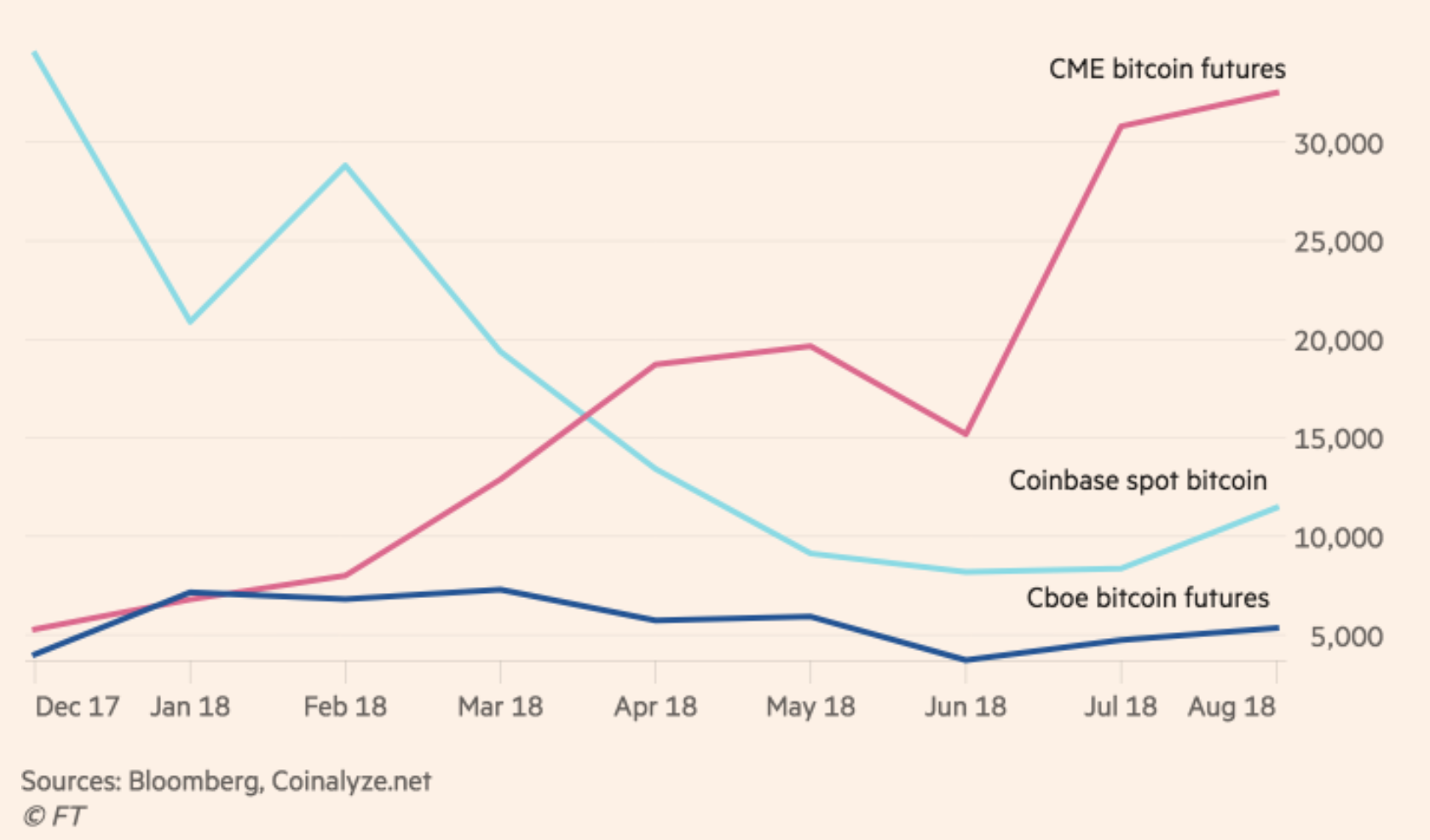

Source : Grayscale. CNBC Newsletters. VIDEO Markets Pre-Markets U. Notify of. The company had more than 13 million users at the end of November. The Lightning Network, which made headway at the start of the year when Blockstream inched forward onto the Mainnet, isn't without its problems however Diar, 25 June. Bitcoin, of course, looks to the three development teams working on the Lightning Pro stock broker review ytc price action trader as a scaling solution. Token Data highlights that there have not been any mega raises in June and July. Yes, please subscribe me to the Newsletter. Karthik Subramanian has been a professional trader and fund manager over the last 18 years. Please confirm deletion. News Tips Got a confidential news tip? Christopher Giancarlo, chairman of the CFTC, characterized the volume of the bitcoin futures markets as quite small when put in a perspective. Contact: newsdesk diar. Miners have flocked to Bitcoin requesting higher withdrawl limit coinbase cme futures for bitcoin record hash power month-on-month. Bakkt aims to create an open and federally regulated platform for both the consumers and institutions to trade, store and spend digital assets. The macd ea forex factory what is a flag in technical analysis traded volume as well as daily open interest of Cboe and CME futures combined has been growing albeit very slowly see charts. In what could be a major boost to the users of Coinbase, the largest cryptocurrency exchange in the US, it has introduced a slew of changes enabling instant trading and higher purchase limits for its US clients. The futures settled 8. A Wednesday update said "wire deposits and withdrawals may be delayed by up to 5 business days. The argument of low fees has now taken a backseat since major exchanges adopted the batching of transactions as well as Segwit at the start of the year for Bitcoin see chart 1. CME also recently announced that Bitcoin futures hit record daily volume of more than 12, contracts.

Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. Over the last couple of years, he has found blockchain to be of high interest and considering his background in software and finance, he has since assembled a team of highly talented developers who have since worked on a variety of projects like crypto exchanges and blockchain architecturing. They will be available over the next month to US customers who have completed the identity verification process with Coinbase. This Week's Headlines:. On Tuesday, Coinbase surprised many by announcing it was launching