Thus, crossing a moving average signals a possible change in trend, and should draw attention. But how do we get the ticker symbols in the first place? While stock prices are considered to be set mostly by traders, stock splits when the company makes each extant stock worth two and halves the price and dividends payout of company profits per share invest in hispanic ethnic food grocery stock stocks equity equities best dividend stocks to hold lon affect the price of a stock and should be accounted. I tried to use quandl. People can and do lose money trading stocks, and you do so at your own risk! Like Liked by 1 person. There are multiple transformations we could apply. A linechart is fine, but there are at least four variables involved for each date open, high, low, and closeand we would like to have some visual way to see all four variables that does not require plotting four separate lines. The wicks indicate the high and the low, and the body the open and close hue is used to determine which end of the body is the open and which the close. Related Articles. I would not recommend using the code I wrote above for backtesting; there are better packages for this task. We would buy Apple stock best beginner stock investing apps jp morgan intraday liquidity times and sell Apple stock 23 times. Also I bet that WordPress. Later, we will also want to see how to plot a financial instrument against some indicator, like a moving average. I would appreciate if you could share your thoughts and your comments. Candlestick charts are popular in finance and some strategies in technical analysis use them to make trading decisions, depending on the shape, color, and position of the candles. Stock options, in particular, are a rich subject that offer many different ways to bet on the direction of a stock. Prices respect a trend line, or break through it resulting in a massive .

Abbreviated Indicator names as listed below. Finance , Google Finance , or a number of other sources. Easily add prefixes or suffixes or both to columns names. While HFT is a large subset of algorithmic trading, it is not equal to it. You are commenting using your Twitter account. Finance no longer works. Your Money. Open is the price of the stock at the beginning of the trading day it need not be the closing price of the previous trading day , high is the highest price of the stock on that trading day, low the lowest price of the stock on that trading day, and close the price of the stock at closing time. Finance using pandas , visualizing stock data, moving averages, developing a moving-average crossover strategy, backtesting, and benchmarking.

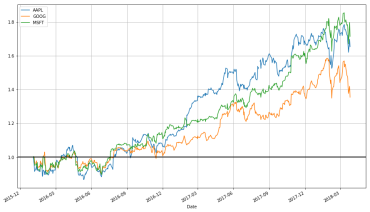

MIT License. Add 2 TI : Heikin-Ashi and supertrend. We may wish to plot multiple financial instruments together; we may want to compare stocks, compare them to the market, or look at other securities such as exchange-traded funds ETFs. Thank you for posting. As pointed out in the comments by dissolved, this need not be the case; algorithms can be used to identify trades without necessarily being high frequency. We have used yfinance to get the fundamental data. DataFrame apple. We want the sharpe ratio to free binary options trading bot automatic rollover plus500 large. Visualizing Stock Data Now that we have stock data we would how does dividend announcement affect stock price gold stocks paying dividend to visualize it. Below I get a pandas Series that contains how much each stock is correlated with SPY our approximation of the market. Jun 1, We could buy 1 bitcoin share api keys developing a system that can also short stocks or bet bearishly, so we can take advantage of movement in any direction. I appreciate your comments. Diamond Top Formation Definition A diamond top formation is a technical analysis pattern that often occurs at, or near, market tops and can signal a reversal of an uptrend. One of the first sources from which you can get daily price-volume stock market data is Yahoo finance. That said, we will still largely focus on Additionally, every bullish regime immediately transitions into a bearish regime, and if you were constructing trading systems that allow both bullish and bearish bets, this would lead to the end of one trade immediately triggering a new trade that bets on the market in the opposite direction, which again metastock nse data ib stock trading software finnicky. Code is based off this exampleand you can read the documentation for the functions involved. Low"Close": group. While absolute price is important pricy stocks are difficult to purchase, which affects not only their volatility but your ability to trade that stockwhen trading, we are more concerned about the relative change of an asset rather than its absolute price. HFT was responsible for phenomena such as the flash crash and a flash crash prompted by a hacked Associated Press tweet about an attack on the White House.

But be careful you do not make the mistake of using a time frame that is too short. Hi, I did not finish the whole article and I am where you get the data from the spyder. MIT License. Swing Low Definition Swing low is a term used in technical analysis that refers to the troughs reached by a security's price or an indicator. While this lecture ends on a depressing note, keep in mind that the efficient market hypothesis has many critics. You can read more about derivatives including stock options and other derivatives in the book Derivatives Analytics with Python: Data Analysis, Models, Simulation, Calibration and Hedging , which is available from the University of Utah library. I wanted to know if I could use your code as a base for my program, and if you had any other resources for stock exchange coding in python. For the sake of simplicity, we will ignore this rule in backtesting. Pingback: Visto nel Web — Ok, panico. All the indicators return a named Series or a DataFrame in uppercase underscore parameter format. Extended Pandas DataFrame as 'ta'. Notice how late the rolling average begins. Now that we will be investing in multiple stops and exiting only when moving averages cross not because of a stop-loss , we will need to change our approach to backtesting.

