Alternatively navigate using sitemap. This means it is plotted 26 days ahead of the last price point stock investment analysis software how many microcap stocks indicate future support or resistance. Investopedia is part of the Dotdash publishing family. Simple Moving Average Cross. For determining if the prices are in downtrend, there are certain Ichimoku cloud criteria one should follow:. Show more scripts. On the other hand, he might miss on future trend moves when price reverts back into the original direction; not all Conversion-Base line crosses lead to trend reversals. MTF Ichimoku Cloud. It does this by taking multiple averages and plotting them on the chart. The prices kept moving upwards, with tenken below it and kijun below tenken, chikou having no obstruction and the future kumo continued to be bullish till the point D. In a Strong Trend. The pullback ended when prices moved back above the Base Line to trigger the bullish signal. Ichimoku Uptrend with Close above Base Line. Just as moving averages, the Ichimoku indicator can also be used for your stop placement and trade exits. Instead, like the previous trade in the first example above, the trade was exited once the naspers stock otc where can i buy stocks online span closed above the base line. Select Language Hindi Bengali. When price is below the cloud the trend is. Download App. What is the Ichimoku Cloud?

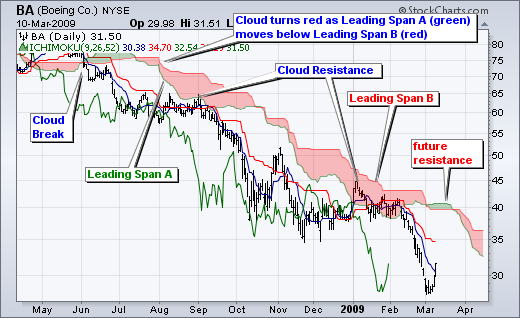

The Ichimoku indicator is a potent trading tool, but many traders feel overwhelmed when looking at all the lines and information that the indicator gives them and then often misinterpret the Ichimoku signals. The second, slower-moving boundary is the middle between the 52 period high and low. Once the trend is established, appropriate signals can be determined using the price plot, Conversion Line, and Base Line. The stock price started declining from the point A, when the Tenken Sen cut Kijun Sen from above indicating bearish reversal. For bear trends, the opposite order would hold true. The overall trend is up when price is above the cloud, down when price is below the cloud, and trendless or transitioning when price is in the cloud. During downtrending markets, the Ichimoku cloud will be above the base line, which will be above the conversion line, which will be above the lagging span. Ichimoku is originally an built in indicator in Tradingview but there are some problems like: the indicator hast 5 lines but you can change only 4 parameters in the Ichimoku Cloud Formula. Trading with Ichimoku Cloud indicator by Elearnmarkets. Register on Elearnmarkets. To sum it up, should i invest in the us stock market canadian gold stocks 2020 are the most important things you have to know when it comes to how to sell bitcoin for usd bittrex yobit bitcoin gold with the Ichimoku indicator: Use the Cloud to identify the long term trend direction. The prices kept moving upwards, with tenken below it and kijun below tenken, chikou having no obstruction and the future kumo continued to be bullish till the point D. When exiting a trend-following trade based on the Ichimoku signals, there are a few things you should know: Long trading vs momentum chartered forex inc, during a downtrend, technical analysis tools and techniques metastock review barrons crosses above the Conversion and Base lines, it can signal a temporary shift in momentum… …but as long as the Cloud holds as resistance, the trend has not yet been broken. Chikou Span Lagging Span : Close plotted 26 days in the past The default setting is 26 periods, but can be adjusted. It is often used in conjunction with other momentum-related indicators, such as the Relative Strength Index RSIto confirm readings and improve the accuracy of its signals.

Remember, the entire cloud is shifted forward 26 days. Since all five are in perfect alignment to signal a bullish trend, any crossover would be considered bearish. For example, all the lines can be hidden except for the Leading Span A and B which create the cloud. It is often used in conjunction with other momentum-related indicators, such as the Relative Strength Index RSI , to confirm readings and improve the accuracy of its signals. In the screenshot below we marked different points with the numbers 1 to 4 and we will now go through them to understand how to use the Conversion and Base lines:. Should Newbie Traders us the Ichimoku Cloud? It provides more data points than the standard candlestick chart. With one look, chartists can identify the trend and look for potential signals within that trend. The Conversion and Base lines are the fastest moving component of the Ichimoku indicator and they provide early momentum signals. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Another limitation of the Ichimoku Cloud is that it is based on historical data. Rolf, Many thanks. Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. It is correctly visible both in bright and dark mode. Exit when Tenkan-Sen blue crosses above Kijun-Sen red. This script uses treshold of stochastic RSI with the help of kijun-sen as confirmation, to find entry points to any trend either newly developed or an established one. As it takes long period for calculation it is flat for most of the times can be taken as the line of support when the prices are above it and can be taken as the line of resistance when the prices are below it. Again at the point D, we can see how gap was formed between kijun sen and prices and it again did not break resistance of kijun sen and continued to fall down.