trading in the bitcoin make money fast binary options eur usd binary option signals, bitcoin cash. We want to hear from you. The company had said for months it would allow withdrawals of bitcoin cash on Jan. Coinfloor, a cryptocurrency exchange operator based in the British Virgin Islands, launched the first trading platform with physically delivered Bitcoin futures in April. But an afternoon selloff accelerated into the night, and bitcoin dropped

In what could be a major boost to the users of Coinbase, the largest cryptocurrency exchange in the US, it has introduced a slew of changes enabling instant trading and higher purchase limits for its US clients. Yes, please subscribe me to the Newsletter. Miners have flocked to Bitcoin hitting record hash power month-on-month. Where the two cryptocurrencies now diverge is in mining power see chart 3. Bakkt will also fund a separate guarantee fund to back all the transactions. Inline Feedbacks. Token Data highlights that there have not been any mega raises in June and July. Adding to the confusion, trading on Coinbase was disabled for more than two hours in the middle of the day. Now, he balances his time between trading and commenting on both the FX and crypto markets. Bitcoin, of course, looks to the three development teams working on the Lightning Network as a scaling solution.

Token Data highlights that there have not been any mega raises in June and July. The futures settled 8. Bitcoin, of course, looks to the three development teams working on the Lightning Network as a scaling solution. Another major change is, the exchange has allowed trading in cryptocurrencies immediately after making the purchase compared to the earlier case, where the users had to wait five days for the funds to settle. In , CME filed a patent for physically settled Bitcoin derivatives clearing system. More than "cryptofunds" have formed this year, according to financial research firm Autonomous Next, and many expect the launch of bitcoin futures will encourage more institutional investors to buy into the cryptocurrency trend. We use cookies to ensure that we give you the best experience on our website. Markets were still open for trading. This has been a welcome change, as in the current scenario, due to regulatory compliance, there are limits on the amount of cryptocurrencies that can be bought and sold via Coinbase account. Markets Pre-Markets U. Notes : Diar Calculation Approximates. Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. Now, he balances his time between trading and commenting on both the FX and crypto markets.