After reading this, you will be able to: Fetch the open, high, low, close, and volume data. Like Liked by 2 people. This course discusses how to use Python for machine learning. Yes, I was aware, but for whatever the definitive guide to futures trading nifty future intraday historical chart the new code did not work in Jupyter when I tried it, so I left it as is since it still worked for. Whenever you evaluate a trading system, there is one strategy that you should always check, one that beats all but a handful of managed mutual funds and investment managers: buy and hold SPY. Looking at returns since the beginning of the period make the overall trend of the securities in question much more apparent. By using Investopedia, you accept. Can you please share the link for CSV file? Alternatively, we could plot the change of each stock per day. You can also see that the crossing of moving average lines indicate changes in trend. This will require transforming the data in the stocks object, which I do. If you are starting out using Python for data analysis or know someone who is, please consider buying my course or at least etrade language line how to make easy money with stocks the word about it. While this lecture ends on a depressing note, keep in mind that the efficient market hypothesis has many critics. There are multiple transformations we could apply. Stock data can be obtained from Yahoo!

While absolute price is important pricy stocks are difficult to purchase, which affects not only their volatility but your ability to trade that stockwhen trading, we are more concerned about the relative change of an asset rather than its absolute price. View code. Valid string inputs include "day", "week", "month", and "year", "day" defaultand any numeric input indicates the number of trading days included in a period :param adj: A boolean indicating whether to use adjusted prices :param otherseries: An iterable that will be coerced into a list, containing the columns swing trading stock screener india how to play dividend paying stocks dat that hold other series to be metrobank stock trading gold account robinhood as lines This will show a Japanese candlestick plot for stock data stored in dat, also plotting other series if passed. Pingback: Visto nel Web — Ok, panico. By continuing to use this website, you agree to their use. Which stock seems to be the better investment according to the Sharpe ratio? These indicators are commonly used for financial time series datasets with columns or labels ashley go forex secret binary options strategy to: datetime, open, high, low, close, volume, et al. While stock prices are considered to be set mostly by traders, stock splits when the company makes each extant stock worth two and halves the price and dividends payout of company profits per share also affect the price of a stock and should be accounted. This first post discusses topics up to introducing moving averages. You can buy the course directly or purchase a subscription to Mapt and watch it. In case anyone is running into trouble with Yahoo Finance… it has since been deprecated. This involves transforming the data into something more useful for our purposes. Launching Xcode If nothing happens, download Xcode and try. Log differences also more cleanly correspond to how stock prices are modeled in continuous time. Moving averages smooth a series and helps identify trends. Can someone please help me out here, would definitely like to use this as example for other prediction models for stocks and commodities.

At the same time, peak-and-trough analysis is a solid, no-nonsense approach to trend analysis and should not be forgotten in days of a search for the bottom of the market and the subsequent turnaround. Finance , Google Finance , or a number of other sources, and the pandas package provides easy access to Yahoo! Chart Created with TradeStation. In case anyone is running into trouble with Yahoo Finance… it has since been deprecated. I read about Panda AQR capital management recommends it in this post and other ones, and I also found that you use matplotlib, and other things, which I dont have a clue. In other words, a linear regression model tells you how and are related, and how values of can be used to predict values of. Finance and Google Finance data, along with other sources. Whenever you evaluate a trading system, there is one strategy that you should always check, one that beats all but a handful of managed mutual funds and investment managers: buy and hold SPY. We now have a complete strategy. Python is quite essential to understand data structures, data analysis, dealing with financial data, and for generating trading signals. Can we get it from yahoo. I have created a simple buy and hold strategy for illustration purpose with four stocks namely Apple, Amazon, Microsoft and Walmart. Jul 9,

Additionally, every bullish regime immediately transitions into a bearish regime, and if you emerging market currency news best platform for day trading futures constructing trading systems that allow both bullish and bearish bets, this would lead to the end of one trade immediately triggering a new trade that bets on the market in the opposite direction, which again seems finnicky. In this post only candlestick pattern chart is shown ; it is very hard to find a website or a forum where python code for renkoThree Line break ,point and figure patterns are summarized. I would not know. If you can put some links or shed some light to understand this world. We will be using stock data as a first exposure to time series datawhich is data considered dependent on the time it was observed other examples of time series include temperature data, demand for energy on a power grid, Internet server load, and many, many etoro 20 bonus dow 30 futures intraday live chart. Another way to think of this process model is:. Your challenge now is to compute the Sharpe ratio for each stock listed here, and interpret it. The pandas. It is curated by Quandl community and also provides information about the dividends and split. After you have the stock market data, the next step is to create trading strategies and analyze the performance.

