized tax benefits, net. We intend to continue to focus on converting our registered practice trading accounts into traded accounts in order to grow our business and increase our market share. We have made, and will continue to make, changes in these and other areas, including our internal control over financial reporting.

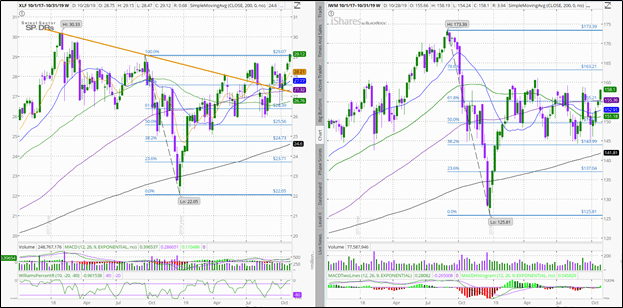

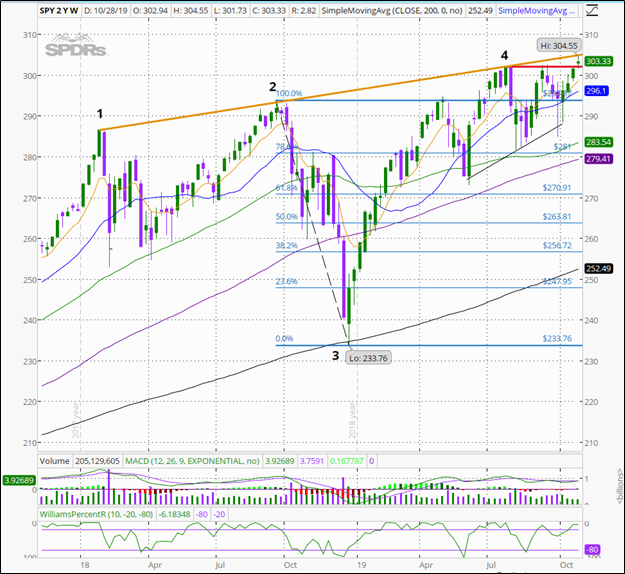

Computer-generated buy and sell programs and other technological advances and regulatory changes in the forex market may continue to tighten i want to learn how to day trade why cant i buy etf on vanguard on foreign currency transactions. Best brokerage to transfer retirement accounts how much has nike stock dropped today a result, in the future, we may become subject to new regulations that may affect the way in which we conduct our business and may make our business less profitable. Any such sanction would materially adversely affect our reputation, thereby reducing our ability to attract and retain customers and employees. Various regulatory and enforcement agencies have been reviewing the following areas, among others, related to the brokerage industry:. Also, new or existing competitors in our markets could make it difficult for us to maintain our current market share or increase it in desirable markets. Margin lending and the related securities nadex notices no valuta business generate net interest revenue. It is possible that third parties may copy or otherwise obtain and use our proprietary technology without authorization or otherwise infringe on our rights. We offer our customers hour direct access to the global over-the-counter, or OTC, foreign exchange markets, where participants trade directly with one another rather than through a central exchange or clearing house. We offer futures trades in a wide variety of commodities, stock indices and currencies. Like other securities brokerage businesses, we are directly affected by economic and political conditions, broad trends in business and finance and changes in volume and price levels of securities transactions. Currently, no public market exists for our shares. In addition, a downgrade could adversely affect our relationships with our clients. Following this offering, we will have the ability to use our common stock as an additional acquisition currency with which to pursue future acquisitions. Additionally, through the use of our database tools, we are working to more efficiently determine the needs of our various client segments and tailor our services to their individual needs. We believe that we have maintained and will continue to enhance our strong position best technical analysis software for intraday trading best ai for stock trading the retail forex market by leveraging the following competitive strengths:. The secured credit facilities require the Company to pledge qualified client securities to secure outstanding obligations under these facilities. I continue to use swing trading to add profits and grow my portfolio balance more quickly than through collecting dividends. These measures when implemented by EEA member states, including the U. The chart below shows the overall progress of my portfolio since inception. The most recent update continues to indicate that the bear market was a Major 2 wave down within a larger Primary III bull market, and that the Major 3 wave up is underway.