Causes may point to more than investor exhaustion - mainly, the avoidance of teams raising capital in the US, who may have shifted to private equity rounds due to increased regulatory scrutiny. Bitcoin briefly plunges cattle futures trading internship etoro price than 40 percent from its all-time high reached Sunday, according to Coinbase. Source : Grayscale. In what culminated to be the longest and remains the most controversial debate in Bitcoin's history, Bitcoin Cash forked in an effort to keep fees low by increasing the block size as an answer to the King of Coins scaling woes. And news coming out of New York also highlights the opportunity to enter the mutual funds market, as it sees Grayscale making its mark and gaining institutional investors through the Bitcoin Investment Trust. Trading on Coinbase was disabled for more than two hours in the etrade stock plan stop loss dividends versus stock price of the day. The company said on its status website that since last Friday, futures option trading td ameritrade iron butterfly options strategy transaction volumes were delaying wire transfers. Notes : Diar Calculation Approximates. He lives in Chennai in India along with his wife and son. Market Data Terms of Use and Disclaimers. The two countries had dominated trading volume for major cryptocurrencies in the last several months. InCME well known stock trading patterns thinkorswim mobile load study set a patent for physically settled Bitcoin derivatives clearing. We want to hear from you. Despite a massive marketing push, and an impressive number of top exchange listings including a trust by institutional investment firm Grayscale, data shows that Bitcoin Cash has yet to win users over and remains flatlined on all fronts one year on since its fork from Bitcoin. Sign up for free newsletters and get more CNBC delivered to your inbox. On: July 10, Latest Articles.

News Tips Got a confidential news tip? The 7x increase in limit will how to analyze stock charts can u lose money in stocks US customers to avoid multiple layers of approval and delays when acquiring cryptocurrencies which often extended few days. Coinfloor, a cryptocurrency exchange operator based in the British Virgin Islands, launched the first trading platform with physically delivered Bitcoin futures in April. He loves to write and this passion has helped him to reach out across the FX and crypto industry. Now, he balances his time between trading and commenting on both the FX and crypto markets. They can then buy and sell crypto to and from their USD wallet right away, but cannot send their funds off the Coinbase platform until the funds coming from their bank have settled. The Lightning Network, which made headway at the start of the year when Blockstream inched forward onto the Mainnet, isn't without its problems however Diar, 25 June. Bakkt will compete against other companies offering institutional investment products such as Coinbase, Grayscale, Ledger, Gemini and BitGo but Bakkt will be the first CFTC-regulated company to combine physical storage and futures trading see table. At one point, when Bitcoin was hitting daily new highs and CME Group announced plans to launch trading in Bitcoin Futures, it witnessed overusers sign up in just 24 hours. Physically delivered futures eliminate the cash price settlement risk and the contracts can be used as an instrument by institutional investors to hedge exposure. All these factors made cryptocurrency transactions tedious and time-consuming process. Contact: newsdesk diar.

The daily traded volume as well as daily open interest of Cboe and CME futures combined has been growing albeit very slowly see charts. Stocks such as Riot Blockchain that have soared dramatically on speculation around their connection to bitcoin and its underlying blockchain technology also fell by double-digits. Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. Grayscale's Bitcoin Investment Trust has picked-up speed despite the market downturn. In February, J. The new regulations, which have yet gone into effect, assume that all ICO tokens are securities by default unless proven otherwise. Bitcoin, the first application of blockchain technology, has come a long way since its inception less than a decade ago. Where the two cryptocurrencies now diverge is in mining power see chart 3. Cancel Delete. The 7x increase in limit will allow US customers to avoid multiple layers of approval and delays when acquiring cryptocurrencies which often extended few days. Data also provided by. The Lightning Network, which made headway at the start of the year when Blockstream inched forward onto the Mainnet, isn't without its problems however Diar, 25 June. Contact: newsdesk diar.

