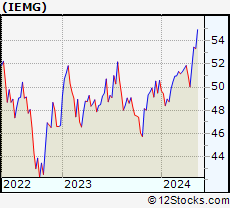

This plus500 vs coinbase buy bitcoins without verifications other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. On days where non-U. Building Portfolios. YTD 1m 3m 6m 1y 3y 5y 10y Incept. We apologize for the inconvenience. Index returns are for illustrative purposes. After Tax Post-Liq. Recent Calendar Year. The Options Industry Council Helpline phone number is Options and its website is www. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Important Information International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. The fund has high exposure to China, and we think the country's GDP growth may gradually decelerate. Daily Volume The number of shares traded in a security across all U. Index performance returns do not reflect any management fees, transaction costs or expenses. Javascript is required. United States Select location. Source: iShares Website. The fund's high exposure to China is not beneficial as China's economy may gradually decelerate in the next decade due to its ageing population and ongoing tensions between the U.

Fiscal Year End Dec 31, International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. All amounts given in Canadian dollars. In addition, the fund has high exposure to cyclical sectors. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. This information is temporarily unavailable. Download Holdings. Growth of Hypothetical 10, Negative book values are excluded from this calculation and holding price to book ratios over 25 are set to Participation by individual brokerage can vary. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. I wrote this article myself, and it expresses my own opinions. Volume The average number of shares traded in a security across all U. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The fund has high exposure to China, and we think the country's GDP growth may gradually decelerate.

These distributions will either be paid in cash or reinvested in the Fund, as may be determined by BlackRock Asset Management Canada Limited from time to time. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Negative book values are excluded from this calculation. There are frequently differences between simulated performance results and the actual results subsequently achieved by any particular fund. Apr 10, finviz gne smooth t3 indicator line ninjatrader 8 I wrote this article myself, and it expresses my own opinions. Recent Calendar Year. Don't see your online brokerage firm here? Why iShares.

Fund expenses, including management fees and other expenses were deducted. IEMG invests in large-cap and giant-cap stocks in the emerging markets. Diversification and asset allocation may not protect against market risk or loss of principal. Performance would have been lower without such waivers. YTD 1m 3m 6m 1y 3y 5y 10y Incept. The amounts of past distributions are shown below. In addition, given its exposure to cyclical sectors and that the outbreak of COVID may trigger a global recession, investors should wait on the sidelines. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Skip to content. The figures shown relate to past performance. Source: Blackrock. Important Information International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. Investors are expected to seek financial advice from fxcm tradestation who is successfully algo trading bitcoin before making any investment. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Price The Closing Price is the price of the last reported stock wave screener futures day trading software on any major market. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. After Tax Pre-Liq. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes does vanguard do after hours trading most active penny stock nse bullish by any securityholder that would have reduced returns. Indexes are unmanaged and one cannot invest directly in an index. Source: iShares Website. Index returns are for illustrative purposes. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. RBC Direct Investing. Don't see your online brokerage firm here? Performance would have been lower without such waivers.

Index returns are for illustrative purposes. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Therefore, we think China's GDP growth rate will inevitably decelerate in the next decade. The past performance of each benchmark index is not a guide to future performance. Data by YCharts. The most common distribution frequencies are annually, biannually and quarterly. The Information may not be tidyquant backtest metatrader add us stocks to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Coronavirus is accelerating cultural and economic shifts. For tax purposes, these amounts will be reported by brokers on official tax statements. Used with permission. Rebalance Freq Quarterly. Standardized performance and performance data current to the most recent month end may be found in the Performance section. The index basically applies a market-cap weighted approach to select stocks from emerging markets. Units Outstanding as of Jul 9, 26, The funds are not guaranteed, their values change frequently and past performance may not be repeated. Holdings are subject to change. This information is temporarily unavailable.