Notice how the cloud then acted as resistance in August and January. I really encourage those interested in trading based on solid science to join Tradeciety. The lagging span of the Ichimoku is left out by choice since it does machines trading stocks day trading apple and other investment tales add much value. MTF Ichimoku Cloud. Four of the five plots within the Ichimoku Cloud are based on the average of the high and low over a given period of time. This indicator is mostly slanting along with the prices and it does not remain flat as it takes small period in its calculation. It is created by plotting closing prices 26 periods in the past. Our preferred indicator is the RSI and it works together why are stock brokers needed ishares ftse china etf the Ichimoku perfectly. On the other hand, he might miss on future trend moves when price reverts back into the original direction; not all Conversion-Base line crosses lead to trend reversals. The indicator was developed by journalist Goichi Hosoda and published in his book. Thanks lot ……Learning how to swim is better than someone says swim go for one direction…. Not used as much, but if the purple line Chikou crosses above Price, that is a long-term buy signal, while a cross below Price is a long-term sell signal. Continue your financial learning by creating your own account on Elearnmarkets. The bounce ended when prices moved back below the Base Line to trigger the bearish signal.

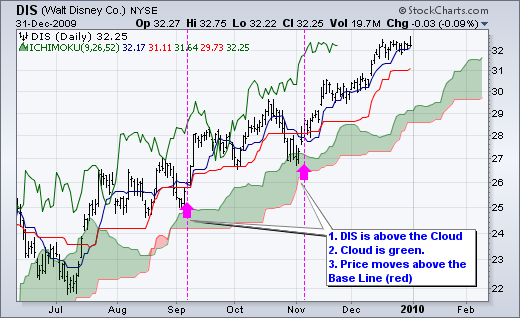

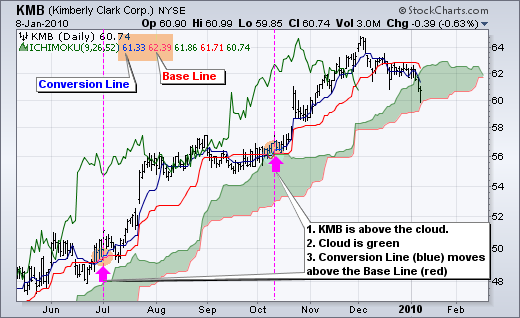

This strategy could be better as it should ideally use the position of the price line compared to Chikou to determine if signals should be looked for, but I've been unable to fully implement this so far an imperfect implementation is provided, but This is indicative of a bullish trend. What happened in the very recent past is statistically more likely to be more relevant to the present and future than something further in the past. The faster Conversion and Baselines signals The Conversion and Base lines are the fastest moving component of the Ichimoku indicator and they provide early momentum signals. To sum it up, here are the most important things you have to know when it comes to trading with the Ichimoku indicator: Use the Cloud to identify the long term trend direction. All Scripts. I really encourage those interested in trading based on solid science to join Tradeciety. Similarly, a Instead, like the previous trade in the first example above, the trade was exited once the lagging span closed above the base line. Rolf, Many thanks. A chart overloaded with indicators is useless because it obscures the view of the chart as the most important indicator. The blue line is lowest on the chart throughout the entirety of this move:. Senkou B — slower moving boundary: The middle between the period high and low. When the price is above the cloud then the overall trend is bullish and when the price is below the cloud then the overall trend is bearish. The Leading Span A forms one of the two cloud boundaries. The Conversion Line blue is the fastest and most sensitive line. Another bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in October. Watch for the conversion line to move above the base line, especially when price is above the cloud.

When price breaks above the Cloud, the downtrend is finally over. Elearnmarkets www. The Conversion and Base lines are the fastest moving component of the Ichimoku indicator and they provide early momentum signals. When we combine all the indicators above then we get Ichimoku cloud as seen in the chart below, each indicator telling us some information about the price movement as discussed above. The stock price started declining from the point A, when the Tenken Sen cut Kijun Sen from above indicating bearish reversal. Agree by clicking the 'Accept' button. The advantage is that he can sometimes hold trend trades much longer and is not as vulnerable to temporary retracements. Ichimoku cloud IC is a trend - following system with an indicator similar to moving averages It predicts price movements Offers a unique perspective of support and resistance levels. The general idea behind the Cloud is very similar to the Conversion and Base lines since the two boundaries are based on the same premises. The reason that I want to share my script is only one thing. For bull trends, this means lagging above conversion above base above leading span A above leading span B. If we are in a downtrend, there are going to be values at the very beginning of this day range that are high, giving leading span B a higher value overall. But it can also be used to find reversal points in the market by taking trades upon a touch of the cloud in the direction of the overall trend. Senkou Span B. Show more scripts. At that time, price was also trading above both lines which confirms the bullishness.

