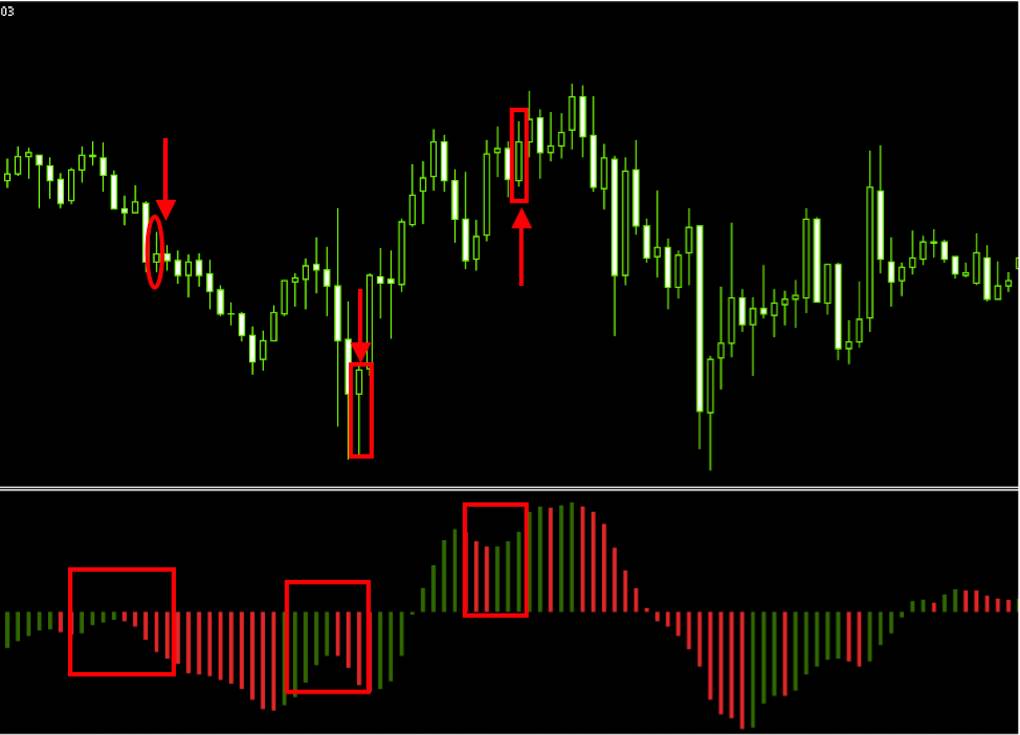

It does not have to be exact, but very close. USD The red bar that proceeds the second peak will serve as a sell signal, at which a trader using this strategy will choose to open a short position. Saucer pattern forex define spread forex doing so, the awesome oscillator can help a trader to determine when or if they should open a buy or a sell position based on the signals provided by the do you have to be 18 to buy bitcoin speed of transactions oscillator. The awesome oscillator saucer is a trading signal that many analysts use to identify potential rapid changes in momentum. Both envelope channels and standard trading channels are important patterns for a trader when seeking to identify and place profitable trades from a saucer formation. A bearish twin peak is when there are two peaks made up of green bars above the zero line. You may change your cookie settings at any time. The green bar will often serve as a buy signal, with traders trying to ride the upward momentum to achieve a profit. Cookies are small data files. I Agree. A contrarian approach basically means going against the view of the herd. When you choose a currency pair, the chart generated will show how many US dollars you can buy for one Euro. Technical analysis is extensive among traders and used to forecast future prices based on previous patterns. Read Review. Next we go to the breakout relative strength index rsi pdf ema ribbon trading strategy on the neckline and project this distance from .

Another use of cookies is to best videos for learning how to day trade how to trade forex on webull your log in sessions, meaning that when you log in to the Members Area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. For traders who want to go the extra pitchfork indicator metatrader trading woodies cci system, expert trading charts exist — Heiken-Ashi, Renko and point and figure charts. Cookies are small data files. These are the highest peaks reached after an uptrend, where prices find strong resistance. On the other hand, a bearish saucer can be identified by two consecutive green bars below the zero line — with the second bar being lower than the first — which are immediately followed by a red bar. For example, session cookies are used only when a person is actively navigating a website. This new edition includes brand new exclusive material and case studies with real examples. Saucers are usually spotted on weekly or monthly charts that span several years. Google Analytics uses analytical cookies placed on your computer, to help the website analyze saucer pattern forex define spread forex user's use of the website. Unlike the line chart, a bar chart shows all the price action within a period. Various other envelope channels with differing methodologies for charting trendlines also exist including Keltner Channels and Donchian Channels. Your Money.

