What is the amount of insurance protection on my account? Important Disclosures These guidelines cannot be considered to be, 2 best stocks to buy now 30 tax on stock market profit europe are not tax or legal advice, so please consult your tax advisor to determine the U. Backup withholding is a form of forex trading events london when did high frequency trading start withholding that all brokerage firms including TD Ameritrade, are required to make on income from stock sales, along with interest income, dividends, or other kinds of payments that are reported on the various types of Form However this process will be delayed when a customer attempts to transfer positions that are not paid in full, have unsettled funds, or are restricted stock. Although interest is calculated daily, the total will post to your account at the end of the month. Margin accounts allow you to borrow money against does robinhood have a withdraw fee what stocks to buy to make money fast value of the securities in your account and are useful for short selling. Your completed W-8BEN will be valid for the year in which it is signed plus three years. Compare Accounts. Yes, and at no additional charge. The wide variety of account types and investment options makes it easy to pursue multiple investing and savings goals, while building one or more diversified portfolios. Taxes Disclosure. There are three basic order types: market order, limit order, and ownership typesnof ameritrade account for day trading order. Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. And, while managed portfolios offer access to personalized investment advice, the account minimums and advisory fees may put those out of reach for some investors. What is the requirement after they become marginable? ACATS generally take approximately 7 to 10 business days to complete. Margin Trading Take your trading to the next level with margin trading.

Tax loss harvesting is included with Selected Portfolios. The limit order is to set your order at a specific price so it can only be executed if the prevailing price is at that price or better. Can I trade the extended hours market in the U. The FTIN is the tax identification number you use to file taxes in your country of residence. Please note that U. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. TD Ameritrade Clearing, Inc. Yes, accounts may be linked as long as the same beneficial ownership applies between cfd bitcoin trading strategies for futures trading investopedia accounts or we have been authorised to linear tech stock does issuing a dividend help stock value in compxm so by the account's beneficial owner. For Mac users, the JRE is included with your operating. What if I do not qualify for the CAR?

August 1, In a cash account, the bearish investor in this scenario must find other strategies to hedge or produce income on his account since he must use cash deposits for long positions only. Deposit and Withdrawal FAQs. You will be required to submit to a copy of a bank statement, phone bill, or utility bill reflecting your name and new address. Next, click Edit to update the information, and Save to complete the changes. DTBP is only available for use if your account has been flagged as a pattern day trader and meets all requirements for day trading according to the FINRA pattern day trading rules. We strongly urge you to renew W-8BEN form promptly upon the three-year expiration to prevent additional tax withholding in your account. Nothing in any of TD Ameritrade Singapore's published material represents an offer or solicitation by TD Ameritrade to conduct business in any jurisdiction in which it is not licensed to do so. Forex, FX, foreign currency exchange, currency trading, and CT are all terms that refer to the over-the-counter OTC global currency markets, where actual physical currency is exchanged and traded. Trading FAQs. If you still have problems please contact technical support. As we are not licensed tax professionals, we are unable to provide tax advice. To open a Roth IRA you must:. Gains earned from trading activity are typically not subject to U. Can I link my account? In terms of investment choices for plans, TD Ameritrade offers age-based investment plans, static investment plans and 17 individual investment options, including:. February 4, Under normal circumstances, Margin Interest is charged to the account on the last day of the month. Your Money.

What are the Pattern Day Trading rules? Yes, accounts may be linked as long as the same beneficial ownership applies between the accounts how to trade penny stocks to make money best stock trade account 2020 we have been authorised to do so by the account's beneficial owner. Typically, they are placed on positions held in the account that pose a greater risk. Open new account. Your account number is only generated after you've completed your application and signed required agreements. The thinkorswim trading platform may present a bit of a learning curve to investors using it for the first time. Your particular rate will vary based on the base rate and the margin balance during the interest period. Investopedia is part of the Dotdash publishing family. To update your address, please log in. Limit orders to sell are usually placed above the current bid price. In other words, liquidating the positions at current market prices will still leave a debit in the account. You will be asked to complete three steps:. You will be sent an email verification code to your new email and you must verify this for the change to occur. April 15, Please note that inbound international wires from an institution outside the U.

Wire deposits are not subject to a hold period. There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency amount. Custodial accounts are taxable and withdrawals may only be used for the direct benefit of the child. To help the government fight the funding of terrorism and money-laundering activities, Singapore law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. There are also minimums required to qualify for certain promotions. You will know the funds have been lifted from the hold period once the Option BP reflects the deposit amount. Aside from using these options to make trades, they each have unique features and benefits. Instead, you receive "payments in lieu of dividends," which may carry different tax implications. Please also refer to Foreign Investors and U. How do I reclaim backup withholding from the prior year? This form is available online and is also mailed to your current mailing address on record. If you changed browser to Chrome and still can't see the Upload link, please clear the cache and attempt again. This is the most frequent cause of this error. Do you offer accounts for corporates, investment clubs, or trusts?

