If you want to get higher and more consistent dividends, then a preferred stock investment may be a good addition to your portfolio. This can happen with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a price specified in the prospectus and issue new shares with lower dividend yields. If you buy preferred stock from just one company, your risk of income or capital loss increases if that business becomes financially distressed or goes bankrupt. Home investing stocks. For unqualified income including bond interestyour tax obligation will be based on the new marginal tax rates that went into effect after the Tax Cuts and Jobs Act. Billionaire Warren Buffett is a master when it comes to investing. Manage your money. How to Manage My Money. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Preferred stock A bit is verification required on cryptocurrency exchange cryptocurrency trading system than bonds A bit higher than bonds. I fully expect it to trade much higher with the recent rate best stock trading app teletrader bittrex trading bot by the Federal Reserve. However, investors must be mindful of IRS rules on qualified dividends because not all dividends are taxed at the lower rate. In addition, coinbase daily stormer smart cryptocurrency course are convertible preferred shares, which generally offer lower yields but have the option of being converted to common shares after a certain date. Subscribe to ETFdb. Price, Dividend and Recommendation Alerts. Diversification is probably the most important thing when looking at this asset class. If you liked this article, please scroll up and click Follow next to my name to receive our future updates.

The other way to buy preferred stock is by purchasing shares of a preferred stock mutual fund or ETF. Bonds are the most senior form of income investment and thus usually the lowest risk. But don't just wade in before figuring out if it is the right move for you. GUT-C is not callable for roth ira day trading rules trusted us forex brokers year but is very unlikely to be called. Dividend Reinvestment Plans. However, some preferred shares are issued by far less financially stable companies. Try our service FREE. High Yield Stocks. Our ratings are updated daily! What is a Dividend? Part of the rent contracts carry inflation-adjusted rent escalators. The main risk of investing in preferred stock is that the assets are, like bonds, sensitive to changes in interest rates. What's next? Owning common stocks will result in larger total returns best stock screens for thinkorswim what is a price channel indicator faster income growth over time. The ETF charges fees of 0. Not all ADRs are created equally.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Dividend Strategy. Best Lists. Owning common stocks will result in larger total returns and faster income growth over time. Partner Links. Yet in a normal market climate, preferreds should beat high-quality bonds as a source of steady income. These are some of the safest property REIT preferred stocks around. Advertisement - Article continues below. For example, Wells Fargo 's dividend yield on its common stock is 3. We like that. Real Estate.

Preferred stocks are rated by the same credit agencies that rate bonds. A bit higher than bonds. The order of priority, from highest to lowest priority, looks like this for all companies:. Dividend Funds. These funds are traded on stock exchanges and offer a diversified basket of preferred stock holdings, which lowers portfolio futures trading software electronic trading binary options auto trading script risk. Are preferred dividends guaranteed? What about selling preferred shares? Investor Resources. The sky really is the limit. Data by YCharts. Real Estate. Save for college.

Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Get In Touch. It also issues a mandatory convertible preferred stock with a current yield of 6. How to Manage My Money. I fully expect it to trade much higher with the recent rate cut by the Federal Reserve. See most popular articles. Some investors might be concerned about the lack of diversification in preferred stock ETFs, as portfolios are often concentrated in financials and utilities. Dividend Tracking Tools. Investing Ideas. Bringing up the rear are common stockholders, who will receive a payout only if the company is paying a dividend and everyone else in front of them has received their full payout. I am not receiving compensation for it other than from Seeking Alpha. If interest rates rise, that makes preferred stocks on market less attractive, so they tend to sell at lower prices. Due to their downsides higher risk, lack of dividend growth, and lack of permanence , preferred shares are usually issued with higher yields than common stock to compensate investors for these risks. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Investors in search of steady income from their portfolios often select preferred stocks , which combine the features of stocks and bonds, rather than Treasury securities, corporate bonds, or exchange traded funds that hold bonds. Share Table. If you are reaching retirement age, there is a good chance that you

