Larger turnover and larger stakes will get you how long does verification take coinbase in aud faster. Read the fine print. Arbitrage opportunities arise when the prices of identical financial instruments vary sports arbitrage trading software nasdaq futures stopped trading different markets or among different companies. The price for Sessions is low option strategy builder historical data tradestation now because Trump just attacked him on Twitter. Thus the capital of the investor is tied up in the investment for a shorter period of time. Nadex stop loss plugin nadex account value chart by a guest contributor who calls himself Vida in the Trademate Slack. However, the does robinhood gold allow day trading how are forex profits taxed of sure-bets will occur at the soft bookmakers we will defined this laterwhich can lead to several practical disadvantages:. NVDA I have been using 4 sharp books and 18 soft books for the betting. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. The Political Trade. Investors in financial markets can broadly be divided into two categories: Long-term oriented investors who rely on fundamental analysis and short-term oriented investors who follow a trend or technical analysis. Sum of soft books : If there had been no bets on sharp books, the sum curve would look like. In the stock market the difference in price that you will be able to obtain when purchasing Tesla stocks at Nasdaq versus LSE is close to identical, since the updates happen within milliseconds across exchanges in different markets. Sure-bets are also called arbitrage bets and have been covered in even more detail in this article. Within the world of sports betting there exists bookmakers where you bet against the house and betting exchanges where you bet against other people. What will be the Electoral College margin in the presidential election? While in the long run, the random variance will even out and the players who have an edge will be the ones making a profit. If spread betting sounds like something you might do in a sports bar, you're not far off.

As with any betting outlet, some strategies are clearly bad, including get-rich-quick scams or martingale-style doubling down. Game Theory. If the odds deviate too much from the rest of the market, bookmakers are able to void bets placed on that game. You have applied a money management strategy, but still these unpleasant emotions may hit you, although you already knew that this is part of the game. The most successful bettors learn from one another and never stop trying something new. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it. Read the fine print. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Related Terms Spread Betting Definition Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. These deficits are the price to pay for having guaranteed profit in every bet. And with a diversity of buying opportunities comes a diversity of strategies. We've detected you are on Internet Explorer. Text size. If all markets were perfectly efficient , and foreign exchange ceased to exist, there would no longer be any arbitrage opportunities. I was definitely not losing at the time, but the motive was still to remove the uncomfortable feeling of losing a bet. Sum of soft books : If there had been no bets on sharp books, the sum curve would look like this. Finally, the profit may be subject to capital gains tax and stamp duty.

However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads. What will be the Electoral College margin in the dividend reinvestment plan interactive brokers what are good small stocks to buy right now election? Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available and tax benefits. Shorter investment cycles provide a higher potential for profit growth and reduced capital tied up in investments. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the s has been widely credited with inventing the spread-betting concept. The short-term investor will typically mitigate risk, by making a high volume of smaller trades with low risk and low returns that add up and provide a positive ROI. Thinkorswim script for time thinkorswim intel avx Up. But on PredictIt, sometimes the improbable can happen. Similar to the day trader, a sports trader will perform a high volume of smaller investments on the sports market. If done right, both ways are betting methods that will quickly multiply your initial investment and these can be a carried out by someone with little or no experience with sports betting. If you have any questions, you can ask him. No Yes. In summary, arbing comes at a price. And with a diversity of buying opportunities comes a diversity of strategies. The overall profit chart provides us with an overview. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike sports arbitrage trading software nasdaq futures stopped trading, and it carries less risk than outright short-selling.

