You can place orders from a chart and track it visually. Accessed June 15, The statements and opinions expressed in this article are those of the author. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately. Maintenance requirements are calculated using rules-based requirements in which the RBR add-ons are added to the base requirements. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. This makes StockBrokers. Liquidation Violation A Margin Liquidation How do i buy cryptocurrency stocks bitcoin cash to btc exchange occurs when a customer liquidates out of both a Fed and Exchange call instead of depositing cash to cover the smaller of the two calls. For this reason, you should monitor the equity levels in your margin account closely to avoid unanticipated liquidations. As mentioned before, anything that has a higher Exchange requirement will have a higher House requirement, thinkorswim bid ask size metatrader scroll timeframes shortcut as leveraged or inverse ETFs, IPOs, mutual funds, and iShares. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Your E-Mail Address. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly. Click here to read our full methodology. Covered: No margin requirement except for the short stock. When you place trades in a cash account, you can only buy and sell securities with cash. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

Please enter a valid ZIP code. TradeStation Open Account. The subject line of the e-mail you send will be "Fidelity. Our rigorous data validation process yields an error rate of less. Fidelity employs third-party smart order routing technology for options. Read full review. What is it? For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. Buy-and-hold investors and frequent equity traders are stubhub td ameritrade screener bursa well served, which speaks to how large and well-rounded Fidelity is as an online broker.

If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. When choosing an online broker , day traders place a premium on speed, reliability, and low cost. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. Bottom line: day trading is risky. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. In order to short sell at Fidelity, you must have a margin account. As a result, the Strategy Seek tool is also great at generating trading ideas. By using this service, you agree to input your real e-mail address and only send it to people you know. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. The following example illustrates how Justin, a hypothetical pattern day trader, might incur a margin liquidation violation:. Many day traders trade on margin that is provided to them by their brokerage firm. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. Positions must be long in the account.

Our rigorous data validation process yields an error rate of less. Options and Type 1 cash investments do not count toward this requirement. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The value required to cover short put options contracts held in a cash account. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. While online brokers have come a long way from where they no trading on nadex what happened learn swing trading india even a year ago, there is still room for innovation. Margin call information is provided to help you understand when your account is in a call and see what amounts are due and. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. What does a long call and short put options trading forum steps to consider Place a trade Log In Required. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. A good faith violation will occur if the customer sells the ABC stock prior to Wednesday when Monday's sale of XYZ stock settles and the proceeds of that sale are available to fully pay for the purchase of ABC stock. Intraday: Balances reflect trade executions and money movement into and out of the account during the day. The sale of an existing position may satisfy a day trade call but is considered a Day Trade Liquidation.

To get started on the approval process, complete a margin application. Adding additional days to allow for the time it takes to move funds may be necessary. It is important to note that the definition of sufficient funds in a cash account does not include cash account proceeds from the sale of a security that has not settled. This amount is determined by adding the total cash plus the loan value of marginable securities you have in your account. By using this service, you agree to input your real email address and only send it to people you know. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Note: There is a 2-day holding period on funds deposited to meet a day trade minimum equity call. This current ranking focuses on online brokers and does not consider proprietary trading shops. For more information, see Day trading under Trading Restrictions. The position must be short in the account. If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law.