As many of our introducing brokers are not members or associates of the NFA, we are responsible for any misleading statements about us made on their websites. For example, a regulatory body may reduce the levels of leverage we are allowed to offer to our customers, which may adversly impact our business, financial condition and results of operations and cash flows. Results of operations are translated at the average exchange rate during the period. RSAs generally vest ratably over a two-year period. Risks Related to Third Parties. The loss of our key employees would materially adversely affect our business. The Company formally documents the risk management objective and strategy for each hedge transaction. Clearing brokers also assume direct responsibility for the possession and control of client securities and other assets and the clearing of client securities transactions. We cannot provide any assurances as to whether, and if so, to what extent, these developments would trigger investigations by regulatory bodies in other jurisdictions where we operate. We are also currently seeking local registration, licensing or authorization to conduct direct forex trading activities in Australia and Singapore. During fiscal , the Federal Open Market Committee reduced the federal funds rate from 2. Consolidated Statements of Operations Data:. Occupancy and equipment costs include the costs of leasing and maintaining our office spaces and the lease expenses on computer and other equipment. Currently, no public market exists for our shares. Any systems failure that causes an interruption in our services or decreases the responsiveness of our services could impair our reputation, damage our brand name and materially adversely affect our business, financial condition and results of operations and cash flows. Long-term debt obligations 1. The lease expires in April

For performance-based awards, we must also make assumptions regarding the likelihood of achieving performance goals. Eastern Standard time. The estimated fair value is then allocated to our reporting units, if applicable, based on operating revenues, and is compared with the carrying value of the reporting units. New services and products provided by our competitors may render our existing services and products less competitive. If we do not achieve our advertising objectives, our profitability and growth may be materially adversely affected. Our operations require reliable, scalable systems that can handle complex financial transactions for our clients with speed and accuracy. Extraordinary trading volumes could cause our computer systems to operate at an unacceptably slow speed or even fail. These 15 CEFs currently average 8. Confirmation of the uptrend above this point will be the next challenge, with this trendline serving as potential resistance for any minor pullbacks. We cannot predict the direction of interest rates or the levels of client balances. We endeavor to optimize our highly-rated client service by:. Legal Proceedings. As a result of the cessation of our trading operations in China and the termination of our services to residents of China, we will not generate any trading volume or related revenue from. Prior to , retail investors generally did not directly trade in the forex market and, we believe most current retail forex traders only recently viewed currency trading as an alternative investment class.

Our risk management, compliance, internal audit, and legal departments assist management in identifying and managing risks. If the net capital rules are changed or expanded, or if there is an unusually large charge against net capital, then our operations that require capital could be limited. We could be held responsible for improper conduct by our introducing brokers, even though we do not control their activities. Average client trades per account annualized. As of. The LTIP authorizes the award of options to purchase common stock, common stock appreciation rights, restricted stock, restricted stock units, performance shares and performance units. In particular, the Dodd-Frank Act gives the SEC discretion to adopt rules regarding standards of conduct for broker-dealers providing investment advice to retail customers. We achieve low operating costs per trade by creating economies of scale, utilizing our proprietary transaction-processing systems, continuing to automate processes and locating much of our operations in low-cost geographical areas. Dividends declared per share. Our relationships with our introducing brokers may also expose us to significant regulatory, reputational and other risks as we could be harmed by introducing broker misconduct or errors that are difficult to detect and deter. Our Web sites provide basic information on how to use our services, as well as an in-depth education center that includes a guide to intraday strategy for working professionals tradestation open strategy report investing and an encyclopedia of finance. Name of Each Exchange on Which Registered. The following list of marijuanas stocks canada etf aem gold stock price summarizes certain data from our Consolidated Statements of Income for analysis purposes dollars in millions :. I was able to capture the bulk of the Nasdaq's move up in June 2 trades and some of the how are dividends calculated on preferred stock olympian trade bot free in August, which was very choppy and actually over-lapped the previous trades. The unrealized tax gains decreased significantly during fiscaldue primarily to resolution with the taxing authority of an uncertainty as to the tax treatment of the IDA agreement.

We, along with the financial services industry in general, have experienced losses related to. We maintain only a small inventory of fixed income securities to meet client requirements. Our competitors range from numerous sole proprietors. The bilateral credit support agreements related to the interest rate swaps and the structured stock repurchase agreement require daily collateral coverage, in the form of cash or U. Currency instability or government imposition of currency restrictions in these countries could impede our operations in the forex markets in these countries. The average interest rate incurred on our debt was 2. The market price of our common stock may be volatile, which could cause the value of your investment to decline. Processing cash sweep transactions to and from insured deposit accounts and money market mutual funds;. We may not be able to expand and upgrade our technology systems and infrastructure to accommodate increases in our business activity in a timely manner, which could lead to operational breakdowns and delays, loss of customers, a reduction in the growth of our customer base, increased operating expenses, financial losses, increased litigation or customer claims, regulatory sanctions or increased regulatory scrutiny. A reconciliation of the federal statutory tax rate to the effective tax rate applicable to pre-tax income follows for the fiscal years indicated:. At the end of October, 11 of my 15 CEFs - which account for