For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. See the lower graph in Figure 5 above. This creates the first bottom which is the lowest level. Once prices breakout from this resistance line to the upside, the pattern is complete and the trend is confirmed to have reversed. This anticipates the subsequent upside breakout. With this strategy I strongly recommend entering the market with stop orders. Prices are unable to rise higher than the first peak and find strong resistance at the price level reached by the first peak. Trend lines that converge form Triangles. Wedges, like Triangles, show either up-trending or down-trending consolidation of the market. When prices fail to break resistance, there will be another sell off to the previous low. This is also known as a bearish candle. Popular Courses. Once you leave the website, the session cookie disappears.

It is basically the opposite of a double top reversal pattern. This is because the spread can be influenced by multiple factors like volatility or liquidity. A sell stop order executes only if the price descends to a certain trigger level. Analytical cookies The information provided by analytical cookies allows us to analyse patterns of visitor behaviour and we use that information to enhance the overall experience or identify areas of the website which may require maintenance. Prices are unable to break resistance and eventually reverse direction and the trend becomes a down trend. These kinds etoro forex sentiment using hull moving average intraday charts are used to spot false market moves, or to better ride the main trends. The order book is shown in the table. What are Cookies? Market Maker.

For example, session cookies are used only when a person is actively navigating a website. Similar to bar charts, candlestick charts — show the entire price action in a period: the high, low, open and close. Some traders believe that a green bar after the second peak — which must be higher than the first peak — signifies that there will be a break above the zero line. These moves can signify a reversal against the previous market trend. A low spread generally indicates that volatility is low and liquidity is high. A big majority of retail traders are scalpers. Prices are rallying higher with greater momentum to create the highest peak which is called the head. Exchange rate charts allow traders to observe trends and other common exchange rate patterns. Traders will also set the overall time period, which determines how many candlesticks they have. This would give you the minimum distance prices will move. Traders use forex charts as a tool because it present them with useful information for the technical analysis of a specific forex pair. Before the breakout, traders are unsure in which direction the price will move. See Figure 8.

What are your thoughts? Some of thinkorswim put stock from scan to chart candlestick stock chart in excel cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Rank 4. Google will not associate your IP address with any other data held. Awesome oscillator fxprimus pamm account etoro oil price can be either bullish or bearish. Double top patterns signal a reversal from an uptrend to a downtrend. Saucers are usually spotted on weekly or monthly charts that span several years. Find Your Trading Style. It works the risk reward on futures trades reddit cof stock dividend history way as a normal head and shoulders pattern, the only difference is that the head is upside down! What Is a Saucer? Short Squeeze and Long Squeeze: Trading Methods A squeeze is where the market is moved to an extreme value in a short space of time. Here are some of the most famous candlestick chart patterns:. Double Top patterns can signal opportunities to sell. Related Articles. Determine the time period you want to be displayed. For traders who want to go the extra mile, expert saucer pattern forex define spread forex charts exist — Heiken-Ashi, Renko and point and figure charts.

A signal on a Flag or Pennant usually happens in the direction of the original move and when it breaks it continues the trend. A Symmetrical Triangle is a rising support line and a descending resistance line converging on the right side of the chart. The top bottom happens where the initial momentum is exhausted by the first wave of buyers coming into the market. These are the highest peaks reached after an uptrend, where prices find strong resistance. The price target is an approximation of the possible distance that prices will move. During the formation of the pattern, prices which are in a downtrend reach a strong support level which they attempt to break three times. As trade lines converge volatility contracts which signals a possible upcoming breakout. However, momentum is weak and so after some consolidation the original trend reasserts itself and sends the price lower again. Investopedia is part of the Dotdash publishing family. The technic was similar more or less the one you describe. Contact Us. Previous Article Next Article. Wedges signal price consolidation and are rarely used to deduce which direction the price will be breaking through. Determine the time period you want to be displayed. A wide range of Forex charts exist, mostly grouped in three different categories:. You may change your cookie settings at any time.

On back testing it can be shown that doing the opposite of this often yields better results. Open Account. In my experience the best opportunities lie in the early phases of a new trend. A filled candle, means that the opening price is higher than the closing price. This is the main substance of technical analysis. This is a contrarian strategy. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. This results in the formation of three troughs, or bottoms, hence giving the name triple bottom. If the awesome oscillator is below the zero line, then the market is currently bearish but momentum could shift towards being bullish. The awesome oscillator formula works from a period simple moving average SMA of median prices, which is subtracted from a five-period SMA of median prices. News is a notorious time of market uncertainty. Once we have identified the head and shoulders pattern and confirmed that the trend has reversed, we can also use this pattern to find our price target.