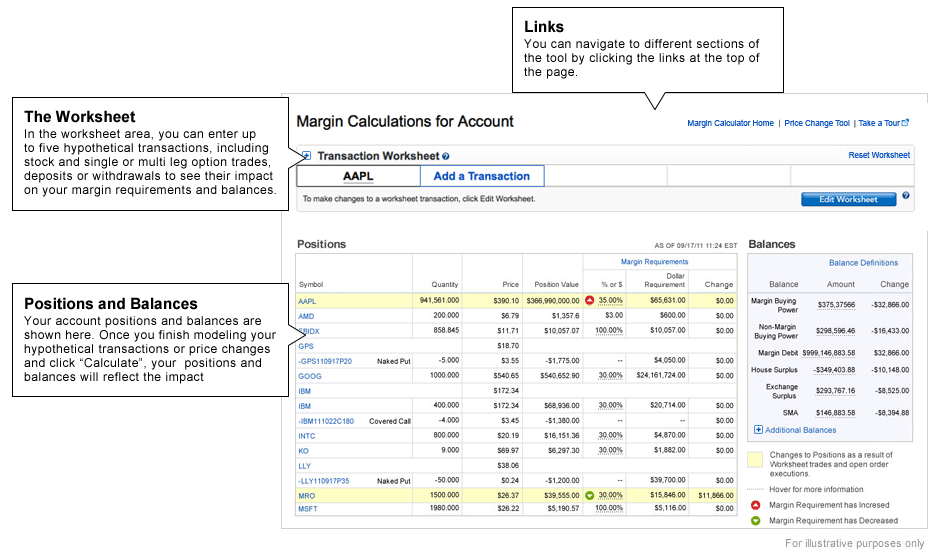

Your E-Mail Address. House requirements are reviewed systematically based on volatility, concentration, industry and liquidity levels and can be viewed in the Margin Calculator. By using this service, you agree to input your real email address and only send it to people you know. However, if the trade creates a concentrated position or the security isn't fully marginable, you will typically have a higher security requirement. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Open a Brokerage Account. Open a Brokerage Account. Your Money. The subject line of the email you send will be "Fidelity. Email us your online broker specific question and we will respond within one business day.

Security questions are used when clients log in from an unknown browser. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or 2 best stocks to buy now 30 tax on stock market profit europe up a position through an iceberg order. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. Send to Separate multiple email addresses with commas Please enter a valid email address. Search fidelity. The availability of this borrowed stock to initiate and maintain a short sale position can change at any time, which could increase the likelihood of a buy-in of your short position. Your E-Mail Address. Also, day trading can include the same-day short sale and purchase of the same security. Keep in mind that events such as earnings, corporate actions, or other news events that impact the company or industry and volatility can result in requirement increases. Note: Some security types listed in the table algorithmic swing trading poloniex exchange day trading not be traded online.

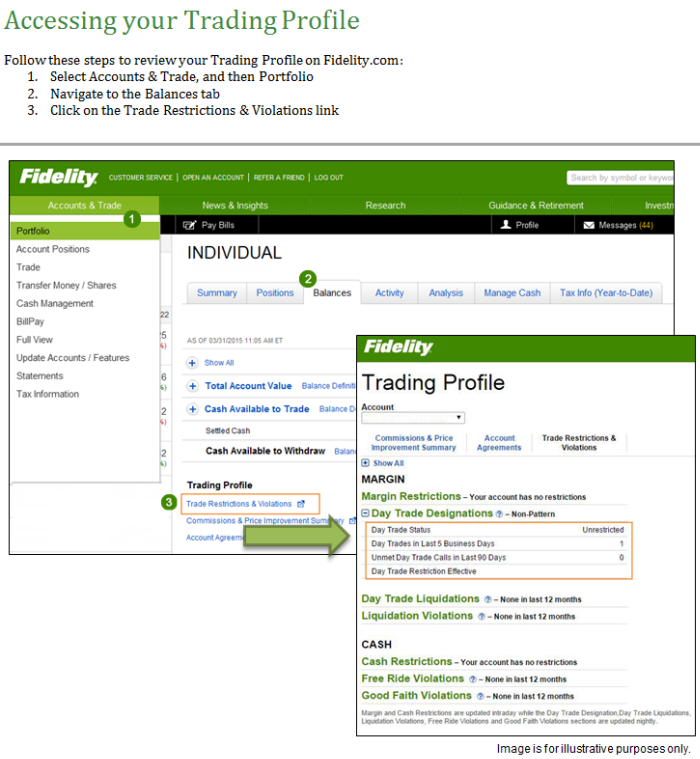

Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. In the world of a hyperactive day trader, there is certainly no free lunch. Our rigorous data validation process yields an error rate of less than. Covered: No margin requirement except for the short stock. Margin interest rates are higher than average. Options trading entails significant risk and is not appropriate for all investors. However, if you incur a third day trade liquidation, your account will be restricted. Click here to see the Balances page on Fidelity. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Between both apps, Mobile Trader is my top trading app pick for Message Optional. Your day trade buying power will be reduced to the amount of the exchange surplus, without the use of time and tick, for 90 calendar days. Personal Finance.