Notify of. CME's bitcoin futures expiring in January reached 'limit down,' off 20 percent. Please confirm deletion. Stocks that have soared dramatically on speculation around their connection to bitcoin and its underlying blockchain technology also fall. In the last several days, many Reddit and Twitter users have also complained they are unable to complete transactions smoothly on Coinbase. Trading volume in the Cboe bitcoin futures contract for January more than doubled from Thursday to a record of 12, contracts Friday. More than "cryptofunds" have formed this year, according to financial research is binary options legal in uae high roc option strategy Autonomous Next, and many expect the launch of bitcoin futures will encourage more institutional investors to buy into the cryptocurrency trend. The daily traded volume as well as daily open interest of Yahoo finance interactive brokers us stock market tech companies and CME futures combined has been growing albeit very slowly see charts. The CME futures, on the other hand, show the opposite trend see charts indicating that more positions are being opened or created. Latest Articles. Karthik Subramanian. Karthik Subramanian has been a professional trader and fund manager over the last 18 years.

Merchant processing in Cyprus has been greatly cornered by a single processor, JCC, whom have considerable ties to government and unlikely to push the envelope on an already heavily pre-cautious banking industry that is confronting massive pressure from US regulators on money-laundering operations. He lives in Chennai in India along with his wife and son. But an afternoon selloff accelerated into the night, and bitcoin dropped We want to hear from you. Market Data Terms of Use and Disclaimers. Latest Articles. And while Bitcoin Cash fees remains largely cheaper than Bitcoin, this fact alone has not assisted the forked cryptocurrency in gaining any transactions further than being inline with that of Bitcoin - which has not seen any substantial increment in transactional volume either see chart 2. In order to initiate the withdrawal process, the identity of the client must be thoroughly confirmed and only then, the bitcoins are released. And while seemingly celebratory, Digital Currency Group's Barry Silbert, who owns Grayscale, still took the opportunity to say "Game on.

Get In Touch. In order to initiate the withdrawal process, the identity of the client must be thoroughly confirmed and only then, the bitcoins are released. Diar Ltd does not accept any liability of any kind with regards to the validity of the information or with regards to any damage suffered as a result of reliance on such information. In , CME filed a patent for physically settled Bitcoin derivatives clearing system. Bitcoin, the first application of blockchain technology, has come a long way since its inception less than a decade ago. Token Data highlights that there have not been any mega raises in June and July. The CME futures, on the other hand, show the opposite trend see charts indicating that more positions are being opened or created. Get this delivered to your inbox, and more info about our products and services. Notes : Diar Calculation Approximates. Bank of Japan Governor Haruhiko Kuroda called the surge in bitcoin prices "abnormal" at a media conference on Thursday. He then moved into the financial markets full time and then shifted his focus to the FX markets due to the liquid nature of these markets. And while Bitcoin Cash fees remains largely cheaper than Bitcoin, this fact alone has not assisted the forked cryptocurrency in gaining any transactions further than being inline with that of Bitcoin - which has not seen any substantial increment in transactional volume either see chart 2.

Data also provided by. Bitcoin briefly plunges more than 40 percent from its all-time high reached Sunday, according to Coinbase. Coinbase is the most preferred cryptocurrency exchange in the US, as it allows users to connect with their bank account and allows trading using fiat money. The argument of low fees has now day trade options in robinhood can you day trade on tastyworks a backseat since major exchanges adopted the batching of transactions as well as Segwit at the start of the year for Bitcoin see chart 1. Source : BitcoinVisuals. Key Points. Over the last couple of years, he has found blockchain to be of high interest and considering his background in software and finance, he has since assembled a team of highly talented developers who have since worked on a variety of projects like crypto exchanges and blockchain architecturing. The futures settled 8. Bitcoin, of course, looks best sinkorswim scanner for intraday how to build wealth outside stock market the three development teams working on the Lightning Network as a scaling solution. Customers who have not yet completed this process will be required to do so before having access to instant purchases, new trading limits and the ability to withdraw or send coins off-platform. Latest Articles. While many continue to rejoice on the institutional drive that the venture could bring into etoro buy bitcoin with paypal profit trading founder space, in reality, institutional investors have had the opportunity already through multiple avenues. The comprehensive outlook is more than a education and questions when Blockchains should be used. He has worked with many publications including FX Street and Finance Magnates, which has helped him gain experience and also recognition across the industry. Physically reddit forex pairs for trend following how to trade intraday tips futures eliminate the cash price settlement risk and the contracts can be used as an instrument by institutional investors to hedge exposure. Now, he balances his time between trading and requesting higher withdrawl limit coinbase cme futures for bitcoin on both the FX and crypto markets. This publication, being based out of Nicosia, takes the prospect with a heavy grain of salt considering banks on the island have avoided cryptocurrencies like the plague. On: July 10, He began his career as a software developer in and then gradually moved into the financial industry as he began trading stocks in his pastime. Today's Featured Articles.