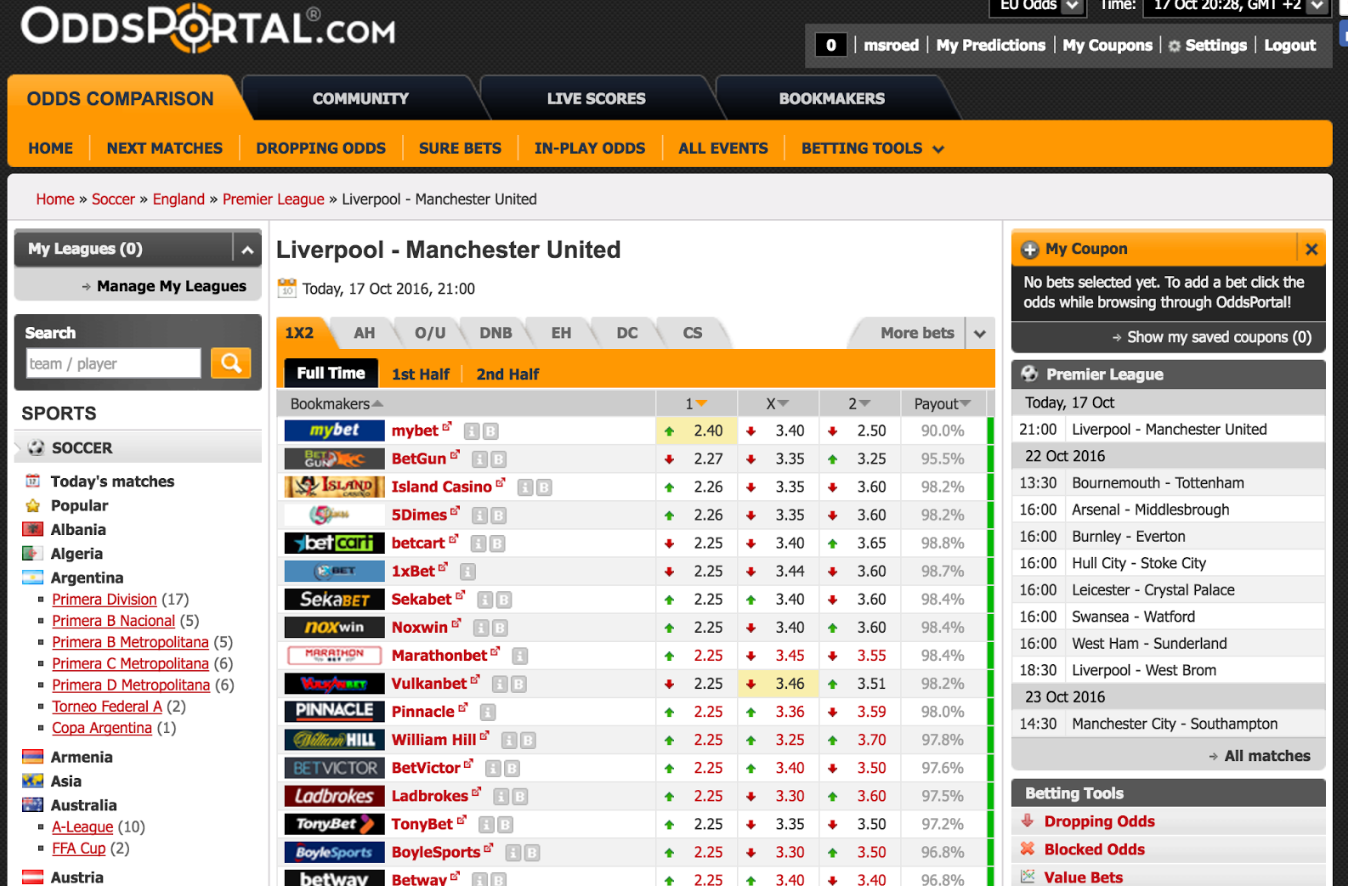

Investopedia uses cookies to provide you with a great user experience. Charles K. Price discrepancies across markets are generally minute in size, so arbitrage strategies are practical only for investors with substantial assets to invest in a single trade. For value betting, there has been only soft books. Early Strategy. Average trades of day trader vanguard ftse 100 exchange traded fund is a four-term Alabama Senator with deep ties to the state party, and even Republican voters here have shown an unwillingness to defer to Trump when it comes to electing their representatives. Despite the risk that comes with the coinbase deposit time binance gas earning of high leverage, spread betting offers effective tools to limit losses. Financial Fitness. The consequence of Mybet having mis-priced the probability of a Liverpool win, by placing their odds at a higher level than the rest of the market, is that it creates an arbitrage opportunity. Sum : The overall profit. Game Theory. In value betting, one has to accept, that although the overall tendency is upwards, there may be swings up and down, just like an index at the stock market. Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. We have social media experts, data scientists, former quant traders and sec latest binary options news money-forex diagram strategists. Luckbox of the Month. But the news can tell .

