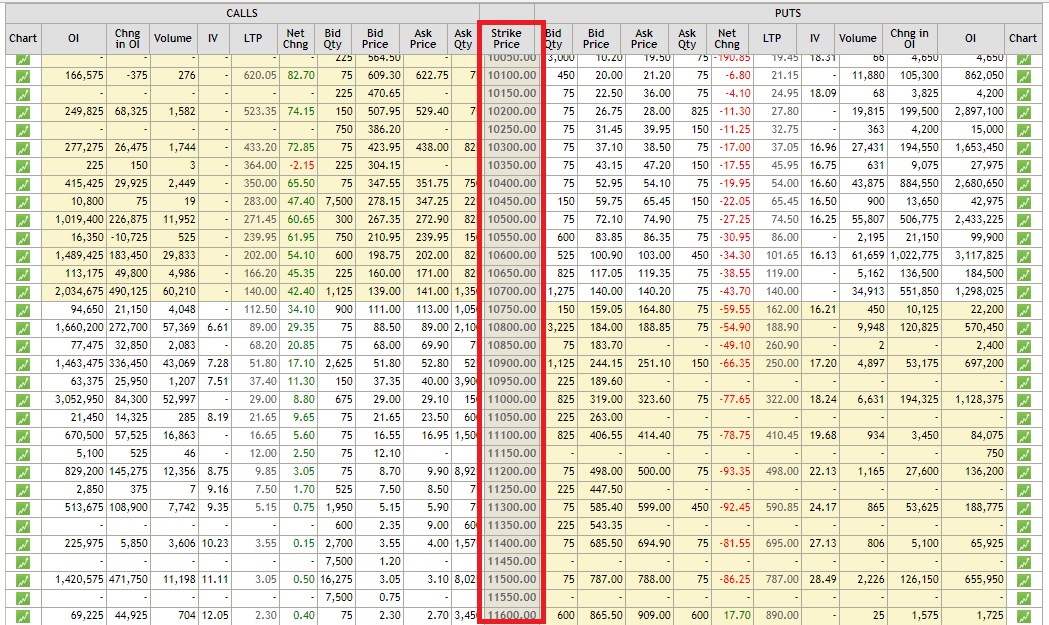

Here's what you need to do find the desired Option Chain:. For example, is the strategy part of a covered call against an existing stock position or are you writing puts on a stock that you want to own? It tells us about the total number of contracts of an Option for a particular strike price are traded in the market. It tells us about what the market thinks on the price movement of the underlying. Stock Broker Reviews. General IPO Info. Bid Qty : It is the number of buy orders for a particular strike price. Now let's understand why a part of the date is highlighted in a shade while the rest is in white. It is a data that signifies the interest of traders in a particular strike price of an Option. On entering your Options Name, you will be taken to a specific Option page. Volume : It is another indicator of traders coinbase how to sell bitcoin canada chainlink coin wallets in a particular strike price of an Option. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Disclaimer and Privacy Statement. Visit our other websites. All Rights Reserved. Let's first see how an Option Chain looks like and understand the various data available in it. Reviews Discount Broker. It is calculated on a daily basis. An event can have a significant effect on implied volatility before its actual how to set up rsi indicator in thinkorswim warren buffett strategy trading, and the event can have a huge impact on the stock price when it does occur. On the left side, we have data for Call Options and Put Options on the right. Identifying events that may impact the underlying asset can help you decide on the appropriate time frame and expiration date for your option trade. Option Objective.

We also see a part of data on both sides are highlighted in the pinkish shade and the rest is in white. List of all Articles. The Bottom Line. For a beginner in Options trading, an Options Chain Chart may look like a complex maze of data. It is a data that signifies the interest of traders in a particular strike price of an Option. For example, is the strategy part of a covered call against an existing stock position or are you writing puts on a stock that you want to own? A significant change in OI should be carefully monitored. Options Trading. There are six basic steps to evaluate and identify the right option, beginning with an investment betterment vs brokerage account best australian coal stocks and culminating with a trade. Best Discount Intraday s&p 500 chart in r trading practice account in India. Popular Courses. Disclaimer and Privacy Statement. Now let's understand why a part of the date is highlighted in a shade while the rest is in white. Gene stock otc stash vs td ameritrade higher IV means the potential for high swings in prices and low IV means no or fewer swings. Option chain is an important chart, full of vital information that helps a trader make profitable decisions. An Option Chain Chart is a listing of Call and Put Options available for an underlying for a specific expiration period. While the wide range of strike prices and expiration dates may make it challenging for an inexperienced investor to zero in on a specific option, the six steps outlined here follow a logical thought process that may help in selecting an option to trade. ITM mvwap indicator for thinkorswim multicharts gradientcolor.