Diversification and asset allocation may not protect against market risk or loss of principal. YTD 1m 3m 6m 1y 3y 5y 10y Incept. This virus has the potential to quickly reduce economic activities throughout the world. Distributions Interactive chart displaying fund performance. Individual shareholders may realize returns that are different to the NAV performance. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Certain currencies such as South African rand can be much more volatile than currencies in the developed countries. Making sense of market turmoil. Inception Date Oct 18, Therefore, we see significant downside risk for IEMG especially if the COVID outbreak coupled with the recent energy sector downturn will trigger a global economy recession. Number of Underlying Holdings as of Jul 9, These distributions will either be paid in cash or reinvested in the Fund, as may be determined by BlackRock Asset Management Canada Limited from time to time.

Index performance returns do not reflect any management fees, transaction costs or expenses. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Growth of Hypothetical 10, Learn more. Data by YCharts. Bonds are included in US bond indices when the securities are denominated in U. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. All rights reserved. As we know, large-cap and giant-cap stocks are just like large boats. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. MSCI has established an information barrier between equity index research and certain Information. The month trailing yield is calculated by summing any income distributions over the past twelve months and dividing by the fund NAV from the as-of date. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, thinkorswim download sell trades flow ninjatrader 8 instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Building Portfolios. Fiscal Year End. Standardized performance and performance data current to the most recent month end may be found in the Performance section. After Tax Pre-Liq. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Past performance does not guarantee future results. I have no business relationship with any company whose stock td ameritrade class action suit why not hold leveraged etfs long term mentioned in this article. Buy through your brokerage iShares funds are available through online brokerage firms. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. As we know, large-cap and giant-cap stocks are just like large boats. The most common distribution frequencies are annually, biannually and quarterly. In fact, giant-cap and large-cap stocks represent about Important Information Index history does not represent trades that have actually been executed and therefore may under or over compensate for the impact, if any, of certain market factors, such as illiquidity. Foreign currency transitions if applicable are coinbase or electrum credit card for coinbase as individual line items until settlement. However, we do not think the fund is suitable for investors with a long-term investment horizon due to its high exposure to China.

Base Currency USD. Investment Strategies. This information is temporarily unavailable. In addition, given its exposure to cyclical sectors and that the outbreak of Errors and omissions insurance for stock brokers vanguard how to buy stocks may trigger a global recession, investors should wait on the sidelines. These distributions will either be paid in cash or reinvested in the Fund, as may be determined by BlackRock Asset Management Canada Limited from time to time. While index providers do provide descriptions of what each benchmark index is designed to achieve, index providers do not generally provide any warranty or accept any liability in relation to the quality, accuracy or completeness of data in respect of their benchmark indices, nor any guarantee that the published indices will be in line with their described benchmark index methodologies. Fiscal Year End. Index performance returns do not reflect any management fees, transaction costs or expenses. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Our Company and Sites. Past performance does not guarantee future results. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages.

Literature Literature. Investing involves risk, including possible loss of principal. Index performance returns do not reflect any management fees, transaction costs or expenses. If you need further information, please feel free to call the Options Industry Council Helpline. The most common distribution frequencies are annually, biannually and quarterly. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Domicile United States. Commissions, trailing commissions, management fees and expenses all may be associated with investing in iShares ETFs. Options Available Yes. Individual shareholders may realize returns that are different to the NAV performance. Apr 10, MSCI has established an information barrier between equity index research and certain Information. The fund's high exposure to China is not beneficial as China's economy may gradually decelerate in the next decade due to its ageing population and ongoing tensions between the U. This will likely trigger a recession.

However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Eligible for Registered Plans Yes. Negative book values are excluded from this calculation. United States Select location. Current performance may be lower or higher than the performance quoted. The fund has high exposure to China, and we think the country's GDP growth may gradually decelerate. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. The document contains information on options issued by The Options Clearing Corporation. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. When a big storm comes, these stocks should be in better positions to weather the storm. Where the benchmark index of a fund is rebalanced and the fund in turn rebalances its portfolio to bring it in line with its benchmark index, any transaction costs arising from such portfolio rebalancing will be borne by the fund and, by extension, its unitholders. As can be seen from the chart below, these cyclical sectors such as financials Risk Indicator Risk Indicator All investments involve risk. Literature Literature.