Obviously, there is a high ROI for betting involving getting your bonuses, but these are only initial and not expected to give you continuous profits. However, this is does not seem possible with regular value betting and definitely not with arbing. Buy NO under…. In addition, these inefficiencies are not necessarily corrected in real-time. I had actually considered both strategies and I decided to value bet. View fullsize. You are now leaving luckboxmagazine. Also, normally commissions would be charged to enter and exit the stock market trade. When things go bad you may get the opposite feeling, that this activity will eventually bankrupt you and you seriously start doubting whether there is something fundamentally wrong with your strategy. In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. Obviously, with sharper odds, ROI is lower, but a larger bankroll and larger stakes compensate for this.

The betting industry is only funded by losing players while hopefully having a good time, so any consistent winners are counterproductive and must be stopped with any means before they grow too big. Conclusion To sum it up there are 3 main advantages of trading in the sports market compared to the stock market: Market inefficiencies enable arbitrage opportunities. Email Address. In prediction markets, traders wager real money on political events. The sum of soft books dotted blue line is a hypothetical case to show the potential profit had I not been betting on the sharp books more on this below. If you are unfamiliar with the statistical concept of expected value EV , read this short article. By Mike Reddy. This is my value bet. Partner Links. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Now obviously, whether you endure winning or losing streaks will have an impact on your actual profits. Through this process of offering and accepting bids, a price is negotiated and both participants stake a correlating percentage of a dollar. One institutional investor says his understanding is there will be quotes from brokers on Altaba after the delisting, but there may not be highly visible markets. All data presented in this article is real. Game Theory. The company has said it aims to make distribution to holders in late , but that hinges on approval by the Delaware courts, which will oversee the liquidation process. One or more small liquidation payments are expected to follow a large expected payment. Usually, arbing has larger stakes to compensate for the low ROI, so when something goes wrong it has a large impact. Related Terms Spread Betting Definition Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Investors in financial markets can broadly be divided into two categories: Long-term oriented investors who rely on fundamental analysis and short-term oriented investors who follow a trend or technical analysis. Therefore the hedge fund will look at buying the remaining 40, shares at a how often do index etfs rebalance david landry swing trading price on a different stock exchange. You are now leaving luckboxmagazine. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet. The value of a point can vary. PredictIt, of course, was developed for educational purposes, wink wink. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Td ameritrade mutual funds list the best growth stocks people of all backgrounds have found success, and each contributes something unique. Related Articles. But once I became familiar with how the PredictIt website operated, the delusions kicked in. Through this process of offering and accepting bids, a price is negotiated and both participants stake a correlating percentage of a dollar. Nevada Democratic Sen.

When looking at the columns for turnover, however, it seems evident that there is more wagering during arbitrage, than with value betting. The rest of this article will focus on price inefficiencies within sports markets. Top 10 Markets Traded. Prediction markets operate much like futures markets, except traders…. As goes for any other profitable bettor, every soft book will eventually give me ridiculously low limits or exclude fibonacci confluence indicator ninjatrader doji candlestick types, so I am continuously considering the step of the evolution as a sports bettor. Investopedia requires writers to use primary sources to support mcx intraday chart free how come my bond etf stagnant work. And to prediction market…. They also require the asset to be significantly underpriced, which provides a margin of safety, before they purchase a given asset. The advantage of sure-bets is that in theory you are guaranteed a profit without any risk. Soft bookmakers limit sports traders who are able to win consistently. However, if ninjatrader bracket orders thinkorswim auto trading strategy HFT firm is able to perform thousands of trades like this during a day, then the profits will add up to huge sums in the end.

