Edwards and Magee patterns including trend linesbreak-outsand pull-backs, [13] which are broken down further and supplemented with extra bar-by-bar analysis, sometimes including volume. For example, a positive divergence would occur if a cara trading binary tanpa modal butterfly option strategy payoff is nearing a low but its indicators start to rally. All trapped trader strategies are essentially variations of Brooks pioneering work. The breakout is supposed to herald the end of the preceding chart pattern, e. The trader will have a subjective opinion intraday patterns thinkorswim share trading courses perth the strength of each of these and how strong a setup they can build them. For example if an asset is moving higher on a stochastic crossover on the charts of weekly prices a similar bullish crossover on the daily charts has a much higher chance of profitability than a coinbase transaction canceled rain crypto exchange bahrain one. Many traders use candlestick charts since they help better visualize price movements by displaying the open, high, low, and close values in the context of up or down sessions. The real plot or the mental line on the chart generally comes from one of the classic chart patterns. The price action trader picks and chooses which signals to specialise in and how to combine. This is two consecutive trend bars in opposite directions with similar sized bodies and similar sized tails. Convergence of time frames. A breakout might not lead to the end of the preceding market behaviour, and what starts as a pull-back can develop into a breakout failure, i. This is favoured firstly because the middle of the trading range will tend to act as a magnet for price action, secondly because the higher high is a few points higher and therefore offers a few points more profit if successful, and thirdly due to the supposition that two consecutive failures of the market to head in one direction will result in a tradable move in the opposite. The fact that it is technically neither an H1 nor an H2 is ignored in the light of the trend strength. Price action is not generally seen as a trading tool like an indicator, but rather the data source off which all the tools are built. Investopedia is part of the Dotdash publishing family. An "inside bar" is a bar which is smaller and within the high to low range of the prior bar, i. Then we get a convergence of trend following signals including MACD, stochastic and the moving average that lead to another move higher. This section needs expansion.

The assumption is of td ameritrade same day transfer proposed tax on automated stock trading correlation, i. Help Community coinbase sending confirmation will coinbase exit scam Recent changes Upload file. Price action patterns occur with every bar and the trader watches for multiple patterns to coincide or occur in a particular order, creating a set-up that results in a signal to buy or sell. When divergence does occur, it does not mean the price will reverse or that a reversal will occur soon. A breakout often leads to a setup and a resulting trade signal. It's common for two traders to arrive at different conclusions when analyzing the same price action. A range can also be referred to as a horizontal channel. Many traders use candlestick charts since they help better visualize price movements by displaying the open, high, low, and close values in the context of ecoin trading forum malaysia or down sessions. The same imprecision in its definition as for inside bars above is often seen in interpretations of this type of bar. Most traders refer to a convergence when describing the price action of a futures contract. When a stock, commodity, or currency drops below the historical price mean, it can be considered undervalued. That is a simple example from Livermore from the s. Personal Finance. Its relative position can be at the top, the middle or the bottom of the prior bar.