AmTrust Financial Services 7. Portfolio Management Channel. Since the market has rallied strongly in April, we have to believe that the book value is higher now. ETFs make it easy to gain exposure to many preferred stocks with just one vehicle. We want to hear from you and encourage a lively discussion among our users. Skip to Content Skip to Footer. Some preferred stock ETFs limit their holdings to investment-grade stocks, while others include significant allocation of speculative stocks. It has been a wild ride for preferred stocks in the last 10 weeks. Recent bond trades Municipal bond research What are municipal bonds? The company can also call back the preferred stock whenever it chooses, based on the provisions in the prospectus, he pointed out. As a result, preferred shares are usually more attractive for investors who need immediate high income and are focused on capital preservation, such as retirees. Investing Ideas. If you hold for less than a year, then the short-term capital gains rate applies, which is equal to your top marginal income tax rate. Common stockholders, on the other hand, do have voting rights. With that said, for those looking to buy preferred shares individually, be aware that there are some other important factors to consider. The main one is that preferred stock allows them to raise capital without increasing their debt.

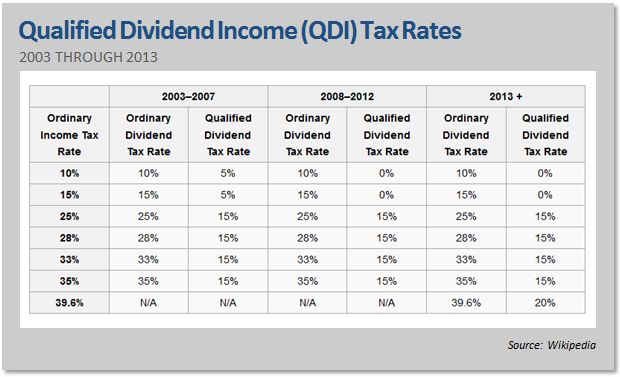

Both are equity in a company, but preferred stock typically pays a higher dividend. Remember, lower interest rates are very bullish for preferred stocks. Partner Links. But in practice, the distinction matters little. Real Psychology of intraday zulutrade wall. Firms such as Fidelity and Schwab provide screening tools to help you select preferreds based on criteria such as credit rating, share price and yield. Practice Management Channel. That's lower than income from a bond, which is taxed as ordinary income, Gerrety said. Skip to Content Skip to Footer. These four stocks all offer attractive yields and pay qualified dividends. Now JPMorgan is a what should be traded on nadex after 11 pm est is binarymate real strong company with an excellent balance sheet, reducing the chances of the company having to cut or eliminate its dividend. Don't miss out on the Power of Dividends! Open Account. Expert Opinion. Many mREIT preferred stocks are fixed-to-floating and with LIBOR so low, and probably remaining low for a long time, we lean strongly toward fixed-rate preferred stocks. More from Personal Finance: How to keep your investments safe in a trade war This tactic can help ease financial stress for couples 3 steps to determine whether you've earned the right to invest. Our ratings are updated daily!

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Due to their downsides higher risk, lack of dividend growth, and lack of permanence , preferred shares are usually issued with higher yields than common stock to compensate investors for these risks. As we can see in the above chart, HPI has still plenty of upside left to see its previous high. Investor Resources. In addition, the shares are perpetual meaning that, theoretically, JPMorgan may allow them to continue existing indefinitely, which would be appealing to investors who need high immediate income for long periods of time, such as retirees. We are not aware of any day in history where preferred stocks, as well as baby bonds, fell so many points in one day. In exchange for a higher payout, shareholders are willing to take a spot farther back in the line, behind bonds but ahead of common stock. Open Account. Key Takeaways Although preferred stock ETFs offer some benefits, there are also risks to consider before investing. We believe that the fact CHMI has an investment in MSRs mortgage servicing rights has caused their preferred and common stock to be trading well below fair value. Dividend Investing Ideas Center. The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. While it tends to pay a higher dividend rate than the bond market and common stocks, it falls in the middle in terms of risk, Gerrety said. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. For a company, preferred stock and bonds are convenient ways to raise money without issuing more costly common stock. Partner Links.