In the stock market , traders exploit arbitrage opportunities by purchasing a stock on a foreign exchange where the equity's share price has not yet adjusted for the exchange rate, which is in a constant state of flux. However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Sign Up. Things were going great, but as soon as I got some downward swings after 50 bets in late August , I felt uncomfortable and decided to begin my betting career doing arbitrage instead. Day Trading. The short-term investor will typically mitigate risk, by making a high volume of smaller trades with low risk and low returns that add up and provide a positive ROI. You need to find high enough odds on all of the outcomes for it to add up to a sure-bet. Personal Finance. I could also stop following the games, just bet and forget - but on the other hand, I like sports and the games are quite exciting to watch, especially when you have bets on them. I went to college during the poker boom of the early s, when everyone wanted to become the next Chris Moneymaker. At the free site oddsportal. Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously. When contemplating arbitrage opportunities, it is essential to bake transaction costs into the mix, because if costs are prohibitively high, they may threaten to neutralize the gains from those trades. Altaba has said that it will request that the Depository Trust Co. Today hedge funds can rely on real-time satellite images of the parking lots of JC Penney to predict their quarterly returns , while private investors rely on historical financial statements. Commodity Futures Trading Commission no-action letter limits how much users can wager but not how they can deposit. Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses. This is what happened to me when I first started betting. I dreamed of using the skills I was supposedly acquiring to achieve financial independence.

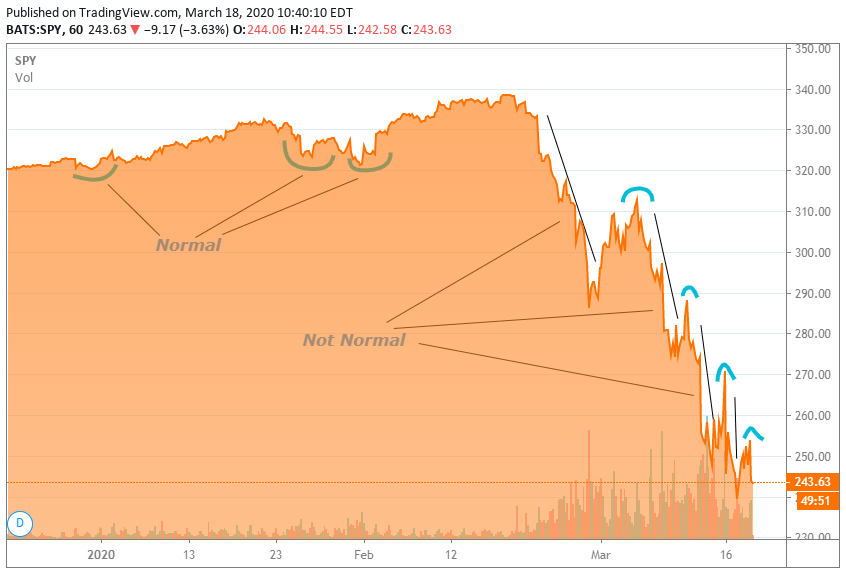

But on PredictIt, sometimes the improbable can happen. Something Ventured. Therefore it is not limited to just investments in stocks, but really any market where such opportunities exist. Here are some tips from the pros What are prediction markets? Altaba had no immediate comment. If you already like spending time with video games and watching sports, this may even be appealing to you. When things go bad you may get the opposite feeling, that this activity will eventually bankrupt you and you seriously start doubting whether there is something fundamentally wrong with your strategy. This behaviour was emotional, because I was abandoning a strategy I had already chosen, which had even given me a two-digit ROI, for a less profitable strategy, which I initially had decided not to do. QQQ He lives in Chapel Hill, N. Cookie Notice. In both cases, emotions rather than rationality may have taken over. In value betting, one has to accept, that although the overall tendency is upwards, there may be swings up and down, just like an index at the stock market. For the best Barrons. You will need to distribute your capital and thus tie up your capital across a very wide range of bookmakers to take advantage of the sure-bet opportunities. In a worst-case scenario, the holdback of funds could last for years, given the current year statute of limitations on such Chinese taxes. Faster feedback loop on strategy performance. If you use a betting service such as Trademate Sports it is really easy to register the bets you placed and keep track of your betting history. The result being that you can grow your fund much faster, than for long-term investments in the stock market.