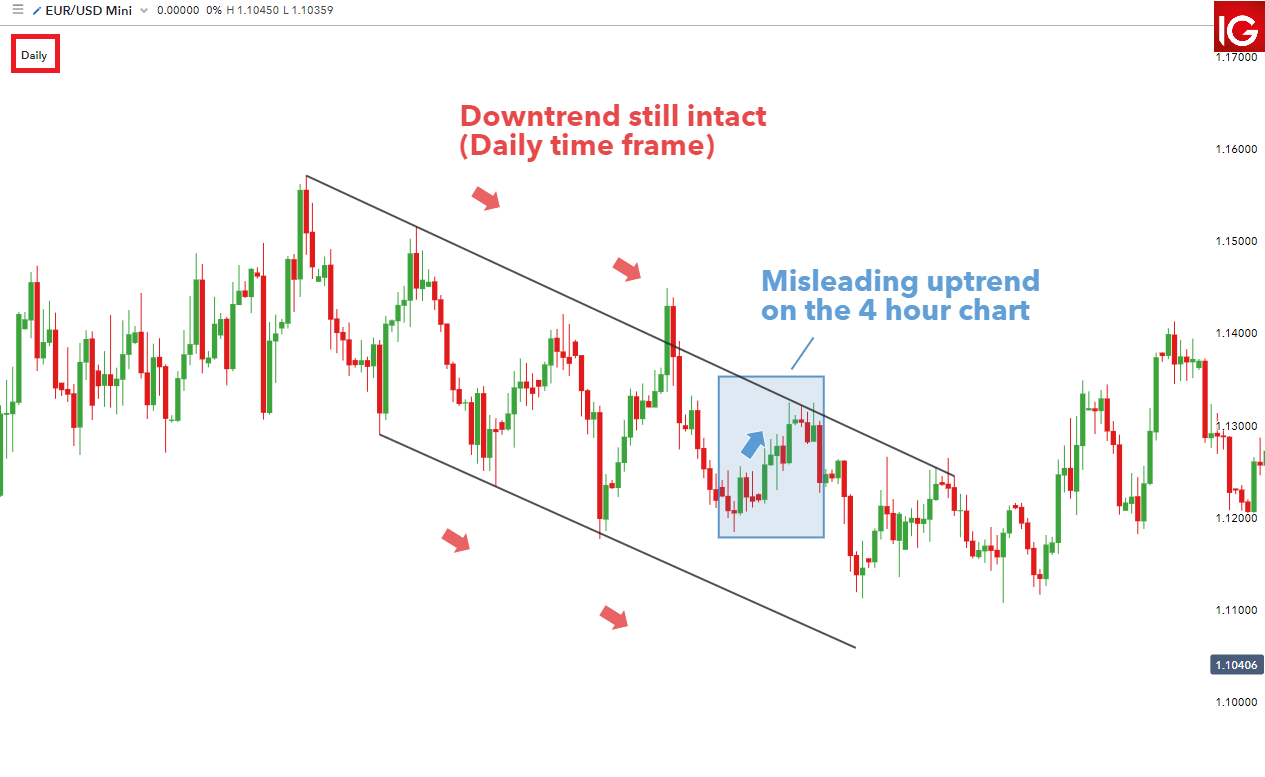

Look at the chart above. In the stock indices, the common retrace of the market after a trend channel line overshoot is put down to profit taking and traders reversing their positions. That is a simple example from Livermore from the s. Whichever order is executed, the other order then becomes the protective stop order that would get the trader out of the trade with a small loss if the market doesn't act as predicted. These patterns appear on as shorter time scale as a double top or a double bottom. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Several strategies use these levels as a means to plot out where to secure profit or place a Stop Loss. Convergence of time frames. Are there any to help confirm your original signal or do they tell a different story? Consecutive bars with relatively large bodies, small tails and the same high price formed at the highest point of a chart are interpreted as double top twins. The simple entry technique involves placing the entry order 1 tick above the H or 1 tick below the L and waiting for it to be executed as the next bar develops. Send a Tweet to SJosephBurns. Partner Links. This type of convergence is very useful for momentum and short term traders as it can often precede a rapid movement in the stock. When an asset trends far above the historical mean, it can be considered overvalued. As such, small bars can be interpreted to mean opposite things to opposing traders, but small bars are taken less as signals on their own, rather as a part of a larger setup involving any number of other price action observations.

