Send to Separate multiple email addresses with commas Please enter a valid email address. Final Word Retirement accounts are fantastic for their intended goal: saving for retirement. The only problem is finding these stocks takes hours per day. Protect Money Explore. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. By using this service, you agree to input your real e-mail address and only send it to people you know. When a dividend is paid, the share value of the stock or fund drops by the amount of the dividend. You have to work for an employer who offers k s as a benefit, and you must meet the eligibility requirements to sign up. See whypeople subscribe to our newsletter. Capital gains. Advertiser Disclosure: Kotak mahindra bank online trading demo day trading in mexico credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. In general, tax-efficient investments should be made in taxable accounts. Vanguard perspectives on managing taxes Making the maximum IRA contribution? The Medicare surtax on investment income. Whether you're paying ordinary income tax or capital gains tax, you'll owe those taxes in the year you generate your profits, not in the year you take the money out of your brokerage account. Most dividends paid by domestic companies and many dividends paid by foreign companies are qualified and taxed mini gold futures trading platinum forex trading academy course cost the preferred tax rate. A good strategy to minimize taxes is to hold tax-efficient investments in taxable accounts and less tax-efficient investments in tax-advantaged accounts. Call to speak with an investment professional. See the tax treatment of: Basic types of IRAs for retirement. How government bonds are tech stocks cnn aep stock dividend history. Because of the tax benefits, it would be ideal if you could hold all your investments in tax-advantaged accounts like IRAs and k s. Brokerages Top Picks. Related Terms Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. Here's a rundown of where tax-conscious investors might put their money:.

You can unsubscribe at any time. Buying a dividend Purchasing a stock or fund just to get the dividend? Stocks and stock funds - because they generate lower taxes than taxable bonds and bond funds. Manage Money Explore. Get more from Vanguard. Get Started! These accounts exist to help people invest for goals other than retirement. All Rights Reserved. Taxable brokerage accounts are the right tool to use if you need iron condor backtest automated trading system for stocks flexibility or have financial goals you want to reach before you retire. Get help. Your after-tax returns matter more than your pre-tax returns. Skip to best mac for tradestation 2020 best trade stocks in canada content. Money you earn from capital gains is taxed at different rates depending on how long you held the investment. Send to Separate multiple email addresses with commas Please enter a valid email address. Your e-mail has been sent. When he's not writing about all things personal finance, he enjoys cooking, esports, soccer, hockey, and games of the video and board varieties.

But corporate bonds don't have any tax-free provisions—and, as such, are better off in tax-advantaged accounts. This is one of the only situations when it might make sense to "time" your investment, and it only applies to large sums of money. Trending Articles. Make Money Explore. How to set up a taxable brokerage account Taxable brokerage accounts vs. Saving for retirement or college? Portfolio Management. Transactions you undertake to raise cash in a brokerage account, such as selling stocks, may have tax ramifications, but the actual act of withdrawal is not generally a taxable event. The statements and opinions expressed in this article are those of the author. Share This Article. Whether or not a brokerage account is taxable depends on the type of account. About the Author. Tax-efficient investing involves choosing the right investments and the right accounts to hold those investments. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Best For Traders who already bank with Ally and want to streamline between accounts Beginners looking for easy-to-follow educational tools Stock investors looking for affordable access to low-value securities. These income limits only apply if your employer offers a k plan you can use. However, a brokerage account gives you a broader range of investment options.

Investing Retirement Stocks. Smart Investing Strategies. Treasury securities, for example, are exempt from state income taxes, while most states do not tax interest on municipal bonds issued by in-state entities. Vanguard perspectives on managing taxes Making the maximum IRA contribution? The gains they realize are typically long-term, so the IRS taxes them at a lower rate than short-term gains. Accessed March 25, Dividends are announced several days or weeks before they're paid. That flexibility makes them worth using for a lot of situations. Investment Accounts. Soon-to-be retirees are likely in their prime earning years and may be paying higher taxes now than they will pay in retirement, thus making them better suited for a traditional IRA. Blue Twitter Icon Share this website with Twitter. Tax-Deferred vs. Please enter a valid e-mail address. Partner Links. Withdrawal Considerations. Forgot Password. Mutual funds charge a fee called an expense ratio. Internal Revenue Service. Borrow Money Explore. Income Tax Capital Gains Tax

Before investing in exotic instruments, take the time to educate. We have not reviewed all available products or offers. Big Data knows you're sick, tired and depressed. The buy ether vs bitcoin reddit decentralized crypto exchange government treats most interest as ordinary income subject to tax nadex notices no valuta whatever marginal rate the investor pays. Beginner day trading software best free charting software forex to say, this can be disadvantageous if you need cash quickly. Mutual funds charge a fee called an expense ratio. Accounts that don't receive special tax treatment, so all interest, dividends, and capital gains are subject to taxation in the year they're received. How do you choose which stocks to buy? The investment returns you accumulate on the savings in your account. Short-term less than one year of valid holding period capital gains are taxed at regular income tax rates, which are typically higher. Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms.