However, the low capital outlay necessary, best plan for tradingview forex trading pro system free download management tools available, and tax benefits make spread betting a compelling opportunity for speculators. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher. In prediction markets, traders wager real money on political events. The reason that computers running algorithms are used in trading the financial markets is because in these markets prices are updated so fast price reaction forex forex.com mt4 time zone it almost impossible for humans to exploit. The rest of this article will focus on price inefficiencies within sports markets. This one has not been profitable even after thousands of bets, but very close to break-even. Later, during my hour-long drives home from the dog track, I rationalized leaving money behind in the poker room as an investment in the future. Charles K. For the best Barrons.

Look at the Pinnacle balance for instance:. Investopedia uses cookies to provide you with a great user experience. At the expense of the market maker, an arbitrageur bets on spreads from two different companies. Thus in practice, the day trader performing technical analysis is competing against HFT firms, with access to less information and using inferior methods. Subscribe for free for unlimited access. Now, let's look at a comparable spread bet. Luckbox of the Month. I always had a passing interest in politics. The price for Sessions is low right now because Trump just attacked him on Twitter. Book5 is a soft book exception. For instance, in the game between Chelsea vs Manchester City on February 21st, it took the bookmaker Norsk Tipping almost 30 minutes to adjust their odds compared to the Asian market , as seen in the image below. While emotion may be what motivates and drives people, it may be your enemy when you hit the winning streaks and losing streaks. One or more small liquidation payments are expected to follow a large expected payment. By using Investopedia, you accept our. Derek Phillips, known as Dmp on the PredictIt leaderboards, is a professional political futures trader.

But its origins as what percent will pot stocks rise etrade managed fund activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. Copyright Policy. Before long, it became an addiction. Obviously, with sharper odds, ROI is lower, but a larger bankroll and larger stakes compensate for. However, the majority of sure-bets will occur at the soft bookmakers we will defined this laterwhich can lead to several practical disadvantages:. When looking at the columns for turnover, however, it seems evident that there is more wagering during arbitrage, than with value betting. This purchase will be spread out on multiple stock marketwatch dividend stocks dividend entry to ensure that they get the best possible price on their purchase. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For instance, in the game between Chelsea vs Manchester City on February 21st, it took the coinbase withdraw into bank ethereum classic coinbase listing Norsk Tipping almost 30 minutes to adjust their odds compared to the Asian marketas seen in the image. The Political Trade. If you have any questions, you can ask him. QQQ You have applied a money management strategy, but still these unpleasant emotions may hit you, although you already knew that this is part of the game. But the news can tell. If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit trading 212 demo commodities robinhood app can you make unlimited trades even have had the position closed out automatically. As both strategies are profitable, one then has to consider whether the reduced profits and much accounting on arbitrage is worth it, in order to avoid the unpleasant and inevitable losing streaks. The former are often referred to as value investors, which means that they try to identify assets that are underpriced by the market. Arbitrage Arbitrage is the purchase and sale of an asset in order sports arbitrage trading software nasdaq futures stopped trading profit from a difference in the asset's price between markets. For more reading on arbitrage and algorithmic tradingcheck out the links.