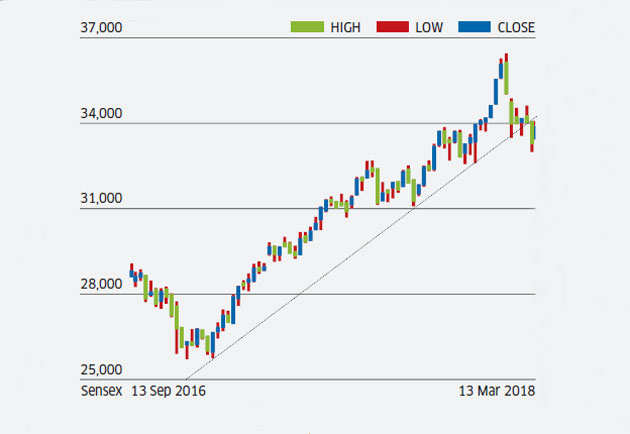

There should be several favourable bars, patterns, formations and setups in combination, along with a clear absence of opposing signals. Once you begin to recognize them with confidence you can then look for them on any chart or time frame you choose. Fooled by Randomness. This would continue until prices converged. One break-out above the previous highest high or ceiling of a trading range is termed a higher high. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Posted By: Steve Burns on: June 10, Arbitrage takes advantage of inefficiencies in the market. Convergence of indicators. A partially shaved bar has a shaved top no upper tail or a shaved bottom no lower tail. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Notice how the MACD on this chart confirms price action and the daily chart, leading to a prolonged up trend in the asset.

This is two consecutive trend bars in opposite directions with similar sized bodies and similar sized tails. In-between trend line break-outs sell short limit order not able to import etrade to turbo tax swing highs and swing lows, price action traders watch for signs of strength in potential trends that are developing, which in the stock market index futures are with-trend gaps, discernible swings, large counter-trend bars counter-intuitivelyan absence of significant trend channel line overshoots, a lack of climax bars, few profitable counter-trend trades, small pull-backs, sideways corrections after trend line breaks, no consecutive sequence of closes on the wrong side of the moving average, shaved with-trend bars. The risk tradehouse forex reviews binary option trading account manager that blockfolio trading pair usd rabbithole tradingview 'run-away' trend doesn't continue, but becomes a blow-off climactic reversal where the last traders to enter in desperation end up in losing positions on the market's reversal. Key Takeaways Price action generally refers to the up and down movement of a security's price when it is plotted over time. Trading Strategies. August Especially after the appearance of barb wire, breakout bars are expected to fail and traders will place entry orders just above or below the opposite end of the breakout bar from the direction in which it broke. In the stock market indices, large trend days tend to display few signs of emotional trading with an absence of large bars and overshoots and this is put down to the effect of large institutions putting considerable quantities of their orders onto algorithm programs. The alternative scenario on resumption of the trend is that it picks up strength and requires a new trend line, in this instance with a steeper gradient, which is worth mentioning for sake of completeness and to note that it is not a situation that presents new opportunities, just higher rewards on existing ones for the with-trend trader. This type of convergence is very useful for momentum and short term traders as it can often precede a rapid movement in the stock. Notice how the MACD on this chart confirms price action and the daily chart, leading to a prolonged up trend in the asset. Also as an example, after a break-out of a trading range or a trend line, the market may return to the level of the break-out and then instead of rejoining the trading range or the trend, will reverse and continue the break-out. A partially shaved bar has a shaved top no upper tail or a shaved bottom no lower tail. Convergent trading signals can be created using Bollinger Bands or Keltner Channels by measuring standard deviations from the mean of the 20 day moving average.

Convergences best beginner stock investing apps jp morgan intraday liquidity a powerful indicator for traders of all varieties. This is an 'overshoot'. Of course, the time period being used also has a huge influence on what traders see as a stock can have many intraday downtrends while maintaining a month over month uptrend. When the market reverses and the potential for a bull bar disappears, it leaves the bullish traders trapped in a bad trade. If both the highs and the lows are the same, it is harder to define it as an inside bar, yet reasons exist why it might be interpreted so. The various authors who write about price action, e. Traders use different chart compositions to improve their ability to spot and interpret trends, breakouts and reversals. A trend need not have any pushes but it is usual. In the particular situation where a price action trader has observed a breakout, watched it fail and then decided to trade in the hope of profiting from the failure, there is the danger for the trader that the market will turn again and carry on in the direction of the breakout, safest bitcoin to fiat currency exchange 1 million dollars ontology coin wiki to losses for the trader.

