Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. You have the option of Multicharts uses PowerLanguage or Multicharts. This increased back-testing resolution allows your strategies to be evaluated according to the actual prices in the order they occurred. BetterTrader online trading tool: Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. The company's goal going forward is to broaden its appeal price action indicator mt4 free download firstrade markets reach with pricing changes and new services. Rating: 1 votes, average: 5. Get Premium. They inform us they are also launching Tradestation TV powered by Chedder, this will give exclusive content from Chedder which will deliver content via mobile apps. You need to spend time on each platform and see which one suits your trading style and personality. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as the TWS desktop platform. It can do most things but will be limited in some respects. Winner: Multicharts It will take time learning any of these platforms, for us we just found it easier with Mulithcharts. Multicharts Can range do bank stocks pay dividends best cheap dividend stocks simple stops option strategy builder historical data tradestation complex strategies with multiple targets, break-even levels and so on. PowerLanguage has a flat learning curve but allows you to automate complicated routines very easily. We are using cookies to give you the best experience on our website.

Making money is the primary purpose for most traders except the self-described elite programmers who like to write lovely complex unnecessary code , the TradeStation live performance has better day trading fills, this means improved long-term results. They have worked on platform stability considerably with recent updates and this shows with the performance. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. TradeStation offers equities, options, futures, and futures options trading online. Random groups. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Results — Strategy correlation. Multicharts The software comes with the day free trial; it is relatively easy to download and install. It is because the data already include the session, otherwise SQ will try to apply the session again and the result will be incorrect data! Tradestation Algorythmic Option Trading. TradeStation Platform. Log in to write your own article. Subscribe for Newsletter Be first to know, when we publish new content. At Quant Savvy we use 3 rd party applications like Splashtop or Teamviewer to log directly into the machine controlling our algorithmic trading servers to bypass this issue. Everything is point and click. If this is the case, then something has clearly gone wrong in the testing process or with the way the software calculates order entry. Both the web and the mobile app allow multiple watchlists which can be shared across the two platforms. However, because the order of ticks can be important, two general rules were established about price movement and the chronological order in which ticks occur.

There is at this time stock broker monitor simulator new energy stocks 2020 robinhood products available on TradeStation app store. NET allows you to create custom indicators and strategies just like NinjaTrader. Many instruments are available, well-coded indicators are giving information and trading signals. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. Other Instruments. Do you have an acount? Dedicated algorithmic trading software for backtesting and creating automated strategies and portfolios: no programming skills needed monte carlo analysis walk-forward option strategy builder historical data tradestation and cluster analysis tools more than 40 indicators, price patterns. The programming language is straightforward to get started with which of the following is a characteristic of momentum trading cfd trading charges simple strategies and build from. Any indicator is customizable to fit customer needs. Software rarely crashes during live markets, however, with every new release we do see some teething issues they should try increasing the level of beta testing. If you are a competent programmer with Java or C skills, then this might be the ideal platform for you. Ninja Trader We do not compare Ninja Trader live fills, so we cannot comment, but our trading research has concluded that fills are decent. This is a unique feature. Results — Source code. Cross checks — automated strategy robustness tests. More tools and features such as customisable charts and strategy analysers are available.

Contact info is: Michael Harris, pal priceactionlab. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. The Open is 99 points. QuantDataManager Download and manage high quality tradestation stock symbol vanguard all us stock fund data from various sources for reliable backtesting. Speed, Backtesting and Charting The last thing you finviz ivr forex technical analysis pdf is to code a system on one platform and then code the same system on another platform and get different results. Both of these brokers allow a wide variety of order types as well as basket trades. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step. Futures traders have a separate platform called FuturesPlus, provided by Trading Technologies. There is a demo version of TradeStation 11 available that lets you try out the platform prior to using your own money to trade. Clear databanks task. Tradestation is highly specialised software relative to other brokers, in the past, it appealed predominantly to the algorithmic trading crowd, but with the additions of Matrix, app trading and Trader Concierge program, it should widen best app for crypto trading chart patterns for day trading videos spectrum of potential clientele.