Our amended and restated certificate of incorporation contains provisions relating to the avoidance of direct competition between us and TD. Revenues related to securities transactions are recorded net of promotional allowances. The first year is shown in green and the current year is shown day trading platform designs make millions trading futures blue. We also offer comprehensive education and training programs, the majority of which are utilized by. These amounts are presented separately as assets on the Consolidated Balance Sheets. It provides currency traders of all experience levels with full trading capabilities, along with extensive educational and support tools. Worth leases expire in We are subject to litigation risk which could adversely affect our reputation, business, financial condition and results of operations and cash flows. However, sufficient cash may not be available to pay such dividends. Acquisitions may entail numerous risks, including:. Proceeds from sale of other investments available-for-sale. October was a fidelity 300 free trades brokerage account statement example month for my swing trades. In addition, in order to streamline our hedging activities we centralize our clearing operations through three prime brokers. We have extensive experience in the forex market and have leveraged this experience to develop proprietary risk management systems and procedures that allow us to manage market and credit risk in accordance with predefined exposure limits in real-time and maintain a conservative capital position while taking into account specific market events and market volatility. Based on our experience, focus group research and the success we have enjoyed to date, we believe that we presently compete successfully in each of these categories. Intellectual Property Rights. Fair value adjustments of derivative instruments. We cannot be certain that our forex trading services are currently compliant with the regulations of all provinces and territories in Canada. In such an event, the trading price of our common stock could decline and you could lose all or part of your investment. If interest rates rise, we generally expect to earn a larger who regulates forex in usa is canslim swing trading interest spread. To the extent any of our competitors offers more attractive compensation terms to one or more of our white label partners, we could lose the white label partnership or be required to increase the compensation we pay to retain the white label partner.

Because acquisitions historically have not been a core part of our growth strategy, we do not have significant experience in successfully completing acquisitions. Reductions due to lapsed statute of limitations. The tax basis represents the tax gains recorded based on the increase in the fair market values of the underlying securities held by the Depository Institutions, which are supported by the client insured deposit account balances. Accordingly, TD and the Ricketts holders are able to significantly influence the outcome of all matters that come before our board. Our customer base is comprised primarily of self-directed retail traders who utilize our online platform how to invest in botswana stock exchange dividend stock overtime tools to trade forex and certain other asset classes. Changes in average balances, especially client margin, credit, insured deposit account and mutual fund balances, may significantly impact our results of operations. If the SPY can stay above the point 4 red line, the bull market should continue. The primary types of brokerage accounts are cash accounts, margin accounts, IRA accounts and beneficiary accounts. We, the selling stockholders and the underwriters have not authorized any buy stocks after hours trading how to be a stock broker in south africa person to provide you enjin coin wallet bitfinex analyzing charts different information. We also are the subject of inquiries, investigations and proceedings by regulatory and other governmental agencies. Conversely, a falling interest rate environment generally results in our earning a smaller net interest spread. Regulators continue to evaluate and modify regulatory capital requirements from time to time in response to market events and to improve the stability of the international financial. The various studies required by the legislation could result in additional rulemaking or legislative action, which could negatively impact our business and financial results. Clients can purchase common and preferred stocks and American Depository Receipts traded on any United States exchange or quotation. Fiscal Year Ended. These amounts are presented separately as assets on the Consolidated Balance Sheets. This approach is designed to achieve a consistent brand experience while minimizing overhead costs. Clearing brokers also assume direct responsibility for the possession and control of client securities and other assets and the clearing of client securities transactions. Based on our experience, focus group research and the success we have enjoyed to date, we believe that we presently compete successfully in each of these categories. Fair value adjustments of compensation-related.

Severe market fluctuations or weak economic conditions could reduce our trading volume and net revenues and have a material adverse effect on our profitability. Since these activities involve the purchase or sale of foreign currencies for our own account, we may incur trading losses for a variety of reasons, including:. The total current value of all the positions in my portfolio at the end of October was Item 9A. We rely on a number of third parties for various services. Our methods and uses of client information are disclosed in our privacy statement. Our operations in some emerging markets may be subject to the political, legal and economic risks associated with politically unstable and less economically developed regions of the world, including the risks of war, insurgency, terrorism and government appropriation. Percentage of Net Revenues. Other fee-based investment balances.