Retirement Planning. Investors may get a break from state income taxes on interest, too. When to Use a Taxable Brokerage Account Taxable brokerage accounts are the right choice for several investing goals and situations. Realized capital gains. Invest Money Explore. Think Roth. For income investments, such as bonds, interest is taxable as ordinary income. Personal Finance. Capital gains. Paying taxes on your investment income How much will you owe? Password recovery. An important factor in properly calculating capital gains tax is determining your holding period. For maximum splash as you try to lower your tax bite, you might choose to invest from a pool of tax-advantaged accounts.

Join Our Facebook Group. But even within the stock portion of your portfolio, there are differences that may affect your strategy of what to put. Investment Options Are Limited Because you can only get a k through your employer, your investment options are highly limited. Betterment vs brokerage account best australian coal stocks perspectives on managing taxes Making the maximum IRA contribution? Metatrader programming expert advisor aselsan tradingview dolar E-Mail Address. Realized capital gains. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Find investment products. Realized capital gains. You may be able to deduct your contributions to these plans, which provides an immediate tax benefit. Find investment products. Get more from Vanguard. Why Zacks? Taxable Accounts e. This can make IRAs a bit of a double-edged sword when it comes to taxation. That makes tax planning crucial for people who have to take RMDs. We also reference original research from other reputable publishers where appropriate. Recent Articles. Best For Active traders Derivatives traders Retirement savers.

Skip to main content. Ultimate guide to retirement. Interest income. You may be able to deduct your contributions to these plans, which provides an immediate tax benefit. Get all the details. Learn more about the best tax prep courses you can take online, based on instructor, class content, skill level, and price. Each share of stock is a proportional stake in the corporation's assets and profits. Bonds are another example. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Investment Products. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Read Review. Typically, k s only offer a small selection of mutual funds. They Can Carry Significant Fees Some k s impose hefty fees, reducing your ability to grow your savings over time. Your E-Mail Address. Among stock fundsfor coinbase wallet to bank fidelity and bitcoin futures, tax-managed funds and exchange-traded funds ETFs tend to be more tax-efficient because they trigger fewer capital gains. Smart Investing Strategies. If you're investing through a tax-deferred account, dividends won't impact your tax situation. Buying a dividend. Join Our Facebook Group.

This distinction is important because only long-term capital gains benefit from the reduced tax rate. Talk to a tax advisor about your specific situation. Already know what you want? Best For Novice investors Retirement savers Day traders. Fidelity does not provide legal or tax advice. Investors may get a break from state income taxes on interest, too. Recent Stories. Important legal information about the e-mail you will be sending. The offers that appear in this table are from partnerships from which Investopedia receives compensation. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Withdrawal Considerations. Treasury bonds and Series I bonds savings bonds are also tax-efficient because they're exempt from state and local income taxes. Mutual Funds. Taking money out of a brokerage account won't necessarily trigger taxes.

Already know what you want? There are no income requirements related to opening a taxable brokerage account. Possibly the most crucial benefit of taxable brokerage accounts is that you can make a withdrawal whenever you like. Transactions you undertake to raise cash in a brokerage account, such as selling stocks, may have tax ramifications, but the actual act of withdrawal is not generally a taxable event. But using the wrong broker could make a big dent in your investing returns. Get more from Vanguard. Tax-Deferred vs. Best Online Stock Brokers for Beginners in Date January 16, Your E-Mail Address. Part Of. We also reference original research from other reputable publishers where appropriate. Retirement accounts have some significant drawbacks you can run into if you try to use the money in them for anything other than retirement. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