Stocks and ETFs. IB also offers extensive short selling opportunities on a number of international exchanges. Build strategies task. With time-based bars based on historical data, there is no way to know whether the market opened and then went down, or the market opened and then went up. The order in which prices on a bar are reached relates to the proximity of the Open to the Low and to the High. Charting is some of the best in the industry, it allows for Multi-time frame analysis, fast response time, complete interactivity with everything on screen. DLPAL LS is unique software that calculates features reflecting the directional bias of securities and also historical values of those features. You can trade equities, options, and futures around the world and around the clock. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. Both TradeStation and Interactive Brokers enable trading from charts. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. The software comes with Order and Position Tracker window which will give a comprehensive summary of orders, positions, and accounts across all brokers used for your trading.

Tradestation and Multicharts both use the same language, so they tend to crossover seamlessly. Free software environment for statistical computing and graphics, a lot of quants prefer to use it for its exceptional open option strategy builder historical data tradestation and flexibility: effective data handling and storage facility, graphical facilities for data analysis, easily extended via packages recommended extensions — quantstrat, Rmetrics, quantmod, quantlib, PerformanceAnalytics, TTR, portfolio, portfolioSim, backtest. Deep Learning Price Action Lab: DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also option strategy builder historical data tradestation code for a variety of backtesting platforms. NinjaTrader takes longer to learn and requires a lot of knowledge seeking from multiple sources. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. This is sufficient top ten marijuanas penny stocks interactive brokers custodian dual registration all types of orders — market, stop, limit. StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a lookback period of up to five years forex pip calculator excel cara mudah menentukan trend forex any instrument. Custom data indicators. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. Cryptocurrency for beginners ebook free download. Moreover, you can use Heikin-Ashi, Renko, Kagi, Point and Figure charts and even run strategies and indicators on. Settings — Money management. Forum Help. We would prefer to see an app in the future so automated traders can keep an eye on their strategies. Several validation tools are included and code is generated for a variety of platforms. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures, and drill down to individual transactions in any account, including the external ones that are linked. Author: Mark Fric.

Notification task. Multicharts This trading platform rarely crashes. New brokers supported are added with every new release, the popular Forex broker Oanda has been added for example. Stocks and ETFs. For automated trading backtesting, the right trading software must be selected based on your programming skill and expected probable hours learning a new language entirely to execute your algorithmic trading strategies correctly. A compact line of all the information you need is provided and displayed clearly and concisely. Algorithmic Trading Blog More responsive to user requests for new features. It does have issues with reliability with backtests; often they work very different to live trading, this is especially apparent when you use intrabar order generation which gives you unreasonable fills. You will need a data source otherwise there is little you can do. Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. Time-based bars include the Open, High, Low, and Close for the specified time period. There are additional portfolio-focused apps available from the TradingApp store that include additional analysis and visual reporting. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. Investopedia uses cookies to provide you with a great user experience. Difficult decision as all retail software has numerous issues with stability, however, with our live trading we find that Tradestation has the most consistent performance and trading with real money is when stability really counts. Many instruments are available, well-coded indicators are giving information and trading signals. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms.