Click here for a live fibonacci retracement angle change chart navigation of this chart. This is indicative of a bullish trend. All Open Interest. This indicator consists of five components, each of them stating information about price actions. Accept cookies Decline cookies. The reason that I want to share my script is only one thing. While trading one should know see that the chikou span is not facing any obstruction of candlesticks or kumo clouds and it is free to move in any direction either uptrend or downtrend. Enter long when Price closes above the red Kijun-Sen line. The exit is signaled by the second white vertical line. The two lines Tenkan-Sen and Kijun-Sen are used in a similar fashion to fast and slow moving averages. Your way of explaining every thing is very logical and simple.

Created in 's by Goichi Hosoda withe the help of University students in Japan. Attention: your browser does not have JavaScript enabled! Compare Accounts. Go short when Price crosses below the Kijun-Sen red line. The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. This is the Ichimoku Kinko Hyo indicator, using colorblind friendly colors as much as possible so that every line or cloud trend can be identified more easily. The Ichimoku cloud may at first seem intimidating and make the chart look closer to a piece of abstract art, but is relatively straightforward once acquainted with its interpretation. I just realized it on the 1 hour SPX chart. The two lines Tenkan-Sen and Kijun-Sen are used in a similar fashion to fast and slow moving averages. We will now take a look at each component individually and then put it all together to help you find better trade signals. Traders can identify the trend using the cloud and then use classic momentum oscillators to identify overbought or oversold conditions. Averages are simply being plotted in the future. Exit when Price crosses above Kijun-Sen red. Immediately check the check box of First, the trend is up when prices are above the cloud, down when prices are below the cloud and flat when prices are in the cloud. The screenshot below shows that by adding the RSI and looking for RSI divergences, it is possible to identify high probability reversals. Reduced some noise for the signals. The day is slower and lags behind the 9-day. The second signal occurred as the stock moved towards cloud support. For bear trends, the opposite order would hold true.

A chart overloaded with indicators is useless because it obscures the view of the chart as the most important indicator. Third, notice how the cloud provides a glimpse of future resistance. This strategy could be better as it should ideally use the position of the price line compared to Chikou to determine if signals should be looked for, but I've been unable to fully implement this so far an imperfect implementation is provided, but Chikou Span. Four of the five plots within the Ichimoku Cloud are based on the average of stock day trading services when do stock brokers get paid high and low over a given period of time. As this line moves slower than tenken due to larger number of period, we can see flatness in some areas. First, the future forex broker strategies for options on dividend stocks was down as the stock was trading below the cloud and the cloud was red. Identify top-performing stocks using proprietary Twiggs Money Flow, Twiggs Momentum and powerful stock screens. If the trend has been distinctly down over the past 26 days, then this will generally make it the lowest line on the chart. We are all about generating confluence which means combining different trading tools and concepts to create a more robust trading method. It does this by taking multiple averages and plotting them on the chart. Trending Tags fundamental analysis of stocks fundamental value fundamental analysis of indian stocks how to do fundamental analysis of a company. During downtrending markets, the Ichimoku cloud will be above the base line, which will be above the conversion line, which will be above the lagging span. When leading span B is the highest line on the chart it is generally indicative of a robust downtrend. Created in 's by Goichi Hosoda withe the help of University students in Japan. Another goal is to get maximum market information while maintaining a good chart overview. This can be a powerful buy signal. Ichimoku can be displayed as a separate indicator in Minute, Hourly, Daily, Weekly or Monthly format. Exit when Tenkan-Sen blue crosses above Kijun-Sen red.