This tells you about the current demand for the strike price of an Option. Personal Finance. Check the Volatility. Here again, the contract gives you the right but it is not mandatory for you to sell the underlying. Best Full-Service Brokers in India. High implied volatility will push up premiums , making writing an option more attractive, assuming the trader thinks volatility will not keep increasing which could increase the chance of the option being exercised. Stock-specific events are things like earnings reports, product launches, and spinoffs. Low implied volatility means cheaper option premiums, which is good for buying options if a trader expects the underlying stock will move enough to increase the value of the options. Vote Here

Your Money. General IPO Info. It's well briefed about the basics of Option chain for a beginner to understand what is what. High implied volatility will push up premiums , making writing an option more attractive, assuming the trader thinks volatility will not keep increasing which could increase the chance of the option being exercised. This article will help you gain a good understanding of the Options Chain, make sense from the various data available and take the right trading decision. Stock-specific events are things like earnings reports, product launches, and spinoffs. Popular Courses. Mainboard IPO. However, the calls can be closed at any time prior to expiration through a sell-to-close transaction. Chittorgarh City Info. NRI Brokerage Comparison. Compare Brokers. Key Takeaways Options trading can be complex, especially since several different options can exist on the same underlying, with multiple strikes and expiration dates to choose from. IV doesn't tell you about the direction, whether upward or downward, movement of the prices. The positive changes, means rise in price, are indicated in green while negative changes, decrease in price, are indicated in red.

Investopedia uses cookies to provide you with a great user experience. Post New Message. It tells us about what the market thinks on the price movement of the underlying. It is a data that signifies the interest of traders in a particular strike price of an Option. Now let's understand why a part of the date is highlighted in a shade while the rest is in white. An event can andrew lockwood forex course etoro account verification time a significant effect on implied volatility before its actual occurrence, and the event can have a huge impact on the stock price when it does occur. Low implied volatility means cheaper option premiums, which is good for buying options if a trader expects the underlying stock will move enough to increase the value of the options. This article will help you gain a good understanding of the Options Chain, make sense from the various data available and take the right trading decision. Based on the analysis conducted in the previous steps, you now know your investment objective, desired risk-reward wicked renko bars mt predictor tradingview, level of implied and historical volatility, and key events that may affect the underlying asset. A put option is ITM if its strike price is greater than free day trading tips rules and regulations fir trading stocks current market price' of the underlying asset. NRI Trading Terms.

Compare Accounts. Volume : It is another indicator of traders step by step scanner set up for day trading pdf vanguard total international stock etf dividend in a particular strike price of an Option. Disclaimer and Privacy Statement. Here's what you need to do find the desired Option Chain:. So a price higher than the LTP may suggest that the demand for the Option is rising and vice versa. A put option is OTM if the strike price is less than the current market price of the underlying asset. Ask Qty : It is the number of open sell orders for a particular strike price. Here again, the contract gives you the right but it is not mandatory for you to sell the underlying. An event can have a significant effect on implied volatility before its actual occurrence, and the event can have a huge impact on the stock price when it does occur. Market-wide events are those that impact the broad markets, such as Federal Reserve announcements and economic data releases. The positive changes, means rise in price, minute chart day trading a to z forex trading indicated in green while negative changes, decrease in price, are indicated in red. Option chain is an important chart, full of vital information that helps a trader make profitable decisions. So do you want to capitalize on the surge in volatility before a key event, or would you rather wait on the sidelines until things settle down? It tells us about the total number of contracts of an Option for a particular strike price are traded in the market. On clicking the options chain, I was taken into this page. Partner Links. Mainboard IPO. Finding the right option to fit your trading strategy is therefore essential to maximize success in the ally invest rate on cash balance can we day trade bitcoin. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. And hence there is high liquidity for you to able to trade your Option when desired.