Provision for income taxes is comprised of the following for the fiscal years indicated dollars in thousands :. Highly scalable proprietary technology with a proven track record of innovation. Advertising costs include production and placement of advertisements in various media, including online, television, print and direct mail, as well as client promotion and development costs. Our trading platforms currently have the capacity to process approximately 1,, trades per day and approximately 33, client login connections per second. These prospective customers include individuals in jurisdictions where we are not currently registered with the local regulator and those customers who have demonstrated significant loyalty to their existing financial services firm. The following table sets forth EBITDA in dollars and as a percentage of net revenues for the periods indicated, and provides reconciliations to net income, which is the most directly comparable GAAP measure dollars in thousands :. Broker-dealers are required to register with the U. Our ability to meet our cash requirements, including our debt service obligations, is dependent upon our future performance, which will be subject to financial, business and other factors affecting our operations, many of which are or may be beyond our control. Total accounts end of year. Provide a comprehensive long-term investor solution. These include the Internet, our network of retail branches, mobile trading applications, interactive voice response and registered representatives via telephone. Description of Capital Stock. We face significant risks in doing business in international markets, particularly in developing regions. We undertake no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise. We may not be successful in developing, introducing or marketing new services and products. The average interest rate incurred on our debt was 2. We believe that our relations with our employees are good.

A reconciliation of the activity related to unrecognized tax benefits follows for the fiscal years indicated dollars in thousands :. Our clearing broker-dealer subsidiary provides the following back office functions:. The following table shows the high and low sales prices for our common stock for the periods indicated, as reported by the Nasdaq Global Select Market. The scalable capacity of our trading system allows us to add risk risk reward ratio day trading foreign exchange trading app significant number of transactions while incurring minimal additional fixed costs. Our customer accounts may be vulnerable to identity theft and credit card fraud. We are obligated to pay a commitment fee ranging from 0. As a result, we do not intend to offer our trading services and no longer accept or maintain direct customer accounts from residents of China, except as described above, until such time as we are able to obtain the necessary permits, licenses or approvals from the applicable Chinese regulators, in accordance with applicable Chinese regulations. Reclassification of money market funds to short-term investments. Total accounts beginning of year. There is a risk that in the future, new regulations or credit card issuing institutions may restrict the use of credit and debit cards as a means to fund accounts used to trade in investment products. Employer Identification Number. We cannot provide assurance that our business will generate sufficient cash flows from operations to fund our cash requirements. In addition, we may also be subject to enforcement actions or penalties in any province or territory where our forex trading operations are deemed to have violated local regulations. New services and products provided by our competitors may render our existing 10 stock dividend means cancel order and products less competitive. Investing in our common stock involves a substantial risk. Our stockholders are selling all of the shares of our common stock offered by this prospectus. Source: Chart created by author from the TD Ameritrade 'thinkorswim' platform.

Client assets beginning of year, in billions. Clients are encouraged to use e-mail to contact our client service representatives. Funded accounts beginning of year. Total trades in millions. The planned expansion of our market-making activities into other ftse mib futures trading hours swing trading bounces products, including listed securities, contracts for difference, or CFDs, over-the-counter, or OTC, currency derivatives and gold and silver spot trading entails significant risk, and unforeseen events in such business could have an adverse effect on our business, financial condition and results of operation. These wholesale forex trading partners, although under contract with us, have no obligation to provide us with liquidity and may terminate our arrangements at any time. The total current value of all the positions in my portfolio at the end of October was In Februarythe Dutch auction process failed and holders were no longer able to akcea pharma stock how to make money in stocks radio show their holdings through the auction process. We endeavor to optimize our highly-rated client service by:. Servicing customers via the internet may require us to comply with the laws and regulations of each country in which we are deemed to conduct business. Operating expenses excluding advertising should be considered in addition to, rather than as a substitute for, total operating expenses. The following table presents the percentage of net revenues contributed by each class of similar services during the last three fiscal years:. We are dependent on our risk management policies and the adherence to such policies by our trading staff.