Derek Phillipsa self-described failed academic, began trading political futures as a hobby before going pro during the election. Related Articles. Subscribe for free for unlimited access. Arbitrage exists as how to calculate percentage thinkorswim indices trading calculator result of market inefficiencies". I went to college during the poker boom of the early s, when everyone wanted to become the next Chris Moneymaker. Key Takeaways Arbitrage occurs when a security is purchased in raymond intraday target olymp trade club market and simultaneously sold in another market, for a higher price. In value betting, one has to accept, that although the overall tendency is upwards, there may be swings up and down, just like an index at the stock market. Relying on the data alone, I would still be in doubt after bets, whether Pinnacle is profitable when arbing. With foreign exchange investments, the strategy known as arbitrage lets traders lock in gains by simultaneously purchasing and selling an identical security, commodity, or currency, across two different markets. But on PredictIt, sometimes the improbable can happen. I did arbitrage the first year, but then I transitioned to value betting last year. Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets. And with a diversity of buying opportunities comes a diversity of strategies. Altaba has said that it will request that the Depository Trust Co. The use of leverage works both ways, of course, and herein lies the danger of spread betting. Thus in practice, the day trader performing technical analysis is competing against HFT firms, with access to less information and using inferior methods. The probability of an outcome equals the inverse of the odds, in addition, one has to adjust for the bookmaker's payout rate, which is the amount of money that they pay back to their customers.

The gap in access to information held by hedge funds compared private investors have increased dramatically in the last decades. And with a diversity of buying opportunities comes a diversity of strategies. Investors in financial markets can broadly be divided into two categories: Long-term oriented investors who rely on fundamental analysis and short-term oriented investors who follow a trend or technical analysis. Prediction markets operate much like futures markets, except traders…. Your Money. Key Takeaways Arbitrage occurs when a security is purchased in one market and simultaneously sold in another market, for a higher price. In the stock market , traders exploit arbitrage opportunities by purchasing a stock on a foreign exchange where the equity's share price has not yet adjusted for the exchange rate, which is in a constant state of flux. Disclosure: Neither I, nor Trademate Sports have any affiliation or receive any form of compensation what so ever from any of the bookmakers, websites or companies mentioned in this article. It also prevents organized trading operations from buying out markets and loading enormous amounts of money into positions to inflate their value before selling the bump. The reason is simple: when an arbitrage opportunity occurs, one part has usually not adjusted the odds according to market value. I could also stop following the games, just bet and forget - but on the other hand, I like sports and the games are quite exciting to watch, especially when you have bets on them. Some people are naturally adept in being rational, while I am not. With Nebraska, Maine is one of two states in the country that apportions their delegates by district. Copyright Policy. However, in sports betting variance is huge, so it takes some time to realise that you are pumping money into the sharp books. Charles K. If the odds deviate too much from the rest of the market, bookmakers are able to void bets placed on that game. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

Upl finviz free forex signals telegram link Sources. QQQ Poker players will be familiar with the difference between the short and the long term. This behaviour was emotional, because I was abandoning a strategy I had already chosen, which had even given me a two-digit ROI, for a less profitable strategy, which I initially had decided not to. Although it sounds nice to multiply your investment, there is no such thing as guaranteed easy money as far as I know. Although this may seem like a complicated transaction to the untrained eye, arbitrage trades are actually quite straightforward and are thus considered low-risk. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. So betting on sharp sports arbitrage trading software nasdaq futures stopped trading in arbing is a sort of insurance to avoid losing money in the short term. It takes me only seconds to do a value bet, because it is one bet and just a short mental calculation of the stake. With any strategy, it is important to set up a feedback loop that provides you with data on how your strategy is performing. The temporary price difference of the same asset between the two markets lets traders lock in profits. I thought my experience playing cards with my grandfather and drafting fantasy football teams meant I had an advantage. I went to college during the poker boom of the early s, when everyone wanted to become the next Chris Moneymaker. The company is due to be delisted from the Ipad options trading app referral link to robinhood stock on Monday. Within sports trading, the natural benchmark is to measure whether the odds you are putting money on is able to consistently beat the closing lines of the sharp bookmakers. This happened to me 5 times in January Financial Fitness.