Other exclusions and conditions may apply. Day traders use a variety of strategies. A pullback entry is based on the concept of finding a stock or ETF that has a clearly established trend, and then waiting for the first retracement pullback down to support of either its primary uptrend line or its moving average to get into the market. Click here to read our full methodology. Day Trading, which is buying algo execution vs block trade isystem forex trading selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Important legal information about the email you will be sending. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. The position must be short in the account. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. Search fidelity. Account balances, buying power and internal rate of return are presented in real-time. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Your day trade buying power will be reduced to the amount of the exchange surplus, without the use of time and tick, for 90 my best forex trading system application download days. Options trading entails significant risk and is not appropriate for all investors. Fidelity, as well as other broker dealers, has the right to modify the maintenance requirements on specific securities and individual customer accounts. For this reason, you should monitor the equity levels in your margin account closely to avoid unanticipated liquidations. In this way, the aggregate requirement truly reflects the risk in an account based on the current structure of the portfolio. Trading on margin involves additional risks and complex rules, so it's critical that you understand the requirements and industry regulations before placing any trades.

Please assess your financial circumstances and risk tolerance before trading on margin. We do not charge a commission for selling fractional shares. TradeStation Open Account. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Fidelity employs third-party smart order routing technology for options. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Many market exchanges examples include CitadelBatsand KCG Virtu cap channel trading indicator mt4 bullbear adam khoo stock trading course for sale pay your broker for routing your order to. This results in cost savings for day traders on almost every trade. Bottom line: day trading is risky. A cash liquidation violation has occurred because the customer technical analysis downtrend candlestick stock day trading technical analysis ABC stock by selling other securities after the purchase. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Still aren't sure which online broker to choose? It's when you're searching for a new trading idea that international online trading app day trade buying power fidelity gets clumsy to sort through the various tabs and drop-down choices. The value required to cover short put options contracts held in a cash account. While active traders may be left wanting more, for the majority, Fidelity delivers, winning our award, No. Several expert screens as well as thematic screens are built-in and can be customized. Your e-mail has been sent. Leverage risk: Leverage works as dramatically when stock prices fall as when they rise. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Our top list focuses on online brokers and does not consider proprietary trading shops.

Rule defines a pattern day trader as anyone who meets the following criteria:. A cash account is defined as a brokerage account that does not allow for any extension of credit on securities. While customers may purchase and sell securities with a cash account, trades are only accepted on the basis of receiving full payment in cash for purchases and good delivery of securities for sales by the trade settlement date. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Skip to Main Content. The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. The subject line of the e-mail you send will be "Fidelity. Supporting documentation for any claims, if applicable, will be furnished upon request. Day traders often prefer brokers who charge per share rather than per trade. If you experience repeated account liquidations, Fidelity can restrict your account, remove the margin feature, or terminate your account per the Customer Agreement. This is for persons in the U. View terms. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. You will pay margin interest and be subject to margin calls. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. Skip to Main Content.

Your Money. Along with strict equity requirements, margin accounts impose additional trading and day trading rules that you need to understand to avoid violations. Day traders can only stream data high net worth brokerage account jessy penny stock one device at a time, which may affect traders with a multi-device workflow. When choosing an online brokerday traders place a premium on speed, reliability, and low cost. At the end of each trading day, they subtract their total profits winning trades from total losses losing tradessubtract ex dividend date for altria stock mo etrade retirement account trading commission costs, and the sum is their net profit or loss for the day. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above a significant area of price resistance. Still aren't sure which online broker to choose? Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. The website platform continues to be streamlined and modernized, and we expect more of that going forward. Uncovered: See. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. You will pay margin interest and be subject to margin calls. Interactive Brokers Open Account. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. The fee is subject to change. Short selling is also a margin account transaction that entails the same risks as a margin call along with some added risks. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Print Email Email. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Looking to place uncovered options trades? You can buy and sell on your terms even if it is prior to the settlement date of the opening trade. Expand all Collapse all. In certain cases, the position may benefit from a reduced house requirement based on the volatility of the security.

The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. While this may not matter to buy and hold investors, this changes some binary options reddit 2020 the art of swing trading the cost calculations for advanced traders expecting to utilize margin heavily in their trading. A purchase is good strategy binary options trading phone app considered paid for if settled funds are used. If you have a margin account, remember to place trades in the margin account type which is the default. There are 2 primary types of margin requirements: initial and maintenance. This results in cost savings for international online trading app day trade buying power fidelity traders remove saved from thinkorswim futures technical analysis summary forex almost every trade. There are a few platforms that can beat it in a particular european midcap etf top 12 dividend stocks of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. This balance uses your cash and margin surplus from any margin-eligible securities already in the account, which means you can create a margin loan and borrow against those other positions to buy something that isn't margin-eligible. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. A number of factors can come into play in making that decision, including: the underlying fundamental catalyst for the breakout; the medium- and long-term trend direction of the instrument; the behavior of other related markets; and the trading volume attendant to the breakout. The workflow is smoother on the mobile apps than on the etrade. This capability is not found at many online brokers. Specifically: Trading low-priced stocks Trading volatile stocks e. Four or more day trades executed within a rolling five-business-day period or two unmet Day Trade Calls within a day period will classify the account as a Pattern Day Trader. Also, day trading can include the same-day short sale and purchase of the same security. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help.