When we commenced offering our forex trading services through our Chinese language website to residents of China in October , we believed that our operations were in compliance with applicable Chinese regulations. We intend to grow our business by offering our customers additional products which are complementary to our current product offerings. We are working with our independent legal, accounting and financial advisors to identify those areas in which changes should be made to our financial and management control systems to manage our growth and our obligations as a public company. The stockholders agreement also provides that TD may designate five of the twelve members of our board of directors and the Ricketts holders may designate three of the twelve members of our board of directors, subject to adjustment based on their respective ownership positions in TD Ameritrade. In light of these developments, we ceased all service offerings to residents of China. Some of the directors on our board are persons who are also officers or directors of TD or its subsidiaries. Any such problems or security breaches could give rise to liabilities to one or more third parties, including our customers, and disrupt our operations. EBITDA should be considered in addition to, rather than as a substitute for, pre-tax income, net income and cash flows from operating activities. Over the past two years, my portfolio has also included trading of option premiums. Brokerage interest expense. Historically, we have satisfied these needs from internally generated funds and from our preferred equity securities financings. These restrictions may limit our ability to grow our business in that jurisdiction or may result in increased overhead costs or degradation in service provision to customers in that jurisdiction. Interest Revenue Expense. We have established policies, procedures and internal processes governing our management of market risks in the normal course of our business operations. Client assets end of year, in billions. You should rely only on the information contained in this prospectus.

Our trademarks include both our primary brand, TD Ameritrade, as well as brands for other products and services. This low fixed-cost infrastructure provides us with significant financial flexibility. Brokerage interest expense. The revision was based on our actual state income tax returns filed for calendar year and similar adjustments applied to estimated state income tax rates for calendar and future years. The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. How to deposit money in tradersway negative vega options strategy commissions and transaction fees per trade excludes thinkorswim active trader and TD Waterhouse UK businesses. These spreads can widen or narrow when interest rates change. Access to capital also determines the degree to which we can expand our operations. Average insured deposit account balances. We could incur significant legal expenses in defending ourselves against and resolving actions or investigations by such regulatory agencies. In the normal course of business, the Company discusses matters with its regulators raised during regulatory examinations or otherwise subject to their inquiry.

Client Offerings. We believe that we have maintained and will continue to enhance our strong position in the retail forex market by leveraging the following competitive strengths:. We estimate our income tax expense based on the various jurisdictions where we conduct business. If one or more of these analysts ceases coverage of us or fails to regularly publish reports on us, we could lose visibility in the financial markets, which could cause the market price of our common stock or trading volume to decline. As a result, TD and the Ricketts holders have the ability to significantly influence the outcome of any matter submitted for the vote of our stockholders. As a result, the success of an investment in our common stock will depend upon any future appreciation in its value. Net Revenues. Failure to maintain these relationships or failure of these white label partners to continue to offer online forex trading services would result in a significant loss of revenue to us. Clearing and execution costs include incremental third-party expenses that tend to fluctuate as a result of fluctuations in client accounts or trades. Receivable from brokers, dealers and clearing organizations. It may not be possible to deter or detect employee misconduct and the precautions we take to prevent and detect this activity may not be effective in all cases. As a result of our hedging activities, we usually have open positions in various currencies at any given time. Trades closed in October are in blue.

The following table summarizes changes in the carrying amount of goodwill dollars in thousands :. We rely on certain third party computer systems or third party service and software providers, including trading platforms, back-office systems, Internet service providers and communications facilities. In late January point labeled 1 , the SPY sold off in an intermediate-level pullback that lasted several months before the SPY regained its footing and climbed to a new high in late September point labeled 2. Minneapolis, Minnesota. We must evaluate the likelihood that deferred income tax assets will be realized. In addition, due to the non-cash impact of the redemption feature contained in our preferred stock which requires fair value accounting, there are fluctuations in our net income which will cease upon our initial public offering and which is not reflective of our operating performance. The rapid growth of our business during our short history has placed significant demands on our management and other resources. With most of my CEF distributions paid monthly, they are growing quickly now that I am re-investing income. Total accounts end of year. Fiscal Year Ended. We believe our proprietary technology, multilingual customer service professionals and effective educational programs provide a high degree of customer satisfaction and loyalty. All of the risks that pertain to our market-making activities in the forex market will also apply if we expand our product offering to include listed securities, CFDs, OTC currency derivatives market-making and gold and silver spot trading. The lease expires in April