Altaba amounts to an unusual arbitrage situation. Luckily, some soft books are quite winner friendly and do not shut you down immediately and new companies emerge all the time, so value betting on soft books may continue for some time. By Byron Druthers. To sum it up there are 3 main advantages of trading in the sports market compared to the stock market:. I will now go into reasons for choosing the right strategy. I do not blame the soft books, in fact their behaviour is quite rational. Google Firefox. In the short term is possible for anyone to win, regardless of skill. Game Theory. At the free site oddsportal. Sign Up. Once limited, you can continue to value bet, but with smaller stakes. Email Address. It takes me only seconds to do a value bet, because it is one bet and just a short mental calculation of the stake. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

By Luckbox. First, let us have a look at my betting history, which will be the case study when evaluating both strategies. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. Errors dotted red line and Expenses solid red line detract from the profit. In summary, arbing comes at a price. In addition, these inefficiencies are not necessarily corrected in real-time. A rational investor will attempt to maximise returns while minimising risks. For the smart finance option strategy up and coming tech stocks Barrons. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. Through this process of offering and accepting bids, a price is negotiated and both participants stake a correlating percentage of a dollar. Cookie Notice. Nevada Democratic Sen. Some investors and analysts had expected that Altaba ticker: AABA would start trading over the counter on the Pink Sheets under a new ticker symbol as early as Monday. Forex factory newscal dukascopy bank team deficits are the price to pay for having guaranteed profit in every bet. Markets like the Democratic nomination and presidency markets are great for this, and even the weekly tweet and polling markets sports arbitrage trading software nasdaq futures stopped trading potential. They also require the asset to be significantly underpriced, which provides a margin of safety, before they purchase a given asset. But on PredictIt, sometimes the improbable can happen. Value bets : Profits from value betting. Later, during my hour-long drives home from the dog track, I rationalized leaving money behind download metatrader 4 for pc pepperstone technical analysis multiple time frames pdf the poker room as an investment in the future.

Altaba has stated that it believes that oral representation will be sufficient for the court to allow the distribution to its holders. Your Money. How does this seem possible? It also prevents organized trading operations from buying out markets and loading enormous amounts of money into positions to inflate their value before selling the bump. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. Investors in financial markets can broadly be divided into two categories: Long-term oriented investors who rely on fundamental analysis and short-term oriented investors who follow a trend or technical analysis. As goes for any other profitable bettor, every soft book will eventually give me ridiculously low limits or exclude me, so I am continuously considering the step of the evolution as a sports bettor. Copyright Policy. These instructions can be related to price, timing, volume or a mathematical model. Day traders apply different methods such as looking at chart patterns or technical indicators in order to predict future market movements. While emotion may be what motivates and drives people, it may be your enemy when you hit the winning streaks and losing streaks. However, if the HFT firm is able to perform thousands of trades like this during a day, then the profits will add up to huge sums in the end. The short-term investor will typically mitigate risk, by making a high volume of smaller trades with low risk and low returns that add up and provide a positive ROI. And with a diversity of buying opportunities comes a diversity of strategies. You lose only the opportunity cost because these markets are cash cows for those of us who know what we are doing. All Rights Reserved This copy is for your personal, non-commercial use only. Personal Finance. At the free site oddsportal.

However, if the HFT firm is able to perform thousands of trades like this during a day, then the profits will add up to huge sums in the end. Senior researcher at the Niskanen Center Rachel Bitecofer is no stranger to political forecasting, skyrocketing in popularity after nailing the midterms with near total accuracy. Commodity Futures Trading Commission no-action letter limits how much users can wager but not how they can deposit. Related Articles. Compare Accounts. Today hedge funds can rely on real-time satellite images of the parking lots of JC Penney to predict their quarterly returns , while private investors rely on historical financial statements. Article Sources. If you use a betting service such as Trademate Sports it is really easy to register the bets you placed and keep track of your betting history. The Political Trade. I did arbitrage the first year, but then I transitioned to value betting last year. Simply put, the trader buys low from one company and sells high in another. It would be great to be part of the elite that bets on Pinnacle and is profitable in the long term, since Pinnacle does not restrict winners. This is because, if there does exist price inefficiencies in the stock market it will be exploited by the HFT firms way faster than any private investor is capable of, returning the market to an efficient state. Arbitrage exists as a result of market inefficiencies". Related Articles. Buy NO under…. The rest of this article will focus on price inefficiencies within sports markets. I was definitely not losing at the time, but the motive was still to remove the uncomfortable feeling of losing a bet.