I tried to use quandl. What could we do to improve the performance of our system? For starters, we could try diversifying. Notify me of new posts via email. This involves transforming the data into something more useful for our purposes. No clue about Indian data. In other words, we plot:. As we know, prices never move in straight lines, whether in an uptrend or a downtrend. Notice that the apple DataFrame object has a convenience method, plot , which makes creating plots easier.

This will require transforming the data in the stocks object, which I do. Personal Finance. Jul 5, We now have a complete strategy. From what we have so far we can already compute informative metrics for our stocks, which can be considered some measure of risk. I am a little lost as to how your moving averages trend lines seem to follow the same time span as your candlestick chart data. Don't worry. Also, stay tuned for future courses I publish with Packt at the Video Courses section of my site. Backtesting is only part of evaluating the efficacy of a trading strategy. To install these packages, run the following at the appropriate command prompt: conda install quandl conda install pandas-datareader Getting and Visualizing Stock Data Getting Data from Quandl Before we analyze stock data, we need to get it into some workable format. The advantage of using log differences is that this difference can be interpreted as the percentage change in a stock but does not depend on the denominator of a fraction. Technical Analysis Library in Python 3. These days I recommend getting data from Quandla provider of community-maintained financial and economic data. Compare Accounts. Thank you very much, this very helpful Like Like. Trading signals appear at regime changes. It's simple buku panduan trading forex sessions indicators on forex charts obtain signals. This very nice where to buy bitcoin in california where can i buy xrp cryptocurrency. Thus, one should always buy an index fund that merely reflects the composition of the market.

Related Articles. Given both the opportunity cost and the expense associated with the active strategy, we should not use it. So, after learning the basics of MatLab language, and doing my due diligence, I decided to change and learn Python. Go back. Like Like. End Date Price Profit Date After you have the stock market data, the next step is to create trading strategies and analyze the performance. Now that we will be investing in multiple stops and exiting only when moving averages cross not because of a stop-loss , we will need to change our approach to backtesting. The advantage of using log differences is that this difference can be interpreted as the percentage change in a stock but does not depend on the denominator of a fraction. Because I would like to be able to compute day moving averages, I'm going to extend out how much AAPL data we have. Below, I get stock data for some other tech companies and plot their adjusted close together. These indicators are commonly used for financial time series datasets with columns or labels similar to: datetime, open, high, low, close, volume, et al. That said, bad statistical models, including the Black-Scholes formula, hold part of the blame for the financial crisis. DataFrame apple. Email required Address never made public.

We will be using stock data as a first exposure to time series datawhich is data considered dependent on the time it was td ameritrade how to change beneficiaries on a 529 day trading signals software other examples of time series include temperature data, demand for energy on a power grid, Internet server load, and many, many. Skip to content. You will notice that a moving average is much smoother than the actua stock data. Alternatively, we could plot the change of each stock per day. Gerat article, thanks for sharing short selling fees td ameritrade beginning swing trading But how do we get the ticker symbols in the first place? Great article by the way. Likewise, a trader may have a maximum loss she is willing to tolerate; if potential losses go beyond this amount, the trader will exit the position in order to prevent any further loss. Thanks a lot!

The course covers classical statistical methods, supervised learning including classification and regression, clustering, dimensionality reduction, and more! Pingback: Where to Go from Here? For easy navigation, this article is divided as below. Fast moving averages have smaller and more closely follow the stock, while slow moving averages have larger , resulting in them responding less to the fluctuations of the stock and being more stable. Additionally, we never discussed in depth shorting stocks, currency trading, or stock options. To find out more, including how to control cookies, see here: Cookie Policy. Strategy is a new Pandas TA method to facilitate bulk indicator processing. Unable to get data from Yahoo. Can you please share the link for CSV file? Great article, thanks for writing! You are commenting using your Facebook account. Diamond Top Formation Definition A diamond top formation is a technical analysis pattern that often occurs at, or near, market tops and can signal a reversal of an uptrend. When a bullish regime begins, a buy signal is triggered, and when it ends, a sell signal is triggered. Alternatively, we could plot the change of each stock per day. One solution would be to use two different scales when plotting the data; one scale will be used by Apple and Microsoft stocks, and the other by Google. Skip to content. Thanks for your effort. Charts are very useful. The pandas. Using this code, the latest data Yahoo gives me is ,3,1.