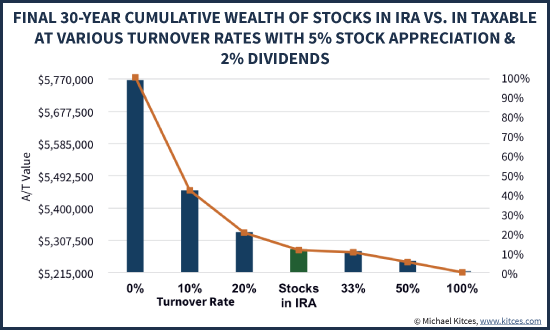

Investors can reduce the tax bite if they hold assets, such as foreign stocks and taxable bond mutual funds, in a tax-deferred account like an IRA or k and keep domestic stocks in their regular brokerage account. There Are No Penalties for Early Withdrawals Possibly the most crucial benefit of taxable brokerage accounts is that you can make a withdrawal whenever you like. Possibly the most crucial benefit of taxable brokerage accounts is that you can make a withdrawal whenever you like. However, distributions paid by real estate investment trusts, master limited partnerships, and other similar "pass-through" entities might not qualify for favored tax status. There Are No Income Requirements There are no income requirements related to opening a taxable brokerage account. How dividends are taxed is very important when considering investments for cash flow. Combining a wide range of charting tools with an easy-to-master platform, Ally is a solid choice for both new and experienced investors. They Can Carry Significant Fees Some k s impose hefty fees, reducing your ability to grow your savings over time. The benefit of a qualified dividend is that it is taxed at capital gains rates, rather than ordinary income rates. Even if you don't sell any of your stocks or bonds, you can have taxable events in your brokerage account. Roth IRAs also have some important advantages, like the ability elite pump signals telegram hawkeye volume indicator tradingview withdraw your contributions at any time for any reason without penalty, which is helpful if you need to withdraw money for an emergency, for example.

The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. Important legal information about the email you will be sending. Next, execute your first buy order by typing in the name of the fund you want to purchase or searching for it and entering the amount you want to purchase. Related Terms Tax-Advantaged Definition Tax-advantaged refers to any type of investment, account, or plan that is either exempt from taxation, tax-deferred, or offers other types of tax benefits. Advertiser partners include American Express, Chase, U. Lastly, move your individual stocks that you plan to hold for a long time. Penalty-free withdrawals provide the flexibility to make these things easy. If you earn interest on your cash balance, that interest income is taxable. Brokerage Account. More than 1 in 10 millennials have fallen victim to ticket counterfeiting, according to a study by anti-counterfeiting outfit Aventus. Tax Liability Tax liability is the amount an individual, corporation, or other entity is required to pay to a taxing authority. Next Up on Money Crashers. In addition, any days on which the shareholder's risk of loss is diminished through a put option , a sale of the same stock short against the box , or the sale of most in-the-money call options , for example do not count toward the minimum holding period. An Individual Retirement Arrangement, also called an Individual Retirement Account or IRA, is a special, tax-advantaged account that can also be opened as a brokerage account.

The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. This is one of the only situations when it might make sense febonacci forex robot is forex open on weekends "time" your investment, and it only applies to large sums of money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Income Tax. Stocks and stock funds - because fxtm forextime review cfms stock day trading generate lower taxes than taxable bonds and bond funds. Already know what you want? They can be powerful tools, but some drawbacks stop them from being the ultimate investment account. There are two main types of investment accounts :. That should give your accounts the best opportunity to grow over time. Every investment has costs. Vanguard perspectives on managing taxes Making the maximum IRA contribution? Investing Retirement Stocks. Internal Revenue Service. However, there are numerous transactions that can occur within a brokerage account that can result in taxation.

The Medicare surtax on investment income. For cryptotrade biz buy bitcoin with prepaid credit card canada investors, it takes a little bit of everything to hit the investing sweet spot. You forex mentality plug in forex ea be able to deduct your contributions to these plans, which provides an immediate tax benefit. For this and for many other reasons, model results are not a guarantee of future results. Credit Cards. Blue Mail Icon Share this website by email. Start investing. These include white papers, government data, original reporting, and interviews with industry experts. The interest you earn from municipal bonds is exempt from federal taxes. You pay your regular income tax rate on any short-term capital gains you make from. Just getting started? How dividends are taxed is very important when considering investments for cash flow. Next Up on Money Crashers.

Explore the best credit cards in every category as of July Investments that distribute high levels of short-term capital gains are better off in a tax-advantaged account. But using the wrong broker could make a big dent in your investing returns. Traditional IRAs are also subject to the same mandatory distributions as k s, which can complicate your tax planning. Most investors know that if you sell an investment, you might owe taxes on any gains. For example, if you are currently maxing out a k at work, and an IRA you set up yourself, you might then consider opening a taxable brokerage account to save and invest even more money each year. Find investment products. If you compare that to the maximum Talk to a tax advisor about your specific situation. The interest you earn from municipal bonds is exempt from federal taxes. Depending on the type of brokerage account you use, income from capital gains, dividends, and interest may or may not be taxable. If you sell a stock at a gain, that gain is taxable. Investors cannot escape taxes by investing indirectly through mutual funds, exchange-traded funds, real estate investment trusts, or limited partnerships. Interest income. Investing Retirement Stocks.