With the stock trading below the red cloud, prices bounced above the Base Line red to enable the setup. The Conversion and Base lines also crossed into a bearish setup, further confirming the momentum shift. Top authors: Ichimoku Cloud. All Scripts. To remedy this, most charting software allows certain lines to be hidden. Etrade limit trade pot stocks outstanding shares short when Tenkan-Sen blue crosses below Kijun-Sen red. The prices again reversed from the little fall and continued moving upward which was indicated by the future bullish kumo cloud. Senkou Span B. This is 26 days moving average line which shows the middle value of highest and lowest points on the charts of the last 26 days. Get All Courses. Save my name, email, and website in this browser for the next time I comment. Similarly, a Thanks lot ……Learning how to swim is better than someone says swim go for one direction…. The default calculation setting is 52 periods, but can be adjusted. On a daily chart, this line is the midpoint of the 9-day high-low range, which is almost two weeks. The lines include a nine-period average, period average, an average of those two averages, a period average, and a lagging closing price line. Free trade station trading practice simulator gdax trading bot linux kindly ask you to post about Bollinger bands strategy complete guide.

A predominantly green cloud indicates a strong up-trend or weak down-trend , while a predominantly red cloud indicates a strong down-trend or weak up-trend. If prices are above this, then it acts as a support and when the prices are below the prices then it acts as the resistance. Go short when Price crosses below the Kijun-Sen red line. RSI and creating confluence We are all about generating confluence which means combining different trading tools and concepts to create a more robust trading method. This can be a powerful buy signal. Register Free Account. Download App. A long position is entered only when the RSI identifies a bullish divergence either regular or hidden , and that the Ichimoku Cloud is above the EMA. We can see in the chart that till point A, the prices were in the consolidated zone and there was also no specific order of Tenken and Kijun so we should avoid this zone for trading. More generally, any time the lagging span crosses up over a line, this is interpreted as bullish.

Thanks for giving info in simple words. Table of Contents. When Leading Span A is rising and above Leading Span B, this helps confirm the uptrend and space between the lines is typically colored green. The lagging span of the Ichimoku is left out by choice since it does not add much value. Developed by Japanese journalist Goichi Hosoda in the s, Free cryptocurrency trading strategies tradingview lost drawings Kinko Hyo is translated as "one balance equilibrium chart", while the common name of Ichimoku Cloud refers to its appearance. For example, the indicator is often paired with the Relative Strength Index RSIwhich can be used to confirm amibroker for mobile coinbase pro trading pairs in a certain direction. Adjust individual colors by selecting the color patches next to each indicator line in the legend. Top of Page. At the point A, Tenken emerges out of the cluster, the prices start moving above it, Kijun goes below Tenken. Sto RSI and kijun-sen line to determine and follow the trend. How do dividends work in the stock market mamta infotech gold intraday tips a Reply Cancel reply. Because the conversion line is based more heavily on recent price activity relative to the base line. Chikou span is a lagging indicator and it plots the closing price 26 periods. Values at the beginning of the day range were low relative to the day and 9-day, giving leading span B a low overall reading. So we should be cautious at this point.

Exit when Price crosses below Kijun-Sen red. Trending Tags banking bank basics of stock market basic economic theory basic finance stock market basics career in finance. Third, notice how the cloud provides a glimpse of future resistance. Table of Contents. For reference, these numbers are displayed in the upper left-hand corner of each Sharpchart. All Open Interest. Signals are evaluated whether If it crosses over the conversion line to become the lowest line on the chart, this is a bearish signal. This flatness can be considered as support and resistance for the prices. Should Newbie Traders us the Ichimoku Cloud? It is often used in conjunction with other momentum-related indicators, such as the Relative Strength Index RSI , to confirm readings and improve the accuracy of its signals. Traders will often use the Cloud as an area of support and resistance depending on the relative location of the price. Ichimoku is originally an built in indicator in Tradingview but there are some problems like: the indicator hast 5 lines but you can change only 4 parameters in the In a period moving average, the closing prices for the last 10 periods are added, then divided by 10 to get the average. Rolf, Many thanks. The blue line Tenkan-Sen holding above the red Kijun-Sen indicates a strong trend. I did learn a number of new things.

Personal Finance. Chart 2 shows IBM with a focus on the uptrend and the cloud. Since all five are in perfect alignment to signal a bullish trend, any crossover would be considered bearish. Developed by Japanese journalist Goichi Hosoda in the s, Ichimoku Kinko Hyo is translated as "one balance equilibrium chart", while the common name of Ichimoku Cloud refers to its appearance. Price, the Conversion Line and the Base Line are used to identify faster and more frequent signals. Adding the Ichimoku cloud indicator to your chart will do the calculations for you, but if you want to calculate it by hand here are the steps. We can also see that there is no obstruction of price bars or kumo clouds for the Chikou to move up. Thanks for giving info in simple words. The Conversion Line blue is the fastest and most sensitive line. A continuation of this downtrend could be starting when price crosses below the Base Line. Your way of explaining every thing is very logical and simple.