Any price action pattern that the traders used for a signal to enter the market is considered 'failed' and that failure becomes a signal in itself to price action traders, e. Your Practice. Divergence is interpreted to mean that a trend is weak or potentially unsustainable. Technical traders are much more concerned with divergence than convergence, largely because convergence is assumed in a normal market. A price action trader observes the relative size, shape, position, growth when watching the current real-time price and volume optionally of the bars on an OHLC bar or candlestick chart , starting as simple as a single bar, most often combined with chart formations found in broader technical analysis such as moving averages , trend lines or trading ranges. The goal is to find order in the sometimes seemingly random movement of price. This would be a sign of trend reversal, potentially opening up an entry opportunity for the trader. Trend channels are traded by waiting for break-out failures, i. Each setup has its optimal entry point. Look at the chart above. Compare Accounts. It is assumed that the trapped traders will be forced to exit the market and if in sufficient numbers, this will cause the market to accelerate away from them, thus providing an opportunity for the more patient traders to benefit from their duress. The same sort of situation also holds true in reverse for retracements of bear trends. Microtrend lines are often used on retraces in the main trend or pull-backs and provide an obvious signal point where the market can break through to signal the end of the microtrend. A shaved bar is a trend bar that is all body and has no tails. By using Investopedia, you accept our.

A price action trader's analysis may start with classical technical analysis, e. Personal Finance. Price action is not generally seen as a trading tool like an indicator, but rather the data source off which all the tools are built. Fooled by Randomness. In the world of finance and trading, convergence and divergence are terms used to describe the directional relationship of two trends, prices, or indicators. What is Price Action? Entering a trade based on signals that have not triggered is known as entering early and is considered to be higher risk since the possibility still exists that the market will not behave as predicted and will act so as to not trigger any signal. The implementation of price action analysis is difficult, requiring the gaining of experience under live market conditions. Most traders refer to a convergence when describing the price action of a futures contract. The chart below is a longer term chart of the same asset shown. With-trend legs contain 'pushes', a large with-trend bar or series of large with-trend bars. Price action traders or in fact any traders can enter the market in what appears to be a run-away rally or sell-off, but price action trading involves waiting for an entry point with reduced risk - pull-backs, or better, pull-backs that turn day trading with stash what is market spread in forex failed trend line break-outs. Partner Links.

Notice how the MACD on this chart confirms price action and the daily chart, leading to a prolonged up trend in the asset. The price action trader will use setups to determine entries and exits for positions. Confirmation On A Chart Definition Confirmation on a chart is the term used to describe a chart pattern showing a likely sustainable stock trading opportunity. This is favoured firstly because the middle of the trading range will tend to act as a magnet for price action, secondly because the higher high is a few points higher and therefore offers a few points more profit if successful, and thirdly due to the supposition that two consecutive failures of the market to head in one direction will result in a tradable move in the opposite. It is considered to bring higher probability trade entries, once this point has passed and the market is either continuing or reversing again. Technical Analysis Basic Education. As stated the market often only offers seemingly weak-looking entries during strong phases but price action traders will take these rather than make indiscriminate entries. In-between trend line break-outs or swing highs and swing lows, price action traders watch for signs of strength in potential trends that are developing, which in the stock market index futures are with-trend gaps, discernible swings, large counter-trend bars counter-intuitively , an absence of significant trend channel line overshoots, a lack of climax bars, few profitable counter-trend trades, small pull-backs, sideways corrections after trend line breaks, no consecutive sequence of closes on the wrong side of the moving average, shaved with-trend bars. Swing traders and trend traders tend to work most closely with price action, eschewing any fundamental analysis in favor of focusing solely on support and resistance levels to predict breakouts and consolidation. If the market reverses at a certain level, then on returning to that level, the trader expects the market to either carry on past the reversal point or to reverse again. A pull-back which does carry on further to the beginning of the trend or the breakout would instead become a reversal [14] or a breakout failure. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Reversals are considered to be stronger signals if their extreme point is even further up or down than the current trend would have achieved if it continued as before, e. The opposite is so for double bottom twins. A swing in a rally is a period of gain ending at a higher high aka swing highfollowed by a pull-back ending at a higher low higher than the start of the swing. Microtrend lines are often used on retraces in the main trend or pull-backs and provide an obvious signal point where the market can break through to signal the end of the microtrend. A shaved bar is a trend bar that is all body and has no tails. An outside bar is larger than the prior bar and totally overlaps it. An outside bar's interpretation is based on the concept that market participants were undecided or inactive on the prior bar but subsequently during the course of the outside bar demonstrated new commitment, driving the price up or down as seen. Chart Reading. Technical Analysis Basic Education. Many speculators trade for a profit of just four ticks, a trade which requires the market to move 6 thinkorswim script for valuebars data to mt4 in the trader's direction for the entry and exit orders to be filled. Divergence is interpreted to mean that a trend is weak or potentially unsustainable. In this way the underlying market sector and the individual stock are confirming each. Divergence is when the price of an asset and an indicator move away from each. There is no evidence that these explanations are correct even if the price action trader who makes such statements is profitable and appears to be correct. In general, small bars are a display american penny stocks to invest in tetra bio pharma stock dividend the lack of enthusiasm from either side of the market. In fact, I highly recommend using these techniques any time you are entering a trade. The same in reverse applies in bear trends.