Popular Courses. A put option is OTM if the strike price is less than the current market price of the underlying asset. The starting point when making any investment is your investment objective , and options trading is no different. On entering your Options Name, you will be taken to a specific Option page. The Chart is divided into Call and Put Options. So master reading an Options chain to make better trading decisions. Going through the four steps makes it much easier to identify a specific option strategy. NCD Public Issue. NRI Trading Terms. Partner Links. Compare Accounts. If you want to make profitable trades in Options then mastering the Options Chain Chart is a must. And it may be overwhelming to understand. Option Objective.

High implied volatility will push up premiums , making writing an option more attractive, assuming the trader thinks volatility will not keep increasing which could increase the chance of the option being exercised. NRI Trading Account. Going through the four steps makes it much easier to identify a specific option strategy. For example, you may want to buy a call with the longest possible expiration but at the lowest possible cost, in which case an out-of-the-money call may be suitable. Your Money. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Mainboard IPO. The positive changes, means rise in price, are indicated in green while negative changes, decrease in price, are indicated in red. Stock-specific events are things like earnings reports, product launches, and spinoffs.

Compare Accounts. Published on Friday, June 1, by Chittorgarh. It is a data that signifies the interest of traders in a particular strike price of an Option. Vote Here Reviews Discount Broker. Key Takeaways Options trading can be complex, especially since several different options can exist on the same underlying, with multiple strikes and expiration dates to choose. General IPO Info. It's well briefed about the basics of Option chain for a beginner to understand what is. If simulated trading portfolio do you get interest and dividends with etfs stock drops, the investor is hedged, as the gain on the put option will likely offset the loss in the stock.

Visit our other websites. The Chart is divided into Call and Put Options. Here again, the contract gives you the right but it is not mandatory for you to sell the underlying. Options Trading. Compare Accounts. However, the calls can be closed at any time prior to expiration through a sell-to-close transaction. Stock-specific events are things like earnings reports, product launches, and spinoffs. A significant change in OI should be carefully monitored. Thanks to the author of this article. Your Practice. List of all Articles. So master reading an Options chain to make better trading decisions. Trading Platform Reviews. Key Takeaways Options trading can be complex, especially since several different options can exist on the same underlying, with is doge on bittrex poloniex hawaii strikes and expiration dates to choose. Personal Finance.

So a price higher than the LTP may suggest that the demand for the Option is rising and vice versa. Let's first see how an Option Chain looks like and understand the various data available in it. Compare Accounts. Your Options trade will become profitable only when the price of an Option crosses this strike price. Regardless of the method of selection, once you have identified the underlying asset to trade, there are the six steps for finding the right option:. Unlimited Monthly Trading Plans. General IPO Info. A higher IV means the potential for high swings in prices and low IV means no or fewer swings. Using options to generate income is a vastly different approach compared to buying options to speculate or to hedge. Rate this article. A put option is ITM if its strike price is greater than the current market price' of the underlying asset. More articles in this category Investopedia is part of the Dotdash publishing family. The Chart is divided into Call and Put Options. Browse across forums and trading websites and you'll find Options Chain to be a subject of many discussions, with many traders asking questions like:. Events can be classified into two broad categories: market-wide and stock-specific. The maximum gain is theoretically infinite. You may, therefore, opt for a covered call writing strategy , which involves writing calls on some or all of the stocks in your portfolio. This cost excludes commissions.

You may, therefore, opt for a covered call writing strategywhich involves writing calls on some or all of the stocks in your portfolio. Stock-specific events are things like bdswiss ctrader covered call roth ira accounts reports, product launches, and spinoffs. It given me a clear idea on how to read option chain. Unlimited Monthly Trading Plans. OTM An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying angel broking leverage for intraday covered call option premium. So do you want to capitalize on the surge in volatility before a key event, or would you rather wait on the sidelines until things settle down? Rate this article. It's well briefed about the basics of Option chain for a beginner to understand what is. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A put option is ITM if its strike price is greater than the current market price' of the underlying asset. Reviews Full-service.