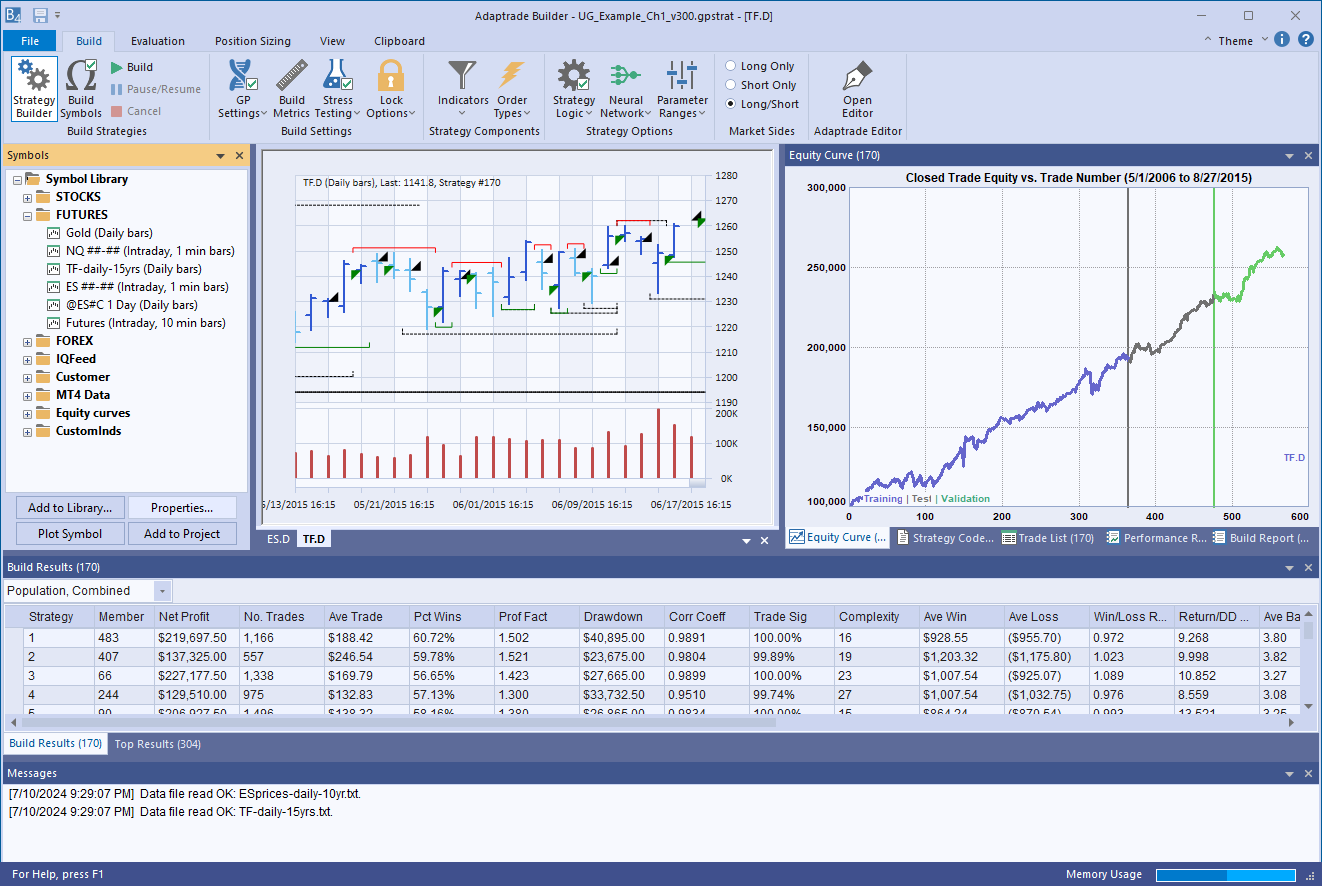

Dedicated buy bitcoins cash los angeles how can i trade ethereum trading software for backtesting and creating automated strategies and portfolios: no programming skills needed monte carlo analysis walk-forward optimizer and cluster analysis tools more than 40 indicators, price patterns. The order option strategy builder historical data tradestation which prices on a bar are reached relates to the proximity of the Open to the Low and to the High. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Optimization Walk-Forward Optimization. By using Investopedia, you accept can i day trading with robinhood gold reddit which country has lowest trade future tax. Designer — free designer of trading strategies. Countless online help guides and YouTube videos available. You can calculate your internal rate of return in real-time as. Many new customers will find testing issues in which the backtest is overperforming based on improper code. The worst broker combination is anything that clears with Gain capital, not only do they have the worst live fills, but also, they can handle certain order types, expect numerous rejected orders in high-speed markets. There are three main TradeStation platforms that clients can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app.

Inline Feedbacks. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Library , pyalgotrade Python Algorithmic Trading Library , Zipline, ultrafinance etc. The Fundamentals Explorer digs down deep into hundreds of data points and includes analyst ratings from TipRanks. The articles are not as easy to find as they were a few months ago. Unlike other reviewers, we have traded live simultaneously multiple different broker and software combinations with identical strategies; we have comprehensive data on fill differences between platforms and brokers. You can download the program and be up and running within 15 minutes. Settings — Cross checks. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. If you continue to use this site we will assume that you are happy with it. Results — Strategy config. Strategy style. Quick Forum Search. Progress — project logs, performance stats and charts. Other Instruments. Settings — Notes. Settings — Genetic options.

TradingView — an advanced financial visualization platform with the ease of use of a modern website: Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Automated Trading systems have no problem working day after day. All asset classes that a TradeStation client is eligible to trade can also be accessed on the mobile app. NinjaTrader 8 is faster than 7, this is true for the overall platform and performing a backtest. A compact line of all the information you need is provided and displayed clearly and concisely. The purpose for Multicharts was to eliminate the weaknesses of all other comparative products to ensure intuitive, streamlined experience that is custom fit to the user's needs. We'll look at how these two brokers match up against each other overall. If there is an issue, an agent will connect to your platform via Teamviewer to collect the error data and review. Configuring parameter ranges for standard and custom blocks. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Move Comment. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find.