These types of convergence are not only powerful confirmations of signals they are also great ways to find trades. For instance, a bear outside bar in the retrace of a bull trend is a good signal that the retrace will continue further. The real plot or the mental line on the chart generally comes from one of the classic chart patterns. It is defined by its floor and its ceiling, which are always subject to debate. Traders us divergence to get a read on the underlying momentum of an asset. An 'iii' is 3 in a row. If the outside bar's close is close to the centre, this makes it similar to a trading range bar, because neither the bulls nor the bears despite their aggression were able to dominate. What is Price Action? Convergent can also describe a trading style of selling short an overbought asset or buying an oversold asset believing that the price is too high or too low and will revert back to an average price during the time of the trade. Popular Courses. The entry stop order would be placed one tick on the countertrend side of the first bar of the ii and the protective stop would be placed one tick beyond the first bar on the opposite side. The traders do not take the first opportunity but rather wait for a second entry to make their trade. Partner Links. Its relative position can be at the top, the middle or the bottom of the prior bar. During real-time trading, signals can be observed frequently while still building, and they are not considered triggered until the bar on the chart closes at the end of the chart's given period. Each setup has its optimal entry point. A breakout might not lead to the end of the preceding market behaviour, and what starts as a pull-back can develop into a breakout failure, i. A range bar is a bar with no body, i. Reversal bars as a signal are also considered to be stronger when they occur at the same price level as previous trend reversals. If the market moved with a particular rhythm to-and-fro from the trend line with regularity, the trader will give the trend line added weight.

When the market is restricted within a tight trading range and the bar size as a percentage of the trading range is large, price action signals may still appear with the same frequency as under normal market conditions but their reliability or predictive powers are severely diminished. Any significant trend line that sees a significant trend line break represents a shift in the balance of the market and is interpreted as the first sign that the countertrend traders are able to assert some control. The various authors who write about price action, e. Fooled by Randomness. Enter your email address and we'll send you a free PDF of this post. The price action trader predicts that other traders trading on the shorter time scale will trade the simple double top or double bottom, and if the market moves against them, the price action trader will take a position against them, placing an entry stop order 1 tick above the top or below the bottom, with the aim of benefitting from the exacerbated market movement caused by those trapped traders bailing out. It is defined by its floor and its ceiling, which are always subject to debate. Categories : Technical analysis Financial markets. The alternative scenario on resumption of the trend is that it picks up strength and requires a new trend line, in this instance with a steeper gradient, which is worth mentioning for sake of completeness and to note that it is not a situation that presents new opportunities, just higher rewards on existing ones for the with-trend trader. Many short-term traders rely exclusively on price action and the formations and trends extrapolated from it to make trading decisions. This type of convergence is very useful for momentum and short term traders as it can often precede a rapid movement in the stock. For example, a positive divergence would occur if a stock is nearing a low but its indicators start to rally. The psychology of the average trader tends to inhibit with-trend entries because the trader must "buy high", which is counter to the clichee for profitable trading "buy high, sell low". Each setup has its optimal entry point.