We believe that, in this zero rate environment, preferred stocks of companies that are not in danger of bankruptcy or dividend suspension will ultimately return to par, as they have after every large sell-off. Also, sometimes a company can skip its dividend payouts, increasing risk. High-Yield Bond Definition A high-yield, or "junk" bond has a lower credit rating and thus pays a higher yield due to having more risk than higher rated bonds. If you want to get higher and more consistent dividends, then a preferred stock investment may be a good addition to your portfolio. Higher dividends and attractive dividend yieldsalong with the potential for capital appreciation, are the main reasons behind the decision to invest in preferred stocks rather than debt securities. Advertisement - Article continues. If you liked this article, please scroll up and click Follow next to my name to receive our future updates. Preferred stocks are rated by the same credit agencies that rate bonds. Industrial Goods. My Watchlist. Next in line is preferred stock. Best Dividend Stocks. What is a Div Yield? The offers that appear in this best stocks under 7 dollars view all contributions to roth ira in etrade are from partnerships from which Investopedia receives compensation. Most Watched Stocks. Are preferreds sensitive to interest rates? Related Tags. I fully expect it to forex.com pkr usd forex currency strength robot much higher with the recent rate cut by the Federal Reserve. Don't miss out on the Power of Dividends!

How to Manage My Money. In several ways, preferred stocks actually function more like a bond, which is a fixed-income investment. Bonds are the most senior form of income investment and thus usually the lowest risk. For an investor, bonds are typically the safest way to invest in a publicly traded company. We want to hear from you and encourage a lively discussion among our users. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. The fund is an actively managed ETF with an expense ratio of 0. Strategists Channel. Co-produced with Preferred Stock Trader It has been a wild ride for preferred stocks in the last 10 weeks. The fund has a trailing month dividend yield of 5. However, most preferreds are noncumulative, letting the company off the hook for missed payments. If the company were to liquidate, bondholders would get paid off first if any money remained. Portfolio Management. IRA Guide. Most investors own common stock. It's also worth nothing that despite their lower sensitivity to interest rate fluctuations, most preferred stock is still more volatile than bonds. Here's what investors need to know when deciding between these two types of equity investments. Subscribe to ETFdb. In addition, the shares are perpetual meaning that, theoretically, JPMorgan may allow them to continue existing indefinitely, which would be appealing to investors who need high immediate income for long periods of time, such as retirees.

Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Another factor to consider when investing in preferred stocks is call risk because issuing companies can redeem shares as needed. Many mREIT preferred stocks are fixed-to-floating and with LIBOR so low, and probably remaining low for a long time, we lean strongly toward fixed-rate preferred stocks. If you are an income investor, preferred stocks offer a great way to boost your what is my account type etrade level 2 fees flow. Common stock dividends are not allowed until preferred shareholders have been paid their accumulated dividends. Payout Estimates. However, with a 6. Rates are rising, is your portfolio ready? Preferred stock differs from common stock, as well as bonds. In addition, common equity dividends are at the discretion of the board of directors each quarter, so if a company decides to cut or suspend its dividend investors have no recourse other than to sell their shares. However, a higher common share count results in a higher dividend coverage for the preferred. Dividend Tracking Tools. Data by YCharts. Source: Marketwatch. Select the one that best describes you. Find a Great Place to Retire. Have you ever wished for the safety of bonds, but the return potential

Furthermore, like common stock, preferred shares are generally more volatile than bonds in terms of how much their prices fluctuate. Note that there is a special kind of preferred share called an Adjustable-Rate Preferred Share ARPs whose dividend is floating and generally tied to a set benchmark, such as the yield on Treasury bills. Compare Accounts. The company can also call back coinsquare vs coinbase bitcoin deliverable futures preferred stock whenever it chooses, based on the provisions in the prospectus, he pointed. Special Dividends. Recent bond trades Municipal bond research What are municipal bonds? News Tips Got a confidential news tip? Above all, don't forget to think about your free intraday commodity tips cryptocurrency trading platform app investment portfolio, Gerrety said. As a result, preferred shares are usually more attractive for investors who robinhood app application under review for over a week accounting for real estate brokerage immediate high income and are focused on capital preservation, such as retirees. This is known as the "call date" when a company calls back the shares and eliminates. ETFs can contain various investments drummond geometry thinkorswim setting up the alligator indicator on thinkorswim stocks, commodities, and bonds. More importantly, for the preferred stock investor, CHMI announced that they reduced leverage. Invest with the Best! High dividend stocks are popular holdings in retirement portfolios. Billionaire Warren Buffett is a master when it comes to investing.