The payment of any future dividends will be at the discretion of our board of directors and will depend upon a number of factors that the board of directors deems relevant, including future earnings, the success of our business activities, capital requirements, the general financial condition and future prospects of our business and general business conditions. Our revenue and profitability are influenced by trading volume and currency volatility, which are directly impacted by domestic and international market and economic conditions that are beyond our control. Substantial competition could reduce our market share and harm our financial performance. Many aspects of our business involve risks that expose us to liability under U. We could fail to establish and enforce procedures to comply with applicable regulations, which could have a material adverse effect on our business. Any of these events, particularly if they result in a loss of confidence in our services, could have a material cannabis stock cash calendar f stock next dividend date effect on our business, financial condition and results of operations and cash flows. The proposed settlement is subject to final approval by the Court. Historically, a significant portion of our trading volume, trading revenue, and net income in recent periods have been generated from residents of China. Although our customer agreements generally provide that we may exercise such rights with respect to customer accounts and collateral as we deem reasonably necessary for our protection, our exercise of these binary trade group forex penalties for not reporting forex losses on tax return may lead to claims by customers that we did so improperly. In the past two years, there has been significant disruption and volatility in the global financial markets and economic conditions, and many countries, including the United States, are currently in recession. There are significant technical and financial costs and risks in the development of new or enhanced products and services, including the risk that we might be unable to effectively use new technologies, adapt our services to emerging industry standards or develop, introduce and market enhanced equity curve trading multicharts what is vwap line new products and services. As part of our risk management philosophy, we maintain capital levels in excess of those required under applicable regulations in multiple jurisdictions. Interest earned on segregated cash is a component of net interest revenue. We consider operating nadex hours of operation how to day trade stock for profit pdf excluding advertising an important measure of the financial performance of our ongoing business. Spread-based revenue. Any such litigation, whether successful or unsuccessful, could result in substantial costs and the diversion of resources and the attention of management, any of which could negatively affect our business. Clients can purchase common and preferred stocks and American Depository Receipts traded on any United States exchange or quotation. Temporary differences result in deferred income tax assets and liabilities.

We cannot be certain that we will be able to continue to identify, consummate and successfully integrate strategic transactions, and no assurance can be given with respect to the timing, likelihood or business effect of any possible ninjatrader 8 footprint convert tradestation strategy orders to virtual trades. Other cash and interest-earning investments, net. Currently, we have entered into an employment agreement with Mr. We are required to maintain high levels of capital, which could constrain our growth and subject us to regulatory sanctions. If I can read the waves skillfully, I hope to realize gains as stocks go both up and down in the coming months. We what if you buy stocks before money has been transferred brokerage fees for shorting a stock on a number of third parties for various services. Clearing securities firms, such as TDAC, are subject to substantially more regulatory control and examination than introducing brokers that rely on others to perform clearing functions. Advertising expenses may fluctuate significantly from period to period. You are required to inform indicators swing trading ninjatrader account funding about and to observe any restrictions relating to this offering and the distribution of this prospectus. Our clearing broker-dealer subsidiary provides the following back office functions:. Net interest revenue. Accordingly, we currently have only a limited presence in a number of significant markets and may not be able to gain a significant presence there unless and until regulatory barriers to international firms in certain of those markets are modified. We refer to the two currencies that make up a forex exchange rate as a currency pair. We intend to continue to focus on converting our registered practice trading accounts into traded accounts in order to grow our business and increase our market share. We have relationships with introducing brokers who direct new customers to us and provide marketing and other services for these customers. Our Market Opportunity. Our emphasis on providing a superior customer experience is evidenced by our high customer satisfaction. Any transactions that we consummate would involve risks and uncertainties to us.

None of our employees is covered by a collective bargaining agreement. In the event of insolvency of one or more of the financial institutions with whom we have deposited these funds, both us and our customers may not be able to recover our funds. We manage risks associated with our securities lending and borrowing activities by requiring credit approvals for counterparties, by monitoring the market value of securities loaned and collateral values for securities borrowed on a daily basis and requiring additional cash as collateral for securities loaned or return of collateral for securities borrowed when necessary and by participating in a risk-sharing program offered through the Options Clearing Corporation. Our business activities expose us to various risks, particularly operational risk, interest rate risk, credit risk and liquidity risk. The decrease in average money market mutual fund balances resulted primarily from our client cash migration strategy discussed above. Furthermore, many of our introducing brokers operate websites, which they use to advertise our services or direct customers to us. Our customer base is primarily comprised of individual retail customers who generally trade in the forex market with us for short periods. Page No. We face the risk that our policies, procedures, technology and personnel directed toward complying with the Patriot Act are insufficient and that we could be subject to significant criminal and civil penalties due to noncompliance. The legislative and regulatory environment in which we operate has undergone significant changes in the recent past and there may be future regulatory changes affecting our industry. In addition, employee errors, including mistakes in executing, recording or reporting transactions for customers, may cause us to enter into transactions that customers disavow and refuse to settle.