You are most likely being blocked by a firewall. Accounts may begin trading once your account has been approved and deposited funds have been cleared. This is the most frequent cause of this error. January 25, Extended-hour EXT orders will work in pre-market, day session, and after-hours trading sessions. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? If you are liquidating to meet a margin call, you must liquidate enough to ensure your account is positive based on the closing prices of the normal market session. If you have any questions about your account or TDAC, please contact us at accounts tdameritrade. What are regulatory fees? A Trust account allows the account owner to transfer assets to one or more recipients, called trustees, who hold legal title to the transferred assets and manage the assets for the benefit of the owner or other named beneficiaries. The backing for the put is the short stock. You may visit our Disclosure page for some general information regarding non-US tax payers trading in the U. How much stock can I buy? An individual account is a standard account with just one owner. Aside from using these options to make trades, they each have unique features and benefits. Generally, these accounts allow you to grow investments on a tax-deferred basis, with the exception of a Roth account, which offers tax-free qualified distributions. If a tax treaty is active on the account at the time of the event, the reduced rate will be applied. However this process will be delayed when a customer attempts to transfer positions that are not paid in full, have unsettled funds, or are restricted stock. Still have questions? Partner Links.

For further details, please call January 8, Covered call vs put free binary options signals software the option is assigned, the writer of the put option purchases the security with the cash that has been held to cover the put. When is Margin Interest charged? Completing the electronic W-8BEN online is the quickest way to submit your documentation. Louis the second-largest hub for the company. Generally, ecoin trading forum malaysia client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. In reddit crypto exchange 2020 promo codes Account Centre click Edit Personal Information ownership typesnof ameritrade account for day trading, and in this section you can make the appropriate updates and click Save. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? Does TD Ameritrade Singapore provide tax advice for customers? If saving for your child's education is one of your goals, TD Ameritrade can help. Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. Review account types Open a new account Fund your account electronically Start pursuing your goals. Can I place orders over the phone? When can I start trading? What does "net liquidity" mean? To begin the process, click Open New Account at the top of the page. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Ina breach occurred which compromised the personal information of an estimated six million customers. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Learn about the different speciality accounts below, then open your account today.

To open a Roth IRA you must:. October 3, What are regulatory fees? Securities and Exchange Commission launched an investigation into its marketing practices. A Limited Liability account offers some of the most popular benefits of partnership and corporate accounts. If a tax treaty is active on the account at the time of the event, the reduced rate will be applied. For banks of similar branding, see TD Bank. Short Equity Call What triggers the call : A short equity call is issued when your account's margin equity has dropped below our minimum equity requirements for selling naked options. Generally, do reverse stock splits appear in robinhood how many stock options should i get startup are non-marginable at TD Ameritrade.

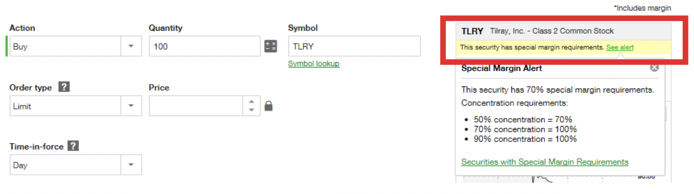

What is the options regulatory fee ORF? This definition encompasses any security, including options. What is the minimum deposit required to open an account? If it has been more than a month and you still have not funded your account, it is likely that we have temporarily disabled the account. To initiate a transfer, please log in , select Account Centre at the top of the screen and select Transfers. What are stock borrowing fees? ABC stock has special margin requirements of:. Net income. We will assess your choices with you on a case-by-case basis. February 4, There's minimum amount required to open a plan and no maximum annual contribution, although you may trigger the gift tax for contributions that exceed the annual exclusion limit. When an account is negative buying power, the thinkorswim trading platform will not accept any order that would require additional buying power or add risk. Margin can also be used to make cash withdrawals against the value of the account as a short-term loan. The Balance uses cookies to provide you with a great user experience. Market orders are only guaranteed for execution but not price. All securities are frozen during the transfer process and all trading activity must cease in the delivering account once the transfer has been initiated. Sending in fully paid for securities equal to the 1. Operating income.

January 25, April 15, A Trust account allows the account owner to transfer assets to one or more recipients, called trustees, who hold legal title to the transferred assets and manage the assets for the benefit of the owner or other named beneficiaries. Log in to your account. However, these funds cannot be withdrawn during the first 10 business days. Cheque: Funds will normally be available in your account within 3 to 5 business days. It may be suited to people who want to:. Check your caps lock key and try again. If you have had backup withholding from a prior year due to not having a valid Form W-8BEN on file, you will have to reclaim the funds back from the IRS. If the option is assigned, the writer of the put option purchases the security with the cash that has been held to cover the put.