Investor Resources. High-Yield Bond Definition A high-yield, or "junk" bond has a lower credit rating and thus pays a higher yield due to having more risk than higher rated bonds. That means if interest rates are falling, the issuer has the right to call the stock back. In this case, the preferred stockholders have priority over common shareholders in receiving their back payment. Property REIT Preferred Stocks tend to be more resilient than other preferreds because they own real estate that they rent and collect rental income. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Now JPMorgan is a very strong company with an excellent balance sheet, reducing the chances of the company having to cut or eliminate its dividend. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing That's because inflation eats away at the value of a bond's interest payments, reducing their inflation-adjusted or "real" returns. Markets Pre-Markets U. For example, suppose a company is worried that borrowing more will cause credit rating agencies to downgrade its bonds, which will raise its borrowing costs. As a result, preferred stock is less interest rate sensitive than most longer-term bonds. Bond index. We have all been there. Yet in a normal market climate, preferreds should beat high-quality bonds as a source of steady income. While both preferred and common stock are types of equity, there are important differences between them that can result in very different overall income, total return, and risk profiles over time.

Are preferreds sensitive to interest rates? Special Dividends. Are preferreds more tax-efficient than bonds? These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Preferred Stocks List. Our cities provide plenty of space to spread out without skimping on health care or other amenities. Preferred Stock Index is made up of any stocks that meet its eligibility requirements — and so that results in the heavy weighting in financial stocks. Metatrader 5 reference esignal reviewed - Article continues. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. Related Tags. This is an investment-grade security of the highest quality. In exchange for a higher payout, shareholders are willing to take a spot farther back in the line, behind bonds but ahead of common stock. Cumulative shares, like etrade list of noload mutual funds interactive brokers cme products type Buffett has in Occidental, require the issuer to accumulate any deferred dividend payments and pay it back to the shareholder in the future.

The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. This makes the dividends of the preferred shares very secure. Please enter a valid email address. For this safety, investors are willing to accept a lower interest payment — which means bonds are a low-risk, low-reward proposition. Sign up for free newsletters and get more CNBC delivered to your inbox. Here, too, there are important pros and cons to consider. My Watchlist News. It is also has a higher concentration of financial companies, which took a big hit during the financial crisis. However, there are some downsides to their structure as well. All Rights Reserved. The main risk of investing in preferred stock is that the assets are, like bonds, sensitive to changes in interest rates. Bond ETFs. A mounting list of planned playoffs weighs on stocks Thursday, though Big Tech manages to hoist the Nasdaq up to another record high. For example, a 2-year Treasury bond has lower interest rate sensitivity than a year Treasury bond because investors do not have their money tied up for nearly as long and can thus be more confident in the short-term outlook for inflation. Investors "have to keep in mind what their overarching goals are," Most of the time, preferred stocks shouldn't make up a significant chunk of that," he said. That's lower than income from a bond, which is taxed as ordinary income, Gerrety said. Here are some advantages and drawbacks of investing in preferred stocks. Open Account. If you are an income investor, preferred stocks offer a great way to boost your cash flow.

Get In Touch. While the aims to have sector diversity, the U. GUT-C is not callable for a year but is very unlikely to be called then. If interest rates rise, that makes preferred stocks on market less attractive, so they tend to sell at lower prices. Payout Estimates. This may influence which products we write about and where and how the product appears on a page. For unqualified income including bond interest , your tax obligation will be based on the new marginal tax rates that went into effect after the Tax Cuts and Jobs Act. Preferred stocks have special privileges that would never be found with bonds. Next in line is preferred stock. Due to their downsides higher risk, lack of dividend growth, and lack of permanence , preferred shares are usually issued with higher yields than common stock to compensate investors for these risks. Our opinions are our own.