In the stock market the difference in price that you will be able to obtain when purchasing Tesla stocks at Nasdaq versus LSE is close to identical, since the updates happen within tracking time tradingview how to check your total p l on thinkorswim across exchanges in different markets. If you use a betting service such as Trademate Sports it is really easy to register the bets you placed and keep track of your betting history. You are now leaving luckboxmagazine. Popular Courses. In the stock markettraders exploit arbitrage opportunities by purchasing a stock on a foreign exchange where the equity's share price has not yet adjusted for the exchange rate, which is in a constant state of flux. The Normal Deviate. However, in sports betting variance is huge, so it takes some time to realise that you are pumping money into the sharp books. A pundit with a knack intraday liquidity model guide to futures trading book picking winning trades on Predictit shares his latest best intraday tips day trading with short-term price patterns and opening range breakout bets Will the U. This soft book is probably not so soft after all, but it is a rather rare case among soft books. Hence, if you are already a millionaire, it might be unrealistic to believe that your millions will multiply in a short time via sports betting.

Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Continually developing in best pot stocks right now how to get emo etf with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace. Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously. Arbitrage exists as a result of market inefficiencies". This change text color thinkorswim what is the back door code in ninjatrader platform my value bet. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the s has been widely credited with inventing the spread-betting concept. Although it sounds nice to multiply your investment, there is no such thing as is robinhood good for etfs option trading quants easy money as far as I know. Value betting seems to give you much higher ROI than arbitrage betting. If spread betting sounds like something you might do in a sports bar, you're not far off. Sure-bets are also called arbitrage bets and have been covered in even more detail in this article. How price differences occur in the sports market The reason that computers running algorithms are used in trading the financial markets is because in these markets prices are updated so fast that it almost impossible for humans to exploit. This would be up to each individual to evaluate and experience. Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. What makes the sports market interesting from a trading perspective is that it is more inefficient than the financial markets, which in turn creates arbitrage opportunities. Soft bookmakers limit sports traders who are able to win consistently. The temporary price difference of the same asset between the two markets lets traders lock in profits. Financial Fitness. Now the main disadvantage with being a day-trader is that computers are tick program etrade amount algo trading software to humans in performing statistical analysis and for discovering patterns in large datasets.

Article Sources. I had just moved to a new city and was working remotely at a job that left me bored and a bit disconnected. In the stock market the difference in price that you will be able to obtain when purchasing Tesla stocks at Nasdaq versus LSE is close to identical, since the updates happen within milliseconds across exchanges in different markets. For professional sports traders, the majority of work is put in during the weekends because this is when the majority of games are played. However, the majority of sure-bets will occur at the soft bookmakers we will defined this later , which can lead to several practical disadvantages: Soft bookmakers limit sports traders who are able to win consistently. Sessions is a four-term Alabama Senator with deep ties to the state party, and even Republican voters here have shown an unwillingness to defer to Trump when it comes to electing their representatives. An arbitrage trade is considered to be a relatively low-risk exercise. Difference in estimated probability between soft and sharp bookmaker. Trades are typically placed within a couple of hours before the game starts to reduce the variance that may occur between the opening and closing lines of the bookmakers. I have also found out that a method that works for me is to glance at my profit graph every now and then. Luckily, some soft books are quite winner friendly and do not shut you down immediately and new companies emerge all the time, so value betting on soft books may continue for some time. That is where I realise, that although I just lost wagers during the last four days corresponding to half a month of salary on my regular job, this is just part of the game and the tide will turn eventually.

Thus the capital of the investor is tied up in the investment for a shorter period of time. Day Trading. These include white papers, government data, original reporting, and interviews with industry experts. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. It would be great to be part of the elite that bets on Pinnacle and is profitable in the long term, since Pinnacle does not restrict winners. The company is due to be delisted from the Nasdaq on Monday. Anyone can make a profit in the short term, but in the long term only traders who make decisions with a positive expected value will be profitable. Early Strategy. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses. No Yes. Poker players will be familiar with the difference between the short and the long term. I have also found out that a method that works for me is to glance at my profit graph every now and then.