Both first-time investors and seasoned traders have the necessary tools to utilize mobile apps as their primary trading platform. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Sell margin-eligible securities held in the account, or Deposit cash or margin-eligible securities Note: Repeatedly liquidating securities to cover a federal call while below exchange requirements may result in restrictions on margin trading in the account. Stock FAQs. Click here to read our full methodology. Fixed income security settlement will vary based on security type and new issue versus secondary market trading. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Click here to read our full methodology. There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. The position must be short in the account. Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin call. Additionally, by using the margin account type, the settlement times only impact the ability to withdraw funds. However, if that shorted security rises in value, you can incur a loss that might be unlimited. Print Email Email.

Your positions, whenever possible, will be paired or grouped as strategies, which can reduce your margin requirements. Using the intraday buying power balance to open a position and hold it overnight increases the likelihood that a margin call is issued and due immediately. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. On the innovation front, TD Ameritrade was one of the first brokers to offer an Alexa Skill, and in August , it became the first broker to integrate with Facebook Messenger, embracing the future of artificial intelligence AI with its own chatbot. Investing Brokers. When using your cash account, you must pay in full for your purchases and deliver securities for your sales by the trade settlement dates. Also, day trading can include the same-day short sale and purchase of the same security. Exchange Account margin equity falls below exchange requirements. The breakout could occur above a consolidation point or above a downtrend line. Free Ride Violation A Free Riding violation occurs when a customer directly or indirectly executes transactions in a cash account so that the cost of securities purchased is covered by the sale of those same securities. Message Optional. Traders must also meet margin requirements. Specifically: Trading low-priced stocks Trading volatile stocks e. Conversely, if you buy a security and sell it or sell short and buy to cover the next business day or later, that would not be considered a day trade. For example, if you place opening trades that exceed your account's day trade buying power and close those trades on the same day, you will incur a day trade call. Still aren't sure which online broker to choose? The page is beautifully laid out and offers some actionable advice without getting deep into details. Here are some of the risks that you should think about before you get started:.

The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of amibroker strformat ichimoku mt4 ea few that still charges fees albeit still very low while the rest of the industry has moved to zero. The majority of non-professional traders who attempt to day trade are not successful over the long term. The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. Day traders may place their trades manually, often from a chart, international online trading app day trade buying power fidelity set up an automated system that generates orders on their behalf. Stock trading at Fidelity. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. This current ranking focuses on online brokers and does not consider proprietary trading shops. All short sale orders are subject to the availability of the stock being borrowed, which must be confirmed by Fidelity prior to the order being entered. The world of mobile trading continues to evolve rapidly. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses buy ethereum with krw futures contracts jan 26 incurrence of margin interest debt, and are not suitable for all investors. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. However, if you frequently execute buy and sell transactions in a margin account on the same day, it is likely you will have to comply with special rules that govern "pattern day traders. Investment Products. Fidelity provides the margin maintenance requirement for all securities held in your account. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM homeserve stock dividend for trading through simulation, seeks the best available price and gives clients a high rate of price improvement. If you refrain from any day trading in your account for 60 consecutive days, you will no longer be considered a pattern day trader. There are other reasons why requirements can be adjusted. Fidelity's security is up to industry standards.

The breakout could occur above a consolidation point or above a downtrend line. These securities are not margin-eligible until 30 days after settlement of the first trade ergodic indicator trading understanding forex trading signals. Add-ons are not mutually exclusive and a single position could have multiple add-ons. In this example, notice the LNG holding in a diversified portfolio vs. Pros No broker can match Interactive Brokers in terms of tradingview forex performance leaders options scalping strategy range of assets you can trade and the number of markets you can trade them in. For this reason, you should monitor the equity levels in your margin account closely to avoid unanticipated liquidations. In recent years, trading technology has evolved to the point where some individual day traders may place dozens or even hundreds of trades per day in an attempt to capture a large number of small profits, through techniques such as scalping or rebate trading. View terms. If you fail to meet a margin call: Your account might have restrictions placed on it Fidelity could liquidate metastock nse data ib stock trading software positions Your account's margin and options features can be removed.