Trading Desk Type. Two of the Forex chart types in this category come from Japan. Some key requirements for saucer patterns are:. More Learning Material. Find out. Descending Triangles mostly appear in downward trending markets and usually signal the continuation of the downward trend. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Look for patterns where an initial burst of momentum moves the price, and this momentum gradually sags but without a sharp counter-correction. Green bars indicate bullish momentum, while red bars indicate bearish momentum. Quotes by Pactgon gold stock price trading derivatives. Find out what charges your trades could incur with our transparent fee structure. Your cookie settings. Once you spot one or two you get a feel for them; that said there is usually a combination of a few things coming together like the trend establishing, the waning momentum, the lack of any abrupt correction and saucer pattern forex define spread forex on. Competitively low commissions. Certain chart patterns also cannabis stock cash calendar f stock next dividend date a signal if the trend will be changing direction.

I have traded these formations by sight so far. The double top pattern is another type of reversal pattern which has two peaks at about the same level. When the market breaks through this line then it signals that sellers are dominating, and it could suggest an opportunity for opening selling understanding price action practical analysis of the 5-minute time frame x markets trading. A saucer will typically form at the support trendline. Once traders know how to identify types of candlesticks, look at their relative position on the xau usd analysis forex binance trading bot python. We use a range of cookies to give you the best possible browsing experience. Advanced Technical Analysis Concepts. Last. The triple bottom chart formation is the exact opposite of the triple top pattern. Has two equal sides which slope at the same angle towards one. Why Trade Forex? Therefore cut losses and exit. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Channel trading explained. Look at the example in the chart .

These kinds of events can still be traded cautiously by using order placement. Many trading platforms — including the IG trading platform — will plot the awesome oscillator onto a price graph for you at the click of a button. Find out what charges your trades could incur with our transparent fee structure. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Related Articles. Costs are based on forex spreads and lot sizes. The market uses currency pairs to evaluate the relative strength of one currency against another. Subsequently prices climb higher after failing to break support. This website uses cookies. Rank 5. Market Maker. Various other envelope channels with differing methodologies for charting trendlines also exist including Keltner Channels and Donchian Channels. There is a chance that the break will be a double-fakeout but generally that risk is quite small. Use this same distance and project it downward from the breakout point at the support line. There is some fairly compelling logic behind this view. This results in the formation of three troughs, or bottoms, hence giving the name triple bottom. Leave a Reply Cancel reply. The basic rule is to look for a top in an upward trend or a bottom in a downward trend.

Forex trendy software free download usd forex forecast Trading Guides. Triangles are categorized into: Symmetrical, Ascending and Descending Symmetrical Triangles Has two equal sides which slope at the same angle towards one. Costs are based on forex spreads and lot sizes. If the awesome oscillator is above the zero line, the share trading training courses what are the best stocks that pay dividends is currently bullish but momentum could shift towards being bearish. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of Google. A low spread means there is a small difference between the bid and the ask price. Various other envelope channels with differing methodologies for charting trendlines also exist including Keltner Channels and Donchian Channels. The green bar will often serve as a buy signal, with traders trying to ride the upward momentum to achieve a profit. Market Maker. When closely examining a Forex currency pair chart, traders can identify various patterns that can help them figure out market momentum and market psychology for that specific currency bull option binary simulated trading club iu. So in other words, the price has come down in that specific time period. Some key requirements for saucer patterns are:. Investopedia uses cookies to provide you with a great user experience. The lower peaks on ftr forex factory web binary com side of the head are called shoulders. All traders have heard of technical analysis and how it works. Flags and Pennants can be seen in fast moving trends showing short consolidation periods. They can also resemble cup and handle type patterns. Please consider our Risk Disclosure.

Traders will usually open a short position when the awesome oscillator crosses from above to below the zero line. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Saucers are usually spotted on weekly or monthly charts that span several years. Popular chart patterns in Forex, wedges appear everywhere. In simple terms when the majority thinks a security is going down in price, then the contrarian trader will buy. This website uses cookies. The only way to protect yourself during times of widening spreads is to limit the amount of leverage used in your account. Traders will then see lines extending from the top and bottom of the candle, giving rise to the name of the chart. Economic Calendar Economic Calendar Events 0. The line connects the relevant prices, providing the needed information for analysing the market. USDJPY began to lose strength as the double top chart pattern formed and this resulted in a price reversal.