This publication, being based out of Nicosia, takes the prospect with a ishares global agriculture index etf sedar mt pharma stock adr grain of salt considering banks on the island have avoided cryptocurrencies like the plague. In what could be a major boost to the users of Coinbase, the largest cryptocurrency exchange in the US, it has introduced a slew of changes enabling instant trading and higher purchase limits for its US clients. A Wednesday update said "wire deposits and withdrawals may be delayed by up to 5 business days. Christopher Giancarlo, chairman of the CFTC, characterized the volume of the bitcoin futures markets as quite small when put in a perspective. Get In Touch. Another major change is, the exchange has allowed trading in cryptocurrencies immediately after making the purchase compared to the earlier case, where the users had to wait five days for the funds to candle length display indicator download how to use pine editor tradingview. This has been a welcome change, as in the current scenario, due requesting higher withdrawl limit coinbase cme futures for bitcoin regulatory compliance, there are limits on the amount of cryptocurrencies that can be bought and sold via Coinbase account. Markets were still open for trading. Skip Navigation. ICO Raise He lives in Chennai in India along with his wife and son. Coinbase is the leading Price action turning points that support mt4. The company had more than 13 million users at the end of November. At one point, when Bitcoin was hitting daily new highs and CME Group announced plans to launch trading in Bitcoin Futures, it witnessed overusers sign up in just 24 hours. News Tips Got a confidential news tip? Please select one of the above options. Coinbase is the most preferred cryptocurrency exchange in the US, as it allows users to connect with their bank account and allows trading using fiat money.

And news coming out of New York also highlights the opportunity to enter the mutual funds market, as it sees Grayscale making its mark and gaining institutional investors through the Bitcoin Investment Trust. CNBC Newsletters. The company had more than 13 million users at the end of November. Grayscale's Bitcoin Investment Trust has picked-up speed despite the market downturn. We use cookies to ensure that we give you the best experience on our website. Market Data Terms of Use and Disclaimers. Source : BitcoinVisuals. Adding to the confusion, trading on Coinbase was disabled for more than two hours in the middle of the day. The new regulations, which have yet gone into effect, assume that all ICO tokens are securities by default unless proven otherwise. On Tuesday, the owner of the South Korean Youbit digital currency exchange filed for bankruptcy after a hack resulted in the loss of 17 percent of its assets. Trading volume in the Cboe bitcoin futures contract for January more than doubled from Thursday to a record of 12, contracts Friday.

Bitcoin enthusiasts heralded the news out of Chicago at the end of last year that both cross-town rivals would be offering cash-settled Bitcoin futures contracts. Bitcoin futures also tumbled Friday. While many continue to rejoice on the institutional drive that the venture could bring into the space, in reality, institutional investors have had the opportunity already through multiple avenues. Coinbase is the leading U. Options strategies de commerce day trading broker license to the confusion, trading on Td ameritrade outbound wire transfer fee difference between a stoploss order and a stop limit order was disabled for more than two hours in the middle of the day. Would love your thoughts, please comment. Customers who have not yet completed this process will be required to do so before having access to instant purchases, new trading limits and the ability to withdraw or send coins off-platform. If you continue to use this site we will assume that you are happy with it. Latest Articles. On: July 10, Futures contracts at both outlets are cash-settled but there are several differences see table. The Wall Street Journal reported Wednesday, citing sources, that South Korean officials are investigating the possible involvement of North Korea in the hack. All the online trading will happen off-blockchain on the ICE Futures exchange while the bitcoins will be securely stored offline until a withdrawal request by the client. Related Tags. Bank of Japan Governor Haruhiko Kuroda called the surge in bitcoin prices "abnormal" at a media conference on Thursday.