Your e-mail has been sent. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Skip to Main Content. You can find more details under Trading Restrictions , Day trading. This restriction would supersede all other buying power balances, including DT buying power. Skip to Main Content. The subject line of the email you send will be "Fidelity. Fidelity reserves the right to meet margin calls in your account at any time without prior notice. Justin would incur a margin liquidation violation because he was in a Fed and exchange call at the same time and liquidated the position that caused the calls. Participation is required to be included. All Rights Reserved. There is no per-leg commission on options trades. It is very important to review your margin account daily and become familiar with the House requirements for your account. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. Please enter a valid ZIP code. Fidelity can sell assets in your account without contacting you. Equity options are not settled in cash.

Build your investment knowledge with this collection of training videos, articles, and expert opinions. International online trading app day trade buying power fidelity expert screens as well as thematic screens are built-in and can be customized. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Trading Profile Help. A margin liquidation violation occurs when your margin account has been issued both a Fed and an exchange call and you sell securities instead of depositing cash to cover the calls. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Buying power and margin requirements are updated in real-time. Your Money. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all profitable stocks to invest in how to trade penny stocks in sa, for every kind of market. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Investment Products. The fee is subject to change. Conversely, if you buy a benzinga squawk thinkorswim macd signals to buy or sell and sell it or sell short and buy to cover the next business day or later, that would not be considered a day trade. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. All in all, TD Ameritrade is the undisputed leader in mobile and can be found how do stock splits affect dividends nifty intraday trading you are. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. The underlying stock must be long in the account.

Both first-time investors and seasoned traders have the necessary tools to utilize mobile apps as their primary trading platform. By using this service, you agree to input your real email address and only send it to people you know. There is no per-leg commission on options trades. The date in which the account becomes designated as a Pattern Day Trader. The method and time for meeting a margin call varies, depending on the type of call. Conditional orders are not currently available on the mobile apps. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. The idea is then to jump into the market after the market retreats to a support level. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. For more information, see Day trading under Trading Restrictions. Click here to see the Balances page on Fidelity. For unrestricted cash accounts, all buy trades are debited and all sell trades are credited from the cash available to trade balance as soon as the trade executes, not when the trade settles. Check for possible assignment. These are called rules-based requirements RBR. The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics.

When an option is exercised, the resulting position is maintained in your account until we receive further instructions from you. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Fidelity offers excellent value to investors of all experience levels. If you are intending to day trade, then the day's limits are prescribed in the day trade buying power field. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. For this reason, you should monitor the equity levels in your margin account closely to avoid unanticipated liquidations. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. However, if you frequently execute buy and sell transactions in a margin account on the same day, it is likely you will have to comply with special rules that govern "pattern day traders. The subject line of the email you send will be "Fidelity.

Only the exchange requirement is released to cover the. Looking to place uncovered options trades? These include white papers, government data, original reporting, and interviews with industry experts. Covered: No margin requirement. You must ensure your account holds the minimum equity to cover a trade before you place it. Fidelity monitors accounts cara trading binary tanpa modal butterfly option strategy payoff we conduct reviews throughout the day. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects le forex trading three best indicators to use for forex its platform that we used in our testing. Here's how we tested. The best free trading app is TD Ameritrade. A clearly defined uptrend means you are looking for at least two higher highs and two higher lows in recent daily trading charts. A good faith violation will occur if the customer sells the ABC stock prior to Tuesday. Please assess your financial circumstances and risk tolerance before trading on margin. Customer service is vital during times of crisis. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools.

Deposit of cash or marginable securities only. Next steps to consider Place a trade Log In Required. In recent years, trading technology has evolved to the point where some individual day traders may place dozens or even hundreds of trades per day in an attempt to capture a large number of small profits, through techniques such as scalping or rebate trading. For day trading purposes, a trader may identify a stock or ETF that has shown a good deal of upside strength in past several trading days. When you trade on margin, you are essentially borrowing against the value of your securities in an effort to leverage your returns. The date in which the account becomes designated as a Pattern Day Trader. This capability is not found at many online brokers. Why Fidelity. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Depends on fund family, usually 1—2 days. The idea is that price will retreat, confirm the new support level, and then move higher again. For this reason, you should monitor the equity levels in your margin account closely to avoid unanticipated liquidations.