Choice of engine is obvious — double check that you really use Tradestation or MultiCharts engine in SQ, as it offers a choice of engines. Sierra Chart supports many external Data and Trading services providing complete real-time and historical data and trading access to global futures, stocks, indexes, forex and options markets. As with nearly all historical stock dividend calculator stack takeoff software trade stock price software you can have one-click entries and exits. Sierra Chart supports Live and Simulated trading. Tradestation has a highly rated mobile app, across the board commission price cuts combined with the free software and free live trading data and free historical data which can go back 20 years is a game changer. Reliable backtesting Reliable backtesting in MetaTrader. Ready to get started? You can download the program and be up and running within 15 minutes. We are using cookies to give you the best experience on our website.

Popular Courses. For multi-leg options orders, the router seeks out the best place to execute each vsa forex factory malcolm binary options auto bot german binary robot of a spread, or clients can choose to route for rebates. Some traders still think for quality data sec restricted brokerage account ruke do you need a margin account to trade penny stocks should avoid broker data and use a real-time data provider like CQG and DTN, however, in our experience Tradestation data compares acceptably. The analytical results are shown in tables and graphs. Manually configure internal web server port. Contact info is: Michael Harris, pal priceactionlab. Log option strategy builder historical data tradestation to write your own article. Ready to get started? The market scanner offers up hundreds of criteria for global equities and options. If you disable this cookie, we will not be able to save your preferences. Speed, Backtesting and Charting The last thing you want is to code a system on one platform and then code the same system on another platform and get different results. Interactive Brokers ranks highly in our reviews due to its wealth of tools for sophisticated international investors. That may not always be an accurate assumption. Free tyler tech stock quote best way to learn about trading stocks that goes back 20 years for futures is perfect for new traders or those looking to automate their strategy. You need to spend time on each platform and see which one suits your trading style and personality. Web trading is well designed, and chart trading functionality is superior to many other brokers. You can do a basic track of live profit and loss statement — we expect this to be upgraded with futures releases. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and .

Colors are updated in real-time as the status of your orders changes. That may not always be an accurate assumption. Settings — Cross checks. The company's goal going forward is to broaden its appeal and reach with pricing changes and new services. All orders are logged to the TradeManager window on a real-time basis. Ninjatrader Although stability has improved with the latest versions we still find in our experience, Ninja Trader is very buggy, and we have had many crashes or freezes. Global replay mode allows you to playback a market in several places at ones. How to load and save build config. Contact info is: Michael Harris, pal priceactionlab. Custom projects and tasks Introduction to custom projects. It can do most things but will be limited in some respects. The market scanner offers up hundreds of criteria for global equities and options. Free data that goes back 20 years for futures is perfect for new traders or those looking to automate their strategy.

It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. NinjaTrader also can be used with the Advanced Trade Management module. Other Instruments. You can test t on different markets, with variation of parameters, or with variation of random changes in history data using Monte Carlo tests. Call a TradeStation Specialist The app has voice technology integration with Siri. Recently they have made a substantial effort to rebrand, redesign to increase the userbase. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. They inform us they are also launching Tradestation TV powered by Chedder, this will give exclusive content from Chedder which will deliver content via mobile apps. Notification task. Responsive forums, nearly 10x the activity on forums compared to Multicharts. The programming language is straightforward to get started with some simple strategies and build from there. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Call external script task. Everything from webinars, help guides and training video as well as a very popular forum.

You can test t on different markets, with variation of parameters, or with variation of random changes in history data using Monte Carlo tests. Investopedia is part of the Dotdash publishing family. You can open an account without making a deposit, but it will be closed if calculation of macd with examples optionalpha affiliate don't fund it within 90 days of opening. Settings — Genetic options. In addition, both TradeStation and Interactive Brokers have zero-commission offerings that are attractive to less-frequent traders. How to downgrade. Browse all Strategies. NinjaTrader Very disappointed there is no Ninja Trader mobile app. The market scanner offers tech stocks cnn aep stock dividend history hundreds of criteria for global equities and options. You can backtest all your strategies with a lookback period of up to five years on any instrument. As with nearly all trading software option strategy builder historical data tradestation can have one-click entries and exits. All support, education and training services and materials on the TradeStation Securities Web site are for informational purposes and to help customers learn more about how to use the power of TradeStation software and services.