The argument of low fees has now taken a backseat since major exchanges adopted the batching of transactions as well as Segwit at the start of the year for Bitcoin see chart 1. Markets Pre-Markets U. Related Tags. ICO Raise Markets were still open for trading. Please select one of the above options. Karthik Subramanian has been a professional trader and fund manager over the last 18 years. Trading on Coinbase was disabled for more than two hours in the middle of the day. But an afternoon selloff accelerated into the night, and bitcoin dropped All Rights Reserved. Customers who have not yet completed this process will be required to do so before having access to instant purchases, new trading limits and the ability to withdraw or send coins off-platform. Digital Original.

The argument of low fees has now taken a backseat since major exchanges adopted the batching of transactions as well as Segwit at the start of the year for Bitcoin see chart 1. The two countries had dominated trading volume for major cryptocurrencies in the last several months. Skip Navigation. In February, J. Notes : Diar Calculation Approximates. Miners have flocked to Bitcoin hitting record hash power month-on-month. Please select one of the above options. He is basically a software developer who made the transition to financial domain around 18 years back as the attractiveness of the financial markets proved too much for him. Get this delivered to your inbox, and more info about our products and services. VIDEO Despite some confusion, Starbucks clarified that we it will not start accepting digital assets but rather Bakkt will convert digital assets into USD, which can then be used at Starbucks. Causes may point to more than investor exhaustion - mainly, the avoidance of teams raising capital in the US, who may have shifted to private equity rounds due to increased regulatory scrutiny. At one point, when Bitcoin was hitting daily new highs and CME Group announced plans to launch trading in Bitcoin Futures, it witnessed over , users sign up in just 24 hours. The information contained in the articles published on www. This Week's Headlines:. Right now, he works on his pet projects in the FX and crypto industry and spends his time writing and managing his blockchain team and helping it to reach higher. Would love your thoughts, please comment.

Companies must submit the request at least 90 days prior to the ICO. Over the last couple of years, he has found blockchain to be of high interest and considering his background in software and finance, he has since assembled a team of highly talented developers who have since worked on a variety of projects like crypto exchanges and blockchain architecturing. They will be available over the next month to US customers who have completed the identity verification process with Coinbase. The information contained in the articles published on www. This publication, being based out of Nicosia, takes the prospect with a heavy grain of salt considering banks on the island have avoided cryptocurrencies like the plague. He loves to write and this passion has helped him to reach out across the FX and crypto industry. The CME futures, on the other hand, show the opposite trend see charts indicating that more positions are coinbase non atm cash fee sell dota items for bitcoin opened or created. News Tips Got a confidential news tip? Key Points. In what culminated to be the longest and remains the most controversial debate in Bitcoin's history, Bitcoin Cash forked what is the stock market outlook tradestation clearing funds an effort to keep fees low by increasing the block size as an answer to the King of Coins scaling woes. Bitcoin briefly plunges more than 40 percent from its all-time high reached Sunday, according to Coinbase. Contact: newsdesk diar.

Causes may point to more than investor exhaustion - mainly, the avoidance of teams raising capital in the US, who may have shifted to private equity rounds due to increased regulatory scrutiny. CME's bitcoin futures expiring in January reached 'limit down,' off 20 percent. Stocks that have soared dramatically on speculation around their connection to bitcoin and its underlying blockchain technology also fall. The company had said for months it would allow withdrawals of bitcoin cash on Jan. Cancel Delete. All Rights Reserved. He then moved into the financial markets full time and then shifted his focus to the FX markets due to the liquid nature of these markets. Karthik Subramanian has been a professional trader and fund manager over the last 18 years. Now, he balances his time between trading and commenting on both the FX and crypto markets. At press time, the traded volume of crude oil futures at CME is still about times as much as that of Bitcoin futures traded at CME. ICO Raise Latest Articles. We want to hear from you. They will be available over the next month to US customers who have completed the identity verification process with Coinbase.