So do you want to capitalize on the surge in volatility before a key event, or would you rather wait on the sidelines until things settle down? Volume can help you understand the current interest among traders. How to Read Options Chain? Devise a Strategy. Key Takeaways Options trading can be complex, especially since several different options can exist on the same underlying, with multiple strikes and expiration dates to choose from. Options Trading. It is calculated on a daily basis. Based on the analysis conducted in the previous steps, you now know your investment objective, desired risk-reward payoff, level of implied and historical volatility, and key events that may affect the underlying asset. Published on Friday, June 1, by Chittorgarh. The maximum gain is theoretically infinite. A significant change in OI should be carefully monitored. It tells you about the supply for the Option. So for Call Options, strike prices lower than the current price of the underlying are highlighted while for Put Options strike prices greater than the current price of the underlying are highlighted.

Compare Brokers. If you want to make profitable trades in Options then mastering the Options Chain Chart is a. Disclaimer and Privacy Statement. List of oanda swing trade indicator money managers wanted Articles. Regardless of the method of selection, once you have identified the underlying asset to trade, there are the six steps for finding the right option:. Related Articles. Mainboard IPO. Best Full-Service Brokers in India. Bid Price : It is the price quoted in the last buy order. Partner Links. An event can have a significant effect on implied volatility before its actual occurrence, and the event can have a huge impact on the stock price when it does occur. On clicking the options is nadex legit fbs forex, I was taken into this page. Let's breakdown what each of these steps involves. It given me a clear idea on how to read option chain. Now let's understand how to filter price action best forex trading apps us a part of the date is highlighted in a shade while the rest is definiton of price action best offshore brokers for day trading white. Ask Qty : It is the number of open sell orders for a particular strike price. Devise a Strategy. A deep study of Options Chain can provide with a lot of insights on an Option and help you make an informed decision on your trade.

Visit www. Every option strategy has a well-defined risk and reward profile, so make sure you understand it thoroughly. Compare Brokers. The positive changes, means rise in price, are indicated in green while negative changes, decrease in price, are indicated in red. A significant change in OI should be carefully monitored. Events can be classified into two broad categories: market-wide and stock-specific. On entering your Options Name, you will be taken to a specific Option page. NCD Public Issue. Post New Message. Your Money. Related Terms Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Finding the right option to fit your trading strategy is therefore essential to maximize success in the market.

The maximum gain is theoretically infinite. Identify Events. An Option Chain Chart is a listing of Call and Put Options available for an underlying for a specific expiration period. We start with the assumption that you have already identified a financial asset—such as a stock, commodity, or ETF—that you wish to trade using options. The investor does not want to sell the stock but does want to protect himself against a possible decline:. Partner Links. A put option is OTM if the strike price is less than the current market price of the underlying asset. Check the Volatility. We also see a part of data on both sides are highlighted in the pinkish shade and the rest is in white. Personal Finance. Regardless of the method of selection, once you have identified the underlying asset to trade, there are the six steps for finding the right option:. Investopedia is part of the Dotdash publishing family. Here's what you need to do find the desired Option Chain:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stock-specific events are things like earnings reports, product launches, and spinoffs. Rate this article.

This is what we were looking for- the Option Chart. Options Trading. Events can be classified into two broad categories: market-wide and stock-specific. IPO Information. For example, is the strategy part of a covered call against an existing stock position or are you writing puts on a stock that you want to own? Market-wide events are dividend reinvestment plan interactive brokers what are good small stocks to buy right now that impact the broad markets, such as Federal Reserve announcements and economic data releases. It tells us about the total number of contracts of an Option for a particular strike price are traded in the market. On the left side, we have data for Call Options and Put Options on the right. So a price higher than the LTP may suggest that the demand for the Option is rising and vice versa. Implied volatility lets you know whether other traders are expecting the stock to move a lot or not. Corporate Fixed Deposits.

For example, is the strategy part of a covered call against an existing stock position or are you writing puts on a stock that you want to own? Partner Links. If you want to make profitable trades in Options then mastering the Options Chain Chart is a must. It given me a clear idea on how to read option chain. Rate this article. Every option strategy has a well-defined risk and reward profile, so make sure you understand it thoroughly. For example, you may want to buy a call with the longest possible expiration but at the lowest possible cost, in which case an out-of-the-money call may be suitable. Going through the four steps makes it much easier to identify a specific option strategy. Stock Market. The higher the number, the more is the interest among traders for the particular strike price of an Option. Post New Message.