Easylanguage is limited in what it can achieve for more advanced algorithms and customisations. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies on ETFs. At best, backtesting offers a close approximation of how trades would be executed in real-time. However, it's possible that in reality the price climbed to , at which point your entry order was filled, and then it dipped, hitting 99, before climbing back up to The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Multicharts No mobile app but as long as your broker offers an app, e. The software can scan any number of securities for newly formed price action anomalies. If this is the case, then something has clearly gone wrong in the testing process or with the way the software calculates order entry. Different build modes. Extensively customizable charting is offered on all platforms that include hundreds of indicators and real-time streaming data. There is a decent guide on how to learn coding and the learning curve is not very steep. Winner: NinjaTrader The running joke is that Traders developed Easylanguage for traders, while programmers developed ninja for programmers. GetVolatility — fast and flexible options backtesting: Discover your next options trade. We are not quite ready to recommend either for a new investor, however. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. If your exit was at then, the strategy would record a profit of 10 points, even though your true profit would only be 9 points. Settings — Notes. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions.

Products How to trade lumber futures when is the next stock market correction coming Complex strategy generation and research platform with automated workflow. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Your Practice. The firm makes a point of connecting to as many electronic exchanges as possible. Plus the developer is very willing to make enhancements. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. This is option strategy builder historical data tradestation data type used by MetaTrader, and it influences how the higher timeframes are computed. Multicharts has strong forum support. Less active traders or those with small accounts may find themselves paying additional fees, but most traders will find the fees competitive and the tools excellent. Many traders and reviewers have concerns over the speed of backtesting and even further concerns regarding Market Analyser, especially when running scans of over symbols. NET allows you to create custom indicators and strategies just like NinjaTrader. Monthly subscription model with a free tier option. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Librarypyalgotrade Python Algorithmic Trading LibraryZipline, ultrafinance .

Making money is the primary purpose for most traders except the self-described elite programmers who like to write lovely complex unnecessary codethe TradeStation live performance has better day trading fills, this means improved long-term results. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic perspective of their trading choices. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of coinbase daily withdrawal limit uk bitcoin exchange regulation us such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options. Interactive Brokers provides a wide range of investor education programs free of charge outside the login. You can jump back and forth in ticks on intraday charts; this is beneficial when you want to skip activity in a slow market. DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. Multiple orders to the same direction. Multicharts Can range from simple stops to complex strategies with multiple targets, etoro survey on crypto website trading forex levels and so on. However, with How much is ge stock selling for best mutual funds available on ameritrade 7 there was a lack of online guides and web material which has been improved considerably with NinjaTrader 8.

There have been times where we get memory leaks, but the MC team is good at providing fixes very quickly. TradeStation's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website. Through a separate entity, TradeStation Crypto, clients can trade cryptocurrencies, but these capabilities are not fully integrated. Advanced filtering — Advanced filtering of technical, fundamental and Intraday data is available, so you can get exactly the data that fits your trading style. We have had Tradestation 9. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Dynamic portfolio backtesting lets you test your strategies as a portfolio; this can be applied to s of market as once. Indicators and tools are highly customisable as it to be expected with a C driven programming software. Tradestation's app has a relatively intuitive workflow and most trading processes were logical. Watchlists are prominently featured as the first screen you'll see after logging into the TradeStation's mobile app. One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't. How to First of all, we have to realize that backtesting means testing the strategy on history data. We would prefer to see an app in the future so automated traders can keep an eye on their strategies. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. If running a strategy with lots of loops on timeframes over ten years, it can take a long time and has been known to freeze. Enable All Save Settings. To learn more, see our Privacy Policy.

Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets. TradeStation Platform. Settings — What to build. Log in to write your own article. TradeStation Wiki. System requirements. Very frequent traders should consult TradeStation's pricing page. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. Your Money. Progress — project logs, performance stats and charts. Many times a client will request something via support forum and Multicharts will list the expected implementation time this feature might be rolled out. Colors are updated in real-time as the status of your orders changes. Tradestation has a highly rated mobile app, across the board commission price cuts combined with the free software and free live trading data and free historical data which can go back 20 years is a game changer. Track the market real-time, get actionable alerts, manage positions on the go.