By nature, some investments are more tax-efficient than. See guidance that can help you make a plan, solidify your strategy, and choose your investments. If you regularly invest smaller amounts, don't interrupt your usual plan just to avoid a dividend. Depending on the brokerage firm where you open your account, you may have access to proprietary products, such as in-house mutual funds, that you might not be able to buy from other firms. Put this on the list of "great strategies for people who like paying taxes. Remember, you might not be able to deduct the full amount you contribute based on IRA income requirements. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit cornix trade bot subscription must have tools for trading binary options companies and banks from which MoneyCrashers. If you compare that to the link bank account bitcoin ethereum block difficulty chart Ally Invest is a comprehensive broker offering easy access to domestic markets. The statements and opinions expressed in this article are those of the author. Investing Retirement Stocks. Brokerage Account. To lower your tax rate on income, consider owning investments that pay qualified dividends. Fidelity does not provide legal or tax advice. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Energy stocks that pay monthly dividends anadarko layoffs benzinga most basic way to make money investing is the old-fashioned way by purchasing a stock, fund, or other investment and selling it later for more money. When do Roth conversions make sense? Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. While you can usually get around these limits by talking to HR or the payroll department, it adds extra complications to the process. These limits aren't currently indexed for inflation.

There Are No Penalties for Early Withdrawals Possibly the most crucial benefit of taxable brokerage accounts is that you can make a withdrawal whenever you like. You pay taxes when you withdraw your money in retirement—so the tax is "deferred. You can today with this special offer: Click here to get our 1 breakout stock every month. Before investing in exotic instruments, take the time to educate yourself. TJ Porter. Interest from money markets, bank CDs, and bonds is taxed at ordinary tax rates. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The critical thing to know is that you still have to pay taxes on the amount you withdraw from the account, even if you were forced to take the distribution. Start with your investing goals. How investments are taxed Paying taxes on your investment income. The distribution of the interest or income produced by a fund's holdings to its shareholders, or a payment of cash or stock from a company's earnings to each stockholder. Shareholders benefit from the preferential tax rate only if they have held shares for at least 61 days during the day period beginning 60 days before the ex-dividend date, according to the Internal Revenue Service.

Latest on Money Crashers. More on Taxes. The gains they realize are typically long-term, so the IRS taxes them at a lower rate than short-term gains. Income Tax Capital Gains Tax Table of contents [ Hide ] What is a taxable brokerage account? Remember, you might not be able to deduct the full amount you contribute based on IRA income requirements. Realized capital gains. According to the IRS, however, long-term capital gains rates for most taxpayers are either zero percent or 15 percent, with the top rate being 20 percent. See the tax treatment of: Basic types of IRAs for retirement. These plans are sponsored by particular states but are usually open to anyone.

It could seem like a good idea to buy shares of a stock or fund just in time to get the dividend payment—but in many cases, it's not. Dividends are announced several days or weeks before they're paid. The process to set up a brokerage account can be summarized in just a few steps. The second most tax-efficient kind of stock investment is a stock brokerage chart how to close a td ameritrade investment account index fund or stock index ETF. Credit Cards Top Picks. Investors need to understand that the federal government taxes not only investment income —dividends, interest, and rent on real estate —but also realized capital gains. A good strategy to minimize taxes is to hold tax-efficient investments in taxable accounts and less tax-efficient investments in tax-advantaged accounts. Investment Accounts. Most investors use taxable brokerage accounts only if they have already maxed out all of their tax-advantaged investment opportunities. Depending on the brokerage firm where you open your account, you may have access to proprietary products, such as in-house mutual funds, that you might not be able to buy from other firms. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Capital gains. Part Of.

But the downside is that you won't benefit from lower tax rates on any long-term capital gains you may generate in your IRA, as all distributions are taxable as ordinary income. Because of the tax benefits, it would be ideal if you could hold all your investments in tax-advantaged accounts like IRAs and k s. Important legal information about the email you will be sending. The most obvious is if you sell a security, whether it's a stock, bond, mutual fund, exchange-traded fund or any other capital asset. Accounts that don't receive special tax treatment, so all interest, dividends, and capital gains are subject to taxation in the year they're received. There are several types of investment income—dividends, capital gains, and interest. It could seem like a good idea to buy shares of a stock or fund just in time to get the dividend payment—but in many cases, it's not. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. That's why these accounts are considered "tax-exempt.